Discover and read the best of Twitter Threads about #Lehman

Most recents (10)

@threadreaderapp @Ova_Wit_lol @GavinClimie Shall we continue? The US Bankruptcy Court Judge in Manhattan on Friday Sep 19, 2008 was essentially forced to approve an agreement unprecedented and possibly not entirely legal (post 9/11) because foreign-bank, HQ in London, Barclays Plc was the only viable rescue buyer in 9/08

@threadreaderapp @Ova_Wit_lol @GavinClimie The LBHI company core assets sold in less than a week. LBHI had however pre-shopped some of its assets, like Neuberger Berman Asset Management in summer 2008 for raising cash. Still acting quick on selling LBHI's CH11 assets was imperative with value crashing fast since 9/15/08

@Ova_Wit_lol @GavinClimie The link in this thread to Dick Fuld's 2010 statement about the collapse was very defiant about the fact he claims LBHI (the parent of LBI) was "mandated" into filing. And that is the truth. No sane decision to file CH 11 would be made by a company with cash/assets bal sheet.

@Ova_Wit_lol @GavinClimie The most telling thing is while Sep 28, 2022 LBI (the subsidiary and former brokerage arm of LBHI) finished paying off its liquidation - LBHI remains in the LBHI Trust" filing with the SEC regularly and not only that, 332 Million in its 8-K from March 2023 w/o $ ongoinglitigation

1/ #SBF might have ignited the FINAL death spiral

🧵A thread on why an #FTX bankruptcy is the #Lehman of #DeFi

#CZBinance #FTT #SamBankman #BlockFi #DeFi

🧵A thread on why an #FTX bankruptcy is the #Lehman of #DeFi

#CZBinance #FTT #SamBankman #BlockFi #DeFi

2/ With $2+bn raised, support from virtually every tier 1 fund, a $32bn valuation, 1.2m wallets & $10bn in deposits, #FTX was 2nd to none other than the man that triggered their bank run - #CZ's #Binance.

3/ As @FTX_Official files for bankruptcy, what's left are 100K+ creditors, $10+bn in liabilities, and... a new high score on a certain graph

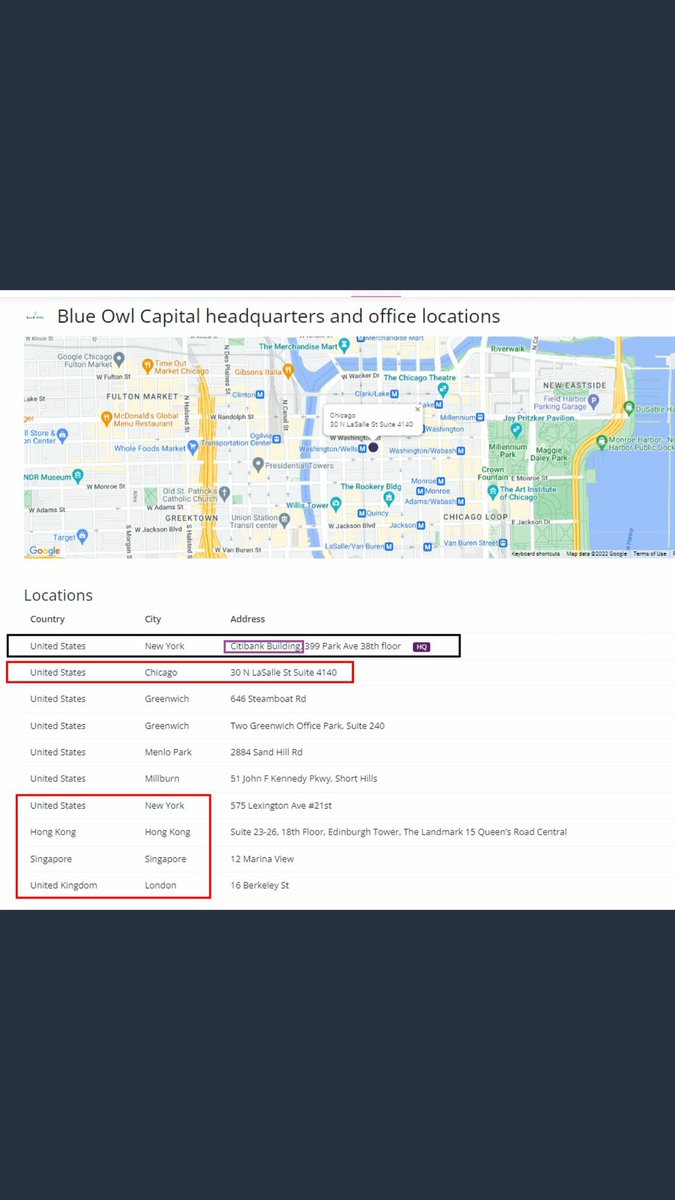

(2/13) Blue Owl was brought up by @SylviaRey Recently

The Mcafee KillSwitch/Blockchain

Data Dropped This Image 👇 I will go Through The Locations In these next tweets

The Mcafee KillSwitch/Blockchain

Data Dropped This Image 👇 I will go Through The Locations In these next tweets

(3/13) 🔮What I found Near the Location is More Important than the Location itself

#Blackrock/Blackrock Financial/#Blackstone Group

#Citi & Citi Private

Shadow/Real? Synthetic Everything? 1:1 Seen/Unseen

#Blackrock/Blackrock Financial/#Blackstone Group

#Citi & Citi Private

Shadow/Real? Synthetic Everything? 1:1 Seen/Unseen

#Hilo express

El #DeutscheBank siempre aparece en las noticias cuando hay una crisis financiera.

Antes de la quiebra de #LehmanBrothers ,entre los candidatos para la quiebra estaba el #DB,al final sobrevivió,pero han pasado 14 años y su apodo del “nuevo #Lehman” no pasa de moda.

El #DeutscheBank siempre aparece en las noticias cuando hay una crisis financiera.

Antes de la quiebra de #LehmanBrothers ,entre los candidatos para la quiebra estaba el #DB,al final sobrevivió,pero han pasado 14 años y su apodo del “nuevo #Lehman” no pasa de moda.

Antes de seguir definamos que es un #CDS

Los Credit Default Swaps son instrumentos que permiten invertir sobre la solvencia de una empresa o de un gobierno.

Son como pólizas de seguro crediticio.A mayor valor de los CDS,mayor será la prima.A mayor riesgo mas caro asegurarse.

Los Credit Default Swaps son instrumentos que permiten invertir sobre la solvencia de una empresa o de un gobierno.

Son como pólizas de seguro crediticio.A mayor valor de los CDS,mayor será la prima.A mayor riesgo mas caro asegurarse.

Welcome to the Most Anticipated Recession in History–Part 2 -It's a #GlobalRecession & #LiquidityCrisis. Consumer perspective shaped by what’s going on in their own world despite politicos ignoring the chaos - by @TraderStef for @crushthestreet #Recession

crushthestreet.com/articles/break…

crushthestreet.com/articles/break…

The #GeorgeFloydMurder is the latest in a long history of #racist atrocities visited on Black people & minorities in the US & elsewhere.

If u are in some position of authority, power, privilege & have a public platform you need to speak up and be counted. A v personal #thread

If u are in some position of authority, power, privilege & have a public platform you need to speak up and be counted. A v personal #thread

I am brown of Indian origin, but when asked, I always say I don't really know what #racism looks like, I have almost never experienced it, and I am in a position of power and privilege so I don't think its appropriate for me to speak about it. But today, I write about it here ...

Proviamo a spiegare in un #thread cosa c’è di sbagliato (e di falso) in ciò che dicono #AlesinaGiavazzi sul @Corriere a proposito di #Irlanda #Spagna e #Portogallo (1/10)

Cominciamo con il ricordare a #AlesinaGiavazzi che nel 2008 il debito pubblico di #Portogallo #Irlanda e #Spagna al momento dello scoppio della #crisi #Lehman era rispettivamente pari grosso modo al 70%, 40%-42% e 39%-40% del PIL (2/10)

#AlesinaGiavazzi ignorano cioè o fingono di ignorare che un livello di debito pubblico relativamente basso (spesso addirittura al mitologico 60% stabilito da #Maastricht) non previene affatto l’insorgenza di una crisi (3/10)

The ghosts of 2008 are back. We had #Lehman. Today we have #ILFS and #RupeeAt75. The bulls have given up. #Sensex is down 4500 points in 25 sessions. As shared by @Prashanth_Krish over 50% of stocks traded on NSE are down 50% or more. Friday’s fall would have made it more brute.

Obligatory #Lehman reminisce:10yrs ago I spent 2am-8pm daily desperately trying to fund the bank's FX balance sheet. Ironically, the measures the firm put in place in 1998 to reduce liquidity pressure turned out to be an albatross. Back then, we had access to USDs, but 1/

Counterparty credit concerns meant that swapping those USDs for FX was extremely tricky, leading to position liquidation. Saloman, in the end, backed to back most of these presumably under regulatory nudge and wink.... Anyhow, following 98 #Lehman sought to hold large foreign 2/

Currency funding across G10 given the assumption that as it was a US financial institution, it should find it much easier to borrow USDs than FX from foreign banks domestically in a liquidity crisis. The Fed's Liquidity programmes in late 07/early 08 (especially the PDCF) 3/