Discover and read the best of Twitter Threads about #STEEL

Most recents (24)

‼️👇🚢 This is really interesting👇Who knew⁉️@ItsTheAtmospher @pen_is_mighty #SCUBA #Salvage #Shipwrecks #Radioactive #Steel #Technology #WWII #History @pewtergod @JohnA_USMCvet #Navy #Physics

“Low-background metals are valuable because they carry particularly low levels of radiation. Used as shielding in advanced particle physics projects and medical science devices like X-ray chambers, these metals won’t interfere with specialized, highly radiation-sensitive tools.”

2/“Most steel is made by blowing air or pure O2 into molten pig iron to remove impurities & make it stronger. Since start of atmospheric nuclear tests, all air-even purified O2, contains elevated levels of isotopes like cobalt-60,most new steel is infused w/radioactive particles.

US flat rolled #steel prices spike week-over-week, but how long will it last?

Sources close to #SteelOrbis have confirmed that domestic flat rolled #steelprices have continued to spike in the past 7 days.

The big question relates to how long this uptrend will last.⏬

Sources close to #SteelOrbis have confirmed that domestic flat rolled #steelprices have continued to spike in the past 7 days.

The big question relates to how long this uptrend will last.⏬

One source was quick to point out that overall steel demand is lower than it was in 2019. Auto production has not returned to 2019 levels, he said, adding that nonresidential construction is still more than 25% lower that it was in 2019.⏬

“If there was enough steel in 2019, there should be enough now,” he said. “[These increases aren’t because of] demand, it’s because capacity is offline.”

Not only is the domestic capacity utilization rate still hovering below 75%,⏬

Not only is the domestic capacity utilization rate still hovering below 75%,⏬

Brazilian high-grade iron ore price increases

The price of Brazilian high-grade #ironore exports, 65 percent iron contents, is $149/mt today, against $144/mt on March 10, CFR China conditions.⏬

The price of Brazilian high-grade #ironore exports, 65 percent iron contents, is $149/mt today, against $144/mt on March 10, CFR China conditions.⏬

The price is the highest since mid-June 2022, reflecting the confirmation that the operation pace of blast furnaces in China, in relation to their nameplate capacities, has reached 88.03 percent last week, after having increased for nine consecutive weeks.⏬

Such recovery of operations is attributed to the possibility that #steel producers could achieve higher margins, due to higher #steelprices in the international markets.

Full story 🔗 bit.ly/40agVTb

Full story 🔗 bit.ly/40agVTb

Earlier today, #EU agreed on a badly needed reform of the EU Emissions Trading System (#EUETS) which is the system of cap-and-trade of #carbonemissions allowances for #energyintensive industries and the #powergeneration sector. The most critical points are:

1. Agreement to make it compulsory for #EU members to dedicate all their auctioning revenues to #climateaction #investments

2. Sectors covered by the Carbon Border Adjustment Mechanism (recently agreed #EU #carbon import tax) such as #cement, #aluminium, #fertilisers, #electricty production, #hydrogen, #iron and #steel, will see an end to free #allowances for these sectors between 2026 and 2034

JUST IN

China Q3 GDP data:

Q3 GDP YoY +3.9%[Est.+3.3%;Prev.+0.4%]

Q3 GDP QoQ +3.9%[Prev.-2.6%]

#China #GDP #EconTwitter 🇨🇳

More data will be updated in this thread.

1/

China Q3 GDP data:

Q3 GDP YoY +3.9%[Est.+3.3%;Prev.+0.4%]

Q3 GDP QoQ +3.9%[Prev.-2.6%]

#China #GDP #EconTwitter 🇨🇳

More data will be updated in this thread.

1/

China' Sept urban surveyed unemployment rate 5.5%[Est. 5.2%; Prev. 5.3%]

Jan-Sept urban fixed assets investment +5.9% y/y [Est.+6.00%;Prev.+5.8%]

Industrial value-added +6.3% y/y [Est.+4.5%;Prev.+4.2%]

Retail sales +2.5% y/y [Est.3.3%;Prev.5.4%]

#China #GDP #EconTwitter 🇨🇳

3/

Jan-Sept urban fixed assets investment +5.9% y/y [Est.+6.00%;Prev.+5.8%]

Industrial value-added +6.3% y/y [Est.+4.5%;Prev.+4.2%]

Retail sales +2.5% y/y [Est.3.3%;Prev.5.4%]

#China #GDP #EconTwitter 🇨🇳

3/

📰📊 @BrookingsInst takes a look at the role of 🇨🇳#China in #nickel from 🇮🇩#Indonesia following our report on China's overseas #coal projects:

brookings.edu/blog/up-front/…

brookings.edu/blog/up-front/…

Captive coal power plants in 🇮🇩#Indonesia highlight a loophole in 🇨🇳#China’s no new overseas #coal pledge & Indonesia’s domestic policy.

Two new #CaptiveCoal plants on China-backed #nickel & #steel complexes secured construction & purchasing agreements from Chinese firms in 2022.

Two new #CaptiveCoal plants on China-backed #nickel & #steel complexes secured construction & purchasing agreements from Chinese firms in 2022.

Last week, a presidential regulation in 🇮🇩 #Indonesia listed “National Strategic Projects” as exempted from their moratorium on new #coal — a move that may endanger its #NetZero targets.

📊🇨🇳NEW REPORT

In 2022, #coal use for power & #steel production in #China has dropped. The target to peak #CO2emissions means it must fall more, yet investments in coal power & coal-based steel plants have increased.

Our new report w/@GlobalEnergyMon looks at what's happening.

In 2022, #coal use for power & #steel production in #China has dropped. The target to peak #CO2emissions means it must fall more, yet investments in coal power & coal-based steel plants have increased.

Our new report w/@GlobalEnergyMon looks at what's happening.

In the first half of 2022, China’s local governments approved 28 new coal-power units, with 15 gigawatts of capacity, while Chinese steel firms announced 16 new coal-based steelmaking projects in the same period, the most since 2019, with a capacity of 30 million tonnes/year.

Steel emissions are due to peak by 2025. Emissions are falling now & there is little scope for them to increase before the peaking deadline. The steel emission peak target also means China can't use the infrastructure & construction push it used for previous economic slowdowns.

#China's August urban surveyed unemployment rate 5.3%[Est. 5.4%;Prev. 5.4%]

Jan-Aug urban fixed investment +5.8% y/y [Est.+5.5%;Prev.+5.7%]

Aug industrial value-added +4.2% y/y [Est.+3.8%;Prev.+3.8%]

Aug retail sales +5.4% y/y [Est.+3.5%;Prev.+2.7%]

1/n #GDP #EconTwitter 🇨🇳

Jan-Aug urban fixed investment +5.8% y/y [Est.+5.5%;Prev.+5.7%]

Aug industrial value-added +4.2% y/y [Est.+3.8%;Prev.+3.8%]

Aug retail sales +5.4% y/y [Est.+3.5%;Prev.+2.7%]

1/n #GDP #EconTwitter 🇨🇳

China produced 5.74 million tons of non-ferrous metal in August, which rose by 6.7%, the most since January 2021.

Jan-Aug non-ferrous metal productions +1.9% to 44 million tons.

2/ #China #copper #aluminum

Jan-Aug non-ferrous metal productions +1.9% to 44 million tons.

2/ #China #copper #aluminum

In Aug, #China's total retail sales were recorded at 3.6258 trillion yuan, up 5.4% y/y but dropped 0.05% m/m.

Among them, retail sales of goods were 3.25 trillion yuan, which rose by 5.1% y/y; The total revenue for the catering industry was 374.8 billion yuan, surged 8.4% y/y.

3/

Among them, retail sales of goods were 3.25 trillion yuan, which rose by 5.1% y/y; The total revenue for the catering industry was 374.8 billion yuan, surged 8.4% y/y.

3/

OK, talked about this a little last month, and outlined some thoughts on a Spaces last night, but it's time to revisit the "China will save commodities" thesis.

I'll use the #steel & #coal space because that's what I know best, but there are analogs to other industries too...1/x

I'll use the #steel & #coal space because that's what I know best, but there are analogs to other industries too...1/x

For better or worse, I've always relied on China credit impulse to give me a sense of where we are in the #steel cycle...3 out of the past four cycles, prices peaked 12-24 months after a peak in credit.

Except for 2013/14...2/x

Except for 2013/14...2/x

(1/9) I’ve seen a lot of op-eds about how awful it is that #CCS was included in the #IRA. Most lack nuance, because they haven’t clocked that the #energytransition isn’t just about the power sector anymore. Sorry #energytwitter. So, a 🧵 on why carbon capture still has a place.

(2/9) First, I get this. I was a huge #CCS skeptic. Two things changed my mind: modelling pathways to #netzero for materials with my @BloombergNEF team, and the #BNEFNEO team's carbon budgets for industry. Sobering work that taught me a lot.

(3/9) Some industries just can’t do without CCS. Process emissions are just as harmful as combustion. And we’re past the point where abatement of emissions is enough. That means removals, which means #DirectAirCapture.

#AviationMinister @JM_Scindia to CNBC-TV18: The primary responsibility of overseeing safety lies with the DGCA... All #airlines must follow the SOPs with regard to the safety

#CNBCTV18Exclusive

#CNBCTV18Exclusive

#AviationMinister @JM_Scindia to CNBC-TV18: Metro #airports capacity to increase to almost 400 million passengers in next 3-4 years

#CNBCTV18Exclusive

#CNBCTV18Exclusive

#AviationMinister @JM_Scindia to CNBC-TV18: Aviation one of the sectors that has endured through pandemic & seen a V-shaped recovery

#Aviation is a seasonal industry, some dips in business are not surprising

"Very bullish" on the future of #aviation in India

#CNBCTV18Exclusive

#Aviation is a seasonal industry, some dips in business are not surprising

"Very bullish" on the future of #aviation in India

#CNBCTV18Exclusive

JUST IN

China Q2 GDP data:

Q2 GDP YoY +0.4%[Est.+1.0%;Prev.+4.8%]

Q2 GDP QoQ -2.6%[Est.-1.5%;Prev.+1.3%]

#China #GDP #EconTwitter 🇨🇳

More data will be updated in this thread.

1/

China Q2 GDP data:

Q2 GDP YoY +0.4%[Est.+1.0%;Prev.+4.8%]

Q2 GDP QoQ -2.6%[Est.-1.5%;Prev.+1.3%]

#China #GDP #EconTwitter 🇨🇳

More data will be updated in this thread.

1/

China' June urban surveyed unemployment rate 5.5%[Est. 5.7%; Prev. 5.9%]

Jan-June urban fixed investment +6.1% y/y [Est.+6.0%;Prev.+6.2%]

June industrial value-added +3.9% y/y [Est.+4.1%;Prev.+0.7%]

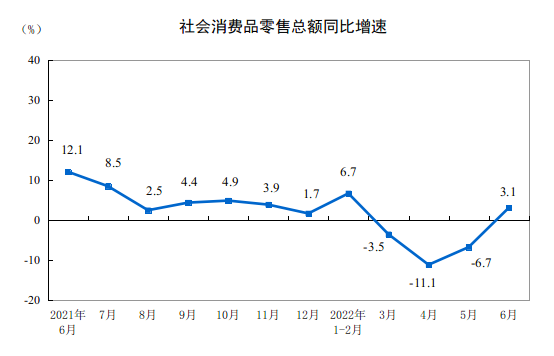

June retail sales +3.1% y/y [Est.0%;Prev.-6.7%]

#China #GDP #EconTwitter 🇨🇳

2/

Jan-June urban fixed investment +6.1% y/y [Est.+6.0%;Prev.+6.2%]

June industrial value-added +3.9% y/y [Est.+4.1%;Prev.+0.7%]

June retail sales +3.1% y/y [Est.0%;Prev.-6.7%]

#China #GDP #EconTwitter 🇨🇳

2/

In June, #China's total retail sales were recorded at 3.87 trillion yuan, up 3.1% y/y or up 0.53% m/m.

Among them, retail sales of goods were 3.50 trillion yuan, which rose by 3.9% y/y; The total revenue for the catering industry was 376.6 billion yuan, down 4.0%.

3/

Among them, retail sales of goods were 3.50 trillion yuan, which rose by 3.9% y/y; The total revenue for the catering industry was 376.6 billion yuan, down 4.0%.

3/

🚨Iron ore and coke are plummeting 9% in China, and coking coal is down 6.45%, HRC and steel rebar futures are dropping more than 5%.

Crude oil is down 4.23% in Shanghai.

#China #futures #Ironore

Crude oil is down 4.23% in Shanghai.

#China #futures #Ironore

#Ironore futures slumped as much as 5% in Singapore to hit $114 a ton, the lowest in six months.

Iron ore in Dalian drops to 760 yuan per ton, the lowest in a month.

Iron ore in Dalian drops to 760 yuan per ton, the lowest in a month.

We have been writing about #Inflation and how it is impacting common people like us.

In this #Thread 🧵we did a detailed study on "How Government is Attempting to Control Inflation, which is here to stay."

Like ❤️ and Retweet 🔄 for more such Informational Threads.

In this #Thread 🧵we did a detailed study on "How Government is Attempting to Control Inflation, which is here to stay."

Like ❤️ and Retweet 🔄 for more such Informational Threads.

Retail Inflation reached 7.79% in April, which is the highest level in 8 years. Since then, the Government has come under fire.

The Government needed to act quickly to help all the poor and middle-class who have been suffering from poverty since the pandemic.

The Government needed to act quickly to help all the poor and middle-class who have been suffering from poverty since the pandemic.

𝙍𝙚𝙙𝙪𝙘𝙚 𝙀𝙭𝙘𝙞𝙨𝙚 𝘿𝙪𝙩𝙮

Reduced the excise duty on #Petrol by Rs 9.5/Litre and Diesel by Rs 7/Litre, lowering the transportation costs for the commodities.

business-standard.com/article/econom…

Reduced the excise duty on #Petrol by Rs 9.5/Litre and Diesel by Rs 7/Litre, lowering the transportation costs for the commodities.

business-standard.com/article/econom…

#stockstowatch #steel #ironore

Steel, iron ore & iron ore pellet prices are all likely to correct sharply given the imposition of export duties. Export taxes levied are

Steel- 30% from NIL

Iron Ore- 50% from 30%/0%

Iron Ore Pellets- 45% from NIL

Let's calculate the price impact

Steel, iron ore & iron ore pellet prices are all likely to correct sharply given the imposition of export duties. Export taxes levied are

Steel- 30% from NIL

Iron Ore- 50% from 30%/0%

Iron Ore Pellets- 45% from NIL

Let's calculate the price impact

Global iron ore prices are currently around US$129/t. Based on the current duty of 50% export tax up from 30%, the iron ore prices should fall in India by Rs1500/t. See table below for calculations

Iron Ore Pellet prices in India ex Raipur stands at Rs10300/t. Accounting for increase in export tax to 50% from 0% and also factoring in the cost of making pellets post possible drop in iron ore price. Expect iron ore pellet prices to drop by Rs3500/4000/t to Rs6500-7000/t

FM #NirmalaSitharaman announces a slew of measures to curb inflation, citing PM #NarendraModi's commitment to help the poor and common man, including a Rs.8 reduction in central excise duty per litre of #petrol and a Rs.6 cut in the duty on #diesel, reports @tragicosmicomic

She exhorted all States, especially those that had not cut State levies when central #taxes on #fuel products were cut the last time in November 2021, to implement a similar cut and give relief to the common man.

A subsidy of Rs. 200 per gas cylinder for upto 12 cylinders a year, will be granted to over 9 crore beneficiaries of the PM Ujwala Yojana.

1/12 Our government, since when @PMOIndia @narendramodi took office, is

devoted to the welfare of the poor.We’ve taken a number of steps to help the poor and middle class. As a result, the average inflation during our tenure has remained lower than during previous governments.

devoted to the welfare of the poor.We’ve taken a number of steps to help the poor and middle class. As a result, the average inflation during our tenure has remained lower than during previous governments.

2/12 Today, the world is passing through difficult times. Even as the world is recovering from Covid-19 pandemic, the Ukraine conflict has brought in supply chain problems and shortages of various goods. This is resulting in inflation & economic distress in a lot of countries.

3/12 Even during the pandemic, our government set a paradigm of welfare, especially with PM Garib Kalyan Anna Yojana. This is now acknowledged and appreciated the world over. #PMGKAY

US HRC #steel forward curve has been correcting for about a month, but near term prices (highlighted in white) showing more resilience than further out.

Got to keep in mind that with tariffs still in place there's a floor price here...possible it has four digits.

Got to keep in mind that with tariffs still in place there's a floor price here...possible it has four digits.

Not sure if an analogous dynamic could play out in prime #scrap too...busheling forward curve 1st contract flattening but out months continue to decline.

This week’s #IPCCReport reiterated that there’s simply no room for new #fossilfuel infrastructure if we’re to keep warming below 1.5C. New guidance by #China's state planner sheds light on 🇨🇳 pledge to stop building #coal projects overseas🧵

@oykusenlen @leonickroberts @byfordt

@oykusenlen @leonickroberts @byfordt

Latest data suggests countries outside 🇨🇳 are considering over 124GW new #coal power projects,much of which was expected to rely on 🇨🇳 public finance. Since Xi’s announcement at #UNGA 2021, the lack of clarity or follow-up has created some confusion bit.ly/3uYf0TA

New guidance by #China’s state planner #NDRC has now shed some light on what it would look like for China to ‘stop further construction’ of coal power plants overseas. There are 3 parts to this new guidance 👇 bit.ly/3jfPp32

Dalian iron ore futures gain 4.7% in night session, coking coal futures up 2.9%, coke futures up 2.3%.

#coal #CoalTwitter #ironore #iron

#coal #CoalTwitter #ironore #iron

Shanghai INE crude oil futures rise 1.9%, low sulfur fuel oil futures rise 2.1%. #OOTT

The Ukraine war is a nightmare for the people in the country and far beyond. It will also have major ripple effects on global decarbonization. A 🧵 on the implications on global steel decarbonization... 1/

Both 🇺🇦 and 🇷🇺 are major steel producers producing 21Mt and 76Mt respectively. Together this is ~5% of global steel production according to @worldsteel

worldsteel.org/steel-by-topic… 2/

worldsteel.org/steel-by-topic… 2/

But even if those capacities would be completely withdrawn from the market this would only leave a dent in global overcapacity which was at 625Mt in 2020 according to OECD. oecd.org/industry/ind/l… 3/

Warum

#UkraineKonflikt ?

For those who ask:

“Why does Ukraine matter? “

How the nation of #Ukraine ranks:

1st in #Europe in proven recoverable reserves of #uranium ores;

2nd place in Europe and 10th place in the world in terms of #titanium ore reserves;

1/1

#UkraineKonflikt ?

For those who ask:

“Why does Ukraine matter? “

How the nation of #Ukraine ranks:

1st in #Europe in proven recoverable reserves of #uranium ores;

2nd place in Europe and 10th place in the world in terms of #titanium ore reserves;

1/1

2nd place in the world in terms of explored reserves of #manganese ores (2.3 billion tons, or 12% of the world's reserves);

2nd largest iron ore reserves in the world (30 billion tons);

2nd place in Europe in terms of #mercury ore reserves;

1/2

2nd largest iron ore reserves in the world (30 billion tons);

2nd place in Europe in terms of #mercury ore reserves;

1/2

This is #Ukraine 🇺🇦 pictured on top of a map of #Europe. It's the biggest European country, bigger than France. Donbass' territories occupied by Russia are as big as Switzerland.

What is happening now is not a small local conflict, but a hazard for the whole world.

🧵↓

What is happening now is not a small local conflict, but a hazard for the whole world.

🧵↓

Why does #Ukraine 🇺🇦 matter?

✅ 1ˢᵗ in Europe in proven recoverable reserves of uranium ores;

✅ 2ⁿᵈ place in Europe and 10th place in the world in terms of titanium ore reserves;

🧵↓

✅ 1ˢᵗ in Europe in proven recoverable reserves of uranium ores;

✅ 2ⁿᵈ place in Europe and 10th place in the world in terms of titanium ore reserves;

🧵↓