Discover and read the best of Twitter Threads about #HDFC

Most recents (24)

Last week the latest #SalmanKhan starrer arrived in theatres, and the reviews seem mixed, depending whether one is a #Bhai fan or a critic. Meanwhile, what is the review on the market’s performance last week? Let’s break out the popcorn and watch. (1/8)

#Sensex and #Nifty dropped by over 1.1%. #RBI representatives remained optimistic about India’s #domesticgrowth during the monetary policy committee meeting, despite concerns about uneven growth in the economy & weak demand from outside India. (2/8)

Be vary about getting caught into a value trap with #HAL #OFS ..... just some points to keep in mind

Tech had always been HDFC Bank’s big weakness. And, @bhavintu led Zeta is set to change that forever! ✅

HDFC Bank’s apps & website have earned a serious reputation for bugs & recurring outages.

Here is all there is to know its Digital 2.0 project meant to solve this 👇

HDFC Bank’s apps & website have earned a serious reputation for bugs & recurring outages.

Here is all there is to know its Digital 2.0 project meant to solve this 👇

The project was meant to rebuild its consumer-facing tech 🤳🤳

For this, it brought in Zeta with the precondition, that it won't take any new project from another Indian bank for a set timeline.

But, what’s Zeta?

For this, it brought in Zeta with the precondition, that it won't take any new project from another Indian bank for a set timeline.

But, what’s Zeta?

It’s an 8-year-old banking tech startup that has previously worked with likes of RBL Bank, Axis Bank & IDFC FIRST Bank.

However, HDFC Bank’s mandate is Zeta’s most consequential project ever.

However, HDFC Bank’s mandate is Zeta’s most consequential project ever.

The Nifty Financial Services Index, also known as the #FinNifty, is an index that tracks the performance of the financial services sector in India. @bbrijesh explains about the index in detail.

#FinNifty is an index that tracks the performance of the financial services sector in India, which includes #banks, #insurance companies, #housingfinance, and Non-Banking Financial Companies (NBFCs). #FinancialServicesSector #India

The financial services sector in India is one of the largest and most diverse in the world, and FinNifty provides a way to track the performance of this sector. #FinancialServicesSector #GrowthPotential

🚨 #HDFC to Accor ALL (Accor Live Limitless) is now live

A thread 🧵 as how #Accor transfer is a fantastic partners

How about ~Rs 1.8 value per point? 🔥

A thread 🧵 as how #Accor transfer is a fantastic partners

How about ~Rs 1.8 value per point? 🔥

Accor Hotels Basics

▶️ One of the largest hotel chains with over 5300 hotels

▶️ They have brands right from luxury like Raffles and Pullman to budget segment like ibis

▶️ Can transfer points to airline miles! (we will deep dive below) 😀

▶️ One of the largest hotel chains with over 5300 hotels

▶️ They have brands right from luxury like Raffles and Pullman to budget segment like ibis

▶️ Can transfer points to airline miles! (we will deep dive below) 😀

HDFC transfer Basics

ℹ️ We can transfer in 1:1 ratio for Infinia and DCB

ℹ️ offers.reward360.in/infinia/miles_… - Portal to transfer

ℹ️ (Officially) it takes 5 days for the transfer

ℹ️ We can transfer in 1:1 ratio for Infinia and DCB

ℹ️ offers.reward360.in/infinia/miles_… - Portal to transfer

ℹ️ (Officially) it takes 5 days for the transfer

Hello Infinia Card holders,

There's definitely very good news for you all. NEW partners have been raked in by HDFC for converting Infinia Points to Airmiles & Hotel Loyalty Programs.

I'll share them in the next series of tweets.

(1/n)

#HDFC #Infinia #miles

There's definitely very good news for you all. NEW partners have been raked in by HDFC for converting Infinia Points to Airmiles & Hotel Loyalty Programs.

I'll share them in the next series of tweets.

(1/n)

#HDFC #Infinia #miles

Time for some fun.

Instead of mocking others, let's do some self mocking.

This is the "best collection" of stocks.

I'm going #equalweight.

Just Ten MostBoring Stocks.

All-in-one Hall of fame list.

Presenting

The #BoringStocks of 2023.

Feel free to track & ridicule.

Here we go.

Instead of mocking others, let's do some self mocking.

This is the "best collection" of stocks.

I'm going #equalweight.

Just Ten MostBoring Stocks.

All-in-one Hall of fame list.

Presenting

The #BoringStocks of 2023.

Feel free to track & ridicule.

Here we go.

#HDFC. The mother of all boring stocks. Soon to be #hdfcbank.

Should do better simply because the expectations have never run so low.

1/10

Should do better simply because the expectations have never run so low.

1/10

#COALINDIA. No less boring. Much hated. Much bitched on WhatsApp. Everybody loves to abuse." Dividend play that's a widow stock" is what #BAAP Moghuls will call it on TV.

Most "intelligent investors" feel the same way about its owner as they do about their own mother-in-law.2/10

Most "intelligent investors" feel the same way about its owner as they do about their own mother-in-law.2/10

PPFAS agm2022

A thread

*Views are personal. Retweet if you like. Mute if you don't like. ;)

#onefund #ppfas

A thread

*Views are personal. Retweet if you like. Mute if you don't like. ;)

#onefund #ppfas

Neil, talks about value of cash and how fund is absolutely fine holding cash. Had 28% cash almost in 2018.

The returns would be lumpy. Minimum 5 years if not more

Underperformance is guaranteed in short term, so is volatility.

Over long term, the returns are satisfactory

The returns would be lumpy. Minimum 5 years if not more

Underperformance is guaranteed in short term, so is volatility.

Over long term, the returns are satisfactory

Do you have a process or plan to invest. The fund prefers to follow their own plan. Circle of competence about 500 stocks.

Can't Chase / pick up all opportunity.

I recall, last few years their were question on some Spanish companies like Zara or Chinese companies.

Can't Chase / pick up all opportunity.

I recall, last few years their were question on some Spanish companies like Zara or Chinese companies.

Best Buying Levels for all #Nifty50 #Stocks as per Demand Zone:

1️⃣ #ADANIPORTS: ₹562

2️⃣ #ASIANPAINT: ₹2,552

3️⃣ #AXISBANK: ₹620

4️⃣ #BAJAJFINSV: ₹10,445

5️⃣ #BAJAJAUTO: ₹3,280

Save it for later ✅

Tags:

#StockMarket #NSE #Nifty #Trading #Investing #sharemarket

Thread🧵(1/11)

1️⃣ #ADANIPORTS: ₹562

2️⃣ #ASIANPAINT: ₹2,552

3️⃣ #AXISBANK: ₹620

4️⃣ #BAJAJFINSV: ₹10,445

5️⃣ #BAJAJAUTO: ₹3,280

Save it for later ✅

Tags:

#StockMarket #NSE #Nifty #Trading #Investing #sharemarket

Thread🧵(1/11)

Best Buying Levels for all #Nifty50 #Stocks as per Demand Zone:

6️⃣ #BAJFINANCE: ₹4,668

7️⃣ #BHARTIARTL: ₹552

8️⃣ #BPCL: ₹255

9️⃣ #BRITANNIA: ₹2,534

🔟 #CIPLA: ₹850

Save it for later ✅

Tags:

#StockMarket #NSE #Nifty #Trading #Investing #sharemarket #Trader #OI

Thread🧵(2/11)

6️⃣ #BAJFINANCE: ₹4,668

7️⃣ #BHARTIARTL: ₹552

8️⃣ #BPCL: ₹255

9️⃣ #BRITANNIA: ₹2,534

🔟 #CIPLA: ₹850

Save it for later ✅

Tags:

#StockMarket #NSE #Nifty #Trading #Investing #sharemarket #Trader #OI

Thread🧵(2/11)

Best Buying Levels for all #Nifty50 #Stocks as per Demand Zone:

1️⃣ #COALINDIA: ₹163

2️⃣ #DIVISLAB: ₹3,154

3️⃣ #DRREDDY: ₹3,365

4️⃣ #EICHERMOT: ₹2,431

5️⃣ #GRASIM: ₹1,221

Save it for later ✅

Tags:

#StockMarket #NSE #Nifty #Trading #Investing #sharemarket #BSE

Thread 🧵(3/11)

1️⃣ #COALINDIA: ₹163

2️⃣ #DIVISLAB: ₹3,154

3️⃣ #DRREDDY: ₹3,365

4️⃣ #EICHERMOT: ₹2,431

5️⃣ #GRASIM: ₹1,221

Save it for later ✅

Tags:

#StockMarket #NSE #Nifty #Trading #Investing #sharemarket #BSE

Thread 🧵(3/11)

#THREAD on #WHAT is #RBI likely to do tomorrow at the #MPC and #Why and how it would #IMPACT Markets? #RETWEET

(1) A rate Hikes I’d probably 30-40bps

(2) More #Importantly, a 25-50bp CRR Hike as well

What are the Drivers of this Decision?

(1) A rate Hikes I’d probably 30-40bps

(2) More #Importantly, a 25-50bp CRR Hike as well

What are the Drivers of this Decision?

RBI biggest Driver of Policy in my view is FOREX.

India is suffering Daily Forex Outflows Due to

(1) high Commodity Prices (Oil & Coal etc)

(2) FPI outflows

(3) Rising Remittances while FDI has slowed down

Recall that Jndia is still NOT added to the JPM EM debt Index (NA)

India is suffering Daily Forex Outflows Due to

(1) high Commodity Prices (Oil & Coal etc)

(2) FPI outflows

(3) Rising Remittances while FDI has slowed down

Recall that Jndia is still NOT added to the JPM EM debt Index (NA)

Two ways to arrest the INR depreciation is to raise Rates (REPO) or reduce Liquidity (CRR)

But we know India has a Demand Issue.

More #IMPORTANTLY, higher Rates will HURT the Govts Borrowing Cost and Eventually Raise System Deposit Rates

But we know India has a Demand Issue.

More #IMPORTANTLY, higher Rates will HURT the Govts Borrowing Cost and Eventually Raise System Deposit Rates

#HDFC- HDFC Bank surprising interim shareholding disclosure-

The foreign shareholder disclosure by the two giants (HDFC Ltd and #HDFCBank)today is one of the rare events,as generally the shareholdings for a quarter is disclosed only in the beginning of next quarter

The foreign shareholder disclosure by the two giants (HDFC Ltd and #HDFCBank)today is one of the rare events,as generally the shareholdings for a quarter is disclosed only in the beginning of next quarter

HDFC - bseindia.com/xml-data/corpf…

HDFCB - bseindia.com/xml-data/corpf…

🔹Since the announcement of merger on April 04, 2022 HDFCB has corrected by 20% and HDFC by 18% vs Nifty Index which has declined by 10% till date.

HDFCB - bseindia.com/xml-data/corpf…

🔹Since the announcement of merger on April 04, 2022 HDFCB has corrected by 20% and HDFC by 18% vs Nifty Index which has declined by 10% till date.

The surprising foreign shareholding disclosure today reflects more of a pro-active measure by the management to help calm jittery nerves of the investor community

What has changed since March 31, 2022 shareholding toMay13,2022 Foreigners have trimmed stake in both the entities

What has changed since March 31, 2022 shareholding toMay13,2022 Foreigners have trimmed stake in both the entities

🏦Norges Bank, Singapore sovereign wealth fund GIC subscribe to anchor book: local MFs also come in as investors (#Kotak, #HDFC Mutual fund, #ICICI, SBI)

🧵2

🧵2

💳The #government is selling 22,13,74,920 shares in Life Insurance Corporation (#LIC) at a price band of Rs 902-949 a share, targeting to raise about Rs 21,000 crore.

🧵3

🧵3

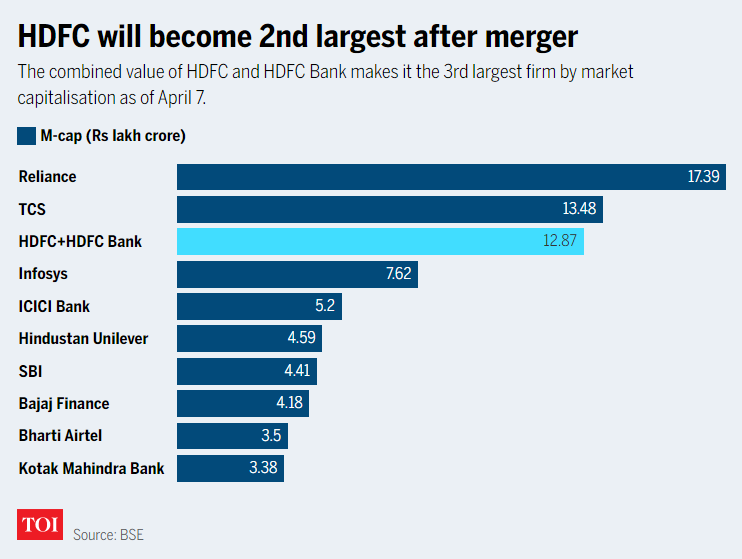

#hdfcmerger | Housing finance company #HDFC Limited announces merger with #hdfcbank

Following the announcement, shares of the two entities witnessed a sharp rise of between 8-9% each on key equity indices. scroll.in/latest/1021058

Following the announcement, shares of the two entities witnessed a sharp rise of between 8-9% each on key equity indices. scroll.in/latest/1021058

#hdfcmerger | As per the proposed deal, HDFC Bank will be 100% owned by public shareholders and existing shareholders of HDFC will own 41% of the bank.

Each shareholder will get 42 shares of HDFC Bank for every 25 shares of HDFC scroll.in/latest/1021058

Each shareholder will get 42 shares of HDFC Bank for every 25 shares of HDFC scroll.in/latest/1021058

In a press conference, #HDFC chairperson Deepak Parekh termed the deal a merger of equals.

“After 45 years in housing finance, we have to find a home for ourselves which we found in our own family company HDFC Bank.” scroll.in/latest/1021058

“After 45 years in housing finance, we have to find a home for ourselves which we found in our own family company HDFC Bank.” scroll.in/latest/1021058

HDFC-HDFC Bank Merger | Merger of HDFC & HDFC Bank is subject to shareholder & regulator approvals, says HDFC CEO, Keki Mistry

#HDFC #HDFCBank

#HDFC #HDFCBank

Investing for long term is always projected as a complex task, reading about the nature of company business, balance sheets, Profit and loss statements etc. Is there any easy way to find the best stocks to invest for long term? That's what this thread is all about.

Many recommend companies like #ITC, #HDFC, #Reliance, #AsianPaints etc. Even people outside the stock market know that these are market leaders in their respective category. ITC controls 77% market share of Cigarettes and more than 85% of their revenue comes from Tobacco.

But when we are investing for long term we are looking for time period of 15 to 20 years. Will these stocks continue to be a market leader even after so many years? What if their competitor catch up? In order to find an answer for that, let's consider the below example.

US markets have given a break-down from Head & Shoulders pattern

Most of the Indian sectors too look vulnerable

THREAD: Technical Analysis for US market & 10 Indian sectors🧵

Collaborated with @AdityaTodmal

Most of the Indian sectors too look vulnerable

THREAD: Technical Analysis for US market & 10 Indian sectors🧵

Collaborated with @AdityaTodmal

It's Time to Bargain Hunt 💯

24 Picks to Beat the Market!🚀

Kindly 'Like & retweet' for max reach 🙏

A major thread🧵

@kuttrapali26 @caniravkaria @Puretechnicals9 @ProdigalTrader @nakulvibhor

24 Picks to Beat the Market!🚀

Kindly 'Like & retweet' for max reach 🙏

A major thread🧵

@kuttrapali26 @caniravkaria @Puretechnicals9 @ProdigalTrader @nakulvibhor

1/ RELIANCE INDUSTRIES LTD.

⚡Volatility Contraction Pattern (VCP) + Descending Channel Formation + Retracement

⚡All are indicating that stock might show a quick rally of 15-20% in upcoming weeks

⚡Timeframe - 3 months

#RelianceIndustries #nifty50

⚡Volatility Contraction Pattern (VCP) + Descending Channel Formation + Retracement

⚡All are indicating that stock might show a quick rally of 15-20% in upcoming weeks

⚡Timeframe - 3 months

#RelianceIndustries #nifty50

2/ TATA CONSULTANCY SERVICES

⚡Volatility contraction pattern + Double bottom formation + May form Inverted Head & Shoulder pattern

⚡As the company announced the buyback, this stock has a low chance of risk. One may add for 4-5 months for 20% from this IT giant.

#TCS

⚡Volatility contraction pattern + Double bottom formation + May form Inverted Head & Shoulder pattern

⚡As the company announced the buyback, this stock has a low chance of risk. One may add for 4-5 months for 20% from this IT giant.

#TCS

An educational #Thread on 200 DEMA & its imp. in current scenario!

To cut things short 200 DEMA is considered as the decider between who is in dominating i.e bulls or bears. Its equally imp. for #investors & #Traders! Price sustaining below it is considered bad for bulls.

1/n

To cut things short 200 DEMA is considered as the decider between who is in dominating i.e bulls or bears. Its equally imp. for #investors & #Traders! Price sustaining below it is considered bad for bulls.

1/n

Though major indices like #nifty50 , banknifty, small & mid caps index are all trading above 200 DEMA but the major ones are not far from it. A major concern is the darlings of the market having high weightage have started trading below it.

Lets understand more with e.g's.

2/n

Lets understand more with e.g's.

2/n

#HDFC Twins - Combined they have 15% weightage in Nifty & the picture doesn't look rosy.

For the 1st time in this entire bull market rally both have closed below 200 DEMA which was earlier a strong support. Though a LL again would be a confirmation of bears dominating both.

3/n

For the 1st time in this entire bull market rally both have closed below 200 DEMA which was earlier a strong support. Though a LL again would be a confirmation of bears dominating both.

3/n

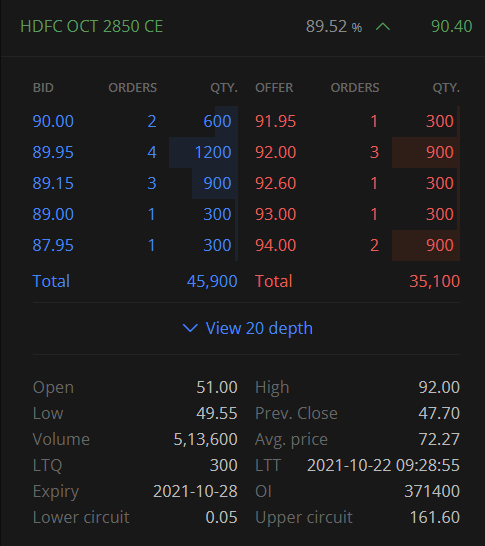

#Hdfc

Week-Day-Hour aligned to take out ATH.

2 scenarios:

1. A 5th to complete soon to bring back time consuming consolidation.

2. A major 3rd wave as was seen in #NiftyIT few months ago and is being seen in #Banknifty last few weeks

ST Holding "2825"

Week-Day-Hour aligned to take out ATH.

2 scenarios:

1. A 5th to complete soon to bring back time consuming consolidation.

2. A major 3rd wave as was seen in #NiftyIT few months ago and is being seen in #Banknifty last few weeks

ST Holding "2825"

#Hdfc

Week-Day-Hour "aligned" to take out ATH

Making ATH

From Day's low 2856 to "2905" so far..

2850CE 50 to 81.

Week-Day-Hour "aligned" to take out ATH

Making ATH

From Day's low 2856 to "2905" so far..

2850CE 50 to 81.

#Banknifty in focus.

#Hdfcbank 8 days of cons. A move past 1560-65.

#Icicibank 10 days of cons. A move past 717

#Reliance 6 days of cons. A move past 2400

#Hdfc 3 days of cons. Holding 2785-2805 & move past 2825

#Hdfcbank 8 days of cons. A move past 1560-65.

#Icicibank 10 days of cons. A move past 717

#Reliance 6 days of cons. A move past 2400

#Hdfc 3 days of cons. Holding 2785-2805 & move past 2825

#Hdfc breaking out..

#Icicibank is poised..

My core portfolio and business tracking thread...

Growth

#laurus

#deepaknitrite

Compounder

#astral

#polycab

Financial

#hdfcbank

#hdfclife

#hdfc

#idfcfirstbank

#sbicard

#bajajfinance

#muthootfinance

FMCG & Consumer/Discretionary

#tataconsumer

#hul

Growth

#laurus

#deepaknitrite

Compounder

#astral

#polycab

Financial

#hdfcbank

#hdfclife

#hdfc

#idfcfirstbank

#sbicard

#bajajfinance

#muthootfinance

FMCG & Consumer/Discretionary

#tataconsumer

#hul

IT Service oriented

#tcs

#hcl

#infy

#happiestminds

IT software & product oriented

#tanla

#intellect

#subex

#tataelxsi

Pharma

#divis

#syngene

#sequent

#neuland

#laurus

#jbchemical

Chemical

#pidilite

#alkylamines

#navinfluorine

Niche

#rajratan

#saregama

#tcs

#hcl

#infy

#happiestminds

IT software & product oriented

#tanla

#intellect

#subex

#tataelxsi

Pharma

#divis

#syngene

#sequent

#neuland

#laurus

#jbchemical

Chemical

#pidilite

#alkylamines

#navinfluorine

Niche

#rajratan

#saregama

Platform

#iex

#cdsl

#irctc

Other good businesses

#aplapollo

#relaxo

#dmart

#titan

#jubiliantfoodworks

#tatamotors

#bkt

#iex

#cdsl

#irctc

Other good businesses

#aplapollo

#relaxo

#dmart

#titan

#jubiliantfoodworks

#tatamotors

#bkt