Discover and read the best of Twitter Threads about #Banknifty

Most recents (24)

#WhatStocksToBuy

1) Who is the Promotor

2) Promoter Holding (Movement over last 1 year - Shud have increase or remain stagnant)

3) Promotor holding shud be more than 65% and Retail max holding shud not be more than 10%

3) It shud be a product based co and not services oriented

1) Who is the Promotor

2) Promoter Holding (Movement over last 1 year - Shud have increase or remain stagnant)

3) Promotor holding shud be more than 65% and Retail max holding shud not be more than 10%

3) It shud be a product based co and not services oriented

4) ROCE, ROE shud be more than 20%

5) Operating Mgn shud be more than 15%

6) FII Holding shud b there (Best is FII shud have increased the stake in the company in last 1 year)

7) There shud be Nil Debt or if debt is there check the DSCR ratio.. it shud be more than 4 ideally)

5) Operating Mgn shud be more than 15%

6) FII Holding shud b there (Best is FII shud have increased the stake in the company in last 1 year)

7) There shud be Nil Debt or if debt is there check the DSCR ratio.. it shud be more than 4 ideally)

8) Check OTHER INCOME in Qtrly and Yearly balance sheet (It shud not be more than 5% of the total income)

9) Div payout history (Its good if they r sharing their income to shareholders)

9) Div payout history (Its good if they r sharing their income to shareholders)

#stockmarkets #Pennystocks #microcap #hiddengem #nifty50 #prsunder

* Not Financial Advice* Just Analysis of A Share

Stock Name: Tyche industries

Mirco Cap

looking Fundamentals Good

Read Full Article Here

1. Company Overview

* Not Financial Advice* Just Analysis of A Share

Stock Name: Tyche industries

Mirco Cap

looking Fundamentals Good

Read Full Article Here

1. Company Overview

2. Company Data: Tyche is a leading manufacturer of APIs & Advanced Intermediates of API’s for anti-retroviral, anti-depression, anti-arthritic, anti-diarrheal, anti-psychotic etc.

#stockmarkets #Pennystocks #microcap #hiddengem #nifty50

#stockmarkets #Pennystocks #microcap #hiddengem #nifty50

Shared this setup not just here but with my @HavanaOreen students as well at 11.45 am for #banknifty. This was the zone where most conventional studies could have been neutral to the max but not bearish for sure. But there lies the difference of having a view and trading the

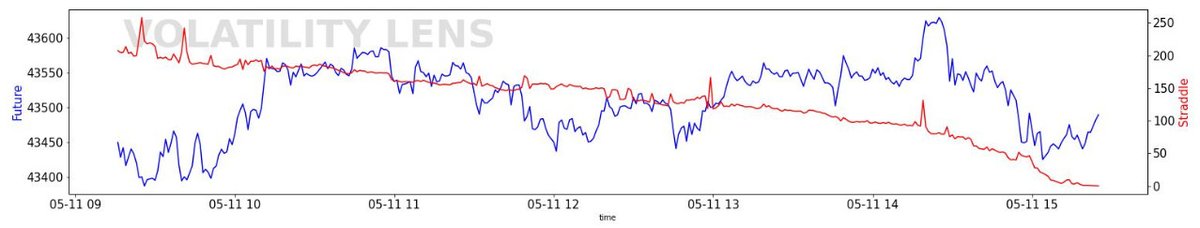

How to decode THE VOLATILITY REPORT ?

#trading #nifty #banknifty #nse #wealth #investing #stockmarkets

#trading #nifty #banknifty #nse #wealth #investing #stockmarkets

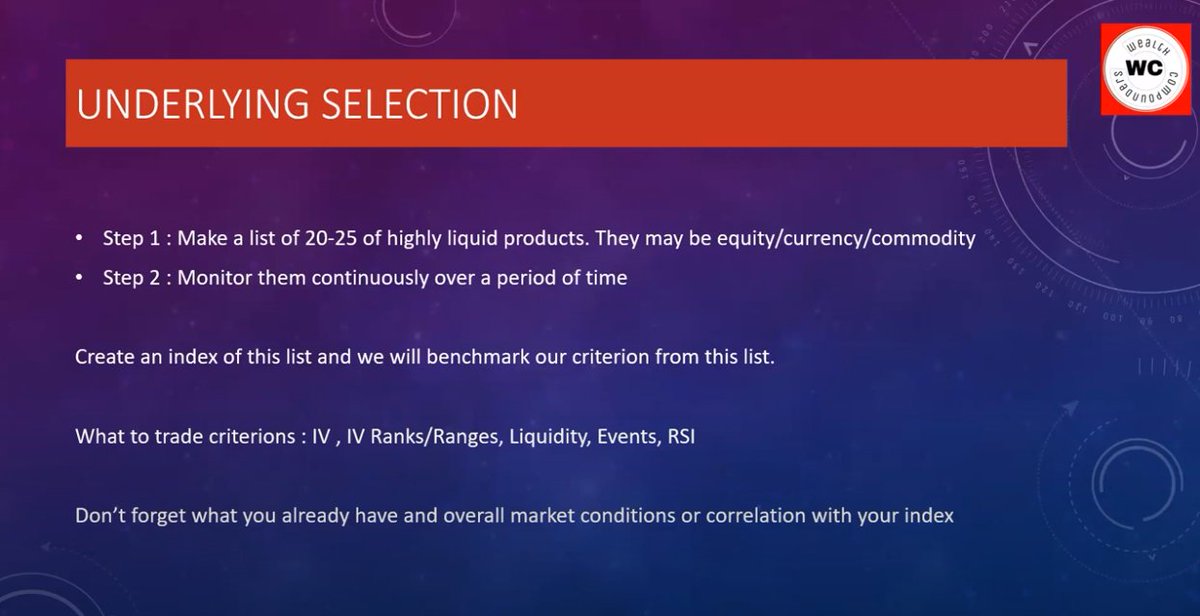

I always wondered which stock/index to select for trading.

@DestinedMusk gives us his insights on the criterias to select an underlying for trading in the YT video

#OptionsTrading #Nifty #banknifty #finnifty #TradingSuccess #wealthcompounders #trading

1/4

@DestinedMusk gives us his insights on the criterias to select an underlying for trading in the YT video

#OptionsTrading #Nifty #banknifty #finnifty #TradingSuccess #wealthcompounders #trading

1/4

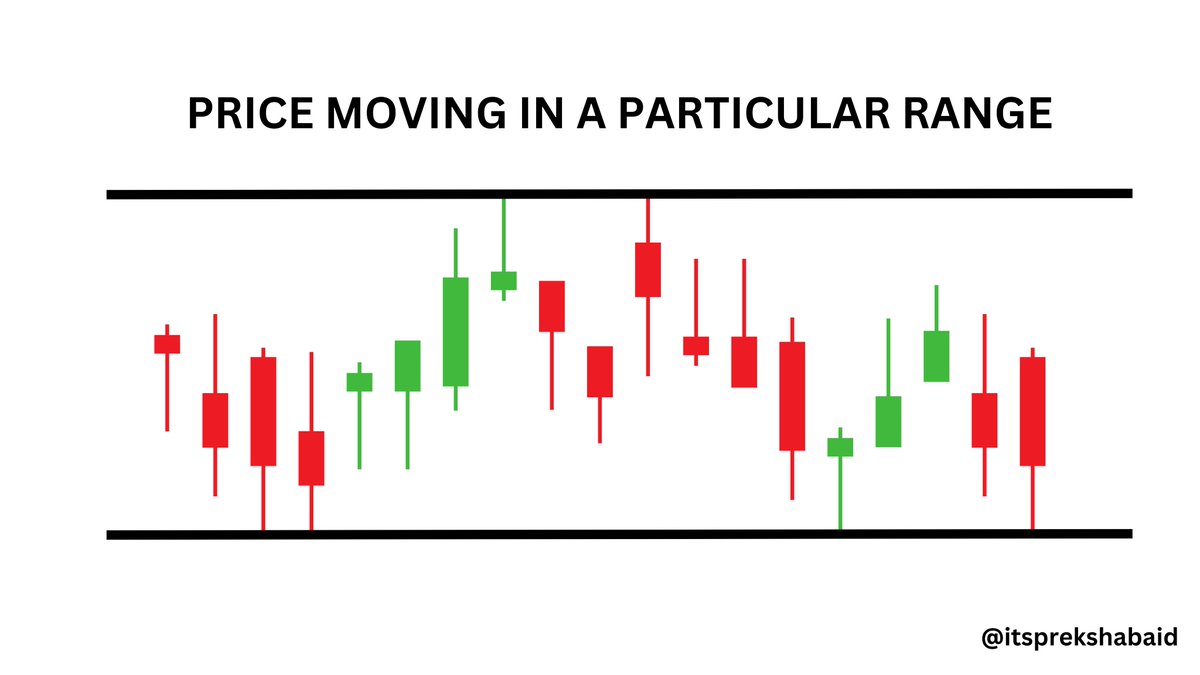

Hope people marked the zones and made use of them yesterday for #banknifty now anything that can be learnt from yesterday ? N I specifically mentioned " If you are an Options Buyer "

1. A buyer only makes money when there is a range expansion - what is the simplest way to

1. A buyer only makes money when there is a range expansion - what is the simplest way to

understand if there is a range expansion - Look at +/- DI if they are trading closeby and are below 25 you might make a few bucks by scalping(40-60 points in Spot) but it wont facilitate a range expansion (300+ points )

2. When price is between @HavanaOreen Bullish and Bearish

2. When price is between @HavanaOreen Bullish and Bearish

I started trading 4 years ago by buying options.

Had I known this intraday sell strategy by Vishal Mehta, I would have avoided the loss that I faced in my 1st year.

Don't do the same mistake that I did!

#OptionsTrading #tradingstrategy

#nifty #banknifty #finnifty

Let's go 👇

Had I known this intraday sell strategy by Vishal Mehta, I would have avoided the loss that I faced in my 1st year.

Don't do the same mistake that I did!

#OptionsTrading #tradingstrategy

#nifty #banknifty #finnifty

Let's go 👇

Did you know ?

You can earn monthly rental income(between 1%-2%) from share market just like any house owner earns rent.

I have been doing this for last few years.

#OptionsTrading #Optionselling #coveredcallstrategy #stockmarkets #StockMarketindia #Nifty #Banknifty

Read on 👇

You can earn monthly rental income(between 1%-2%) from share market just like any house owner earns rent.

I have been doing this for last few years.

#OptionsTrading #Optionselling #coveredcallstrategy #stockmarkets #StockMarketindia #Nifty #Banknifty

Read on 👇

The strategy is Covered call strategy

Pre-requisites for the covered call strategy

1. You need to own a house. (Let's take #Nifty index for an example)

2. You need to own the complete house.

In our case, we need to own atleast 1 lot of Nifty.

How do we do that ? Read next

Pre-requisites for the covered call strategy

1. You need to own a house. (Let's take #Nifty index for an example)

2. You need to own the complete house.

In our case, we need to own atleast 1 lot of Nifty.

How do we do that ? Read next

3. #Nifty is currently at ~18000 & it has a lot size of 50.

We need to own Nifty ETF worth 18000 * 50 = 9,00,000

Nifty Bees is the most liquid ETF & we get 90% amount after pledging as collateral margin.

So you get 8,00,000 back as collateral as well if you need more margin.

We need to own Nifty ETF worth 18000 * 50 = 9,00,000

Nifty Bees is the most liquid ETF & we get 90% amount after pledging as collateral margin.

So you get 8,00,000 back as collateral as well if you need more margin.

10 tweets that will teach you more than a 49,999 course.

#TradingSuccess #tradingpsychology #OptionsTrading #nifty #banknifty #finnifty

👇

#TradingSuccess #tradingpsychology #OptionsTrading #nifty #banknifty #finnifty

👇

1. Technical indicators are overrated, Market doesn't care about them.

Price action and volume is what feeds into indicators.

Price action and volume is what feeds into indicators.

2. Stick to 1 strategy. Don't do strategy hopping.

Successful trading is all about doing the same thing over and over again.

Successful trading is all about doing the same thing over and over again.

🚨🚨Ghansyam Tech (Art of Trading) makes ₹1.5 Crores / month by only OPTIONS BUYING

I spent 69+ hours analyzing his strategy and found the 11 Rules that made him a Crorepati

I turned it simple for you

FREE

Like + Retweet & read this thread 🧵

I spent 69+ hours analyzing his strategy and found the 11 Rules that made him a Crorepati

I turned it simple for you

FREE

Like + Retweet & read this thread 🧵

1. Start with Less Captial

No Matter how much money you have you will lose it all if you don't have trading experience so start small like Max 2 Lot, even 1 is better.

No Matter how much money you have you will lose it all if you don't have trading experience so start small like Max 2 Lot, even 1 is better.

2. Trade Everyday

No Matter what happens but never skip a day without trading it, which helps you understand the price action behavior and give you important teaching about market dynamics that impact the price behavior.

No Matter what happens but never skip a day without trading it, which helps you understand the price action behavior and give you important teaching about market dynamics that impact the price behavior.

2/n

🟥 Nifty

♦️ The Nifty extended its gains by 1% in a truncated week & tested our targets of 17800 driven largely by short covering

♦️ Once again financial stocks were major gainers along with mid & small caps, which continued their momentum in the new financial year

🟥 Nifty

♦️ The Nifty extended its gains by 1% in a truncated week & tested our targets of 17800 driven largely by short covering

♦️ Once again financial stocks were major gainers along with mid & small caps, which continued their momentum in the new financial year

3/n

♦️ Going ahead, we expect the Nifty to consolidate with support near 17500 amid results from heavyweights

♦️ The current open interest in the Nifty is nearly at a one year low as short closure continued during the series

♦️ Going ahead, we expect the Nifty to consolidate with support near 17500 amid results from heavyweights

♦️ The current open interest in the Nifty is nearly at a one year low as short closure continued during the series

Ghanshyam Sir has made sometimes more than a #Crore in a Single day and is one of the Best option Traders in India, watched almost all of his videos and shared my learning that how to become the best #option trader.

Le's Start

Le's Start

1. Start with Less Captial :

No Matter how much money you have you will lose it all if you don't have trading experience so start small like Max 2 Lot, even 1 is better.

No Matter how much money you have you will lose it all if you don't have trading experience so start small like Max 2 Lot, even 1 is better.

2. Trade Everyday: No Matter what happens but never skip a day without trading it, which helps you understand the price action behavior and give you important teaching about market dynamics that impact the price behavior.

Hi Friends,

Sharing some useful #trading threads here

Like & Retweet for Max Reach for learners benefit

it's 100% FREE

by @TechTradesTT & @Stocktwit_IN

1- Technical Analysis, a candlestick pattern -- part 1

#TechnicalTrades #TradingView

Sharing some useful #trading threads here

Like & Retweet for Max Reach for learners benefit

it's 100% FREE

by @TechTradesTT & @Stocktwit_IN

1- Technical Analysis, a candlestick pattern -- part 1

#TechnicalTrades #TradingView

Some Complex candlestick patterns ---- thread Part 2

@KommawarSwapnil @nakulvibhor @Abhishekkar_ @chartmojo @KhapreVishal

@KommawarSwapnil @nakulvibhor @Abhishekkar_ @chartmojo @KhapreVishal

How to create a watch list before market opening- A thread

@tapariachandan @Rishikesh_ADX @kuttrapali26 @ProfitKing7

@tapariachandan @Rishikesh_ADX @kuttrapali26 @ProfitKing7

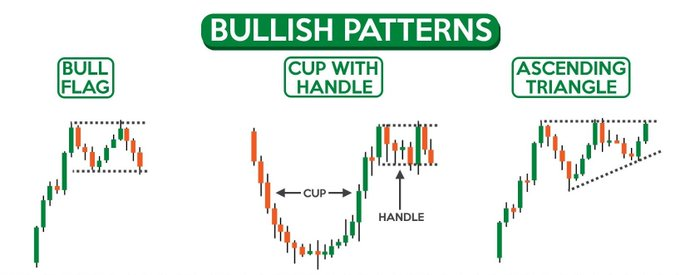

Candlestick #charts patterns is a movement in prices shown graphically on a candlestick chart that some believe can predict a particular market movement

A thread by Naren Joshi @valuelevels

🧵👇

#like & #Retweet for MAX Reach

A thread by Naren Joshi @valuelevels

🧵👇

#like & #Retweet for MAX Reach

Bullish Patterns

1- BULL FLAG

2- CUP WITH HANDLE

3- ASCENDING TRIANGLE

#stocks #TradingView

#nifty #niftybank #banknifty

1- BULL FLAG

2- CUP WITH HANDLE

3- ASCENDING TRIANGLE

#stocks #TradingView

#nifty #niftybank #banknifty

BEARISH PATTERNS

1- BEAR FLAG

2- INVERTED CUP WITH HANDLE

3- DESCENDING TRIANGLE

#niftyoptions #niftyfuture

#niftytoday

1- BEAR FLAG

2- INVERTED CUP WITH HANDLE

3- DESCENDING TRIANGLE

#niftyoptions #niftyfuture

#niftytoday

🏦"Everything You Need to Know About AT1 Bonds"

Bonds are like loans that people can give to companies or governments.

[THREAD🧵]👇

1) What are AT1 Bonds?

AT1 bonds are a type of investment that banks can use to raise money when they need it.

#bonds #Banking #banknifty

Bonds are like loans that people can give to companies or governments.

[THREAD🧵]👇

1) What are AT1 Bonds?

AT1 bonds are a type of investment that banks can use to raise money when they need it.

#bonds #Banking #banknifty

2) How AT1 Bonds are different from traditional Bonds?

a) Higher Risk

AT1 bonds are considered to be high-risk investments as they are designed to absorb losses in the event of a bank's financial distress.

a) Higher Risk

AT1 bonds are considered to be high-risk investments as they are designed to absorb losses in the event of a bank's financial distress.

Interest Payments in AT1 Bonds

AT1 bonds often have non-cumulative coupons, which means that if the bank misses an interest payment, it is not obligated to make it up in the future.

AT1 bonds often have non-cumulative coupons, which means that if the bank misses an interest payment, it is not obligated to make it up in the future.

#BANKNIFTY

The bulls took the bears by the horns.

Let's check out where from here.

Outlook for the week Mar 6 - 10, 2023.

THREAD: Deconstructing BANKNIFTY on 4 different TF's.

The bulls took the bears by the horns.

Let's check out where from here.

Outlook for the week Mar 6 - 10, 2023.

THREAD: Deconstructing BANKNIFTY on 4 different TF's.

You can also check out video where I have explained, how I do a multi-timeframe analysis & have shared my views on #BANKNIFTY for the upcoming week.

For those of you who prefer to read it lets continue:

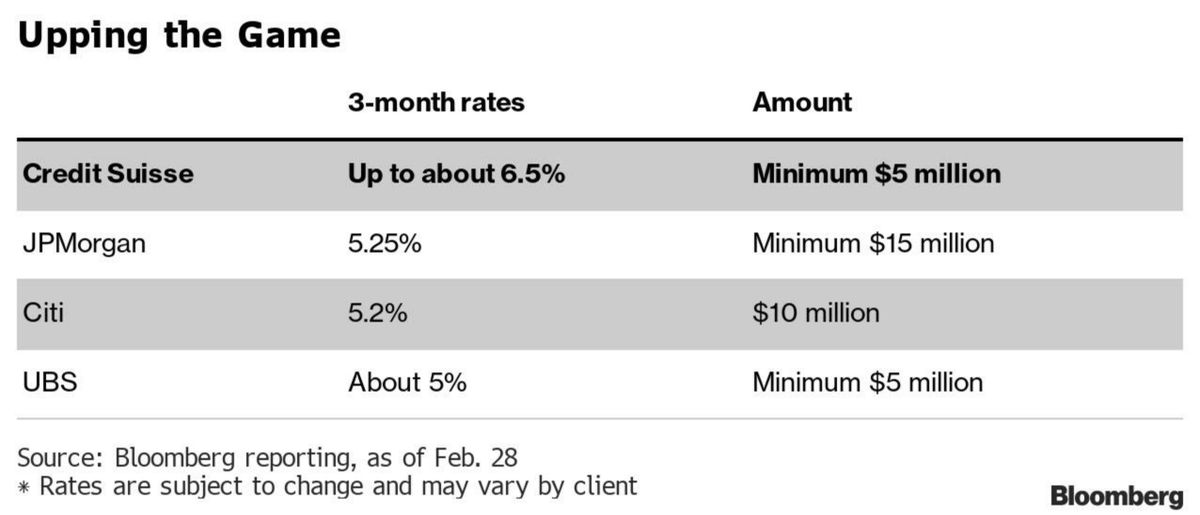

Credit Suisse - a bank too big to fail - crashes to all-time low after raising deposit rates to reverse bank run📉

Read the thread!

1/4

$CS #banknifty $SPY $QQQ #recession #stockmarketcrash

Read the thread!

1/4

$CS #banknifty $SPY $QQQ #recession #stockmarketcrash

Credit Suisse offering a 6.5% annual rate on new three-month deposits of $5 million or above - and a rate as high as 7% for one-year deposits — far above matched maturity Bills, and suggesting that to attract a client, the bank is forced to eat a GIANT loss.

2/4

2/4

Beyond liquidity woes, Credit Suisse faces significant talent bleed as dozens of private bankers at managing director-level & above have left, taking client assets with them. Senior bankers handling at least $1 bn. may take up to 60% of funds managed to their new employers.

3/4

3/4

MOVING AVERAGES:

1/n

In this thread,I am sharing about moving averages,its key strategies,entry,exit,target everything..

These strategies are scalable to all timeframes,instruments etc

Simple thinks works in the market.

#Nifty50 #StockMarketindia #banknifty #movingaverage

1/n

In this thread,I am sharing about moving averages,its key strategies,entry,exit,target everything..

These strategies are scalable to all timeframes,instruments etc

Simple thinks works in the market.

#Nifty50 #StockMarketindia #banknifty #movingaverage

2/n

MOVING AVERAGES:

Moving average is simplest method to understand and trade.Most common moving average is SMA,which totals close price over a certain period,then divides this total by number of period.Ex:10 SMA would calculate close price of last 10 period and divide sum by 10

MOVING AVERAGES:

Moving average is simplest method to understand and trade.Most common moving average is SMA,which totals close price over a certain period,then divides this total by number of period.Ex:10 SMA would calculate close price of last 10 period and divide sum by 10

3/n

EXPONENTIAL MOVING AVERAGES:

I prefer EMA,as it put more weight on recent price data when calculating moving average. It will react quicker than to sma.

What ema I use

13-short trend

34-intermediate trend

55-long trend

EXPONENTIAL MOVING AVERAGES:

I prefer EMA,as it put more weight on recent price data when calculating moving average. It will react quicker than to sma.

What ema I use

13-short trend

34-intermediate trend

55-long trend

THREAD ABOUT HOW I USE BOLLINGER BAND SYSTEM:

LIKE ,RETWEET AND YOUR INPUTS HELPS

Basics:

Bollinger bands are used to determine whether the price are high or low on relative basis.Bollinger bands use 20sma and 2 standard deviation of it.

I use three setup combined with RSI

LIKE ,RETWEET AND YOUR INPUTS HELPS

Basics:

Bollinger bands are used to determine whether the price are high or low on relative basis.Bollinger bands use 20sma and 2 standard deviation of it.

I use three setup combined with RSI

1/n

This bollinger system is suitable for intraday traders,swing traders and even for long term players.

Top down approach increases accuracy.

Only the timeframe changes ,system remains constant.

%b indicator and bollinger bandwidth can be used to code this system

This bollinger system is suitable for intraday traders,swing traders and even for long term players.

Top down approach increases accuracy.

Only the timeframe changes ,system remains constant.

%b indicator and bollinger bandwidth can be used to code this system

Curious how to make use of India's best social stock market app for free? Here are a few reasons you should check out Stocktwits to improve your investing skills 📈 🚀 #nifty #banknifty

If you're not on Stocktwits, join here - stocktwits.onelink.me/Lo6t/yv9mvw6t

A thread 🧵

If you're not on Stocktwits, join here - stocktwits.onelink.me/Lo6t/yv9mvw6t

A thread 🧵

Follow your favourite investors, media houses, & financial institutions to know what everyone is saying & thinking. Follow them & enjoy their posts on your timeline.

Pro Tip: Hit the🔔 icon for real-time alerts. Also, see our “Suggested” stream to find more people to follow.

Pro Tip: Hit the🔔 icon for real-time alerts. Also, see our “Suggested” stream to find more people to follow.

Update your Watchlist. Track prices of your favourite stocks (India & US). Know when a stock on your watchlist is “Trending” in our community. 📊

Pro Tip: Set up your watchlist to automatically receive real-time Trending notifications on stocks you care about.

Pro Tip: Set up your watchlist to automatically receive real-time Trending notifications on stocks you care about.

1.

Infra gets boost:

- Highest ever capital outlay of Rs. 2.40 lakh crores for Railways

- 50-year interest-free loans to states one more year for infra spends

Infra gets boost:

- Highest ever capital outlay of Rs. 2.40 lakh crores for Railways

- 50-year interest-free loans to states one more year for infra spends

2.

Agri & Fisheries to benefit:

- Agricultural accelerator fund to promote agri-startups

- 10,000 bio-input resource centres in next 3 yrs to promote natural farming

- 6000 Cr outlay for Animal husbandry, dairy, and fisheries

Agri & Fisheries to benefit:

- Agricultural accelerator fund to promote agri-startups

- 10,000 bio-input resource centres in next 3 yrs to promote natural farming

- 6000 Cr outlay for Animal husbandry, dairy, and fisheries

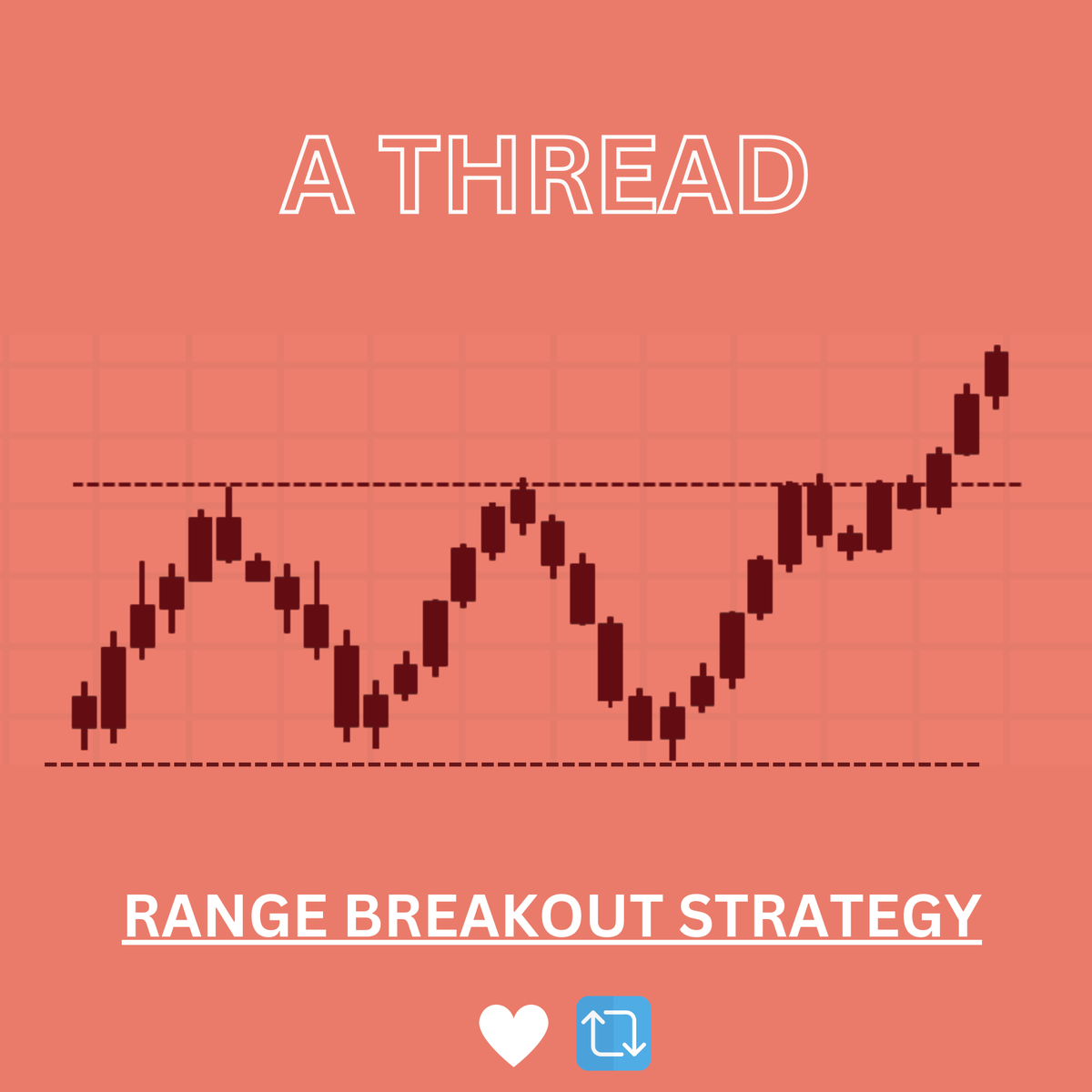

We traders, always make our trading so complicated & in live market that results into losses.

Simple range breakout strategy to catch Index trades.

A Thread 🧵

(1/14)

#StockMarket #trading @kuttrapali26

Simple range breakout strategy to catch Index trades.

A Thread 🧵

(1/14)

#StockMarket #trading @kuttrapali26

(1/8) Scam 1992 Explained Simply:-

Harshad Mehta was a stock broker on BSE & was alleged to have engineered the BSE scam in 1992 using ready forward deals.#stockmarketcrash

#StockMarket #Budget2023 #banknifty #OptionsTrading #Singapore #Hedgefund $VRA $SNFTS #Wealth #Adani #BBC

Harshad Mehta was a stock broker on BSE & was alleged to have engineered the BSE scam in 1992 using ready forward deals.#stockmarketcrash

#StockMarket #Budget2023 #banknifty #OptionsTrading #Singapore #Hedgefund $VRA $SNFTS #Wealth #Adani #BBC

(2/8)A ready forward refers to a short term, typically 15 day, secured interbank lending. In reality, the borrowing bank actually sells securities to the lending bank & then buys them back at the end of the loan period at a slightly higher price. #stockmarketcrash #banknifty #BBC

(3/8) A typical ready forward deal involves 2 banks brought together by a broker in a lieu of commission. As a part of the settlement process, the buyer & the seller need not even know eachother. #stockmarketcrash #StockMarket #Budget2023 #Adani #optiontrading #Wealth #singapore

#orderflow can help make a reasonable guess if markets will remain in range or find potential strong break out points. This then helps build context to take positions on either range reversals or range breaks.

So today markets opened lower. Question- Break lower or pullback?(1/n)

So today markets opened lower. Question- Break lower or pullback?(1/n)

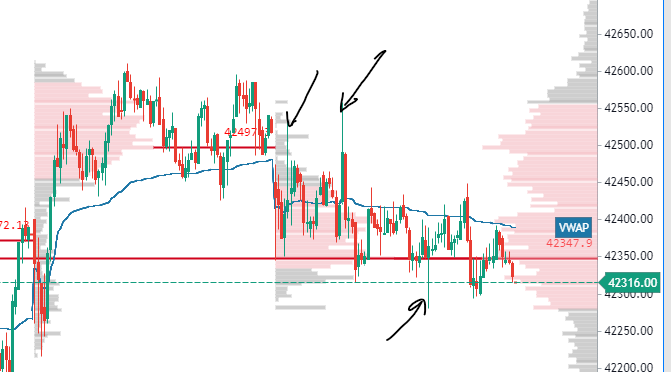

#banknifty as an eg., assuming first scenario as a potential pullback into yday range. This is stopped out by large limit sellers near 42500, this coupled with large OI increase and aggressive selling at 42500CE adds credence to a downside theory. 150K+ traded in 2 candles (2/n)