Discover and read the best of Twitter Threads about #HealthInsurance

Most recents (24)

#Health #Insurance #India

Public sector general insurance companies in India are facing a huge challenge as they continue to lose market share in their #healthinsurance portfolio to private insurance Cos. Should you switch from a PSU to a Pvt Insurer

A thread🧵

1/n ⬇️

Public sector general insurance companies in India are facing a huge challenge as they continue to lose market share in their #healthinsurance portfolio to private insurance Cos. Should you switch from a PSU to a Pvt Insurer

A thread🧵

1/n ⬇️

According to #Statista Pvt insurers across India held around 49 % of the industry’s market share in FY 2021, compared to 36 % by public sector insurers. Standalone health insurers had a market share of around 8 % and specialized insurers had a market share of over 6 %

2/n

2/n

Public sector insurers are facing challenges such as low profitability, high claims ratio, outdated products, poor customer service, and lack of innovation. They have also been unable to compete with the aggressive pricing and marketing strategies of the private players.

3/n

3/n

This is borderline fraud by #Health and General #insurance companies in #India

The Misuse of "The Reasonable and Customary Clause" in #HealthInsurance

A Thread 🧵

1/n

👇

The Misuse of "The Reasonable and Customary Clause" in #HealthInsurance

A Thread 🧵

1/n

👇

We all know that health insurance is crucial, but a concerning trend has re-emerged post the pandemic in India. Insurance companies are back to misusing the "reasonable and customary clause" to reduce reimbursement claims, leaving ordinary people in a difficult situation.

2/n

2/n

🏥 Understanding the "Reasonable and Customary Clause"

The clause sets the maximum amount an insurance company will reimburse for medical procedures. It aims to prevent overcharging. However, some companies are misusing this provision

Let me share 2 recent cases

3/n

The clause sets the maximum amount an insurance company will reimburse for medical procedures. It aims to prevent overcharging. However, some companies are misusing this provision

Let me share 2 recent cases

3/n

Looking for a 1 crore #Health #insurance cover?

A stand alone #Healthinsurance policy of 1 crore or a combination of a 10 lakh base + 90 lakh Super Top up policy, which one will you choose.

A 🧵

1/n

👇

A stand alone #Healthinsurance policy of 1 crore or a combination of a 10 lakh base + 90 lakh Super Top up policy, which one will you choose.

A 🧵

1/n

👇

The rising cost of healthcare and the need for adequate health insurance coverage, makes it extremely important to have a sufficiently large health insurance cover, to take care of any unforseen expenses due to hospitalisation or prolonged treatment of critical illnesses.

2/n

2/n

Let's discuss why combining a base policy of 10 lakh with a super top-up of 90 lakh is a more cost-effective option compared to a standalone 1 crore health insurance policy, choose what works for you but if premium is an important consideration read further.

3/n

3/n

#Chapter5

Insurance Policies in Native Language: Is it a must have for customer delight?

By: @rk_process9

In #India, #insurance penetration is very low. When an uninsured family member requires hospitalization, it can deplete a middle-class family’s entire savings.

1/n

Insurance Policies in Native Language: Is it a must have for customer delight?

By: @rk_process9

In #India, #insurance penetration is very low. When an uninsured family member requires hospitalization, it can deplete a middle-class family’s entire savings.

1/n

Having a #healthinsurance policy comes as a boon in such times. Unfortunately, many individuals struggle to comprehend the benefits of these policies due to the complex #language and unclear #claim procedures.

2/n

2/n

This lack of understanding can be attributed to both the inadequate #communication of #insurance companies and the public’s difficulty in deciphering the complicated terms used in documentation.

3/n

3/n

Hospitalisation can burn a hole in your pocket and derail your finances. It will become even tough, if the person who brings in the money, is now in a hospital bed. All this can be avoided by just paying a small annual premium towards health insurance

#healthinsurance #hospital

#healthinsurance #hospital

There are some loop holes in these insurance policies which may again end up leaving a hole in your pocket. So let's shed light on a few things you should be aware of before purchasing insurance.

#HealthForAll #healthinsurance #hospitalised #hospitals

#HealthForAll #healthinsurance #hospitalised #hospitals

1) What type of health plan it is?

There are various types of health insurance plans -

Individual Health Insurance

Family

Senior Citizen

Surgery & Critical Illness,etc

Go thoroughly through the benefits of each plan and then choose the one that best caters to your requirement.

There are various types of health insurance plans -

Individual Health Insurance

Family

Senior Citizen

Surgery & Critical Illness,etc

Go thoroughly through the benefits of each plan and then choose the one that best caters to your requirement.

#newtaxregime - good or bad?

The debate has just begun.

Firstly, no sensible person saves or invests to avoid taxes.

We do it because we know we need to.

It's for our own good.

By investing a part of our income, we ensure we have enough money when our income stops or reduces.1/n

The debate has just begun.

Firstly, no sensible person saves or invests to avoid taxes.

We do it because we know we need to.

It's for our own good.

By investing a part of our income, we ensure we have enough money when our income stops or reduces.1/n

When we invest for our future, we need to have a plan.

We need to have measurement.

We need flexibility.

We need to practice a blended approach.

When one studies what people did with their tax savings, it will be amply clear their investing lacked on these critical needs. 2/n

We need to have measurement.

We need flexibility.

We need to practice a blended approach.

When one studies what people did with their tax savings, it will be amply clear their investing lacked on these critical needs. 2/n

Here are some glaring blunders.

Firstly, look at insurance.

Most people were missold insurance.

Yet they ended up being under insured.

People bought 50k worth of insurance policies.

Yet, they weren't even insured for 1 cr .

They saved taxes. But, still were exposed to risks. 3/n

Firstly, look at insurance.

Most people were missold insurance.

Yet they ended up being under insured.

People bought 50k worth of insurance policies.

Yet, they weren't even insured for 1 cr .

They saved taxes. But, still were exposed to risks. 3/n

#Budget2023WishList:

For #MutualFund Industry:

@nsitharaman

1. Removal of #GST for commissions paid to #MutualFundDistributors who cannot recover the same from their investors. Only industry where this happens

We need more #MFDs to achieve goal of reaching Rs.100 lac crs in AUM

For #MutualFund Industry:

@nsitharaman

1. Removal of #GST for commissions paid to #MutualFundDistributors who cannot recover the same from their investors. Only industry where this happens

We need more #MFDs to achieve goal of reaching Rs.100 lac crs in AUM

Removal of #LTCG from #Equity and #EquityMFSchemes. Will have very low impact on fiscal collections.

But it will improve sentiments and move funds from non-productive assets like #Gold to #FinancialAssets like equity.

But it will improve sentiments and move funds from non-productive assets like #Gold to #FinancialAssets like equity.

#MutualFunds help in mobilizing small savings - channelizing them into building economy thru #Equity & #Debt. This will help in reaching $5 trln GDP target

Inclusive Medical/Health Insurance Policies are integral to ensure Universal Health Coverage. However, grim reality is that our insurance policies aren't inclusive of persons with disabilities among other marginalized groups despite the circular by IRDAI dated 2nd June 2020. 1/n.

2/ Delhi High Court in Saurabh Shukla v. Max Bupa Insurance & Anr., dated 13th December 2022, ordered the Insurance Regulatory and Development Authority of India to ensure insurance policies are designed for persons with disability.

3/ The court remarked that "it is the settled position in law that the right to life includes the right to health and healthcare is an integral part of the same." [livelaw.in/news-updates/c…]

This mornings rant is about #paidfamilyleave in Colorado & how #voters overwhelmingly passed FAMLI

[& employers can now register for CO’s new program finally; employees max 12 weeks of paid leave a yr + 4 additional wks for #pregnancy or #childbirth complications]

#copolitics

[& employers can now register for CO’s new program finally; employees max 12 weeks of paid leave a yr + 4 additional wks for #pregnancy or #childbirth complications]

#copolitics

Let’s get 1st thing straight - this 🧵 is no insight into the near 15 yrs #advocates fought for #paidfamilyleave at the CO state Capitol before #voters passed it on the #ballot

I, like many folks - came into the advocacy for #FAMLI yrs after lots of fight. Grateful to have it

I, like many folks - came into the advocacy for #FAMLI yrs after lots of fight. Grateful to have it

Many of us worked on the #ballotmeasure in 2020 & #voters approved the program by 57% of the vote ✨ the amount of barriers set in place to #advocate for #paidfamilyleave & #pass it & then #implement it - have been eye opening 👁 to say the least. #copilitics

To all of you who are new to the workforce… Congratulations!!! You have secured your first job.

But are you confused about how to best use your current salary? (1/n)

#salary #cashflow #payday #money

But are you confused about how to best use your current salary? (1/n)

#salary #cashflow #payday #money

Most people complicate things. It is only natural when there are so many investment products to choose from. That need not be the case.

Here are some simple tips for someone just starting! (2/n)

#equity #fixedincome #gold #realestate

Here are some simple tips for someone just starting! (2/n)

#equity #fixedincome #gold #realestate

#1 Start Building an Emergency Fund

This should be your first priority. In case of emergencies, you shouldn't be left empty-handed.

Having 3-6 months of expenses set aside will be optimal. (3/n)

#emergencyfund #savings

This should be your first priority. In case of emergencies, you shouldn't be left empty-handed.

Having 3-6 months of expenses set aside will be optimal. (3/n)

#emergencyfund #savings

1/ @CVSHealth , CVS Caremark recently denied coverage for my son's medication, which he has received for 2 + years. We arrived at this medication after two previous meds were ineffective & included serious side effects. #healthcare #healthinsurance #CVS

2/ For context, I have expertise in measuring patient outcomes & worked with pediatrician to evaluate meds for effectiveness & side effects. Your decision to not cover meds indicates we must try 2 covered meds prior to you considering covering med he has received for 2 + yrs.

3/ Previous meds we've tried caused significant side effects. My son suffered. We're happy with current med. You also indicated if we want to continue current med we could pay out of pocket, which would be $450 ish per month. @KarenSLynch , you can afford that cost, but I can't.

#healthinsurance

Health insurance சிறு குறிப்பு வரைக:-

Health insurance என்பது ஒரு வகை insurance. எதேனும் உடல் நலக்குறைவு/விபத்து ஏற்பட்டால், அதனால் ஆகும் மருத்துவ செலவினத்தை இன்சுரஸ் கம்பெனி ஏற்க்கும்.

இதுவே Health Insurance எனப்படும்.

Health insurance சிறு குறிப்பு வரைக:-

Health insurance என்பது ஒரு வகை insurance. எதேனும் உடல் நலக்குறைவு/விபத்து ஏற்பட்டால், அதனால் ஆகும் மருத்துவ செலவினத்தை இன்சுரஸ் கம்பெனி ஏற்க்கும்.

இதுவே Health Insurance எனப்படும்.

Health Insurance யார் யார் எடுக்கனும் ?

1. பணக்காரர்கள் or Elite

2. Corporate (office) Insurance இல்லாதவர்கள்

3. வியாதி உள்ளவர்கள் மட்டும்

1. பணக்காரர்கள் or Elite

2. Corporate (office) Insurance இல்லாதவர்கள்

3. வியாதி உள்ளவர்கள் மட்டும்

WHATTT!!! Health insurance premiums are likely to go up? 🤯

Yup! Because of higher claims due to COVID-19 resulting in rising healthcare inflation.

But here are some hacks to reduce your premiums ⤵️

#investing #StockMarket

Yup! Because of higher claims due to COVID-19 resulting in rising healthcare inflation.

But here are some hacks to reduce your premiums ⤵️

#investing #StockMarket

How could you reduce premiums on your health insurance:

• Get treatment in Network Hospitals

• Opt for voluntary deductible

• Pay 2-3 years’ premium to earn 7.5% discount

• Switch to policies with sub limits

#healthinsurance #FinancialFreedom

• Get treatment in Network Hospitals

• Opt for voluntary deductible

• Pay 2-3 years’ premium to earn 7.5% discount

• Switch to policies with sub limits

#healthinsurance #FinancialFreedom

▣ Get treatment in Network Hospitals 🏥

A hospital that has an agreement with an insurance company for providing cashless treatment is referred to as a Network Hospital.

A hospital that has an agreement with an insurance company for providing cashless treatment is referred to as a Network Hospital.

Travel is back on the table! With restrictions easing off, most of us are now determined to plan our next exotic vacation.

We have our bucket lists ready, a list of places to see, things to do, and cuisines to savour. But what about insurance? (1/8)

#insurance #travelinsurance

We have our bucket lists ready, a list of places to see, things to do, and cuisines to savour. But what about insurance? (1/8)

#insurance #travelinsurance

Travelling on a budget is not easy. We know from practice that we need to set aside money for unforeseen expenses. But, when travelling to a foreign land, could we take an extra step to be a little more prepared? (2/8)

#travel #financialplanning

#travel #financialplanning

Why should you take travel insurance? It safeguards the interests of the travellers on foreign land.

Imagine falling sick, meeting with an accident, or even losing your luggage & passport. As glum as it may sound, it is essential to prepare for emergencies. (3/8)

#uncertainity

Imagine falling sick, meeting with an accident, or even losing your luggage & passport. As glum as it may sound, it is essential to prepare for emergencies. (3/8)

#uncertainity

@MondayNightIBD @southasianIBD @ibdesis @Empoweringpts9 @DCharabaty @ownyourcrohns @crohnsbabble @LivingWithUmeed @vkckiranpullela @TheMaveilousGut @dunung_ruchita 📣 #IBD patients & caregivers:

#IBDPoll 1️⃣

📊Thinking abt your IBD needs, what's been the biggest hurdle to your care?

📝 In the replies, elaborate. What’s helped your care?

Please share your #PatientExperience w #MondayNightIBD 👇🏽

👨👩👧👦=Family

👩🏼🤝👩🏽=Friends

🥼=Specialist

#IBDPoll 1️⃣

📊Thinking abt your IBD needs, what's been the biggest hurdle to your care?

📝 In the replies, elaborate. What’s helped your care?

Please share your #PatientExperience w #MondayNightIBD 👇🏽

👨👩👧👦=Family

👩🏼🤝👩🏽=Friends

🥼=Specialist

@MondayNightIBD @southasianIBD @ibdesis @Empoweringpts9 @DCharabaty @ownyourcrohns @crohnsbabble @LivingWithUmeed @vkckiranpullela @TheMaveilousGut @dunung_ruchita #MondayNightIBD #PatientExperience

#IBDPoll 2️⃣

🧐Thinking about your culture’s expectations

📊 Have you tried Complementary and Alternative (CAM) Therapies (ex: ayurveda, homeopathy)?

What drove you to try these therapies? Please share your experience.

SE=side effects

#IBDPoll 2️⃣

🧐Thinking about your culture’s expectations

📊 Have you tried Complementary and Alternative (CAM) Therapies (ex: ayurveda, homeopathy)?

What drove you to try these therapies? Please share your experience.

SE=side effects

@MondayNightIBD @southasianIBD @ibdesis @Empoweringpts9 @DCharabaty @ownyourcrohns @crohnsbabble @LivingWithUmeed @vkckiranpullela @TheMaveilousGut @dunung_ruchita Thank you @MondayNightIBD for shining a spotlight on 🌏 #SouthAsianIBD pt experience!

I'm Madhura from 🇮🇳, co-founder Team @ibdesis. We are proud to lead #PatientExperience on #MondayNightIBD!

We hope to improve care for our community around the 🌍 through @SouthAsianIBD.

I'm Madhura from 🇮🇳, co-founder Team @ibdesis. We are proud to lead #PatientExperience on #MondayNightIBD!

We hope to improve care for our community around the 🌍 through @SouthAsianIBD.

A thread on how to choose MS/Ph.D. programs if you have multiple offers (from International Students' perspective, @Omviser1 )

Disclaimer: These are my personal thoughts and do not represent any organizations that I'm associated with.

#gradschool @AcademicsSay #phdstudent

Disclaimer: These are my personal thoughts and do not represent any organizations that I'm associated with.

#gradschool @AcademicsSay #phdstudent

Before I jump in, some background:

When I chose Penn State over my other acceptances (UIUC, Purdue, UC Santa Barbara etc.), my friends and family were surprised to hear that I gave up a top 5 school to attend a top 15/20 in my area.

Sharing my decisioning criteria below 👇

When I chose Penn State over my other acceptances (UIUC, Purdue, UC Santa Barbara etc.), my friends and family were surprised to hear that I gave up a top 5 school to attend a top 15/20 in my area.

Sharing my decisioning criteria below 👇

While funding wasn't an issue to me at all, I encourage everyone to think from a ROI perspective at MS or Ph.D. levels.

I read somewhere that an acceptance without proper funding is essentially a polite decline. $$ matters.

#Funding #PhDposition #Scholarships

I read somewhere that an acceptance without proper funding is essentially a polite decline. $$ matters.

#Funding #PhDposition #Scholarships

You do realize that your telling the truth about why #VoteBlue is pointless when even the #Democrats get a Supermajority, they won't get anything done?

Because that's what your admitting here, your saying "You shouldn't vote for us, because we still won't get anything done!"

Because that's what your admitting here, your saying "You shouldn't vote for us, because we still won't get anything done!"

We could've had #MedicareForAll or a #PublicOpinion under the @BarackObama Administration. But what we've gotten was a Right-wing #Healthcare Plan by the the @Heritage Foundation that kept the For-profit #HealthInsurance Companies in Control!

That was @MittRomney's Plan & it was supported by Right-wing idiots like @ChuckGrassley & @newtgingrich.

If @BarackObama cared about #SocialJustice, then he would've gone the Franklin D. Roosevelt & Lyndon B. Johnson route to make Democrats pass his Bills! But no.

If @BarackObama cared about #SocialJustice, then he would've gone the Franklin D. Roosevelt & Lyndon B. Johnson route to make Democrats pass his Bills! But no.

Daily Bookmarks to GAVNet 12/10/2021 greeneracresvaluenetwork.wordpress.com/2021/12/10/dai…

Tropical cyclones will become longer and more devastating, new research shows

usatoday.com/story/news/wor…

#TropicalCyclones #intensity #duration #ClimateChange #consequences

usatoday.com/story/news/wor…

#TropicalCyclones #intensity #duration #ClimateChange #consequences

Reshaping the plastic lifecycle into a circle

phys.org/news/2021-11-r…

#PlasticWaste #recycling #degradation #pervasiveness #consequences

phys.org/news/2021-11-r…

#PlasticWaste #recycling #degradation #pervasiveness #consequences

Key takeaways on Health Insurance from @Delhi_Investors DIA Expert Talk by:

Deepak Mendiratta @DeepakMendirtta, Founder @PlanCover

organised by

Delhi Investors Association's Brajesh Rawat @BrajeshRawat, Utkarsh Pandey @cautkarshpandey & other members.

A 🧵

#healthinsurance

Deepak Mendiratta @DeepakMendirtta, Founder @PlanCover

organised by

Delhi Investors Association's Brajesh Rawat @BrajeshRawat, Utkarsh Pandey @cautkarshpandey & other members.

A 🧵

#healthinsurance

Why health insurance?

To protect savings in case of health issues.

Access to quality health care is easy when you don't need to:

~ Dip into your savings

~ Withdraw your investments

~ Borrow from friends or bank

Health Insurance is thus a planning for tomorrow!

To protect savings in case of health issues.

Access to quality health care is easy when you don't need to:

~ Dip into your savings

~ Withdraw your investments

~ Borrow from friends or bank

Health Insurance is thus a planning for tomorrow!

What is Health Insurance?

Health Insurance covers cost of treatment of any:

~ Illness

~ Injury

~ Disease

which requires hospitalisation of a minimum of 24hrs.

Hospitalisation is not required in cases where due to technology advancement,treatment is done in less than 24hrs now.

Health Insurance covers cost of treatment of any:

~ Illness

~ Injury

~ Disease

which requires hospitalisation of a minimum of 24hrs.

Hospitalisation is not required in cases where due to technology advancement,treatment is done in less than 24hrs now.

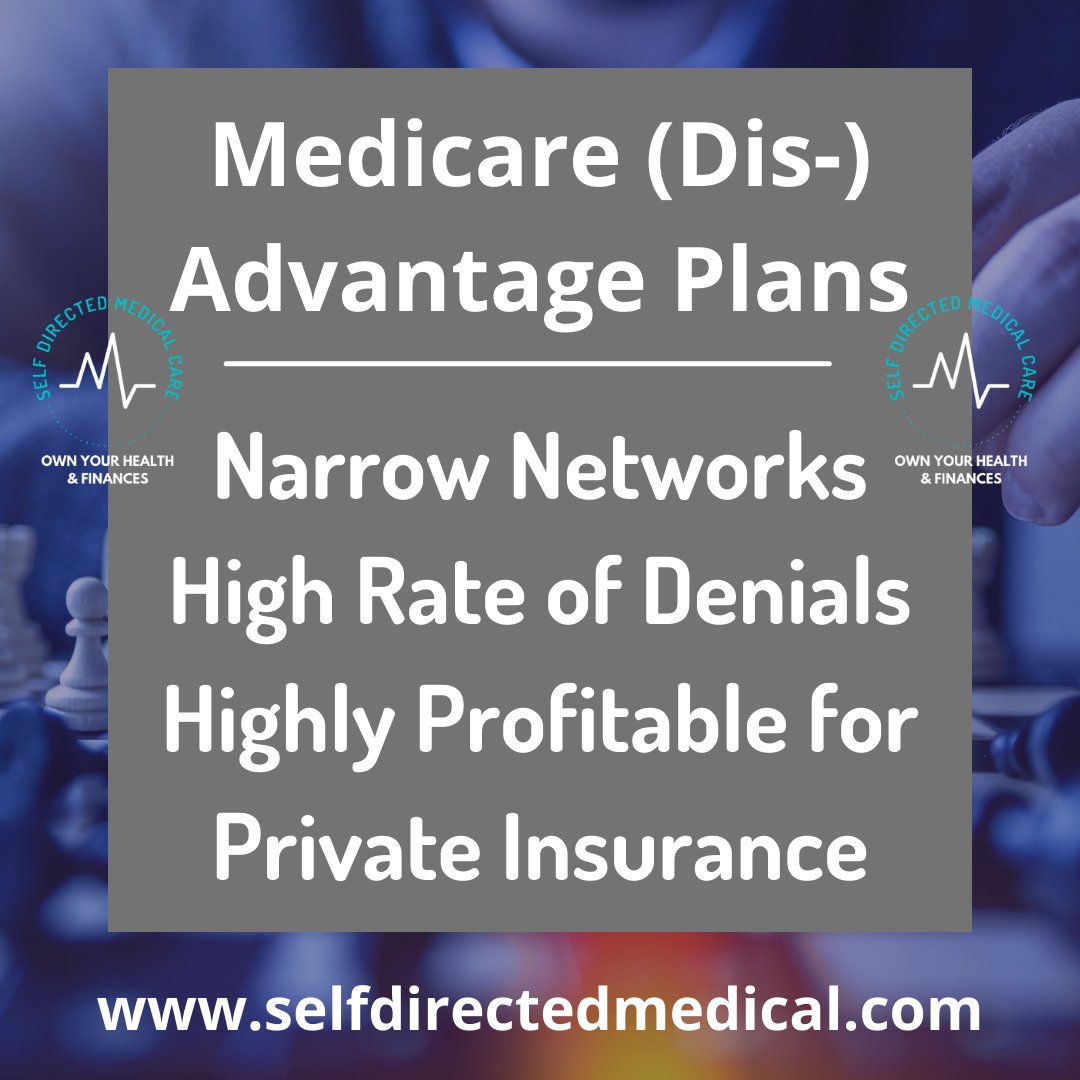

The Medicare DIS-Advantage Plans...

Many seniors are being lured into Medicare Advantage Plans due to the added benefits of hearing, dental, and gym membership coverage.

Many seniors are being lured into Medicare Advantage Plans due to the added benefits of hearing, dental, and gym membership coverage.

These plans are actually run by private insurers and actually quite profitable for insurance companies with profit margins of 5% or greater (industry average is 4%) khn.org/.../medicare-a…

Further these plans have the added problems of:

1) Narrow Networks - in fact, many of the most prestigious cancer centers in the country are excluded from these plans. Oddly enough 60% of Cancer diagnoses are in Medicare aged individuals... cancer.gov/about.../cause…

1) Narrow Networks - in fact, many of the most prestigious cancer centers in the country are excluded from these plans. Oddly enough 60% of Cancer diagnoses are in Medicare aged individuals... cancer.gov/about.../cause…

People and Corporations show you who they are... We choose to believe them!

Ohhhh the irony, two of the bad actors (insurance companies and private equity) that are inflating medical costs and harming patients and healers are suing each other and exposing to us all just a

Ohhhh the irony, two of the bad actors (insurance companies and private equity) that are inflating medical costs and harming patients and healers are suing each other and exposing to us all just a

glimpse of the deception/exploitation/greed that these corps have been using to put profits >>> patients.

United is suing Team Health (owned by the private equity Blackstone group) for over coding and thus overcharging patients by $100 million.

United is suing Team Health (owned by the private equity Blackstone group) for over coding and thus overcharging patients by $100 million.

Fremont Emergency Medicine (an affiliate of Team Health) is suing United for their gross underpayment of frontline clinicians.

It's likely that to some extent both are true...

Private Equity is harmful to patient care because they often boost their own profits by

It's likely that to some extent both are true...

Private Equity is harmful to patient care because they often boost their own profits by

No, no thanks, no gracias, not in a million years, never ever…

No Optum I do not want to be apart of your racketeering swamp of vertical integration.

Let’s talk about some Optum facts:

Optum is now the single largest owner of Physicians.

No Optum I do not want to be apart of your racketeering swamp of vertical integration.

Let’s talk about some Optum facts:

Optum is now the single largest owner of Physicians.

Optum is a subsidiary of United Health Group.

In Q2 of 2021 UHG made $4.3 billion in profits and $71.3 billion in revenue.

UHG stock share prices have grown 2200% (from $20.02 to $460.47) since Nov 2008.

In Q2 of 2021 UHG made $4.3 billion in profits and $71.3 billion in revenue.

UHG stock share prices have grown 2200% (from $20.02 to $460.47) since Nov 2008.

Two of the main ways UHG makes such massive profits is to deny payments to physicians for services rendered (I hear from physicians everyday that this happens to) and because their PBM OptumRx uses spread pricing to inflate the cost of medications their members purchase

"The Healthcare System breed passivity and dependence..." ~ Steve Forbes

The main ways that the hospitals and insurance companies do this is to:

1) Hide their prices

2) Make it complex to understand

3) Build rapport to enlist trust in patients that they will be taken care of

The main ways that the hospitals and insurance companies do this is to:

1) Hide their prices

2) Make it complex to understand

3) Build rapport to enlist trust in patients that they will be taken care of

However what we see everyday is that these folks use deception, complexity, narrow networks and many more tactics to make it difficult and complex for patients to get any benefit from their health insurance.

Where health insurance is difficult and complex, Medical Cost Sharing

Where health insurance is difficult and complex, Medical Cost Sharing

is simple and easy.

You make a monthly contribution, you have an initial unsharable amount, and you can choose any doctor you want! #simple #easy

Check out our website selfdirectedmedical.com for more information about how you too may be able to find your Checkmate

You make a monthly contribution, you have an initial unsharable amount, and you can choose any doctor you want! #simple #easy

Check out our website selfdirectedmedical.com for more information about how you too may be able to find your Checkmate

Insurers can REJECT your claim if your disease treatment falls under a "waiting period"

Here are the key things you need to know about waiting periods in your health #insurance policy.

A thread. (1/8)

Here are the key things you need to know about waiting periods in your health #insurance policy.

A thread. (1/8)

💡| As the name suggests, waiting periods in health insurance is quite literally the amount of time you need to wait, for an insurance policy to cover your diseases.

But since it’s insurance, it’s not that simple.

There are mainly 3 types of waiting periods...(2/8)

But since it’s insurance, it’s not that simple.

There are mainly 3 types of waiting periods...(2/8)

(1) Initial 30-day waiting period:

~This waiting period is only so that insurers can make sure that someone doesn’t take a policy after they get sick.

~Accidents (since they are unpredictable) & COVID (waiting period could be 15 -30 days) are exceptions. (3/8)

~This waiting period is only so that insurers can make sure that someone doesn’t take a policy after they get sick.

~Accidents (since they are unpredictable) & COVID (waiting period could be 15 -30 days) are exceptions. (3/8)