Discover and read the best of Twitter Threads about #MutualFunds

Most recents (24)

SEBI has come out with EOP guidelines which hugely impacts how Direct Plans are currently being sold in the country. Read on for finer details:

1) All online platforms to classify themselves as EOP1 or EOP2 which means an Execution-Only Platform

#mutualfunds #directplans #SEBI

1) All online platforms to classify themselves as EOP1 or EOP2 which means an Execution-Only Platform

#mutualfunds #directplans #SEBI

2) Background - Most of the online platforms offering Direct Plans operate under the SEBI RIA (advisory) regulations but owing to the size & scale of business they act as mere facilitators of Direct Plans. They dont necessarily give full-fledged advisory services to clients.

3) To bring more clarity around such online platforms, SEBI has issued new circular which allows such platform to move from being advisory in nature to being execution paltforms.

4) All platforms will have to opt one mechanism --EOP 1 or EOP2.

#investing

#personalfinance

4) All platforms will have to opt one mechanism --EOP 1 or EOP2.

#investing

#personalfinance

The actual cost of delaying an #investmentdecision is often unknown until one notices a shortfall in their corpus.

This often prevents one from achieving your goals on time.

Let's explore the cost of delay with an example. (1/n)

#financialplanning #financialgoals

This often prevents one from achieving your goals on time.

Let's explore the cost of delay with an example. (1/n)

#financialplanning #financialgoals

Let's say you are 15 years away from retirement.

After retirement, you require ₹60,000 per month in expenses (in today's value) to live comfortably. (2/n)

#retirement #financialplanning #savings #investing

After retirement, you require ₹60,000 per month in expenses (in today's value) to live comfortably. (2/n)

#retirement #financialplanning #savings #investing

The final total goal amount that you require to sustain yourselves through retirement is ₹3 Crores. (3/n)

#retirementcorpus

#retirementcorpus

New iOS in #Markets

Indian #Options Speculators.

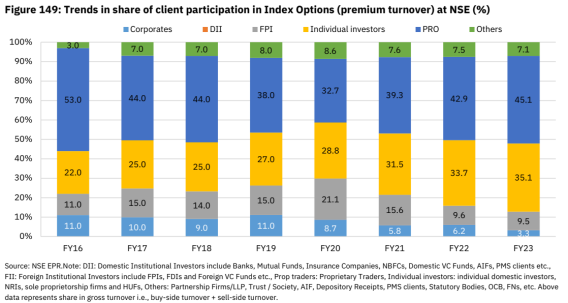

There has been a huge surge in #Retail and #Proprietary trading in #Options and more specifically in #Index Options.

The Data & Charts below are just #Crazy and getting crazier.

Indian #Options Speculators.

There has been a huge surge in #Retail and #Proprietary trading in #Options and more specifically in #Index Options.

The Data & Charts below are just #Crazy and getting crazier.

1/🚨@SEBI_India tightens regulations to protect investors and prevent fraud!

Here's what you need to know: ⬇️

Here's what you need to know: ⬇️

2/ #SEBI just had a board meeting, and they made some big decisions.

Some of the key takeaways are:👇

Some of the key takeaways are:👇

3/📈Amendments to SEBI Disclosure Norms:

▶ Starting from October 1st, 2023, the top 100 listed companies by market capitalization in the #stock market must confirm or deny any rumors going around about them.

And by April 1st, 2024, the top 250 companies must do the same.✅

▶ Starting from October 1st, 2023, the top 100 listed companies by market capitalization in the #stock market must confirm or deny any rumors going around about them.

And by April 1st, 2024, the top 250 companies must do the same.✅

Here is this Week’s Market Wrap

'The Times Get Taxing' written by @shyamsek

A Thread (1/n)

#tax #investing #taxbenefits #marketwrap

'The Times Get Taxing' written by @shyamsek

A Thread (1/n)

#tax #investing #taxbenefits #marketwrap

Investment decisions can be taken based on tax implications. There is a natural tendency among investors to be drawn to investments where they feel taxes are lower. (2/n)

#taxes #investments #investors

#taxes #investments #investors

When the tax concessions are withdrawn for certain investments, they tend to look less attractive to investors. (3/n)

#taxconcession #investing

#taxconcession #investing

You won’t be able to SELL your #mutualfunds if you haven’t added a nominee to your account.

Starting April 1, 2023, @SEBI_India has asked fund houses to halt transactions for all such investors.

Here’s how to check the status & add a nominee if you haven’t done so already.

A🧵

Starting April 1, 2023, @SEBI_India has asked fund houses to halt transactions for all such investors.

Here’s how to check the status & add a nominee if you haven’t done so already.

A🧵

First, a brief background.

It all started in June 2022.

SEBI asked fund houses to give two options to their investors.

One, nominate a beneficiary for their #investments.

Two, opt out by filling out a declaration form.

The deadline for this is Mar 31, 2023.

It all started in June 2022.

SEBI asked fund houses to give two options to their investors.

One, nominate a beneficiary for their #investments.

Two, opt out by filling out a declaration form.

The deadline for this is Mar 31, 2023.

If investors fail to provide a nominee or no-nomination form by the deadline, their folios will be frozen.

This means they won't be able to sell or redeem their investment until the necessary details are submitted.

This means they won't be able to sell or redeem their investment until the necessary details are submitted.

Are you a Senior Citizen looking to secure your Retirement and generate regular income?

Let's explore the Top investment avenues that offer stability & security! (1/n)

#seniorcitizen #investment #retirement #fixedincome

Let's explore the Top investment avenues that offer stability & security! (1/n)

#seniorcitizen #investment #retirement #fixedincome

As we grow older, it's important to plan for retirement and consider investment options that offer stability and security.

Here are a few Investment avenues that offer capital preservation and regular income. (2/n)

#retirementplanning #investment #income

Here are a few Investment avenues that offer capital preservation and regular income. (2/n)

#retirementplanning #investment #income

#1 Senior Citizen Savings Scheme (SCSS)

SCSS is a popular investment option for individuals above the age of 60.

It offers an interest rate of 8% p.a., which is higher than most fixed deposits and has a tenure of 5 years. The interest is payable quarterly. (3/n)

#SeniorCitizen

SCSS is a popular investment option for individuals above the age of 60.

It offers an interest rate of 8% p.a., which is higher than most fixed deposits and has a tenure of 5 years. The interest is payable quarterly. (3/n)

#SeniorCitizen

Una cronología del 2do colapso bancario más grande en la historia de EEUU. Las redes están a full con publicaciones sobre #SiliconValleyBank, y la historia es difícil de seguir. Acá un hilo 🧵con un poquito de research para intentar entender mejor cómo se llegó a esta situación

El miércoles pasado, Silicon Valley Bank $SIVB tenía $212 billones en activos y una capitalización de mercado de $16bn. 48 horas después, el banco quebró. ¿CÓMO SE LLEGÓ HASTA ESTA SITUACIÓN CRÍTICA?

La raíz del problema empezó en 2021 cuando las firmas, mayoría #startups respaldadas por #venturecapital, recaudaron $330bn (el doble que el año anterior). Todo esto en un mundo en donde sobraba liquidez, con Fed fund rates de 0,25 %, T-Bonds a 10 años al 1% e inflación de 1,4%

I got a lot of replies and counterarguments to this, so I'm just going to add a few crucial points, on why you should NOT buy this type of insurance plan (in fact ANY kind of life insurance, except term insurance.

First, flexibility. In insurance you sign up for a multi-year payment plan. Next year you could lose your job or you have some stress in your finances. Your agent will still ask for the premium. Surrendering a plan attracts huge charges. This is a major issue in insurance.

In fact if you look at something called the 5 year persistency ratio for the industry on average it is below 50%. Meaning half of the customers have dropped out of paying premiums by this time. In #mutualfunds you get FULL flexibility. Invest when you want, withdraw when you want

Recent circular issued by @SEBI_India issued to @amfiindia & directed the AMCs & MFDs to comply. Being a MFD we all surely will. It further states that we cannot print/ post/ type future returns based on assumptions & projections for which disclaimer was being used (1/n)

Not challenging the decision made but what if the #investor asks that how much is expected returns - What should we say kindly enlighten the MFDs? In case of stocks upsides are always projected by way of Target & this must stop as its misleading. (2/n) @MFSahiHai

Those who distribute #mutualfunds & promote it by misusing the code of conduct in any way stern action is always taken & should always be taken. Professionally we are perfectly in favor of it. Rules & regulations must be abided. (3/n)

म्युच्युअल फंड की स्टॉक - गुंतवणूक नक्की कशात करावी?

बऱ्याच नवीन गुंतवणूकदारांचा स्टॉक विकत घ्यावेत? की म्युच्युअल फंडामध्ये गुंतवणूक करावी? याबाबत गोंधळ उडताना दिसतो. या थ्रेड मधून आपण दोन्हीही पर्यायांची थोडक्यात तुलना करणार आहोत. #Thread #StockMarket #MutualFunds #म #मराठी

बऱ्याच नवीन गुंतवणूकदारांचा स्टॉक विकत घ्यावेत? की म्युच्युअल फंडामध्ये गुंतवणूक करावी? याबाबत गोंधळ उडताना दिसतो. या थ्रेड मधून आपण दोन्हीही पर्यायांची थोडक्यात तुलना करणार आहोत. #Thread #StockMarket #MutualFunds #म #मराठी

थेट कंपन्यांच्या स्टॉकमध्ये केलेली गुंतवणूक लॉंग टर्ममध्ये मोठा कॉर्पस निर्माण करू शकते. मात्र बरेच गुंतवणूकदार मार्केटमध्ये शॉर्ट टर्म साठी येणाऱ्या बदलांमुळे भावनिक होऊन खालील चुका करताना दिसतात - #Thread #StockMarket #MutualFunds #म #मराठी

We have a SPIVA report for #mutualfunds, but what about PMS? Using data from PMS Bazaar, Mint has done a similar study. In most categories, less than 50% of PMS strategies beat their corresponding #mutualfund category. To that, add the unfavourable taxation(tax on booked profits)

There isn't much of an argument for investing in Portfolio Management Services. They have largely grown over the past few years on the back of hefty fees and expenses. This is slowly changing. #Sebi banned upfront commissions in PMS and introduced direct plans only in 2020.

There's much talk about the mushrooming of #mutualfund schemes, but the same has happened with PMS - a vast thicket of strategies offered by each manager. Some portfolio managers have done well, but finding them a priori is very difficult. Better to stick with a simple index fund

A simple hack helps you save tax on #stocks and #mutualfunds.

Here’s what you do:

- Sell your investments

- Book profits & losses

- Repurchase immediately

This is called Tax Harvesting

A 🧵on how it’s done.

Here’s what you do:

- Sell your investments

- Book profits & losses

- Repurchase immediately

This is called Tax Harvesting

A 🧵on how it’s done.

Let’s first talk about the #tax on #equities.

The profit you book is divided into two buckets.

1. Shot term: If you sell within one year (of purchase)

2. Long-term: If you sell after one year

You pay a higher tax for short-term profits and lower for long-term (Check table)

The profit you book is divided into two buckets.

1. Shot term: If you sell within one year (of purchase)

2. Long-term: If you sell after one year

You pay a higher tax for short-term profits and lower for long-term (Check table)

Now, let’s jump to the sweet part - how to reduce taxes?

You pay LTCG tax only when your gains exceed Rs 1 lakh.

So the trick is not to let your gains go beyond this tax-free limit.

How to do it? Sell a part of your gains to book LTCG and reinvest it.

An example will help.👇

You pay LTCG tax only when your gains exceed Rs 1 lakh.

So the trick is not to let your gains go beyond this tax-free limit.

How to do it? Sell a part of your gains to book LTCG and reinvest it.

An example will help.👇

If you are looking for an efficient investment to save tax in India, this is for YOU!

The BEST way is to invest in ELSS Mutual Funds. You can save up to ₹46,800 in taxes under Section 80C!

Here is how! (1/n)

#ELSS #mutualfunds #taxexemption #thread

The BEST way is to invest in ELSS Mutual Funds. You can save up to ₹46,800 in taxes under Section 80C!

Here is how! (1/n)

#ELSS #mutualfunds #taxexemption #thread

Every year in March, as the financial quarter comes to an end, there is a rush to invest in tax-saving funds.

And with the quarter end so near, let's look at why ELSS is so popular as a tax saving scheme. (2/n)

#ELSSfunds #taxsavings #investment

And with the quarter end so near, let's look at why ELSS is so popular as a tax saving scheme. (2/n)

#ELSSfunds #taxsavings #investment

What is ELSS Fund?

ELSS fund, or Equity Linked Savings Scheme fund, is a tax-saving scheme that allows you to save tax while investing for your long-term goals. (3/n)

#savetax #financialgoals #taxsavingschemes

ELSS fund, or Equity Linked Savings Scheme fund, is a tax-saving scheme that allows you to save tax while investing for your long-term goals. (3/n)

#savetax #financialgoals #taxsavingschemes

Wondering if you should start a SIP?

Here is a thread that can help! (1/n)

#mutualfunds #investing #SIP #thread

Here is a thread that can help! (1/n)

#mutualfunds #investing #SIP #thread

The market has been very volatile for the last couple of months.

With 2023 lined up to be another uncertain year, how should investors take advantage of such a year? (2/n)

#investors #volatility #wealthcreation

With 2023 lined up to be another uncertain year, how should investors take advantage of such a year? (2/n)

#investors #volatility #wealthcreation

The answer is simple. Rather than waiting on the sidelines, the best way to participate in the market is via a SIP! (3/n)

#SIP #investingtips #compounding

#SIP #investingtips #compounding

Some reasons why the Adani Group is still a good investment.

A thread:

A thread:

1)Adani's strong financials: total assets of ₹10 lakh crore and debt of only ₹1.8 lakh crore show stability and strength. A solid foundation for future growth. #AdaniGroup

2)Adani's ownership structure sets it apart: he personally owns 70% of the company, with only 5-8% in public hands and 10-15% with foreign investors. Unlike other companies listed in stock markets with 55-60% public ownership, Adani's control minimizes risk of manipulation

ELSS vs PPF

A short thread...

ELSS (Equity Linked Savings Scheme) and public provident fund PPF, both help you save taxes, but apart from that, they differ on many parameters.

#ELSS #PPF #Taxsaving #investing #investingtips #mutualfunds #wealth

A short thread...

ELSS (Equity Linked Savings Scheme) and public provident fund PPF, both help you save taxes, but apart from that, they differ on many parameters.

#ELSS #PPF #Taxsaving #investing #investingtips #mutualfunds #wealth

In India, With both ELSS and PPF, you can get a maximum deduction of INR 1.5 Lakh under Section 80C of the Income Tax Act, 1961.

#WealthCreators #stockmarket #MoneyMatters

#WealthCreators #stockmarket #MoneyMatters

What are ELSS funds?

ELSS is d tax saving mutual fund which serves both d purpose of saving taxes & help U create long term wealth. ELSS funds generate returns by investing in equity & related instruments. This makes it a suitable investment option 4a person with LT goals.

ELSS is d tax saving mutual fund which serves both d purpose of saving taxes & help U create long term wealth. ELSS funds generate returns by investing in equity & related instruments. This makes it a suitable investment option 4a person with LT goals.

#Budget2023WishList:

For #MutualFund Industry:

@nsitharaman

1. Removal of #GST for commissions paid to #MutualFundDistributors who cannot recover the same from their investors. Only industry where this happens

We need more #MFDs to achieve goal of reaching Rs.100 lac crs in AUM

For #MutualFund Industry:

@nsitharaman

1. Removal of #GST for commissions paid to #MutualFundDistributors who cannot recover the same from their investors. Only industry where this happens

We need more #MFDs to achieve goal of reaching Rs.100 lac crs in AUM

Removal of #LTCG from #Equity and #EquityMFSchemes. Will have very low impact on fiscal collections.

But it will improve sentiments and move funds from non-productive assets like #Gold to #FinancialAssets like equity.

But it will improve sentiments and move funds from non-productive assets like #Gold to #FinancialAssets like equity.

#MutualFunds help in mobilizing small savings - channelizing them into building economy thru #Equity & #Debt. This will help in reaching $5 trln GDP target

Direct Plans in #mutualfunds completed 10 years on January 1, 2023.

These plans don’t include commissions, and hence you earn more.

But how much more?

We crunched SIP and Lumpsum data for the past decade to figure it out.

The results are surprising.

A thread 🧵

These plans don’t include commissions, and hence you earn more.

But how much more?

We crunched SIP and Lumpsum data for the past decade to figure it out.

The results are surprising.

A thread 🧵

Let’s begin with some numbers.

Say you chose 3 schemes – an equity, a debt, and a hybrid fund.

You have a monthly SIP of Rs 10,000 each in these schemes for a decade.

👉 Your excess returns are Rs 5.4 lakh (or 6.4%) more than the regular plan.

Say you chose 3 schemes – an equity, a debt, and a hybrid fund.

You have a monthly SIP of Rs 10,000 each in these schemes for a decade.

👉 Your excess returns are Rs 5.4 lakh (or 6.4%) more than the regular plan.

#economy of #cigarettes: Cost, returns (if invested), impact on #Health

1. A pack of cigarettes costs Rs 330. For a month, it would cost Rs 9900 (one pack/day).

A 30-year old person has the option of smoking one pack/day or investing this amount in #mutualfunds via #SIP route.

1. A pack of cigarettes costs Rs 330. For a month, it would cost Rs 9900 (one pack/day).

A 30-year old person has the option of smoking one pack/day or investing this amount in #mutualfunds via #SIP route.

2. If Rs 10000/ is invested every month in mutual funds via SIP route (since age 30) and the expected return is 10% per annum, the savings would become a whopping 2.28 crores after 30 years (when he turns 60).

3. In addition, not smoking would reduce the risk of #heartattack, #stroke and several #cancers.

Medical insurance premium would also be lower.

So, healthcare costs would be significantly lesser for a non-smoker (as compared to a smoker).

Medical insurance premium would also be lower.

So, healthcare costs would be significantly lesser for a non-smoker (as compared to a smoker).

To all of you who are new to the workforce… Congratulations!!! You have secured your first job.

But are you confused about how to best use your current salary? (1/n)

#salary #cashflow #payday #money

But are you confused about how to best use your current salary? (1/n)

#salary #cashflow #payday #money

Most people complicate things. It is only natural when there are so many investment products to choose from. That need not be the case.

Here are some simple tips for someone just starting! (2/n)

#equity #fixedincome #gold #realestate

Here are some simple tips for someone just starting! (2/n)

#equity #fixedincome #gold #realestate

#1 Start Building an Emergency Fund

This should be your first priority. In case of emergencies, you shouldn't be left empty-handed.

Having 3-6 months of expenses set aside will be optimal. (3/n)

#emergencyfund #savings

This should be your first priority. In case of emergencies, you shouldn't be left empty-handed.

Having 3-6 months of expenses set aside will be optimal. (3/n)

#emergencyfund #savings