Discover and read the best of Twitter Threads about #CashlessConsumer

Most recents (10)

There is a lot of confusion on this #UPI charges and its being made to spread multiple 'fake news' in a area where there is clarity. This directly stems from fact - who is allowed to price on what?

#CashlessConsumer will attempt to decode this in a 🧵

#CashlessConsumer will attempt to decode this in a 🧵

1. What is being announced?

NPCI will charges #MDR for transactions above ₹2000 - when the payment mode by user is a wallet.

Note - this is not the same as using PhonePe / GPay.

It is applicable only when you use Wallet - PhonePe / PayTM are popular wallets still exist.

NPCI will charges #MDR for transactions above ₹2000 - when the payment mode by user is a wallet.

Note - this is not the same as using PhonePe / GPay.

It is applicable only when you use Wallet - PhonePe / PayTM are popular wallets still exist.

It is not applicable when you use UPI via banks.

2. Who is making this announcement?

NPCI.

3. Can NPCI make this announcement?

All Payment operators are at liberty to price payment products - except ATM interchange - which @RBI actively regulates.

2. Who is making this announcement?

NPCI.

3. Can NPCI make this announcement?

All Payment operators are at liberty to price payment products - except ATM interchange - which @RBI actively regulates.

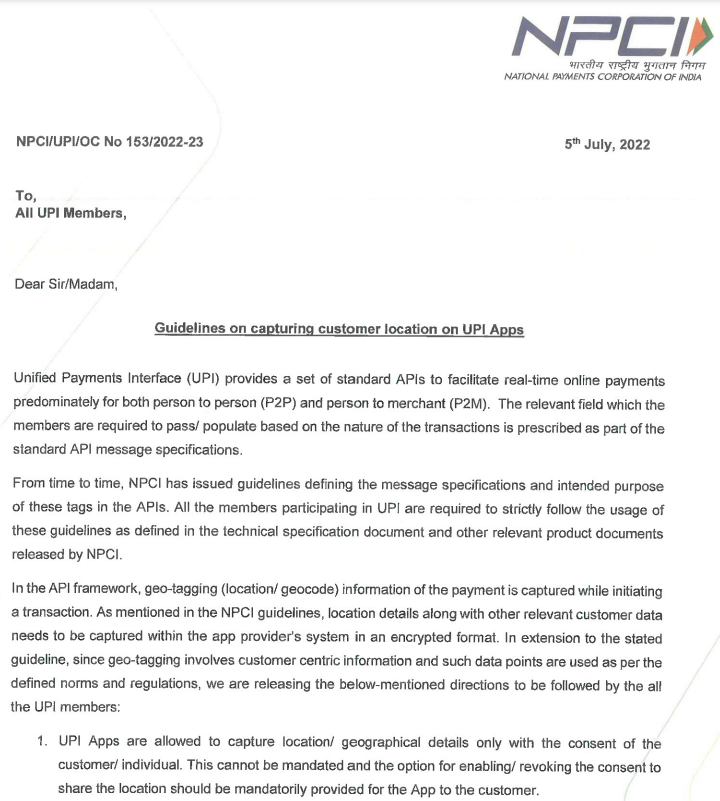

After 6 years and billions of transaction, @NPCI_NPCI talks about 'consent' while collecting geo-coords for every #UPI txn & gives 6 more months time to make such data collection a choice based consent.

Is there a #GPS coord in India - where @NPCI_NPCI doesn't have txn data

Is there a #GPS coord in India - where @NPCI_NPCI doesn't have txn data

#CashlessConsumer had noted about this geo-coord collection for every txn as a key surveillance concern back in 2017 - medium.com/cashlessconsum…

In the light of recent #CrPC91 request - it is valuable to revisit the privacy guarentees in the payment systems and #PaymentsPrivacy is key to having civil liberties and is no longer a niche digital rights problem.

#CashlessConsumer #Policy The Committee of Experts (CoE), led by #KrisGopalakrishnan, released a revised report on the Non-Personal Data (NPD) Framework (NPD Version 2) report on 16 December 2020 static.mygov.in/rest/s3fs-publ… 1/

Payments has seen data governance related regulation since #PaymentsDataLocalisation and data governance (both personal and non-personal data) impacts consumers as much as any other regulation 2/

#CashlessConsumer in the past have expressed strongly on issues of data governance, especially with #BBPS (medium.com/cashlessconsum…) and #FASTag (docs.google.com/document/d/e/2…) 3/

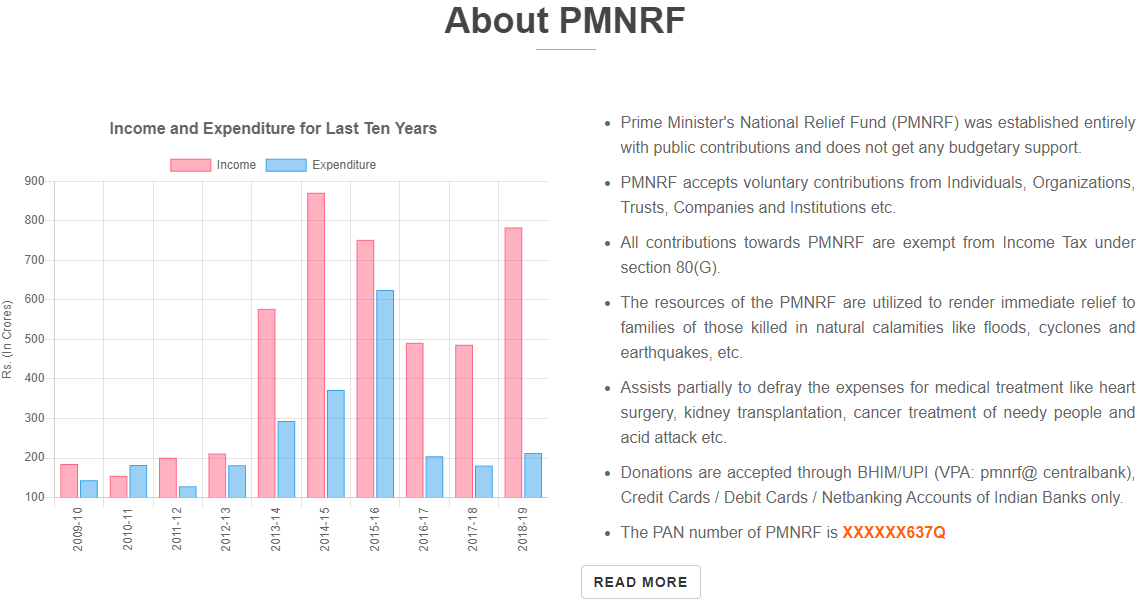

Why is pmnrf.gov.in not used and a personal branding named fund being used for this? PMNRF has receipt generation, in existance for ages. PM-CARES attempts at profiting out of disaster. #DisasterPayments

But there is more. pmnrf.gov.in/en masks PAN of the fund to XXXXXX 637Q. What is the need for masking a PAN of a fund? Privacy for PM fund?

#CashlessConsumer studied #DisasterPayments and AACTP 4637 Q is the PAN of PMNRF. PMNRF also allows people to download receipts. PM-CARES doesn't have neither, didn't give a PAN for claiming 80G exemption.

docs.google.com/spreadsheets/d…

docs.google.com/spreadsheets/d…

#CashlessConsumer Following up on consent-less auto fetch privacy violations in #BBPS

#NPCI's own data shows the practice of building credit profiles continue rampantly completely disregarding user consent & NPCI notice.

medium.com/cashlessconsum…

#NPCI's own data shows the practice of building credit profiles continue rampantly completely disregarding user consent & NPCI notice.

medium.com/cashlessconsum…

In Oct 2018, #CashlessConsumer complained to RBI/NPCI and top fintechs/banks about the privacy abuse in #BBPS for building credit profile database without the consent of individual medium.com/cashlessconsum…

NPCI responded on Nov 1, 2018 with a circular mandating all BBPS ecosystem participants to ensure customer consent for bill fetch and provide opt out of auto fetch provisions and comply with circular in 60 days

bharatbillpay.com/download.php?f…

bharatbillpay.com/download.php?f…

#CashlessConsumer @anivar@chowchow.social is at #AadhaarTribunal and is talking on intersection of #Aadhaar and #DigitalPayments / #Fintech.

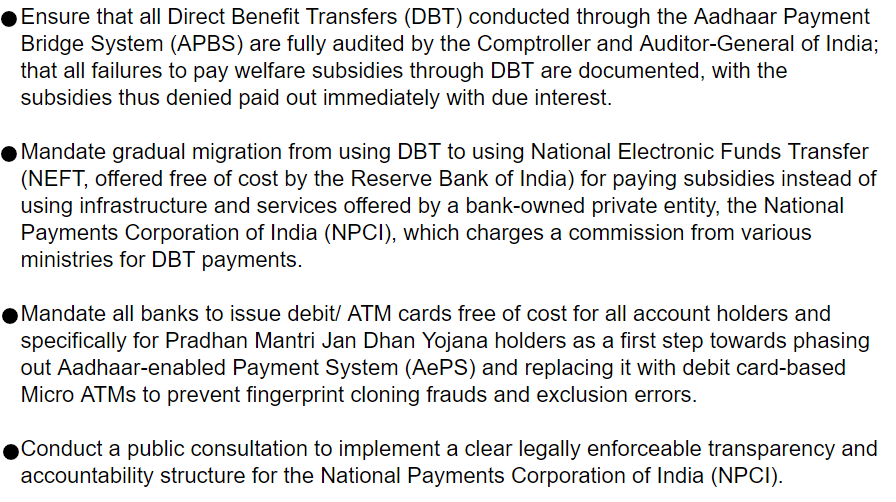

#CashlessConsumer makes the following demands to seek a reform in #DBT / payments infrastructure

#CashlessConsumer makes the following demands to seek a reform in #DBT / payments infrastructure

1. A thorough #CAG audit on #DBT infra to officially document the reasons for exclusions (untraceable payments referred in #NITIAayog Poshan report) and detailed report on #APB, compensate the beneficiaries who are denied welfare benefits with interest

thehindu.com/news/cities/ch…

Just read about #Paranur toll plaza violence that happened over weekend. The issue is mainstream debate in Tamil media. #Thread

Just read about #Paranur toll plaza violence that happened over weekend. The issue is mainstream debate in Tamil media. #Thread

The incident allegedly sparked off after SETC bus entered over the extreme left lane meant for 2 wheeler / emergency vehicles and there was a verbal tussle between driver and toll staff.

#Paranur toll is highly saturated, gets 2.5x traffic than designed capacity of the highway.

#Paranur toll is highly saturated, gets 2.5x traffic than designed capacity of the highway.

It must also be noted the concession period has ended and there is a case pending in Madras HC. Voices in media suggest bouncers being used to collect toll (and there are allegations of dwindling0

#CashlessConsumer Much has been talked about #ZeroMDR amidst lot of panic based misinformation, half truths.

1.1.2020 marked 3 significant changes to payment industry all of which have deep implications. #Thread

1.1.2020 marked 3 significant changes to payment industry all of which have deep implications. #Thread

Facts first and opinions later.

On 30 Dec, FinMin clarified provisions in Finance Act relating to digital payments

1. 269SU meant for large companies > 50 Crores, mandating to accept "prescribed modes"

2. 271DB - Penalty for violating 269SU

On 30 Dec, FinMin clarified provisions in Finance Act relating to digital payments

1. 269SU meant for large companies > 50 Crores, mandating to accept "prescribed modes"

2. 271DB - Penalty for violating 269SU

incometaxindia.gov.in/communications… - Link to notification.

269SU makes #ZeroMDR, but important to note its applicable only for large businesses and only for "prescribed modes"

Prescribed modes came via incometaxindia.gov.in/communications…

269SU makes #ZeroMDR, but important to note its applicable only for large businesses and only for "prescribed modes"

Prescribed modes came via incometaxindia.gov.in/communications…

QR code option may be must for shops toi.in/AkXzyY66/a24gk via @TOIBusiness | This take over of cash by a lobby is suicidal for the economy. #Thread time #CashlessConsumer

The above story starts from 29th @GST_Council meeting where GoM on digital payments discussed incentivising digital payments. The minutes are at gstcouncil.gov.in/sites/default/… …

Start at Page 29.

Start at Page 29.

The incentive is restricted to @NPCI_BHIM and @RuPay_npci cards - casually mentioned in 8.13 as "Government·oflndia owned cards i.e. RuPay (Debit card) and tlle BHIM application"

Plain lies being used to divert sovereign tax to a private company. If this is not scam, what is?

Plain lies being used to divert sovereign tax to a private company. If this is not scam, what is?

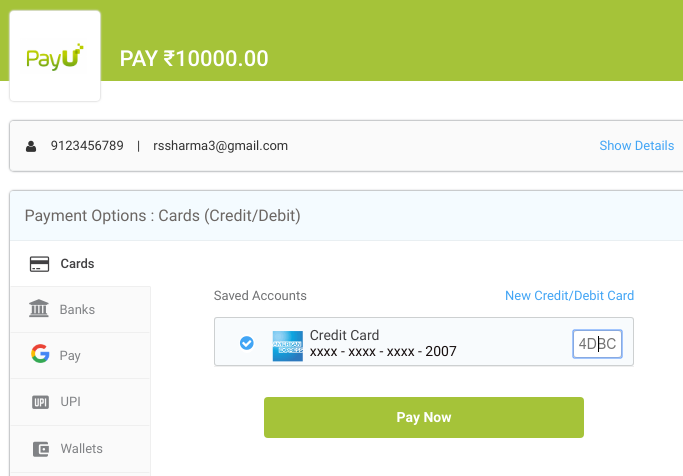

Dear @rssharma3 This is NOT about #Aadhaar, but your data is being leaked by @PayUmoney I just had to enter your email ID to get your stored card. I don't know how you see this. #Privacy #DataProtection

1. Please Delete your stored card from payumoney.com/customer/dashb…

1. Please Delete your stored card from payumoney.com/customer/dashb…

The issue was reported to PayU months back, but the company seems to not understand the issue of tokenized card information exposing last 4 digits as a privacy issue.

netspaceindia.com/warning-payu-u…

netspaceindia.com/warning-payu-u…

This was what @PayUmoney had to say when @jaivardhan88 of @entrackr asked them about it few months back.