Discover and read the best of Twitter Threads about #banks

Most recents (24)

Rising volume in $XLK, $VTV, and good enough $SMH transparently prepared the ground for improving #ES market breadth – but the one factor that made me reconsider the requisites of the medium-term (bearish) outlook, was this.

Financials.

LONG THREAD 👇

Financials.

LONG THREAD 👇

Since the recent event with arguably the largest echo was the #FOMC decision, it's called - what else- "The Pause That Refreshes"

1/n

#FRB

#FederalReserve

1/n

#FRB

#FederalReserve

The first thing to notice is that goods prices have broadly stabilised and volumes are fairly flat - in other words, #NGDP has ceased its torrid pace of increase. Service prices are still elevated but #payroll cost increase is slowing.

2/n

2/n

The #ISM #PMI showed an uptick but is still below 50 which implies that revenue growth is NOT about to accelerate again. Again, slower #inflation & flatline volume = an end to the boom, but not yet a bust.

3/n

3/n

How to analyse Banking Stocks?

• Net Interest Margin(NIM)

• Return on Assets(ROA)

• Non Performing Assets(NPAs)

• CASA Ratio

Let's analyse each one in detail 🧵⤵️

#StockMarketindia #banks

• Net Interest Margin(NIM)

• Return on Assets(ROA)

• Non Performing Assets(NPAs)

• CASA Ratio

Let's analyse each one in detail 🧵⤵️

#StockMarketindia #banks

The business of bank is quite different frm the rest.

Banks accept deposits from common people & promise a certain rate of interest in return. It lends this money to borrowers & charges higher interest.

The diff between both is called spread which is bank’s actual profit

Banks accept deposits from common people & promise a certain rate of interest in return. It lends this money to borrowers & charges higher interest.

The diff between both is called spread which is bank’s actual profit

Transition towards a #sustainable (solarpunk) #future? Then we first have to rewrite the rules of the game. The creation of #money, political economics and its rules are designed in such way it will always concentrate power within the same elite.

It doesn’t matter much which #governance model you have as long as any system depends on so called neutral central #banks issuing money and commercial banks granting debt. You ll always have a system that creates #inequality, exploitation & destruction.

We should rewrite the rules, #monetary policy should be a key #political topic. I made this #comic once to show alternative rules about ownership of land, hoarding and speculation and land-use. A #Georgist approach.

US banks witness $126B withdrawal by March 22, with the top 25 shedding $90B in current financial unrest! 🚨

A thread 🧵:

#banks #svb #silvergate #crisis

A thread 🧵:

#banks #svb #silvergate #crisis

(1/6) Post Silicon Valley Bank & Signature seizures, smaller banks rebound by reclaiming $6B (seasonally adjusted) 💪

(2/6) Total industry deposits at lowest since July 2021, now at $17.3T 😲

[1/🧵] A short synopsis of Joachim Nagel's most recent speech on the future of #economic and #monetary union, presented and released by @OMFIF (@OMFIFDMI). 👇

[2/7] Joachim Nagel, a member of the @bundesbank's Executive Board, discusses:

🔸 #Inflation

🔸 #Monetary policy

🔸 #Fiscal development, ...

... among other topics.

🔸 #Inflation

🔸 #Monetary policy

🔸 #Fiscal development, ...

... among other topics.

[3/7] According to Nagel, the ongoing #energy #crisis in #Ukraine has resulted in:

🔸 Greater #inflation

🔸 Higher #energy prices ...

... influencing:

🔸 #Industrial costs

🔸 #Financial insecurity.

🔸 Greater #inflation

🔸 Higher #energy prices ...

... influencing:

🔸 #Industrial costs

🔸 #Financial insecurity.

Two striking resemblances btw #SVB & former @CreditSuisse.

Both banks did not pay attention to the top 8–20 risks, which every board must.

Either these banks kept their risk desks understaffed or didn't hire key managerial position holders at all.

Why?

Need introspection now.

Both banks did not pay attention to the top 8–20 risks, which every board must.

Either these banks kept their risk desks understaffed or didn't hire key managerial position holders at all.

Why?

Need introspection now.

@CreditSuisse It was reported on this forum that #SVB did not have a CRO for some 8 months during the VC Market spiralling.

Also, I read just now that former @CreditSuisse was sacking key MDs in their across their risk desks.

This trend continued since the #Archegos fiasco surfaced after 2019

Also, I read just now that former @CreditSuisse was sacking key MDs in their across their risk desks.

This trend continued since the #Archegos fiasco surfaced after 2019

CRO Chief Risk Officer or Head of Risk Management is a key managerial decision-making position and C Suite Level role which every financial institution can afford to keep empty these days.

The Front, Middle, and Back Office roles form key lines of defence against top risks.

The Front, Middle, and Back Office roles form key lines of defence against top risks.

Credit Suisse #CS chairman says We were affected by a market model that does no longer work in this environment, last autumn we had this social media storm & it had huge repercussions, more in the retail sector than wholesale sector, when he was asked Who is responsible?

#GME

#GME

If one of the largest Swiss bank is not safe by holding a bet against retail investors, let the #US #banks rethink who are the real whales in this game now. #GME investors have fallen in love with the stock, #WeAreNotSelling #WeAreNotLeaving eventually everyone will pay the price

Market Makers who used algo to drive down the price, firms that removed the buy button,Regulatory bodies which allowed Market Makers & others to hide their short pos,Regulatory body which failed to shut down #darkpool,Brokers who took part in illegal activities are responsible!!!

For those interested in what Silicon Valley Bank's $74 billion loan (rather than securities) portfolio looked like at the end of last year, take a look at this table. 1/4

#banks #loans #vcfunding #wineries

#banks #loans #vcfunding #wineries

The $6.7 billion in "investor dependent" loans to Venture-backed startups are the ones that are difficult for national banks to acquire. They are also the key to the whole SVB ecosystem, including the Global Fund Banking portfolio of $41.3 billion which is by far 2/4

the biggest segment, followed by the $10.5 billion private bank portfolio. Wine at $1.2 billion seems small but is a huge part of US lending to wineries.

The challenge for FDIC in a nutshell: these apparently disparate lending businesses are all deeply intertwined. 3/4

The challenge for FDIC in a nutshell: these apparently disparate lending businesses are all deeply intertwined. 3/4

With regional banks on their back foot, yield curve suggesting imminent recession and a Fed facing both a fragilized financial system and inflation, DoubleLine CEO Jeffrey Gundlach shares his views with @ScottWapnerCNBC 12 pm PT/3 pm ET today on CNBC.

#rates #banks #Powell

#rates #banks #Powell

Gundlach: All of us have experienced nothing but systematically declining interest rates over the last 40 years. We all think we know things based on our past experience. But we've no experience for a climate of rapidly rising interest rates.

Jeffrey Gundlach: This regional bank crisis may portend problems down in the riskier areas of credit, including high yield corporate bonds.

These companies may experience trouble refinancing and rolling over their debt.

These companies may experience trouble refinancing and rolling over their debt.

आजच्या थ्रेडमध्ये आपण सध्या जगभरात Hot Topic असणार्या विषयाबद्दल जाणुन घेऊ. म्हणजेच अमेरिकेतील

१)'Silicon Valley Bank'(SV bank)

२)ती बुडण्यामागील कारणे

३)त्याचे परिणाम,ले ऑफ

सुरुवातीला सांगु इच्छितो की इथे बर्याच जणांना २००८ साली 'Lehman brothers bank' बुडाली

#threadकर #वसुसेन

१)'Silicon Valley Bank'(SV bank)

२)ती बुडण्यामागील कारणे

३)त्याचे परिणाम,ले ऑफ

सुरुवातीला सांगु इच्छितो की इथे बर्याच जणांना २००८ साली 'Lehman brothers bank' बुडाली

#threadकर #वसुसेन

🆘SVB Financial $SIVB collapse explained 🥵

~ Just 24 hours ago $SIVB was trading at over $260/share it hit a low of $33.40 today

~ It is currently halted after being shut down by regulators & taken over by the FDIC

~ Largest bank failure since 2008

#banks #financialcrisis

🧵⤵️

~ Just 24 hours ago $SIVB was trading at over $260/share it hit a low of $33.40 today

~ It is currently halted after being shut down by regulators & taken over by the FDIC

~ Largest bank failure since 2008

#banks #financialcrisis

🧵⤵️

🚨 What happened? Here's the $SIVB story

~ Silicon Valley Bank parent company SVB Financial Group has collapsed after disclosing large losses from securities sales & a stock offering meant to provide a boost to its balance sheet

#BankCrash

🧵⤵️

~ Silicon Valley Bank parent company SVB Financial Group has collapsed after disclosing large losses from securities sales & a stock offering meant to provide a boost to its balance sheet

#BankCrash

🧵⤵️

⏺️ $SIVB helps fund technology startups backed by venture-capital firms

~ Rising interest rates, fears of a recession & a slowdown in the market for initial public offerings has made it harder for early-stage companies to raise cash

~ This led firms to draw down on their deposits

~ Rising interest rates, fears of a recession & a slowdown in the market for initial public offerings has made it harder for early-stage companies to raise cash

~ This led firms to draw down on their deposits

Many have asked me on preparation and my opinions about #gold , #stocks , #Cash and #banks .

We have presented these and preparation guidelines in the following reports, which will continue next week.

Our latest forecasts. 👇

@GnSEconomics

🧵1/10

gnseconomics.substack.com/p/deprcon-outl…

We have presented these and preparation guidelines in the following reports, which will continue next week.

Our latest forecasts. 👇

@GnSEconomics

🧵1/10

gnseconomics.substack.com/p/deprcon-outl…

The fundamental thing to understand, concerning preparation, is how prices of different assets are likely to behave in the coming crisis.

In this report, we present historical patterns of key assets classes during crises.

2/

gnseconomics.substack.com/p/the-preppers…

In this report, we present historical patterns of key assets classes during crises.

2/

gnseconomics.substack.com/p/the-preppers…

As a historical 'appendix' we also report the best performing stocks during and after the GFC and the Great Depression. (Free.)

3/

gnseconomics.substack.com/p/the-best-per…

3/

gnseconomics.substack.com/p/the-best-per…

The latest Sovereign Gold Bond (SGB) issue is open till Mar 10.

You can buy 1 gram (or 1 unit) of SGB at Rs 5,561.

But there’s a cheaper alternative.

You can buy previous issues of SGBs on #stock exchanges at a 5-6% discount. (Check image)

Should you buy them?

A 🧵

You can buy 1 gram (or 1 unit) of SGB at Rs 5,561.

But there’s a cheaper alternative.

You can buy previous issues of SGBs on #stock exchanges at a 5-6% discount. (Check image)

Should you buy them?

A 🧵

First, some quick facts.

Each SGB unit equals 1 gram of gold (999 purity).

New issues are sold through #banks.

There’s a Rs 50 discount on online purchases.

After the issue is over, #SGB is listed on stock exchanges.

This gives you the option to exit before maturity.

Each SGB unit equals 1 gram of gold (999 purity).

New issues are sold through #banks.

There’s a Rs 50 discount on online purchases.

After the issue is over, #SGB is listed on stock exchanges.

This gives you the option to exit before maturity.

SGBs mature in 8 years.

But they have a 5-year lock-in, which means you have the option to exit after 5 years.

On redemption, you get the prevailing market price of gold.

Plus, you earn an #interest of 2.5% every year on the issue price.

But they have a 5-year lock-in, which means you have the option to exit after 5 years.

On redemption, you get the prevailing market price of gold.

Plus, you earn an #interest of 2.5% every year on the issue price.

The #AdaniGroups Saga- For Naive #Investors. A thread

I, Mr A(#Adani) have 100 chips. By #Law, I cannot own more than 75, so I hav 73 chips. 27 chips r sold in d market. Anther 15 Chips: My uncle buys them by pretending to b normal people. This is illegal, bt who will catch me?

I, Mr A(#Adani) have 100 chips. By #Law, I cannot own more than 75, so I hav 73 chips. 27 chips r sold in d market. Anther 15 Chips: My uncle buys them by pretending to b normal people. This is illegal, bt who will catch me?

So there are 12 chips left in the market. Out of these, #Funds like #LIC buys 9 chips. 3 chips are now left on the open market.

My #media, #political and PR management and #connections are excellent. There are whispers that I am related to the #king and #Government.

My #media, #political and PR management and #connections are excellent. There are whispers that I am related to the #king and #Government.

[1/🧵] @DigiEuro interviewed @moderndosh and @AntonyWelfare on the @Ripple #CBDC-Manager software.

The underlying private #CBDC-ledger based on #XRPL was also heavily discussed.

I summarized the most of the interview for you, along with my personal comments. 🧵👇

The underlying private #CBDC-ledger based on #XRPL was also heavily discussed.

I summarized the most of the interview for you, along with my personal comments. 🧵👇

[2/19] To begin, if you are completely unfamiliar with #CBDCs and the #Ripple solution, here is a nice place to start:

[3/19] One important reason for using a private version of the public #XRPL is that a central #bank needs to be able to control the #money supply.

Why use a private ledger ❓

▶️ Central banks and #governments must be able to mint and destroy #currencies.

Why use a private ledger ❓

▶️ Central banks and #governments must be able to mint and destroy #currencies.

2/8 What we've been saying: banks and the consumer are no longer the problem. #Banks are the new utilities.

3/8 The #government and business sector are the problems. Businesses have seen record #debt and record low #tax rates help inflate margins to unsustainable levels.

The Nifty Financial Services Index, also known as the #FinNifty, is an index that tracks the performance of the financial services sector in India. @bbrijesh explains about the index in detail.

#FinNifty is an index that tracks the performance of the financial services sector in India, which includes #banks, #insurance companies, #housingfinance, and Non-Banking Financial Companies (NBFCs). #FinancialServicesSector #India

The financial services sector in India is one of the largest and most diverse in the world, and FinNifty provides a way to track the performance of this sector. #FinancialServicesSector #GrowthPotential

"Suicides shake India's broking community" News headlines in 2001.

Dalal Street saw people lose their jobs, leading brokerages lose trading rights & the 'Bombay Bull' broker, Ketan Parekh, facing fraud charges.

"The Same Gang is back"

#HindenburgReport #StockMarket #stocks

Dalal Street saw people lose their jobs, leading brokerages lose trading rights & the 'Bombay Bull' broker, Ketan Parekh, facing fraud charges.

"The Same Gang is back"

#HindenburgReport #StockMarket #stocks

"The Gujarat earthquake was rattling, but for many, their real earthquake came afterwards", a broker.

Many people who gambled with other people's funds, with their knowledge or without, could finally smell the money - but unfortunately it was the smell of money burning.

Many people who gambled with other people's funds, with their knowledge or without, could finally smell the money - but unfortunately it was the smell of money burning.

But the better prices are too late for the players who lost so much, and thought DEATH was their only option.

Markets recovered later, Regulators vowed to tighten up trading rules & a parliamentary panel to investigate the sell-offs.

"But they were good at it,

N they are now"

Markets recovered later, Regulators vowed to tighten up trading rules & a parliamentary panel to investigate the sell-offs.

"But they were good at it,

N they are now"

🇺🇸⚡️In the United States, there is a trend of contraction in the money supply despite record growth in lending.

1/6

#usa #finance #money #dollar #ukrainewar #economy #liquidity #banks #banking #fed #ustreasury

1/6

#usa #finance #money #dollar #ukrainewar #economy #liquidity #banks #banking #fed #ustreasury

This is due to the critical gap between weighted average deposit rates, which are below 1%, and the current market rate for government and corporate bonds.

2/6

2/6

This gap creates an incentive for people to redistribute the money supply into alternative financial instruments. And the decrease in the intensity of distribution of helicopter money from the US Treasury & the Fed reducing the balance sheet also contribute to this trend.

3/6

3/6

ரொம்ப நாளாக எழுதணும் நினைத்த த்ரெட்.

இன்று நேரம் அமைந்ததால் பதிவிடும் வாய்ப்பு கிடைத்தது.

" கடன்"இந்த வார்த்தை பலரின் வாழ்க்கையில் மிகவும் பரிச்சயமான வார்த்தை (1)

#கடன்

இன்று நேரம் அமைந்ததால் பதிவிடும் வாய்ப்பு கிடைத்தது.

" கடன்"இந்த வார்த்தை பலரின் வாழ்க்கையில் மிகவும் பரிச்சயமான வார்த்தை (1)

#கடன்

"Bitcoin is a system based on rules not rulers"

Recently, RBI Governor called for a ban on crypto

But, the promise of Crypto and Bitcoin is stronger than ever 👇👇

#bitcoin #crypto #RBI #money #commodity #banks #gold

cryptobeans.beehiiv.com

Recently, RBI Governor called for a ban on crypto

But, the promise of Crypto and Bitcoin is stronger than ever 👇👇

#bitcoin #crypto #RBI #money #commodity #banks #gold

cryptobeans.beehiiv.com

Let's look at the The History of Money to understand more.

From Barter to Fiat Currency to Cryptocurrency

1/ It all started with the need for trade....

From Barter to Fiat Currency to Cryptocurrency

1/ It all started with the need for trade....

🔸In ancient times, people used the barter system to trade goods and services.

🔸This means that they would directly exchange one item for another without using a medium of exchange, such as money.

2/ But barter is not scalable....

🔸This means that they would directly exchange one item for another without using a medium of exchange, such as money.

2/ But barter is not scalable....

Wondering about latest news 📰 in the #realestate #housingmarket 🏡💵 with pricing, #interestrates, etc.? Here's an updated thread for January 23' that includes all the latest macro/market data... 🧵/👇🏼

📊h/t @RealEstateCafe

📊h/t @RealEstateCafe

1/🧵 "44% year/year drop in @MBAMortgage

Purchase Index is largest decline on record." 🇺🇸📉

📊h/t @LizAnnSonders @bloomberg

#realestate #realestateinvesting #FederalReserve #interestrates #macro #realator #mortgagerates

Purchase Index is largest decline on record." 🇺🇸📉

📊h/t @LizAnnSonders @bloomberg

#realestate #realestateinvesting #FederalReserve #interestrates #macro #realator #mortgagerates

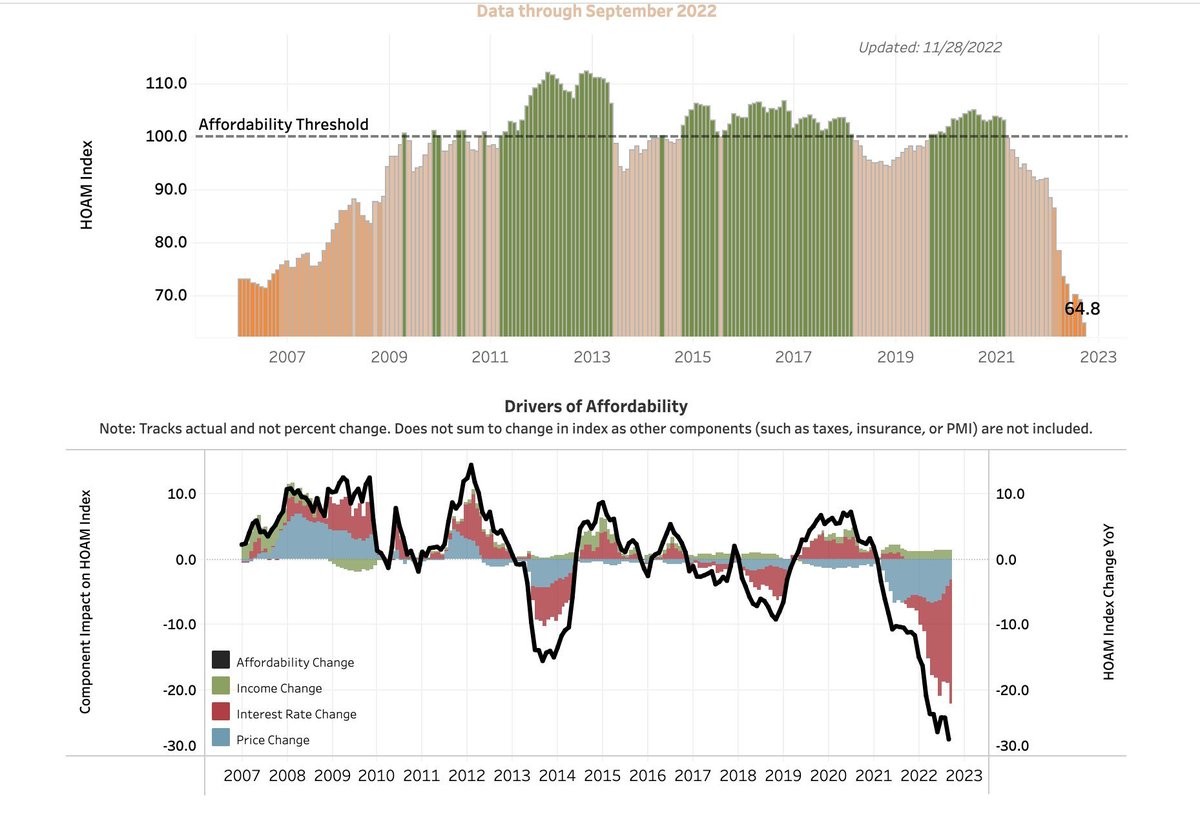

2/🧵 Affordability "threshold" for housing, via the @AtlantaFed 🏡

📊h/t @NewsLambert

#realestate #realestateinvesting #FederalReserve #interestrates #macro #realator #mortgagerates

📊h/t @NewsLambert

#realestate #realestateinvesting #FederalReserve #interestrates #macro #realator #mortgagerates

(1/11) Is #Blockchain an enabler for sustainable future? Fasten your seatbelts as we’re all set to embark on a deep topic voyage. 🧵 Read more at:

medium.com/zignaly/llts72…

medium.com/zignaly/llts72…

(2/11) 💻 #Blockchain is a shared #ledger or repository that computer #subnets may access. It is similar to a #database, but it is secure and #decentralized. #Cryptocurrency systems like #Bitcoin use blockchains to keep a secure and decentralized database of transactions. 🔐

(3/11) 💡Blockchain eliminates a #centralized command structure, allowing #data sharing among parties without needing a centralized system or administrator. It is #secure and #data can't be corrupted or destroyed by anyone with access to the main database. #FinancialTechnology