Discover and read the best of Twitter Threads about #alameda

Most recents (24)

1/4

🚨 #VOYAGER UPDATES 🚨

This 🧵 THREAD 🧵 gives you information on my Twitter Space link and agenda to be discussed.

I need to do a Twitter Space to disseminate a bunch of information I obtained.

🚨 #VOYAGER UPDATES 🚨

This 🧵 THREAD 🧵 gives you information on my Twitter Space link and agenda to be discussed.

I need to do a Twitter Space to disseminate a bunch of information I obtained.

2/4

Hello, my fellow @VGX_Heroes, Sidekicks, and Voyagers.

I'm #VGXHero Spock. 🖖

Please join me for some updates on what's going on with the #Voyager toggle option, appeal, and other info.

TODAY at 5:00 p.m. (PACIFIC Time).

#VoyagerBankruptcy

twitter.com/i/spaces/1MYxN…

Hello, my fellow @VGX_Heroes, Sidekicks, and Voyagers.

I'm #VGXHero Spock. 🖖

Please join me for some updates on what's going on with the #Voyager toggle option, appeal, and other info.

TODAY at 5:00 p.m. (PACIFIC Time).

#VoyagerBankruptcy

twitter.com/i/spaces/1MYxN…

㊙️揭秘Flow Traders

最近做市商DWF Labs频繁投资吸引眼球,此前Jump、Wintermute、GSR、 #Alameda 等交易机构也积极参与项目投资和孵化。而另一家低调的传统交易机构Flow Traders @FlowTraders 也频繁地出现在项目投资机构的名单中。

本推一起了解Flow Traders有何不同之处🧵

最近做市商DWF Labs频繁投资吸引眼球,此前Jump、Wintermute、GSR、 #Alameda 等交易机构也积极参与项目投资和孵化。而另一家低调的传统交易机构Flow Traders @FlowTraders 也频繁地出现在项目投资机构的名单中。

本推一起了解Flow Traders有何不同之处🧵

1\Flow Traders是专注于交易所交易产品 ETP 的全球数字流动性提供商, 2004 年成立在荷兰成立,是欧盟最大的ETF交易公司之一,主要提供股票及衍生品、货币、债券方面的交易服务,还基于BTC和ETH创建了交易所交易凭证,开展加密货币ETN交易业务。去年拿到了中国的合格境外机构投资者(QFII) 牌照。

2\Flow Traders自2017年开始从事加密货币交易,其子公司在荷兰央行注册,以实现加密资产和法币之间的兑换。 Flow Traders连接到全球多个头部交易所,交易品类覆盖多个资产类别,并利用这些资产类别来抵消交易风险。尽管加密交易活动仅占该公司整体业务的一小部分,但几年来已对其产生了“积极影响”。

从2020(个别2019年)-2021年整个大牛市周期中,市值前600的加密货币中,诞生了61个百倍以上的项目。今天我们来看看它们有什么特征,它们的属性,并对我们即将到来的2023-2025新周期有什么启示!(由于数据源原因,个别数据有些许出入,请谅解,选取二级市场可买品种,一级除外)

🧵1/Ω

➤ #Binance announcing increasingly dire issues w/its fiat on and off ramps.

➤ #CryptoCom's Euro bank accounts were frozen or seized by #BankOfLithuania on 1/21 for money laundering, terrorist financing, and sanctions violations (screenshot)

Let's dig...

Ω👇Ω

➤ #Binance announcing increasingly dire issues w/its fiat on and off ramps.

➤ #CryptoCom's Euro bank accounts were frozen or seized by #BankOfLithuania on 1/21 for money laundering, terrorist financing, and sanctions violations (screenshot)

Let's dig...

Ω👇Ω

🧵2/Ω

Recently users of #CryptoCom were surprised to receive an email saying that #SEPA transfers of $EUR were being “migrated to a new provider” and thus Euro-denominated deposits and withdrawals were temporarily suspended.

Yikes.

Ω👇Ω

Recently users of #CryptoCom were surprised to receive an email saying that #SEPA transfers of $EUR were being “migrated to a new provider” and thus Euro-denominated deposits and withdrawals were temporarily suspended.

Yikes.

Ω👇Ω

🧵3/Ω

#Cryptocom customers couldn't deposit/withdraw for ~100 hours yet #CDC did not send any kind of prior notice to their customers. Many redditors confirm problems began > 24 hours BEFORE #CDC sent out the first (and only) email about the disruption.

Some got 0 emails.

Ω👇Ω

#Cryptocom customers couldn't deposit/withdraw for ~100 hours yet #CDC did not send any kind of prior notice to their customers. Many redditors confirm problems began > 24 hours BEFORE #CDC sent out the first (and only) email about the disruption.

Some got 0 emails.

Ω👇Ω

OG: @pandanaiksapi:

#Binance is the largest crypto exchange in the world with a daily volume of over $15 billion, 10x bigger than the second. It's considered the safest for trading and storing #crypto assets, but is it truly #SAFU? #crypto #trading

A 🧵from a stupid trader (1/?)

#Binance is the largest crypto exchange in the world with a daily volume of over $15 billion, 10x bigger than the second. It's considered the safest for trading and storing #crypto assets, but is it truly #SAFU? #crypto #trading

A 🧵from a stupid trader (1/?)

Binance, founded by @cz_binance in 2017, has its origins in China. Due to the government's ban on #crypto, it had to move its headquarters to Japan. However, as Japan also started to implement stricter regulations for #crypto, Binance had to move again, this time to Malta. (2/?)

On Feb 21, 2020, the Malta Financial Services Authority (MFSA) announced that @binance does not have an operating license. Binance has also been investigated multiple times by the IRS and the US Department of Justice on charges of money laundering.

(3/?)

(3/?)

Claims that DCG Grayscale's $btc / $eth trust are ponzis and/or on the verge of collapse is FUD from #crypto twitter void of facts and rational thought.

🧵 I outline why grayscale's $gbtc is positioned for a 100% annualized return in the next 12 months:

Data below.

🧵 I outline why grayscale's $gbtc is positioned for a 100% annualized return in the next 12 months:

Data below.

/1 #grayscale funds are safe

#Coinbase Custody Trust is the custodian of Grayscale’s bitcoin, who reaffirmed that #DCG's Grayscale’s bitcoin assets are secured and not used as collateral in a manner similar to FTX:

#Coinbase Custody Trust is the custodian of Grayscale’s bitcoin, who reaffirmed that #DCG's Grayscale’s bitcoin assets are secured and not used as collateral in a manner similar to FTX:

/2 Why?

US-domiciled public crypto exchanges under US regulatory supervision are solvent. All exchange catastrophes we’ve witnessed have been a byproduct of unregulated off-shore crypto firms domiciled in The Bahamas, Antigua, Hong-Kong or some other far-away land ....

US-domiciled public crypto exchanges under US regulatory supervision are solvent. All exchange catastrophes we’ve witnessed have been a byproduct of unregulated off-shore crypto firms domiciled in The Bahamas, Antigua, Hong-Kong or some other far-away land ....

1/ Genesis Trading eliminates 30% of staff in latest cuts and may have to file for bankruptcy protection.

bloomberg.com/news/articles/…

We analyzed 6 addresses of Genesis Trading:👇

- Genesis currently holds $364M assets.

- Alameda and 3AC are the biggest counterparties of Genesis.

bloomberg.com/news/articles/…

We analyzed 6 addresses of Genesis Trading:👇

- Genesis currently holds $364M assets.

- Alameda and 3AC are the biggest counterparties of Genesis.

🚨.@GenesisTrading laid off 30% of its employees and is "considering" filing for bankruptcy according to @WSJ.

wsj.com/amp/articles/c…

1. How did genesis end up here?

2. How does this gonna affect the market and why should you care?

A explain thread.

👇

wsj.com/amp/articles/c…

1. How did genesis end up here?

2. How does this gonna affect the market and why should you care?

A explain thread.

👇

Now, Who is #Genesis?

Genesis "was" a leading CeFi platform that provides mainly lending services for institutions.

A lending platform usually borrows money from one side and lends the borrowed money to the other side to profit from the interest gap.

That's what CeFi does.

Genesis "was" a leading CeFi platform that provides mainly lending services for institutions.

A lending platform usually borrows money from one side and lends the borrowed money to the other side to profit from the interest gap.

That's what CeFi does.

But #Genesis is not independent, it is under the control of @DCGco and @BarrySilbert.

#GrayScale is also part of the group.

That's why you see @cameron battling Barry on CT with an open letter.

#GrayScale is also part of the group.

That's why you see @cameron battling Barry on CT with an open letter.

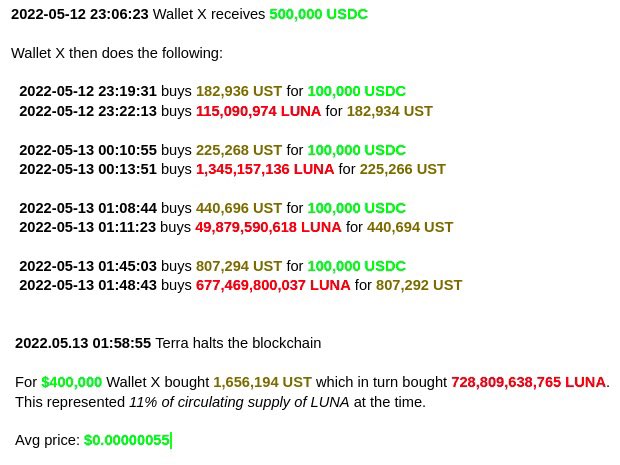

Ok guys it turns out that Alameda funded Wallet X on Coinbase and helped blow up Terra. Anyone want to talk about wrapped luna now? #FTX

Exhibit A: 0x213640fB2FCaDB6f246937aa52021A6b2a6aaccf #whoiswalletx

Exhibit B: 0x28C66F6358Ba0c9defF64FC4888BF1705484645B #Alameda so… Alameda funded the wallet that blew up wluna on Coinbase and helped depeg Luna

A mixture of surprise and anger greeted the news that Sam Bankman-Fried would be roaming free until October.

The chess strategy has begun and we may be in for a long, drawn-out affair:

(0/8)

The chess strategy has begun and we may be in for a long, drawn-out affair:

(0/8)

Sam Bankman-Fried made a brief appearance in court yesterday, where he recorded a not-guilty plea to all charges.

He is facing "eight felony counts including fraud, conspiracy, and money laundering".

(1/8)

He is facing "eight felony counts including fraud, conspiracy, and money laundering".

(1/8)

In contrast to this, #SBF's close associates Caroline Ellison and Gary Wang both pleaded guilty to counts of fraud.

In addition, Ellison also admitted to money laundering.

It is believed that they are both cooperating with prosecutors.

(2/8)

In addition, Ellison also admitted to money laundering.

It is believed that they are both cooperating with prosecutors.

(2/8)

📑Weekly Fud Buster Dashboard

- Pi is open for trade in @HuobiGlobal

- Ongoing noises with @FTX_Official and @SBF_FTX

- @cameron 's open letter to @BarrySilbert

- @BlackRock loaned to @Core_Scientific

Here's the wrap-up of the latest Crypto Issues.🧵

cryptoquant.com/dashboard/63b2…

- Pi is open for trade in @HuobiGlobal

- Ongoing noises with @FTX_Official and @SBF_FTX

- @cameron 's open letter to @BarrySilbert

- @BlackRock loaned to @Core_Scientific

Here's the wrap-up of the latest Crypto Issues.🧵

cryptoquant.com/dashboard/63b2…

/1 @PiCoreTeam is now open for trade in the #Huobi.

What can be the reasons behind Huobi listing $Pi in their service?

- To increase Huobi's Stablecoins Reserve

- To generate more revenue from trading fees

What are the potential dangers?

Link👇

cryptoquant.com/dashboard/63b2…

What can be the reasons behind Huobi listing $Pi in their service?

- To increase Huobi's Stablecoins Reserve

- To generate more revenue from trading fees

What are the potential dangers?

Link👇

cryptoquant.com/dashboard/63b2…

/2 Altcoin dump risk by #FTX, and #Alameda research.

- Bahamas regulators have taken custody of $3.5B in FTX customer assets.

- Alameda Research made many transactions for converting altcoins into $ETH / $USDT.

Live Dashboard👇

cryptoquant.com/dashboard/63b2…

- Bahamas regulators have taken custody of $3.5B in FTX customer assets.

- Alameda Research made many transactions for converting altcoins into $ETH / $USDT.

Live Dashboard👇

cryptoquant.com/dashboard/63b2…

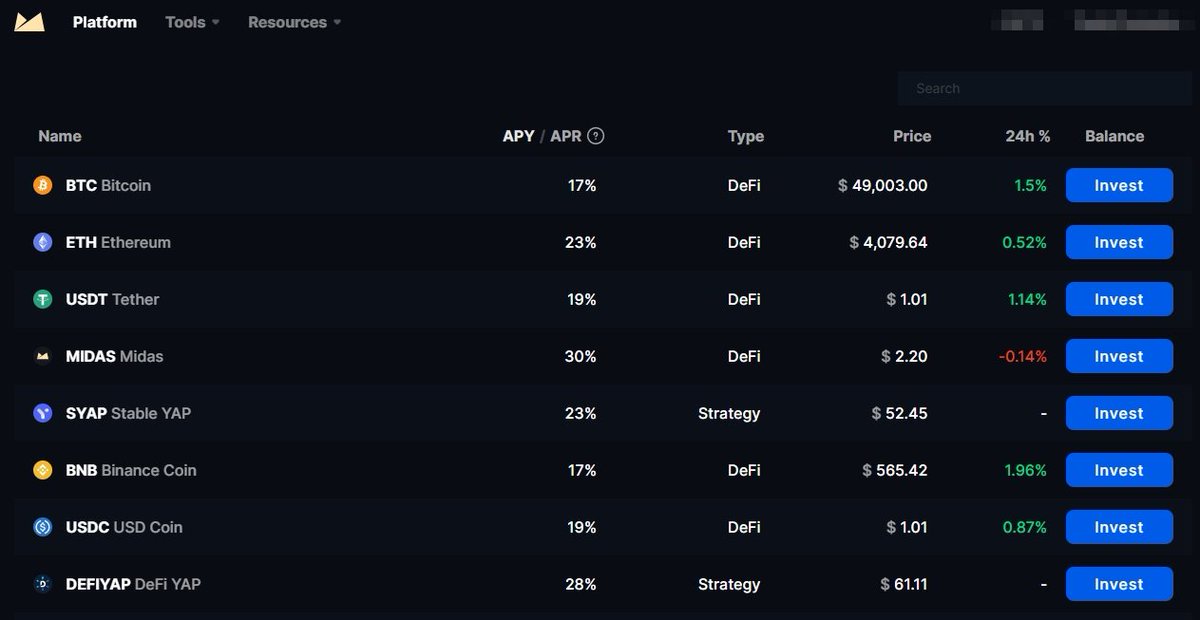

Another CeFi platform #Midas Investments @Midas_platform is shutting down with a $63.3 million hole in the balance sheet.

blog.midas.investments/midas-closure-…

Read the full thread about what happened:

#MidasInvestments

blog.midas.investments/midas-closure-…

Read the full thread about what happened:

#MidasInvestments

@CasPiancey Mate that's so cool you think this. It means alot.

@CasPiancey Just a couple more thoughts on the interview.

@CasPiancey Full disclosure I didn't listen to the entire interview. I listened to the first part...running out of time so fast forwarded to Cas and got so annoyed I couldn't listen to the rest. I did think the host was pretty good and I will go back and listen to the full interview soonish.

😈 LUNA崩盘幕后黑手,SBF罪加一等?

SBF或是LUNA崩盘的幕后黑手?Alameda Research涉嫌在今年五月利用市场操纵交易手段导致TerraUSD和LUNA崩盘,SBF的罪名可能要再加一条——市场操纵!

📌本推带你跟上最新进度 #Alameda #SBF

欢迎转推、点赞、收藏 🧵🧵

SBF或是LUNA崩盘的幕后黑手?Alameda Research涉嫌在今年五月利用市场操纵交易手段导致TerraUSD和LUNA崩盘,SBF的罪名可能要再加一条——市场操纵!

📌本推带你跟上最新进度 #Alameda #SBF

欢迎转推、点赞、收藏 🧵🧵

一、SBF罪加一等?

1/ 根据两位知情人士透露,美国曼哈顿联邦检察官已经开始调查前FTX首席执行官Sam Bankman-Fried(SBF)和他的对冲基金Alameda Research是否在今年五月利用市场操纵交易手段导致TerraUSD和LUNA崩盘

1/ 根据两位知情人士透露,美国曼哈顿联邦检察官已经开始调查前FTX首席执行官Sam Bankman-Fried(SBF)和他的对冲基金Alameda Research是否在今年五月利用市场操纵交易手段导致TerraUSD和LUNA崩盘

2/ 目前相关调查尚处于初期阶段,因此还不确定检察官是否已经确定SBF存在相关不当行为,也不知道检察官审查TerraUSD和LUNA交易的起始时间。据悉,本次调查将是监管和执法机构针对SBF、以及FTX挪用数十亿美元客户资金更广泛调查的一部分。

1/ The reason why you should NOT ignore #MultiversX…

🚨 Before reading please know anything shared is NOT an opinion. It is fact and backed by data 🚨

The reason you may not have heard much about #MultiversX formerly @ElrondNetwork is 🧵

@egld_initiative #Elrond

🚨 Before reading please know anything shared is NOT an opinion. It is fact and backed by data 🚨

The reason you may not have heard much about #MultiversX formerly @ElrondNetwork is 🧵

@egld_initiative #Elrond

2/ because they were primarily self funded. Their seed round July 15th, 2019 raised $1.9mill

Another $15mill in 2021 and $40mill raised in 2022

Let’s compare:

#Solana $400mill +

#DOT $300mill +

#Cardano $160mill +

#Avax $600mill 🤯

#Elrond $67 mill

Why does this matter? 👇

Another $15mill in 2021 and $40mill raised in 2022

Let’s compare:

#Solana $400mill +

#DOT $300mill +

#Cardano $160mill +

#Avax $600mill 🤯

#Elrond $67 mill

Why does this matter? 👇

3/ Unless you have been living under a rock lately you know that VC’s manipulate markets *cough* #FTX #Alameda

They only care about hyping and pumping their own bags

To keep from being heavily VC controlled #Elrond limited their early investors 👏

#MultiversX 👇

They only care about hyping and pumping their own bags

To keep from being heavily VC controlled #Elrond limited their early investors 👏

#MultiversX 👇

1- Crypto Winter everywhere @Bybit_Official Crypto Exchange Layoffs

🧵👇

#layoffs #cryptocrash $BTC $ETH

cryptoavanza.com/crypto-winter-…

🧵👇

#layoffs #cryptocrash $BTC $ETH

cryptoavanza.com/crypto-winter-…

2- After $UST incident, everyone is talking about “Crypto Winter” because of the liquidity crunch that’s why Exchange reduced its workforce today’s #Bybit announced layoffs workforce to survive the bear market. #Bybit previously cut its workforce by an unspecified number in June

3- @benbybit, the CEO, and co-founder of the Singapore-based crypto exchange, previously worked for XM, one of the world’s largest forex and CFD trading brokerage firms. made the announcement on Twitter at 12:32 a.m. ET.

1- 75% of the $FTM current supply is locked, with the remaining 25% unlocked, indicating that whales and holders believe in the FTM token. #Fantom

2- As of today $FTM is down more than 90% from its previous all-time high of $3.3, and its market cap has dropped from $7.6 bn to less than $600 mn,

1- #Fantom is Up 25% in 2 days Let’s discuss FTM’s next price move after Andre Cronje’s article

$FTM

🧵👇

cryptoavanza.com/fantom-up-25-i…

$FTM

🧵👇

cryptoavanza.com/fantom-up-25-i…

As @WatcherGuru muted my tweets. Here again without any censorship. 🤡

#MoonstoneBank #Farmington #FTX #Alameda #Tether #Deltec #crypto #SIG

#MoonstoneBank #Farmington #FTX #Alameda #Tether #Deltec #crypto #SIG

Interesting. SIG invested in #Voyager, bankrupt. SIG invested in #BlockFi, bankrupt.

inflation.us/content/susque…

Why does that matters? Where is the connection?

Jean Chalopin is the connection. Who is that? Chairman of Deltec Bank Bahamas (banking provider of Tether and FTX). /1

inflation.us/content/susque…

Why does that matters? Where is the connection?

Jean Chalopin is the connection. Who is that? Chairman of Deltec Bank Bahamas (banking provider of Tether and FTX). /1

Jean Chalopin was director of SIG Investment II Limited SIG Investment I Limited

offshoreleaks.icij.org/nodes/152449

But Jean is also former CEO (2020) and current director of FTX Farmington State Bank or Moonstone Bank. The bank with few staff but with a huge vision. 🤡 /2

offshoreleaks.icij.org/nodes/152449

But Jean is also former CEO (2020) and current director of FTX Farmington State Bank or Moonstone Bank. The bank with few staff but with a huge vision. 🤡 /2

1/ Negli ultimi giorni c’è molto timore dietro i token wrapped di Bitcoin. Ho già sollevato qualche qualche giorno fa la questione di wBTC, ma facciamo un piccolo recap perché ci sono delle cose che DEVI sapere!

🧵

🧵

2/ C’è una forte incertezza dietro al token #renBTC per via del suo legame con #alamedaresearch. Ma, a differenza di #wBTC possiamo vedere che il suo valore è ancora peggato, sostanzialmente perché c’è ancora il collaterale a sostenerne il prezzo

coingecko.com/it/monete/renb…

coingecko.com/it/monete/renb…

3/ La bancarotta di #alameda ha prosciugato le casse del team che sta dietro il progetto. Per questo chiuderà l’attuale versione di #ren in favore di una sorta di #renDAO. Qui @renprotocol ci spiega tutti i dettagli:

1- The #FTX scandal shook crypto and even the TradFi world, but how did we not see this coming? Here are the signs we missed

Some Red Flags that show SBF has been engaging in fraud since #Alameda discovered it.

🧵

Some Red Flags that show SBF has been engaging in fraud since #Alameda discovered it.

🧵

2- Red Flag raised #3AC Founder Sam Bankman Fried was known for betting big and often promised: “HIGH RETURNS, NO RISK”

@zhusu

@zhusu

3- Red Flags comes from Sam Trabucco When Trabucco, Alameda’s former co-CEO, posted a thread about superpowers, that should have been a warning sign. This thread was on April 22, 2021, and he resigned on august 25,2022.

@AlamedaTrabucco

@AlamedaTrabucco

1/ DeFi can't solve the issue of basic record keeping and general accounting if institutional crypto continues operating off-chain.

Let's explore the opaque centralized finance (CeFi) practices @FTX_Official group used to get ahead.🧵

Let's explore the opaque centralized finance (CeFi) practices @FTX_Official group used to get ahead.🧵

2/ @FTX_Official and #Alameda’s operations consisted of a few key, related areas:

+Market making

+Exchange operation

+Liquidation protection

+Venture funding

+OTC trading and lending

+Market making

+Exchange operation

+Liquidation protection

+Venture funding

+OTC trading and lending

3/ Crypto hedge fund #Alameda was best known for its trading strategies and arbitrage expertise, both key to its work as a market maker.

As the space became more crowded, less profit was available for each player.

Enter a brand new exchange in @FTX_Official.

As the space became more crowded, less profit was available for each player.

Enter a brand new exchange in @FTX_Official.

This is an interesting in-depth analysis using on-chain data to piece together the fallen dominos of #FTX and #Alameda compiled by @nansen_ai :

Here are their key takeaways :

Via nansen.ai/research/block…

Here are their key takeaways :

Via nansen.ai/research/block…

1. FTX and Alameda have had close (on-chain) ties since the very beginning.

2. FTX created FTX Token (FTT), a token for their platform, involving Alameda since day one. The two of them shared the majority of the total FTT supply which did not really enter into circulation.

2. FTX created FTX Token (FTT), a token for their platform, involving Alameda since day one. The two of them shared the majority of the total FTT supply which did not really enter into circulation.

3. The initial success of Alameda, FTX, and the meteoric rise of FTT most likely led to a rise in the value of Alameda’s balance sheet. This high balance sheet value of the FTT positions was likely used as collateral by Alameda to borrow against.

Die #FTX-Pleite und die Machenschaften von Sam Bankman-Fried (#SBF) ziehen immer weitere Kreise. Es geht um #China, das #WEF, den Krieg in der #Ukraine und die US-Präsidentschaftswahlen. Eine Übersicht der kursierenden Theorien 👇🧵

Vorab: #SBF hat Kunden um mindestens zehn Milliarden US-Dollar betrogen. Es ist der vielleicht größte Betrug der Finanzgeschichte. Was geschehen ist, findest Du hier: blingbling.substack.com/p/sam-bankrun-…

Theorie 1: Sam Bankman-Fried ist Sohn zweier Professoren und ist bestens vernetzt in der amerikanischen Elite - insbesondere unter den Demokraten. Mit seinen Spenden soll er für den Wahlsieg von Joe #Biden verantwortlich sein