Discover and read the best of Twitter Threads about #crude

Most recents (24)

Future of Russian Oil: 5 Key Trends

#Russia's oil industry transitions from chaos to relative stability in 2023, with India emerging as the largest seaborne buyer. Let's explore the industry's outlook for the next 2-3 years, from refinery upgrades to a shadow tanker fleet.👇

#Russia's oil industry transitions from chaos to relative stability in 2023, with India emerging as the largest seaborne buyer. Let's explore the industry's outlook for the next 2-3 years, from refinery upgrades to a shadow tanker fleet.👇

Russia's refinery upgrades increase gasoline production

Despite overall throughputs not reaching pre-sanction levels, there's a hidden growth story. Jan-April 2023 saw record-high monthly #gasoline production. Dec 2022-Feb 2023 saw the highest-ever production rate of 124 kt/day.

Despite overall throughputs not reaching pre-sanction levels, there's a hidden growth story. Jan-April 2023 saw record-high monthly #gasoline production. Dec 2022-Feb 2023 saw the highest-ever production rate of 124 kt/day.

Operational setbacks for refinery upgrades

Nizhny Novgorod refinery faces setbacks due to fire. Moscow, Yaroslavl, Novoshakhtinsk refineries to halt fuel #oil output by 2025-2026, reducing production by 150 kbd. 🇷🇺-🇺🇦 conflict hinders Kirishi refinery's modernization.

Nizhny Novgorod refinery faces setbacks due to fire. Moscow, Yaroslavl, Novoshakhtinsk refineries to halt fuel #oil output by 2025-2026, reducing production by 150 kbd. 🇷🇺-🇺🇦 conflict hinders Kirishi refinery's modernization.

Last week the latest #SalmanKhan starrer arrived in theatres, and the reviews seem mixed, depending whether one is a #Bhai fan or a critic. Meanwhile, what is the review on the market’s performance last week? Let’s break out the popcorn and watch. (1/8)

#Sensex and #Nifty dropped by over 1.1%. #RBI representatives remained optimistic about India’s #domesticgrowth during the monetary policy committee meeting, despite concerns about uneven growth in the economy & weak demand from outside India. (2/8)

EIA came out with their Short Term Energy Outlook

- These are the largest revisions in key data points impacting oil markets today. Although many of the adjustments are small, it shows the directional bias the EIA sees with its forecast models - a thread

#oott #oilandgas #WTI

- These are the largest revisions in key data points impacting oil markets today. Although many of the adjustments are small, it shows the directional bias the EIA sees with its forecast models - a thread

#oott #oilandgas #WTI

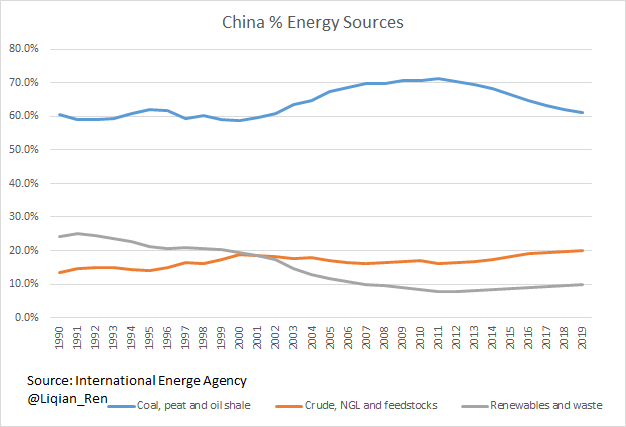

With China showing more signs of opening, oil demand was revised up 1% (160 mb/d). Is there more oil demand revisions to come? Possibly. Expected crude demand in 2023 is still only up 5% to 15.8 mln b/d (from 14.4 mln b/d in 2020) #oott

U.S. oil production in 2024 was lowered 1.4% (150 mb/d) - with much of this oil supply decline near the back-end of the year. As earning season progresses (and capex budgets are revised), we may see more estimate revisions to come #crude #permian #eagleford #midland #bakken

#Siionisti'en bravuuri on junailla #goyim'en tuhoa niiden omalla kustannuksella.

#WEF -ideologia lahtaa yritykset ...kaasulla.

#Gasgrid Imatra #Räikkölä vs. #Korsakov.

- Korsakov on #LNG -satamakaupunki #Venäjä'n

#Sahalin'in alueella.

fi.m.wikipedia.org/wiki/Korsakov_…

#WEF -ideologia lahtaa yritykset ...kaasulla.

#Gasgrid Imatra #Räikkölä vs. #Korsakov.

- Korsakov on #LNG -satamakaupunki #Venäjä'n

#Sahalin'in alueella.

fi.m.wikipedia.org/wiki/Korsakov_…

‘#India buying #Russian #crude oil is good economics, don’t bring #politics into it’ | Jan 12

- India is among the world's top crude oil importers. The Asian nation has been largely purchasing Russian oil

firstpost.com/world/india-bu…

- India is among the world's top crude oil importers. The Asian nation has been largely purchasing Russian oil

firstpost.com/world/india-bu…

#EUSanctions #Hoax #EnergyWar

#India’s breaking all records for buying #Russian #oil, but who is the surprise buyer? | Jan 15

- The #US Is Snapping Up Refined #PetroleumProducts From India Made From #RussianCrude Oil

telegraphindia.com/business/india…

#India’s breaking all records for buying #Russian #oil, but who is the surprise buyer? | Jan 15

- The #US Is Snapping Up Refined #PetroleumProducts From India Made From #RussianCrude Oil

telegraphindia.com/business/india…

Recent article in an online publication made some comments on Crude #oilimports from Russia & raised questions about the benefits of recent decisions of the Govt. It is essential to bring #clarity to the issue through this thread (1/9) @PMOIndia @HardeepSPuri @Rameswar_Teli

Claim of Indian refiners reselling Russian crude back to Europe is based on a link which no longer exists. Extrapolation of unvalidated 30 day data (May 2022) to the whole year lacks the necessary economic rigour (2/9)

#OilPolicy @PMOIndia @HardeepSPuri @Rameswar_Teli

#OilPolicy @PMOIndia @HardeepSPuri @Rameswar_Teli

India and Russia have been all-weather friends and trade partners who have significant bilateral trade. The composition of the #tradebasket between the countries, varies from time to time, purely on #economicfactors (3/9) @PMOIndia @MEAIndia @DrSJaishankar @HardeepSPuri

US inventories of gasoline, diesel, and jet fuel are at dangerously low levels. Wind farms and solar panels aren’t going to help us out of this mess. Biden just green-lighted importing additional production from Venezuela (Amnesty International comments below). #OOTT #NoPlan

‘For years, Amnesty International has documented and denounced the policy of repression implemented by Nicolas Maduro’s government in Venezuela, which aims to silence critics and dissent. Crimes under international law and human rights violations, including politically…

motivated arbitrary detentions, torture, extrajudicial executions and excessive use of force, have been systematic and widespread, and may therefore amount to crimes against humanity.’ When all we have to do is allow the Keystone Pipeline to be built between Canada and the 🇺🇸.

A thread – Our takeaways from the Dallas Fed Energy Survey (and how sentiment has changed from prior surveys)

Costs: Expected Finding & Development costs have slowed. Only 66% of Oil & Gas companies surveyed expect costs to rise (vs 72% last quarter) #oott #WTI #oilgas #invest

Costs: Expected Finding & Development costs have slowed. Only 66% of Oil & Gas companies surveyed expect costs to rise (vs 72% last quarter) #oott #WTI #oilgas #invest

A thread –Dallas Fed Energy Survey

The drop in WTI has ‘Company Outlooks’ falling quite hard from prior quarters – with only 39% reporting a better outlook (vs. a high of 82% seeing a positive outlook in 1Q22). #oott #oilandgas #WTI

The drop in WTI has ‘Company Outlooks’ falling quite hard from prior quarters – with only 39% reporting a better outlook (vs. a high of 82% seeing a positive outlook in 1Q22). #oott #oilandgas #WTI

Thread (1/5): EIA Short-Term Oil Outlook Highlights

A top concern we hear from investors is the "Backwardation in the oil strip". This price reflects a recovery in crude inventories but as the EIA revisions show today, they’re back to revising inventory levels lower again #oott

A top concern we hear from investors is the "Backwardation in the oil strip". This price reflects a recovery in crude inventories but as the EIA revisions show today, they’re back to revising inventory levels lower again #oott

Thread (2/5): EIA Short-Term Oil Outlook Highlights

Despite recession fears & high gasoline prices, global oil expected consumption was left essentially unchanged (OECD countries revised 0.2% lower; offset by non-OECD countries higher) #crude

Despite recession fears & high gasoline prices, global oil expected consumption was left essentially unchanged (OECD countries revised 0.2% lower; offset by non-OECD countries higher) #crude

Thread (3/5): EIA Short-Term Oil Outlook Highlights

Although no changes were made m/m, oil supply has still been revised down from Jan forecasts. This is despite WTI prices moving higher since then. Overall, shows the discipline with producers and not rushing back to drill #oott

Although no changes were made m/m, oil supply has still been revised down from Jan forecasts. This is despite WTI prices moving higher since then. Overall, shows the discipline with producers and not rushing back to drill #oott

#Oil #ropa #crude #ban #USA #export

1/6

Dlaczego rozważany przez Biały Dom ban eksportowy na ropie jest pomysłem niezwykle dziwnym?

Zakaz eksportu nie uwzględnia złożonej sieci globalnego rynku ropy naftowej. Nie każdy kraj produkuje ropę naftową lub produkty rafinowane takiej

1/6

Dlaczego rozważany przez Biały Dom ban eksportowy na ropie jest pomysłem niezwykle dziwnym?

Zakaz eksportu nie uwzględnia złożonej sieci globalnego rynku ropy naftowej. Nie każdy kraj produkuje ropę naftową lub produkty rafinowane takiej

2/6

jakości, jaką sam konsumuje. Amerykański sektor rafineryjny jest najbardziej zaawansowany na świecie, co pozwala mu przetwarzać tanią ciężką ropę naftową z Ameryki Środkowej i Kanady w wysokogatunkową benzynę. Zdolność Ameryki do sprowadzania taniej ropy naftowej i eksportu

jakości, jaką sam konsumuje. Amerykański sektor rafineryjny jest najbardziej zaawansowany na świecie, co pozwala mu przetwarzać tanią ciężką ropę naftową z Ameryki Środkowej i Kanady w wysokogatunkową benzynę. Zdolność Ameryki do sprowadzania taniej ropy naftowej i eksportu

3/6

wysokowartościowych produktów rafinowanych przyczynia się do nadwyżki handlowej US. Rafinerie są tak skonfigurowane, aby przetwarzać ropę naftową określonego gatunku - lekką, słodką lub ciężką, kwaśną, albo coś pomiędzy - aby zmaksymalizować jej wydajność. O tym, czy podaż

wysokowartościowych produktów rafinowanych przyczynia się do nadwyżki handlowej US. Rafinerie są tak skonfigurowane, aby przetwarzać ropę naftową określonego gatunku - lekką, słodką lub ciężką, kwaśną, albo coś pomiędzy - aby zmaksymalizować jej wydajność. O tym, czy podaż

Volatility on first leg down 31;

Volatility on retest 27

Volatility on retest 27

Tail 1

96.73

96.73

Just in | #Inflation in India's wholesale prices hit a 4 month high of 14.55% in March, from 13.11% in February, driven by accelerating price rise across all categories of goods, with fuel and power as well as primary articles driving most of the gains., reports @tragicosmicomic

While the wholesale food prices index inched up marginally from 8.47% in February to 8.71% in March, manufactured products inflation moved up from 9.84% to 10.71%. However, the month-on-month change in the index for manufactured goods was sharper at 2.31%.

Fuel and power inflation surged to 34.52% in March, compared to 31.5% in February, while inflation in primary articles accelerated from 13.39% to 15.54%.

#Asian #shares climb, oil drops ahead of Russia-Ukraine peace talks | 20 min ago

- #Trading has remained choppy as investors try to gauge what’s next for inflation and the global economy as the repercussions of Russia-Ukraine conflict continue to play out.

trtworld.com/business/asian…

- #Trading has remained choppy as investors try to gauge what’s next for inflation and the global economy as the repercussions of Russia-Ukraine conflict continue to play out.

trtworld.com/business/asian…

Russian #Crude Continues To Flow Despite Harsh Sanctions | Mar 28

- Buyers in #China and #India have found ways to circumvent Western sanctions

- Russia continues to make a large profit per barrel, even with a $30 per barrel discount on its crude

oilprice.com/Energy/Crude-O… #oilprice

- Buyers in #China and #India have found ways to circumvent Western sanctions

- Russia continues to make a large profit per barrel, even with a $30 per barrel discount on its crude

oilprice.com/Energy/Crude-O… #oilprice

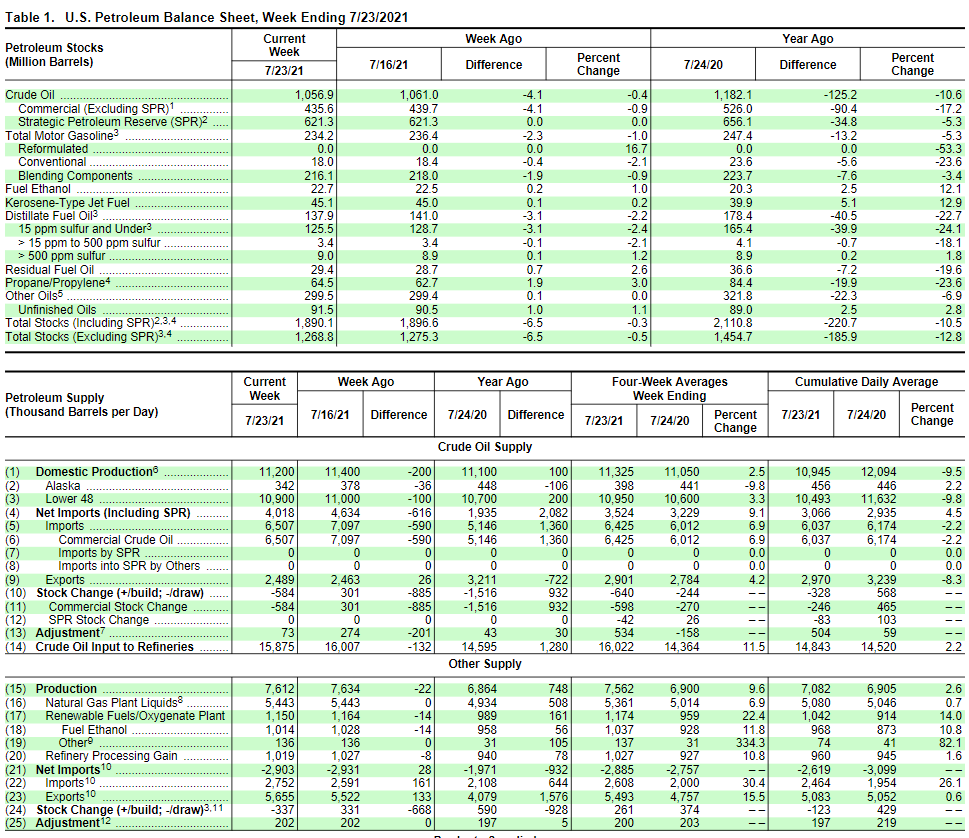

#EIA #oil data: #crude -1.9 mln bbls; at 411.6 mln; -13% v 5-yr avg for period

#gasoline -1.4 mln bbls; +1% v 5-yr avg

#distillate -5.2 mln bbls; -18% v 5-yr avg

#propane -1.6 bbls; -21% v 5-yr avg

Total commercial stocks -8.1 mln bbls

#OOTT #OPEC #diesel #shipping #energy

#gasoline -1.4 mln bbls; +1% v 5-yr avg

#distillate -5.2 mln bbls; -18% v 5-yr avg

#propane -1.6 bbls; -21% v 5-yr avg

Total commercial stocks -8.1 mln bbls

#OOTT #OPEC #diesel #shipping #energy

Quick thread on 2022, Ukraine and India

Q: Why does it feel like everything's falling apart since Ukraine ?

A: Things were already pretty bruised. Ukraine has ripped the band-aid off 1/n

Link to my story : thewire.in/economy/the-uk…

#UkraineRussianWar #India @thewire_in

Q: Why does it feel like everything's falling apart since Ukraine ?

A: Things were already pretty bruised. Ukraine has ripped the band-aid off 1/n

Link to my story : thewire.in/economy/the-uk…

#UkraineRussianWar #India @thewire_in

Inflation is now a full-blown problem. Estimates indicate that EVEN if the central government were to cut fuel taxes average CPI inflation for FY’23 could shoot past the RBI’s plimsol line of 6.0%. #inflation #Crude #India #UkraineRussianWar

A short thread on Crude again. Aside from the jokes about filling your tanks now (really solves nothing), the problem with crude is not that retail prices will rise at $115. That is happening worldwide. 1/n

#Crude #PriceHike #inflation

#Crude #PriceHike #inflation

The problem is that

1. Election tactics will squeeze a very large increase into a very short window causing stress to people

2. What have we done with policy? Last time crude was $100, then RBI head Raghuram Rajan suggested deregulating diesel - nothing done . 2/n

#Crude

1. Election tactics will squeeze a very large increase into a very short window causing stress to people

2. What have we done with policy? Last time crude was $100, then RBI head Raghuram Rajan suggested deregulating diesel - nothing done . 2/n

#Crude

3. Despite all our chest thumping, domestic oil production has been DECLINING.India’s crude oil production fell by 5.2 % and natural gas production by 8.1 % in FY21 . Ageing wells, not enough tech upgrade, no change in policies like cess.

#Crude #PriceHike #inflation

#Crude #PriceHike #inflation

Alright, this one’s for all of the price chasers out there that are wondering what’s been happening with the Energy industry.

Here’s the story.

🧵🪡

Here’s the story.

🧵🪡

Let’s start in 2014.

After rising over 10% in the first half of the year, oversupply caused petroleum prices to slip in July. With growing production from both the Permian and abroad, the crude index continued to fall, down 51% by January 2015.

bls.gov/opub/btn/volum…

After rising over 10% in the first half of the year, oversupply caused petroleum prices to slip in July. With growing production from both the Permian and abroad, the crude index continued to fall, down 51% by January 2015.

bls.gov/opub/btn/volum…

In the years that followed, many people’s attention turned to climate change. The idea of peak oil consumption & society becoming carbon neutral caught on fast.

While spot prices went sideways, the rotation out of energy companies continued.

While spot prices went sideways, the rotation out of energy companies continued.

#China Jan -Sept. imports rise 22.6% y/y and Jan.-Sept. exports +22.7% y/y in yuan terms.

#trade #import #export #economy 🇨🇳

#trade #import #export #economy 🇨🇳

China's General Customs' Jan-Sept Import Data: (YoY)

#crude oil imports fall 6.8% y/y to 387 mln tonnes;

#natgas imports rise 22. 2% y/y to 89.85 mln tonnes;

#ironore imports fall 3% y/y to 842 mln tonnes;

#copper imports 4.02 mln tonnes, down 19.5% y/y.

#OOTT #trade #import🇨🇳 🇺🇸

#crude oil imports fall 6.8% y/y to 387 mln tonnes;

#natgas imports rise 22. 2% y/y to 89.85 mln tonnes;

#ironore imports fall 3% y/y to 842 mln tonnes;

#copper imports 4.02 mln tonnes, down 19.5% y/y.

#OOTT #trade #import🇨🇳 🇺🇸

In the first three quarters of this year, #China's #exports reached 15.55 trillion yuan, up 22.7% y/y and #imports reached 12.78 trillion yuan, up 22.6% y/y.

Foreign trade imports and exports have achieved positive year-on-year growth for five consecutive quarters.

#commodities

Foreign trade imports and exports have achieved positive year-on-year growth for five consecutive quarters.

#commodities

#Crude down 5% in the last few days. Crude prices have been correcting over the last few days by around 5% from its recent high of $75.4 on Wednesday. This comes on the back of press reports quoting #OPEC+ sources that the #UAE had reached a compromise. UAE's baseline...(1/4)

...output is expected to be increased to 3.65mbpd from the current 3.17mmbpd. This is broadly in line with recent market expectations. This eases the markets' read of a tight supply situation and helps soften the demand-supply balance, especially given the...(2/4)

...expectation of a demand pickup in H2 of 2021. Further on the Iranian wildcard we had written about in an earlier tweet, Iran is not expected to return to the negotiating table with the #US until it forms a new government, that is expected to take office...(3/4)

Does the #US10Y yield puzzle affect India? An earlier tweet covered the various angles to the US10Y yield puzzle. The perceived softness around #USgrowth appears to stand-out as a prominent reason. During the same time last week, we saw a sharp rise in the Indian 10Y...(1/12)

...yield to 6.18%. This appears to have been on the back of the #RBI's surprising (disappointing for traders/underwriters) choice of picking relatively illiquid papers for its new tranche of G-SAP 2.0. The announcement of a new 10Y benchmark paper auctioned on...(2/12)

...Friday, with a higher traded yield was another reason. Are the US and Indian bond markets related in anyway? The answer is an obvious yes. Given that the US is a key global driver, the #Fed's policy rates naturally push monetary policy of emerging markets and...(3/12)

1/n

Thread on Intermarket Relationship 1999-2021

Historical Correlation between #US30 #DowJones, #US100 #Nasdaq, #Gold #XAUUSD, #Brent #Crude, #copper #US10Y

1. US 30 / US 100 vs US 10Y

US30 / US100 was at ~2 multiple in 2000 and it is now at same level in 2021

Thread on Intermarket Relationship 1999-2021

Historical Correlation between #US30 #DowJones, #US100 #Nasdaq, #Gold #XAUUSD, #Brent #Crude, #copper #US10Y

1. US 30 / US 100 vs US 10Y

US30 / US100 was at ~2 multiple in 2000 and it is now at same level in 2021

2/n

Above chart shows that sole factor responsible for this anomaly is US 10Y rates

Rates were kept for real economy to recover, generation of jobs etc. however it has clearly backfired.

US Tech definitely does not deserve this kind of valuation

Above chart shows that sole factor responsible for this anomaly is US 10Y rates

Rates were kept for real economy to recover, generation of jobs etc. however it has clearly backfired.

US Tech definitely does not deserve this kind of valuation

3/n

The multiple of 2 in 2000 went to 9 in 2001 represents the US tech bubble burst.

In todays terms if 2 were to go to 9, Dow would be at 25000 and Nasdaq ~2700 or any such other level. It may not hit 9 since tech has much larger role to play today vs 2000,

The multiple of 2 in 2000 went to 9 in 2001 represents the US tech bubble burst.

In todays terms if 2 were to go to 9, Dow would be at 25000 and Nasdaq ~2700 or any such other level. It may not hit 9 since tech has much larger role to play today vs 2000,