Discover and read the best of Twitter Threads about #Reliance

Most recents (24)

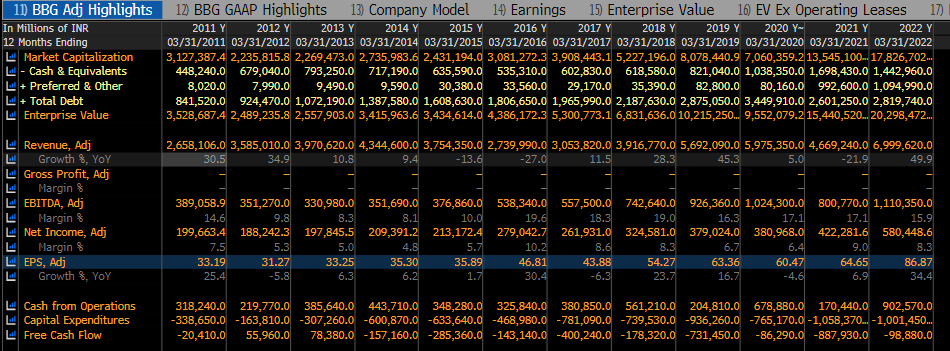

I am revealing the MESSI of my Portfolio. #FMF10 is #CCLProducts . It has 4% of my Portfolio allocation, so I am BIASed.

If you are here for the NAME, you can skip the 🧵. But if you want to know the THESIS, stay on. It will be a LONG Thread, as it's my 2 Years of Research!

1/

If you are here for the NAME, you can skip the 🧵. But if you want to know the THESIS, stay on. It will be a LONG Thread, as it's my 2 Years of Research!

1/

What's fuelling the insane 4X Stock Price growth in under 3 Years? ( From COVID Lows)

That's almost a 69% CAGR🤔 Let's Explore.

2/

That's almost a 69% CAGR🤔 Let's Explore.

2/

In JUNE 2021 I wrote this first & small thread on #CCLProducts. It was at 300 Levels.

Have touched upon why I sensed it was a STRONG re-rating Candidate.

I started NIBBLING in "APRIL 2021" ( I ALWAYS FAIL to catch the BOTTOM and that's OK😅)

3/

Have touched upon why I sensed it was a STRONG re-rating Candidate.

I started NIBBLING in "APRIL 2021" ( I ALWAYS FAIL to catch the BOTTOM and that's OK😅)

3/

Mukesh Ambani’s AJIO Luxe is such an unbelievable growth machine! 🚀🚀

But, most people don’t know that Luxe & @AJIOLife are two separate platforms.

Here is all there is to know 👇

But, most people don’t know that Luxe & @AJIOLife are two separate platforms.

Here is all there is to know 👇

AJIO was launched in FY17, and it grew at a decent pace until Covid happened.

It saw:

⚡ 4x growth in revenues

⚡ 3.5x growth in web visits

⚡ 6x growth in no. of brands

⚡ 4.6x growth in no. of products

It was promising.

It saw:

⚡ 4x growth in revenues

⚡ 3.5x growth in web visits

⚡ 6x growth in no. of brands

⚡ 4.6x growth in no. of products

It was promising.

Most importantly, it threw out some strategic pointers:

💡 AJIO recorded >70% of orders from Tier-3 & beyond

💡 It carried the image of a bargain-hunter’s paradise

💡 It hadn’t been able to crack Tier-1 & Metros as well

💡 AJIO recorded >70% of orders from Tier-3 & beyond

💡 It carried the image of a bargain-hunter’s paradise

💡 It hadn’t been able to crack Tier-1 & Metros as well

Acquired by Mukesh Ambani in a hostile takeover, #Milkbasket is growing on steroids 🚀🚀🚀

Who knew #Reliance could turn it around & expand so well, so quick!

Let’s start from the beginning 👇

Who knew #Reliance could turn it around & expand so well, so quick!

Let’s start from the beginning 👇

Founded in 2015, Milkbasket raised ~$40 million in its lifetime 💰

It shot to attention after Vani Kola of Kalaari Capital invested in it.

Kola was known to have the Midas touch. Thus, marquee investors like Blume Ventures, Mayfield Fund, Unilever Ventures & many more followed.

It shot to attention after Vani Kola of Kalaari Capital invested in it.

Kola was known to have the Midas touch. Thus, marquee investors like Blume Ventures, Mayfield Fund, Unilever Ventures & many more followed.

Milkbasket would let people order till midnight & then deliver by 7am.

By mid-2019, it was doing >1L orders/day.

But, it had burnt a lot of funds to get there, and was facing difficulty in convincing investors anymore 😓

By mid-2019, it was doing >1L orders/day.

But, it had burnt a lot of funds to get there, and was facing difficulty in convincing investors anymore 😓

🥤"Campa Cola Returns: Reliance Brings Back the Iconic Brand"

[THREAD🧵]👇

1) Campa Cola was a popular soft drink brand in India in the 1980s and 1990s.

It was owned by Pure Drinks Group, which was founded in 1977 by the Ramesh Chauhan family.

#Reliance #Campa #campacola

[THREAD🧵]👇

1) Campa Cola was a popular soft drink brand in India in the 1980s and 1990s.

It was owned by Pure Drinks Group, which was founded in 1977 by the Ramesh Chauhan family.

#Reliance #Campa #campacola

2) In 2000, the Indian government banned the production and sale of Campa Cola due to concerns about the use of pesticides in soft drinks.

3) Reliance Consumer Products Limited(RCPL) acquired Campa for INR 22 Cr from Pure Drinks Group.

4) The initial Campa portfolio will consist of Campa Cola, Campa Lemon, and Campa Orange.

4) The initial Campa portfolio will consist of Campa Cola, Campa Lemon, and Campa Orange.

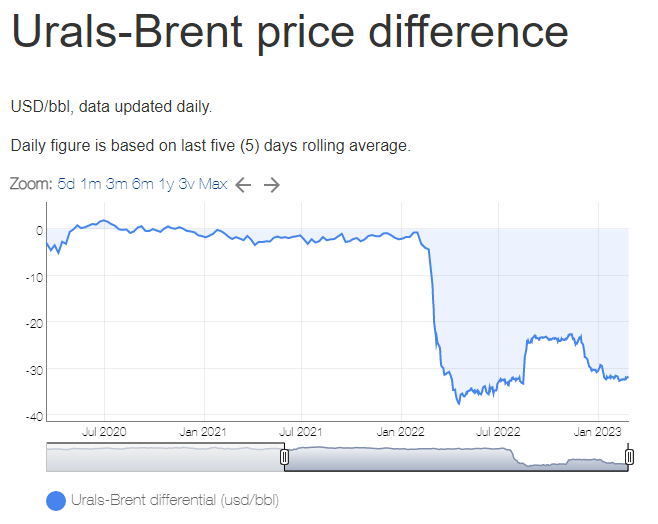

#BigPicture #Modinomics Do you know why your #PETROL price is NOT falling despite the 30% Discount #Russian Crude? 3 Charts to explain it.

1/n

Chart 1 is Weekly Brent Price & 4 wk moving avg

Chart 2 is Monthly INDIA crude Oil Basket.

Chart 3 is Russian Oil Discount.

1/n

Chart 1 is Weekly Brent Price & 4 wk moving avg

Chart 2 is Monthly INDIA crude Oil Basket.

Chart 3 is Russian Oil Discount.

As you can see from

Chart 1: Apr Brent Px is $104. Today 4wk lagged is $83/bbl

Chart 2: Indian Basket in Apr is also $103, Today in month of Feb its $82.3/bbl

Chart 3: Shows Discount is $31/bbl.

Chart 4: As of today $30 Discount Russian Crude is 28% of India Basket

Chart 1: Apr Brent Px is $104. Today 4wk lagged is $83/bbl

Chart 2: Indian Basket in Apr is also $103, Today in month of Feb its $82.3/bbl

Chart 3: Shows Discount is $31/bbl.

Chart 4: As of today $30 Discount Russian Crude is 28% of India Basket

How come even while foreign Minister @DrSJaishankar justifies Russian Crude saying he has COUNTRY to take care off when buying cheap crude, How come PUBLIC are get ZERO BENEFIT?

Who is benefiting from this Cheap Russian Crude ? #Reliance and (#Russian Owned) #NayaraEnergy.

Who is benefiting from this Cheap Russian Crude ? #Reliance and (#Russian Owned) #NayaraEnergy.

Our ace chartist @bbrijesh posts the Index chart in his video. Let us understand on how he creates this index in Tradingview to analyze the charts. #Index #TechnicalAnalysis #charting

🚨 "Mixed Results for Reliance in Q3: Revenue Up, Profits Stagnant"

Key Takeaways of Reliance Industries Q3 Result in this🧵

Reliance Industries operates 4 major business segments: Jio, Retail, Oil & Chemical, & Media.

#Reliance #RelianceJio

Key Takeaways of Reliance Industries Q3 Result in this🧵

Reliance Industries operates 4 major business segments: Jio, Retail, Oil & Chemical, & Media.

#Reliance #RelianceJio

1) The total revenue of Reliance Industries for Q3 stands at 240,963 Cr, showing a 14.8% increase compared to the previous year, driven by sustained growth in the consumer businesses.

2) The profit after tax saw a marginal increase of 0.6% YoY, coming in at 17,806 crores.

2) The profit after tax saw a marginal increase of 0.6% YoY, coming in at 17,806 crores.

3) Under the leadership of Akash Ambani, Jio's business recorded a 20.8% increase in revenue compared to the previous year, reaching a total of 29,195 Cr.

4) Jio's profit increased by 28.6% YoY, reaching 4,881 Cr. 27% of Reliance Industries' total profit is coming from Jio.

4) Jio's profit increased by 28.6% YoY, reaching 4,881 Cr. 27% of Reliance Industries' total profit is coming from Jio.

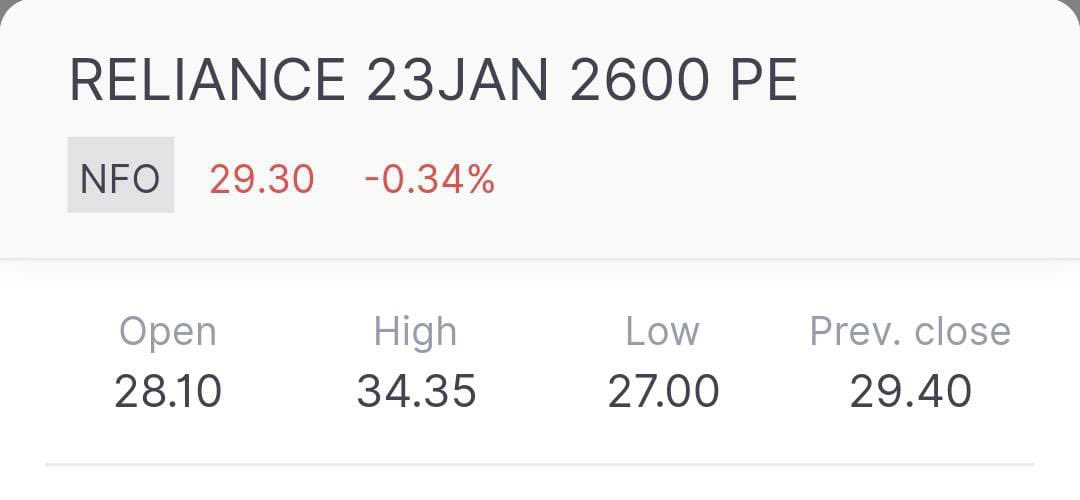

#Nifty at all time high & investors are in dilemma whether to buy the Stocks or not.

The fear factor is if I buy at current levels & if markets fall,then the capital would be blocked in losses & will lose Bank FD interest also!

Here’s is a solution.

A 🧵Thread

For Learning!

1/9

The fear factor is if I buy at current levels & if markets fall,then the capital would be blocked in losses & will lose Bank FD interest also!

Here’s is a solution.

A 🧵Thread

For Learning!

1/9

Assume u have 6.5lacs & wish to Buy #Reliance but it’s trading at 2722.U find it costlier & wait for the stock to come down to 2600.

It’s a good approach but while u wait for ur desired 127 pts fall in this stock;

YOU ARE LOSING YOUR BANK INTEREST! Isn’t it?

Here we go.

2/9

It’s a good approach but while u wait for ur desired 127 pts fall in this stock;

YOU ARE LOSING YOUR BANK INTEREST! Isn’t it?

Here we go.

2/9

Why we liked Amara Raja Batteries but never recommended it?

✅ India's 2nd largest mfg. of lead-acid batteries, mostly used in vehicles; but...

❌ No usage in electric 2w & 3w and rising env. concerns regarding lead batteries

More reasons in this thread ⤵️

✅ India's 2nd largest mfg. of lead-acid batteries, mostly used in vehicles; but...

❌ No usage in electric 2w & 3w and rising env. concerns regarding lead batteries

More reasons in this thread ⤵️

✅ With $1Bn capex, expanding to Li-ion batteries that are preferred for EVs

❌ Li-ion batteries require much more techno-chemical expertise and new ways of mfg., unclear if Amara can imbibe

#ElectricVehicles #vehicles

❌ Li-ion batteries require much more techno-chemical expertise and new ways of mfg., unclear if Amara can imbibe

#ElectricVehicles #vehicles

❌ Li-ion batteries amount to > 50% of the cost of EVs, so auto cos. may produce it in-house (Tata, M&M, Ola already exploring)

#business

#business

#MustRead #NIFTY #CostOfCapital

How Does #Rising #InterestRates/ #CostOfCapital/#DiscountingRate Impact Stock #Valuations. A STUDY of large Cap INDIAN Stocks

A long THEAD, pls stay with me...Exercise Shows a #StockWise Impact of Higher Discounting Rates & Implied Long Term Growth

How Does #Rising #InterestRates/ #CostOfCapital/#DiscountingRate Impact Stock #Valuations. A STUDY of large Cap INDIAN Stocks

A long THEAD, pls stay with me...Exercise Shows a #StockWise Impact of Higher Discounting Rates & Implied Long Term Growth

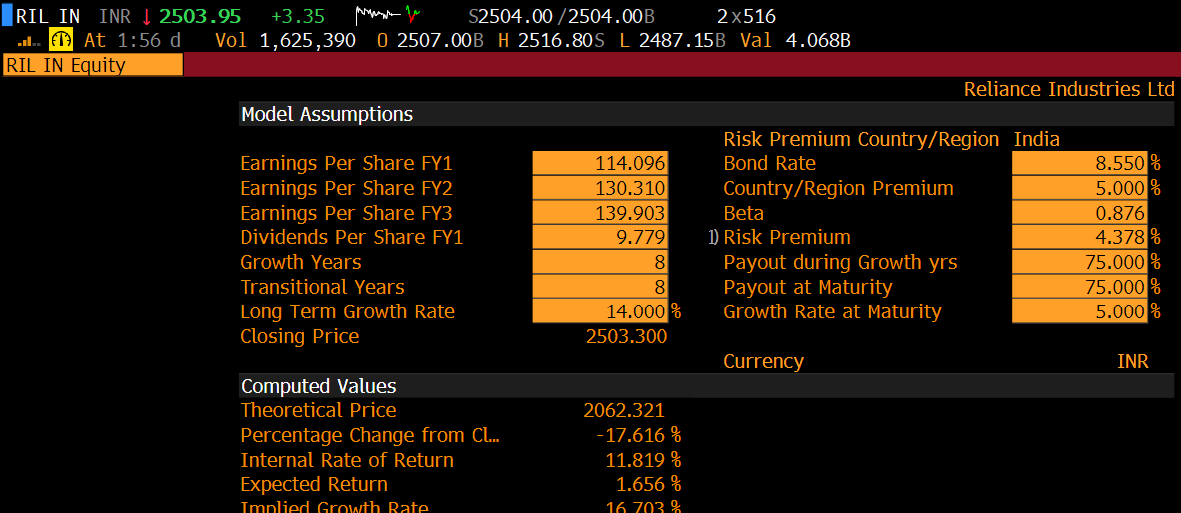

Exercise based on Div Discounting Model (DDM) for Current GSEC vs 8.5% GSEC (Every Justification for it to be 9%).

Starting with #Reliance

Tab 1: Stk px implies 14% CAGR LT Growth (8yr + 8yr) @ 7.45% GSEC

Tab 2: Same Growth (14% CAGR) @ 8.55% GSEC

=>18% Lower Fair Value(Rs2062)

Starting with #Reliance

Tab 1: Stk px implies 14% CAGR LT Growth (8yr + 8yr) @ 7.45% GSEC

Tab 2: Same Growth (14% CAGR) @ 8.55% GSEC

=>18% Lower Fair Value(Rs2062)

1/n रिलायंस इंडस्ट्रीज लिमिटेड (आरआईएल) की 45वीं वार्षिक आम सभा (AGM) के मुख्य बिंदु

#RILAGM #WeCare

#RILAGM #WeCare

1/n 45th Annual General Meeting (Post-IPO) of Reliance Industries Limited (RIL) begins…

#RILAGM #WeCare

#RILAGM #WeCare

10 Trade Ideas for August 2022 🧵🧵

Started this new Monthly Thread

Re-Tweet and like for Max Reach 🙏

#investing #stocks

Started this new Monthly Thread

Re-Tweet and like for Max Reach 🙏

#investing #stocks

1) #AmbujaCement

- Looks prime setup for pump in short term

- 400+ expected in short term

Disc - Invested

- Looks prime setup for pump in short term

- 400+ expected in short term

Disc - Invested

2) #YesBank

As already posted above 15 Yes Bank can pump well in short term.

Price action may change completely.

Chart will be posted in telegram

As already posted above 15 Yes Bank can pump well in short term.

Price action may change completely.

Chart will be posted in telegram

#Reliance

2 Scenarios likely.

In ST, both point towards a min. rise to 50DSma, 2615

50% - 61.8% #retracement of last fall from 2817 to 2365 @ 2591-2645

2 Scenarios likely.

In ST, both point towards a min. rise to 50DSma, 2615

50% - 61.8% #retracement of last fall from 2817 to 2365 @ 2591-2645

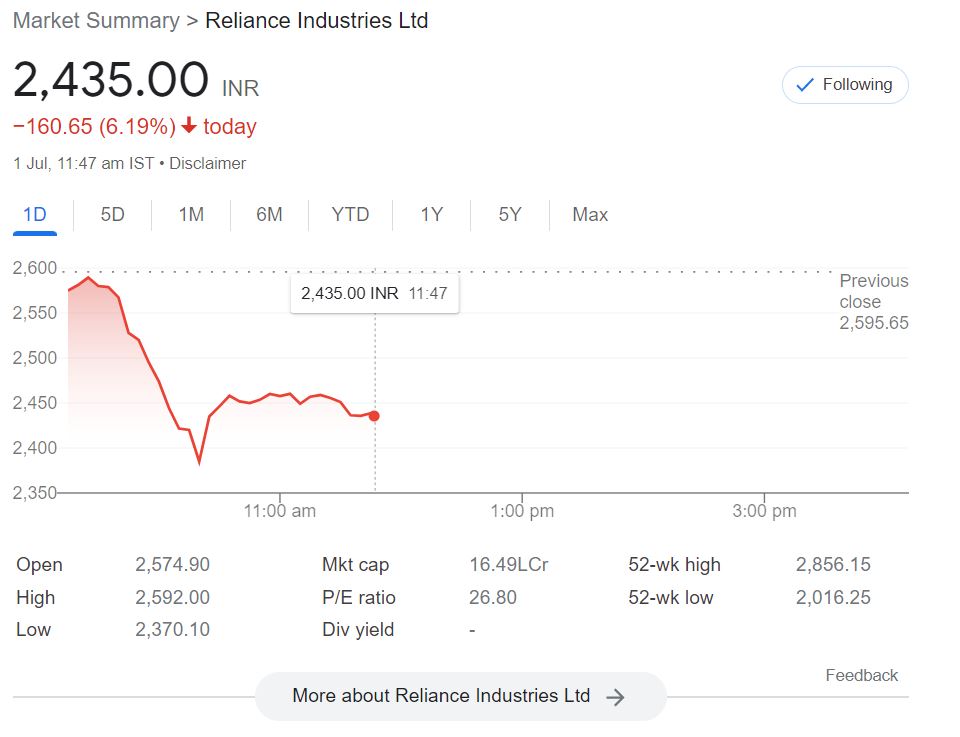

Yesterday, most of the Oil Explorer and Producing Companies Like #Reliance, #Ongc, #MRPL were down by 10%.

There were multiple reasons for this. So let's discuss each reason one by one.

Before going ahead, Like and Retweet this tweet for wider reach.

There were multiple reasons for this. So let's discuss each reason one by one.

Before going ahead, Like and Retweet this tweet for wider reach.

First Reason:

#Government imposed taxes on the export of petrol, diesel, and jet fuel shipped overseas by Indian firms.

A tax of ₹6/L on exports of petrol and aviation turbine fuel and ₹13/L on exports of diesel will be levied.

#Government imposed taxes on the export of petrol, diesel, and jet fuel shipped overseas by Indian firms.

A tax of ₹6/L on exports of petrol and aviation turbine fuel and ₹13/L on exports of diesel will be levied.

The step is aimed at meeting the demand of the domestic market.

The taxes on exports come after oil refiners, particularly from the private sector, attracted huge gains from exporting fuel to markets such as Europe and the US amid a surge in international oil prices.

The taxes on exports come after oil refiners, particularly from the private sector, attracted huge gains from exporting fuel to markets such as Europe and the US amid a surge in international oil prices.

Why Mukesh Ambani is dividing the Reliance empire again?

A thread 🧵 - 1/16

#Reliance #MukeshAmbani #jio #RelianceRetail

A thread 🧵 - 1/16

#Reliance #MukeshAmbani #jio #RelianceRetail

It took Dhirubhai Ambani and the Ambani family 40 years to make Reliance the biggest private company in India. Just 1 year after his death, the biggest business in India was divided among the next generation of the Ambani family.

2/16

2/16

Dhirubhai Ambani did not leave behind a will and proper succession plan for Reliance. It was probably an error of Dhirubhai which led to this division.

3/16

3/16

Reliance and ONGC have faced a bloodbath since morning with their share prices taking a huge fall 📉

And it’s all because of one of their main products: Oil 🛢️

And it’s all because of one of their main products: Oil 🛢️

#Reliance saw a fall in their share price because the government imposed an export duty of ₹6 per litre on petrol & aviation fuel and ₹13 per litre on diesel 💸

This is so that the government can benefit from the rising exports 💰

This is so that the government can benefit from the rising exports 💰

#Reliance - Biggest Heavyweight of the market.. Tanking today.. What happened.. Shall we find out ?

🧵

🧵

(1/n) Govt today announced an increase in taxes on the export of petrol, diesel, and aviation turbine fuel (ATF).

It introduced 6/L tax on petrol exports, 13/L on diesel exports. This will dent Reliance profits, of which the Oil refining business was roughly 40% in Q4.

It introduced 6/L tax on petrol exports, 13/L on diesel exports. This will dent Reliance profits, of which the Oil refining business was roughly 40% in Q4.

(2/n) The government has also announced taxes on windfall gains made by crude oil producers.

Akash Ambani appointed chairman as #MukeshAmbani steps down 🪜

Planned succession move or impulsive decision?

A thread🧵

Planned succession move or impulsive decision?

A thread🧵

Akash Ambani has been appointed as the chairman of the board at #RelianceJio, following the resignation of Mukesh Ambani, signalling a transition in leadership 🫡

According to report, Isha Ambani is also set to become the chairman of the #Reliance conglomerate’s retail unit 🛒

According to report, Isha Ambani is also set to become the chairman of the #Reliance conglomerate’s retail unit 🛒

Succession plan?

Mukesh Ambani has studied the ways in which billionaire families pass on the baton to the next generation 🔑

He is finally taking the steps necessary to bring new and fresh perspectives into India’s largest conglomerate 🇮🇳

Mukesh Ambani has studied the ways in which billionaire families pass on the baton to the next generation 🔑

He is finally taking the steps necessary to bring new and fresh perspectives into India’s largest conglomerate 🇮🇳

Best Buying Levels for all #Nifty50 #Stocks as per Demand Zone:

1️⃣ #ADANIPORTS: ₹562

2️⃣ #ASIANPAINT: ₹2,552

3️⃣ #AXISBANK: ₹620

4️⃣ #BAJAJFINSV: ₹10,445

5️⃣ #BAJAJAUTO: ₹3,280

Save it for later ✅

Tags:

#StockMarket #NSE #Nifty #Trading #Investing #sharemarket

Thread🧵(1/11)

1️⃣ #ADANIPORTS: ₹562

2️⃣ #ASIANPAINT: ₹2,552

3️⃣ #AXISBANK: ₹620

4️⃣ #BAJAJFINSV: ₹10,445

5️⃣ #BAJAJAUTO: ₹3,280

Save it for later ✅

Tags:

#StockMarket #NSE #Nifty #Trading #Investing #sharemarket

Thread🧵(1/11)

Best Buying Levels for all #Nifty50 #Stocks as per Demand Zone:

6️⃣ #BAJFINANCE: ₹4,668

7️⃣ #BHARTIARTL: ₹552

8️⃣ #BPCL: ₹255

9️⃣ #BRITANNIA: ₹2,534

🔟 #CIPLA: ₹850

Save it for later ✅

Tags:

#StockMarket #NSE #Nifty #Trading #Investing #sharemarket #Trader #OI

Thread🧵(2/11)

6️⃣ #BAJFINANCE: ₹4,668

7️⃣ #BHARTIARTL: ₹552

8️⃣ #BPCL: ₹255

9️⃣ #BRITANNIA: ₹2,534

🔟 #CIPLA: ₹850

Save it for later ✅

Tags:

#StockMarket #NSE #Nifty #Trading #Investing #sharemarket #Trader #OI

Thread🧵(2/11)

Best Buying Levels for all #Nifty50 #Stocks as per Demand Zone:

1️⃣ #COALINDIA: ₹163

2️⃣ #DIVISLAB: ₹3,154

3️⃣ #DRREDDY: ₹3,365

4️⃣ #EICHERMOT: ₹2,431

5️⃣ #GRASIM: ₹1,221

Save it for later ✅

Tags:

#StockMarket #NSE #Nifty #Trading #Investing #sharemarket #BSE

Thread 🧵(3/11)

1️⃣ #COALINDIA: ₹163

2️⃣ #DIVISLAB: ₹3,154

3️⃣ #DRREDDY: ₹3,365

4️⃣ #EICHERMOT: ₹2,431

5️⃣ #GRASIM: ₹1,221

Save it for later ✅

Tags:

#StockMarket #NSE #Nifty #Trading #Investing #sharemarket #BSE

Thread 🧵(3/11)

A thread🧵 on Why gross refining margins (GRM) are at multi year high & what it means for refining stocks

"Exxon made more money than God this year," said Biden

#RIL #HPCL #iocl #BPCL #MRPL #CHENNAIPETRO

"Exxon made more money than God this year," said Biden

#RIL #HPCL #iocl #BPCL #MRPL #CHENNAIPETRO

GRM is difference between value of crude based products & value of crude oil.

GRM trends

Q1FY23 GRM (in average basis)- $23

Q4FY22 GRM - $8.1

Q3FY22 GRM - $6.1

Q2FY22 GRM - $3.7

Q1FY22 GRM - $2

Q4FY21 GRM - $1.2

GRM trends

Q1FY23 GRM (in average basis)- $23

Q4FY22 GRM - $8.1

Q3FY22 GRM - $6.1

Q2FY22 GRM - $3.7

Q1FY22 GRM - $2

Q4FY21 GRM - $1.2

Why GRMs are multi year high?

- refiners shut several unprofitable facilities after crude turns negative in pandemic

- refining capacity down to 17.2 Mn bpd in Mar-22 bpd from 19 Mn bpd in April-20 while Downstream products demand remain robust, (1st time in 30 yrs).

- refiners shut several unprofitable facilities after crude turns negative in pandemic

- refining capacity down to 17.2 Mn bpd in Mar-22 bpd from 19 Mn bpd in April-20 while Downstream products demand remain robust, (1st time in 30 yrs).

Must Read #Thread 👇🏻

Few strategic destructions done by #ModiGovt to help two of his Corporate friends

#BSNL was not allowed to bid in for 4G so that Modi ji’s #JIO enjoys a free run

(1/8)

Few strategic destructions done by #ModiGovt to help two of his Corporate friends

#BSNL was not allowed to bid in for 4G so that Modi ji’s #JIO enjoys a free run

(1/8)

#AAI bids for the new airports were rejected with no reason so that Modi’s #Adani takes away all new airports

Note: Adani has no prior #aviation experience

(2/8)

Note: Adani has no prior #aviation experience

(2/8)

#SBI was pushed to give $ 1 Bullion debt to Modi’s #Adani to purchase #CoalMines in Australia.

Takes money from Indians & makes money by selling it back with huge profits! Wah Modi Wah

(3/8)

Takes money from Indians & makes money by selling it back with huge profits! Wah Modi Wah

(3/8)

Refineries have potential with current situation to outperform index by least 100%. World 've crude oil boiling above 120$ but couldn't hv enough refining capacity to convert this crude oil into useful products like jet fuel, petrol & Diesel.

@AdeptMarket

Thread - 1/6 🔽

@AdeptMarket

Thread - 1/6 🔽

As demand picking up suddenly post COVID, global refineries couldn't able to meet demand by Airlines & other domestic demand. Result to this last week American President given order to open closed oil refineries to meet demand.

Thread - 2/6🔽

Thread - 2/6🔽

Similar situation arising in African Continent also, where shortage of oil refineries shot up fuel prices. Due to this situation GRM (Gross Refining Margin) shot up like wild bull to all time high of 30.15$ BBL on Singapore exchange.

Thread - 3/6🔽

Thread - 3/6🔽