Discover and read the best of Twitter Threads about #bitcointrading

Most recents (3)

Bitcoin remains within range, after starting corrective process. Even falling to fibo 61.8% ($8750) we would still maintain bullish structure. RSI and MACD in neutral zones, between 50 and 0 points respectively.

#Bitcoin #BTC #bullish #coinbase #binance #bitcointrading

#Bitcoin #BTC #bullish #coinbase #binance #bitcointrading

Update:

Time to short enter Bitcoin?bearish divergences in RSI and MACD in 1D. Target $10,100 got. Range $9,600 - $9,700 (bullish guideline) 1stsupport. Dominance compared to falling alts and with bearish crosses.

#Bitcoin #Binance #BTC #TradingView

Time to short enter Bitcoin?bearish divergences in RSI and MACD in 1D. Target $10,100 got. Range $9,600 - $9,700 (bullish guideline) 1stsupport. Dominance compared to falling alts and with bearish crosses.

#Bitcoin #Binance #BTC #TradingView

Bitcoin sigue dentro de rango, tras iniciar proceso correctivo. Aun cayendo hasta fibo 61,8% ($8750) seguiríamos manteniendo estructura alcista. RSI y MACD en zonas neutrales, entre los 50 y 0 puntos respectivamente.

#Bitcoin #BTC #bullish #binance #coinbase #bitcointrading

#Bitcoin #BTC #bullish #binance #coinbase #bitcointrading

Actualización:

¿Momento de entrar en corto en Bitcoin?divergencias bajistas en RSI y MACD en 1D.Objetivo $10.100 cumplido. Rango $9.600 - $9.700 (directriz alcista) 1ºsoporte. Dominancia respecto a las alts en caída y con cruces bajistas.

#Bitcoin #BTC #Binance #TradingView

¿Momento de entrar en corto en Bitcoin?divergencias bajistas en RSI y MACD en 1D.Objetivo $10.100 cumplido. Rango $9.600 - $9.700 (directriz alcista) 1ºsoporte. Dominancia respecto a las alts en caída y con cruces bajistas.

#Bitcoin #BTC #Binance #TradingView

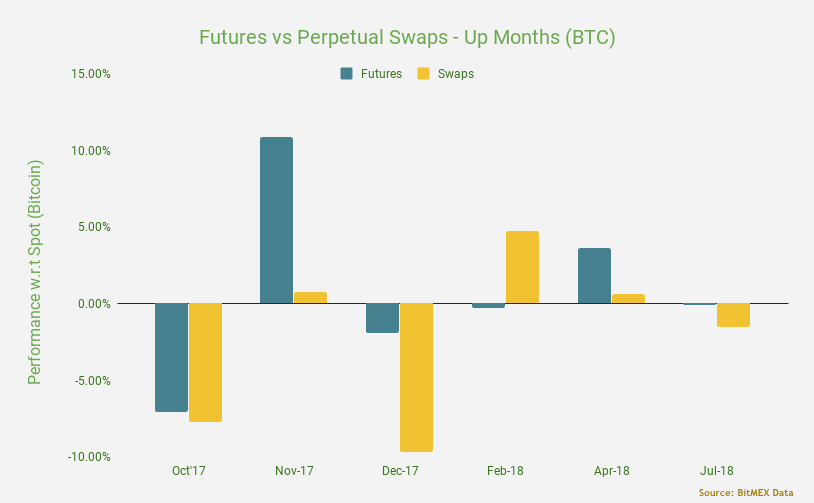

Perpetual Swaps are expensive to trade!

We compared Futures & Perpetual Swaps to see which is better for #trading

Futures outperformed Swaps in 13 out of 16 months. Irrespective of #bitcoin performance.

GREEN: $BTC monthly returns were +ve

RED: $BTC yielded -ve monthly returns

We compared Futures & Perpetual Swaps to see which is better for #trading

Futures outperformed Swaps in 13 out of 16 months. Irrespective of #bitcoin performance.

GREEN: $BTC monthly returns were +ve

RED: $BTC yielded -ve monthly returns

In DOWN months, i.e. where $BTC monthly returns were negative shorting via Futures would've yielded higher returns

This underperformance makes Perp. Swaps poor instrument for hedging

“Hedging Bitcoin balance by shorting 1x Perpetual Swap” would've cost you roughly 2% per month

This underperformance makes Perp. Swaps poor instrument for hedging

“Hedging Bitcoin balance by shorting 1x Perpetual Swap” would've cost you roughly 2% per month

For UP months ( where $BTC monthly returns were positive) a levered Long in Futures would have given higher returns.

Funding eats away from the returns of a trade!

#cryptocurrency #cryptos

Funding eats away from the returns of a trade!

#cryptocurrency #cryptos