Discover and read the best of Twitter Threads about #CMBS

Most recents (3)

Rising office vacancy rates mean building owners may soon have to think about expensive redevelopments @WSJ #CMBS wsj.com/articles/home-…

The average office vacancy rate will hit an almost three-decade high of 17% in the U.S. in 2022, according to CBRE estimates. That compares with around 7% in Europe.

Idle offices may end up being converted into other uses where supply is tight, such as warehousing or homes. Logistics vacancy rates in both the U.S. and Europe fell below 4% last year, and house prices soared during the pandemic.

After a week that saw extraordinary policy moves from the @federalreserve in response to the #CoronaCrisis, the central bank has gone further and taken off its gloves for a bare-knuckled battle against the forces of #uncertainty and #deflation!

To support critical market functioning, the #FOMC dropped previously indicated limits and: “will purchase Treasury securities and agency [MBS] in the amounts needed to support smooth market functioning and effective transmission of monetary policy...”

Further, the #Fed has expanded the range of purchasable #securities to include agency commercial mortgaged-backed securities (#CMBS).

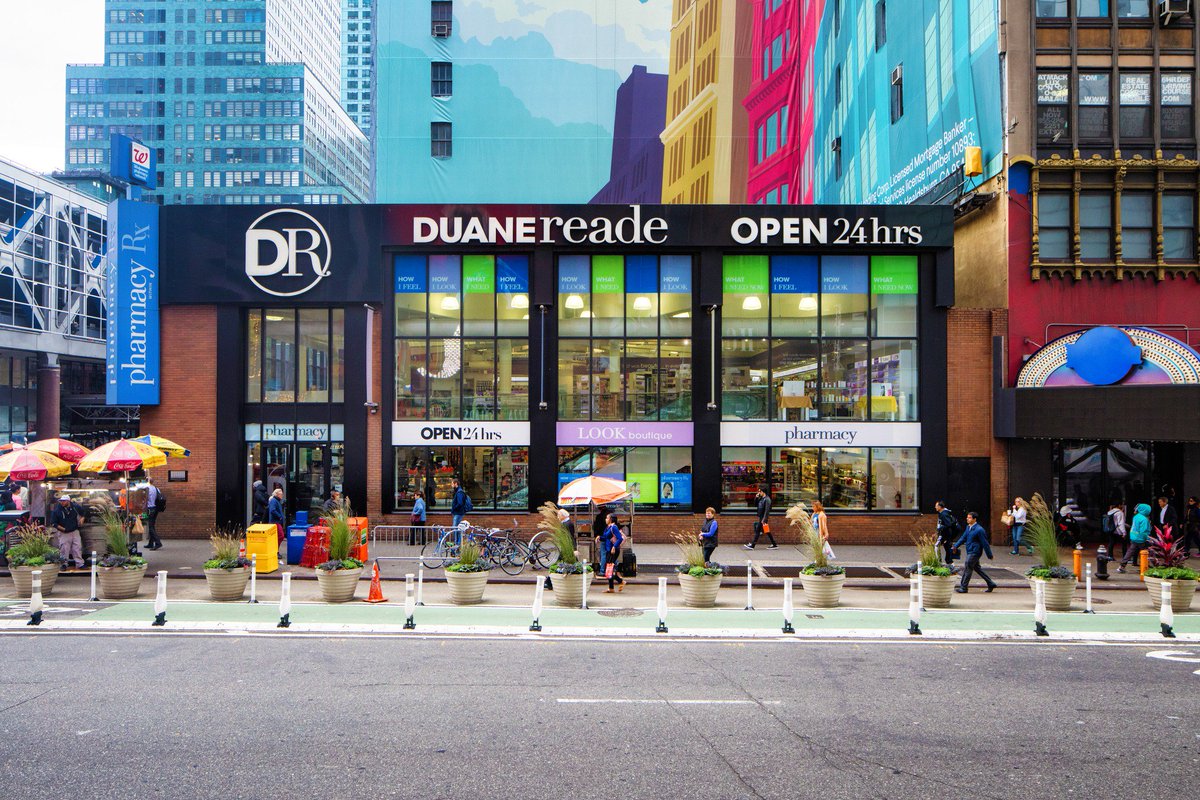

THREAD: We recently identified the property characteristics which were featured in the best performing #retail properties over the last five years. Our categories were property subtype, region, the year in which it was built, and tenant mix. More info on the top performers below.