Discover and read the best of Twitter Threads about #IncomeTax

Most recents (24)

How to file ITR for F&O trading for FY 2022-23

The last date to file is 31 July

Let's start.

The last date to file is 31 July

Let's start.

Which ITR you have to select;

ITR 3

So up to 2 cr Turnover you can file ITR under Section 44AD (Presumptive Income)

So the main question how to calculate turnover

So the agreegate of Profit and loss is your Turnover

ITR 3

So up to 2 cr Turnover you can file ITR under Section 44AD (Presumptive Income)

So the main question how to calculate turnover

So the agreegate of Profit and loss is your Turnover

Example

Banknifty 42200 ce you have profit of 12000

And in banknifty 45000 pe you have loss of 3000

So your Turnover will be 15000

You can download the file and calculate this is in excel easily.

Banknifty 42200 ce you have profit of 12000

And in banknifty 45000 pe you have loss of 3000

So your Turnover will be 15000

You can download the file and calculate this is in excel easily.

#BREAKING: #DelhiHighCourt dismisses pleas moved by Rahul Gandhi, Sonia Gandhi, Priyanka Gandhi Wadra, Aam Aadmi Party (AAP) and other charitable trusts challenging the IT authorities' decision to transfer their tax assessments to the central circle.

#IncomeTax #RahulGandhi… twitter.com/i/web/status/1…

#IncomeTax #RahulGandhi… twitter.com/i/web/status/1…

While dismissing the petition a division bench comprising Justice Manmohan and Justice Dinesh Kumar Sharma observed that transfer was in accordance with law.

The bench also clarified that it did not examine the matter on merits.

#IncomeTax #RahulGandhi #SoniaGandhi… twitter.com/i/web/status/1…

The bench also clarified that it did not examine the matter on merits.

#IncomeTax #RahulGandhi #SoniaGandhi… twitter.com/i/web/status/1…

The bench said that the parties are free to raise their contentions before the appropriate statutory authority and that the transfer of their assessment to the Central Circle was for a coordinated investigation.

The court also upheld the orders passed by the IT authorities.… twitter.com/i/web/status/1…

The court also upheld the orders passed by the IT authorities.… twitter.com/i/web/status/1…

Delhi High Court dismisses pleas moved by Rahul Gandhi, Sonia Gandhi, Priyanka Gandhi Wadra, Aam Aadmi Party and other charitable trusts challenging the IT authorities' decision to transfer their tax assessments to the central circle.

#DelhiHighCourt #IncomeTax

#DelhiHighCourt #IncomeTax

A division bench of Justice Manmohan and Justice Dinesh Kumar Sharma dismissed the petitions and observed that transfer was in accordance with law.

However, the court clarified that it did not examine the matter on merits.

#DelhiHighCourt #IncomeTax #RahulGandhi #SoniaGandhi

However, the court clarified that it did not examine the matter on merits.

#DelhiHighCourt #IncomeTax #RahulGandhi #SoniaGandhi

“The parties are free to raise their contentions before the appropriate statutory authority,” the bench added.

#DelhiHighCourt #IncomeTax #AamAadmiParty #RahulGandhi #SoniaGandhi #PriyankaGandhi

#DelhiHighCourt #IncomeTax #AamAadmiParty #RahulGandhi #SoniaGandhi #PriyankaGandhi

Gst On Renting of Immovable Property🧵

In this thread we will discuss renting of both commercial & residential property 🕵️ (1/4)

#gst #tax #incometax #tds #gstn

In this thread we will discuss renting of both commercial & residential property 🕵️ (1/4)

#gst #tax #incometax #tds #gstn

1. Renting of Residential Dwelling.🏡

A) If residential dwelling is used for commercial purpose then GST is payable on Forward charge basis.(office etc)

B) If residential dwelling is used for personal purpose then the service is exempt for both registered & unregistered. (2/4)

A) If residential dwelling is used for commercial purpose then GST is payable on Forward charge basis.(office etc)

B) If residential dwelling is used for personal purpose then the service is exempt for both registered & unregistered. (2/4)

C) If Residential dwelling used for commercial purpose but as a residence i.e Guest house etc. by registered person then it's taxable under RCM.

D) If Residential dwelling used for commercial purpose but as a residence i.e Guest house etc. by unregistered then it is exempt.(3/4)

D) If Residential dwelling used for commercial purpose but as a residence i.e Guest house etc. by unregistered then it is exempt.(3/4)

Step by step process for computation of total income and tax payable (with respect to an individual assessee)

New practicing CAs and professionals may also use this.

#usefulsummary #icai #caintermediate #castudents #taxation #incometax #icaiexams #caexams #superradacademy

New practicing CAs and professionals may also use this.

#usefulsummary #icai #caintermediate #castudents #taxation #incometax #icaiexams #caexams #superradacademy

Figure 1 reference for residential status

Most employees don't really know why they get a tax refund when they add to an RRSP.

They understand that they do get one, and that it's "good" but really they don't understand the mechanics.

It's actually so simple.

🧵

They understand that they do get one, and that it's "good" but really they don't understand the mechanics.

It's actually so simple.

🧵

Your employer is estimating how much tax you'll owe based on how much they're paying you.

If you add to a personal RRSP, your employer doesn't account for that in their estimate.

When you put money into an RRSP, the CRA won’t charge you income tax on the amount you put in.

If you add to a personal RRSP, your employer doesn't account for that in their estimate.

When you put money into an RRSP, the CRA won’t charge you income tax on the amount you put in.

If your employer estimated that you'd owe money on that, they paid that amount to CRA on your behalf.

This is your "withholding tax". It's meant to ensure CRA gets their due.

Withholding tax is just an advance payment of your annual income tax.

This is your "withholding tax". It's meant to ensure CRA gets their due.

Withholding tax is just an advance payment of your annual income tax.

#DelhiHighCourt orders Income Tax Authorities to 'stay their hand' in relation to the income tax notices issued to former union minister and Rajya Sabha MP @KapilSibal

The IT Department had issued a show cause notice to Sibal on March 11.

#IncomeTax #kapilsibal

The IT Department had issued a show cause notice to Sibal on March 11.

#IncomeTax #kapilsibal

The IT authorities had issued notice to Sibal in relation to assesment of his income starting from the year 2013-14.

Sr Advocat P Chidambaram appeared for Sibal today and stated that the income tax proceedings were in violation of principle of natural justice.

The court was also informed that the proceedings were without jurisdiction.

The court was also informed that the proceedings were without jurisdiction.

Delhi High Court restrains Income Tax authorities from acting on the Show Cause notice issued to Rajya Sabha MP and senior lawyer Kapil Sibal on March 11, 2023 in relation to assessment proceedings.

The court said the concerned officer will first dispose of objections preferred by Sibal. "In this context, the concerned officer will issue a notice to the petitioner which would indicate the date, venue and time of the hearing," said the court.

The concerned officer will pass a speaking order qua the objections preferred by the petitioner and a copy of the same will be furnished to the petitioner, a division bench of the court said in the order.

Understanding ESOPs #4

Taxation of ESOPS explained in way that even a 5-years old can understand!

#startups #incometax 🧵

Taxation of ESOPS explained in way that even a 5-years old can understand!

#startups #incometax 🧵

ESOPs are like a special way of getting paid. But when you get paid, you also have to pay taxes.

There are 2 times when you have to pay taxes for ESOPs:

1. When you decide to turn them into shares, and

2. When you sell those shares.

There are 2 times when you have to pay taxes for ESOPs:

1. When you decide to turn them into shares, and

2. When you sell those shares.

Let's say you have 1000 shares that you can turn into shares by paying Rs. 10 for each share. But each share is worth Rs. 100 in the market.

So, the difference between the two prices is Rs. 90 per share, which is taxed.

So, the difference between the two prices is Rs. 90 per share, which is taxed.

बाबांनो ते आधार कार्ड पॅन कार्ड लिंक करून या रे!

दरवेळीस सरकार शेवटची तारीख शेवटची वाॅर्निंग म्हणतय खर पण यावेळी सरकारने मनावर घेतलेलं दिसतय. 🧐 ३१ मार्च २०२३ ही आधार-पॅन लिंक करण्याची शेवटची तारीख असल्याने पटापट सगळ्यांनी लिंक करा नाहीतर १ एप्रिलपासुन तुमचे पॅन कार्ड निष्क्रिय

दरवेळीस सरकार शेवटची तारीख शेवटची वाॅर्निंग म्हणतय खर पण यावेळी सरकारने मनावर घेतलेलं दिसतय. 🧐 ३१ मार्च २०२३ ही आधार-पॅन लिंक करण्याची शेवटची तारीख असल्याने पटापट सगळ्यांनी लिंक करा नाहीतर १ एप्रिलपासुन तुमचे पॅन कार्ड निष्क्रिय

होईल.

याबद्दल सविस्तर माहिती अशी की

Central Board Of Direct Taxes( CBDT) ने ३१ मार्च २०२२ पर्यंत पॅन आधार लिंक करण्याची मुदत दिली होती. ती मुदत ३० जुन २०२२ पर्यंत वाढवली पण ५०० रूपये दंड आकारून!

आणि ३० जुन २०२२ च्या पुढे ५०० रूपये दंडाची रक्कम १००० रूपये करण्यात आलीय याचाच अर्थ

याबद्दल सविस्तर माहिती अशी की

Central Board Of Direct Taxes( CBDT) ने ३१ मार्च २०२२ पर्यंत पॅन आधार लिंक करण्याची मुदत दिली होती. ती मुदत ३० जुन २०२२ पर्यंत वाढवली पण ५०० रूपये दंड आकारून!

आणि ३० जुन २०२२ च्या पुढे ५०० रूपये दंडाची रक्कम १००० रूपये करण्यात आलीय याचाच अर्थ

ज्या लोकांनी आणखी पॅन कार्ड आणि आधार कार्ड लिंक केलेल नाहीय त्यांना आधी १००० रूपये दंडात्मक रक्कम भरावी लागेल. ती पण ३१ मार्च २०२३ पर्यंत मुदत आहे. जर तरीपण तुम्ही आधार पॅन लिंक केल नाहीच तर तुमचे पॅन कार्ड निष्क्रिय होईल आणि तुम्हाला जर पॅन कार्ड चालु करायचे असेल तर त्यासाठी

Confused about tax filing in India?

Don't worry, you're not alone!

Here are some essential Do's and Don'ts to help you file your taxes with ease!

A thread! (1/n)

#taxfiliing #tax #deductions #personalfinance #thread

Don't worry, you're not alone!

Here are some essential Do's and Don'ts to help you file your taxes with ease!

A thread! (1/n)

#taxfiliing #tax #deductions #personalfinance #thread

#1 Be On Time

Remember to file your tax returns on time. This can help you avoid penalties and legal issues with the Income Tax Department.

The deadline for filing taxes in India is usually July 31st. (2/n)

#taxreturns #taxes #incometax #directtax

Remember to file your tax returns on time. This can help you avoid penalties and legal issues with the Income Tax Department.

The deadline for filing taxes in India is usually July 31st. (2/n)

#taxreturns #taxes #incometax #directtax

#2 Disclose Necessary Infomation

Remember to disclose all your sources of income, including salary, rental income, interest, and capital gains while filing your tax returns to avoid penalties. (3/n)

#tax #salary #rentalincome #interest #capitalgains

Remember to disclose all your sources of income, including salary, rental income, interest, and capital gains while filing your tax returns to avoid penalties. (3/n)

#tax #salary #rentalincome #interest #capitalgains

इन्कम टॅक्स साठी तुम्हाला नवी प्रणाली योग्य की जुनी? ठरवा इन्कम टॅक्स डिपार्टमेंटच्या कॅल्क्युलेटरचा वापर करून

माननीय अर्थमंत्री निर्मला सीतारामन यांनी अर्थसंकल्पात इन्कम टॅक्सबाबत महत्वाची घोषणा केली. ७ लाखांपर्यंत उत्पन्न असणाऱ्या व्यक्तीला टॅक्स भरावा लागणार #मराठी #incometax

माननीय अर्थमंत्री निर्मला सीतारामन यांनी अर्थसंकल्पात इन्कम टॅक्सबाबत महत्वाची घोषणा केली. ७ लाखांपर्यंत उत्पन्न असणाऱ्या व्यक्तीला टॅक्स भरावा लागणार #मराठी #incometax

नाही ही ती घोषणा होती. मात्र यासाठी नवीन टॅक्सप्रणालीचा वापर करणे बंधनकारक असणार आहे. यानंतर अनेकांना आपण जुन्या टॅक्स प्रणालीचा वापर करावा की नव्या? असा प्रश्न पडलेला दिसला.#म #मराठी #incometax

म्हणूनच इन्कम टॅक्स डिपार्टमेंटने तुम्हाला मदत म्हणून त्यांच्या वेबसाईटवर ऑफिशियल कॅल्क्युलेटर उपलब्ध करून दिलेले आहेत. यामुळे टॅक्सचे कॅल्क्युलेशन करणे आणि दोन्हीही टॅक्स प्रणालींपैकी कुठे कमी टॅक्स भरावा लागतो हे समजणे सोपे जाईल.

#म #मराठी #incometax

#म #मराठी #incometax

1.

Infra gets boost:

- Highest ever capital outlay of Rs. 2.40 lakh crores for Railways

- 50-year interest-free loans to states one more year for infra spends

Infra gets boost:

- Highest ever capital outlay of Rs. 2.40 lakh crores for Railways

- 50-year interest-free loans to states one more year for infra spends

2.

Agri & Fisheries to benefit:

- Agricultural accelerator fund to promote agri-startups

- 10,000 bio-input resource centres in next 3 yrs to promote natural farming

- 6000 Cr outlay for Animal husbandry, dairy, and fisheries

Agri & Fisheries to benefit:

- Agricultural accelerator fund to promote agri-startups

- 10,000 bio-input resource centres in next 3 yrs to promote natural farming

- 6000 Cr outlay for Animal husbandry, dairy, and fisheries

Union Finance Minister Nirmala Sitharaman presenting Union Budget 2023-24 #Budget2023 #BudgetSession #Budget

Indian economy has increased from being 10th to 5th in the world. EPFO membership doubled to 27 crore and digital payments of 126 lakh crore rupees made through UPI: Sitharaman @nsitharamanoffc #Budget2023 #BudgetSession #Budget

Priority no 1 is inclusive development - covering farmers, women, youth, OBCs, divyang etc. Sustained focus of Jammu & Kashmir, Ladakh and the North East: Sitharaman @nsitharamanoffc #Budget2023 #BudgetSession #Budget

Current year Estimated GDP growth 7%

#Budget2023

#Budget2023

Per capita income doubled in last 9 years

#Budget2023

#Budget2023

Universalisation of targeted scheme

Hahahahaha

#Budget2023

Make all targeted scheme as universal scheme Madam FM.

PDS and MGNREGA is the priority.

Hahahahaha

#Budget2023

Make all targeted scheme as universal scheme Madam FM.

PDS and MGNREGA is the priority.

Are you shifting back to India?

Know #incometax implications & residential status in the year when you come to India.

A thread 🧵

Know #incometax implications & residential status in the year when you come to India.

A thread 🧵

Before we proceed, I want to tell you that from an Income tax perspective, a person can fall into one of these "every year".

Either he/she is a:

1. Resident (R)

2. Non-Resident (NR)

3. Not Ordinarily Resident (R-NOR)

This needs to be checked every financial year (FY).

Either he/she is a:

1. Resident (R)

2. Non-Resident (NR)

3. Not Ordinarily Resident (R-NOR)

This needs to be checked every financial year (FY).

Your residential status for the FY in which you shift to India depends upon your days of stay in India in that FY.

Can be classified in:

Situation 1- <60 days in IND

Situation 2- 60 to 119 days in IND

Situation 3- 120 to 181 days in IND

Situation 4- 182 days or more in IND

Can be classified in:

Situation 1- <60 days in IND

Situation 2- 60 to 119 days in IND

Situation 3- 120 to 181 days in IND

Situation 4- 182 days or more in IND

Thread 🧵

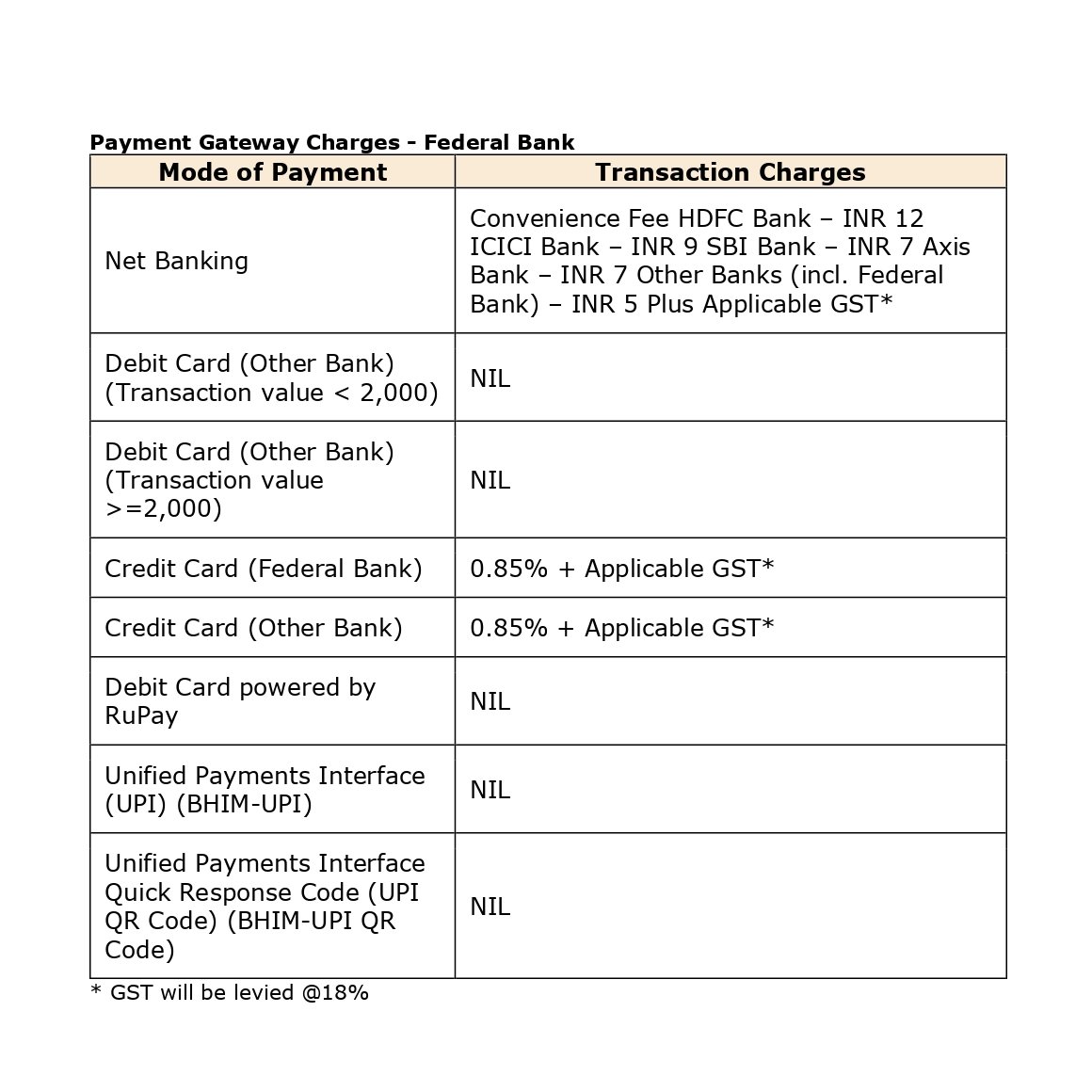

Now you can pay Income Tax via Debit Card, Credit Card, UPI too @IncomeTaxIndia

#incometax #upi

Please note, this is available when you pay taxes through Income Tax Portal and not from @Protean_Tech website.

Now you can pay Income Tax via Debit Card, Credit Card, UPI too @IncomeTaxIndia

#incometax #upi

Please note, this is available when you pay taxes through Income Tax Portal and not from @Protean_Tech website.

Earlier, tax payments majorly were done using 2 modes. Internet Banking or Physically visiting Bank.

Now you can pay via :

👉UPI

👉Internet Banking

👉Debit Card

👉Credit Card

👉Over the Counter

👉NEFT/RTGS

Now you can pay via :

👉UPI

👉Internet Banking

👉Debit Card

👉Credit Card

👉Over the Counter

👉NEFT/RTGS

Paying through UPI, Debit Cards or Rupay Debit Card does not attract any transaction charges.

Income Tax systems using payment gateway of @FederalBankLtd

Snapshot of transaction charges 👇👇

Income Tax systems using payment gateway of @FederalBankLtd

Snapshot of transaction charges 👇👇

Thread on Taxation and Tax Planning through Minor’s Income

We will see:

👉🏻PAN & ITR filing of Minor

👉🏻How Clubbing of Income happens?

👉🏻Taxation of Minor Income

👉🏻Tax Planning

@Spaysocial @investyadnya @AdeParimal @gaurav28jain #minor #TaxTwitter #taxplanning

We will see:

👉🏻PAN & ITR filing of Minor

👉🏻How Clubbing of Income happens?

👉🏻Taxation of Minor Income

👉🏻Tax Planning

@Spaysocial @investyadnya @AdeParimal @gaurav28jain #minor #TaxTwitter #taxplanning

Q. Can minor apply for PAN?

Absolutely yes, Income Tax Act does not bar minors from applying to PAN. Even today’s born baby can also apply for PAN.

There is no age limit for applying for PAN.

Absolutely yes, Income Tax Act does not bar minors from applying to PAN. Even today’s born baby can also apply for PAN.

There is no age limit for applying for PAN.

Q. Can Minor file his ITR?

Yes again. There is no provision in income tax act which says minor cannot file his ITR.

Income tax return can be filed by his representative also.

#incometax #IncomeTaxReturns

Yes again. There is no provision in income tax act which says minor cannot file his ITR.

Income tax return can be filed by his representative also.

#incometax #IncomeTaxReturns

Few Important points to keep in mind while reporting clause 44 of Form 3CD i.e. 'Break-up of total expenditure of entities registered or not registered under GST'

(As per the guidance note on Tax Audit under Section 44AB by @theicai )

[A 🧵]

@PratibhaGoyal @TaxationUpdates

(As per the guidance note on Tax Audit under Section 44AB by @theicai )

[A 🧵]

@PratibhaGoyal @TaxationUpdates

a. The total expenditure will include purchases as well

b. Depreciation & deduction for bad debts are not required to be reported

c. Expenditure incurred in respect of activities mentioned under Schedule III to the CGST Act are not required to be reported. Eg: Employees Salary

b. Depreciation & deduction for bad debts are not required to be reported

c. Expenditure incurred in respect of activities mentioned under Schedule III to the CGST Act are not required to be reported. Eg: Employees Salary

d. Exempt supply will also include non-taxable supply.

Non-taxable supply includes supply of goods or services which are not leviable to GST. For Eg:

(i) alcoholic liquor

(ii) petroleum crude, high speed diesel oil, motor spirit, natural gas & aviation turbine fuel

Non-taxable supply includes supply of goods or services which are not leviable to GST. For Eg:

(i) alcoholic liquor

(ii) petroleum crude, high speed diesel oil, motor spirit, natural gas & aviation turbine fuel

Indian Income Tax has a peculiar category of taxpayers i.e. HUF.

So, Let's understand what is HUF ? [ A 🧵]

@CA_HarshilSHETH @TaxationUpdates @PratibhaGoyal @caanuragwriter #HUF #incometax #taxpayer

So, Let's understand what is HUF ? [ A 🧵]

@CA_HarshilSHETH @TaxationUpdates @PratibhaGoyal @caanuragwriter #HUF #incometax #taxpayer

The Income Tax Act provides several opportunities for taxpayers to reduce their tax liabilities in a legitimate manner.

One such aspect is the creation of the HUF or the Hindu Undivided Family

One such aspect is the creation of the HUF or the Hindu Undivided Family

HUF's features:-

a. HUF is governed under Hindu law board & could be formed by a married couple or by a family

b. Hindus, Buddhists, Jains & Sikhs can form HUFs.

c. HUF consists of a common ancestor and all of his lineal descendants, including their wives & unmarried daughters

a. HUF is governed under Hindu law board & could be formed by a married couple or by a family

b. Hindus, Buddhists, Jains & Sikhs can form HUFs.

c. HUF consists of a common ancestor and all of his lineal descendants, including their wives & unmarried daughters

Do you know, filing of Income Tax return for senior citizen is not compulsory if TDS is deducted u/s 194P.

Let's understand more about section 194P [ A 🧵]

#incometax #IncomeTaxReturns #ITRfiling #seniorcitizens @PratibhaGoyal @TaxationUpdates @AbhasHalakhandi #incometaxportal

Let's understand more about section 194P [ A 🧵]

#incometax #IncomeTaxReturns #ITRfiling #seniorcitizens @PratibhaGoyal @TaxationUpdates @AbhasHalakhandi #incometaxportal

Finance Act, 2021 inserted a new Section 194P to provide relief to a senior citizen who is 75 years or more from the burden of filing of return of income.

It provides that if TDS has been deducted u/s 194P, then such senior citizen shall be exempted from filing Income Tax Return

It provides that if TDS has been deducted u/s 194P, then such senior citizen shall be exempted from filing Income Tax Return

Section 194P provides conditional relief to the senior citizen from filing the Income-tax return.

It is applicable only if the below mentioned conditions are satisfied.

It is applicable only if the below mentioned conditions are satisfied.

In the light of several changes in Reverse Charge Mechanism (RCM) like RCM on Residential Flat or RCM on renting of vehicle by corporate.

Lets understand the basic about RCM [ A 🧵]

#RCM #gst #incometax #gstcouncil @PratibhaGoyal @TaxationUpdates @caanuragwriter #company

Lets understand the basic about RCM [ A 🧵]

#RCM #gst #incometax #gstcouncil @PratibhaGoyal @TaxationUpdates @caanuragwriter #company

Reverse charge is a mechanism where the recipient (buyer) of the goods or services is liable to pay GST to the government instead of the supplier.

Typically, the supplier of goods or services pays the GST on supply.

Under the reverse charge mechanism (RCM), the recipient of goods or services becomes liable to pay the GST, i.e., the chargeability gets reversed.

Under the reverse charge mechanism (RCM), the recipient of goods or services becomes liable to pay the GST, i.e., the chargeability gets reversed.

Second One - Series A Funding [ A 🧵]

#Startup #seedcapital #funding #company @PratibhaGoyal @TaxationUpdates #Incometax #zomato #paytm #icai #ca #cs #incometax #taxology #byjus

#Startup #seedcapital #funding #company @PratibhaGoyal @TaxationUpdates #Incometax #zomato #paytm #icai #ca #cs #incometax #taxology #byjus

Series A funding is a level of investment in a start-up that follows seed capital funding.

Essentially, the Series A round is the second stage of startup financing and the first stage of venture capital financing.

Essentially, the Series A round is the second stage of startup financing and the first stage of venture capital financing.

Series A funding enables a start-up that has potential but lacks needed cash to expand its operations through hiring, purchasing inventory and equipment, and pursuing other long-term goals.

Series A funding is primarily used to ensure the continued growth of a company.

Series A funding is primarily used to ensure the continued growth of a company.