Discover and read the best of Twitter Threads about #GDX

Most recents (11)

Silver (1/4)

The top portion shows silver/nasdaq ratio.

The middle portion shows the gold/silver ratio.

The bottom portion shows the silver price.

Here we have two ratios, which both appear to be about to breakout higher and lower respectfully. See what happens when they do.

The top portion shows silver/nasdaq ratio.

The middle portion shows the gold/silver ratio.

The bottom portion shows the silver price.

Here we have two ratios, which both appear to be about to breakout higher and lower respectfully. See what happens when they do.

HILO #SILVER #GOLD #GDX y colaterales minerías metales industriales. SECTORES PERROS en 2021, a vigilar este 2022, Empiezo por SILVER SEMANAL Y GDX semanal, que es otra tematica en la que había mucha literatura/esperanza, pero está todo relacionado, y los mismos niveles.

Hay dos zona claves, en plata el 25.50, y en GDX 35 para que en semanal podamos decir que ya existe un nuevo set de minimos y máximos crecientes, es decir nacimiento de tendencia.

#SILVER DIARIO el aspecto técnico divergente es bueno, y es sector perro, quiere decir, que si el mercado se fija en lo barato, no tendrá mas remedio.

Gold is now in the third month of consolidating; I view this chart pattern as a bullish consolidation as Managed Money speculative positions are now down 65% from previous highs. One fundamental positive last week, was India returning to a premium to world markets. Indian...

#Gold Feelings have strong impact on investors. We are in wave 2 of wave C (down). This is the hardest place to stay objective. Sentiments influenced by wave B and wave C. My approach: Observe 1) EW-structure 2) USDJPY 3) Miners 4) Silver 5) TIPS. GOLD IS ABOUT TO CRASH

#Silver neg. on Day, #GDX #Miners neg. on Day, #Bitcoin neg. on Day. Massive neg. RSI divergence on #Gold. Major turn in gold is imminent!

Why is it that everybody always panics in wave 2. Look at the structures, guys. We have seen it million times before. Same divergences, same lead from other assets, same looong turns, same sentiments. Structures - and patience!👍🙂

Good morning! Let's have an update on markets as it has now become very clear, that we are to see the #Deflation unfolding, which I have mentioned here for a long time. Why hasn't it really hurt yet - and what to expect? Stay tuned for some #HZupdates

I have shown my #Oil chart for a long time with Ending Diagonal. Since talks of oil >100USD - and during spikes in oil due to attacks in ME. All noise!! Structures drive price - and we are en route towards <20USD - perhaps as low as ~10USD for Oil. #Deflation unfolding!

I have shown #Deflation in #CRB chart. Broken lower trendline and now heading towards much lower levels to be reached this year! It will be a SECULAR BOTTOM - hence this is from where #STAGLFLATION will develop, as economy continues to plummet and prices begin to rise #HZupdates

2020 weekly close thread for PFAS.

Down 0.17% over the first two trading sessions. 11 up, 9 down, 5 unch...

No movements greater than 5%

Divis #ULS #RECI

Exit: #RRE (too crowded, no edge)

Slice: #AAZ (to 20% weight)

Now 8% cash which I plan to deploy next week

Good w/e all

Down 0.17% over the first two trading sessions. 11 up, 9 down, 5 unch...

No movements greater than 5%

Divis #ULS #RECI

Exit: #RRE (too crowded, no edge)

Slice: #AAZ (to 20% weight)

Now 8% cash which I plan to deploy next week

Good w/e all

#Gold BULL TRAP - Wait for it!

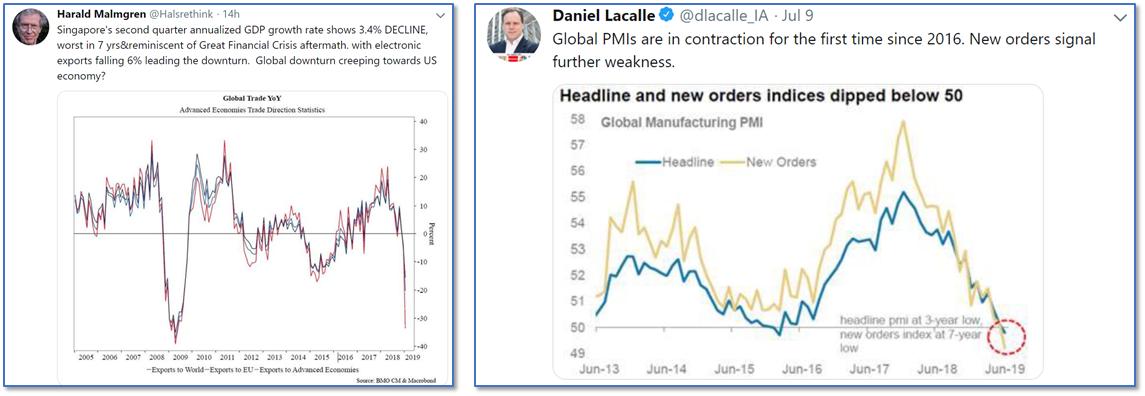

Dear all 🙂Hope you enjoy the weekend! We are still in the Twilight Zone. Despite continued deteriorating economic fundamentals across the globe, US stock market continues to rally. But for how long...? Stay tuned for some #HZupdates

Indicators and signals across the globe continue to suggest economic slowdown - which slowly but surely spreads to all geographical regions and industries. It is my firm belief, that US will not decouple and US #equities will realize this at some point #HZupdates

#WTI sends clear signal from major Ending Diagonal. We may rally further in wave (B) - but soon we will see a reversal, which will send #Oil towards its LT-target of <20USD #HZupdates

So - #Gold is rallying towards AT - right? Bulls have won! Somebody should send the memo to #Silver. While #Silver normally leads or peaks with Gold - Gold has been on its own spree. Man - I would love to join the Gold Euphoria 😉 Bear Flag - perhaps? #HZupdates

Somebody should also send that memo to #GDX. Notice how GDX bottoms and supports Gold in Bull market. New high in Gold = New High in GDX. Not what we see now! #HZupdates

But....#USD is breaking down as Fed will cut rates.... No - it is not! #DXY is CORRECTING in a clear stairs-like structure. We can see 95 or 94 - perhaps lower. But this is no breakdown #HZupdates

Good morning all! 😎 Trust you are well. #Oil declined hard last week. The deflationary environment is unfolding, as it has been laid out in #HZupdates. Please stay tuned for more!

Anybody who has been following my #deflationary scenario remembers my #Oil chart. The bounce, we saw from end 2018 until April 2019 was a wave "B" bounce in this wave 5 of the great Ending Diagonal. We will see Oil plummet to min. 22USD pot. all the wavy to ~10USD #HZupdates

This has not come as a surprise! #AUDUSD (Inflation gauge) had for a long time been flirting with LT-trendline from 2008. This was a sign of weakness in inflation - which could only play out, if Oil dropped (like the Ending diagonal suggested) #HZupdates

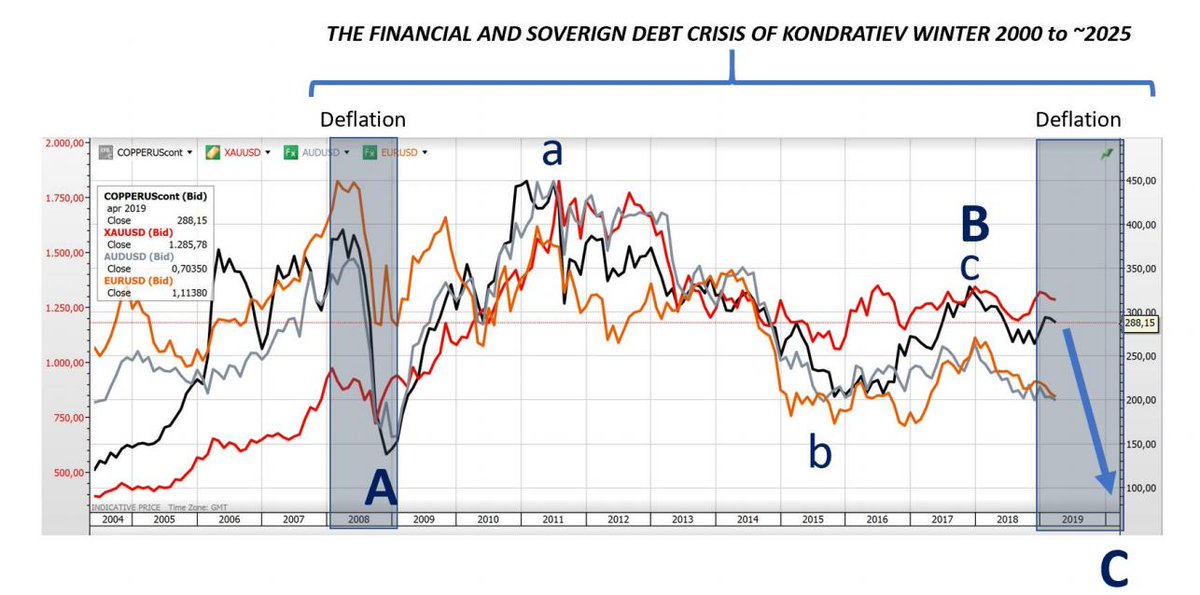

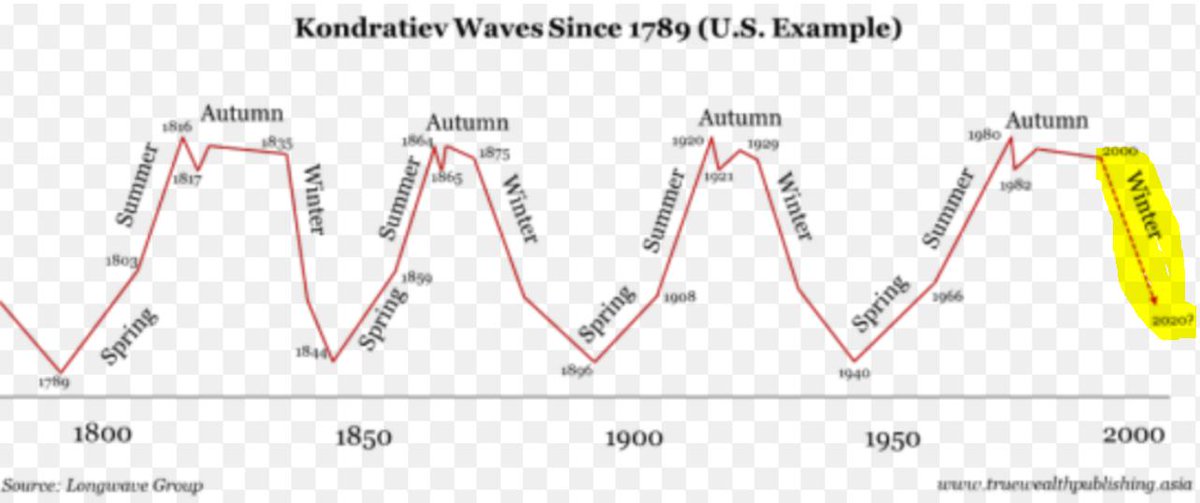

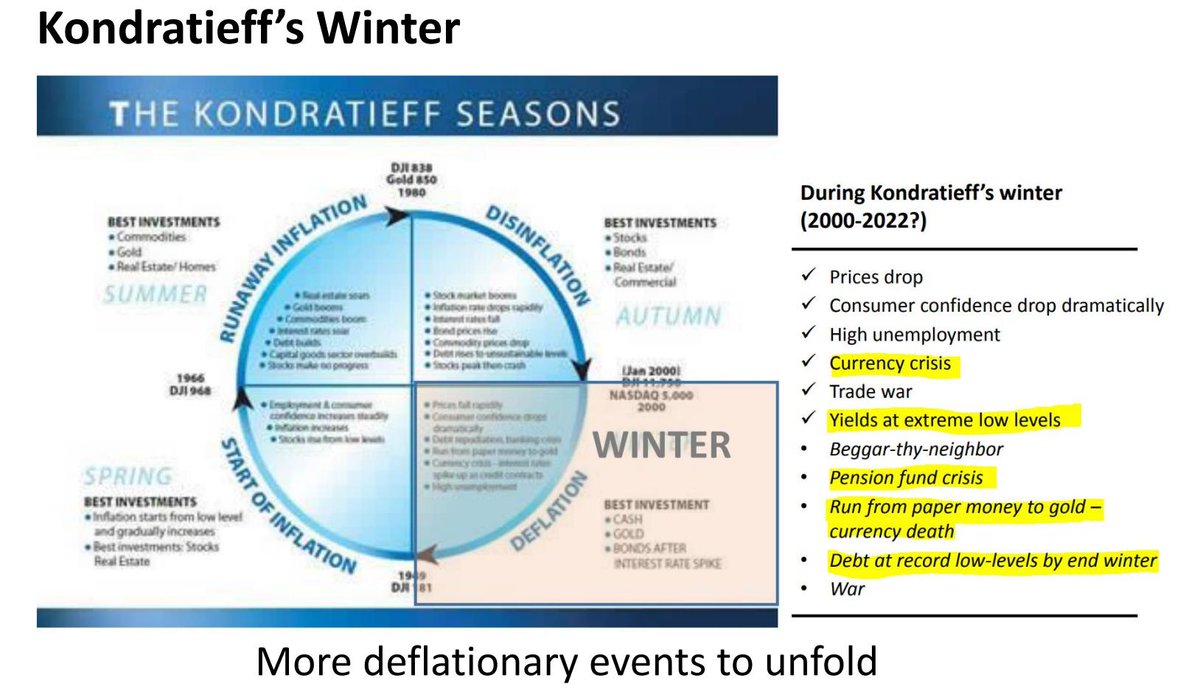

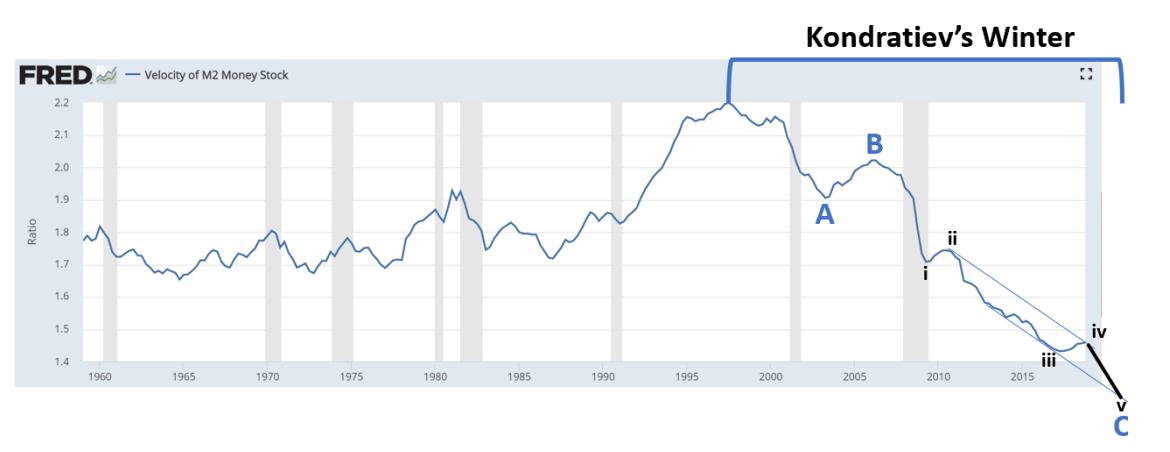

Hi #fintwit 😎 We are approaching a watershed moment in markets. Final deflationary phase of Kondratiev's winter is about to play out. Huge implications for #EUR, #Gold, #SP500, #DXY etc. I have some new interesting followers - hence something extra in this week's #HZupdates

#Kondratiev's winter is a period where #Velocity of Money drops which creates a disinflationary economic environment, where growth is subdued due to #debt levels. Since ~2000 we have been in this winter - and are still to see a range of "major economic events" unfold #HZupdates

In fact, we have never left the #Financial #Crisis. We have only been bouncing in the great "Financial and Sovereign Debt Crisis" of this #Kondratiev's winter. This can be observed from the #Deflation Gauges #Copper, #XAU, AUD, EUR. We are about to see wave C develop #HZupdates