Discover and read the best of Twitter Threads about #ICOs

Most recents (13)

1/10 🧵💡 Why is the US cracking down on #cryptocurrencies, causing significant market volatility. Is the global leader overlooking a trend, or is there a deeper reasoning? 🤔🌐💱 Let's take a look:

2/10 The reasons behind this crackdown are multifaceted 🧩 Critics suggest the U.S.'s primary concern isn't protecting the average investor, contrary to the claims of the @SECGov. #CryptoMarkets #InvestorProtection

3/10 The blooming crypto market, exceeding $2tn in 2021, is pulling capital away from traditional financial systems 🏦 The U.S., among other regulators worldwide, is amplifying its scrutiny of the industry. #Finance #MoneyTalks

1/n

Grey area in securities regulation @SECGov has birthed a new phenomenon: bearer security tokens

Investors aren't aware of the risks associated w/ these assets so I wrote an article to share👇

Buyers Beware: Introducing Bearer Security Tokens👀

Link: blog.stomarket.com/buyers-beware-…

Grey area in securities regulation @SECGov has birthed a new phenomenon: bearer security tokens

Investors aren't aware of the risks associated w/ these assets so I wrote an article to share👇

Buyers Beware: Introducing Bearer Security Tokens👀

Link: blog.stomarket.com/buyers-beware-…

2/n

Security tokens are digital assets that comply w/ government securities regulations & automatically enforce rules, guidelines & parameters given a security

The @STOmarket secondary market capitalization has exploded more than 10x from last year to today & now sits @ $15B 🌴

Security tokens are digital assets that comply w/ government securities regulations & automatically enforce rules, guidelines & parameters given a security

The @STOmarket secondary market capitalization has exploded more than 10x from last year to today & now sits @ $15B 🌴

3/n

#Realestate has been cementing its place in the security token industry as a beneficiary of the technology since 2018 and 2019.🏚

We have seen a multitude of real estate security token offerings. According to the STM Real Estate Intelligence Report, by @pgaff_digital

#Realestate has been cementing its place in the security token industry as a beneficiary of the technology since 2018 and 2019.🏚

We have seen a multitude of real estate security token offerings. According to the STM Real Estate Intelligence Report, by @pgaff_digital

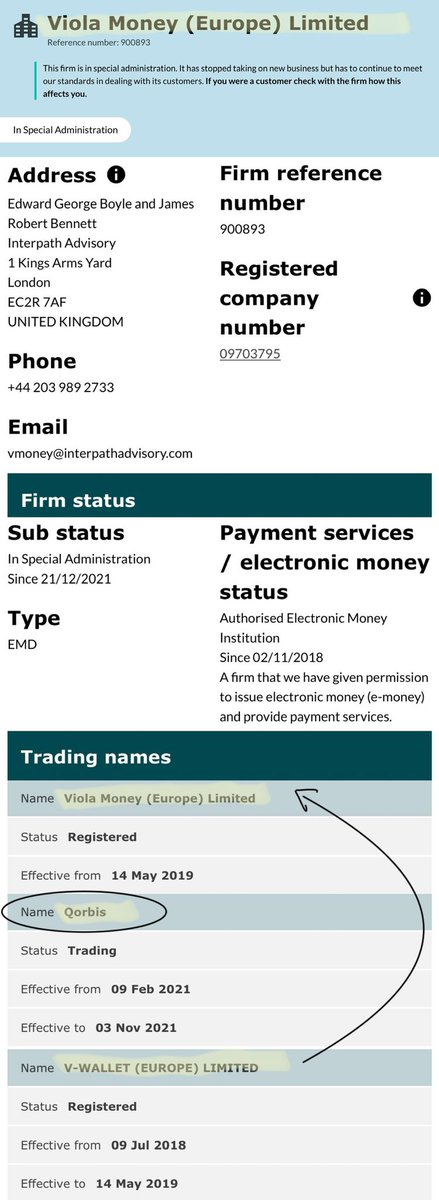

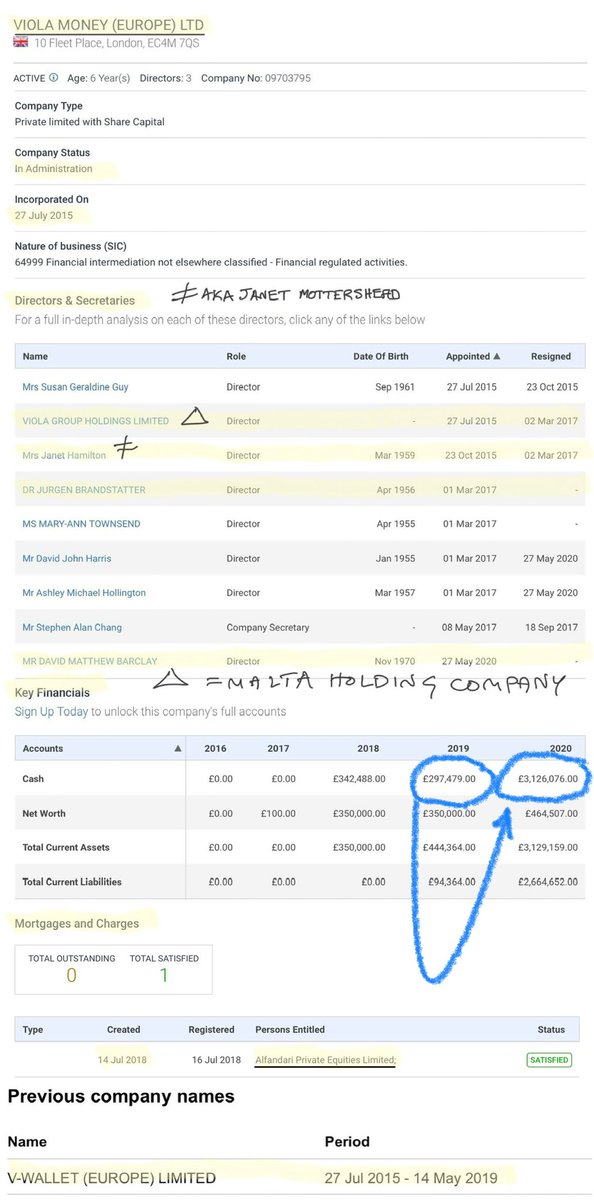

@ArmitageJim @premnsikka 1/ The curious case of “disguise, I see thou art a wickedness” [Viola, Twelfth Night] - PART 1 of 2: <Background>. On 22/Oct/2021 #ClearBank froze the accounts of @theFCA’s notorious #Emoney op #Viola Money(Europe) Ltd “VMEL”, …

2/ citing “financial crime concerns” + informed the slumbering UK regulator (@theFCA). A week later VMEL’s Estonian bank (#LHV) issued 2 months termination notice to VMEL. 4 days later (on 2/11/2021) the FCA finally issued a pitiful ‘1st supervision notice’ BUT astonishingly …

3/ still allowed VMEL to carry out unsupervised ‘individual transactions’ of <£5k (remember this + this date for Part 2). 6 days later astonishingly the FCA reportedly backtracked + rescinded even the conditions of it’s pitiful ‘1st supervision notice’ (#BigLaw no doubt …

Sale hilo 🧵 con sitios web que tenes que tener agregados a tus favoritos, si es que estás en el mundo de las #Criptomonedas

coingecko.com/es

Coingecko es una página donde vas a poder encontrar todos los proyectos #cripto del mercado, con datos oficiales como página web, redes sociales, smart contracts, etc.

También vas a tener datos de exchanges, y mucha información más.

Coingecko es una página donde vas a poder encontrar todos los proyectos #cripto del mercado, con datos oficiales como página web, redes sociales, smart contracts, etc.

También vas a tener datos de exchanges, y mucha información más.

coinmarketcal.com/en/

Un sitio donde vas a poder encontrar un calendario con fechas importantes de miles de proyectos.

Lo bueno es que tiene varios filtros para el caso de que quieras ver algún proyecto en particular.

Un sitio donde vas a poder encontrar un calendario con fechas importantes de miles de proyectos.

Lo bueno es que tiene varios filtros para el caso de que quieras ver algún proyecto en particular.

@el33th4xor caught this. i'm going to break it down in a long, probably painful THREAD.

FinCEN issues, then maybe retracts, 30 pages of guidance that is stated to be a reiteration & consolidation of prior guidance "rules and interpretations to other common business models involving CVC (convertible virtual currency) engaging in the same ...activity"

6 sections: 1. key concepts within the context of the guidance.

2 consolidates & explains current FinCEN regulations, previous

administrative rulings, & guidance involving the regulation of money transmission under the BSA. 3. summarizes FinCEN’s 2013 guidance

2 consolidates & explains current FinCEN regulations, previous

administrative rulings, & guidance involving the regulation of money transmission under the BSA. 3. summarizes FinCEN’s 2013 guidance

👆#TurnKey,Inc.: #SEC turning the (same)key in the lock

Surprised that commentators think there is anything new in this decision. It is simply a different type of argumentation. It is for the first time a #negative #definition of #ICO #regulation by #securities’ #laws. Thread👇

Surprised that commentators think there is anything new in this decision. It is simply a different type of argumentation. It is for the first time a #negative #definition of #ICO #regulation by #securities’ #laws. Thread👇

👉1. In Munchee Inc., SEC claims (sec.gov/litigation/adm…):

⛔️Munchee has no viable product

⛔️tokens sold are not usable, but will possibly be in the future

⛔️ICO will fund the development of the project

⛔️MUN price will vary AND reasonable expectation of future profits

⛔️Munchee has no viable product

⛔️tokens sold are not usable, but will possibly be in the future

⛔️ICO will fund the development of the project

⛔️MUN price will vary AND reasonable expectation of future profits

⛔️#profits (or losses) depend solely on efforts of #Munchee #managers

⛔️#marketing MUN token in the manner to induces the purchasers to believe there is a profit expected solely for buying MUN and reselling it later.

⚠️a positive definition -> this IS a security

⛔️#marketing MUN token in the manner to induces the purchasers to believe there is a profit expected solely for buying MUN and reselling it later.

⚠️a positive definition -> this IS a security

1/19 THE ROAD TO BITCOIN RICHES ISN’T ALWAYS PAVED

Whether it was lost or stolen funds, feuds that broke-up friendships, innovations that went awry, everyone has a #BitcoinRegret.

Welcome to the next chapter of the #BitcoinAt10 multimedia series - ow.ly/QwfK30nvTsQ

Whether it was lost or stolen funds, feuds that broke-up friendships, innovations that went awry, everyone has a #BitcoinRegret.

Welcome to the next chapter of the #BitcoinAt10 multimedia series - ow.ly/QwfK30nvTsQ

2/19 When… Prius?

While the #bitcoin industry is infatuated with Lambos, @Rassah couldn't care less about suicide doors and instead purchased a planet-saving Prius.

There's one catch – he did it when bitcoin was at $22.

ow.ly/t30G30nvV7v #BitcoinRegret

While the #bitcoin industry is infatuated with Lambos, @Rassah couldn't care less about suicide doors and instead purchased a planet-saving Prius.

There's one catch – he did it when bitcoin was at $22.

ow.ly/t30G30nvV7v #BitcoinRegret

3/19 The ole' wiped the hard drive story

.@JosephFiscella is one of those – he mined #bitcoin in the early days, forgot about it and then reformatted his hard drive, erasing everything.

Don't worry, he's still holding out hope.

ow.ly/o1NU30nvVgn #BitcoinRegret

.@JosephFiscella is one of those – he mined #bitcoin in the early days, forgot about it and then reformatted his hard drive, erasing everything.

Don't worry, he's still holding out hope.

ow.ly/o1NU30nvVgn #BitcoinRegret

Had our first event @placeholdervc’s Manhattan office last night, a full-house to discuss @MakerDAO!

Started w/ a presentation from @alexhevans on @MakerDAO’s network adoption (he’ll share graphs soon), and then shifted to opening/closing CDPs, as well as lending $DAI to @compoundfinance to earn 2.5% (0.5% annual fee to take out loans in DAI, earn 3% by lending it on compound)

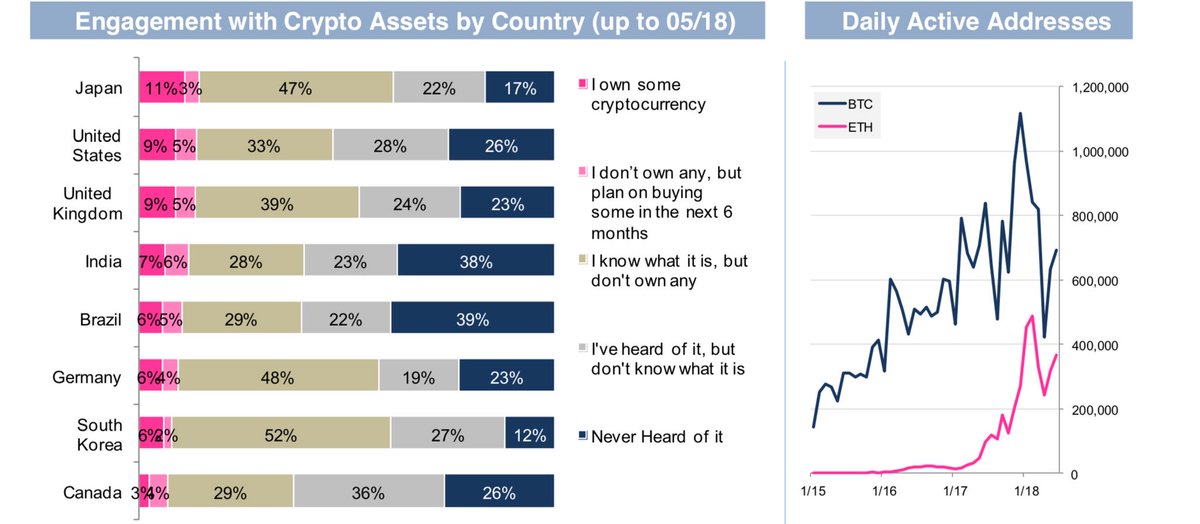

Monster 100+ page #crypto report from @AutonoFinTech: next.autonomous.com/crypto-utopia/ First takeaway graph shows crypto-penetration per country, Japan in the lead w/ 83% awareness

2/ Succinct narrative of 3 waves of #crypto funding:

Bitcoin startups, Enterprise blockchain, ICOs.

#ICO funding in 2018 nearing double that of 2017.

Bitcoin startups, Enterprise blockchain, ICOs.

#ICO funding in 2018 nearing double that of 2017.

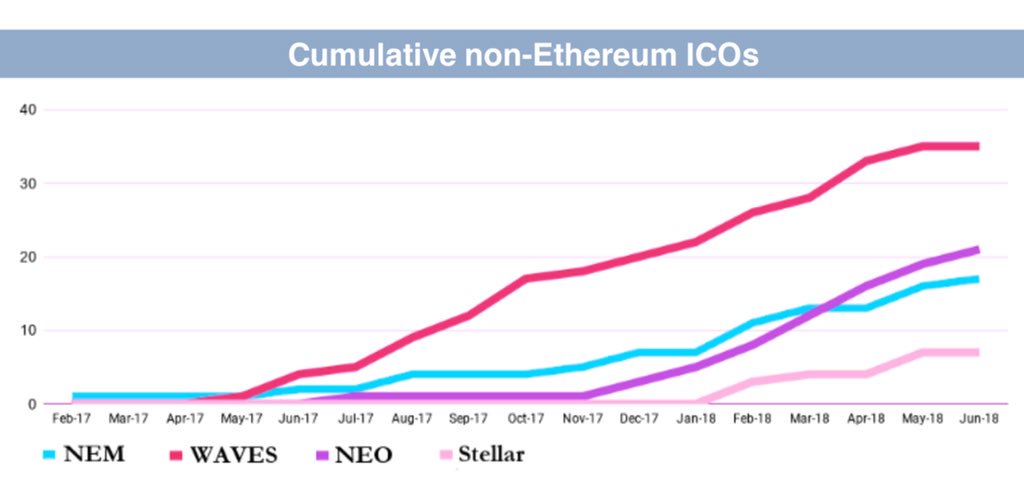

3/ Smart contract platforms other than #Ethereum are growing... but w/ the top (@wavesplatform) at ~30 ICOs, all still pale in comparison.

Appropriate regulation would help lend the crypto field the trust needed for it to flourish.

bbc.com/news/technolog…

bbc.com/news/technolog…

0/ A Brief History of Decentralization in Venture Funding (a thread)

1/ In the early days of venture capital, funding sources were centralized to a few big players with deep pockets handing out checks to entrepreneurs. (e.g. Rockefeller's investment in Fairchild Semiconductor)

2/ In the 60s - 70s, more VC firms emerged as a response to the market's demand for access to outsized returns. Venture capital deployment was gradually decentralized as GPs were entrusted to invest LPs' money in their disparate networks.

As many lawyers in the space have anticipated, state regulators are beginning to get involved with token sales and #icos. Today, the Texas State Securities Board brought a C&D against BitConnect. This C&D has implications for tokens used for staking.

ssb.texas.gov/sites/default/….

ssb.texas.gov/sites/default/….

By way of background, Texas has adopted the federal Howey test for purposes of anlalyzing Texas state securities laws issues. Like federal securities laws, Texas looks to the "economic realities" related to a transaction.

Thus this decision provides additional information about how regulators will view token sales. More importantly, it's our first look at how regulators will view tokens used for staking.

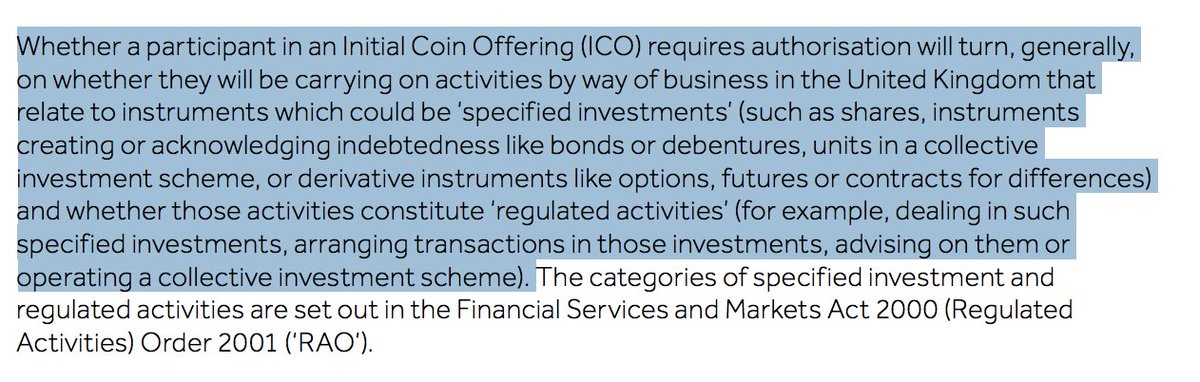

UK Financial Conduct Authority issues some guidance on token sale (#icos). As before seem to indicate that tokens will be adjudged on a case-by-case basis. More detail below:

fca.org.uk/publication/fe…

fca.org.uk/publication/fe…