Discover and read the best of Twitter Threads about #ValueInvesting

Most recents (24)

"Discover the secrets of Warren Buffett, the investing legend. His disciplined approach and focus on undervalued companies have made him a billionaire. #Investor #WealthCreation"

Here Some of His Investing Rule that should Followed Investor

Here Some of His Investing Rule that should Followed Investor

"Rule No. 1: Never lose money. Rule No. 2: Never forget rule No.1." - Warren Buffett #InvestingTips

"The stock market is a device for transferring money from the impatient to the patient." - Warren Buffett #StockMarketWisdom

Once in a life A Once in a Lifetime Opportunity in German Residential Real Estate Stocks🏘️💰🇩🇪

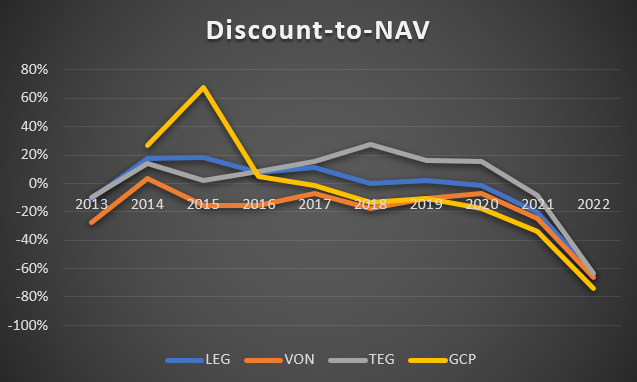

1/ Vonovia, $LEG, $TAG, $GCP currently trade at a 67% discount to NAV, with a potential 200% mid term upside. It's a rare opportunity to buy into this market at a bargain price.

1/ Vonovia, $LEG, $TAG, $GCP currently trade at a 67% discount to NAV, with a potential 200% mid term upside. It's a rare opportunity to buy into this market at a bargain price.

2/ Key stocks to watch: Vonovia, LEG Immobilien, TAG Immobilien, and Grand City Properties. They're trading at deep discounts to NAV, providing an attractive entry point for investors.

3/ Historically, these stocks traded close to their NAV. But today, they're trading at an average 67% discount, offering residential real estate in Germany at a two-thirds discount. #valueinvesting #opportunity

Walter Schloss was an American #investor & fund manager. He studied #valueinvesting under Benjamin Graham and was able to generate a 15.3% annualized return over 45 years in the period of 1955-2000.

Let us understand how he did it and his #investmentframework in today’s thread:

Let us understand how he did it and his #investmentframework in today’s thread:

Journey of Walter Schloss:

Walter Schloss did not go to college and started his career as a runner on Wall Street in 1934 at the age of 18. During this time, he took investment courses taught by Benjamin Graham at the New York Exchange Institute while being employed at Loeb,

Walter Schloss did not go to college and started his career as a runner on Wall Street in 1934 at the age of 18. During this time, he took investment courses taught by Benjamin Graham at the New York Exchange Institute while being employed at Loeb,

Rhoades and Co. He learnt the value investing technique of Benjamin Graham and eventually worked for Mr Graham in the Graham-Newman Partnership, a firm owned by Mr Graham where he met Warren Buffet.

Walter Schloss was an outlier among outliers, and yet most investors probably never heard of him. Even I didn’t hear about him until a few years back, while I was in the process of discovering about #valueinvesting.

Schloss graduated high school in 1934 during the Great Depression and got a job as a “runner” at a small brokerage firm. As a runner, his job was to run and deliver securities and paperwork by hand to various brokers on Wall Street.

The next year, in a stroke of luck, when he asked his senior for a better profile at the brokerage, he was asked to read a book called Security Analysis by Ben Graham.

After Schloss read Security Analysis, he wanted more.

After Schloss read Security Analysis, he wanted more.

Take the time to educate yourself and develop strong financial habits – it will pay off in the long run.

Great personal finance habits are crucial for anyone looking to take control of their money and build wealth.

Great personal finance habits are crucial for anyone looking to take control of their money and build wealth.

From creating a budget, paying off debt, or saving and investing for the future, good personal finance habits will set you up for financial success.

Building wealth isn't just about saving and budgeting – it's also about investing.

Building wealth isn't just about saving and budgeting – it's also about investing.

By putting your money to work through sound investing, you can watch your money grow and multiply over time.

And thanks to the power of compound interest, the earlier you start investing, the more wealth you can build for yourself.

And thanks to the power of compound interest, the earlier you start investing, the more wealth you can build for yourself.

Tras abrir el melón de la rentabilidad del fondo #TrueValue de @alex_estebaranz y analizadas las reflexiones que ha despertado paso a compartir mi opinión al respecto.

🧵

🧵

2/

Parto de dos condiciones que, seguro, condicionan mi opinión:

A/ Siento una notable simpatía hacia Alejandro porque,

1º Es un emprendedor (ya solo eso es de valorar) y además de éxito (pase lo que pase con el fondo, él ya nunca será pobre).

Parto de dos condiciones que, seguro, condicionan mi opinión:

A/ Siento una notable simpatía hacia Alejandro porque,

1º Es un emprendedor (ya solo eso es de valorar) y además de éxito (pase lo que pase con el fondo, él ya nunca será pobre).

3/

2º Considero que es un buen gestor (dentro de las muchas limitaciones que conlleva el #ValueInvesting)

inbestia.com/analisis/value…

2º Considero que es un buen gestor (dentro de las muchas limitaciones que conlleva el #ValueInvesting)

inbestia.com/analisis/value…

67 yaşında halen aktif olarak portföyünü yöneten Thomas Russo, takip ettiğim ve portföyünü izlediğim bir değer yatırımcısı. Büyüyen kaliteli şirketleri al ve tut stratejisinin başarılı bir örneği; 30-40 yıl önce aldığı bir çok pozisyonu hala koruyor.

Stanford'da okurken 1982’de okula gelip şirketlerin marka değerini vurguladığı bir konuşma yapan Buffet’ı dinledikten sonra bazı şirketlere yatırım yapıyor ki bir kısmı hala portföyünde. O zamanlar aldığı Berkshire Hathaway, Nestle ve Heineken hisselerini 40 yıldır hiç satmadı.

Yaklaşık 10 mlr $ yönetiyor ve bu üç şirket portföyünün %36’sını oluşturuyor. Yatırım yapmaya başladığında Berkshire hissesi 900$ seviyesindeydi, şimdi 400 bin $’ın üzerinde. En büyük pozisyonu hala Berkshire Hathaway, portföyünün %18’ini oluşturuyor.

¿Quieres batir al mercado?

Estos son los "perros del Dow" a 15/09/22, es decir, las empresas del Dow Jones con más rentabilidad por #dividendo.

$VZ 6,36%

$DOW 5,97%

$WBA 5,61%

$IBM 5,26%

$MMM 5,12%

$INTC 5,06%

$CVX 3,54%

$CSCO 3,51%

$AMGN 3,41%

$JPM 3,39%

Abro hilo 👇🏼

Estos son los "perros del Dow" a 15/09/22, es decir, las empresas del Dow Jones con más rentabilidad por #dividendo.

$VZ 6,36%

$DOW 5,97%

$WBA 5,61%

$IBM 5,26%

$MMM 5,12%

$INTC 5,06%

$CVX 3,54%

$CSCO 3,51%

$AMGN 3,41%

$JPM 3,39%

Abro hilo 👇🏼

Los perros del Dow son empresas grandes y estables castigadas por el mercado.

Por eso su rentabilidad por dividendo es alta ya que cuando el precio baja la rentabilidad por dividendo sube.

Por eso su rentabilidad por dividendo es alta ya que cuando el precio baja la rentabilidad por dividendo sube.

Esta estrategia de largo plazo y "contrarian" se popularizó en 1991 gracias al libro "Beating the Dow" de Michael o'Higgins.

Históricamente lo ha hecho fantásticamente bien: *un 8,7% anualizado* (incluidos dividendos) desde el año 2000. Mejor que el SP500 y el Dow Jones

Históricamente lo ha hecho fantásticamente bien: *un 8,7% anualizado* (incluidos dividendos) desde el año 2000. Mejor que el SP500 y el Dow Jones

Why $BRK's 2019-20 purchase of #Japan Inc is a potential #stagflation trade for the history books

🧵 follows

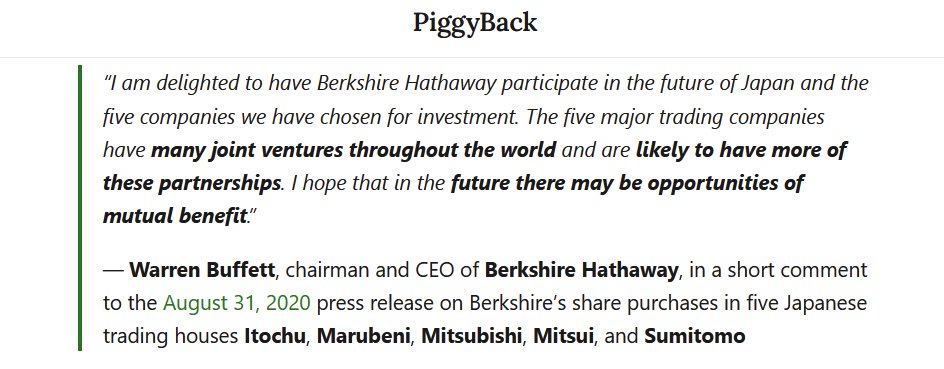

In this week’s PBL (just out!) we PiggyBack:

Warren Buffett’s Berkshire Hathaway into Japanese trading houses

Read/join free @SubstackInc:

piggyback.one/p/buffetts-inf…

1/X

🧵 follows

In this week’s PBL (just out!) we PiggyBack:

Warren Buffett’s Berkshire Hathaway into Japanese trading houses

Read/join free @SubstackInc:

piggyback.one/p/buffetts-inf…

1/X

Let's get to it:

August 31, 2020. $BRK sent out a release that left its many U.S.-focused watchers curious:

Berkshire disclosed having 5+% stakes in all five of #Japan's "big five" general trading houses (Sogo Shosha) after purchasing over 12 months in Tokyo Stock Exchange

2/X

August 31, 2020. $BRK sent out a release that left its many U.S.-focused watchers curious:

Berkshire disclosed having 5+% stakes in all five of #Japan's "big five" general trading houses (Sogo Shosha) after purchasing over 12 months in Tokyo Stock Exchange

2/X

Buffett's / $BRK's "big five"

1 Itochu 🇯🇵TYO:8001|🇺🇸 $ITOCY

2 Marubeni Corp 🇯🇵TYO:8002|🇺🇸 $MARUY

3 Mitsubishi Corp 🇯🇵TYO:8058|🇺🇸 $MTSUY

4 Mitsui & Co 🇯🇵TYO:8031, 🇺🇸 $MITSY

5 Sumitomo Corp 🇯🇵TYO:8053|🇺🇸 $SSUMY

Chart @theTIKR

Disclosure: Long 1+2+3+4+5 piggyback.one/p/legal-discla…

3/X

1 Itochu 🇯🇵TYO:8001|🇺🇸 $ITOCY

2 Marubeni Corp 🇯🇵TYO:8002|🇺🇸 $MARUY

3 Mitsubishi Corp 🇯🇵TYO:8058|🇺🇸 $MTSUY

4 Mitsui & Co 🇯🇵TYO:8031, 🇺🇸 $MITSY

5 Sumitomo Corp 🇯🇵TYO:8053|🇺🇸 $SSUMY

Chart @theTIKR

Disclosure: Long 1+2+3+4+5 piggyback.one/p/legal-discla…

3/X

1 New to investing?

2 Confused by #fintwit jargon?

3 Do we trust people presenting “valuation” to know what they don't know?

(Hint: “my-laser-eyed-golden-skin-ape-pic-is-worth-at-least-twice-your-diamond-skin-ape-pic” = relative pricing. Not valuation)

Follow #PiggyBack🧵

1/X

2 Confused by #fintwit jargon?

3 Do we trust people presenting “valuation” to know what they don't know?

(Hint: “my-laser-eyed-golden-skin-ape-pic-is-worth-at-least-twice-your-diamond-skin-ape-pic” = relative pricing. Not valuation)

Follow #PiggyBack🧵

1/X

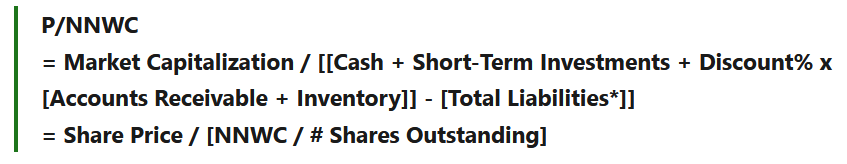

Equity = Assets - Liabilities

But what asset and liability values are we going to use?

The answer as always: it depends on what we are going to use it for.

Here is a summary of equity metrics, from the most conservative:

2/X

But what asset and liability values are we going to use?

The answer as always: it depends on what we are going to use it for.

Here is a summary of equity metrics, from the most conservative:

2/X

What is value investing?

Value investing is a long-term investment strategy used by investors to seek out stocks that are trading for less than their intrinsic or book value.

Value investing is a long-term investment strategy used by investors to seek out stocks that are trading for less than their intrinsic or book value.

Just like online shoppers keep tabs on their favourite items and buy them when they go on sale, value investors track down stocks they think are being undervalued by the stock market.

Investors analyse and use various metrics to find the right valuation of the stock.

Investors analyse and use various metrics to find the right valuation of the stock.

They believe the market overreacts to good and bad news that result in stock price movements disproportionate to the company’s long-term fundamentals.

This offers them an opportunity to buy stocks at a discounted rate.

This offers them an opportunity to buy stocks at a discounted rate.

Beginning of real-estate upcycle? what if an ancillary is set to grow faster and still cheap?

Let's deep dive into Greenply and understand the multiple tailwinds ahead in this thread 🧵🧵

#StocksToBuy #valueinvesting

Let's deep dive into Greenply and understand the multiple tailwinds ahead in this thread 🧵🧵

#StocksToBuy #valueinvesting

Contents:

1) What's Wood panel

2) Industry Business model and players

3) Demand drivers

4) The Trigger - what's changing

5) Financials & Valuation

6) Antithesis

1) What's Wood panel

2) Industry Business model and players

3) Demand drivers

4) The Trigger - what's changing

5) Financials & Valuation

6) Antithesis

(1/8)

Bir işin gerçek değerini ne belirler?

Bunu basitçe ama finansal kavramlar kullanarak anlatmaya çalışacağım.

Bir işin gerçek değeri,

(i) mevcut faaliyetlerin nakit üretme gücü ile

(ii) gelecekte büyümenin yaratacağı ek değerin toplamıdır.

Bir işin gerçek değerini ne belirler?

Bunu basitçe ama finansal kavramlar kullanarak anlatmaya çalışacağım.

Bir işin gerçek değeri,

(i) mevcut faaliyetlerin nakit üretme gücü ile

(ii) gelecekte büyümenin yaratacağı ek değerin toplamıdır.

(2)

Yani şirketin mevcut haliyle değerine gelecekteki büyümenin katkısını ekliyoruz. Her büyümenin şirkete değer katmayabileceğini aşağıda anlatacağım.

Yani şirketin mevcut haliyle değerine gelecekteki büyümenin katkısını ekliyoruz. Her büyümenin şirkete değer katmayabileceğini aşağıda anlatacağım.

(3)

İlk kısım, faaliyetlerden elde edilen nakit akışından tüm işletme maliyetleri ve vergi giderleri düşüldükten sonra kalan nakit (NOPAT) ile ilgilidir. Yani şirketin mevcut faaliyetlerinden elde ettiği yıllık sürdürülebilir net nakit akışı.

İlk kısım, faaliyetlerden elde edilen nakit akışından tüm işletme maliyetleri ve vergi giderleri düşüldükten sonra kalan nakit (NOPAT) ile ilgilidir. Yani şirketin mevcut faaliyetlerinden elde ettiği yıllık sürdürülebilir net nakit akışı.

(1)

Bir şirketin değeri, yaptığı işin değerinden farklı mıdır Peki piyasa fiyatı şirketin gerçek değeri midir?

Şirket diye neyi alıp sattığımızı bilmeliyiz. Önümüzdeki pastanın hepsi bizim olmayabilir :)

Bir şirketin değeri, yaptığı işin değerinden farklı mıdır Peki piyasa fiyatı şirketin gerçek değeri midir?

Şirket diye neyi alıp sattığımızı bilmeliyiz. Önümüzdeki pastanın hepsi bizim olmayabilir :)

(2)

Şirketler gelir elde ettikleri faaliyetleri yürütmek için kaynak (sermaye, dış kaynak) ihtiyacı vardır. Girişimciler şirketi büyütmek için yeni ortak alırlar (stratejik, finansal, melek yatırımcı, risk sermayesi, halka arz vb) ve borçlanırlar (banka kredisi, bono ihracı vb)

Şirketler gelir elde ettikleri faaliyetleri yürütmek için kaynak (sermaye, dış kaynak) ihtiyacı vardır. Girişimciler şirketi büyütmek için yeni ortak alırlar (stratejik, finansal, melek yatırımcı, risk sermayesi, halka arz vb) ve borçlanırlar (banka kredisi, bono ihracı vb)

(3)

Şirket borç aldıklarına faiz öder, borç verenler kazanç pastasından başka ısırık almaz. Tüm giderler sonunda kazanç kalıyorsa devlet de vergi olarak payını alır. İşin riskini üstlenen hissedarlar ise faaliyet kazancının faiz ve vergi gideri sonrası kalanında hak sahibidir.

Şirket borç aldıklarına faiz öder, borç verenler kazanç pastasından başka ısırık almaz. Tüm giderler sonunda kazanç kalıyorsa devlet de vergi olarak payını alır. İşin riskini üstlenen hissedarlar ise faaliyet kazancının faiz ve vergi gideri sonrası kalanında hak sahibidir.

1/13 MEGAHILO tesis de inversión $DOLE y por que creo que su valor intrínseco actual es cercano a 35$.

2/13 Esta empresa es el principal proveedor mundial de productos frescos (frutas y verduras)

Cultivan mas de 300 productos en mas de 30 paises y los distribuyen en mas de 80 a través de canales minoristas, mayoristas y de servicios de alimentos.

Cultivan mas de 300 productos en mas de 30 paises y los distribuyen en mas de 80 a través de canales minoristas, mayoristas y de servicios de alimentos.

3/13 Cadena de suministro integrada verticalmente. Lo que significa se encargan de todo el proceso desde la huerta hasta la distribución. Es una ventaja muy fuerte a la hora de ahorrar costes o incluso como proteccion ante inflaccion. Esto es uno de los MOATs que veremos despues

1/ How does Warren Buffett calculate his growth rates when valuing businesses?

Here's the answer (in a nutshell): Be conservative!

Full answer from WB below👇

How do you come up with a growth rate? 📈

#valueinvesting #StockMarket #GrowthMindset

Here's the answer (in a nutshell): Be conservative!

Full answer from WB below👇

How do you come up with a growth rate? 📈

#valueinvesting #StockMarket #GrowthMindset

2/ WB: "When the [long-term] growth rate is higher than the discount rate, then [mathematically] the value is infinity.

This is the St. Petersburg Paradox, written about by Durand 30 years ago.

Some managements think this [that the value of their company is infinite]."

This is the St. Petersburg Paradox, written about by Durand 30 years ago.

Some managements think this [that the value of their company is infinite]."

3/ "It gets very dangerous to assume high growth rates to infinity – that’s where people get into a lot of trouble."

The idea of projecting extremely high growth rates for a long period of time has cost investors an awful lot of money."

The idea of projecting extremely high growth rates for a long period of time has cost investors an awful lot of money."

1/ In this week's Stock Spotlight, I took a look at Kroger (KR).

I actually came away surprised after my analysis.

In this thread, I will be explaining why $KR is the safest grocery stock you can find on the market.🧵👇

I actually came away surprised after my analysis.

In this thread, I will be explaining why $KR is the safest grocery stock you can find on the market.🧵👇

1/ In 2021, most investors are unwilling to touch energy companies.

I think this is a big mistake.

Why?

Like it or not, we will be using fossil fuels for decades to come.

How can value investors use this to their advantage?

I think I found a company that can deliver. 🧵 🛢️

I think this is a big mistake.

Why?

Like it or not, we will be using fossil fuels for decades to come.

How can value investors use this to their advantage?

I think I found a company that can deliver. 🧵 🛢️

2/ Quick Disclaimer❗

I am an ardent supporter of green energy, and would love to see fossil fuels phased out.

It is no doubt the future.

I truly think it is the future and that in the long run, electrification and renewables will dominate the energy landscape...eventually.

I am an ardent supporter of green energy, and would love to see fossil fuels phased out.

It is no doubt the future.

I truly think it is the future and that in the long run, electrification and renewables will dominate the energy landscape...eventually.

1/25

Some books within minutes , force you to ditch the e-version of kindle & buy the hard copy instead !🙂

The Joys of Compounding is one such 💎

Content ( Curation + Creation ) at its finest !

Compressed JUST A FEW takeaways in this 🧵

#BookTwitter

#BookRecommendation

Some books within minutes , force you to ditch the e-version of kindle & buy the hard copy instead !🙂

The Joys of Compounding is one such 💎

Content ( Curation + Creation ) at its finest !

Compressed JUST A FEW takeaways in this 🧵

#BookTwitter

#BookRecommendation

2/25

Invest in yourself. Read.

Self educate. Think in isolation !

Everything in life can teach you when you possess the right mindset.

Read across a wide spectrum,for the scenes change but the behaviours & outcomes don't.

How to go about #READING & #THINKING effectively.

👇

Invest in yourself. Read.

Self educate. Think in isolation !

Everything in life can teach you when you possess the right mindset.

Read across a wide spectrum,for the scenes change but the behaviours & outcomes don't.

How to go about #READING & #THINKING effectively.

👇

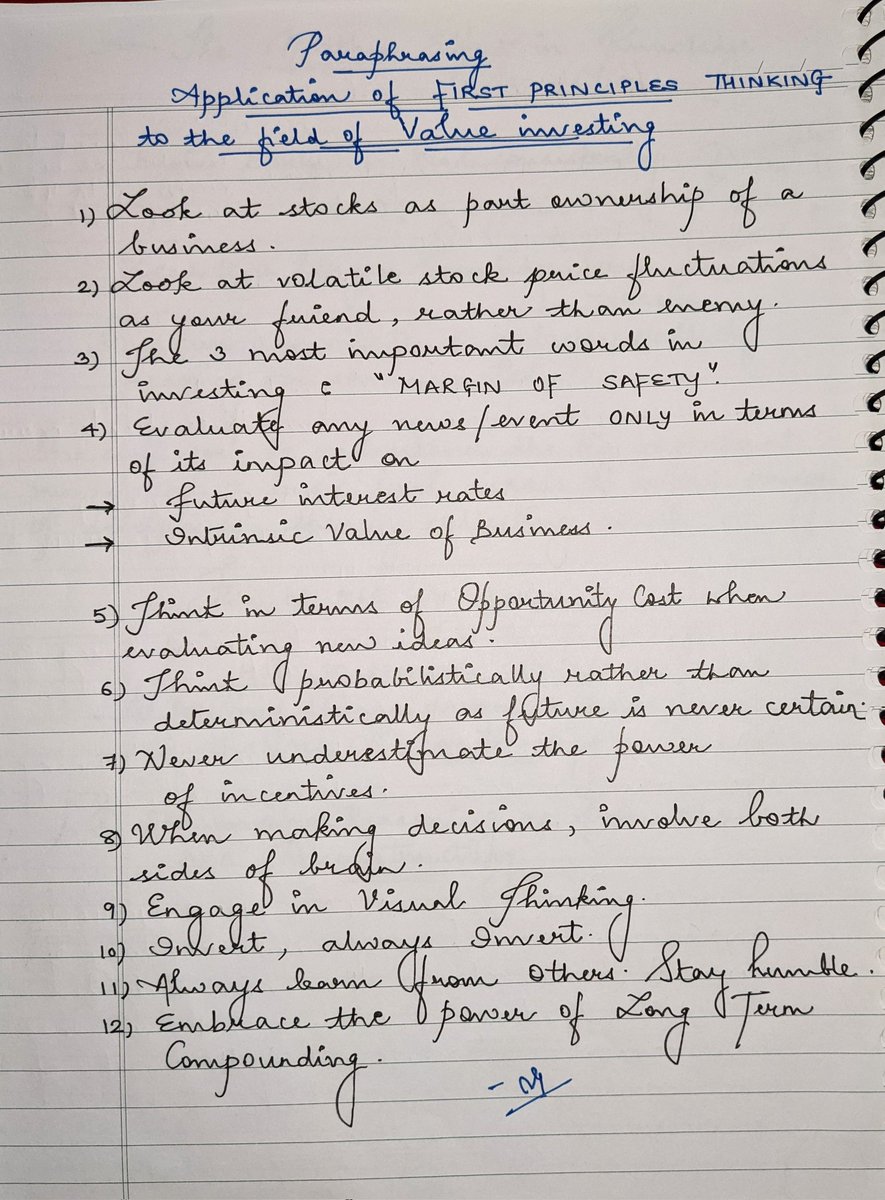

3/25

First Principles Thinking requires us to delve deeper & question everything until one is left with the fundamental truth in essence.

Deconstruct to effectively

Reconstruct ! ( Both in times of Greed & Gloom )

How to apply it to the field of #ValueInvesting

👇

First Principles Thinking requires us to delve deeper & question everything until one is left with the fundamental truth in essence.

Deconstruct to effectively

Reconstruct ! ( Both in times of Greed & Gloom )

How to apply it to the field of #ValueInvesting

👇

1/7 The complete list of Q2 '21 hedge fund letters are out!

Here are my top 5 letters in the list 🧵👇

#hedgefundletters #Q22021 #valueinvesting

Here are my top 5 letters in the list 🧵👇

#hedgefundletters #Q22021 #valueinvesting

2/7 @IntrinsicInv

I love Ensemble's mission and blog content. High quality all around.

This quarter, they focused on their positions in $NTDOY and $ILMN.

Nintendo has a long-term generational mindset, whereas the competition thinks in far shorter time-frames.

#longterm

I love Ensemble's mission and blog content. High quality all around.

This quarter, they focused on their positions in $NTDOY and $ILMN.

Nintendo has a long-term generational mindset, whereas the competition thinks in far shorter time-frames.

#longterm

3/7 Rowan Street Capital

Rowan Street is putting up some great performance over the market.

In this letter, Rowan focuses on their position in $SPOT, and what makes them such desirable businesses.

#patience

Rowan Street is putting up some great performance over the market.

In this letter, Rowan focuses on their position in $SPOT, and what makes them such desirable businesses.

#patience

1/ My top three takeaways from Howard Marks' latest memo "Thinking About Macro".

Thread below🧵👇

#howardmarks #valueinvesting #macro

Thread below🧵👇

#howardmarks #valueinvesting #macro

2/ Most economic forecasters have lousy track records, so why trust them?

Time and attention is best spent elsewhere.

#economy #Economist

Time and attention is best spent elsewhere.

#economy #Economist

3/ Prices are mostly physiological elements reflected in reality.

Perceived increased demand can drive prices up, and vice versa.

Perception is not always reality.

#stockmarket

Perceived increased demand can drive prices up, and vice versa.

Perception is not always reality.

#stockmarket

Some principles of #ValueInvesting

(These are from various sources & some of them practiced by me, credit to all respected and great investors like - Peter lynch, Buffett, @VijayKedia1 , RJ and many more) ...

1. There are no shortcuts - Invest in yourself before you invest

1/n

(These are from various sources & some of them practiced by me, credit to all respected and great investors like - Peter lynch, Buffett, @VijayKedia1 , RJ and many more) ...

1. There are no shortcuts - Invest in yourself before you invest

1/n

into any investment.

2. Ignite the fire inside you, find a mentor -Who can just lit a light and you act like camphor.

3. Never time the market

4. Buy the value and not the price

5. Stay with your conviction

6. NEVER LOSE YOUR MONEY - Capital protection is most important.

2/n

2. Ignite the fire inside you, find a mentor -Who can just lit a light and you act like camphor.

3. Never time the market

4. Buy the value and not the price

5. Stay with your conviction

6. NEVER LOSE YOUR MONEY - Capital protection is most important.

2/n

7. Always take small consistent profits, then waiting for random large gains.

8. When other are celebrating, be cautious.

9. When others are fearful, open your shopping list and buy value stocks.

10. Market is all about repeating history, check for those events and connect

3/n

8. When other are celebrating, be cautious.

9. When others are fearful, open your shopping list and buy value stocks.

10. Market is all about repeating history, check for those events and connect

3/n

Thread ...

A different way of looking at the art of investing.

To make your investment free of cost, how to do that?

1. Picking 1 stocks that can give 100 % returns is difficult

2. Picking 2 stocks that can give 50 % returns, bit difficult but easier than 1.

contd...

A different way of looking at the art of investing.

To make your investment free of cost, how to do that?

1. Picking 1 stocks that can give 100 % returns is difficult

2. Picking 2 stocks that can give 50 % returns, bit difficult but easier than 1.

contd...

3. Picking 10 Stocks that can give 10 % returns each, is what most of us can do ..

By doing so, diversification, risk mgt are also added to the portfolio. Learn the way VCs, look for potential investments in companies. They work on the 80:20 rule, out of this 20% portfolio,

1/n

By doing so, diversification, risk mgt are also added to the portfolio. Learn the way VCs, look for potential investments in companies. They work on the 80:20 rule, out of this 20% portfolio,

1/n

Investment grows multi-folds and covers the losses of even that 80 % bad investments also. If odds are with you, you might also end up finding 2 gems in your portfolio, which can create long-term wealth for you.

The probability of finding 10 such stocks is always high and can be

The probability of finding 10 such stocks is always high and can be

📻 TODOS* los podcasts y canales en español sobre inversiones

*NO trading ⛔️

*Avisar si falta alguno 🙏

🗳️ Votación para rankearlos al final del hilo

Disclaimer: esto sí es una recomendación de escucha

#ValueInvesting #podcasts #EducacionFinanciera

En orden de antigüedad ⬇️

*NO trading ⛔️

*Avisar si falta alguno 🙏

🗳️ Votación para rankearlos al final del hilo

Disclaimer: esto sí es una recomendación de escucha

#ValueInvesting #podcasts #EducacionFinanciera

En orden de antigüedad ⬇️

1/

📻Finect @finect @VicenteVaro

bit.ly/3bFNL7y

📻El Arte de Invertir @alex_estebaranz @Artedeinvertir

bit.ly/3hEbCIm

📻Iceberg de Valor @icebergdevalor

bit.ly/3u5EKuC

📻Value School @Value_school @educalibertad

bit.ly/3f3s0jZ

📻Finect @finect @VicenteVaro

bit.ly/3bFNL7y

📻El Arte de Invertir @alex_estebaranz @Artedeinvertir

bit.ly/3hEbCIm

📻Iceberg de Valor @icebergdevalor

bit.ly/3u5EKuC

📻Value School @Value_school @educalibertad

bit.ly/3f3s0jZ

2/

📻Value Investing FM @ValueInvestingS @The_Godas

bit.ly/3oyJYOy

📻Mas Dividendos @MasDividendos @maal2al

bit.ly/3v6qQKj

📻El bazar de la bolsa @JMPesudo

bit.ly/3yqre8s

📻Píldoras del conocimiento @Lualobus

bit.ly/2T0hxgB

📻Value Investing FM @ValueInvestingS @The_Godas

bit.ly/3oyJYOy

📻Mas Dividendos @MasDividendos @maal2al

bit.ly/3v6qQKj

📻El bazar de la bolsa @JMPesudo

bit.ly/3yqre8s

📻Píldoras del conocimiento @Lualobus

bit.ly/2T0hxgB