Discover and read the best of Twitter Threads about #Macro

Most recents (24)

The Weekly Recap (12.06.23 ~ 16.06.23) 🧵

Missed out anything from a week full of #Macro & #Markets? Don't worry - we got you covered.

Below we share all the updates & opinions threads from last week. Make sure to follow @prometheusmacro for much more.

#MacroMonday #market

Missed out anything from a week full of #Macro & #Markets? Don't worry - we got you covered.

Below we share all the updates & opinions threads from last week. Make sure to follow @prometheusmacro for much more.

#MacroMonday #market

The Weekly Recap (05.06.23 ~ 10.06.23) 🧵

Missed out anything from a week full of #Macro & #Markets? Don't worry - we got you covered.

Below we share all the updates & opinions threads from last week. Make sure to follow @prometheusmacro for much more.

Missed out anything from a week full of #Macro & #Markets? Don't worry - we got you covered.

Below we share all the updates & opinions threads from last week. Make sure to follow @prometheusmacro for much more.

1. We started the week by sharing updates on the latest #construction data. Overall, we noted that residential construction spending improved recently, that also flowed into our GDP Nowcast and real GDP estimate.

2. Next, we provided an update on the latest readings from our Market Regime Monitor and the latest Prometheus Trend Signals.

🧵Smartkarma #macro #threadoftheday

How the Treasury Refresh May Not Be Catastrophic

— Cam Hui @HumbleStudent

1/

How the Treasury Refresh May Not Be Catastrophic

— Cam Hui @HumbleStudent

1/

Key Takeaways from Month in Macro

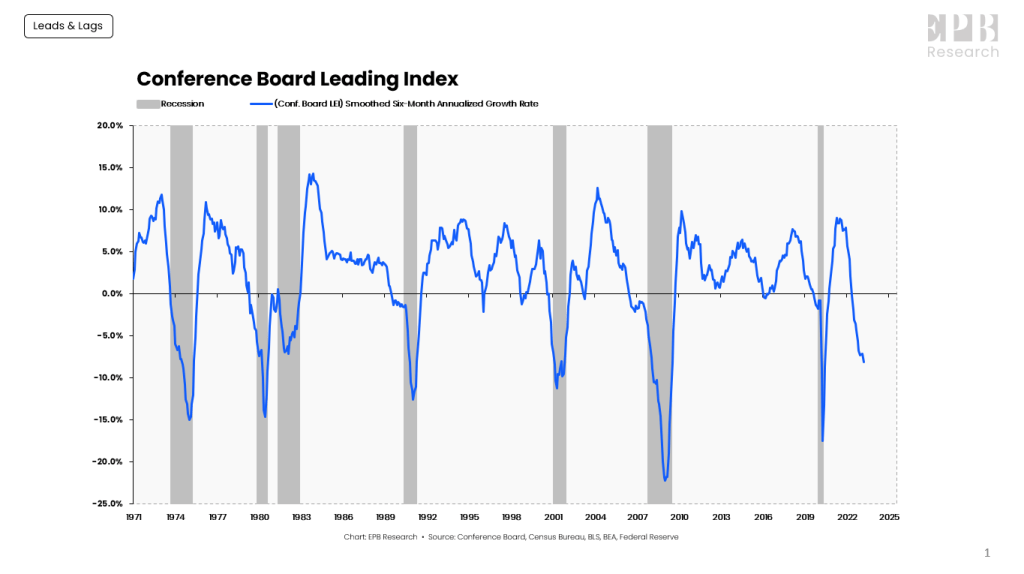

1. Nominal #GDP slowed through April, with real GDP contracting by -0.47% and #inflation rising by 0.23%. #Nominal GDP has grown approximately 4.7% from one year prior, continuing the downtrend beginning in February 2022.

1. Nominal #GDP slowed through April, with real GDP contracting by -0.47% and #inflation rising by 0.23%. #Nominal GDP has grown approximately 4.7% from one year prior, continuing the downtrend beginning in February 2022.

2. During this time, #equity markets have posed significant strength (though lopsided), while #treasury markets have weakened in unison.

3. Looking forward, these sequential improvements have adjusted our #real growth outlook, with a #contraction in yearly real GDP growth more likely in H1 2024 than in Q4 2023. Our #inflation outlook remains one of resilient inflation.

Market Regime Update

1. Over the last week, assets rallied in unison. Below, we show stocks, commodities, and bonds were up while the dollar sold off.

1. Over the last week, assets rallied in unison. Below, we show stocks, commodities, and bonds were up while the dollar sold off.

2. The strength of the moves in commodities has filtered through to the one-month pricing of rising growth outcomes. We show our market regime measures below.

3. While near-term pricing has been of rising growth, the distribution of regime probabilities remains flat, as highlighted above. Our non-linear trend process has worked well in navigating these conflicting market regime dynamics.

In webcast “Dust in the Crevices,” Jeffrey Gundlach shares his macro and market views and makes the case for an imminent dust-up, “in the next few years,” in Washington’s decades-long use of debt finance to skirt hard fiscal decisions.

#macro #markets #Fed #inflation #rates

#macro #markets #Fed #inflation #rates

Sector rotation(s) should be a sign of “healthier” market participation, however only time will tell… 🔄📊

$SPY $SPX $IWM $RUT $QQQ $NDX $DIA $DJIA #stocks #macro #economy #earnings

$SPY $SPX $IWM $RUT $QQQ $NDX $DIA $DJIA #stocks #macro #economy #earnings

Has the $IWM / $SPY ratio (S&P 500/Russell 2000 Small Caps) finally reached oversold territory, as #tech takes a breather & the broader market looks to soak up some of the liquidity flows? 🔄📈

📊h/t @OnTheTapePod @RiskReversal_ @GuyAdami @CarterBWorth for the chart note💡

$SPX… twitter.com/i/web/status/1…

📊h/t @OnTheTapePod @RiskReversal_ @GuyAdami @CarterBWorth for the chart note💡

$SPX… twitter.com/i/web/status/1…

DoubleLine CEO Jeffrey Gundlach presents Total Return webcast "Dust in the Crevices" today at 1:15pm PT.

Stay tuned here for more.

#markets #macro #bonds

Stay tuned here for more.

#markets #macro #bonds

Jeffrey Gundlach: There is dust in the crevices of our financial institutions.

The debt ceiling has been raised 99 times since it started in 1913.

This method of getting along is getting pretty dusty.

The debt ceiling has been raised 99 times since it started in 1913.

This method of getting along is getting pretty dusty.

Gundlach: U.S. Federal Budget Balance as a percentage of GDP on a rolling 1-year basis: We've been in a trend toward worse and worse budget deficits as a percentage of GDP.

The Weekly Recap 🧵

Missed out anything from a week full of #Macro & #Markets? Don't worry - we got you covered.

Below we share all the updates & opinions threads from last week. Make sure to follow @prometheusmacro for much more.

Missed out anything from a week full of #Macro & #Markets? Don't worry - we got you covered.

Below we share all the updates & opinions threads from last week. Make sure to follow @prometheusmacro for much more.

1. We started the week with discussing our view ahead for markets. Our systematic view is that we are headed towards a stagflationary recession.

2. Re 1, we further contextualised our view by sharing our systematic updates on inflation & growth.

On Construction Data 🧵🏚️

1. The most recent data for April show construction spending increased by 1.24%, with 0.2% and 1.04% coming from residential and nonresidential spending, respectively.

1. The most recent data for April show construction spending increased by 1.24%, with 0.2% and 1.04% coming from residential and nonresidential spending, respectively.

2. This data surprised consensus expectations of 0.2% and contributed to an acceleration in the twelve-month trend.

Resilient US Consumer 🧵

1. In April, households saw incomes increase as employment and inflation contributed to nominal incomes. Alongside this increase in employment income, we also saw continued support from income on assets total incomes. Below we show the composition:

1. In April, households saw incomes increase as employment and inflation contributed to nominal incomes. Alongside this increase in employment income, we also saw continued support from income on assets total incomes. Below we show the composition:

2. Personal income increased by 0.36% in April, disappointing consensus expectations of 0.4%. This print contributed to a sequential deceleration in the quarterly trend relative to the yearly trend.

3. The primary drivers of this print were Employee Compensation (0.6%) & Income on Assets (0.25%). Over the last year, Employee Compensation (3.36%), Rental Income (0.5%), & Income on Assets (0.96%). have been the primary sources of the 5.43% growth in income.

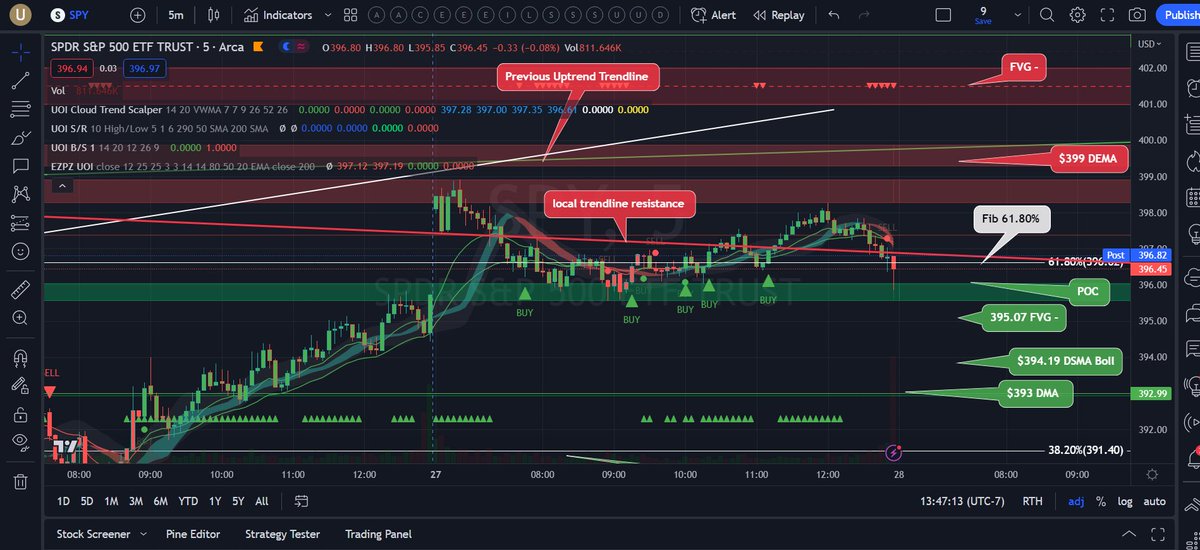

🧵 Our Thoughts On $SPY :

1. Over May, the S&P 500 rose 0.87%, primarily driven by valuations. Earnings expectations & valuations contributed 0.13% & 0.74% to the 0.87% rise in markets. Below, we show the sequential evolution of market prices, along a decomposition:

1. Over May, the S&P 500 rose 0.87%, primarily driven by valuations. Earnings expectations & valuations contributed 0.13% & 0.74% to the 0.87% rise in markets. Below, we show the sequential evolution of market prices, along a decomposition:

Weekly Recap

Do not worry in case you missed out on any action from @prometheusmacro last week. Below we pen down all the key takeaways & opinion threads that were shared with the wider community. Make sure to #SubscribeToday so that you don't miss any of the updates.

Do not worry in case you missed out on any action from @prometheusmacro last week. Below we pen down all the key takeaways & opinion threads that were shared with the wider community. Make sure to #SubscribeToday so that you don't miss any of the updates.

1. We introduced the 'Prometheus Daily Trend Signals' to share the latest trend updates for all 37 ETFs across four asset classes daily.

2. Next, we presented a first glimpse of the Cyclical Rotation Strategy for Equities.

On Wages, Profits & Interest Expense

1. The current macroeconomic picture remains where heightened nominal demand continues to press against the economy's capacity constraints, creating heightened inflation.

1. The current macroeconomic picture remains where heightened nominal demand continues to press against the economy's capacity constraints, creating heightened inflation.

2. We think these dynamics will

likely be resolved through the Fed's tightening cycle by raising interest burdens in the economy relative to incomes, creating pressure on profitability for companies, and leading to an eventual lay-off of

workers.

likely be resolved through the Fed's tightening cycle by raising interest burdens in the economy relative to incomes, creating pressure on profitability for companies, and leading to an eventual lay-off of

workers.

3. Therefore, the key to understanding whether the Fed's hiking cycle has been adequate is

whether profits will contract. This profit contraction will likely come from declining topline, sticky wages, and increasing debt service costs.

whether profits will contract. This profit contraction will likely come from declining topline, sticky wages, and increasing debt service costs.

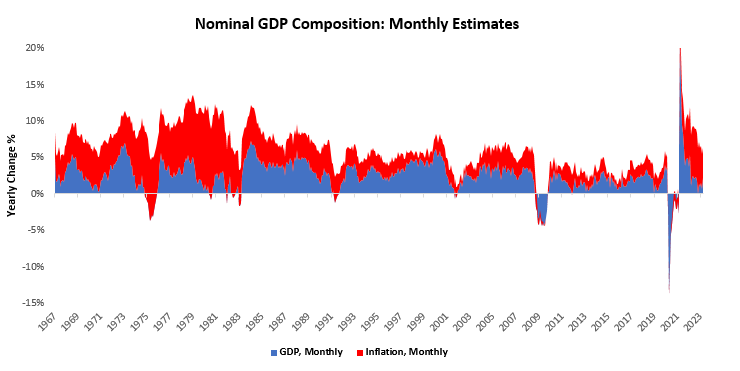

1. Our process tells us that we are likely headed towards a stagflationary environment, i.e., with growth contracting and inflation likely to be persistent. This regime tends to be one of the worst for passive investors, the reasoning for which is twofold.

2. Recessions are the primary risk to stocks as nominal spending collapses. At the same time, inflationary episodes are the primary risk to bonds as their fixed interest rate becomes less attractive relative to other nominal assets.

3. While we intend to provide a more in-depth commentary on both of these components separately in our upcoming Month in Macro report, we provide a sneak peek in what will be further elaborated on.

כמה נקודות מעניינות מסקירת ענף הנדל״ן שפורסם על ידי צוות מחקר נדל״ן באגף הכלכלנית הראשית באוצר:

#pinnedtweet @ShaharHen_ #Macro

#pinnedtweet @ShaharHen_ #Macro

1/בחודש מרץ נמשכה הירידה החדה במספר העסקאות, כאשר אלו הסתכמו ב-6,785 דירות, ירידה של 46% בהשוואה למרץ אשתקד, שיעור הירידה החד ביותר בארבעת החודשים האחרונים, זוהי גם אחת הרמות הנמוכות ביותר שנרשמו בחודשי מרץ מאז תחילת שנות האלפיים לפחות

위의 그림을 보면

경기선행은 마이너스

순환경기는 곧 마이너스를 시사하는데 4월발표된 지표를 종합하여 곧 5월쯤에 적용이되면 공식 순환경기도 마이너스를 기록하게된다.

경기선행은 마이너스

순환경기는 곧 마이너스를 시사하는데 4월발표된 지표를 종합하여 곧 5월쯤에 적용이되면 공식 순환경기도 마이너스를 기록하게된다.

공부하며 알게된 사실

1. 비트코인은 반감기보단 매크로에 따라 움직였다

2. 역사상 비트코인 반감기는 선거시기 , 매크로회복 시기와 맞물렸다

3. 이번 매크로 회복은 최소 2년 이상 걸릴것이다(core cpi 년간 1프로씩 떨어지는중)

4. 금리인상이 멈추면 단기랠리가 나왔다

#bitcoin #macro

1. 비트코인은 반감기보단 매크로에 따라 움직였다

2. 역사상 비트코인 반감기는 선거시기 , 매크로회복 시기와 맞물렸다

3. 이번 매크로 회복은 최소 2년 이상 걸릴것이다(core cpi 년간 1프로씩 떨어지는중)

4. 금리인상이 멈추면 단기랠리가 나왔다

#bitcoin #macro

5. 금리를 인하시엔 오히려 폭락장이 왔다

6. 신용경색이 일으킬 나비효과는 아직 나오지 않은 상황이다

7. 영구 실업률을 발표하지 않고 실업수당 발표를 하는건 아이러니하다

8. 그럼에도 불구하고 실업수당청구치는 최저에서 고개를 드는중

6. 신용경색이 일으킬 나비효과는 아직 나오지 않은 상황이다

7. 영구 실업률을 발표하지 않고 실업수당 발표를 하는건 아이러니하다

8. 그럼에도 불구하고 실업수당청구치는 최저에서 고개를 드는중

9. 생산자 물가상승률이 떨어진다고해서 물가가 낮아진것은 아니다. 고공에서 멈춰있는것

10. 저금리로 실적없이 먹고살던 좀비회사가 갈수록 상환기일이 다가오고있다

11. 제조업 수련자들의 노동시간이 줄어드는중이다

10. 저금리로 실적없이 먹고살던 좀비회사가 갈수록 상환기일이 다가오고있다

11. 제조업 수련자들의 노동시간이 줄어드는중이다

낙관

1. 6월홍콩 리오프닝

2. 테더사 분기마다 5만개씩 비트사는 기대감

3.미국 디폴트 해소

1. 6월홍콩 리오프닝

2. 테더사 분기마다 5만개씩 비트사는 기대감

3.미국 디폴트 해소

비관

1. 매크로 영향 (금리,물가등)

2. 비트 수수료상승

3. 이더리움 체인 멈춤이슈

4. 멈추지않는 sec

1. 매크로 영향 (금리,물가등)

2. 비트 수수료상승

3. 이더리움 체인 멈춤이슈

4. 멈추지않는 sec

#China's GDP (in nominal terms) will never surpass the #US GDP.

For a long time, I have been sceptical of the forecasts that have predicted otherwise. I have been open to the possibility of a short-term situation in the mid-2030s, where it was temporarily higher.

#macro

For a long time, I have been sceptical of the forecasts that have predicted otherwise. I have been open to the possibility of a short-term situation in the mid-2030s, where it was temporarily higher.

#macro

At last !!

A new Acid Capitalist Podcast...

With the indomitable, @Brad_Setser, a senior fellow, no less, of the Council of Foreign Relations

And boy !

Do I have things to get off my chest...

I will complete this tomorrow

So much to say, so little space

A new Acid Capitalist Podcast...

With the indomitable, @Brad_Setser, a senior fellow, no less, of the Council of Foreign Relations

And boy !

Do I have things to get off my chest...

I will complete this tomorrow

So much to say, so little space

Now what doesn't Brad know about foreign trade and the conduct of sovereign nations ?? What doesn't he know about how they conduct themselves in this merry-go-round of economic bedevilment ? He was the perfect and most generous host to titivate my curiosity.

Brad's a master at throwing light on those nations that suppress the scale of their surplus savings and FX exchange balances. The real QE masters that have driven our asset prices to the sky...

And he's not afraid to speak his mind.

Just what could we possibly have to discuss?

And he's not afraid to speak his mind.

Just what could we possibly have to discuss?

1/ Time for a comprehensive thread on current Labor market conditions incl some key indicators to watch closely:

These charts look under the hood of payrolls & unemployment to see how conditions are shifting

We know employment is still increasing:

#macro #stocks $SPY $QQQ

These charts look under the hood of payrolls & unemployment to see how conditions are shifting

We know employment is still increasing:

#macro #stocks $SPY $QQQ

2/ But less well understood is that under the payroll strength is both falling Hires and Separations.

With labor demand still strong, Quits remain elevated and Layoffs low. But Hires & Separations have both already normalized back to 2019 levels.

With labor demand still strong, Quits remain elevated and Layoffs low. But Hires & Separations have both already normalized back to 2019 levels.

3/ From here, we may well see Separations flatten (already apparent) with reducing Quits as conditions soften (people hold onto jobs) offset by rising Layoffs.

However Hires are likely to continue to fall based on 2 things shown below: Employment intentions & Sales expectations

However Hires are likely to continue to fall based on 2 things shown below: Employment intentions & Sales expectations

1a- Contextual understanding

#Macro level

I posted this last night. The rotation from tech to Financial sector was the intervening variable pushing spy & QQQ down. QQQ bottomed at $308 that's when $SPY started to move up:

#Macro level

I posted this last night. The rotation from tech to Financial sector was the intervening variable pushing spy & QQQ down. QQQ bottomed at $308 that's when $SPY started to move up:

🧵Smartkarma #macro #threadoftheday

Bank Watch – Deutsche, Deustche Alles Ist Vorbei

— Andreas Steno @AndreasSteno

1/

Bank Watch – Deutsche, Deustche Alles Ist Vorbei

— Andreas Steno @AndreasSteno

1/