Discover and read the best of Twitter Threads about #NPAs

Most recents (9)

Putting up a thread on National Asset Reconstruction Company (#NARCL) aka #badbank . Why government is setting this up? How effective this could be to tackle the issue of much rising #NPAs. Tried to simplify as much as I could. Please do retweet for wider outreach.

1/n

Story starts with NPA-Non-Performing Assets. A bad loan is a NPA for which EMI or interest hasn't been paid for 90 or more days after the due date.PSU banks usually give loans without even doing the background check-without checking credit history.

Story starts with NPA-Non-Performing Assets. A bad loan is a NPA for which EMI or interest hasn't been paid for 90 or more days after the due date.PSU banks usually give loans without even doing the background check-without checking credit history.

2/n

Pvt. banks on the other hand are bit conservative about lending money. So, their NPAs are less compared to PSU banks. PSU banks have liberal credit policies and loose terms and conditions of loans. So, NPAs become higher.

Pvt. banks on the other hand are bit conservative about lending money. So, their NPAs are less compared to PSU banks. PSU banks have liberal credit policies and loose terms and conditions of loans. So, NPAs become higher.

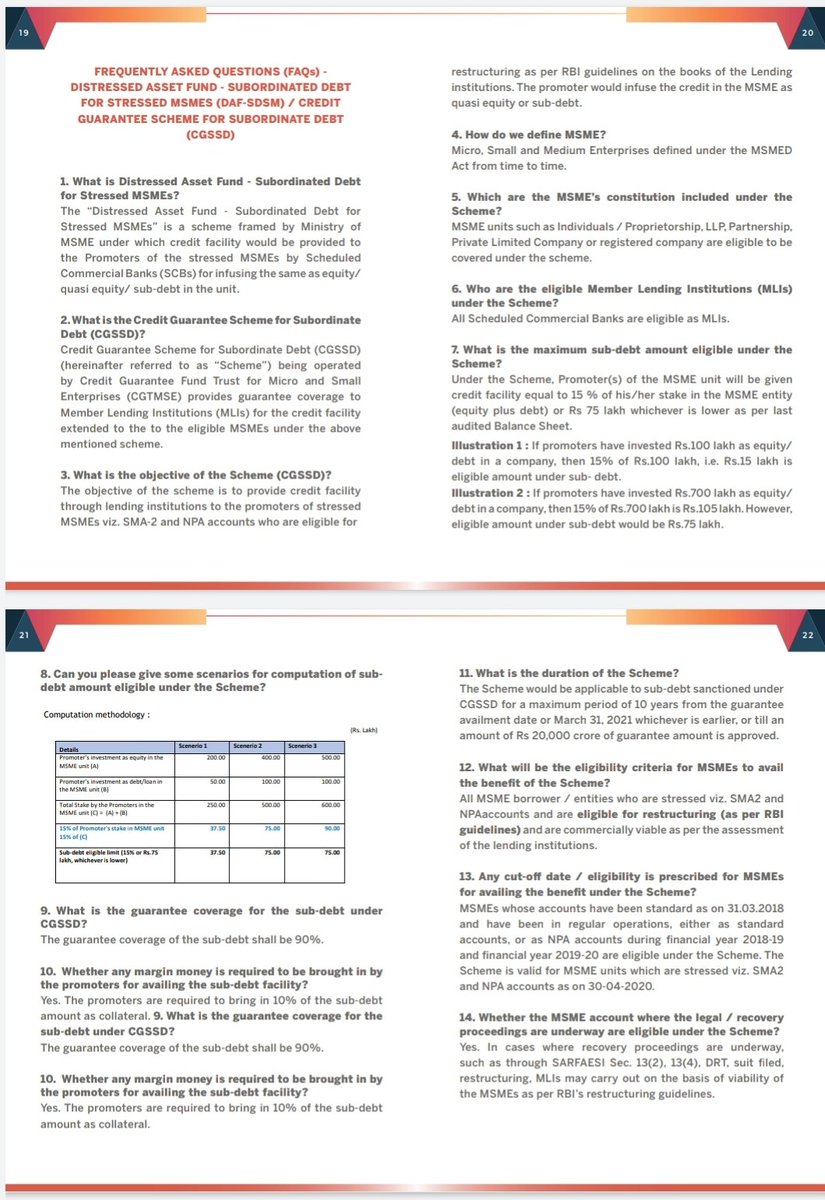

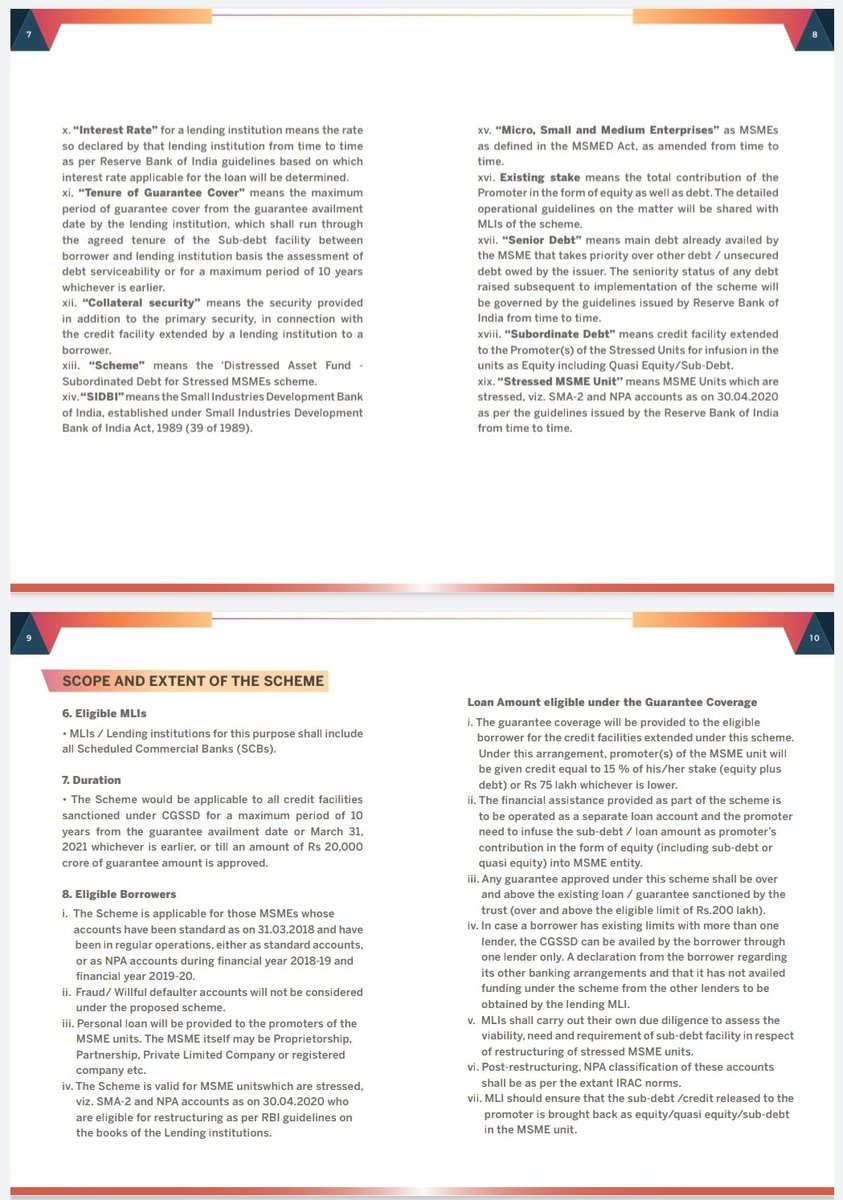

Anidst the #COVID19 pandemic,the @narendramodi govt came out with a slew of steps to help #MSME sector-- a Rs 40000Cr fund to help distressed units by way of #Equity, Quasi-Equity& #SubordinatedDebt, guaranteed to the tune of 90% by govt's #CGTSME is easing stress!

#Modinomics💪

#Modinomics💪

Read👇 to know about eligibility criteria of #MSMEs that qualify, difference between #SeniorDebt & Subordinate Debt,Intetest Rate that will be charged,etc..

#economy

#economy

Amidst*

#AxisBank has raised 10000Cr via #QIP,at Rs 420.10,which is 5% discount to lower end of band

15000Cr,recently raised by #YesBank

In last 6 months,52000Cr raised by #Banks--#CapitalAdequacy will be key in dealing with post #Covid stress

Great move by banks to shore up Capital💪

15000Cr,recently raised by #YesBank

In last 6 months,52000Cr raised by #Banks--#CapitalAdequacy will be key in dealing with post #Covid stress

Great move by banks to shore up Capital💪

#ICICIBank wanted to raise 15000Cr but got bids worth 62000Cr today at floor price of 351.36/-

Within few hours of opening,due to huge oversubscription,#QIP was closed

Clearly,there is no dearth of liquidity in the markets

90000Cr raked in by #DebtFunds in July'20

#GreenShoots

Within few hours of opening,due to huge oversubscription,#QIP was closed

Clearly,there is no dearth of liquidity in the markets

90000Cr raked in by #DebtFunds in July'20

#GreenShoots

Lot has been written about #BoB's loss of 864Cr in June qtr,from 710Cr profit,YoY

Like i have been saying,most Banks now focus on #AssetQuality¬ just Profits

BoB hiked #Provisions by 54% on standard loans,to cover for future losses

In 2013,Banks were doing the opposite😑

Like i have been saying,most Banks now focus on #AssetQuality¬ just Profits

BoB hiked #Provisions by 54% on standard loans,to cover for future losses

In 2013,Banks were doing the opposite😑

#RBIPolicy at 12pm today,is likely to keep status quo on #REPO rate, which was last lowered by 40bps in May 2020,to 4%

In 2020,REPO cut by a total of 115bps

In 2019 REPO cut by 135bps

What may weigh on #MPC's mind is #Inflation,which was 6.09% in June 2020 Vs 5.84%,in March'20

In 2020,REPO cut by a total of 115bps

In 2019 REPO cut by 135bps

What may weigh on #MPC's mind is #Inflation,which was 6.09% in June 2020 Vs 5.84%,in March'20

Some like #ICRA predicting 25bps REPO cut,saying #RBI may want to be ahead of the curve,despite build up of inflationary pressures

Well,10 Yr #BondYield was 5.83% y'day

Today 10 Yr@5.84%--Bond markets are clearly not expecting rate cut

#REPO at 4%,is already lowest in 20yrs

Well,10 Yr #BondYield was 5.83% y'day

Today 10 Yr@5.84%--Bond markets are clearly not expecting rate cut

#REPO at 4%,is already lowest in 20yrs

As expected, #RBIPolicy leaves #REPO& Reverse REPO unchanged

Right thing to do,as further reduction in rates at this stage, would have distorted #YieldCurve

Already,3 month #MCLR of #SBI is 6.65%& 1 yr at 7%

#MonetaryTransmission is happening,so more cuts not needed currently

Right thing to do,as further reduction in rates at this stage, would have distorted #YieldCurve

Already,3 month #MCLR of #SBI is 6.65%& 1 yr at 7%

#MonetaryTransmission is happening,so more cuts not needed currently

#RBI cut by 40bps each of these👇

#Repo rate to 4%

#ReverseRepo to 3.35%

#BankRate to 4.25%

Decision was reached after 5:1 vote,with #ChetanGhate,lone voice calling for 25 bps cut

#MPC meet was held ahead of schedule from 3rd-5th,June

#EMI #moratoroum extended by 3 more months

#Repo rate to 4%

#ReverseRepo to 3.35%

#BankRate to 4.25%

Decision was reached after 5:1 vote,with #ChetanGhate,lone voice calling for 25 bps cut

#MPC meet was held ahead of schedule from 3rd-5th,June

#EMI #moratoroum extended by 3 more months

Moratorium extension till 31st August 2020,is both timely &reflective of @narendramodi govt's alacrity--Big relief to #MiddleClass

Measure to convert #moratorium interest payment into #TermLoan payable in FY21,is helpful

This will reduce #NPAs &stress on banks' balance sheets

Measure to convert #moratorium interest payment into #TermLoan payable in FY21,is helpful

This will reduce #NPAs &stress on banks' balance sheets

#RBI's cut in #Repo will reduce cost of funds&extension of #moratorium will be supportive of financial stability;#Rates across #YieldCurve will move lower from current levels

Fall in #ReverseRepo rate will disincentivise banks from #hoarding #liquidity&coax them to lend

#Covid

Fall in #ReverseRepo rate will disincentivise banks from #hoarding #liquidity&coax them to lend

#Covid

#Thread

What are MSMEs? And why did the #Government set aside ₹3.7Lcr ($49bn) for #MSME support?

As the name suggests, #MSMEs (Micro, Small & Medium Enterprises) are small businesses. Their definition varies by country.

In India, the definition was changed last week.

1/n

What are MSMEs? And why did the #Government set aside ₹3.7Lcr ($49bn) for #MSME support?

As the name suggests, #MSMEs (Micro, Small & Medium Enterprises) are small businesses. Their definition varies by country.

In India, the definition was changed last week.

1/n

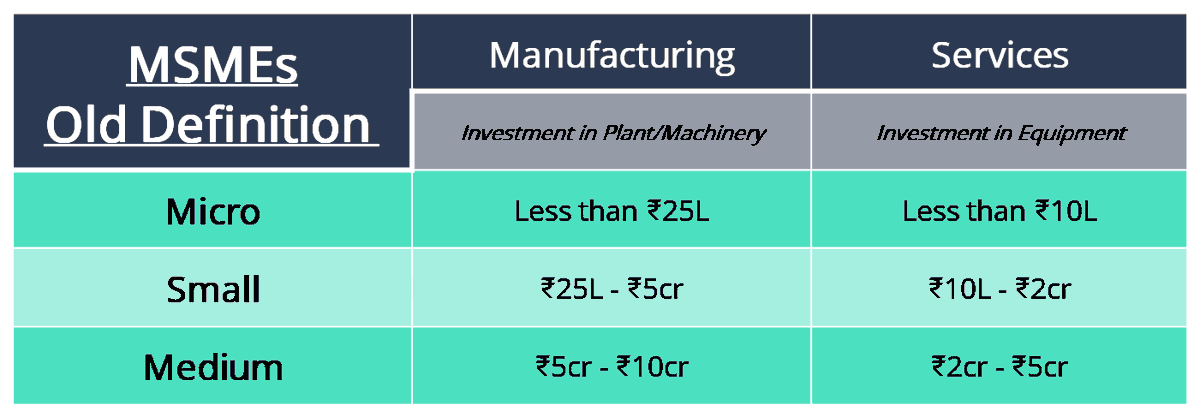

Previously, MSMEs were defined according to investment in plant/machinery (if they were in #Manufacturing) or investment in equipment (if they were in #Services).

It went like this:

2/n

It went like this:

2/n

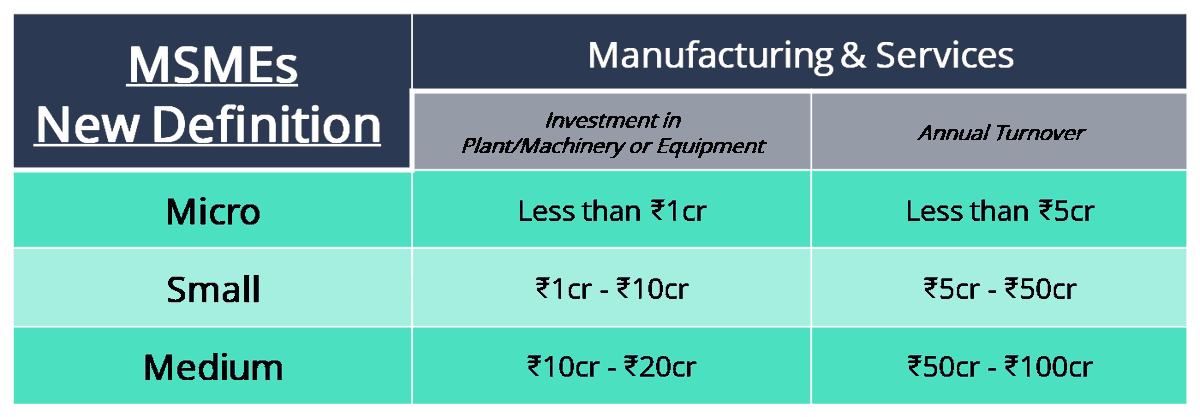

Last Wednesday, @nsitharaman announced a new definition for #MSMEs. Manufacturing & Services were clubbed and a new parameter - annual turnover - was added.

Now it goes like this:

3/n

Now it goes like this:

3/n

Thread

#YesBank Story

How Rana Kapur gobbled 5000 crore in kickbacks

Give out loans to doubtful Co's

They become NPA's

Instead of declaring em NPAs & initiating recovery proceedings, Kapoor conspired with the companies & got them to invest in firms run by his wife & daughters.

#YesBank Story

How Rana Kapur gobbled 5000 crore in kickbacks

Give out loans to doubtful Co's

They become NPA's

Instead of declaring em NPAs & initiating recovery proceedings, Kapoor conspired with the companies & got them to invest in firms run by his wife & daughters.

In 2015, @RBI, under asset quality review, the RBI inspectors found that #YesBank had suppressed its NPAs — reportedly underreporting the same by Rs 2,299 crore in 2018-19, Rs 6,355 crore in FY 2017 and over Rs 4,000 crore in FY2016 —as well as it had cooked up its balance sheet.

Rana Kapoor continued his rein till 2019, when he was shown the door, but by then, it was already too late

Meanwhile, the bank’s bad loans kept growing. Following the RBI’s asset quality review in 2019, its gross #NPA's surged 87% from a year ago, Its net NPAs more than doubled.

Meanwhile, the bank’s bad loans kept growing. Following the RBI’s asset quality review in 2019, its gross #NPA's surged 87% from a year ago, Its net NPAs more than doubled.

#Moodys has pulled down its growth forecast for FY19 to 5.8%. Only surprise is why it’s not even lower. In the past year growth has collapsed from 8% to 5%. /1

@threadreaderapp

#India #CPI #GDP #RBI #bonds #inflation #ratecut #NBFC #jobs #credit #NPA #NCLT #growth

@threadreaderapp

#India #CPI #GDP #RBI #bonds #inflation #ratecut #NBFC #jobs #credit #NPA #NCLT #growth

#Thread on #NPAs. Stay with me.

RBI revealed this in an RTI: At the end of March 2018, a record high 7,990 borrowers of above Rs 5 crore had not repaid a whopping Rs 3.71 lakh crore to banks for 1-30 days after due date. That is a four-year high record of early defaulters! 1/n

RBI revealed this in an RTI: At the end of March 2018, a record high 7,990 borrowers of above Rs 5 crore had not repaid a whopping Rs 3.71 lakh crore to banks for 1-30 days after due date. That is a four-year high record of early defaulters! 1/n

2/n. These early defaults rose by a record 281.9 per cent over December 2017 when they stood at only Rs 972 billion . On a year-on-year basis, the rise is almost 228 per cent - the highest growth of early stage overdue repayments in 4 years.

3/n. More than 5,000 of these 7,990 were new and unique early defaulters of loans above Rs 5 crore. What does this number tell us? We have been told that all bad loans are of UPA era. This number tells us that Modi govt might be brewing its own banking crisis as well.