Discover and read the best of Twitter Threads about #HFT

Most recents (18)

#HFT strategy time, part 2: Examples of features.

- Skew: The simplest type of book feature is called the skew, which is the imbalance between resting bid depth (v₂) and resting ask depth (v₁) at the top of the book.

- Skew: The simplest type of book feature is called the skew, which is the imbalance between resting bid depth (v₂) and resting ask depth (v₁) at the top of the book.

So we can formulate this as some sort of difference between v₂ and v₁. It’s convenient to scale these by their order of magnitude, so we take their log differences instead:

skew = log(v₂)−log(v₁) = log v₂ / v₁

skew = log(v₂)−log(v₁) = log v₂ / v₁

Notice that it doesn’t matter whether it’s log (v₂) − log (v₁) or log (v₁) − log(v₂). It’s just nice to formulate signals in a way that (+) values imply that we expect prices to 📈 & (-) values imply that we expect prices to 📉, so it’s easy to debug your strategy & models.

#HFT Here's an example of an HFT strategy. Keep in mind this is 1 in a billion examples. This isn't investment advice. Don't trade it. I'm in a unique position where I can share strategies without getting sued cuz it's my company & IP.

#HFT Part 1: Important terminology. It's hard to jump into an HFT strategy without explaining some terminology first.

A “feature” or “predictor” is any kind of basic independent variable that we think has some predictive value. Some call it a “feature” if they’re from the machine learning world, others call it a “predictor” or “regressor” if they come from a statistics or econometric background.

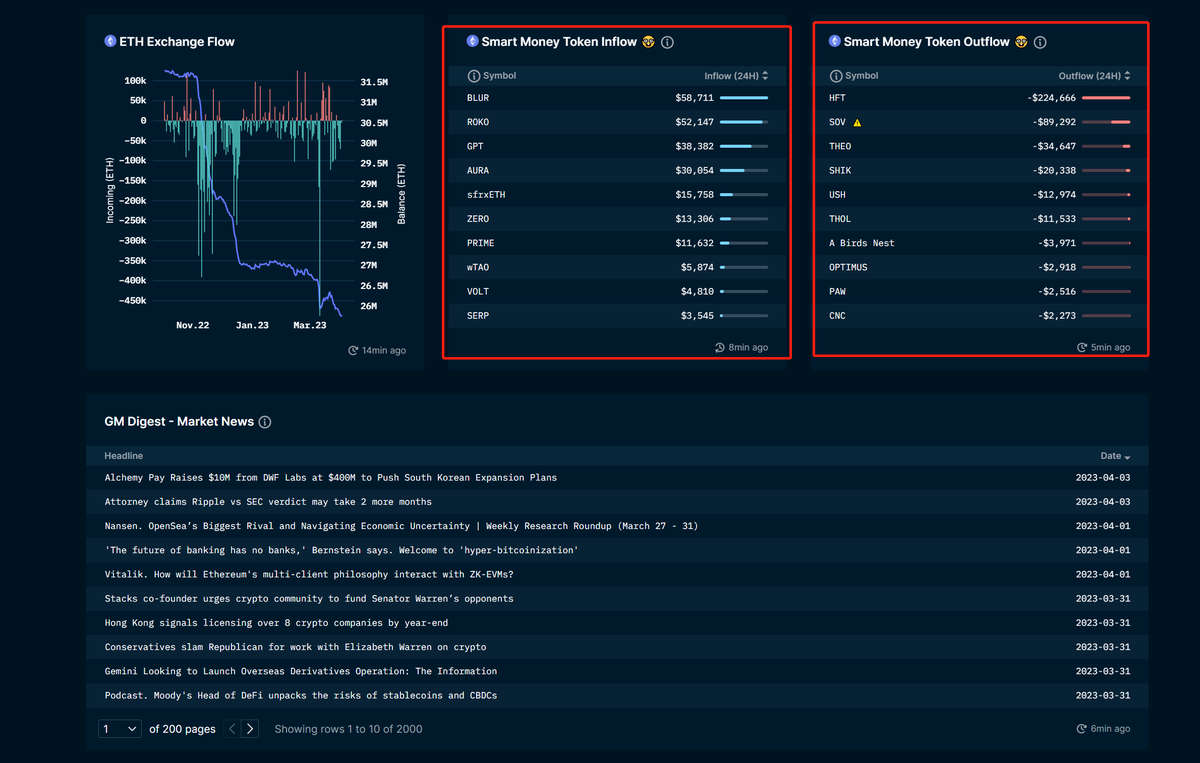

HFT

Annual latency arbitrage profits in Global Equity Markets in 2020.

This is from a BIS Working paper whose details are in the thread below.

#trading #quant #highfrequencytrading #HFT #Citadel #JumpTrading #RennTech #RenaissanceTechnologies $SPY $QQQ $TSLA $NVDA

Annual latency arbitrage profits in Global Equity Markets in 2020.

This is from a BIS Working paper whose details are in the thread below.

#trading #quant #highfrequencytrading #HFT #Citadel #JumpTrading #RennTech #RenaissanceTechnologies $SPY $QQQ $TSLA $NVDA

HFT latency arbitrage race is a probabilistic game!

#trading #quant #highfrequencytrading #HFT #Citadel #JumpTrading #RennTech #RenaissanceTechnologies $SPY $QQQ $TSLA $NVDA

#trading #quant #highfrequencytrading #HFT #Citadel #JumpTrading #RennTech #RenaissanceTechnologies $SPY $QQQ $TSLA $NVDA

Reader can search this paper in Google for details on the high frequency trading arms race.

They've analyzed the message data and limit order book data.

#trading

#quant #highfrequencytrading #HFT #Citadel #JumpTrading #RennTech #RenaissanceTechnologies $SPY $QQQ $TSLA $NVDA

They've analyzed the message data and limit order book data.

#trading

#quant #highfrequencytrading #HFT #Citadel #JumpTrading #RennTech #RenaissanceTechnologies $SPY $QQQ $TSLA $NVDA

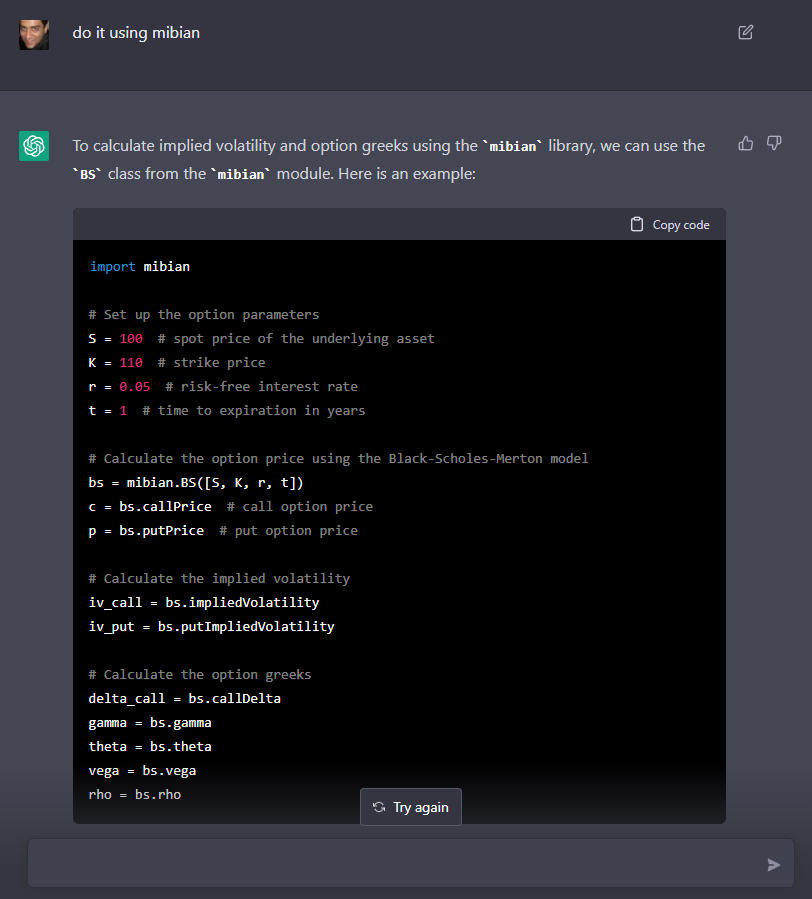

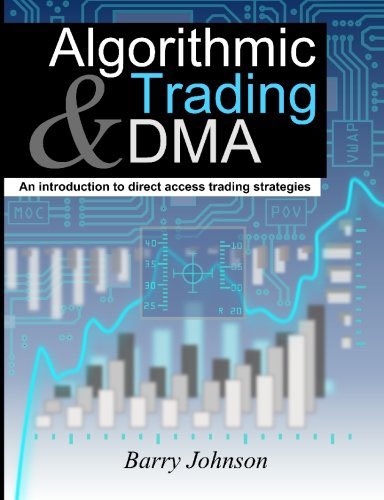

Last day I provided my trading team (they adjust our algos and monitor the market and our PnLs) a list of books that would be great to read if you start being interested in HFT.

#Trading #HFT #cryptocurrecy

#Trading #HFT #cryptocurrecy

I use engineering methods to analysis stocks such as $GME because the overall behavior is so well controlled that it behaves just like a systemic process.

Below is an on-going list of DD I have written. Each subject is organized into general topics with more DD tweeted and linked respectively. Any and all of my future analysis and research will be added to this pin.

The DD is never done.

#suckmyballshedgies

The DD is never done.

#suckmyballshedgies

$GME Cycles:

7/6/21: reddit.com/r/Superstonk/c…

7/7/21: reddit.com/r/Superstonk/c…

7/8/21: reddit.com/r/Superstonk/c…

8/1/21: reddit.com/r/Superstonk/c…

8/9/21:

reddit.com/r/Superstonk/c…

7/6/21: reddit.com/r/Superstonk/c…

7/7/21: reddit.com/r/Superstonk/c…

7/8/21: reddit.com/r/Superstonk/c…

8/1/21: reddit.com/r/Superstonk/c…

8/9/21:

reddit.com/r/Superstonk/c…

The #Algorithm. The Ouroboros: Characterizing #GameStop share price and reverse engineering #HFT #algos.

10/4/21: Part 1

reddit.com/r/DDintoGME/co…

11/18/21 Part 2

reddit.com/r/Superstonk/c…

10/4/21: Part 1

reddit.com/r/DDintoGME/co…

11/18/21 Part 2

reddit.com/r/Superstonk/c…

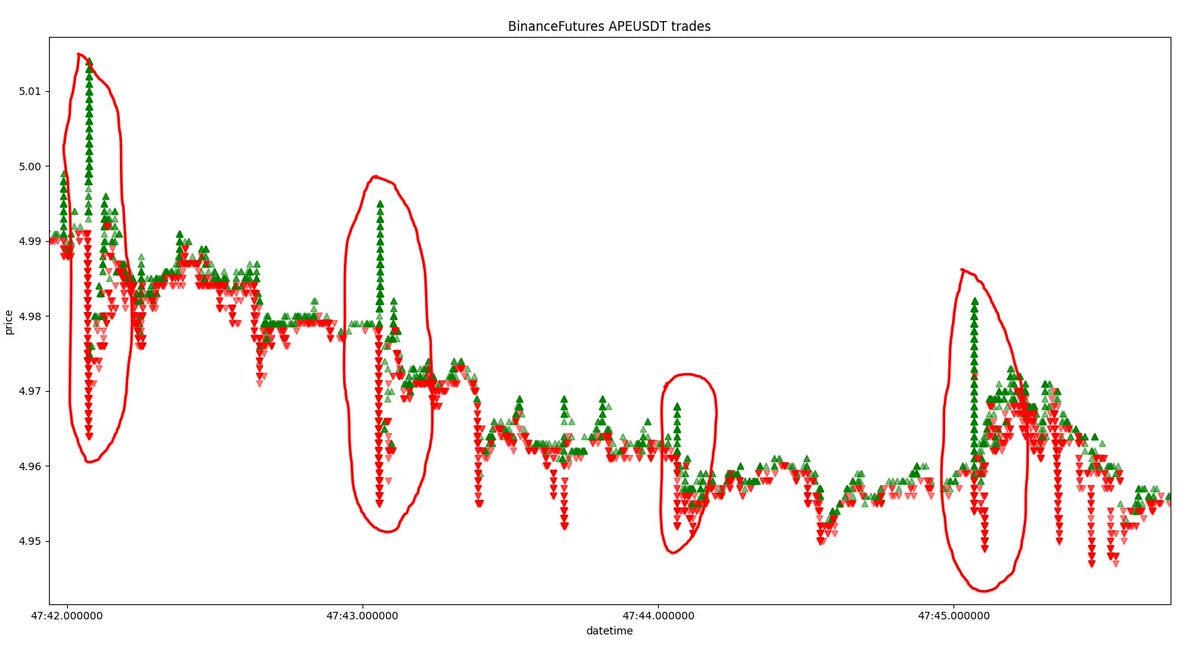

Very interesting behavior on BinanceFutures related to the trades on APEUSDT. It looks like there are simultaneously done orders on two sides with a big market impact. There is the more interesting thing if we will see closer...

#trading #HFT #cryptocurrecy #Binance

#trading #HFT #cryptocurrecy #Binance

Every such behavior looks similar. What is really strange is that the last timestamp related to market sell is always the same as the first market buy. Assuming that those two orders are created by two different players - it is almost impossible that they know each other.

Market impact on those trades is more than average -> mean of the market impact of the market order is about 0.22 ticks (if we exclude all market orders without market impact - it is 1.39 ticks). Here we have more than 30 ticks on this market sell.

How to develop yourself in High-Frequency Trading. First topics, books and good practices.

#HFT #trading #cryptocurrency #algotrading

#HFT #trading #cryptocurrency #algotrading

First of all, I would like to tell you that it is only my opinion about how to develop yourself in HFT and I based it on my experience and background. The most important thing is to be critical and think for yourself.

I think that a great HF Trader should be good in a lot of things. Do not concentrate only on one thing - it will not be good, because a good HF Trader has to be also a leader, not only for algo traders but also for developers and other people. You have to have a lot of skills.

How does a middle office risk management job differ from a risk management job on the trading floor?

@garp @PRMIA @actuarynews @SOActuaries @irmglobal

@garp @PRMIA @actuarynews @SOActuaries @irmglobal

TMO - Treasury Middle Office roles differ from bank to bank.

In other non-banking financial institutions, MO roles may vary according to portfolio size and responsibilities handed over to the risk management team.

In other non-banking financial institutions, MO roles may vary according to portfolio size and responsibilities handed over to the risk management team.

MO is primarily responsible for overseeing trading (front office) activities and applying controls, and reporting violations thereof.

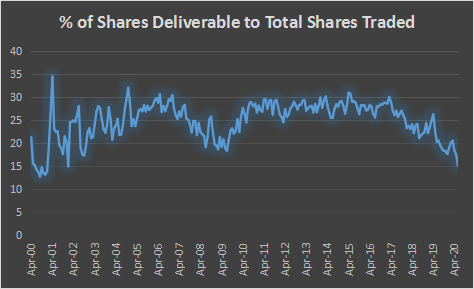

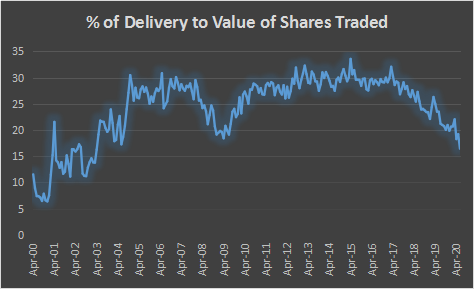

#NSE - Interesting #Statistics - #TweetStorm - •% of Shares Deliverable to Total Shares Traded now at 15.05%. Lowest since 2001. % of Delivery to Value of Shares Traded at 16.44% below 2009 !! #Daytrading increasing or #HFT , #colocation and #marketmaking?

Value of Shares Traded ( Cr ) at the Highest Ever. A peak in this generally an Inflection Point for the long term. For example January 08 value got hit in June 09. What is it now ?

The Top Traded Counter in 2019-2020 was #RelianceInds which is expected that its the top weight. But 3.24% of total Turnover was #YesBank !! Marginally lesser than 3.61% of #RelianceInds

(1/2) #AlgorithmicTrading #AMA - We bring to you the most asked questions about #AlgoTrading. Nitesh Khandelwal (Co-founder and CEO, QuantInsti) answers them in the form of short narrative videos.

Check out the entire playlist here: bit.ly/AMAPLYT

Check out the entire playlist here: bit.ly/AMAPLYT

What is High-Frequency Trading, Low-Frequency Trading and Medium-Frequency Trading?

#HFT #LFT #MFT #AlgorithmicTrading #FAQs #AMA #question #answer #algotrading

#HFT #LFT #MFT #AlgorithmicTrading #FAQs #AMA #question #answer #algotrading

Where to get historical and real-time market data?

#Data #marketdata #AlgorithmicTrading #FAQs #AMA #question #answer #algotrading #traders #trading

#Data #marketdata #AlgorithmicTrading #FAQs #AMA #question #answer #algotrading #traders #trading

連休ほぼ全部潰して,SBI証券の例の一件を調べてみた。興味ある人だけどうぞ。

また,誤りあればご指摘いただければ嬉しいです。

質問はできる限り答えたいですが,当方では無理なこともあるかもしれません。《続

#SBI証券 #SOR #PTS #ジャパンネクストPTS #HFT

また,誤りあればご指摘いただければ嬉しいです。

質問はできる限り答えたいですが,当方では無理なこともあるかもしれません。《続

#SBI証券 #SOR #PTS #ジャパンネクストPTS #HFT

承前》15日(金)までSBI証券がやってたのはこういうこと。

A.顧客からの注文を,東証と,ジャパンネクストPTS(以下JN-PTS)にSOR(スマート・オーダー・ルーティング)

B.(日経報道によれば)非約定分は100-300ミリ秒だけJN-PTSの板にさらす=TIF(タイム・イン・フォース)《続

A.顧客からの注文を,東証と,ジャパンネクストPTS(以下JN-PTS)にSOR(スマート・オーダー・ルーティング)

B.(日経報道によれば)非約定分は100-300ミリ秒だけJN-PTSの板にさらす=TIF(タイム・イン・フォース)《続

承前》Aは東証・PTS・SOR が選べるようだが,デフォルトでは SOR。

BのTIFは100-300ミリ秒のいずれかに設定されていたようだが,不明(SBI証券は日経の取材に答えず。

さらに,BのTIFは18日(月)に撤回し,0ミリ秒にしたとのこと。《続

#SBI証券 #SOR #PTS #ジャパンネクストPTS #HFT

BのTIFは100-300ミリ秒のいずれかに設定されていたようだが,不明(SBI証券は日経の取材に答えず。

さらに,BのTIFは18日(月)に撤回し,0ミリ秒にしたとのこと。《続

#SBI証券 #SOR #PTS #ジャパンネクストPTS #HFT

#Responsibility of #programmers for their #algorithms

😇Shooting stars: from expert advisor to #spoofing criminal

👉Spoofing #algo coder partially acquitted

🤦♂️CFTC and FBI fail with indictment of the programmer who developed the algo at the heart of the infamous 2010 #FlashCrash

😇Shooting stars: from expert advisor to #spoofing criminal

👉Spoofing #algo coder partially acquitted

🤦♂️CFTC and FBI fail with indictment of the programmer who developed the algo at the heart of the infamous 2010 #FlashCrash

😇Jitesh Thakkar, the founder and president of Edge Financial Technologies, one of the leading firms for #software development for #algorithmic and #highfrequencytrading #hft, was acquitted on April 9th, 2019 of the count of #conspiracy to commit spoofing.

⚠️Thakkar’s case is the first in the US where a programmer is prosecuted for his involvement in the development of a manipulative algorithm and shows regulators’ willingness to prosecute programmers in addition to the users of such algorithms.

To know Aleynikov case is to know their code was made from GitHub open source code bits and pieces in the first place :)

#AI #ML #ArtificialIntelligence #HFT AND #IP #intellectualproperty #github

wsj.com/amp/articles/g…

1. US v. Aleynikov, No. 11-1126, 2nd Cir., 11 avril 2012

#AI #ML #ArtificialIntelligence #HFT AND #IP #intellectualproperty #github

wsj.com/amp/articles/g…

1. US v. Aleynikov, No. 11-1126, 2nd Cir., 11 avril 2012

Two cases:

1. United States v. Aleynikov, No. 11-1126, 2nd Cir. 2012, 11 avril 2012

2. People v. Aleynikov, 2015 NY Slip Op 25229, 49 Misc 3rd 286, 7 juillet 2015

1. United States v. Aleynikov, No. 11-1126, 2nd Cir. 2012, 11 avril 2012

2. People v. Aleynikov, 2015 NY Slip Op 25229, 49 Misc 3rd 286, 7 juillet 2015

@threadreaderapp unroll

Arbitraggio di "latenza" e frammentazione della struttura del mercato US sono i concetti (da approfondire) su cui si basa la manipolazione del mercato americano, grazie al ruolo svolto da #HFT e Quants

per iniziare un video che rappresenta un "must"

#ES_F

per iniziare un video che rappresenta un "must"

#ES_F

New from me: Remember that @IEX "speed bump" Michael Lewis profiled in "Flash Boys"?

It's a 350 microsecond delay to inbound orders meant to foil #HFT traders.

An economist at the SEC has studied its impact and found that it's good for investors:

wsj.com/articles/study…

It's a 350 microsecond delay to inbound orders meant to foil #HFT traders.

An economist at the SEC has studied its impact and found that it's good for investors:

wsj.com/articles/study…

Here is a link to the study:

"Intentional Access Delays, Market Quality, and Price Discovery: Evidence from IEX Becoming an Exchange" by SEC's Edwin Hu

papers.ssrn.com/sol3/papers.cf…

"Intentional Access Delays, Market Quality, and Price Discovery: Evidence from IEX Becoming an Exchange" by SEC's Edwin Hu

papers.ssrn.com/sol3/papers.cf…

The paper is certainly not the last word on this topic but it does contradict some of the predictions made in comment letters to SEC opposing @IEX "speed bump" - like this letter from Citadel:

sec.gov/comments/s7-03…

sec.gov/comments/s7-03…