Discover and read the best of Twitter Threads about #charliemunger

Most recents (17)

The more I read, the more I'm amazed about Charlie Munger. Today, I'd like to write about the mental model of "Thought Experiment". Charlie Munger is the right-hand man of Warren Buffet and he's known for his practical and straightforward approach to investing.

2/15: Thought experiments involve imagining a situation and then examining the possible consequences of that situation. Munger believes that doing this can help us make better decisions and avoid costly mistakes.

3/15: For example, let's say you're considering investing in a new technology startup. A thought experiment would involve imagining the best-case and worst-case scenarios for that investment.

Today I'd like to discuss about the mental model "Map is not the territory."

As Charlie Munger says, "The map is not the territory, and if you start thinking that the map is the territory, you will pay a big price for that."

#MentalModel #CharlieMunger

As Charlie Munger says, "The map is not the territory, and if you start thinking that the map is the territory, you will pay a big price for that."

#MentalModel #CharlieMunger

2/ This means that the way we perceive and interpret the world may not always match reality. A map is just a representation of reality and it's important to keep that in mind when making decisions.

#PerceptionVsReality

#PerceptionVsReality

3/ Charlie Munger and Warren Buffet used this mental model to evaluate their investments. They would always look beyond the numbers and do a deep dive into the company's culture, management, and future prospects.

#InvestmentTips

#InvestmentTips

Why do I agree w/ #CharlieMunger? Crypto supply isn't regulated by govt. How much of our inflation bubble was caused by massive unregulated infusion of weird M2 infusions of bitcoin into the economy? And how much recession fear is from an unregulated bust? fortune.com/2023/02/02/ban…

#M2= Money in circulation on Federal Reserve statistical tables. The Federal Reserve uses the indicator to control of the supply of money. #Crypto wreaks havoc with the reliability of this number. On the front end, it created explosive growth that helped trigger inflation. (2)

On the back end, with the #CryptoCrash, it helped to cause an un-measured contraction in the supply of money (M2). Are you happy that a chunk of this key economic tool is now in the hands of con artists, gamblers & dark money launderers? (3)

Warren Buffett & Charlie Munger together run Berkshire Hathaway, the multinational conglomerate worth over $500 Billion. These are the top 10 lessons that have helped them become legendary investors.

#lessons #warrenbuffett #charliemunger

#lessons #warrenbuffett #charliemunger

Mamaearth IPO aims for 1000x multiple of profits - will investors take the bait? - Some Fun Facts From Internet

1/ Last valuation for Mamaearth was $1.2 billion in January 2022. The company is now seeking a $3 billion valuation for its upcoming IPO.

2/ Shilpa Shetty's 0.75Cr investment in Mamaearth could be worth 80Cr if the company goes public at its target valuation of ~$2Bn.

1) Merhaba, uzun bir akışa hoş geldiniz.😱💁🏻♂️

2023 portföy planlarını yapmaya başlayalı 3 hafta kadar oldu ve bu ay, gerek Twitter gerekse de blog yazılarımda hazırlayacağım içeriği paylaşmıştım.

Bugün, ikinci maddede yer alan #abonelikler konusu var.

2023 portföy planlarını yapmaya başlayalı 3 hafta kadar oldu ve bu ay, gerek Twitter gerekse de blog yazılarımda hazırlayacağım içeriği paylaşmıştım.

Bugün, ikinci maddede yer alan #abonelikler konusu var.

2) Öncelikle abonelikler konusunda yaptığım seçimlerin tamamen kişisel, bu paylaşımın da bilgi aktarımı amaçlı olduğunu belirtmek isterim.

Herhangi bir kurum, kuruluş, kişi ya da yayın ile reklam, iş birliği vb. anlaşmam yoktur. Bu yılki başlıca aboneliklerim şöyledir:

Herhangi bir kurum, kuruluş, kişi ya da yayın ile reklam, iş birliği vb. anlaşmam yoktur. Bu yılki başlıca aboneliklerim şöyledir:

3) Ekonomi ve finans dünyasında çok sayıda program, içerik üreticisi ve veri sunucusu var. Haber akışından finansal tablolara, anlık fiyat verilerinden detaylı analiz platformlarına, her gün de gelişen önemli bir lükse sahibiz. Ancak seçerken iki kere düşünmek gerekiyor.

Charlie, Charlie, Charlie, damn dude, c'mon now, this is not a good look for you. Let's break this anti#bitcoin quote down. "It's stupid because it's still likely to go to zero" - have you seen the massive effort people are putting into this monetary system around the world?

The bitcoin tech is disrupting industry after industry including banking, retail, farming, social justice. It's value proposition goes way beyond a number on a balance sheet. It's inherent value of immutability, fungability and censorship resistance is growth oriented.

Charlie says "It's evil because it undermines the Federal Reserve System". That's not evil, that's smart. The Fed is a failed economic model run by elites that incentivizes riskier asset investment and arguably war. If War is evil, the financial system that props it up is evil.

Frage in die Runde wer ist bzw war aus Euer Sicht der beste Vorstand einer AG und wieso ?

Für mich akt @RudigerWeng wegen seiner Leidenschaft und seinen Einsatz für die Gesellschaft dazu natürlich @WarrenBuffett und #CharlieMunger für den konsequenten Weg.

Bitte beachten Ich haben von diesen Gesellschaften auch selber Aktien nach selber deine Analyse dazu und Kauf nicht einfach so. Keine Beratung sowie Haftung oder ein Kauf; Verkauf; Halten einfach meine Meinung zu der Person

Human Capital. Sourcing, sorting, winning and retaining great talent is at the top of every founder's to-do list,

We spent some time with @meghanared and @digmonster uncovering hard won lessons from @nerdwallet @zynga @loom @framer

We spent some time with @meghanared and @digmonster uncovering hard won lessons from @nerdwallet @zynga @loom @framer

1/ Mission matters - In the early stages, people are joining because they believe in the vision of the future that you are articulating; too often founders jump straight into recruiting/interview mode before the candidate has even opted-into a process

2/Don't try to shortcut the upfront work of scoping the role - what do you envision this person doing? Early conversations are much more interactive in articulating this and getting buy-in than one might expect

Some initial thoughts on the #berkshirehathaway annual report.

Random fact, the cover is black for the first time since 2005. Prior to that, 1988 featured a black cover with some funky neon blue.

$BRK $BRKA $BRKB #warrenbuffett #charliemunger

Random fact, the cover is black for the first time since 2005. Prior to that, 1988 featured a black cover with some funky neon blue.

$BRK $BRKA $BRKB #warrenbuffett #charliemunger

Buffett points out that Berkshire paid $3.3 billion or 8/10ths of ALL federal corporate income tax in the United States. That's some $9 million per day to the US Treasury.

Float amounts to an incredible $147 billion. Better still, because of share repurchases, the figure is up 25% over the past two years to just shy of $100k per $BRKA. That's $66 per $BRKB share of (essentially, and for now) better-than-cost-free money working for shareholders

1/ REGATEA CON EL PER o ¡NO TE OLVIDES DE COMPRAR BARATO!

En 1971 #WarrenBuffet se enteró de que #SeesCandies estaba en venta e inmediatamente telefoneó a #CharlieMunger para que le hablara de la empresa, pues éste la conocía muy bien.

Va HILO sobre el ARTE DE REGATEAR

👇

En 1971 #WarrenBuffet se enteró de que #SeesCandies estaba en venta e inmediatamente telefoneó a #CharlieMunger para que le hablara de la empresa, pues éste la conocía muy bien.

Va HILO sobre el ARTE DE REGATEAR

👇

🔝Mis 3 tuits más vistos de la semana🧐

1⃣ Los problemas de una cartera concentrada o una historia sobre un joven #CharlieMunger y cómo lidió con una volatilidad infernal. Casi 90.000 impresiones ha tenido este tuit. Difícil que lo iguale en el futuro.

1⃣ Los problemas de una cartera concentrada o una historia sobre un joven #CharlieMunger y cómo lidió con una volatilidad infernal. Casi 90.000 impresiones ha tenido este tuit. Difícil que lo iguale en el futuro.

2⃣ #TimCook, al poco de hacerse con las riendas de #Apple, llamó al viejo #WarrenBuffett en busca de consejo: ¿qué hago con esta montaña de efectivo? Este "se non è vero, è ben trovato" ha conseguido casi 49.000 impresiones. No está mal para un FAKE.

3⃣ "Rentabilidad Fondos de Inversión en España 2006-2021", el paper del Prof Pablo Fernández donde analiza la performance de los #fondosdeinversión españoles con una trayectoria de ¡15 años! Largo plazo. Casi 48.000 visitas. SPOILER: gana la gestión...🥳

1. ¿VOLATILIDAD? PARA VOLATILIDAD, LA DE CHARLIE MUNGER. ¿Asustado por los recientes vaivenes del mercado? ¡Anda ya! ¿Dices tú de mili? Para mili la de #CharlieMunger. Ahora le adoráis y repetís sus mantras pero suerte para él que en sus tiempos no existía #fintwit.

BREVE HILO👇

BREVE HILO👇

Hoy, Día Internacional del Libro, vamos a crear un hilo con los libros recomendados por los grandes gestores Ray Dalio, Seth Klarman, Charlie Munger, Joel Greenbaltt, Bill Ackman, Michael Burry y Jim Chanos #DíaDelLibro #23deAbril 👇

There aren't many people like #CharlieMunger. In addition to being one of the world's richest people, Munger is also considered to be one of its greatest thinkers.

Here's a collection of some of his best #advice, which can help you build your own fortune ― and live a good life.

Here's a collection of some of his best #advice, which can help you build your own fortune ― and live a good life.

1. "Spend each day trying to be a little wiser than you were when you woke up."

Munger is a voracious reader. He spends most of his day reading and thinking, all the while strengthening and expanding his mental models across a wide variety of academic disciplines.

#charliemunger #BerkshireHathaway

#WarrenBuffett

#Apple

Why #WarrenBuffett missed the transformation from Hard assets to Soft assets , Why the legend never understood the transition to Software and it’s future and he underestimated the Internet to a very vast extent

#WarrenBuffett

#Apple

Why #WarrenBuffett missed the transformation from Hard assets to Soft assets , Why the legend never understood the transition to Software and it’s future and he underestimated the Internet to a very vast extent

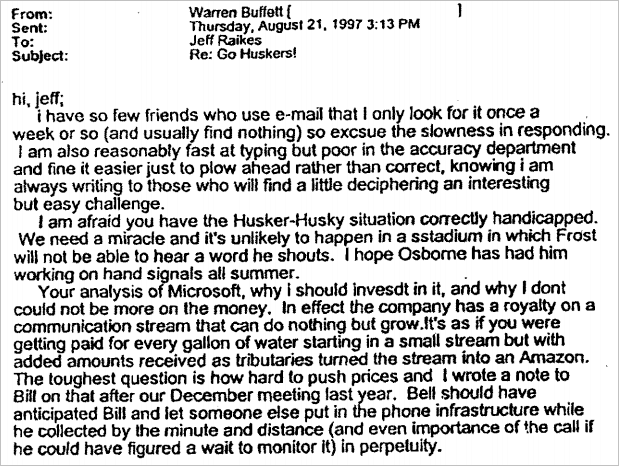

It was 1997 and Warren was offered an opportunity to buy Microsoft stock and he said he believes MS story is pretty good in the short term , but he doesn’t see a great future in another 2 decades.

MS was trading at $16-18 at that times and has split thrice since then...

MS was trading at $16-18 at that times and has split thrice since then...

Berkshire purchased GEICO in 1995-96. It came to Warren’s attention that GEICO was paying $10 to search engine Google for every mouse click on GEICO ad

The cost of this service provided by Google was NIL

Warren couldn’t read the thesis behind this kind of income Google generated

The cost of this service provided by Google was NIL

Warren couldn’t read the thesis behind this kind of income Google generated

Acabo de terminar #Buffettogia de Mary Buffett y David Clark. Me había comprometido a dar alguna idea sobre el libro. Así que ahí van algunas notas rápidas #Buffett #Kindle #LecturasRecomendadas #Biblioteca (1/14)

El libro lo escribe la EXnuera de #Buffett, él no tiene nada que ver (con las #LettersToShareholders ya tiene suficiente). Y no, no hay detalles escabrosos, le deja bastante bien. Alguna anécdota doméstica es ilustrativa #NoBelenEstebanMoment (2/14)

El estilo de #Buffett lo denomina inversión desde la perspectiva empresarial. Y lo desagrega en 7 puntos (3/14)