Discover and read the best of Twitter Threads about #SIP

Most recents (24)

The actual cost of delaying an #investmentdecision is often unknown until one notices a shortfall in their corpus.

This often prevents one from achieving your goals on time.

Let's explore the cost of delay with an example. (1/n)

#financialplanning #financialgoals

This often prevents one from achieving your goals on time.

Let's explore the cost of delay with an example. (1/n)

#financialplanning #financialgoals

Let's say you are 15 years away from retirement.

After retirement, you require ₹60,000 per month in expenses (in today's value) to live comfortably. (2/n)

#retirement #financialplanning #savings #investing

After retirement, you require ₹60,000 per month in expenses (in today's value) to live comfortably. (2/n)

#retirement #financialplanning #savings #investing

The final total goal amount that you require to sustain yourselves through retirement is ₹3 Crores. (3/n)

#retirementcorpus

#retirementcorpus

#SIP or lumpsum - Which is better?

Probably, most people will vote in favour of SIP.

But, that’s not entirely true.

On many occasions, lumpsum has given better results than SIP.

So, where do you make higher returns?

We analysed the data. Here’s what we found.

A 🧵

Probably, most people will vote in favour of SIP.

But, that’s not entirely true.

On many occasions, lumpsum has given better results than SIP.

So, where do you make higher returns?

We analysed the data. Here’s what we found.

A 🧵

We compared SIP and lumpsum returns in #nifty50 over different time horizons.

Consider this example

One person invested Rs 6 lakh 10 years ago.

Another one starts a monthly SIP of Rs 5,000 at the same time (5,000 X 120 months).

Who earns better returns?

Consider this example

One person invested Rs 6 lakh 10 years ago.

Another one starts a monthly SIP of Rs 5,000 at the same time (5,000 X 120 months).

Who earns better returns?

If you are looking for an efficient investment to save tax in India, this is for YOU!

The BEST way is to invest in ELSS Mutual Funds. You can save up to ₹46,800 in taxes under Section 80C!

Here is how! (1/n)

#ELSS #mutualfunds #taxexemption #thread

The BEST way is to invest in ELSS Mutual Funds. You can save up to ₹46,800 in taxes under Section 80C!

Here is how! (1/n)

#ELSS #mutualfunds #taxexemption #thread

Every year in March, as the financial quarter comes to an end, there is a rush to invest in tax-saving funds.

And with the quarter end so near, let's look at why ELSS is so popular as a tax saving scheme. (2/n)

#ELSSfunds #taxsavings #investment

And with the quarter end so near, let's look at why ELSS is so popular as a tax saving scheme. (2/n)

#ELSSfunds #taxsavings #investment

What is ELSS Fund?

ELSS fund, or Equity Linked Savings Scheme fund, is a tax-saving scheme that allows you to save tax while investing for your long-term goals. (3/n)

#savetax #financialgoals #taxsavingschemes

ELSS fund, or Equity Linked Savings Scheme fund, is a tax-saving scheme that allows you to save tax while investing for your long-term goals. (3/n)

#savetax #financialgoals #taxsavingschemes

Wondering if you should start a SIP?

Here is a thread that can help! (1/n)

#mutualfunds #investing #SIP #thread

Here is a thread that can help! (1/n)

#mutualfunds #investing #SIP #thread

The market has been very volatile for the last couple of months.

With 2023 lined up to be another uncertain year, how should investors take advantage of such a year? (2/n)

#investors #volatility #wealthcreation

With 2023 lined up to be another uncertain year, how should investors take advantage of such a year? (2/n)

#investors #volatility #wealthcreation

The answer is simple. Rather than waiting on the sidelines, the best way to participate in the market is via a SIP! (3/n)

#SIP #investingtips #compounding

#SIP #investingtips #compounding

𝗛𝗼𝘄 𝘁𝗼 𝗧𝗵𝗿𝗶𝘃𝗲 𝗕𝗲𝘆𝗼𝗻𝗱 𝘁𝗵𝗲 𝗦𝘁𝗮𝗿𝘁𝘂𝗽 𝗦𝘁𝗮𝗴𝗲

𝗧𝗵𝗶𝘀 𝗶𝗻𝘃𝗼𝗹𝘃𝗲𝘀 𝗰𝗹𝗲𝗮𝗿𝗹𝘆 𝗰𝗼𝗺𝗺𝘂𝗻𝗶𝗰𝗮𝘁𝗶𝗻𝗴 𝘆𝗼𝘂𝗿 𝘃𝗮𝗹𝘂𝗲𝘀 𝗮𝗻𝗱 𝗴𝗼𝗮𝗹𝘀 𝘁𝗼 𝘆𝗼𝘂𝗿 𝘁𝗲𝗮𝗺. ⤵️

𝗧𝗵𝗶𝘀 𝗶𝗻𝘃𝗼𝗹𝘃𝗲𝘀 𝗰𝗹𝗲𝗮𝗿𝗹𝘆 𝗰𝗼𝗺𝗺𝘂𝗻𝗶𝗰𝗮𝘁𝗶𝗻𝗴 𝘆𝗼𝘂𝗿 𝘃𝗮𝗹𝘂𝗲𝘀 𝗮𝗻𝗱 𝗴𝗼𝗮𝗹𝘀 𝘁𝗼 𝘆𝗼𝘂𝗿 𝘁𝗲𝗮𝗺. ⤵️

Moving past the startup phase is a significant milestone and something to be celebrated. As your business grows and evolves, it's important to continue adapting and refining your strategies. A key area to focus on is building a strong and sustainable corporate culture.

𝗧𝗵𝗶𝘀 𝗰𝗮𝗻 𝗵𝗲𝗹𝗽 𝘁𝗼 𝗺𝗶𝘁𝗶𝗴𝗮𝘁𝗲 𝗿𝗶𝘀𝗸 𝗮𝗻𝗱 𝗲𝗻𝘀𝘂𝗿𝗲 𝗹𝗼𝗻𝗴-𝘁𝗲𝗿𝗺 𝘀𝘁𝗮𝗯𝗶𝗹𝗶𝘁𝘆. ⤵️

As your business moves past the startup phase, it's important to consider expanding your product or service offerings, as well as exploring new markets.

🗣️

As your business moves past the startup phase, it's important to consider expanding your product or service offerings, as well as exploring new markets.

🗣️

#economy of #cigarettes: Cost, returns (if invested), impact on #Health

1. A pack of cigarettes costs Rs 330. For a month, it would cost Rs 9900 (one pack/day).

A 30-year old person has the option of smoking one pack/day or investing this amount in #mutualfunds via #SIP route.

1. A pack of cigarettes costs Rs 330. For a month, it would cost Rs 9900 (one pack/day).

A 30-year old person has the option of smoking one pack/day or investing this amount in #mutualfunds via #SIP route.

2. If Rs 10000/ is invested every month in mutual funds via SIP route (since age 30) and the expected return is 10% per annum, the savings would become a whopping 2.28 crores after 30 years (when he turns 60).

3. In addition, not smoking would reduce the risk of #heartattack, #stroke and several #cancers.

Medical insurance premium would also be lower.

So, healthcare costs would be significantly lesser for a non-smoker (as compared to a smoker).

Medical insurance premium would also be lower.

So, healthcare costs would be significantly lesser for a non-smoker (as compared to a smoker).

Three months remain to plan your taxes.

If you invest in #ELSS funds to save tax, here are 5 mistakes you must avoid to earn better returns.

A 🧵

If you invest in #ELSS funds to save tax, here are 5 mistakes you must avoid to earn better returns.

A 🧵

👉1. Lump sum vs SIP

Most investors make lump sum investments in ELSS (See table).

A lump sum investment doesn’t mean you will get lower returns.

#SIP doesn’t guarantee higher returns than a lump sum.

But SIP is still a better option.

Here’s why 👇

Most investors make lump sum investments in ELSS (See table).

A lump sum investment doesn’t mean you will get lower returns.

#SIP doesn’t guarantee higher returns than a lump sum.

But SIP is still a better option.

Here’s why 👇

Assume you have two options👇

A. Walk 20 kms in one day at a stretch

B. Walk 2 kms every day for the next 10 days

Which one looks more feasible? The answer, for most, is obvious.

The same applies to ELSS SIPs

Small amounts every month don’t put a strain on your finances

A. Walk 20 kms in one day at a stretch

B. Walk 2 kms every day for the next 10 days

Which one looks more feasible? The answer, for most, is obvious.

The same applies to ELSS SIPs

Small amounts every month don’t put a strain on your finances

वर्षाला फक्त तीन अधिकचे हफ्ते तुमचं गृहकर्ज व्याजासहित परत करू शकतील ?

गृहकर्जाचा हफ्ता, जिथे कंपाऊंडिंगचा नियम तुमच्या विरोधात काम करतो.

पण या कर्जापोटी भरलेली रक्कम तुम्हाला अगदी व्याजासहित परत मिळाली तर ?

उदाहरणाने पाहूया,

👇

#Thread #वित्तसाक्षरता #म #Homeloan

गृहकर्जाचा हफ्ता, जिथे कंपाऊंडिंगचा नियम तुमच्या विरोधात काम करतो.

पण या कर्जापोटी भरलेली रक्कम तुम्हाला अगदी व्याजासहित परत मिळाली तर ?

उदाहरणाने पाहूया,

👇

#Thread #वित्तसाक्षरता #म #Homeloan

तुमचं गृहकर्ज : ₹40 लाख समजू,

8.9% वार्षिक व्याजदराने 22 वर्षांसाठी मासिक हफ्ता अर्थात ईएमआय : ₹34,583

बावीस वर्षांत होमलोन परतफेडी दाखल तुमच्याकडून बँकेला दिली जाऊ शकणारी एकूण रक्कम,

₹40,00,000 (मुद्दल) + ₹51,29,949 (व्याज) = ₹91,29,949

👇

8.9% वार्षिक व्याजदराने 22 वर्षांसाठी मासिक हफ्ता अर्थात ईएमआय : ₹34,583

बावीस वर्षांत होमलोन परतफेडी दाखल तुमच्याकडून बँकेला दिली जाऊ शकणारी एकूण रक्कम,

₹40,00,000 (मुद्दल) + ₹51,29,949 (व्याज) = ₹91,29,949

👇

म्हणजे 40 लाखांची परतफेडीत फक्त व्याजापोटी तुम्ही मुदलाहून जास्त म्हणजे 128% रक्कम अधिक देता.

थेट सांगायचं तर गुंतवणूक संदर्भातील कंपाऊंडिंगचा नियम इथे मात्र तुमच्या विरोधात असतो.

पण याच कंपाऊंडिंगच्या मदतीने वर्षाला फक्त 3 अधिक हफ्त्यांसह गृहकर्ज व्याजासह परत मिळवता आलं तर?

👇

थेट सांगायचं तर गुंतवणूक संदर्भातील कंपाऊंडिंगचा नियम इथे मात्र तुमच्या विरोधात असतो.

पण याच कंपाऊंडिंगच्या मदतीने वर्षाला फक्त 3 अधिक हफ्त्यांसह गृहकर्ज व्याजासह परत मिळवता आलं तर?

👇

Today I'll make a thread on how i chose my 5 mutual funds.

I am a retailer and i am learning slowly but the evidence way.

Like in medicine we practice evidence based, same principles i apply to investing.

To learn from Data & evidence.

To understand that #MutualFundsSahiHai

I am a retailer and i am learning slowly but the evidence way.

Like in medicine we practice evidence based, same principles i apply to investing.

To learn from Data & evidence.

To understand that #MutualFundsSahiHai

First of all, as a retailer and a non finance background person we really need to understand what are mutual funds and why they are so important for a salaried person who wants to develop a big corpus over the long run

This one video by @PranjalKamra is 👏

This one video by @PranjalKamra is 👏

I think i relate a lot with @PranjalKamra who talks in simple terms and tries to explain how can we find out the best ones for us.

I also did a course by @rachana_ranade ma'am who's my first guru of financial literacy journey.🙏

To all of you who are new to the workforce… Congratulations!!! You have secured your first job.

But are you confused about how to best use your current salary? (1/n)

#salary #cashflow #payday #money

But are you confused about how to best use your current salary? (1/n)

#salary #cashflow #payday #money

Most people complicate things. It is only natural when there are so many investment products to choose from. That need not be the case.

Here are some simple tips for someone just starting! (2/n)

#equity #fixedincome #gold #realestate

Here are some simple tips for someone just starting! (2/n)

#equity #fixedincome #gold #realestate

#1 Start Building an Emergency Fund

This should be your first priority. In case of emergencies, you shouldn't be left empty-handed.

Having 3-6 months of expenses set aside will be optimal. (3/n)

#emergencyfund #savings

This should be your first priority. In case of emergencies, you shouldn't be left empty-handed.

Having 3-6 months of expenses set aside will be optimal. (3/n)

#emergencyfund #savings

पॅसिव्ह उत्पन्न हवं असेल तर आधी पॅसिव्ह #गुंतवणुक सुध्दा करायला शिका.

#Thread

पॅसिव्ह गुंतवणुकीसाठी लागणारं भांडवल कळत-नकळत आपल्याकडून होणाऱ्या बचतीमध्ये असते पण ते आपल्या लक्षात येत नसतं.

खरतर हे रोजच्या व्यवहारांत दडलेलं आहे.

👇🏽

#Thread

पॅसिव्ह गुंतवणुकीसाठी लागणारं भांडवल कळत-नकळत आपल्याकडून होणाऱ्या बचतीमध्ये असते पण ते आपल्या लक्षात येत नसतं.

खरतर हे रोजच्या व्यवहारांत दडलेलं आहे.

👇🏽

#Cost_of_Delay

नमस्कार,

आज आपण गुंतवणुकीला उशिरा सुरवात केल्याने आपले किती नुकसान होते हे एका उदाहरणावरून पाहणार आहोत.चक्रवाढ व्याज कसे काम करते चला तर पाहुया:-

खाली दिलेल्या पहिल्या चार्ट मध्ये पाहू शकता :-

Thread

नमस्कार,

आज आपण गुंतवणुकीला उशिरा सुरवात केल्याने आपले किती नुकसान होते हे एका उदाहरणावरून पाहणार आहोत.चक्रवाढ व्याज कसे काम करते चला तर पाहुया:-

खाली दिलेल्या पहिल्या चार्ट मध्ये पाहू शकता :-

Thread

2) आपण जर 10000 रुपयेची गुंतवणूक #SIP ( Systematic Investment Plan ) द्वारे पुढील 120 महिन्यासाठी केली आणि परतावा 15% भेटला तर भविष्यातील मुद्दल 27.86 लाख असेल . यामध्ये आपण एक लक्षात घेतले पाहिजे की इथे आपण एकही SIP थकवलेली नाही पूर्ण 120 महीने 10000 रुपये गुंतवलेले आहेत .

If #retirement is on the list of #goals you’re investing for, should the current high #inflation lead to any change in your plans? Here’s our take: (1/5)

If annual inflation is at 7%, monthly #expenses of Rs 50,000 per month today, would become Rs 1.9 lakhs per month, in 20 years. At 5% inflation, it would become only Rs 1.3 lakhs per month. It’s best to overestimate, err on the side of caution and invest accordingly. (2/5)

At the same time, it doesn’t help to panic and look only at the short term. Just stick to your #assetallocation, and continue your SIPs. If you think your #SIP investments won’t take you closer to your retirement goal, consider increasing allocation to equity MFs. (3/5)

This maybe the golden opportunity to start investing in Indian stock market in systematic manner. #stock #investing #sip

Find fundamentally strong stocks from large and midcap segments.

It should be a #cashcow

Check:

✓Growing sales

✓Growing Revenue

✓Good profit margin

✓Growing EPS

✓ Good P/E

✓ Strong buisness model to compete with competition.

✓ Dividend paying largecap can be a add-on.

It should be a #cashcow

Check:

✓Growing sales

✓Growing Revenue

✓Good profit margin

✓Growing EPS

✓ Good P/E

✓ Strong buisness model to compete with competition.

✓ Dividend paying largecap can be a add-on.

If you don't have time to research stocks and reallocate.

Just go for the index funds and#ETFss

Here are some indices:

✓ Nifty 50

✓ Nifty next 50

✓ Nifty midcap 150

✓ Nifty midcap 250

✓ Motilal Oswal S&P 500 (US)

✓ Nasdaq 100 FoF (US)

✓ Nifty bluechip growth

Just go for the index funds and#ETFss

Here are some indices:

✓ Nifty 50

✓ Nifty next 50

✓ Nifty midcap 150

✓ Nifty midcap 250

✓ Motilal Oswal S&P 500 (US)

✓ Nasdaq 100 FoF (US)

✓ Nifty bluechip growth

Many investors are wondering if they should shift their #equitymutualfund SIPs to debt investment options, as they watch the markets stew in #volatility. Well, we crunched some numbers and here’s what we think: (1/5)

Shifting #SIP investments to debt products temporarily provides capital protection, but also results in poor yields. You might end up with a smaller corpus, if you follow this strategy. (2/5)

On the other hand, persisting with equity mutual fund SIPs, even if markets are down, pays off over the long term. So far, market growth after dips tends to make up for the crashes. (3/5)

4 Common Mistakes to avoid while investing in Mutual Funds in a volatile market 🚫

Retweet (🔃) to spread awareness.

#investing #stocks

Retweet (🔃) to spread awareness.

#investing #stocks

1) Sector-specific bets 📍

In bull market, it may seem unwise to diversify your portfolio, when you are seeing some segment of the market is performing exceptionally well, but one gets the importance when the tide of the sector goes out and the prices start tumbling.

#business

In bull market, it may seem unwise to diversify your portfolio, when you are seeing some segment of the market is performing exceptionally well, but one gets the importance when the tide of the sector goes out and the prices start tumbling.

#business

The extraordinary returns of sector funds may lure you but remember they are also vulnerable to high losses.

So, it's always advisable to invest in a diversified portfolio, instead of taking concentrated bets on some sectors, especially in a volatile market.

So, it's always advisable to invest in a diversified portfolio, instead of taking concentrated bets on some sectors, especially in a volatile market.

Top 5 Mutual Funds for 2022 where you can start your SIP

In this thread, we will look at the benefits of mutual funds for novice investors who want to increase their wealth and accomplish long-term objectives... (🧵) 👇

#AxisBluechipFund #EdelweissFund #KotakDebtHybridFund #SIP

In this thread, we will look at the benefits of mutual funds for novice investors who want to increase their wealth and accomplish long-term objectives... (🧵) 👇

#AxisBluechipFund #EdelweissFund #KotakDebtHybridFund #SIP

In this thread we talked about:

-Why should you invest in mutual funds?

-Why should you start a SIP?

-List of mutual funds which we have selected for you to start your SIP. 👇

-Why should you invest in mutual funds?

-Why should you start a SIP?

-List of mutual funds which we have selected for you to start your SIP. 👇

Why should you invest in mutual funds?

Investing in mutual funds is a simple, paperless process. Investors can keep an eye on the market & make decisions based on their needs

Furthermore switching between mutual fund schemes & portfolio rebalancing helps keep returns on track👇

Investing in mutual funds is a simple, paperless process. Investors can keep an eye on the market & make decisions based on their needs

Furthermore switching between mutual fund schemes & portfolio rebalancing helps keep returns on track👇

#Blinkit & #Zomato – Long thread:

1/n

Blurred to Opaque to Muddy

How to leverage a listed company to recover losses from failed ventures/adventures?

Danny DeVito famously said in namesake movie – There is only one thing I love more than my money -

"other people’s money"

1/n

Blurred to Opaque to Muddy

How to leverage a listed company to recover losses from failed ventures/adventures?

Danny DeVito famously said in namesake movie – There is only one thing I love more than my money -

"other people’s money"

2/n

Zomato announced that it plans to acquire Blinkit for a “consideration” of $ 578 Mn. We will revisit valuation later. Below is the snapshot of financials.

Who pays $578 Mn on unaudited financials of just 2 mths ? Not even even 1 quarter nos are provided.

@SEBI listening?

Zomato announced that it plans to acquire Blinkit for a “consideration” of $ 578 Mn. We will revisit valuation later. Below is the snapshot of financials.

Who pays $578 Mn on unaudited financials of just 2 mths ? Not even even 1 quarter nos are provided.

@SEBI listening?

3/n

Is the company really growing topline at 162% as claimed ? This invites some curiosity. Where are the past YoY nos ?

I tried to dig out what I could with public reported info. Here is what the past looks like for #Blinkit .Revenues touched Rs 177 Cr in FY 2020 before covid

Is the company really growing topline at 162% as claimed ? This invites some curiosity. Where are the past YoY nos ?

I tried to dig out what I could with public reported info. Here is what the past looks like for #Blinkit .Revenues touched Rs 177 Cr in FY 2020 before covid

SBI Small Cap :- sbimf.com/en-us/quick-in…

Mirae Tax Save - transact.miraeassetmf.co.in/investor/Index…

I have a very logical strategy cum observation for those who like investing in IPOs but not getting allotment

And just watching the price of the IPO going up up and up

1/n

And just watching the price of the IPO going up up and up

1/n

Typically what happens

The #IPOs which are very good are #oversubscribed and we don’t get any allocation

And those IPOs which are not so good then we get the location and then the #IPO get #listed at lower price..

So here is the simple logical observation cum strategy

2/n

The #IPOs which are very good are #oversubscribed and we don’t get any allocation

And those IPOs which are not so good then we get the location and then the #IPO get #listed at lower price..

So here is the simple logical observation cum strategy

2/n

Steps

1. Whenever a good company IPO get listed, just observation for next one month.. it should trade above the allocation price by 20-30%

2. Just after one month Anchor investors gets an opportunity to book their profits..

3. Observe the #stock price for next week

3/n

1. Whenever a good company IPO get listed, just observation for next one month.. it should trade above the allocation price by 20-30%

2. Just after one month Anchor investors gets an opportunity to book their profits..

3. Observe the #stock price for next week

3/n

#PayTmIPO – Long Thread:

There is a new game in town. The rules are “well laid out” by VCs – Report just 3 yr financials, blame flat sales since 2019 on covid, pick consultants to project fancy story, price IPO at 45 times sales, create scarcity of “limited offer” of 12% shares”

There is a new game in town. The rules are “well laid out” by VCs – Report just 3 yr financials, blame flat sales since 2019 on covid, pick consultants to project fancy story, price IPO at 45 times sales, create scarcity of “limited offer” of 12% shares”

12% stake sale ~matches the “principal investment” by VCs. Oh, by the way, get some tranches of funding just before IPO that values your company closer to issue price. It’s like you buying your own house again for 2x price. May not work for you but somehow seems to work for VCs.

Now rope in mutual funds with 75% of this scarce offering (SIP money will go somewhere after all) & leave retail scrambling for 2.5% stake of a brand that is now a “household name”. Get brokerage firms & YouTube advisors to keep pumping story with same broken records from DRHP.

Journée #Josy sur le #DNS indico.mathrice.fr/event/286/

Premier à parler, @remasse (@AFNIC ) qui va exposer les grands principes.

Premier à parler, @remasse (@AFNIC ) qui va exposer les grands principes.

Résolution #DNS (« ça doit marcher 100 % du temps ») puis cycle de vie du nom de domaine (pensez au renouvellement) pour lequel, dans un .fr, on doit passer par un BE (Bureau d'Enregistrement).

#JoSy

#JoSy

L'évolution du .fr : très petit jusqu'en 2004 car enregistrement très restrictif (« nous avions fini par prendre un .com »)

Depuis les réformes de 2004 et 2006, .fr décolle. Bientôt 4 millions de noms.

Depuis les réformes de 2004 et 2006, .fr décolle. Bientôt 4 millions de noms.

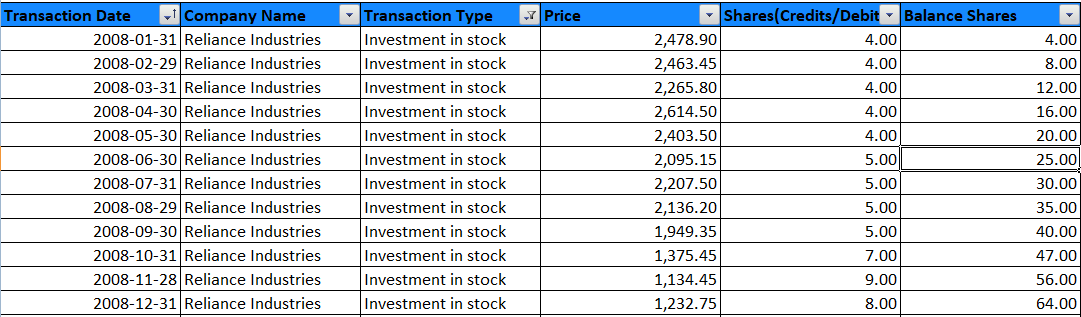

The top 10 stocks in #Nifty50 contributes more than 55% weight-age, the remaining 45% comes from other 40 stocks. This weight-age changes yearly twice based on stock performance. What if I choose to do SIP of Rs.10,000 every month only with Top 1 stock from this list?

I downloaded last 13 years historical Nifty50 constituents from niftyindices.com and grabbed the top stock based on weight-age. Allocated Rs.10,000 every month into that stock.

Used @ValueResearch portal to upload the transaction to compute the final results inclusive of Bonus, Splits, Dividends etc. In last 13 years, these 5 stocks #HDFCBANK #ICICIBANK #ITC #RELIANCE & #INFY had the highest weight-age at different periods.