Discover and read the best of Twitter Threads about #debt

Most recents (24)

@iltalehti_fi #ClimateHoax eli #Meteor-O-Loginen #PunaSiirtymä.

Järjen etääntyessä lähes #valonnopeus'lla, valon #aallonpituus havainnoijaan nähden kasvaa ja etääntyvä kohde näyttää punaiselta.

- #KaakonKulma-#PekkaPouta-@PekkaIlmari ja #JäävuoretSulaa-@KKotakorpi.

- #Sää-#Mää ja #SääksMäki.

Järjen etääntyessä lähes #valonnopeus'lla, valon #aallonpituus havainnoijaan nähden kasvaa ja etääntyvä kohde näyttää punaiselta.

- #KaakonKulma-#PekkaPouta-@PekkaIlmari ja #JäävuoretSulaa-@KKotakorpi.

- #Sää-#Mää ja #SääksMäki.

@iltalehti_fi @PekkaIlmari @KKotakorpi Sc. #ClimateEmergency caused by the #Plants!

- Plants release up to 30% more #Carbondioxide than previously thought.

- #Photosynthesis -> #PlantRespiration produces #CO2.

- Plants release up to 30% more #Carbondioxide than previously thought.

- #Photosynthesis -> #PlantRespiration produces #CO2.

@iltalehti_fi @PekkaIlmari @KKotakorpi #NightLife.

The #zionists' global #CarbonTax business #BUSTED.

#PlantRespiration is when the plant uses #glucose (#Photosynthesis) and #oxygen to produce #energy for growth, as well as #carbondioxide, #CO2 and #water.

- What Do #Plants Do at #Night?

The #zionists' global #CarbonTax business #BUSTED.

#PlantRespiration is when the plant uses #glucose (#Photosynthesis) and #oxygen to produce #energy for growth, as well as #carbondioxide, #CO2 and #water.

- What Do #Plants Do at #Night?

@ir_rkp #Korsakov @MikaLintila

#Gasgrid. #LNG alus ei tuota #kaasua, vaan varastoi #Venäjä'n, aiemmin #Baltiasta ostettua, n. 3x hintaan.

@valtionomistus

- 10v. ajalta terminaalin kokonaiskustannuksiksi arvioidaan noin €460 miljoona, eli noin €126 000 päivässä

#Gasgrid. #LNG alus ei tuota #kaasua, vaan varastoi #Venäjä'n, aiemmin #Baltiasta ostettua, n. 3x hintaan.

@valtionomistus

- 10v. ajalta terminaalin kokonaiskustannuksiksi arvioidaan noin €460 miljoona, eli noin €126 000 päivässä

@ir_rkp @MikaLintila @valtionomistus #GreatReset=#SuurTyöttömyys-#Hätätila

#WEF-#Marxist -ideologia lahtaa yritykset #kaasu'lla. @valtionomistus

#Gasgrid Imatra #Räikkölä vs. #Korsakov.

- Korsakov on satamakaupunki ja piirikunta #Sahalini'n saaren eteläpäässä Venäjän Sahalinin alueella.

#WEF-#Marxist -ideologia lahtaa yritykset #kaasu'lla. @valtionomistus

#Gasgrid Imatra #Räikkölä vs. #Korsakov.

- Korsakov on satamakaupunki ja piirikunta #Sahalini'n saaren eteläpäässä Venäjän Sahalinin alueella.

@ir_rkp @MikaLintila @valtionomistus #Uniper-#Gasgrid #skandaali.

#YGLs veijarit keksivät roudata kaasun #Räikkölä'n sijasta näin. @TyttiTup

- #Prigorodnoje'n satama 10km #Korsakovi'n itäpuolella on #LNG'n vientiin erikoistunut satama

From: Port of #Korsakov

To: Port of #Gibraltar (->#Inkoo)

#YGLs veijarit keksivät roudata kaasun #Räikkölä'n sijasta näin. @TyttiTup

- #Prigorodnoje'n satama 10km #Korsakovi'n itäpuolella on #LNG'n vientiin erikoistunut satama

From: Port of #Korsakov

To: Port of #Gibraltar (->#Inkoo)

Why is the stock market ripping?

#Team42, we joined Real Vision’s @RaoulGMI and @maggielake last week to discuss #Liquidity , #Debt Monetization, #Recession, & more.

In case you missed it, here are seven highlights from what many are calling “the best RV Daily Briefing yet”:

#Team42, we joined Real Vision’s @RaoulGMI and @maggielake last week to discuss #Liquidity , #Debt Monetization, #Recession, & more.

In case you missed it, here are seven highlights from what many are calling “the best RV Daily Briefing yet”:

1) Liquidity Drives Asset Markets

Although we believe the stock market will continue to squeeze bears well into the fall, poor liquidity conditions will likely drag asset markets down this summer.

Although we believe the stock market will continue to squeeze bears well into the fall, poor liquidity conditions will likely drag asset markets down this summer.

Additionally, we are not sure we've seen this market cycle's ultimate lows because we did not price in a recession last year.

What we priced in, in our opinion, was a change in the Liquidity Cycle.

What we priced in, in our opinion, was a change in the Liquidity Cycle.

Why is the stock market ripping?

#Team42, we joined Real Vision’s @RaoulGMI and @maggielake last week to discuss #Liquidity , #Debt Monetization, #Recession, & more.

In case you missed it, here are seven highlights from what many are calling “the best RV Daily Briefing yet”:

#Team42, we joined Real Vision’s @RaoulGMI and @maggielake last week to discuss #Liquidity , #Debt Monetization, #Recession, & more.

In case you missed it, here are seven highlights from what many are calling “the best RV Daily Briefing yet”:

1) Liquidity Drives Asset Markets

Although we believe the stock market will continue to squeeze bears well into the fall, poor liquidity conditions will likely drag asset markets down this summer.

Although we believe the stock market will continue to squeeze bears well into the fall, poor liquidity conditions will likely drag asset markets down this summer.

Additionally, we are not sure we've seen this market cycle's ultimate lows because we did not price in a recession last year.

What we priced in, in our opinion, was a change in the Liquidity Cycle.

What we priced in, in our opinion, was a change in the Liquidity Cycle.

🔺 Real Estate Giant Defaults on over $1.1B in Debt 🔺

Brookfield, a major real estate firm, is facing huge losses in its Downtown L.A. office portfolio, defaulting on over $1.1B in related debt. #RealEstate #LosAngeles

Brookfield, a major real estate firm, is facing huge losses in its Downtown L.A. office portfolio, defaulting on over $1.1B in related debt. #RealEstate #LosAngeles

🏢 The company has lost two prominent assets, the Gas Company Tower and EY Plaza, to court-appointed receivers as the pandemic continues to challenge the office real estate market. #Pandemic #RemoteWork

📉 #Brookfield's Downtown L.A. office portfolio saw occupancy drop to 77.2% at the end of 2021, and around 30% of all office space in the area is now vacant. #OfficeSpace

@Ova_Wit_lol @GavinClimie The link in this thread to Dick Fuld's 2010 statement about the collapse was very defiant about the fact he claims LBHI (the parent of LBI) was "mandated" into filing. And that is the truth. No sane decision to file CH 11 would be made by a company with cash/assets bal sheet.

@Ova_Wit_lol @GavinClimie The most telling thing is while Sep 28, 2022 LBI (the subsidiary and former brokerage arm of LBHI) finished paying off its liquidation - LBHI remains in the LBHI Trust" filing with the SEC regularly and not only that, 332 Million in its 8-K from March 2023 w/o $ ongoinglitigation

Why do governments default on debt!!

News channels won't talk about it at all

But,

It's simple to understand

Let's dive in on the secret of how governments work 👇🧵

#debt #currency #assets

News channels won't talk about it at all

But,

It's simple to understand

Let's dive in on the secret of how governments work 👇🧵

#debt #currency #assets

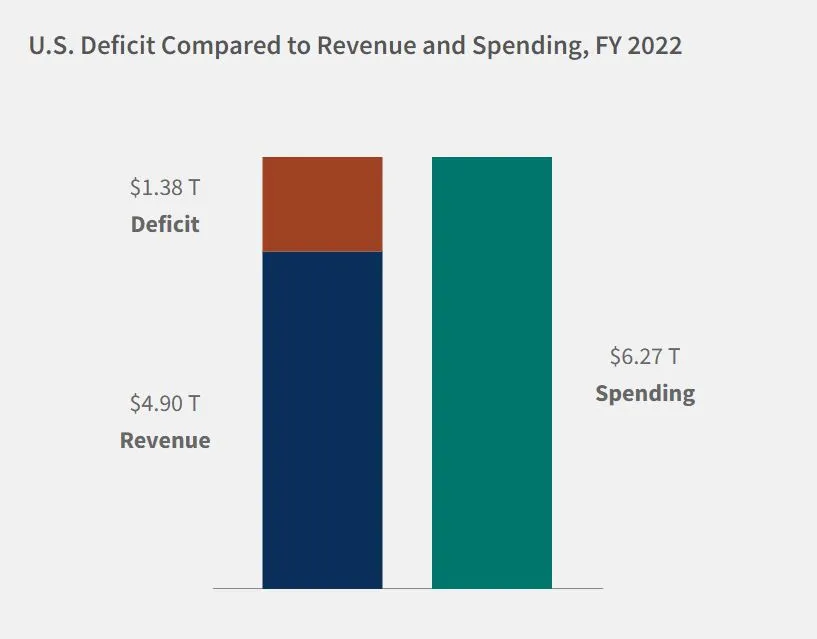

A government runs ultimately on the same simple accounting rules as we all have learnt.

The two basic ingredients:

1. Revenue (money coming in)

2. Expenses (money going out)

The two basic ingredients:

1. Revenue (money coming in)

2. Expenses (money going out)

MisterBond's #RollOfHonour for various #Debt scheme categories for the year ending on March 31'2023.

#IHR - Investor High Returns Score - Higher Returns in Higher Bands

#IER - Investor Experience Returns Score - IHR divided by Std Deviation

#BI - Beating Industry Average

#IHR - Investor High Returns Score - Higher Returns in Higher Bands

#IER - Investor Experience Returns Score - IHR divided by Std Deviation

#BI - Beating Industry Average

MisterBond's Roll of Honour - #BankingAndPSUFund:

MisterBond's Roll of Honour in #CorporateBond Funds:

I recently spent two weeks in #Zambia, mainly in Lusaka, meeting clients, conducting research, speaking to government officials. Here are some of my key takeaways 🧵🇿🇲

DEBT - this issue came up everywhere, and with good reason. Not only is it driving macroeconomic instability, but the government is nowhere near concluding a deal. And why? Because its largest creditor, #China, isn't happy with the terms laid out by the G20.

It's NB to note Chinese debt is both bilateral (i.e. issued by govt) and private (e.g., held by companies/individuals). Govts generally don't mind debt repayments being deferred, but private creditors are different - they usually want their money back sooner, even at a loss.

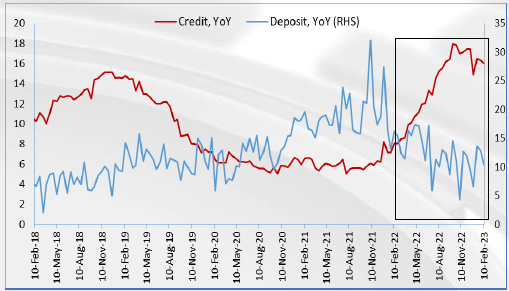

A #BRILLIANT move by the @FinMinIndia hit 4 birds with one stone by introducing 3 changes in the Finance Bill. The 3 birds..

1) Higher Tax Collections

2) Capital Controls

3) Bank Deposits

4) Lower cost of Govt funding.

But will HURT GROWTH. Long #THREAD

1) Higher Tax Collections

2) Capital Controls

3) Bank Deposits

4) Lower cost of Govt funding.

But will HURT GROWTH. Long #THREAD

What are the changes

1) End of LTCG on #debt, Gold ETFs, Overseas or Any mutual fund that invests in less than 35% india equity bought after 1 Apr-23

2) STT Raised by 25%

3) Tax Collected at Source (TCS) raised to 20% (5% earlier) & threshold reduced to Zero (Rs7 lac earlier)

1) End of LTCG on #debt, Gold ETFs, Overseas or Any mutual fund that invests in less than 35% india equity bought after 1 Apr-23

2) STT Raised by 25%

3) Tax Collected at Source (TCS) raised to 20% (5% earlier) & threshold reduced to Zero (Rs7 lac earlier)

"It is finished.

"It is finished.

"it is THE MERCY"

those are the last known words of Donald Crowhurst, an eccentric and erratic man who had failed at several ventures and who finally risked his life on a contest to sail round the world, nonstop, in a one-man boat.

(cont'd)

"It is finished.

"it is THE MERCY"

those are the last known words of Donald Crowhurst, an eccentric and erratic man who had failed at several ventures and who finally risked his life on a contest to sail round the world, nonstop, in a one-man boat.

(cont'd)

he was already in debt to a *successful* businessman, a millionaire named Stanley Best, who'd lent a few thousand pounds to one of Crowhurst's failed businesses. the loss was mere pocket change, to someone like Best—but enough to give Best a *hold* over Crowhurst.

(cont'd)

(cont'd)

that's the *real* power that the #entrepreneur has. #business and #technology propaganda is full of nonsense about how entrepreneurs, people of leisure who gamble on #investment and #cryptocurrency and other sources of "passive income", are the world's creators, but...

(cont'd)

(cont'd)

A version of the finance bill circulating on social media proposes to end LTCG on #debt mutual funds bought after 1 April 2023. Meaning regardless of holding period, you pay tax at slab rate! Currently after 36 months, you pay 20% post indexation. It is a body-blow to debt funds.

Why? Because yields on debt funds are similar to bank FDs, not higher. Without the favorable tax treatment, the case for debt funds almost goes away. I say ALMOST because some benefits still make debt funds marginally better for some people

1) No tax till redemption. FD interest is taxed on accrual

2) Set off and carry forward of capital gains and losses

3) Flexibility- Withdraw or invest as much as you want, anytime. No premature termination penalty. Till we get official confirmation of these proposals, sit tight

2) Set off and carry forward of capital gains and losses

3) Flexibility- Withdraw or invest as much as you want, anytime. No premature termination penalty. Till we get official confirmation of these proposals, sit tight

A week ago, after hearing #ChairPowell’s testimony before Congress, all eyes were set to be on today’s #inflation data, which presumably would help market participants better understand the #FOMC’s policy reaction at its March 22nd meeting.

What a difference a week makes these days! Of course, all eyes are still on today’s data, but now there are many other things we need to consider (such as #FinancialStability concerns), when judging the reaction function of the @federalreserve.

As we have long contended, #markets tend to be fairly myopic and lacking in patience, so having to focus on more than one news item at a time causes tremendous #uncertainty and thus greater market #volatility.

1/2 A growing number of folks realize that California is where they get their produce from & it's been slammed by forest fires, floods, etc. so they are going to grow their own veggies this year and escape the high prices in the grocery chain stores.

2/2 An estimated two-thirds of all produce consumed in Canada is imported from the U.S. accounting for approximately 37% of Canada's fresh fruit imports in 2021. California exported $4.8 Billion to Canada, including: $1.7B in fruits and nuts & $203M in vegetables and roots.

I live on a Gulf Island where the best weather conditions found in Canada are found so I purchase FRESH produce from organic farmers at farm gates and at Farmer's Markets twice weekly. Hubby also grows some of our veggies.

Are you now or will you be growing your own produce?

Are you now or will you be growing your own produce?

The #AdaniGroups Saga- For Naive #Investors. A thread

I, Mr A(#Adani) have 100 chips. By #Law, I cannot own more than 75, so I hav 73 chips. 27 chips r sold in d market. Anther 15 Chips: My uncle buys them by pretending to b normal people. This is illegal, bt who will catch me?

I, Mr A(#Adani) have 100 chips. By #Law, I cannot own more than 75, so I hav 73 chips. 27 chips r sold in d market. Anther 15 Chips: My uncle buys them by pretending to b normal people. This is illegal, bt who will catch me?

So there are 12 chips left in the market. Out of these, #Funds like #LIC buys 9 chips. 3 chips are now left on the open market.

My #media, #political and PR management and #connections are excellent. There are whispers that I am related to the #king and #Government.

My #media, #political and PR management and #connections are excellent. There are whispers that I am related to the #king and #Government.

The Biden administration keeps proving that personnel are policy. Biden himself is a kind of empty vessel into which different wings of the Democratic party pour their will, yielding a strange brew of appointments both great and terrible. 1/

If you'd like an essay-formatted version of this thread to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

pluralistic.net/2023/03/06/per… 2/

pluralistic.net/2023/03/06/per… 2/

On the one hand, you have progressive appointments like #JonathanKanter at @JusticeATR and @linakhanFTC at the @FTC, leaders who are determined to challenge and curb corporate power:

pluralistic.net/2022/01/10/see… 3/

pluralistic.net/2022/01/10/see… 3/

The #RaisinaEdit offers a selection of commentaries that unpack, interpret, and problematise contemporary global developments corresponding to the pillars of the #RaisinaDialogue2023.

Curated by @WarjriLaetitia & @anahitakhanna95.

Read them here 👉 orfonline.org/series/the-rai…

Curated by @WarjriLaetitia & @anahitakhanna95.

Read them here 👉 orfonline.org/series/the-rai…

S Paul Kapur writes on how the #American leaders must abandon their decades-long dream of achieving strategic convergence between the US and #Pakistan. or-f.org/118561

#Australia’s reformed policy towards #China is not a turn to China; it’s a return to normality.

From @MConleytyler. or-f.org/118506

From @MConleytyler. or-f.org/118506

How is the #UkraineRussiaWar affecting the #EU's prospects? Its economy? Its place in the world?

▫️ Zhang Jian (张健): "It will further weaken the 🇪🇺's strength and int. influence and accelerate its marginalisation in the global geopolitical landscape."

sinification.substack.com/p/the-future-o…

▫️ Zhang Jian (张健): "It will further weaken the 🇪🇺's strength and int. influence and accelerate its marginalisation in the global geopolitical landscape."

sinification.substack.com/p/the-future-o…

🔹The author: Zhang Jian (张健) is the director of the Institute of European Studies at China Institutes of Contemporary International Relations (CICIR) – an influential think tank linked to China’s Ministry of State Security.

cicir.ac.cn/NEW/expert.htm…

cicir.ac.cn/NEW/expert.htm…

🔹Some context: Zhang’s assessment is more pessimistic than some in China, but several of his arguments are in line with those made by other Chinese analysts: e.g. the negative impact that the #war has had on the EU’s quest for #StrategicAutonomy. This is bad news for #China.

2/8 What we've been saying: banks and the consumer are no longer the problem. #Banks are the new utilities.

3/8 The #government and business sector are the problems. Businesses have seen record #debt and record low #tax rates help inflate margins to unsustainable levels.

#AgeOfDeception: “#Washington is filled with politicians and organizations that hyperventilate about government #debt and the burden it imposes on our children, but they ignore the burdens imposed by #patent and #copyright monopolies granted by the government.”

“Suppose that we were spending another $50 billion a year on medical #research in order to replace #patent supported research, and all the findings were placed in the #public domain so that all #drugs were sold as #generics. ...

... The annual #deficit would be $50 billion higher due to the additional spending on research, but we would save $380 billion a year on drugs due to generic pricing.”

1/7 This was a FASCINATING article from @FortuneMagazine

Overconfident #tech #CEOs have overpaid for ‘box tickers’ and ‘taskmasters.’ Here’s why the real ‘creators’ will survive the mass #layoffs

yahoo.com/entertainment/…

Overconfident #tech #CEOs have overpaid for ‘box tickers’ and ‘taskmasters.’ Here’s why the real ‘creators’ will survive the mass #layoffs

yahoo.com/entertainment/…

2/7 "$CRM CEO Marc #Benioff and $META CEO Mark #Zuckerberg have admitted that they hired too many employees under the assumption that the growth their #sector experienced during the pandemic would continue."

Here are some highlights from the Voices of Tomorrow Bangalore Chapter! (1/n)

#VoicesofTomorrow #VoT2023 #ithoughtVoT #ithoughtVoT2023

#VoicesofTomorrow #VoT2023 #ithoughtVoT #ithoughtVoT2023

Session #01

ithought Way – The Journey by Mr Shyam Sekhar

Mr @shyamsek answers the question, ‘What pain points does ithought address & solve?’ (2/n)

#ithought #portfoliomanagement #financialplanning

ithought Way – The Journey by Mr Shyam Sekhar

Mr @shyamsek answers the question, ‘What pain points does ithought address & solve?’ (2/n)

#ithought #portfoliomanagement #financialplanning

“We want to make Millennials as $ Millionaires – a well-managed wealth corpus for the 90’s born.” - @shyamsek on what ithought wants to accomplish.

Watch Mr Shyam Sekhar’s talk ‘ithought Way – The Journey’ here youtube.com/live/Gyg3D2djS… (3/n)

#investors #investearly

Watch Mr Shyam Sekhar’s talk ‘ithought Way – The Journey’ here youtube.com/live/Gyg3D2djS… (3/n)

#investors #investearly

Here is this Week’s Market Wrap!

Time to Build a Multi-Asset Portfolio

A Thread! (1/n)

#multiasset #portfoliomanagement #marketwrap #thread

Time to Build a Multi-Asset Portfolio

A Thread! (1/n)

#multiasset #portfoliomanagement #marketwrap #thread

Most investors have been favouring equity for the last 2 years. Recency bias nudges investors to think that equity is the only asset class to bet on.

It is this bias that kept investors from buying gold. (2/n)

#investors #equity #stockmarket #gold

It is this bias that kept investors from buying gold. (2/n)

#investors #equity #stockmarket #gold

Investors thought that gold wouldn’t do well. The post-COVID rally in #cryptos spooked the prospects of gold & added to that conviction. But that conviction has proved to be short-lived, and gold did exceptionally well in 2022. (3/n)

#gold #investments #personalfinance

#gold #investments #personalfinance

#ErikOlsen the lead #investgator of #NordStream #Sabotage found #dead at home.

- #AngloSaxon-#Beesting cause of death, #cremated in (3) hours.

- #AngloSaxon-#Beesting cause of death, #cremated in (3) hours.

At the beginning of February 2022, #Biden warned that "if #Russia invades #Ukraine with tanks and troops, then there will be no more #NordStream2"

#ItsDone #NordStream: Fourth leak found as Russia and West trade blame over alleged sabotage of gas pipeline | Sep 29

- #EU and #US have stopped to directly accusing Russia, a #Kremlin official was rebuked after hinting that #Washington was #responsible.

- #EU and #US have stopped to directly accusing Russia, a #Kremlin official was rebuked after hinting that #Washington was #responsible.