Discover and read the best of Twitter Threads about #EmergingMarkets

Most recents (24)

Union Finance Minister Smt. @nsitharaman, Governor for India in @ADB_HQ, participated as a panelist in the Governors' Seminar on the theme 'Policies to Support Asia's Rebound', held as part of 56th #ADBAnnualMeeting, in Incheon, South Korea, today. @IndiainROK

(1/11)

(1/11)

Besides FM Smt. @nsitharaman representing as Governor for India, Ms Sri Mulyani Indrawati, Indonesia; Mr Niels Annen, Germany; Mr Changyong Rhee, Republic of Korea; & @ADBPresident and Chairperson of the Board of Directors also participated. @IndiainROK

(2/11)

(2/11)

FM Smt. @nsitharaman stated that protection of vulnerable sections has been India's prime focus as the government charted its course towards #recovery from the #COVID19 Pandemic. @IndiainROK

(3/11)

(3/11)

1/3

√ Our global trade index contracted further, the most since July 2009 (-11.2% y/y)

√ For the first time since June, this was reflected in the volume of world exports which slowed to 1.7% y/y

√ Our global trade index contracted further, the most since July 2009 (-11.2% y/y)

√ For the first time since June, this was reflected in the volume of world exports which slowed to 1.7% y/y

2/3

√ In nominal terms, #EmergingMarkets exports had already peaked in June and preliminary data for November suggests a drop of 18% from that peak and 9% y/y

√ In nominal terms, #EmergingMarkets exports had already peaked in June and preliminary data for November suggests a drop of 18% from that peak and 9% y/y

Al Gore (#WEF trustee) et al. are SO CONCERNED about the climate, that they in the process of turning all of #nature into a new asset class – where they will OWN nature, manage/control nature, & profit from nature (via "Natural Asset Companies").

#COP27 #EmergingMarkets #30x30

#COP27 #EmergingMarkets #30x30

Of course, this has nothing to do w/ Gore's Generation Investment (#hedgefund co-founded w/ David Blood from Goldman Sachs), #BlackRock, saving capitalism, or the expansion of #privatization. Rather, it's to save the planet.

The $4,000 trillion #climate wealth opportunity.

⬇️

The $4,000 trillion #climate wealth opportunity.

⬇️

David Blood to Mark Carney (TCFD/TNFD, #UN Special Envoy for #Climate), 2021:

"We know that #NaturalClimateSolutions are a critical part of the transition to #NetZero & we've known this for quite some time. Why is it so difficult for us in finance [] to put a value on nature?"

"We know that #NaturalClimateSolutions are a critical part of the transition to #NetZero & we've known this for quite some time. Why is it so difficult for us in finance [] to put a value on nature?"

Day 1, #COP27: Bloomberg & Three Cairns Group announced the Global Carbon Trust (GCT) to scale #carbon markets. (VCM).

#TSVCM (Mark Carney) estimates that carbon markets must grow 15-fold by 2030 & 100-fold by 2050.

#NetZero #Forests #EmergingMarkets

carboncredits.com/three-cairns-g…

#TSVCM (Mark Carney) estimates that carbon markets must grow 15-fold by 2030 & 100-fold by 2050.

#NetZero #Forests #EmergingMarkets

carboncredits.com/three-cairns-g…

June 30, 2022: "World’s Biggest Ever #CarbonCredits Issue Planned in Gabon"

Nov 8, 2022: #Africa Carbon Markets Initiative (ACMI) launched at #COP27.

Profiting from pollution. #Privatization of nature.

"This is like Black Friday for climate change." - @johnsteppling

Nov 8, 2022: #Africa Carbon Markets Initiative (ACMI) launched at #COP27.

Profiting from pollution. #Privatization of nature.

"This is like Black Friday for climate change." - @johnsteppling

Bloomberg, Jun 2 2021: "If they generate a lower carbon benefit than they claim & the company is still emitting, well then you end up with more emissions than you would have otherwise. We have to be open to the idea that the voluntary market might fail."

bloomberg.com/news/features/…

bloomberg.com/news/features/…

THREAD: A picture is worth a thousand words. Let's look at a few of the globe's largest #ETF's & their graphs & see if we can make some sense of the current market environment.

What a year it's been for #Oil & #Energy! Only positive YTD #MSCI #Sector.

$IXC

What a year it's been for #Oil & #Energy! Only positive YTD #MSCI #Sector.

$IXC

2/19

#Global #CleanEnergy #ETF relative to Global #Energy shows an interesting picture.

$ICLN vs $IXC

#Global #CleanEnergy #ETF relative to Global #Energy shows an interesting picture.

$ICLN vs $IXC

3/19

#EmergingMarkets #ETF seriously lagging #DevelopedMarkets ETF, mostly due to disinvestment from #China.

#SouthAfrica might be down over 1YR, but $EZA performance in USD (-15.9%) is still way ahead of both $URTH (DM -22.2%) & $EEM (EM -28.9%) over the same period.

#EmergingMarkets #ETF seriously lagging #DevelopedMarkets ETF, mostly due to disinvestment from #China.

#SouthAfrica might be down over 1YR, but $EZA performance in USD (-15.9%) is still way ahead of both $URTH (DM -22.2%) & $EEM (EM -28.9%) over the same period.

🧵 Is the American Dream dead? - a tweetstorm

This is a brain dump of .@RaoulGMI's 30+ years of knowledge, how the world works, and how his macro framework fits into it all ⤵️

This is a brain dump of .@RaoulGMI's 30+ years of knowledge, how the world works, and how his macro framework fits into it all ⤵️

1/ There's no denying that we're in a mess!

By the Law of Unintended Consequences, every time we try to fix A, we create problems B, C, D, E, etc.

We hardly understand these new problems unless there's hindsight to connect the dots...

By the Law of Unintended Consequences, every time we try to fix A, we create problems B, C, D, E, etc.

We hardly understand these new problems unless there's hindsight to connect the dots...

1/n #RED #ALERT !! This has to REACH MAXIMUM people so people #RETWEET. You will Understand ONLY when you have read it. I have been talking about the Impact of Interest Rates on #AssetAllocation. There could be NOBODY ELSE world-over who understands this, better than #LarryFink

2/n In response to a question potential for client rebalancing into fixed income just as rates and markets eventually stabilize.

ANSWER: “Traditional 60-40 allocations are certainly at a balance, and portfolio liquidity profiles have also been impacted.”

ANSWER: “Traditional 60-40 allocations are certainly at a balance, and portfolio liquidity profiles have also been impacted.”

3/n “for the first time in years, investors can actually earn very attractive yields without taking much duration or credit risk. Just a year ago, the U.S. two-year treasury notes were yielding 25 basis points”

India is emerging as one of the relatively better-off economies in the post-COVID world.

#indianeconomy

(2/n)

#indianeconomy

(2/n)

Looking closely, we find that India’s inflation is well controlled, ATH FX reserves have acted well as a shock absorber against volatility, and our GDP growth expectations is one the highest in the world!

#inflation #volatility #GDP

(3/n)

#inflation #volatility #GDP

(3/n)

The Power of The Dollar 🧵

[a thread for normies -like me]

[a thread for normies -like me]

Long periods of #dollar-strength often ended with massive financial dislocations like the Latin American #debt crisis of the 80s and the Asian crisis of the 90s.

Oppositely, long periods of a weakening dollar came with strong markets like between 2003-2007.

1/20

Oppositely, long periods of a weakening dollar came with strong markets like between 2003-2007.

1/20

Although the #USdollar is not itself an asset, cash is.

The dollar is the most common currency in which assets are quoted and exchanged in #financialmarkets and the economy.

It's the world's reserve currency (for now at least...) 2/ 20

The dollar is the most common currency in which assets are quoted and exchanged in #financialmarkets and the economy.

It's the world's reserve currency (for now at least...) 2/ 20

Skyrocketing #global #foodprices, panicked low income and poorer fringes of the population facing severe #hardship, struggling #emergingmarkets and #SriLanka on the verge of #anarchy - all wrapped up in a massive #market sell-off: what is happening 🌎 ❓

Things did not improve in April on #food prices:

the #FAO Food Price Index fell 0.8% month-over-month to 158.5 points in April 2022, but still remained close to the all-time high of 159.7 points in March.

the #FAO Food Price Index fell 0.8% month-over-month to 158.5 points in April 2022, but still remained close to the all-time high of 159.7 points in March.

#vegetableoil prices declined significantly (-5.7%) after hitting an all-time high in March under pressure from #palm, #sunflower and #soybean #oils.

In addition, #grain prices fell slightly (-0.4%), after also rising to all-time highs in March.

In addition, #grain prices fell slightly (-0.4%), after also rising to all-time highs in March.

1/x

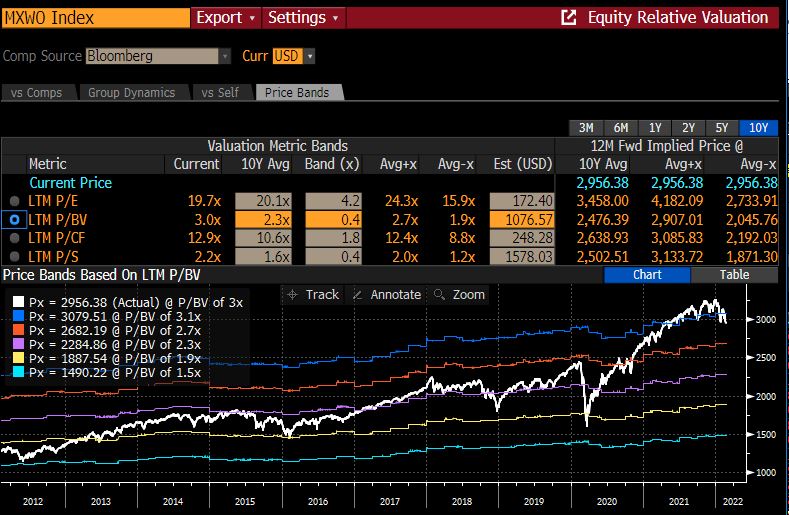

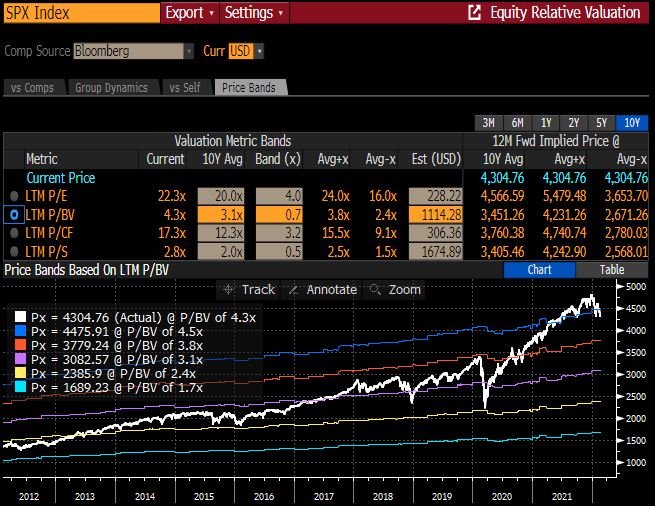

Sentiment check across markets. P/BV vs 10y averages. Assuming companies will perform neither better or worse fundamentally than they've shown historically, and shareholders will pay what they have on average have paid for those companies. Starting with #SPX500

Sentiment check across markets. P/BV vs 10y averages. Assuming companies will perform neither better or worse fundamentally than they've shown historically, and shareholders will pay what they have on average have paid for those companies. Starting with #SPX500

#SPX500 would need to come down to slightly above 3100 to reach its 10y average.

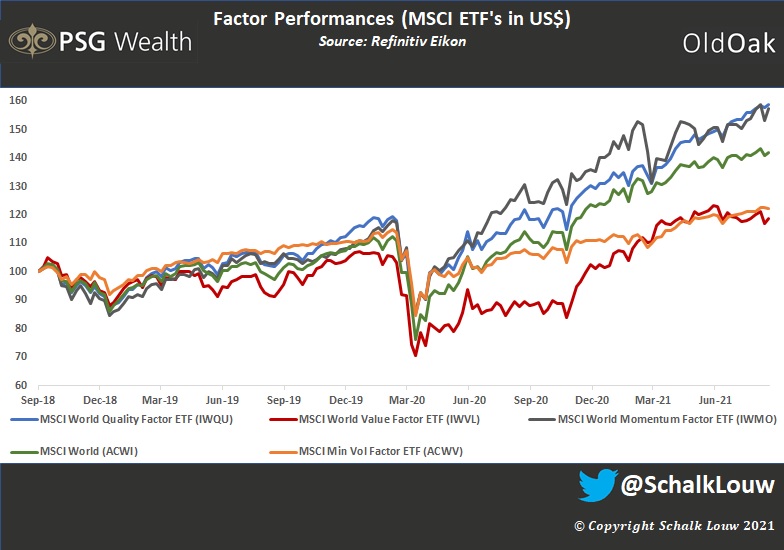

THREAD: A picture is worth a thousand words. Let's look at a few #ETF graphs & see if we can make some sense of the current market environment.

What a year it's been for #Oil & #Energy! Sharing only positive YTD #MSCI #Sector performance with #Financials.

$IXC $IXG

What a year it's been for #Oil & #Energy! Sharing only positive YTD #MSCI #Sector performance with #Financials.

$IXC $IXG

2/15

#EmergingMarkets #ETF seriously lagging #DevelopedMarkets ETF, mostly due to disinvestment from #China.

#SouthAfrica might need a lot of catch up, but $EZA 1YR performance in USD (+9.9%) is still ahead of $EEM (-11.3%)

$URTH

#EmergingMarkets #ETF seriously lagging #DevelopedMarkets ETF, mostly due to disinvestment from #China.

#SouthAfrica might need a lot of catch up, but $EZA 1YR performance in USD (+9.9%) is still ahead of $EEM (-11.3%)

$URTH

The forging of a new social contract. "New normal" requires constant threat w/ potential emergency lurking behind every piece of plexiglass. A new frame in which global #surveillance expands under guise of health w/ bodily autonomy placed under corporate domain. #McKinsey #Reset

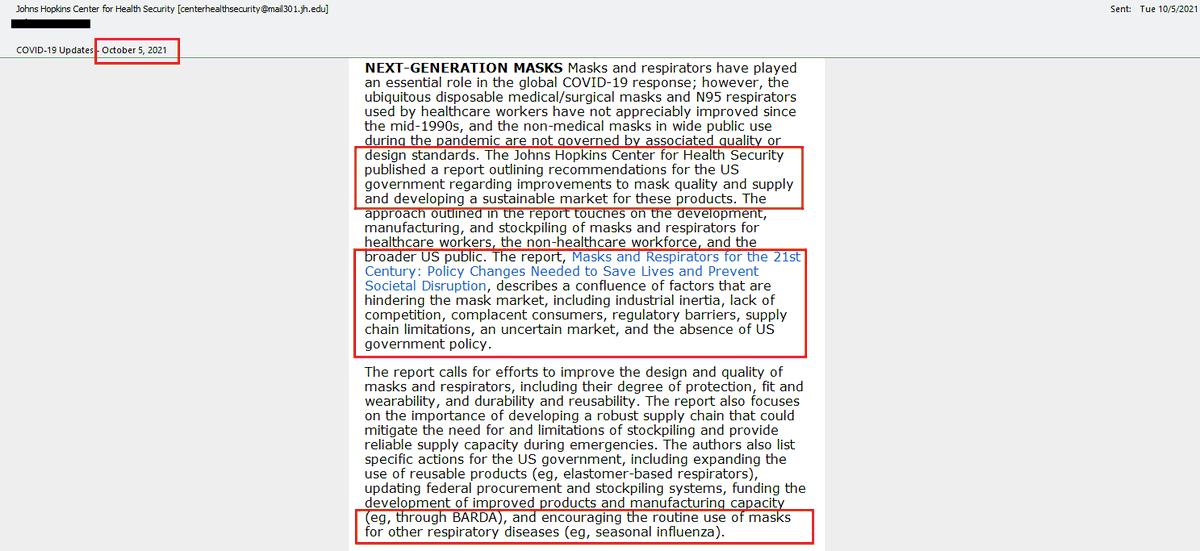

"NEXT-GENERATION MASKS"

Oct 5, 2021, Johns Hopkins: "It is important to have a ready supply & surge manufacturing capacity of high-quality devices when severe or catastrophic respiratory epidemics emerge."

#EmergingMarkets

#NewNormal

#Conditioning

Oct 5, 2021, Johns Hopkins: "It is important to have a ready supply & surge manufacturing capacity of high-quality devices when severe or catastrophic respiratory epidemics emerge."

#EmergingMarkets

#NewNormal

#Conditioning

"#Social #Science of Cultural Change"

"A change in normative #behavior is needed if the goal is to increase public mask use after the pandemic. Some have called this the “culture of safety” in #healthcare; the same behaviors would apply to the general public." [p. 19]

"A change in normative #behavior is needed if the goal is to increase public mask use after the pandemic. Some have called this the “culture of safety” in #healthcare; the same behaviors would apply to the general public." [p. 19]

Again.

Anyone who promotes, supports, condones, normalizes, or stays silent on a global experiment on #children is a monster. It's that simple - & that grotesque. To serve capital, #biotech/#EmergingMarkets, rather than protecting the most vulnerable of society, is unforgivable.

Anyone who promotes, supports, condones, normalizes, or stays silent on a global experiment on #children is a monster. It's that simple - & that grotesque. To serve capital, #biotech/#EmergingMarkets, rather than protecting the most vulnerable of society, is unforgivable.

#Global #ETF (thread): 26 Aug 2021

- 2020 worst perf #sectors making still leading in 2021 $IXG $IXC

- This is helping #oil producing countries with #SaudiArabia & #UAE in top5 #Country ETF YTD performers in USD $KSA $UAE

- #SouthAfrica $EZA still in top30 YTD performers

- 2020 worst perf #sectors making still leading in 2021 $IXG $IXC

- This is helping #oil producing countries with #SaudiArabia & #UAE in top5 #Country ETF YTD performers in USD $KSA $UAE

- #SouthAfrica $EZA still in top30 YTD performers

2/12

#EmergingMarkets #ETF seriously lagging #DevelopedMarkets ETF, mostly due to disinvestment from #China.

#SouthAfrica might need a lot of catch up, but $EZA YTD performance in USD (+8.2%) is still ahead of $EEM (-0.95%)

#EmergingMarkets #ETF seriously lagging #DevelopedMarkets ETF, mostly due to disinvestment from #China.

#SouthAfrica might need a lot of catch up, but $EZA YTD performance in USD (+8.2%) is still ahead of $EEM (-0.95%)

"#Imperialism is driven by the pressure of #capital for external fields of investment. The recurrent crises of overproduction & subsequent diminution of profits & stagnation of capital leads to ever-increasing pressure to expand markets & territories."

#Biotech #EmergingMarkets

#Biotech #EmergingMarkets

January 28, 2019, Imperial College, World Economic Forum partner, Davos.

The question to "global leaders": "How can we lead a #vaccine revolution?" (Twitter, March 16, 2019)

#4IR #Biotech #WEF

The question to "global leaders": "How can we lead a #vaccine revolution?" (Twitter, March 16, 2019)

#4IR #Biotech #WEF

January 2021, TIME, double issue. "The #Vaccine #Revolution" has arrived.

TIME - owned by Marc Benioff, CEO/founder of #Salesforce. World Economic Forum Board of Trustees. Inaugural Chair, Forum Centre for the Fourth Industrial Revolution, San Francisco.

#WEF #4IR #Biotech

TIME - owned by Marc Benioff, CEO/founder of #Salesforce. World Economic Forum Board of Trustees. Inaugural Chair, Forum Centre for the Fourth Industrial Revolution, San Francisco.

#WEF #4IR #Biotech

Within past few days the American Academy of #Pediatrics has quietly removed its "#Face Time & #Emotional #Health" info sheet (PDF) for parents w/ new infants.

It can still be found in web archives:

web.archive.org/web/2021081110…

[h/t @Bleedinheart2MD, @tapuaetai_l, @galexybrane]

It can still be found in web archives:

web.archive.org/web/2021081110…

[h/t @Bleedinheart2MD, @tapuaetai_l, @galexybrane]

American Academy of Pediatrics (AAP) & AAP Friends of Children Fund, partners & corporate donors:

Johnson & Johnson

Seqirus

Sanofi

Sobi

Nestlé

Abbott

Genentech (Roche)

Merck

GlaxoSmithKline

Kaléo

Novo Nordisk

Supernus

More👇

#4IR #Biotech #EmergingMarkets #SDGs

Johnson & Johnson

Seqirus

Sanofi

Sobi

Nestlé

Abbott

Genentech (Roche)

Merck

GlaxoSmithKline

Kaléo

Novo Nordisk

Supernus

More👇

#4IR #Biotech #EmergingMarkets #SDGs

"An Eco-wakening" - "Measuring global awareness, engagement & action for nature" - ©️The Economist Intelligence Unit Limited 2021- commissioned by #WWF

Panel includes #WEF, #Avaaz, etc. Funding: #MAVA.

[p. 3]

Measuring social license required for financialization of #nature.

Panel includes #WEF, #Avaaz, etc. Funding: #MAVA.

[p. 3]

Measuring social license required for financialization of #nature.

Economist Intell. Unit : "Through a global network of more than 650 analysts & contributors, the EIU continuously assesses & forecasts political, economic & business conditions in more than 200 countries."

#CorporateCoup of the commons

#COVID19 as catalyst. #NaturePositive

#CorporateCoup of the commons

#COVID19 as catalyst. #NaturePositive

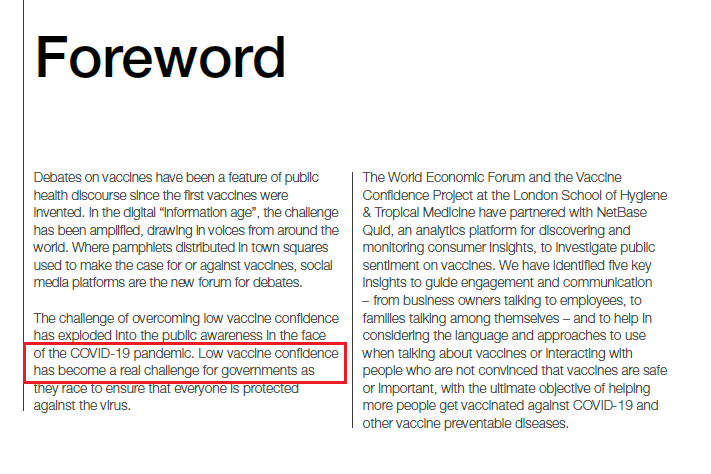

May 2021 report by the #WEF, "How to Build #Trust in #Vaccines seeks to understand how these online conversations can influence our #beliefs around vaccines. [] in partnership w/ the Vaccine Confidence Project, researchers used #AI tools to analyse online discussions." #Biotech

"The report finds that above all, we need to encourage #language that breeds #trust. The researchers say, “trust in the individuals, #institutions & overall #system that together discover, develop & deliver vaccines is fundamental to vaccine confidence.

#4IR #Reset #Biotech

#4IR #Reset #Biotech

Foreword: "Low #vaccine #confidence has become a real challenge for governments..."

The #WEF & Vaccine Confidence Project partnered with NetBase Quid ["How can we help drive your business?"]

#Gates #4IR #Biotech #Bioengineering #EmergingMarkets

The #WEF & Vaccine Confidence Project partnered with NetBase Quid ["How can we help drive your business?"]

#Gates #4IR #Biotech #Bioengineering #EmergingMarkets

"Co-hosted by Richard Curtis & Mark #Carney – & featuring senior leaders from the financial world – the summit discussed how the $50 trillion invested by #pension funds globally can help tackle the #climate #emergency."

#COP26 #SavingCapitalism

#COP26 #SavingCapitalism

"...with 47 trillion dollars in #pension funds globally this sector plays a major role we need to get our savings for the future shaping the future."

#TheyMeanBusiness #EmergingMarkets #COP26

#TheyMeanBusiness #EmergingMarkets #COP26

If recent history serves as a barometer for public embrace of corporate "solutions" (marketed via #storytelling & #NGOs), it is not difficult to envision whole societies soon demanding their #pensions be "unlocked" by those attempting to save the faltering #capitalist system.

Ontario Canada: "The world's longest #lockdown will come to an end next week" (Step 3, July 16/21).

No. It's not over.

New chief medical officer of health, Dr Kieran Moore makes clear #endemic state will emerge in fall w/ Ont. "doing all the due diligence to prepare."

No. It's not over.

New chief medical officer of health, Dr Kieran Moore makes clear #endemic state will emerge in fall w/ Ont. "doing all the due diligence to prepare."

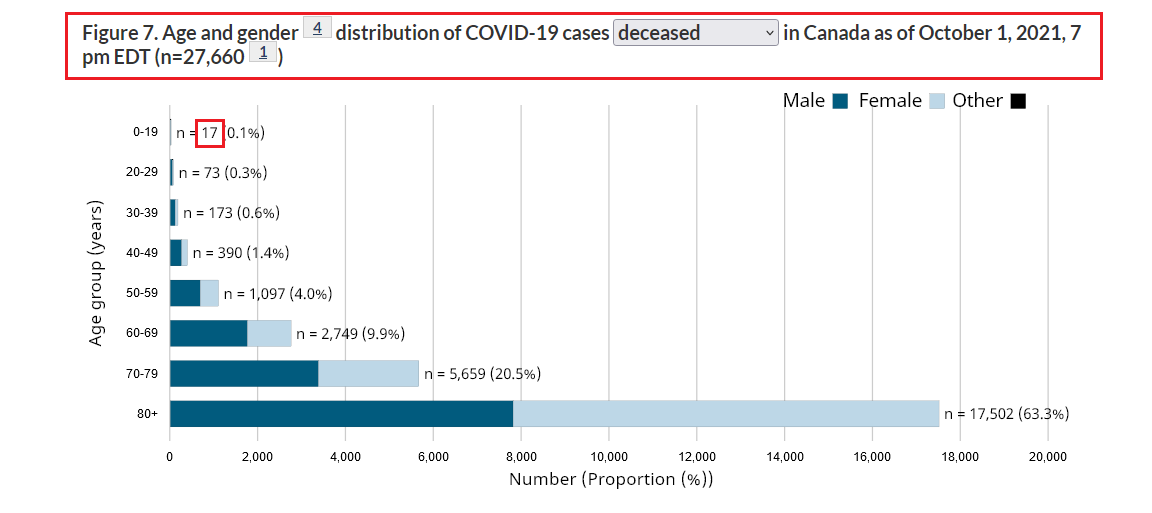

Let's explore numbers behind "world's longest #lockdown", Ont., Canada. Gov't of Ontario website updated July 11, 2021.

"Active cases" in Ont. as of July 11 2021 under 20 yrs of age: 0

Deaths under 20 w/ #COVID19 - 3.

Estimated pop. of Ontario: approx. 14.73 million people.

"Active cases" in Ont. as of July 11 2021 under 20 yrs of age: 0

Deaths under 20 w/ #COVID19 - 3.

Estimated pop. of Ontario: approx. 14.73 million people.

Under 20 yrs:

Jan 15 2020 to July 11 2021:

Resolved cases: 68, 280

Active cases: 0

Deaths (WITH #covid19): 3

[Keeping in mind that Covid tests are inaccurate (false positives) & largely meaningless as testing positive can mean mild to no symptoms whatsoever.]

Jan 15 2020 to July 11 2021:

Resolved cases: 68, 280

Active cases: 0

Deaths (WITH #covid19): 3

[Keeping in mind that Covid tests are inaccurate (false positives) & largely meaningless as testing positive can mean mild to no symptoms whatsoever.]

1/X - So #Pakistan is under review for "downgrade" to Frontier index. Personally I think it would be a good move. At 2bps of MSCI EM it will continue to be ignored. A few observations on MSCI Frontier Index and its use:

#EmergingMarkets #FrontierMarkets

#EmergingMarkets #FrontierMarkets

2/X - There is a structural flaw in the algorithm deciding country weights. As opposed to MSCI EM where 50% free float is required, in FM index a mere 7,5% free-float is required. Not a brilliant idea as it gives a higher weight to "zombie markets" with zero liquidity.

3/X - It is ridiculous that #Bangladesh with >150 musd a day has 1/3 of the weight of #Kenya with 6 musd.

The Best of #Finance #Twitter

.

#Thread

.

Thanks @VolQuant for sharing (!) 👍 and @HSBC trading desk for preparing 👏

.

#EmergingMarkets #forex #cryptocurrency #bitcoin #Macroeconomics #fx #trading #chart #equities #vol

.

Updates at the end of the thread

.

#Thread

.

Thanks @VolQuant for sharing (!) 👍 and @HSBC trading desk for preparing 👏

.

#EmergingMarkets #forex #cryptocurrency #bitcoin #Macroeconomics #fx #trading #chart #equities #vol

.

Updates at the end of the thread

Unprecedented #coercion.

#Trudeau & Theresa Tam (chief public #health officer of #Canada) continue to insist a min. 75% of all Canadians must be injected w/ 1st dose of experimental #vaccines, & 20% w/ 2nd dose- before deadly #lockdowns will be lifted.

ctvnews.ca/health/coronav…

#Trudeau & Theresa Tam (chief public #health officer of #Canada) continue to insist a min. 75% of all Canadians must be injected w/ 1st dose of experimental #vaccines, & 20% w/ 2nd dose- before deadly #lockdowns will be lifted.

ctvnews.ca/health/coronav…

Many Canadians (on stolen land) believe that if they take experimental jab, #lockdowns will end.

Wrong. This is just the beginning - of a #permanent program.

May 8 2021: "Tam warns that full #vaccination does not equal full protection from #COVID19"

ctvnews.ca/health/coronav…

Wrong. This is just the beginning - of a #permanent program.

May 8 2021: "Tam warns that full #vaccination does not equal full protection from #COVID19"

ctvnews.ca/health/coronav…

May 8 2021, CBC:

#COVID19 to becoming #endemic "meaning a base level of infection remains within Canada's borders & may show up annually like the #flu. That situation speaks to the need for booster #shots to adapt to any #variants..."

#EmergingMarkets

cbc.ca/news/health/4t…

#COVID19 to becoming #endemic "meaning a base level of infection remains within Canada's borders & may show up annually like the #flu. That situation speaks to the need for booster #shots to adapt to any #variants..."

#EmergingMarkets

cbc.ca/news/health/4t…