Discover and read the best of Twitter Threads about #WarrenBuffett

Most recents (24)

As the Marxist agitator #AdamSmith once said, "People of the same trade seldom meet together, even for merriment and diversion, but the conversation ends in a conspiracy against the public, or in some contrivance to raise prices."

1/

1/

If you'd like an essay-formatted version of this thread to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

pluralistic.net/2023/06/09/com…

2/

pluralistic.net/2023/06/09/com…

2/

Smith understood that capitalists hate capitalism. They don't want to compete with one another, because that would interfere with their ability to raise the prices their customers pay and reduce the wages they pay their workers.

3/

3/

They said it was impossible. After decades of #antitrust cases over #PredatoryPricing - selling below cost to kill or prevent competitors - the #ChicagoSchool of neoliberal #economists "proved" predatory pricing didn't exist, so courts could stop busting companies for it.

1/

1/

If you'd like an essay-formatted version of this thread to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

pluralistic.net/2023/05/19/fak…

2/

pluralistic.net/2023/05/19/fak…

2/

Predatory pricing - the economists explained - was illegal, but it was also imaginary. A mirage. No one would predatory price, because it was "irrational." Even if someone irrational enough to try it, they would fail. Stand down, American judges - predatory pricing is solved.

3/

3/

Did you see that #ChatGPT, #WarrenBuffett & #ElonMusk Collide To Make A New Artificial Intelligence Tool For Financial Documents?

benzinga.com/news/23/03/315…

benzinga.com/news/23/03/315…

1) ChatGPT, Warren Buffett and Elon Musk have teamed up to create a new artificial intelligence tool for analyzing financial documents. The tool combines machine learning algorithms with natural language processing to scan and analyze #financial documents such as annual #reports.

2) Balance sheets, and income statements.

The AI tool is designed to quickly identify key financial #data and provide insights and #recommendations to investors, allowing for faster and more informed decisions. The tool will also be able to #identify #trends and anomalies"

The AI tool is designed to quickly identify key financial #data and provide insights and #recommendations to investors, allowing for faster and more informed decisions. The tool will also be able to #identify #trends and anomalies"

We all start our investing journey with #WarrenBuffett - The greatest investor of all time

In this detailed thread I have covered some of the most interesting case studies and how he kept on improving his investment framework over the time !

Like and retweet for maximum reach!

In this detailed thread I have covered some of the most interesting case studies and how he kept on improving his investment framework over the time !

Like and retweet for maximum reach!

Journey of Warren Buffet

Warren Buffet started his investing journey at the age of 13 by selling groceries from his grandfather’s shop. He sold chewing gum and newspapers door to door and simultaneously collected caps of Coca-Cola bottles. This was his first exposure to

Warren Buffet started his investing journey at the age of 13 by selling groceries from his grandfather’s shop. He sold chewing gum and newspapers door to door and simultaneously collected caps of Coca-Cola bottles. This was his first exposure to

Coca-Cola and from here he gradually built his understanding of Coca-Cola and created massive wealth by investing in this stock. He used a similar strategy to create massive wealth in his other investments as well.

🧵THREAD - La lettre de Warren #Buffett

Une lettre de 9 pages vient d'être envoyée aux investisseurs de #BerkshireHathaway

Il y partage ses opinions, et ses résultats et surtout son portefeuille.

Le résumé👇

Une lettre de 9 pages vient d'être envoyée aux investisseurs de #BerkshireHathaway

Il y partage ses opinions, et ses résultats et surtout son portefeuille.

Le résumé👇

Les résultats financiers de #Berkshire au Q4 :

Le bénéfice ont chuté de 54 % pour atteindre 18,16 milliards de $ soit 12412$ par action.

Mais Buffett conseille aux #investisseurs d'examiner plutôt les bénéfices d'exploitation qui éliminent les fluctuations trimestrielles.

Le bénéfice ont chuté de 54 % pour atteindre 18,16 milliards de $ soit 12412$ par action.

Mais Buffett conseille aux #investisseurs d'examiner plutôt les bénéfices d'exploitation qui éliminent les fluctuations trimestrielles.

About Wat They do at Berkshire

~Charlie & I allocate your savings at Berkshire between two related forms of ownership.

First, we invest in businesses that we control, by buying 100% of each. Berkshire directs

capital allocation at these subsidiaries & selects the CEOs.

(1/n)

~Charlie & I allocate your savings at Berkshire between two related forms of ownership.

First, we invest in businesses that we control, by buying 100% of each. Berkshire directs

capital allocation at these subsidiaries & selects the CEOs.

(1/n)

~In our second category of ownership, we buy publicly-traded stocks through which we

passively own pieces of businesses. Holding these investments, we have no say in management.

"Charlie and I are not stock-pickers; we are business-pickers".

(2/n)

passively own pieces of businesses. Holding these investments, we have no say in management.

"Charlie and I are not stock-pickers; we are business-pickers".

(2/n)

When a #FreightTrain carrying toxic chemicals derailed near #EastPalestine, #Ohio, bursting into flame and sending up clouds of poisonous vinyl chloride smoke and gas, our immediate concerns were for the people in harm's way and the train's crew:

nytimes.com/2023/02/04/us/… 1/

nytimes.com/2023/02/04/us/… 1/

If you'd like an essay-formatted version of this thread to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

pluralistic.net/2023/02/11/din… 2/

pluralistic.net/2023/02/11/din… 2/

Those immediate concerns were soon joined by broader worries: that the entire rail industry presented a systematic danger, and the Ohio #derailment was a symptom of a much deeper pathology that endangered anyone who lives near one of the rail corridors that crisscross the US. 3/

Warren Buffett & Charlie Munger together run Berkshire Hathaway, the multinational conglomerate worth over $500 Billion. These are the top 10 lessons that have helped them become legendary investors.

#lessons #warrenbuffett #charliemunger

#lessons #warrenbuffett #charliemunger

#India's #startup ecosystem raised $455 million across 24 deals last week (Jan.16-21,'23) with #fintech #unicorn PhonePe turning decacorn at $12 billion valuation.

#StartupIndia #DigitalIndia #VentureCapital #funding #Entrepreneurship #innovation #Motivation #prosunjoyi #Thread

#StartupIndia #DigitalIndia #VentureCapital #funding #Entrepreneurship #innovation #Motivation #prosunjoyi #Thread

1/ La mayoría de las empresas confunden eficiencia operativa con estrategia empresarial. Este🧵será otro intento por vincular las finanzas corporativas con la estrategia a través del benchmarking, el efecto reina roja en los negocios, CAPEX y Production Possibility Frontier ↓:

2/ El mítico gurú Peter Drucker sintetizó con la lucidez que lo caracterizaba la esencia de la estrategia:

"No hay nada tan inútil como hacer con gran eficiencia algo que no debería hacerse en absoluto."

"No hay nada tan inútil como hacer con gran eficiencia algo que no debería hacerse en absoluto."

Take the time to educate yourself and develop strong financial habits – it will pay off in the long run.

Great personal finance habits are crucial for anyone looking to take control of their money and build wealth.

Great personal finance habits are crucial for anyone looking to take control of their money and build wealth.

From creating a budget, paying off debt, or saving and investing for the future, good personal finance habits will set you up for financial success.

Building wealth isn't just about saving and budgeting – it's also about investing.

Building wealth isn't just about saving and budgeting – it's also about investing.

By putting your money to work through sound investing, you can watch your money grow and multiply over time.

And thanks to the power of compound interest, the earlier you start investing, the more wealth you can build for yourself.

And thanks to the power of compound interest, the earlier you start investing, the more wealth you can build for yourself.

Buying the Dip will no longer work?

A big recession is coming?

According to @BlackRock's latest report, 2023 will require a whole new approach to investing in #stocks and #crypto

#BlackRock released their 2023 investment playbook, and I read it all so you don’t have to👇

1/n🧵

A big recession is coming?

According to @BlackRock's latest report, 2023 will require a whole new approach to investing in #stocks and #crypto

#BlackRock released their 2023 investment playbook, and I read it all so you don’t have to👇

1/n🧵

@BlackRock 2/n

In this thread we are going to cover the following interesting claims by #BlackRock:

- A new #investment playbook is needed for this new volatile market state

- “Old Playbook” strats like “buying the dip” may no longer work

In this thread we are going to cover the following interesting claims by #BlackRock:

- A new #investment playbook is needed for this new volatile market state

- “Old Playbook” strats like “buying the dip” may no longer work

3/n

- Central Banks are deliberately slowing down the markets

- Recession is all but certain

- And many more interesting #stock strategies than we can apply on #crypto

For reference, the full outlook is here: blackrock.com/corporate/lite…

- Central Banks are deliberately slowing down the markets

- Recession is all but certain

- And many more interesting #stock strategies than we can apply on #crypto

For reference, the full outlook is here: blackrock.com/corporate/lite…

Yet another "next Warren Buffett" bit the dust last week. This is a thread about how Warren Buffett is truly unique and media's obsession over trying to find his next incarnation.

#investing #WarrenBuffett #nonextwarren

#investing #WarrenBuffett #nonextwarren

There is a long list of people media has called the next Warren Buffett. In the past Eddie Lampert, J. Michael Pearson, Bill Ackman and Seth Klarman have been labelled thus.

However, the recent ones (>2021) have been most egregious.

However, the recent ones (>2021) have been most egregious.

1/ Cathie Wood earned that title - ca.finance.yahoo.com/news/cathie-wo… - as a cursory glance at ARK funds would tell you, she was a single-themed investor who got a massive one-time tailwind in post-covid QE. Neither her investments not her ETF can find a place to hide at the moment.

1/ Ergodicidad y no ergodicidad

Una actividad es ergódica si el resultado de que un solo actor/agente la realice n veces coincide con el resultado de que n actores la realicen una sola vez.

🧵↓:

Una actividad es ergódica si el resultado de que un solo actor/agente la realice n veces coincide con el resultado de que n actores la realicen una sola vez.

🧵↓:

2/ Ergodicidad es la condición en la que el tiempo elimina los efectos molestos de la aleatoriedad; a largo plazo el tonto que se benefició de la suerte regresará a su estado original de un idiota menos afortunado y el que tuvo mala suerte pese a sus habilidades saldrá adelante!!

3/ La diferencia entre 100 personas que van a un casino una vez y una persona que va a un casino 100 veces, es decir, la secuencia importa y las probabilidades entendidas de la manera convencional. Este error ha existido en economía y en psicología desde tiempos inmemoriales!!!

1/ Hay un sesgo casi natural a mitificar, glorificar y celebrar a las personas que responden a la adversidad al seguir adelante, tratándolos como héroes; en cambio satanizamos, crucificamos y menospreciarnos a quienes renuncian, abandonan o se rinden, tratándolos como invisibles

2/ Estratégicamente, la vida es un trade-off entre perseverar o renunciar a algo. La economía, teoría de juegos y psicología del comportamiento lo han estudiado a través de: costos hundidos, sesgo del statu quo, aversión a las pérdidas, escalada del compromiso y mucho más

3/ En un mundo donde la perseverancia es vista casi universalmente como el camino al éxito. Los sinónimos favorecen la determinación: inquebrantable, resuelto, atrevido, audaz, intrépido, valiente. Palabras negativas para la determinación serían rígido, reacio u obstinado

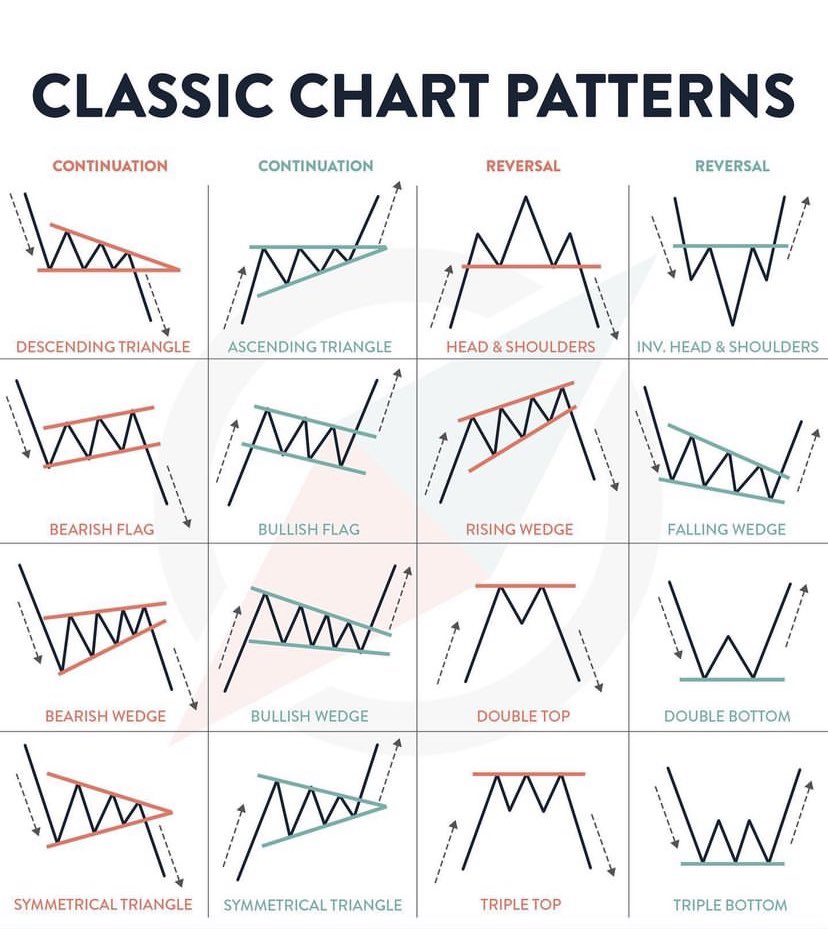

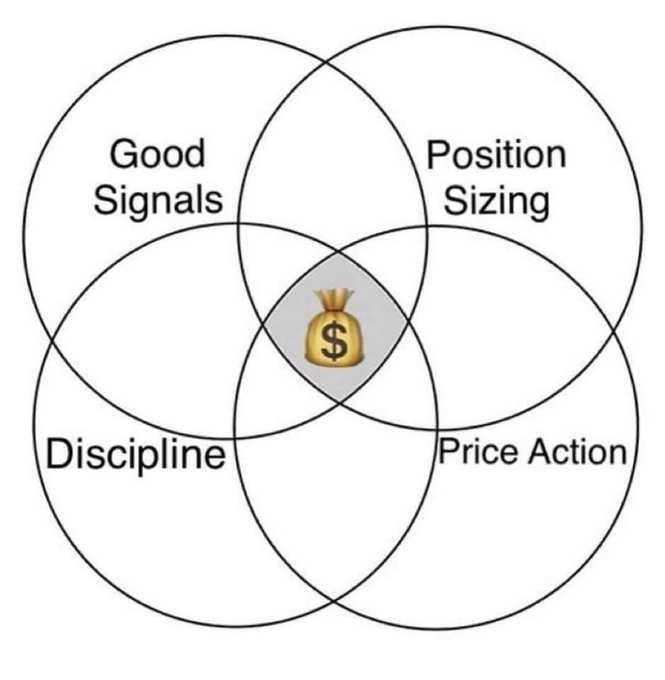

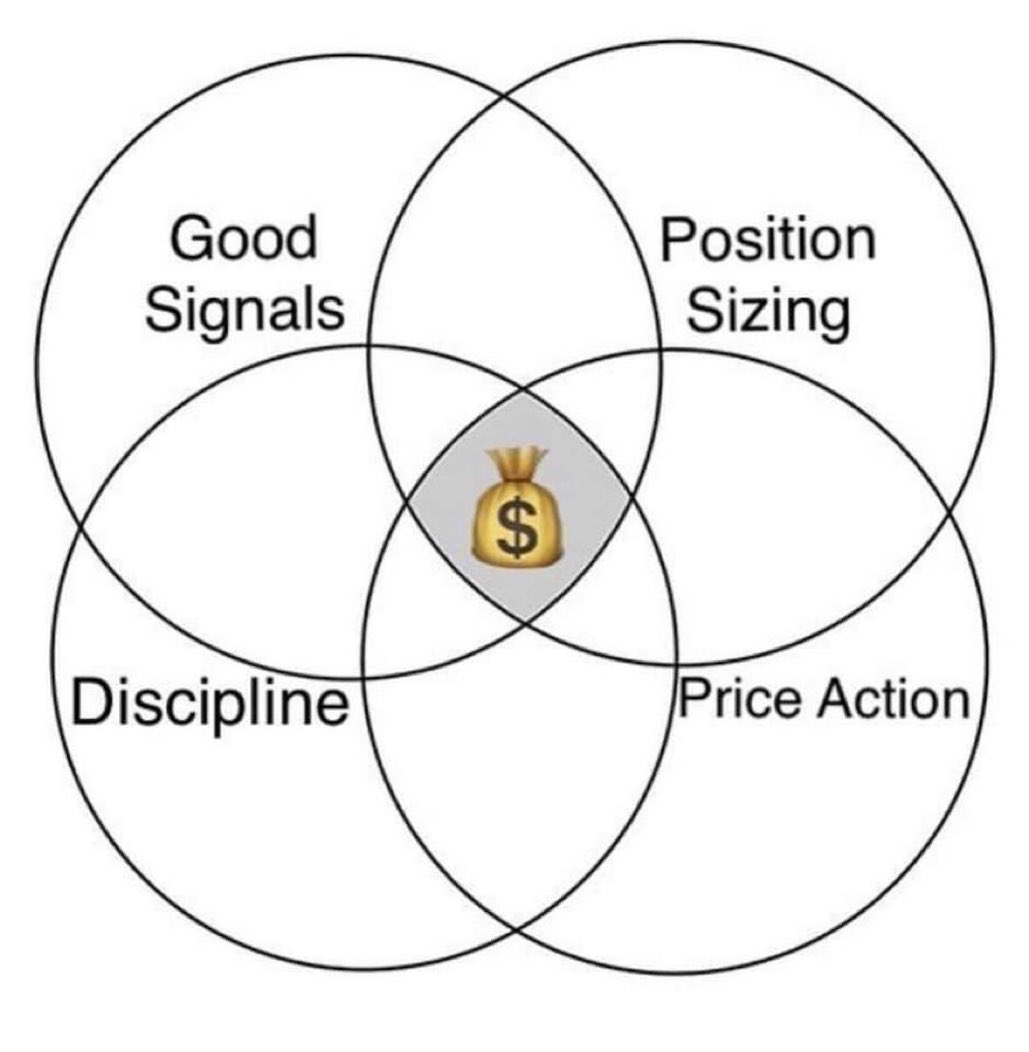

Are you a good stock market trader?

Become better & improve yourself

😎💡📈📊💰 #Thread with @Stocktwit_IN

#trading #learning #StockMarket

Become better & improve yourself

😎💡📈📊💰 #Thread with @Stocktwit_IN

#trading #learning #StockMarket

Are you a good stock market trader?

Become better & improve yourself

😎💡📈📊💰

with @Stocktwit_IN @TradingView_IN

#trading #learning #StockMarket

Become better & improve yourself

😎💡📈📊💰

with @Stocktwit_IN @TradingView_IN

#trading #learning #StockMarket

Are you a good stock market trader?

Become better & improve yourself

😎💡📈📊💰

#trading #learning #StockMarket

Become better & improve yourself

😎💡📈📊💰

#trading #learning #StockMarket

1) Yakından takip ettiğim ve aylık olarak yayımlanan @capitalMagazin dergisinin #Haziran sayısına ilişkin notlarım için kısa bir akış hazırladım.✍️🏻

Almanca olan derginin bu sayısında tehdit altında olan #RefahSeviyesi yer alıyor. Kapak resminde her şeyin yarısı gitmiş durumda.🙄

Almanca olan derginin bu sayısında tehdit altında olan #RefahSeviyesi yer alıyor. Kapak resminde her şeyin yarısı gitmiş durumda.🙄

2) Bunun dışında; #GelişmekteOlanÜlkeler (#EMs), küresel #petrol piyasası, değerli isimlerle röportajlar ve #StartUp konusu aklımda kalan başlıklar oldu. Elbette #WarrenBuffett ve 2022 yılı etkinliği de okumaya değer konular.

Bunlardan bazılarına değineyim:

Bunlardan bazılarına değineyim:

3) Covid-19'da yaşamın değeri birçok kişi için ciddi bir hatırlatma olmuştu. #Enflasyon, düşen alım gücü, #enerji krizi ve son gelişmeler bu kez "Mal canın yongasıdır" düşüncesini gündeme getirdi. Özellikle sabit gelirli kesimin hayat pahalılığı karşısında durumu zor.

1/

¿Cómo se correlacionan el spread ROIC-WACC, con la valuación empresarial y la asignación de capital para establecer métricas financieras en un negocio?

🧵 ↓:

¿Cómo se correlacionan el spread ROIC-WACC, con la valuación empresarial y la asignación de capital para establecer métricas financieras en un negocio?

🧵 ↓:

2/ En la teoría financiera se acepta ampliamente que el objetivo principal de la administración es maximizar el valor para los accionistas. Pero el camino para generar rendimientos superiores no siempre está claro, por varias razones.

3/ Priorizar qué métricas financieras lograr no es un tema fácil para gerencia de cualquier empresa. Los gerentes corporativos a menudo perciben que la gestión para lograr una ventaja competitiva es difícil de compaginar con las demandas a corto plazo del mercado de valores.

Bir çok insan tarafından dünyanın en başarılı yatırımcısı olarak görülen Warren Buffett'ın akıl hocası Benjamin Graham'ın 'Akıllı Yatırımcı' kitabından 10 adet ders;

#yatırım #buffett #finans #borsa #bist #bist100 #Warrenbuffett #yatırımcı #BorsaIstanbul

#yatırım #buffett #finans #borsa #bist #bist100 #Warrenbuffett #yatırımcı #BorsaIstanbul

-Akıllı yatırımcı, optimiste hisseyi satıp pesimit olandan alan bir realisttir.

- Kısa vadede piyasa bir oy kullanma yeridir, uzun vadede ise hassas bir tartıdır.

1- İkinci çeyrek bilançolar öncesinde değerli @ergun_unutmaz hocamızın kaliteli çevirisi ile dilimize kazandırdığı, Warren Buffett ve Finansal Tabloların Yorumlanması kitabını ikinci kez okuyarak notlarımızı alalım.📝🗒

#temelanaliz #finansalokuryazarlık #yatırım #kitap

#temelanaliz #finansalokuryazarlık #yatırım #kitap

2- Warren Buffett’ın şirket arayışına her zaman şirketin Gelir Tablosu ile başladığı ve Warren’ın gelir tablosu madenciliğinin önemli bir adımının da şu olduğu vurgulanıyor.

Şirket, rekabet üstünlüğünü korumak için AR-GE ye çok para harcamak zorunda mıdır? +

Şirket, rekabet üstünlüğünü korumak için AR-GE ye çok para harcamak zorunda mıdır? +

3- ve para kazanmak için büyük bir kaldıraç kullanmaya ihtiyacı var mıdır?

Bu noktada, Warren Buffett için şirketlerin elde ettiği kazançlarının kaynağının, kazançların kendisinden hep daha önemli olduğu belirtilmektedir. +

#temelanaliz #yatırım #kitap

Bu noktada, Warren Buffett için şirketlerin elde ettiği kazançlarının kaynağının, kazançların kendisinden hep daha önemli olduğu belirtilmektedir. +

#temelanaliz #yatırım #kitap

(1/5)

Nos anos 2000, a Berkshire Hathaway superou o índice S&P 500 em 37%.

Então, @WarrenBuffett escreveu uma carta para os acionistas.

Nos anos 2000, a Berkshire Hathaway superou o índice S&P 500 em 37%.

Então, @WarrenBuffett escreveu uma carta para os acionistas.

1) El crecimiento puede destruir valor: modelos comerciales no rentables con márgenes de utilidad mínimos o negativos. Día tras día escuchamos historias de capital quemado en negocios que simplemente no tenían sentido.

¿Cómo curar la adicción al crecimiento no rentable?

🧵↓:

¿Cómo curar la adicción al crecimiento no rentable?

🧵↓:

2) #WarrenBuffett: "cuando te encuentras en un hoyo, lo primero que debes hacer es dejar de cavar". Un negocio debe priorizar su ROIC y después su crecimiento, si su ROIC no es mayor a su costo de capital, el crecimiento es tóxico y cuanto más rápido crezca, más valor destruirá!!

3) El crecimiento de un negocio puede ser bueno o sin impacto, según el diferencial entre su ROIC y el costo de su capital WACC:

1) si es positivo, el crecimiento crea valor

2) si es negativo, el crecimiento destruye valor

3) si la diferencia es 0, el crecimiento no tiene impacto

1) si es positivo, el crecimiento crea valor

2) si es negativo, el crecimiento destruye valor

3) si la diferencia es 0, el crecimiento no tiene impacto