Discover and read the best of Twitter Threads about #db

Most recents (24)

#Bahn #DB #BarrierefreieBahn #5Mai #Hublift #Rollstuhl #Mobilitätsservice #Behinderung

Der @ISL_eV rief zum Bahnfahren am 5. Mai, dem offiziellen Protesttag der Menschen mit Behinderungen, auf.

Diesem Ruf folgte ich gerne, da mir die Idee zur der Aktion sehr gut gefällt.

Der @ISL_eV rief zum Bahnfahren am 5. Mai, dem offiziellen Protesttag der Menschen mit Behinderungen, auf.

Diesem Ruf folgte ich gerne, da mir die Idee zur der Aktion sehr gut gefällt.

@ISL_eV Aus gesundheitlichen Gründen wurde es nur eine Fahrt zu Freunden nach Nürnberg, da ich wegen einer kleinen OP noch etwas leidend bin.

Auf der Hinfahrt hat uns (meine Begleitperson und mich) die Bahn positiv überrascht.

Auf der Hinfahrt hat uns (meine Begleitperson und mich) die Bahn positiv überrascht.

@ISL_eV Wir kamen erst kurz vor Abfahrt an, da der rechtzeitig bestellte Taxifahrer jeden nur erdenklichen Umweg gefahren ist, um mehr Geld zu verdienen.

Wir standen also drei Minuten vor Abfahrt am Infoschalter und waren schon recht aufgelöst.

Wir standen also drei Minuten vor Abfahrt am Infoschalter und waren schon recht aufgelöst.

Am 11.03.23 fand ein groß beworbenes "Weltfrauenstags-Symposium" der antifeministischen Intitiative "Lukreta" um Reinhild Bossdorf im #ZentrumRheinhessen in #Mainz statt. Letztlich nahmen rund 22 TN teil.

1/5

1/5

Das Geschlechterverhältnis war #noAFD-typisch recht ungleich verteilt- auch bei einem sogenannten "Weltfrauenstag-Symposium". Auf eben erwähnte rund 22 TN waren 14 männlich. Als MdL #RheinlandPfalz war Iris Nieland anwesend.

2/5

2/5

Ebenso nahm Mary Khan in #Mainz teil. Sie macht aus ihrer Transfeindlichkeit keinen hehl. Ihr Vater greift schon mal zur Waffe, um ihr in politische Positionen zu verhelfen.

fr.de/rhein-main/afd…

3/5

fr.de/rhein-main/afd…

3/5

Hello hello London! 👋🏻 We’re at IET Savoy Place, London for DSS London 2022 by #YugaByteDB. It’s gonna be super interesting tech session starting at 2 pm today! Don’t miss my #Live #Tweets in this #thread! 🤩🧵

@Yugabyte #DSS22 #DistributedSQL #PraveenScience

@Yugabyte #DSS22 #DistributedSQL #PraveenScience

Yes, the setup is going on for the grand presentation of the #Tech #Track. The master is teaching the student here! #JustKidding Say hi to Julie Wise and Dave Roberts from #YugaByteDB! 👋🏻

@Yugabyte #DSS22 #DistributedSQL #PraveenScience

@Yugabyte #DSS22 #DistributedSQL #PraveenScience

We’ve got our Social Media / Content Director @rachel_pescador from #YugaByteDB here, who’s busy at work and got some cool #swag! 🤩

@Yugabyte #DSS22 #DistributedSQL #PraveenScience

@Yugabyte #DSS22 #DistributedSQL #PraveenScience

Energiekrise: Auch die S-Bahn will sparen, hat jedoch nach eigener Aussage nur wenig Spielraum. Helfen soll das Einkürzen von Zügen. So werden auf der S1 und S2 ab morgen jeweils in den Abendstunden und in der Früh nur noch Kurzzüge angeboten.

Nochmal Sanierung alte Baureihen. Bei der BR481 macht neben der Elektrik auch Rost zu schaffen. Derweil hat sich die Durcharbeitung der (noch von der alten BVG-West bestellten) BR480 bewährt. Unter anderem der neue Antrieb könnten nun sogar Angebotsverbesserungen ermöglichen.

Generalsanierung der Zugsicherungstechnik: Der Einbau des neuen Systems ZBS schreitet weiter voran. Damit ist auch klar: die Tage der DDR-Baureihe 485 sind gezählt.

What's happening to Credit Suisse and it’s impact on Crypto, An ELI5 Thread.

#CreditSuisse is one of the 9 global "Bulge Bracket" banks, the 9 largest multi-national banks in the world.

And it is at a 'Critical Moment' now, says the CEO.

1/

#CreditSuisse is one of the 9 global "Bulge Bracket" banks, the 9 largest multi-national banks in the world.

And it is at a 'Critical Moment' now, says the CEO.

1/

Credit Suisse is considered to be a global systemically important bank, meaning that in the case of their failure, there will be a financial crisis on a global scale.

They are referred to as "too big to fail", like the #LehmanBrothers. Now their situation reminds us of 2008.

2/

They are referred to as "too big to fail", like the #LehmanBrothers. Now their situation reminds us of 2008.

2/

Talking history, Credit Suisse was founded in 1856 to fund the development of Switzerland's rail system. In the 1900s, it began shifting to retail banking. It is known for strict bank–client confidentiality and banking secrecy.

3/

3/

#Hilo express

El #DeutscheBank siempre aparece en las noticias cuando hay una crisis financiera.

Antes de la quiebra de #LehmanBrothers ,entre los candidatos para la quiebra estaba el #DB,al final sobrevivió,pero han pasado 14 años y su apodo del “nuevo #Lehman” no pasa de moda.

El #DeutscheBank siempre aparece en las noticias cuando hay una crisis financiera.

Antes de la quiebra de #LehmanBrothers ,entre los candidatos para la quiebra estaba el #DB,al final sobrevivió,pero han pasado 14 años y su apodo del “nuevo #Lehman” no pasa de moda.

Antes de seguir definamos que es un #CDS

Los Credit Default Swaps son instrumentos que permiten invertir sobre la solvencia de una empresa o de un gobierno.

Son como pólizas de seguro crediticio.A mayor valor de los CDS,mayor será la prima.A mayor riesgo mas caro asegurarse.

Los Credit Default Swaps son instrumentos que permiten invertir sobre la solvencia de una empresa o de un gobierno.

Son como pólizas de seguro crediticio.A mayor valor de los CDS,mayor será la prima.A mayor riesgo mas caro asegurarse.

@AeonCoin @FirstSquawk @SBF_FTX #SpeedOfLight is why DecentralizedDB #SQL= #DB of #Browsers & #OS #WebCache, #BrowserCache, #AppCache (c #CDN @Cloudflare link) #DWeb=#DeCentralizedWeb , #free, #Opensource & #Interops w every #WebEnabledDevice but #Web3 #ReinventsTheWheelSquare c

@AeonCoin @FirstSquawk @SBF_FTX @Cloudflare When'll #Web3 stop breaking #Internet made redundant & scaled by p2p #DWeb stack .01-.02 Milisecond in every #Browser, #OS & #Server w/ an #InternetConnection...if it doesnt use #DWeb Plumbing I'm ready4 10x perf @marknadal #Gun & #Book p2p @SecureRender facebook.com/ak2webd3/video…

Mit dem heutigen Inkrafttreten des ILO-169-Abkommens verpflichtet sich die BRD dem Schutz der Rechte der Indigenen Völker. Wir fordern den sofortigen Rückzug deutschen Kapitals und deutscher Konzerne aus zerstörerischen Megaprojekten in Indigenen Territorien weltweit!

/1

/1

Wir fordern zu diesem Anlass den Rücktritt der deutschen Bahn aus dem 'Tren Maya' in Mexico @DB_Bahn @DB_Presse @Wissing @BMWK @ABaerbock @Bundeskanzler

Die ganze Recherche von @AgRecherche -> deinebahn.com

/2

Die ganze Recherche von @AgRecherche -> deinebahn.com

/2

Das Megaprojekt bedeutet die Zerstörung der letzten Regenwälder Südmexikos, die Missachtung der Rechte der indigenen Bevölkerung, Landnahme- und Vertreibung sowie eine zusätzliche Militarisierung in einer der konfliktreichsten Regionen des Landes.

/3

/3

NEW: UniversititIes UK, the employer body for the UK university sector, said “We have not made misleading claims" about the impact of April 2022 pension cuts on members of the #USS.

UUK:"It's reasonable for us to conclude in headline terms - using the example personas developed by USS – that reductions in retirement benefits will be in range of 10-18%. We've consistently said members should use the USS modeller to check (their specific) possible impacts."

UUK says using a headline of 35 per cent cuts to #USS members' pensions - from the April 2022 benefit reforms - is potentially misleading and potentially damaging to members.

The imminent default of #Evergrande and the hawkish tilt of #Fed is sparking a global risk off event. This has similarities to all 3 of the last major crashes; 97 (LTCM - leverage), 2000 (tech - overvaluation), and 2008 (real estate - highly rated assets defaulting) #QQQ 1/9

97 started with the currency crisis of Thailand, a small economically unimportant country but set off a chain of currency crisis and defaults in Indonesia, Malaysia, Brazil, Argentina & Russia. Culminating in the collapse of the massively over-leveraged LTCM

#QQQ #BTC #SPY 2/9

#QQQ #BTC #SPY 2/9

It started small and took significant time (1 yr) to fully play out, feeding on the most overexposed and over leveraged investors. I expect it to play out much faster this time as we are starting with the 2nd largest economy, and the debt levels are significantly higher

#ETH 3/9

#ETH 3/9

#Gruene beschweren sich heute, dass die #Bahn keine schnelle Alternative für #Inlandsflüge ist und zu viel Geld in den Bau von Autobahnen fließt. Dabei sind es vor allem #Grünen, die bis runter auf die kommunale Ebene den Ausbau des #ICE-Netzes blockieren. Ein #Thread /TN

ICE Strecke Nürnberg-Berlin

Ausbau zur Fahrzeitverkürzung wurde von der rot-grünen Regierung 1999 gestoppt. Gelder wurden in den Ausbau der Autobahnen 71,73 umgeleitet. Erst nach drei Jahren (!) ging es mit dem #Trassenbau weiter.

br.de/franken/inhalt…

publikum.net/grune-planen-u…

Ausbau zur Fahrzeitverkürzung wurde von der rot-grünen Regierung 1999 gestoppt. Gelder wurden in den Ausbau der Autobahnen 71,73 umgeleitet. Erst nach drei Jahren (!) ging es mit dem #Trassenbau weiter.

br.de/franken/inhalt…

publikum.net/grune-planen-u…

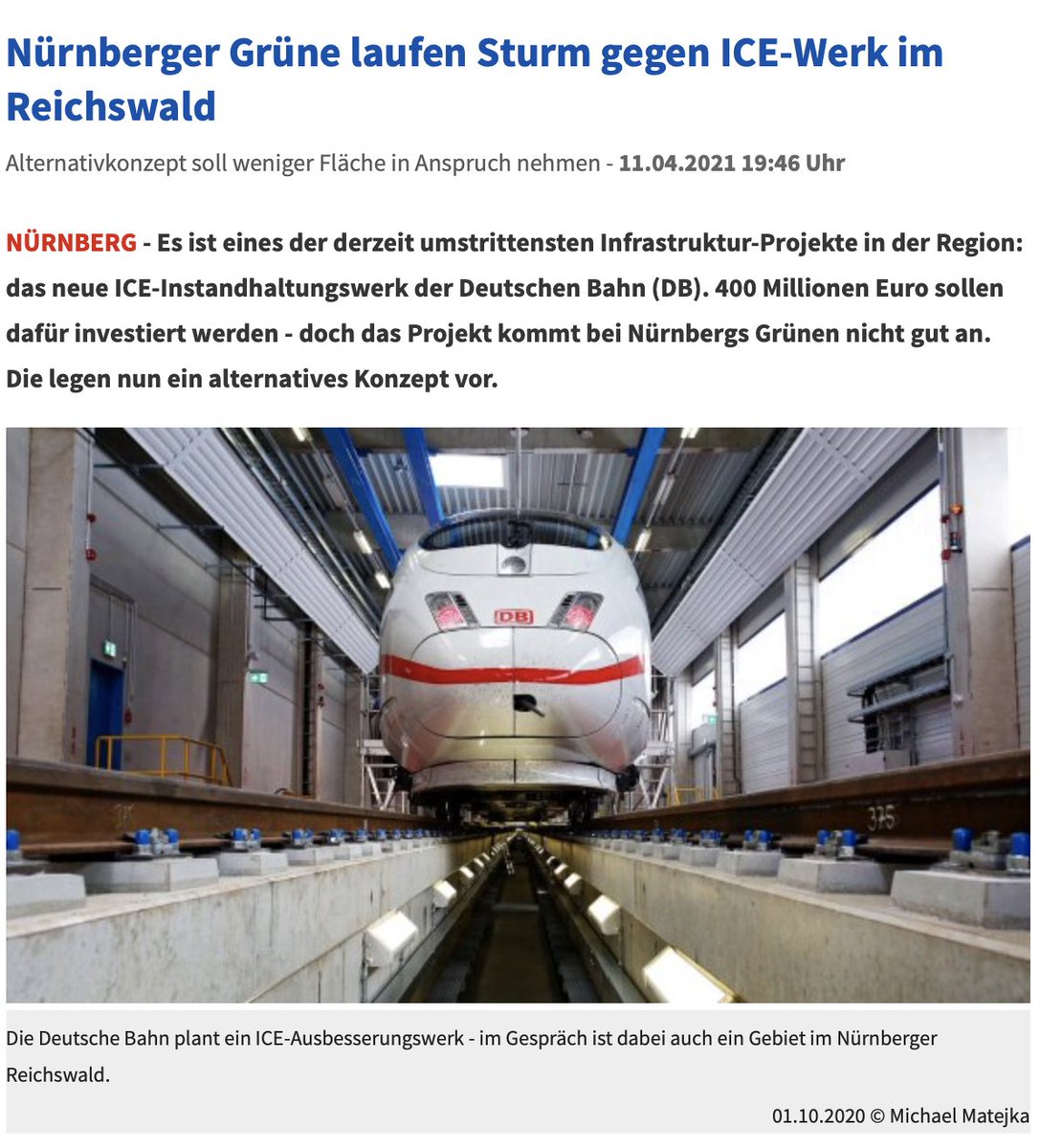

Die #Gruenen in #Nürnberg blockieren derweil den Bau eines neuen ICE-#Ausbesserungswerkes. Der Grund: Die #DB-Anlage ist ihnen zu groß. Gleichzeitig begrüßen sie das Ziel von #CDU/#CSU/#SPD im Koalitionsvertrag die Fahrgastzahlen zu verdoppeln. Aha. nordbayern.de/region/nuernbe…

#EnschaedigungBeiBarrieren wirkt - ein wenig. Ich habe wieder eine Forderung bei der #DB eingereicht, weil es bei 1 Reise im januar wieder Probleme mit der #Barrierefreiheit (Klo nicht erreichbar) gab. Nun ist man bei #DB so nett bissl Geld zu zahlen, natürlich "ohne Erkennung

!b

!b

einer Rechtspflicht" und aus "kundendienstlichen Erwägungen"

Besser wäre, kein Geld und dafür enstapnnte Reise #Barrierefrei

#Ableismus

GWR Artikel zu #EnschaedigungBeiBarrieren

blog.eichhoernchen.fr/post/gemeinsam…

Besser wäre, kein Geld und dafür enstapnnte Reise #Barrierefrei

#Ableismus

GWR Artikel zu #EnschaedigungBeiBarrieren

blog.eichhoernchen.fr/post/gemeinsam…

Ich möchte hier anmerken, dass ich nicht geäußert habe es sei nicht schlimm, sondern dass ich halt keine Wahl habe und mich damit arrangieren müsse.

Mangelnde #Barrierefreiheit ist schlimm und ich meine es besteht Rechtspflicht, siehe Gutachten

behindertenbeauftragter.de/SharedDocs/Dow…

Mangelnde #Barrierefreiheit ist schlimm und ich meine es besteht Rechtspflicht, siehe Gutachten

behindertenbeauftragter.de/SharedDocs/Dow…

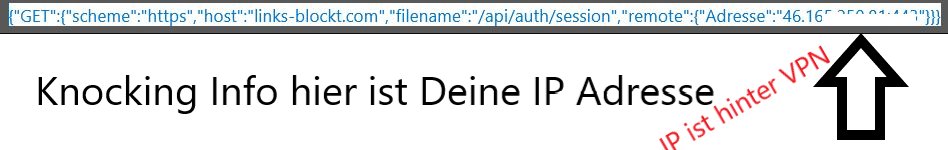

1/ So nun werde ich hier noch mal zum angekündigten, Zusammenhang Zwischen der Webseite ⛔️linke-blockt ⛔️und der #Doxing Szene geben, dies wird ein langer #Thread

Wie kommen #Hacker an #Daten ? #Doxing

man lockt Sie auf eine Webseite #OSINT #WhiteHat

sueddeutsche.de/digital/datenk…

Wie kommen #Hacker an #Daten ? #Doxing

man lockt Sie auf eine Webseite #OSINT #WhiteHat

sueddeutsche.de/digital/datenk…

2/ Man landet auf einer sog. #LandingPage

, diese ist schnell geladen und hat nur 10 html Zeilen und ca. 10 #Javascripte ,

Diese #Sripte tun Ihre Arbeit, und der Anwender wird abgekloppft, #knocking ,

zu diesem Zeitpunkt kennt der Server schon einiges #dnssniff #ipgeoilog #CSS

, diese ist schnell geladen und hat nur 10 html Zeilen und ca. 10 #Javascripte ,

Diese #Sripte tun Ihre Arbeit, und der Anwender wird abgekloppft, #knocking ,

zu diesem Zeitpunkt kennt der Server schon einiges #dnssniff #ipgeoilog #CSS

3/ Da jeder #Hacker faul ist lässt er natürlich andere seine Arbeit machen #Browser , #CPU, #framework #Cookie #Cloudserver #Datenbank wo die Ergebnisse des #Doxing dann in Millisekunden je nach verfügbarer Internetleitung gespeichert werden ohne das der #User was merkt ! #SSS

Der Nachfolgeorganisation der an der #Shoa maßgeblich beteiligten Deutschen Reichsbahn, der Deutschen Bahn (#DB), reicht es nicht, gegen Rassismus und Diskriminierung zu sein,...

threadreaderapp.com/thread/1328270…

...uns und vor allem anderen auch nicht...

threadreaderapp.com/thread/1328270…

...uns und vor allem anderen auch nicht...

.

Die bessere Lösung für den #Bahnhof #Müllheim #Neubau #rheintalbahn

#Verkehrswende

#platzfuersrad

#barrierefrei

#danke @badischezeitung

badische-zeitung.de/so-koennte-der…

@SudbadenVcd @PRO_BAHN @Schienenallianz @FR_Entscheid

@markgraeflerDE @mitforschen @muellheim @Breisgau_S_Bahn

#Verkehrswende

#platzfuersrad

#barrierefrei

#danke @badischezeitung

badische-zeitung.de/so-koennte-der…

@SudbadenVcd @PRO_BAHN @Schienenallianz @FR_Entscheid

@markgraeflerDE @mitforschen @muellheim @Breisgau_S_Bahn

@WinneHermann, lieber: Sind da irgendwo #Förderung #Fördergelder drin vom Land #badenwürttemberg?

VIEL bessere Lösung vor Allem auch #öpnv/#spnv! UND #stationundservice -Standard!

@bwegtBW @DBRegio_BW

@bahnhof #bahnhofvonmorgen

@Eisenbahn @Eisenbahnkurier

@DB_Presse @DB_Bahn

VIEL bessere Lösung vor Allem auch #öpnv/#spnv! UND #stationundservice -Standard!

@bwegtBW @DBRegio_BW

@bahnhof #bahnhofvonmorgen

@Eisenbahn @Eisenbahnkurier

@DB_Presse @DB_Bahn

Hallo nochmal, lieber @WinneHermann, im Ernst #bahnhofmuellheim #RTB @bwegtBW

Vorliegenen DB-Planung negiert uE Belange Nahverkehr (perspektivisch 10.000 Leute/Tag!): Wo/wie Unterstützung her kriegen?

#bhfmh cc @DBRegio_BW @PRO_BAHN @Schienenallianz @Breisgau_S_Bahn @rvf_fgbsued

Vorliegenen DB-Planung negiert uE Belange Nahverkehr (perspektivisch 10.000 Leute/Tag!): Wo/wie Unterstützung her kriegen?

#bhfmh cc @DBRegio_BW @PRO_BAHN @Schienenallianz @Breisgau_S_Bahn @rvf_fgbsued

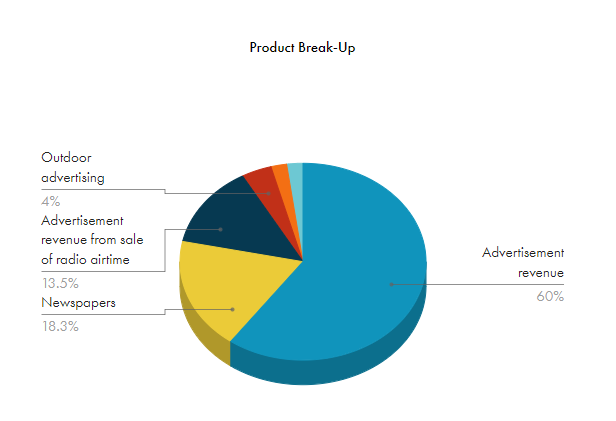

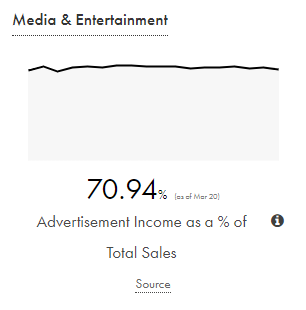

#Jagran Prakashan

Jagran Prakashan is engaged primarily in printing and publication of #Newspapers and #Magazines in India.

The other activities of the company comprise outdoor advertising business, event management and activation services and digital business.

Jagran Prakashan is engaged primarily in printing and publication of #Newspapers and #Magazines in India.

The other activities of the company comprise outdoor advertising business, event management and activation services and digital business.

Company’s revenue comes from #Print, #Radio, #Outdoor and #Digital. Outdoor was 7% revenue so we can write that off in current conditions.

They have a healthy 21% market share in #Radio Broadcasting.

They have a healthy 21% market share in #Radio Broadcasting.

Looking at other breakup it can be segregated as 20% from sales of newspaper and 80% comes from different form of #advertising.

Tokopedia leaked the database THREAD!!!

Semua bermula dari twit ini, ane dan temen ane lgsung cari2 kejelasan infonya dan cek ke forumnya langsung, dan ternyata sang 'actor' menjual file yg berisikan database yg leaked (15jt data) itu seharga 10EUR

Semua bermula dari twit ini, ane dan temen ane lgsung cari2 kejelasan infonya dan cek ke forumnya langsung, dan ternyata sang 'actor' menjual file yg berisikan database yg leaked (15jt data) itu seharga 10EUR

Thread on the massive help @DWP @10DowningStreet + @hmtreasury + others are giving to:

- help firms with pension contributions to pay

- safeguard your pension

- help our vulnerable pensioners

- ensure pension scams are avoided 1/

- help firms with pension contributions to pay

- safeguard your pension

- help our vulnerable pensioners

- ensure pension scams are avoided 1/

Working with @TPRgovuk we have helped Defined Contribution employers by ensuring their Automatic Enrolment contributions are covered by the #Coronavirus Job Retention Scheme 2/

thepensionsregulator.gov.uk/en/covid-19-co…

thepensionsregulator.gov.uk/en/covid-19-co…

We have cancelled the 10% rise in the #PensionsLevy helping the industry cope in these difficult times 3/ professionalpensions.com/news/4013268/g…

[Thread Dragon Ball]

Pour mon second thread, j’ai décidé de parler d’une licence très chère à mon cœur, #DragonBall. La question de la musique est d’autant plus passionnante qu’y trouver des infos relève de l’archéologie.

#DragonBallZ #DB #DBZ #AkiraToriyama #ShunsukeKikuchi

Pour mon second thread, j’ai décidé de parler d’une licence très chère à mon cœur, #DragonBall. La question de la musique est d’autant plus passionnante qu’y trouver des infos relève de l’archéologie.

#DragonBallZ #DB #DBZ #AkiraToriyama #ShunsukeKikuchi

Avant de commencer, je précise que je suis le cocréateur du concert officiel mondial Dragon Ball Symphonic Adventure et concepteur de la setlist, produit avec ma société @Overlook_Events. Je vais aussi revenir à la fin sur la création du concert. #DBSA

J’ai passé un an et demi à étudier la musique et la série pour créer la setlist du concert, comprendre l’instrumentation, les choix narratifs qui ont été faits… il reste encore beaucoup à apprendre, mais je pense déjà pouvoir partager pas mal de choses avec des infos inédites !

Good morning! 😀Fed is all in (again!!) - and this time there is a great confidence among traders (again!!) that Fed can has stopped deflation and supplied enough liquidity to the system. But is that really the case? Stay tuned for my perspectives #HZupdates

Let me start an nontraditional way - with a zoom in. This is #SP500 1 hour chart. I look for corrections and main directional moves. This is a correctional move - and it may have finalized! So - the main wave will soon set in again. Now - lets zoom out #HZupdates

Thread🚆REGIONALVERKEHR

Entgegen anders lautender Meldungen wird die #DB ihre Fahrpläne für den 🇩🇪#Regionalverkehr nicht einschränken. Die DB ist allerdings von wenigen Bundesländern angesprochen worden, sich mit möglichen Einschränkungen auseinander zu setzen...

#COVID19de

Entgegen anders lautender Meldungen wird die #DB ihre Fahrpläne für den 🇩🇪#Regionalverkehr nicht einschränken. Die DB ist allerdings von wenigen Bundesländern angesprochen worden, sich mit möglichen Einschränkungen auseinander zu setzen...

#COVID19de

... @DB_Presse stellt klar, dass Fahrpläne nicht seitens des Unternehmen eingeschränkt werden.

Ziel ist, mit verlässlichen Leistungen eine stabile Versorgung in 🇩🇪 #aufrecht zu erhalten. Die Entscheidung über veränderte #REGIO-Fahrpläne treffen die Besteller vor Ort...

#COVID19de

Ziel ist, mit verlässlichen Leistungen eine stabile Versorgung in 🇩🇪 #aufrecht zu erhalten. Die Entscheidung über veränderte #REGIO-Fahrpläne treffen die Besteller vor Ort...

#COVID19de

... Im grenzüberschreitenden #REGIONALVERKEHR

Bahn gilt (Stand 16.3./10 Uhr):

❌Österreich🇦🇹

❌Polen🇵🇱

☝️eingeschränkt Schweiz🇨🇭

☝️eingeschränkt Frankreich🇫🇷

☝️eingeschränkt Niederlande 🇳🇱

☝️eingeschränkt Belgien🇧🇪

Mehrℹ️@DB_Presse @DB_Bahn

#COVID19de

Bahn gilt (Stand 16.3./10 Uhr):

❌Österreich🇦🇹

❌Polen🇵🇱

☝️eingeschränkt Schweiz🇨🇭

☝️eingeschränkt Frankreich🇫🇷

☝️eingeschränkt Niederlande 🇳🇱

☝️eingeschränkt Belgien🇧🇪

Mehrℹ️@DB_Presse @DB_Bahn

#COVID19de

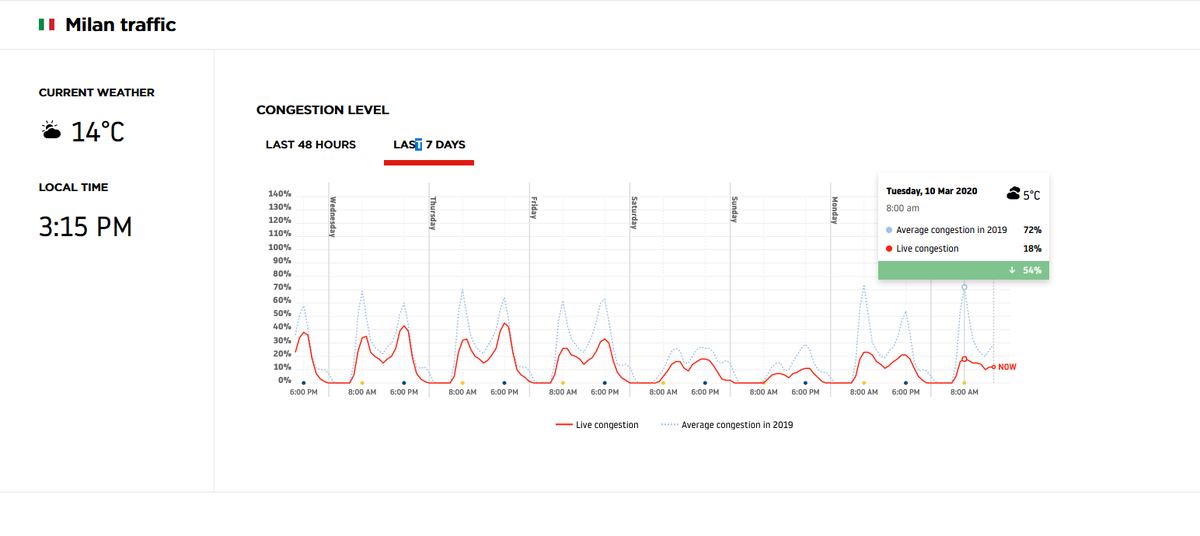

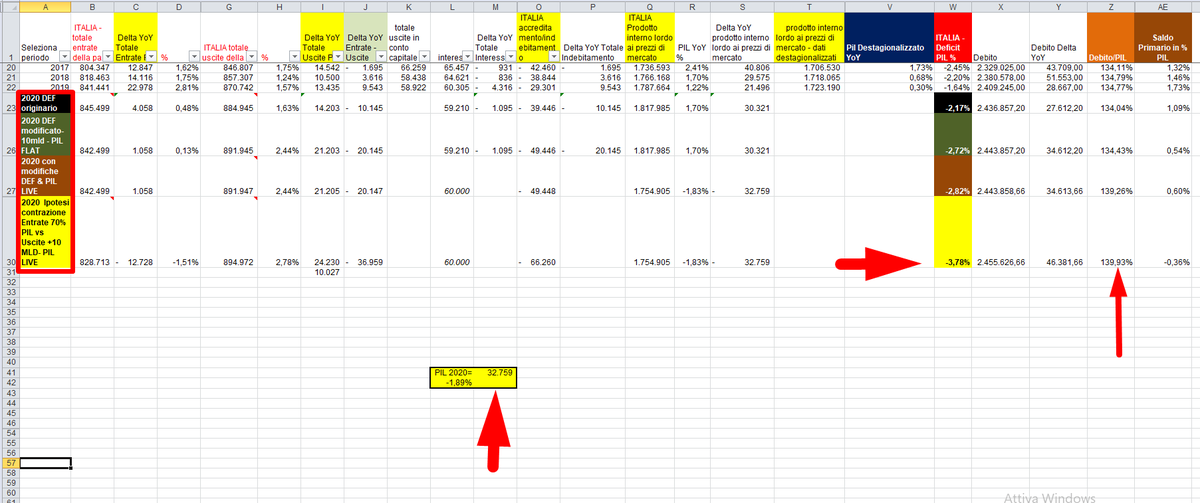

Paese congelato da ieri

delta rispetto al Picco di Congestione del Traffico mattutino superiore al 50% sia a Milano che a Roma

Worst Case ad oggi

-32mld di PIL2020

Deficit/PIL =

-2.82% con +10mld deficit [+7mldUsc vs -3mldEnt]

-3,78% con Entrate ridotte di 12mld vs 2019

AD OGGI

delta rispetto al Picco di Congestione del Traffico mattutino superiore al 50% sia a Milano che a Roma

Worst Case ad oggi

-32mld di PIL2020

Deficit/PIL =

-2.82% con +10mld deficit [+7mldUsc vs -3mldEnt]

-3,78% con Entrate ridotte di 12mld vs 2019

AD OGGI

Ad oggi il maggior indebitamento in qualunque ipotesi con una contrazione così importante del PIL, porterebbe il rapporto debito/PIL italiano vicino al 140%...facendo scattare tutti gli alert di ristrutturazione del debito pubblico...sia Ex-Ante [#MES2] che EX-Post [MES attuale]

...@bancaditalia CODADEPAJA

....e qui capite la CODADEPAJA

👇

👇

👇

👇

I prestiti TLTRO di #PopBari dal bilancio 2015..."anche a nome delle nuove controllate" chiesti ulteriori 516 milioni in 3 mesi...

Evento in stile

#ECB/@bancaditalia 's Ponzi Scheme... 👏👏

Evento in stile

#ECB/@bancaditalia 's Ponzi Scheme... 👏👏