Discover and read the best of Twitter Threads about #HZupdates

Most recents (24)

So how important is RSI DIVERGENCE? Very!! Check charts for #SP500, #Oil, #EURUSD (all neg. divergence) and for #Volatility (pos. divergence) - and you tell me! 👍#HZupdates

Then take a look at this chart for #XAUUSD #Gold. Massive neg. divergence - even stronger the last 5 months as it rallies in massive RISING WEDGE. Tell me again, that Gold cannot crash!

May also add.... Gold sentiment at 91!

These are the "events" we experience during Kondratiev's Winter. We have seen some of these but they will play out a range of times. First in 2000-03, then worse during 2007-09 and now the big one 2020-23(?). Some major dominoes are about to fall - before we reach end of Winter

Major events still to be seen (apart from rest which will be repeated and become much worse than before!): 1) Pension fund crisis 2) Run from paper money 3) War (hope not!) 4) Debt resolution (Monetary Reset?). We are NO where near end of this major crisis, which ends K's Winter

My LT #Copper chart tells me, that we may very well see the crisis (with various phases) continue until end-21 or beginning of '22. That is for the bottom in the economic activity which means, that repercussions may be felt way into 2023-25. No where near the end of this crisis!

US 10 yr yield....Watch Out!! Strong wave C coming? If true then this pattern gives us pot. spike to ~2.0%! USD Shortage. #HZupdates

What happened for #Equities in March Yield spike (wave A)? This 👇 for #SP500. Spike in yields while equities and precious metals sell off. #Deflation Illiquid Phase!

Dear all. I will soon launch my website and Macro & Market services. Stay tuned! 🙂As part of the launch, I will arrange a get-together with everybody who wants to join in person. I will do a presentation and we can exchange ideas over lunch and a beer. Free entrance! #HZupdates

It will take place in HAMBURG at my friend @KlitgaardEgon's hotel in Hamburg. egonhotel.com/en/ Of course we need to get to other side of #coronavirus. Hence, I cannot be specific about the dates yet. But - we will do 3-4 sessions, or more if needed.

Free entrance! 👍 All you need to do, is to book a room (voucher) at @KlitgaardEgon's hotel in Hamburg. Please write in reservation, that you want to participate in the session with Henrik Zeberg. egonhotel.com/en/ Hope I will see you there for a chat and a beer!!

No doubt in my mind, that current rally in #SP500 and #equities is a counter-trend move - and that we will soon see a major deflationary CRASH. I have updated my SP500 outlook - some changes! Stay tuned for #HZupdates this afternoon. First - 88 km bike ride to Helsingør 👍

Back - a little tired - but feeling good! 🚴💪 Stay tuned for some #HZupdates - my perspectives on markets.

#Deflation phase is not over and done. #CRB tells this story. The decline from w4 top must have 5 waves and throw-over. We still need last leg before SECULAR BOTTOM.

Good morning! 😀Fed is all in (again!!) - and this time there is a great confidence among traders (again!!) that Fed can has stopped deflation and supplied enough liquidity to the system. But is that really the case? Stay tuned for my perspectives #HZupdates

Let me start an nontraditional way - with a zoom in. This is #SP500 1 hour chart. I look for corrections and main directional moves. This is a correctional move - and it may have finalized! So - the main wave will soon set in again. Now - lets zoom out #HZupdates

My website is developing! Will go live soon. Still need some testing etc. Content will include: 1) Weekly Macro update 2) Weekly video with further explanation incl. interviews 3) Weekly one hour live Q&A session 4) Write questions directly to me. Stay tuned! #HZupdates

I'm happy to announce, that @KobeissiLetter & I have agreed to cooperate on a range of areas. @KobeissiLetter does a fantastic job in pointing out super trades. I think together, we will form a strong team for assisting our audience. Stay tuned!

The basic idea: Get a clear perspective on, where the economy stand - and what's ahead. Not 100s of different ideas - but 1 clear outline based on structured approach to understanding markets - elaborated in videos - and with a opp. to ask specific clarifying questions.

Trust you are safe! For a long time, I have been forecasting #DEFLATION. We got that! Today, I want to address, why I think we are about to see a NEW ECONOMIC REGIME arise soon - and why #STAGFLATION will be the transformation into the coming Kondratiev Spring #HZupdates

We know, that Fed and CBs around the world have been printing money - and lots of it! However, we have failed to see inflation - to the regret of Draghi, Yellen, etc. Despite their efforts, inflation has been in decline. Why? Because Velocity of Money has been in strong decline.

Two factors to create inflation: 1) Amount of money 2) Speed of circulation. The latter has been in decline for years as during Kondratiev's Winter, debt has become a burden to society - which hinders growth. The more debt - the less growth - and hence slower money circulation

#Deflation unfolding - but as in all moves - we will always see counter-moves or corrections. Last week was such a correction. We must not drop our guard! The economic situation is dire and we are not through the illiquid phase. Major developments ahead! Stay tuned for #HZupdates

It is all about #USD. Last week was a retracement in the new strong spike for #DXY = wave ii (blue). Within days, DXY will likely start strong rally higher - reaching min. 109 within weeks. End target will be reached later this year ~122 #HZupdates

Dear all. #Deflation is here as forecasted. #Oil and #Commodities etc. are declining rapidly towards targets I have put up here in #HZupdates. We are still to see the major fall-outs. The situation is dire! CBs are fully committed to sacrifice the currencies to save the economy!

#Oil has reach the target of ~20 USD. But - I don't think we have seen the bottom yet! Why? Technical. I think we will see a triangle forming as wave iv - before Oil plunges towards its final target ~10 USD. Deflation not done despite massive CB and fiscal intervention!

#CRB has also reached the target area. Still, I expect further lows - following some sideways consolidation. Throw-over is to be expected for a Ending Diagonal. The significance of the bottom cannot be over-emphasized. This is a SECULAR BOTTOM - and the final low for inflation!

"Something is Breaking!" and we are going to see decades worth of developments in the span of few weeks or months. #Coronavirus has been the trigger of the #Deflation, I have been expecting for so long. It is now here! Stay tuned for #HZupdates to get my view on markets

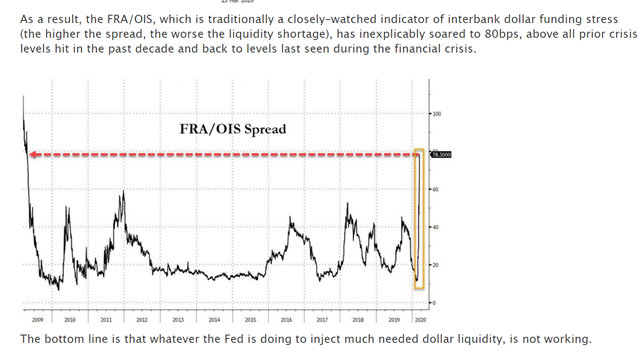

"Something is Breaking" has been taken from zerohedge.com/markets/someth…. We are observing an extreme USD Shortage developing fast and it is going to cause a wild #DXY rally the coming weeks & months. Chart of FRA/OIS provides overview of the severity of the developing USD shortage

My #DXY model supports this macro outlook exactly. Correction from late 2019 has concluded and DXY will now explode higher in 5 impulsive waves higher to target ~111. I expect this move to reach target ~Mid-2020. The consequences of a strong DXY will be wide-spread. #Deflation

Good morning! Let's have an update on markets as it has now become very clear, that we are to see the #Deflation unfolding, which I have mentioned here for a long time. Why hasn't it really hurt yet - and what to expect? Stay tuned for some #HZupdates

I have shown my #Oil chart for a long time with Ending Diagonal. Since talks of oil >100USD - and during spikes in oil due to attacks in ME. All noise!! Structures drive price - and we are en route towards <20USD - perhaps as low as ~10USD for Oil. #Deflation unfolding!

I have shown #Deflation in #CRB chart. Broken lower trendline and now heading towards much lower levels to be reached this year! It will be a SECULAR BOTTOM - hence this is from where #STAGLFLATION will develop, as economy continues to plummet and prices begin to rise #HZupdates

Good morning! #Equities continue to defy gravity. This has more to do with the insane monetary environment CBs have created. Macro economic reality says something completely different. The division (=the bubble) will come to haunt us all. Please stay tuned for #HZupdates

Why is it, that some analysts try to explain away the obvious? We have a major bubble in ...well almost all assets. #Schiller PE for #SP500 tells us, that the bubble is at 1929-level. Could it grow bigger? Sure!! But that does not make it a non-bubble #HZupdates

Amount of neg. yielding debt has skyrocketed. Remember, this is discount factor. If discount factor is closing in on 0 (or goes neg.) then value of any asset is going to infinity. But that has NOTHING to do with true value of any asset. This is "Bubble food"! #HZupdates

Good morning! Trust you are well 😀 Today, I will give the full story of WHY I SEE BOTTOM IN GOLD ~800-890 from an EW-perspective - and the LIKELY PATH getting there! Remember - trolls and haters will be blocked! Use my input for whatever you like 👍 Stay tuned for #HZupdates

All price developments have MAIN direction and CORRECTIONS (Big surprise - I know😄) in FRACTAL STRUCTURE. So - zooming in/out - you will see the same kind of pattern emerge. Observe very LT charts and it becomes obvious. #HZupdates

The FRACTAL structure appears as we as individuals go through the same WAVE of EMOTIONS from LT-scale - down to very ST-scale. MULTIPLY these individual emotional swings by BILLIONS (of transactions) - and you will see patterns emerge. THIS IS THE BASIS OF TECHNICAL ANALYSIS

Hey all! Attention if you are up for an update on my perspective on markets. Deflation and massive moves ahead! Stay tuned #HZupdates

Let's start with #CRB, which created a nice shooting star on weekly chart, and leaving gap open below. Wave "e" often overshoots trend-line only to turn hard the opposite direction. The likely coming decline in #CRB is deflationary #HZupdates

This week we had an #Oil crisis according to some analysts. It played out on Monday😄Like #CRB, #Oil is consolidating in a sideway-consolidation (wave B) before a strong move lower. Target in Ending Diagonal remains <20USD. This will be secular bottom. First #deflation #HZupdates

Good morning! 😀Trust you are well! Some interesting developments in markets. I will provide my perspective here in #HZupdates

#Oil has strong influence on price development (inflation). Seems to be developing in Ending Diagonal. We may see wave (B) develop as a triangle - before next move down towards target <20 USD #HZupdates

Similar pattern in ##Commodity index #CRB. Consolidation below trendline. Next major move should send #CRB much lower. This is deflationary #HZupdates

Good morning! 😀End of August --> Time to look at some Monthly charts. What does the latest Monthly candles suggest for the road ahead for global economy? Stay tuned for #HZupdates

Yesterday, I posted this chart for #EURUSD. This is very central, as it provides indication for direction of USD. Major topping pattern - backtest in early 2018 - now targeting <0.9. Notice August candle! Zoom-in chart 2. It seems to be very Bearish #HZupdates

Turning towards Monthly chart for #DXY, we got corresponding candle to what we observed in #EURUSD. Bullish which set #DXY on the path towards min. 111, pot. as high as 120. Trend line suggest we could get there by Q1/Q2 2020. USD strength will create global challenges #HZupdates

#ECB is likely to crash EUR in attempt to stimulate EU-economy🤦♂️(incompetence in ECB is staggering!). Wait for waterfall moment in #EURUSD. Currently flirting with LT-trendline. Target 0.85-0.91 #HZupdates

Major drop in #EURUSD will send #USD #DXY soaring (following pot. ST weakness). LT-target for DXY is >111. This is likely to be the trigger for REAL Fed intervention, which will push economy out of Deflation #HZupdates

Rally in #USD will push #Gold (#XAUUSD) into major decline in final wave C, which will take yellow pet rock below 1000 USD. Imo no way that structure of rally since 2015 is new Bull market. It is ZigZag-correction topping ~1480 (here!) or ~1590 (-1600). Major Bull trap #HZupdates

Good morning!😀Trust you are well and enjoying this Saturday morning. Deflation is developing in economy. Signs are very clear. Black swan will appear at some point. Stay tuned for a heads-up on my perspectives on market #HZupdates

#Copper sets the direction for real economy. My EW-model for Copper sets target A or more likely B to be reached some time in late 2021 or early 2022. Copper = Real economy. This is a pot. timeline for the total duration of the coming crisis (deflation & stagflation) #HZupdates

Zooming in on #Copper, we have seen the expected development this week. Break has been confirmed by small retest and acceleration. I think we will see further downside develop soon - but cannot rule out a pot. 2nd retest. The outlook for Copper is deflationary #HZupdates

Good morning! 😁Deflationary phase is developing in economy. Stay tuned for my perspectives on coming developments in markets based on charts - technical and fundamental analysis #HZupdates thread coming up!

SP500 recovered some of the loses from early trading this week. Still, I think we have seen the top of the Expanding Diagonal, and we are currently in the Deflationary part of the crisis, where growth in economy is rolling over. Target ~2050 by Q1/Q2 2020 #HZupdates

#SP500 - will we see rally to 2950 for pot. top of wave 2 (black) before reversal and strong decline? That would close the gap in market from early Aug. #HZupdates

Hope you enjoy the weekend! 😀Deflation unfolding in economy. Stay tuned for my view on market and coming macro developments #HZupdates

Short term we may see a bounce in #AUDUSD, as wave 2 develops - which sets us up for strong wave 3 down #HZupdates

#OIL develops in Ending Diagonal, which sets a target <20USD before LT-bottom. Again - we could pot. see that LT-bottom in around early Spring 2020. The period from now - until then is the #DEFLATIONARY phase of the crisis. This is where liquidity (USD) is scarce #HZupdates

And so it begins....! #Copper We can only hope, that downturn will only take us to Target 1 - and not Target 2 (which I think it will drop to). Note - SP500 + VIX + Copper + Oil mutually support break lower! Global recession and Deflation coming #HZupdates

#Gold BULL TRAP - Wait for it!

My updated view on #SP500. Is Fed about to disappoint sending #equities much lover towards ~2000 for SP500? Then stepping back in FOR REAL ~Q2 2020 to avoid #DEFLATIONARY Melt-down - which will create bounce in market and later new major decline during #STAGFLATION #HZupdates