Discover and read the best of Twitter Threads about #Wages

Most recents (24)

Today’s #JobsReport was very solid, but like is often the case in the movies, it’s very hard for the sequel (today’s report) to match such an unexpected hit (January’s revised 504,000 jobs gained).

Still, a nonfarm #payroll gain of 311,000 jobs is quite good and having 815,000 jobs created so far this year after the #economy has already created 12 million #jobs over the past two years is pretty amazing in its own right.

Further, the 3-month moving average of 351,000 jobs, after a 12-month moving average of 362,000 jobs gained per month is also pretty remarkable, particularly after the market-implied pricing of the terminal #FedFunds rate has move up 500 basis points (bps) in a year.

Today’s #JobsReport was a clear indication that #LaborMarket dynamics are softening. For example, the 3-mo. moving average of nonfarm #payroll growth sits at 247k jobs, after a higher-than-expected print of 223k jobs for Dec, in contrast to 2022’s average mo. #job gain of 375k.

🐻♉️↗️↘️↔️⚠️🚩🔺🔻🧮 💰

#CPI Preview

1/10

One 🤡 calls it #macrotourism, but #CPI and #FOMC policy response are the single most important issues to macro investors today.

Let’s dig into the 🧮!

#CPI Preview

1/10

One 🤡 calls it #macrotourism, but #CPI and #FOMC policy response are the single most important issues to macro investors today.

Let’s dig into the 🧮!

2/10

At his Brookings Institute speech at the end of November, Powell broke core #inflation into 3 components:

a) goods inflation

b) housing services inflation

c) services, ex-housing = wages

At his Brookings Institute speech at the end of November, Powell broke core #inflation into 3 components:

a) goods inflation

b) housing services inflation

c) services, ex-housing = wages

1/4

Germany Bans Farmers Fertiling Their Land. UK Wants a Food Price “Reset” UN Warns of Social Unrest‼️☝️🤔🙏👇👇

#UK #Energy #Food #EU #USA #Inflation #Ration #Biometric #Blackout #Wages #Bitcoin #Elsalvador #Germany

Germany Bans Farmers Fertiling Their Land. UK Wants a Food Price “Reset” UN Warns of Social Unrest‼️☝️🤔🙏👇👇

#UK #Energy #Food #EU #USA #Inflation #Ration #Biometric #Blackout #Wages #Bitcoin #Elsalvador #Germany

2/4

Get ready for extremely high food prices in tandem with more and more taxation. More AI articles and it is coming for our jobs‼️

Important articles ‼️🤔🙏👇👇

archive.ph/2P2Om

archive.ph/QoxyG

independent.co.uk/news/uk/home-n…

archive.ph/xajja

Get ready for extremely high food prices in tandem with more and more taxation. More AI articles and it is coming for our jobs‼️

Important articles ‼️🤔🙏👇👇

archive.ph/2P2Om

archive.ph/QoxyG

independent.co.uk/news/uk/home-n…

archive.ph/xajja

3/4

Links and articles‼️🙏👇

uk.finance.yahoo.com/news/why-one-3…

archive.ph/C6HQa

archive.ph/ndKYx

zerohedge.com/markets/von-gr…

msn.com/en-ph/news/oth…

standard.co.uk/business/4-day…

aljazeera.com/economy/2022/1…

uk.finance.yahoo.com/news/councils-…

euroweeklynews.com/2022/12/02/his…

theguardian.com/technology/202…

Links and articles‼️🙏👇

uk.finance.yahoo.com/news/why-one-3…

archive.ph/C6HQa

archive.ph/ndKYx

zerohedge.com/markets/von-gr…

msn.com/en-ph/news/oth…

standard.co.uk/business/4-day…

aljazeera.com/economy/2022/1…

uk.finance.yahoo.com/news/councils-…

euroweeklynews.com/2022/12/02/his…

theguardian.com/technology/202…

#Protest against #Covid19 #lockdown after fire kills 10 in Xinjiang | Nov 26

- Late Friday, videos circulated widely on the Chinese internet showing throngs of residents in #Urumqi marching to a government building and chanting “end lockdowns,”

bangkokpost.com/world/2446825/…

- Late Friday, videos circulated widely on the Chinese internet showing throngs of residents in #Urumqi marching to a government building and chanting “end lockdowns,”

bangkokpost.com/world/2446825/…

#Rothschildism.

#China is #Rothschild's Model for #NWO | Dec 9, 2019

- The #genocide experienced by the #russians in Ukraine, funded by the #oligarchs and carried out by the #Azov-#Nazi - battalions is a copy the #China’s genocide against the #Uyghurs

#China is #Rothschild's Model for #NWO | Dec 9, 2019

- The #genocide experienced by the #russians in Ukraine, funded by the #oligarchs and carried out by the #Azov-#Nazi - battalions is a copy the #China’s genocide against the #Uyghurs

#Rothschildism #MSM: 154 articles in less than two days.

Title: "#China's Communist Party to celebrate 100th #birthday in show of pomp and power."

Title: "#China's Communist Party to celebrate 100th #birthday in show of pomp and power."

Earlier this week the @federalreserve raised #policy rates at an extraordinary 75 basis point increment (its fourth time doing so this year), in an attempt to moderate excessively high levels of #inflation.

Still, if the central bankers were hoping to see signs of slowing in the persistently solid #LaborMarkets, as an indicator that policies were slowing growth and in turn #inflation, they may be somewhat disheartened by today’s data.

Indeed, nonfarm #payrolls increased by 261k jobs in Oct, with private employment rising an average of 262k/month over the past three months, which does not yet imply that the slowing that policymakers believe we’ll need to see to tame #inflation has arrived.

🧵 Is the American Dream dead? - a tweetstorm

This is a brain dump of .@RaoulGMI's 30+ years of knowledge, how the world works, and how his macro framework fits into it all ⤵️

This is a brain dump of .@RaoulGMI's 30+ years of knowledge, how the world works, and how his macro framework fits into it all ⤵️

1/ There's no denying that we're in a mess!

By the Law of Unintended Consequences, every time we try to fix A, we create problems B, C, D, E, etc.

We hardly understand these new problems unless there's hindsight to connect the dots...

By the Law of Unintended Consequences, every time we try to fix A, we create problems B, C, D, E, etc.

We hardly understand these new problems unless there's hindsight to connect the dots...

What really causes inflation? 🧵

[a thread for normies - like me]

[a thread for normies - like me]

2/ The problem with #inflation is that it's a very personal experience.

As I always say, the wallet is the most sensitive organ in the body, so my inflation might not be your inflation.

In fact, my inflation could be seen as #disinflation by you... (more on that later)

As I always say, the wallet is the most sensitive organ in the body, so my inflation might not be your inflation.

In fact, my inflation could be seen as #disinflation by you... (more on that later)

3/ Price inflation and monetary inflation have different definitions:

* For many.- #inflation is the increased prices paid for goods & services.

** To others.- it's a decline in the purchasing power of your #money.

*** In layman's terms.- Too much money chasing too few goods.

* For many.- #inflation is the increased prices paid for goods & services.

** To others.- it's a decline in the purchasing power of your #money.

*** In layman's terms.- Too much money chasing too few goods.

Thread | Quick recap of latest #telecom news and #insights, including BT's new Budapest office, Magyar Telekom's pay deal, exit at Pelipod & much more:

#Office #Telecom #Hybridworking #Europe #Operations #WFH

BT Hungary opens doors to new offices

eu1.hubs.ly/H01HX5G0

#Office #Telecom #Hybridworking #Europe #Operations #WFH

BT Hungary opens doors to new offices

eu1.hubs.ly/H01HX5G0

T-Systems probed over South African ‘state capture’ links

#Legal #Germany #Probe #Complaint #JacobZuma #Corruption #Africa #SouthAfrica #Political #Frankfurt

telcotitans.com/deutsche-telek…

#Legal #Germany #Probe #Complaint #JacobZuma #Corruption #Africa #SouthAfrica #Political #Frankfurt

telcotitans.com/deutsche-telek…

BT’s Pelipod loses managing director

#Management #Subsidiary #Consulting #Logistics #Ventures #Startups #Innovation #BT

telcotitans.com/btwatch/bts-pe…

#Management #Subsidiary #Consulting #Logistics #Ventures #Startups #Innovation #BT

telcotitans.com/btwatch/bts-pe…

Today’s #JobsReport revealed an #economy that is producing #jobs at a slower pace than it has over the prior several months.

That said, a historic number of jobs have been created in this recovery since the fall of 2020, so a slowing in the pace of #growth isn’t unexpected.

#Work/#FunEmployment: "Record numbers of people aged 50 and over in the #UK have become economically inactive since the start of the pandemic, the Office for National Statistics said this spring"

theguardian.com/money/2022/aug…

theguardian.com/money/2022/aug…

"For a number of respondents, caring for family members was a factor, and while most do not envisage having to return to the job market, various people said they may have to do so because of spiralling #costs in Britain."

"'#This profession was who I was, for nearly 30 years. I was surprised at how little the decision impacted me, apart from a feeling of guilt at leaving my colleagues and students mid-year,' he says. 'Now, I look forward to having more control over my life. I won’t be going back'”

In his @federalreserve #JacksonHole speech #ChairPowell stated emphatically that the #FOMC’s “overarching focus right now is to bring inflation back down to our 2 percent goal. Price stability is the responsibility of the Federal Reserve and serves as the bedrock of our economy.”

In other words, we take his statement today to mean that the #Fed won’t be easily swayed into reversing rate #hikes next year, and will stay with the elevated Funds rate for a long time.

The #Fed has clearly been (appropriately) rushing to get to a destination of #inflation-denting restrictive rate (and #liquidity) policy in order to break extremely high levels of inflation, while hopefully not thrusting the economy into a deep #recession.

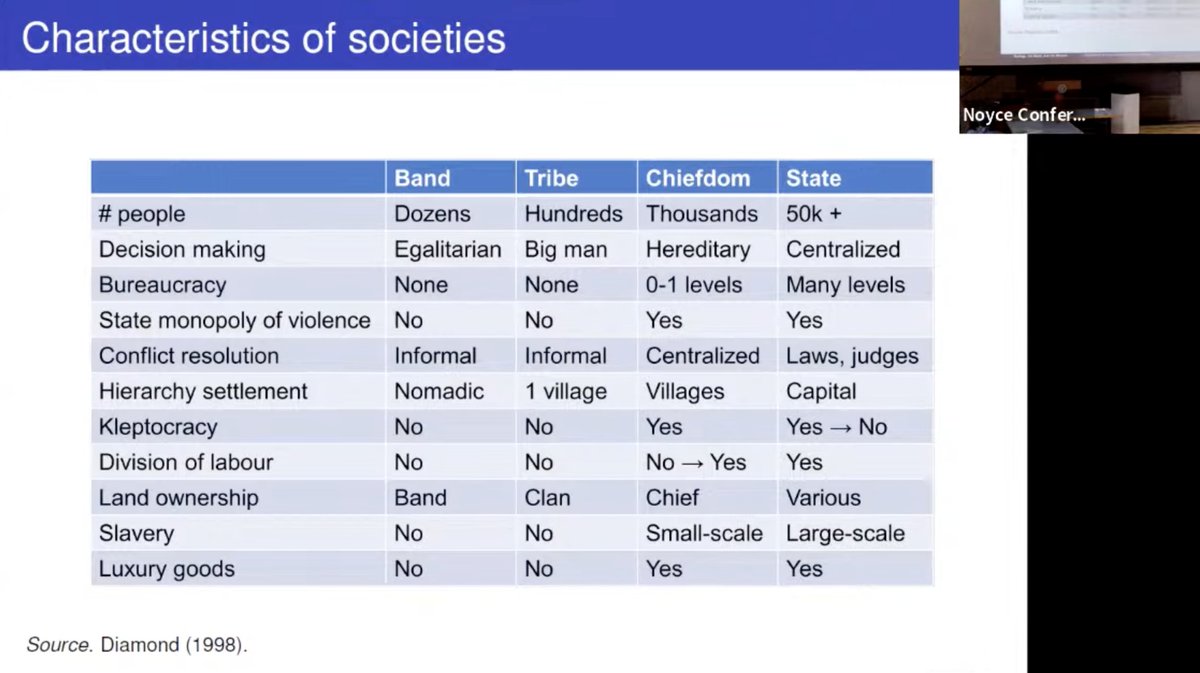

"The emergence of #government as organized #violence-cum-#robbery"

SFI Seminar by @CoenTeulings (@UniUtrecht)

Video link:

Follow this 🧵 for highlights + slides!

SFI Seminar by @CoenTeulings (@UniUtrecht)

Video link:

Follow this 🧵 for highlights + slides!

"What's the motivation of this paper? We've seen in most of these locations that there was an #emergence of some form of hierarchical #government [correlated with] a monopoly of #violence and increased #inequality [and] most people lost."

- @CoenTeulings (@UniUtrecht)

- @CoenTeulings (@UniUtrecht)

Citing work led by SFI's Tim Kohler in 2017 showing the increase in #inequality (as measured by #GINIcoefficient) as society evolves greater political #scale and more complex/abstract means of production:

📢THE COLLAPSE OF THE WORLD ECONOMY AND THE SOLUTION IN THE FORM OF CRYPTO! 📢

In this little story I summarize how Covid, Supply Chain, Debt, Wages, Inflation, a Eecession, Insolvency and an aging population come together to form a common solution: Crypto Assets

1) ...

In this little story I summarize how Covid, Supply Chain, Debt, Wages, Inflation, a Eecession, Insolvency and an aging population come together to form a common solution: Crypto Assets

1) ...

So much is happening in the world. War, High #inflation, Covid, #recession, insolvancy, a debt bubble and Supply Chain problems.

All of these causes have a large impact on the world economy and therefore on your portfolio, which makes it important to understand what is going on.

All of these causes have a large impact on the world economy and therefore on your portfolio, which makes it important to understand what is going on.

"You have the feeling, when you ride, that this animal understands you and you understand this animal. You also have this feeling of mastering this big animal — it makes you feel powerful.” -- Ludovic Orlando @LudovicLorlando greeneracresvaluenetwork.wordpress.com/2022/05/26/dai…

Genetic roots of three mitochondrial diseases identified via new approach

phys.org/news/2022-05-g…

#MitochondrialProteins, #CRISPRCas9, #GeneEditing, #MitochondrialFunction

phys.org/news/2022-05-g…

#MitochondrialProteins, #CRISPRCas9, #GeneEditing, #MitochondrialFunction

In Partial, Grudging Defense Of The Hearing Voices Movement

astralcodexten.substack.com/p/in-partial-g…

#MentalHealth, #NonPharmaceuticalTreatment, #HearingVoicesNetwork, #PeerSupport

astralcodexten.substack.com/p/in-partial-g…

#MentalHealth, #NonPharmaceuticalTreatment, #HearingVoicesNetwork, #PeerSupport

As was widely expected, the @federalreserve’s Federal Open Market Committee raised the target range for the Federal Funds #policy rate by 50 basis points (bps), to between 0.75% and 1.0%, and announced the start of #runoff of the central bank’s balance sheet.

As previously suggested by the #Fed’s March minutes, the pace of runoff was confirmed today as $95 billion/month ($60 billion in U.S. #Treasuries and $35 billion in Agency #MBS, with a three-month phase-in period.

Also as expected, the statement reiterated that the #FOMC “anticipates that ongoing increases in the target range will be appropriate,” underscoring the seriousness of #Fed policymakers in getting #inflation and inflation expectations under control.

Higher #import duties to tackle the #BOP problem is the wrong advice. It won't deliver on the intended objective. Why? 🧵👇 brecorder.com/news/40168085/…

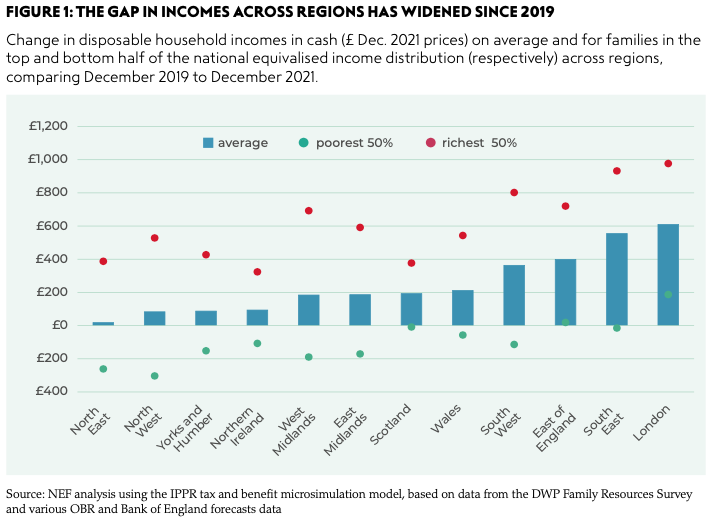

Want the *honest* state of play on #LevellingUp today?

@NEF’s new report shows a staggering 60% of the country needs to be #LevelledUp, and sets out a 5-point policy shift to really do the job, backed by 6 metro mayors.

Report: neweconomics.org/2022/02/closin…

Key findings 🧵👇🏾

1/15

@NEF’s new report shows a staggering 60% of the country needs to be #LevelledUp, and sets out a 5-point policy shift to really do the job, backed by 6 metro mayors.

Report: neweconomics.org/2022/02/closin…

Key findings 🧵👇🏾

1/15

Widening #inequality between regions is damaging millions of lives and holding the UK back.

Since Dec 2019, real incomes have risen by less than £20 per year in the NE, £80 per year in NW and £90 in Yorkshire and the Humber.

2/15

Since Dec 2019, real incomes have risen by less than £20 per year in the NE, £80 per year in NW and £90 in Yorkshire and the Humber.

2/15

By contrast, real incomes in London have increased by more than £600 per year and by more than £550 in the SE.

And despite growing inequality, only £36 per person of the Government’s #LevellingUpFund has gone to these areas.

3/15

And despite growing inequality, only £36 per person of the Government’s #LevellingUpFund has gone to these areas.

3/15

DoubleLine founder and CEO Jeffrey Gundlach presents:

Just Markets 2022 - I Feel Young Again

Today at 1:15pm PT, register here: event.webcasts.com/starthere.jsp?…

#macro #markets #stocks #FX #bonds #commodities #rates #inflation #Fed #QE #bitcoin

Live recap thread⬇️

Just Markets 2022 - I Feel Young Again

Today at 1:15pm PT, register here: event.webcasts.com/starthere.jsp?…

#macro #markets #stocks #FX #bonds #commodities #rates #inflation #Fed #QE #bitcoin

Live recap thread⬇️

Jeffrey Gundlach: 2021 might end up running 7% year on the CPI

#inflation #QE #Powell #fed #hikes #rates

#inflation #QE #Powell #fed #hikes #rates

Jeffrey Gundlach: Low interest rates coupled with inflation generating negative interest rate.

#JustMarkets2022 #CPI #QE #Fed

#JustMarkets2022 #CPI #QE #Fed

Daily Bookmarks to GAVNet 11/26/2021 greeneracresvaluenetwork.wordpress.com/2021/11/26/dai…

Mumbai: India baby girl found in drain recovering

bbc.com/news/world-asi…

#india #BabyGirl #abandonment #recovery

bbc.com/news/world-asi…

#india #BabyGirl #abandonment #recovery

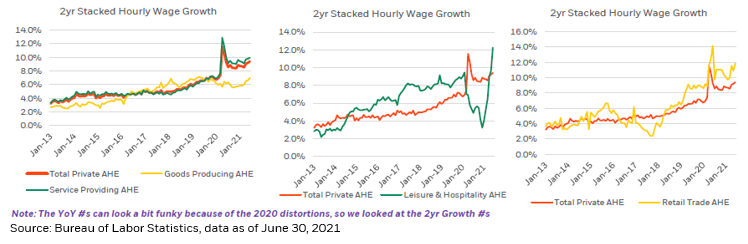

Yesterday's Fed Beige Book commentary on #wages was pretty eye-opening. I'm hearing this daily across housing sector, but definitely spiking across the board.

#Dallas Fed wage commentary

#Atlanta Fed wage commentary

Anyone perusing the top articles of major media outlets last weekend would have read several pieces on the extraordinary #shortages being witnessed in the U.S. #economy today, and particularly those in the #labor market.

The tone of many articles was pessimistic, suggesting that the #supply-side #shortages and dislocations may be systemic, or long-term, but we think there’s evidence that the U.S. #economy will display considerably greater dynamism and resilience than the pessimists believe.

In August we saw #inflation growth moderate further, for the second consecutive month, at least relative to the impressive rate of growth in #prices witnessed around mid-year.

Core #CPI (excluding volatile food and energy components) came in at 0.10% month-over-month and 3.98% year-over-year, which was considerably less than the consensus forecast and was driven higher by #shelter components.

Meanwhile, headline #CPI data printed at a solid 0.27% month-over-month and came in at 5.20% year-over-year.

Inflation data for July moderated somewhat, at least relative to the heady pace of recent months, which should temper #market and policymaker concerns a bit, despite the fact that #inflation will stay sticky-higher for a while and the #risk remains to the high-side.

Core #CPI (excluding volatile food and #energy components) came in at 0.3% month-over-month and 4.3% year-over-year, a bit less than the consensus forecast, and headline CPI data printed at a solid 0.5% month-over-month and came in at 5.4% year-over-year.

While we think that it’s hard to see a case for the recent levels of elevated #inflation turning into “1970s style” runaway price increases, higher #wages and elevated growth for an extended period will allow companies to achieve higher levels of #PricingPower for a time.