Discover and read the best of Twitter Threads about #earnings

Most recents (24)

Sector rotation(s) should be a sign of “healthier” market participation, however only time will tell… 🔄📊

$SPY $SPX $IWM $RUT $QQQ $NDX $DIA $DJIA #stocks #macro #economy #earnings

$SPY $SPX $IWM $RUT $QQQ $NDX $DIA $DJIA #stocks #macro #economy #earnings

Has the $IWM / $SPY ratio (S&P 500/Russell 2000 Small Caps) finally reached oversold territory, as #tech takes a breather & the broader market looks to soak up some of the liquidity flows? 🔄📈

📊h/t @OnTheTapePod @RiskReversal_ @GuyAdami @CarterBWorth for the chart note💡

$SPX… twitter.com/i/web/status/1…

📊h/t @OnTheTapePod @RiskReversal_ @GuyAdami @CarterBWorth for the chart note💡

$SPX… twitter.com/i/web/status/1…

We’ve seen the pace of #payroll gains decelerate to roughly the monthly trend pace from the last expansion; consensus has been waiting for this moment and expected a 195,000 job gain in May, but the data printed considerably stronger at 339,000 #jobs gained.

The three-month moving average of #nonfarm payrolls sits at 283,000, down from 334,000 jobs at the start of the year, but what the #LaborMarket imbalance needs is more supply and more slack.

The #unemployment rate ticked up to 3.65%, close to its 12-month average level, and average hourly #earnings (a volatile figure) gained 0.33% month-over-month and 4.3% on a year-over-year basis.

1/11 $MMAT $MMAX

2023 Q1 Qtrly #Earnings 10-Q

This thread covers the following...

🚨REVENUE

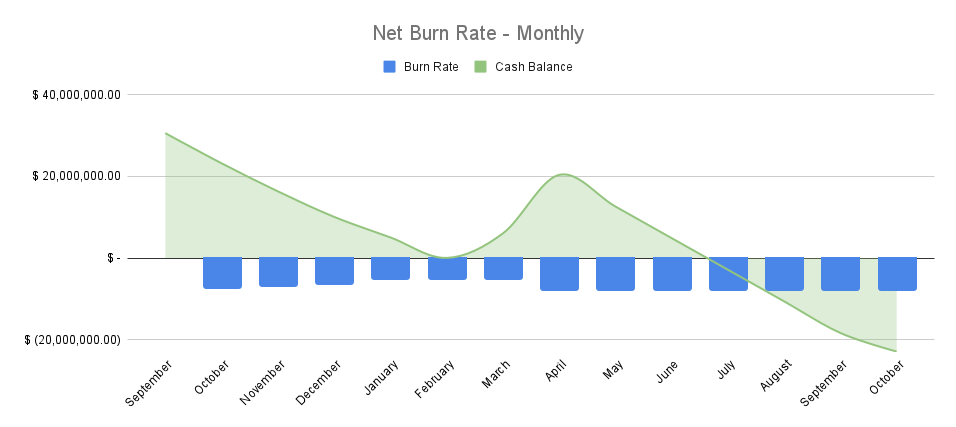

🚨CASH ON HAND & BURN RATE

🚨STOCKHOLDER EQUITY

🚨NET INCOME (LOSS)

🚨DEFERRED REVENUE

🚨GROSS MARGIN

🚨LONG-TERM DEBT

🚨OPERATING EXPENSES

🚨OUTSTANDING SHARES

🚨BOOK VALUE

Source->SEC

2023 Q1 Qtrly #Earnings 10-Q

This thread covers the following...

🚨REVENUE

🚨CASH ON HAND & BURN RATE

🚨STOCKHOLDER EQUITY

🚨NET INCOME (LOSS)

🚨DEFERRED REVENUE

🚨GROSS MARGIN

🚨LONG-TERM DEBT

🚨OPERATING EXPENSES

🚨OUTSTANDING SHARES

🚨BOOK VALUE

Source->SEC

#ES flirted with 4,115 again after that great intraday $HYG reversal portended downside #volatility when cyclicals didn‘t really point higher.

The day ended with a profound deterioration in market breadth and unappealing sectoral overview.

THREAD 👇

The day ended with a profound deterioration in market breadth and unappealing sectoral overview.

THREAD 👇

2. #tech upswing invited selling interest, while #value and especially $IWM turned strongly south.

#ES though had been relatively resilient given both #manufacturing and #retailsales hits, and today‘s data in #housing weren‘t slated to bring a disaster.

The figures are

#ES though had been relatively resilient given both #manufacturing and #retailsales hits, and today‘s data in #housing weren‘t slated to bring a disaster.

The figures are

Now some company #earnings

THREAD 👇

1. After correct predictions of $TSLA, $AAPL earnings (market impact), I was asked about $WMT and $TGT – on a company level, I of course expect $WMT to do considerably better than $TGT.

Note though $XRT weak chart posture, and how

THREAD 👇

1. After correct predictions of $TSLA, $AAPL earnings (market impact), I was asked about $WMT and $TGT – on a company level, I of course expect $WMT to do considerably better than $TGT.

Note though $XRT weak chart posture, and how

2. relatively well $XLY is still doing. Therefore, I‘m looking for especially $WMT beat on profits, less so on revenue (if volume sales are taken into account) and darkening guidance – these earnings won‘t send #ES lower while $TGT effect would be more neutral.

3. As for $HD, this one could be weaknest out of the three tickers mentioned, no matter how well $XHB is doing. I‘m looking for the relative calm in #realestate to go as it‘s impossible to the supply to be brought into the market when favorable #mortgage rates

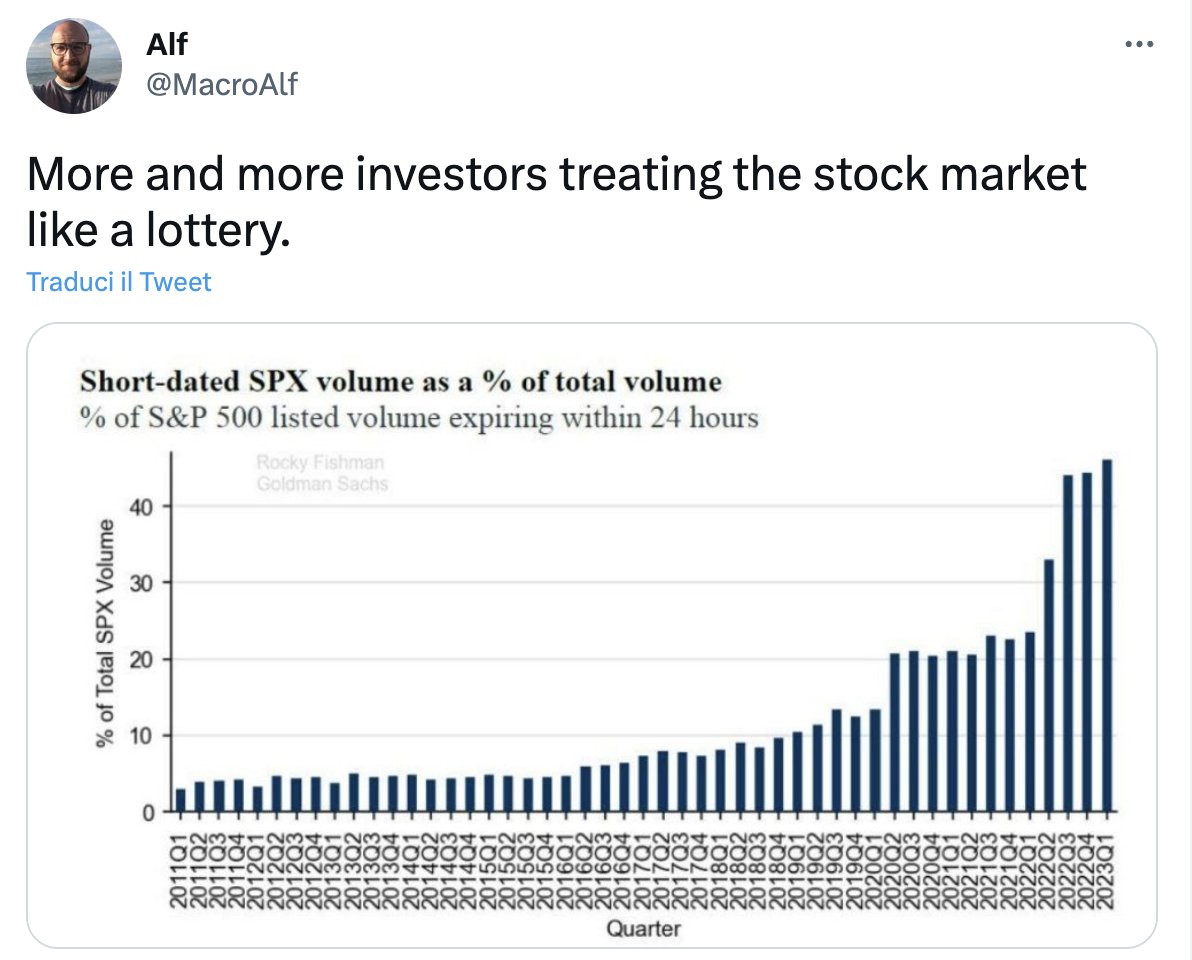

#NewsAlert 🚨 PVR Inox plans to shut down 50 cinema screens over the next 6 months

#PVR #PVRInox #PVRCinemas #MovieTheater #Business

#PVR #PVRInox #PVRCinemas #MovieTheater #Business

#EarningsWithMC | PVR Inox reported net consolidated loss for #Q4FY23 at Rs 333.37 crore, widening from the loss of Rs 107.41 crore in the same quarter last year.

More details⤵️

moneycontrol.com/news/business/…

#PVR #PVRInox #PVRCinemas #Earnings #Q4Results #Stocks #Markets

More details⤵️

moneycontrol.com/news/business/…

#PVR #PVRInox #PVRCinemas #Earnings #Q4Results #Stocks #Markets

#PVR Inox announced its intention to close around 50 #cinema screens within the next six months. These screens either operate at a loss or are situated in malls that have reached the end of their life cycle.

Read at ⬇️

moneycontrol.com/news/business/…

#PVRCinemas

Read at ⬇️

moneycontrol.com/news/business/…

#PVRCinemas

#WeeklyRecap: Markets Remain Unstable Amidst Encouraging and Concerning Economic Data

victoryinvest.substack.com/p/markets-rema…

Here are the key topics discussed in our latest market commentary #Thread 🧵 #Fed #Recession #inflation

victoryinvest.substack.com/p/markets-rema…

Here are the key topics discussed in our latest market commentary #Thread 🧵 #Fed #Recession #inflation

Mixed data created uncertainty for investors. Inflation may be moderating, but retail sales contraction raises concerns for a potential recession. The Fed may pause its rate hike cycle, which could positively impact the stock market. #Investing #Economy #MarketVolatility

📈 Major benchmarks defy recession concerns, posting weekly gains. DJI up 1.34%, SPX up 1.42%, NDX up 1.18%. #stockmarket #investing

Today’s #JobsReport was very solid, but like is often the case in the movies, it’s very hard for the sequel (today’s report) to match such an unexpected hit (January’s revised 504,000 jobs gained).

Still, a nonfarm #payroll gain of 311,000 jobs is quite good and having 815,000 jobs created so far this year after the #economy has already created 12 million #jobs over the past two years is pretty amazing in its own right.

Further, the 3-month moving average of 351,000 jobs, after a 12-month moving average of 362,000 jobs gained per month is also pretty remarkable, particularly after the market-implied pricing of the terminal #FedFunds rate has move up 500 basis points (bps) in a year.

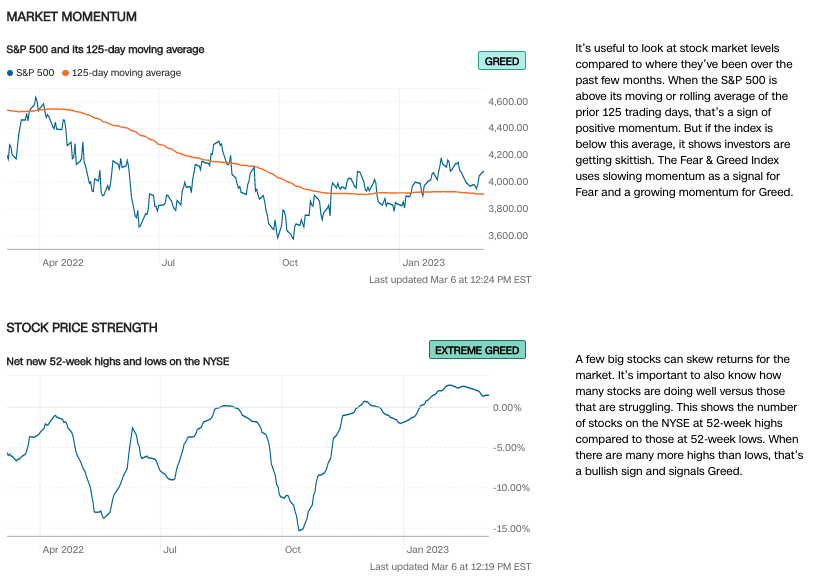

2/🧵 Looking at the latest @CNNBusines “Fear & Greed Index”, the markets are still maintaining their GREED readings on the back of last weeks Thurs - Fri #StockMarket reversal rally that was triggered (all, or in-part) on the back of @federalreserve (non-voting) member Bostic’s… twitter.com/i/web/status/1…

3/🧵 Here are the rest of of the “7 Fear & Greed Indicators” (per @CNNBusiness): 🐂📈 vs. 🐻📉

— Market Momentum (Greed)

— Stock Price Strength (Extreme Greed)

— Stock Price Breadth (Neutral)

— Put/Call Ratio (Greed)

— Market Volatility (Neutral)

— Safe Haven Demand (Greed)

—… twitter.com/i/web/status/1…

— Market Momentum (Greed)

— Stock Price Strength (Extreme Greed)

— Stock Price Breadth (Neutral)

— Put/Call Ratio (Greed)

— Market Volatility (Neutral)

— Safe Haven Demand (Greed)

—… twitter.com/i/web/status/1…

4/🧵 Here is an update on #StockMarket breath, as we did see a pause on selling pressure as market breadth picked up Thursday into Friday’s close… $SPY $SPX

🟣 >20 Day (Current: 38%, Previous: 18%) 📉

🔵 >50 Day (Current: 51%, Previous: 44%) 📉

🟠 >200 Day (Current: 60%,… twitter.com/i/web/status/1…

🟣 >20 Day (Current: 38%, Previous: 18%) 📉

🔵 >50 Day (Current: 51%, Previous: 44%) 📉

🟠 >200 Day (Current: 60%,… twitter.com/i/web/status/1…

💄"From Glam to Glum: Nykaa's Profits Fall by 71%"

[THREAD🧵] to explain Q3 Results & Nykaa's Business👇

1) Nykaa is involved in three different business segments, which are:

a) Fashion

b) Beauty and Personal Care (BPC)

c) Other

#Nykaa #earnings

[THREAD🧵] to explain Q3 Results & Nykaa's Business👇

1) Nykaa is involved in three different business segments, which are:

a) Fashion

b) Beauty and Personal Care (BPC)

c) Other

#Nykaa #earnings

2) The revenue from operations in Q3 is 1,462 crore, reflecting a YoY growth of 33%.

3) There was a 37% growth in the total value of sales, as measured by GMV.

3) There was a 37% growth in the total value of sales, as measured by GMV.

4) There has been a 71% year-on-year decline in the profit after tax, which now stands at 8.5 Cr in Q3.

o Gross profit margin reduced by 293bps

o EBIDTA grew by only 13% but EBIDTA margin fall from 6.3% to 5.3%

o Gross profit margin reduced by 293bps

o EBIDTA grew by only 13% but EBIDTA margin fall from 6.3% to 5.3%

Global commercial banks are on track to report -->>> $2.71T in revenue this year

Ethereum is perfectly positioned to capture that🚨🚨

#ethereum #earnings #price

Why is it important?👇👇

Ethereum is perfectly positioned to capture that🚨🚨

#ethereum #earnings #price

Why is it important?👇👇

Let's take a scenario:

🔸ETH has generated over $5.5B worth of fees over the past year.

🔸The next closest competitors are Binance Chain ($550M) followed by Bitcoin ($152M).

🔸ETH has generated over $5.5B worth of fees over the past year.

🔸The next closest competitors are Binance Chain ($550M) followed by Bitcoin ($152M).

Hypothetically,

🔸If Ethereum were to capture just 2% of global banking revenue i.e

$54 Billion

🔸ETH would be worth >4x its current valuation even if it traded at a conservative 11x earnings

🔸If Ethereum were to capture just 2% of global banking revenue i.e

$54 Billion

🔸ETH would be worth >4x its current valuation even if it traded at a conservative 11x earnings

Here's a thread of (6) charts 📊 that are worth nothing from this last week's @MorganStanley Global Investment Committee (GIC) Weekly Report (01/30/23)... 🧵/👇🏼

#macro #economy #earnings #stocks #StockMarket #bonds

morganstanley.com/pub/content/da…

#macro #economy #earnings #stocks #StockMarket #bonds

morganstanley.com/pub/content/da…

1/🧵 "In the short run, flows, sentiment, positioning & technicals can be powerful drivers, while over the longer term, fundamentals like growth, profitability & productivity are critical, as are earnings surprises." @MorganStanley

#macro #earnings #stocks #StockMarket #bonds

#macro #earnings #stocks #StockMarket #bonds

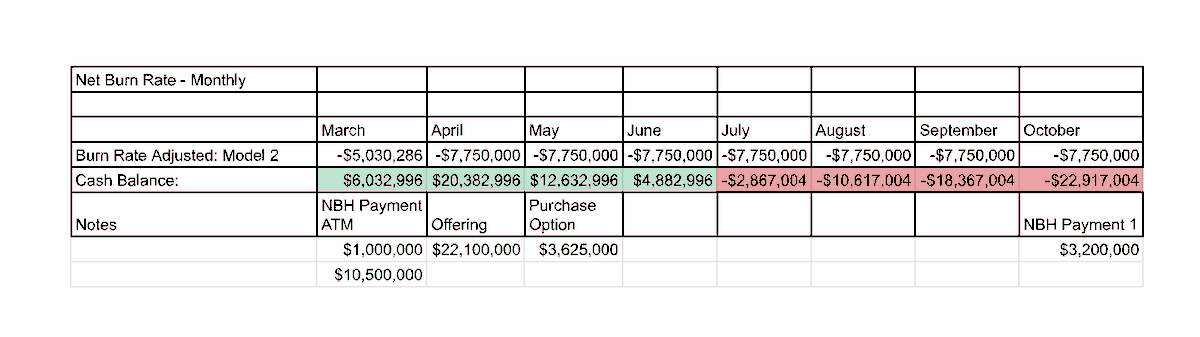

2/🧵 "But sometimes, & for extended periods, markets can settle on one particular thesis, no matter how narrow or implausible." 📊h/t @MorganStanley @GoldmanSachs $MS $GS @Bloomberg

#macro #earnings #stocks #StockMarket #bonds $SPY $SPX

#macro #earnings #stocks #StockMarket #bonds $SPY $SPX

📦 #Amazon releases results after markets close today

☎️ A conference call is scheduled at 1430 PT (1730 ET)

Here is a 🧵 on what to expect from the #earnings...

☎️ A conference call is scheduled at 1430 PT (1730 ET)

Here is a 🧵 on what to expect from the #earnings...

🐌 Virtually all of Amazon's businesses are suffering a slowdown, from ecommerce to cloud computing

This is set to see it deliver its slowest sales growth on record for any Q4 - an important quarter covering the busy holiday shopping season.

This is set to see it deliver its slowest sales growth on record for any Q4 - an important quarter covering the busy holiday shopping season.

#Ecommerce sales are falling as the explosion in demand seen during the pandemic continues to unwind.

However, they remain considerably higher than back in 2019

However, they remain considerably higher than back in 2019

🍎 #Apple releases results after markets close today

☎️ A conference call is scheduled for 1400 PT (1700 ET)

Here is a 🧵 of what to expect from the world's most valuable publicly-listed company...

☎️ A conference call is scheduled for 1400 PT (1700 ET)

Here is a 🧵 of what to expect from the world's most valuable publicly-listed company...

It was a tough quarter thanks to Covid-19 disruption in #China and softening demand

As a result, markets expect sales to drop for the 1st time in 3 years

That will be driven by lower #iPhone and #Mac sales 👇

As a result, markets expect sales to drop for the 1st time in 3 years

That will be driven by lower #iPhone and #Mac sales 👇

🛍️ That will mean it won't deliver growth over the Golden Quarter - the busiest period covering the holiday shopping season.

This raises the question of how many of these sales will be pushed into 2023 or lost entirely

This raises the question of how many of these sales will be pushed into 2023 or lost entirely

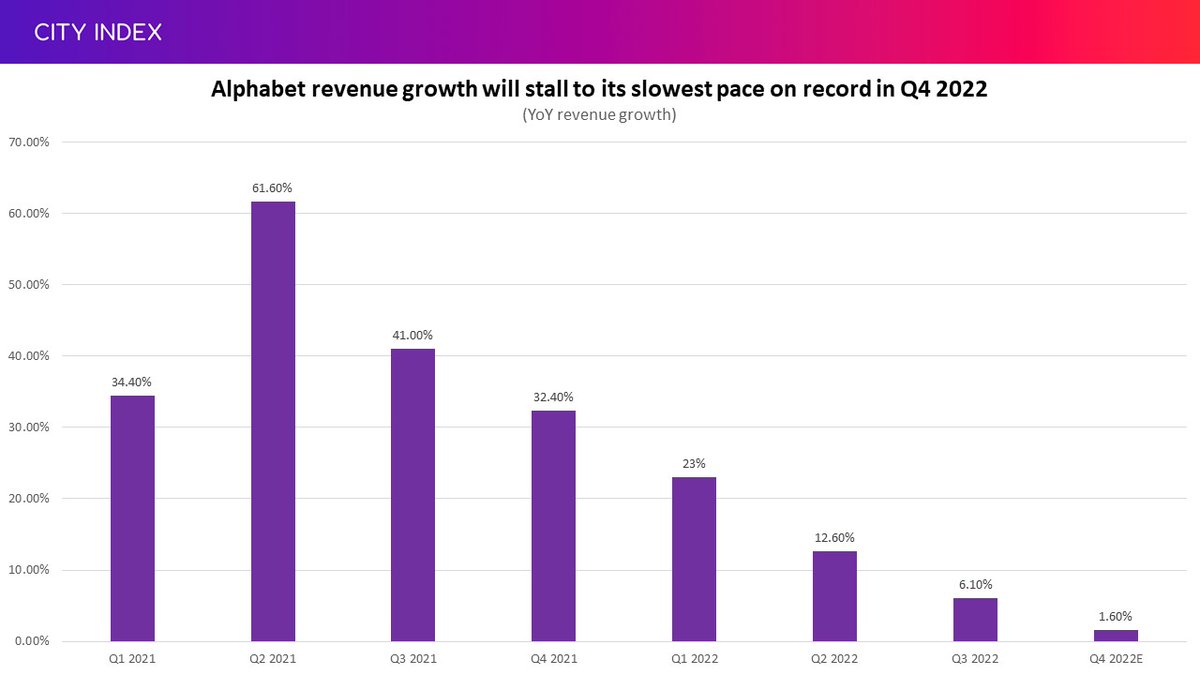

🔎 #Alphabet, the owner of #Google, releases results after markets close today.

☎️ A conference call with management is scheduled for 1330 PT (1630 ET).

Here is a 🧵 on what to expect from the #earnings today...

☎️ A conference call with management is scheduled for 1330 PT (1630 ET).

Here is a 🧵 on what to expect from the #earnings today...

🐌 There has been a pullback in spending by advertisers and this is expected to see the company deliver its slowest revenue growth on record.

🛡️ While not immune, its monopoly over Search has helped it prove more resilient than its social media rivals like #Meta

🛡️ While not immune, its monopoly over Search has helped it prove more resilient than its social media rivals like #Meta

☁️ Google Cloud is forecast to see sales rise 30%, but that would be the 7th consecutive quarter of slower growth.

Plus, unlike rivals #Amazon and #Microsoft, Google Cloud is in the red and not set to deliver a profit for several years.

Plus, unlike rivals #Amazon and #Microsoft, Google Cloud is in the red and not set to deliver a profit for several years.

🚨ADOTTA ANCHE TU UN CHAIR #FED🚨

🎉 Lo ammetto, sono esaltato da questo mese di Gennaio che mi ha regalato forti emozioni e ottimi profit 🤑

Ma stamattina ho sentito un certo rimorso verso quel povero chair della #FED.

Questo thread è per te, Jerome 💙 🧵

🎉 Lo ammetto, sono esaltato da questo mese di Gennaio che mi ha regalato forti emozioni e ottimi profit 🤑

Ma stamattina ho sentito un certo rimorso verso quel povero chair della #FED.

Questo thread è per te, Jerome 💙 🧵

📸 #Snap releases Q4 #earnings after US markets close today.

A conference call is scheduled at 1430 PT (1730 ET).

Here is a 🧵 on what to expect...

A conference call is scheduled at 1430 PT (1730 ET).

Here is a 🧵 on what to expect...

🐦 #Snap was the canary in the coal mine last earnings season, when growth stalled to its slowest pace on record.

👁️ That was followed by disappointing results from fellow #advertising stocks like #Meta and #Alphabet - with both #stocks due to report later this week.

👁️ That was followed by disappointing results from fellow #advertising stocks like #Meta and #Alphabet - with both #stocks due to report later this week.

Let’s dive into one of our next features: The Mixing Bowl! 🥣

It's is a single asset liquidity optimizer which gives you up to 40%* as yearly average return 🫰

Put your #crypto at work and let us optimize your #earnings 🧑🍳

🧵1/3

(*Depending on the asset and market conditions)

It's is a single asset liquidity optimizer which gives you up to 40%* as yearly average return 🫰

Put your #crypto at work and let us optimize your #earnings 🧑🍳

🧵1/3

(*Depending on the asset and market conditions)

Our 🥣 according to your strategy will optimize your #DeFi position (#LP, #staking or #lending) to #earn more rewards without having to manage your strategy!

It can be plugged into any traditional system. 🌎🌐

DeFi, as simple as that. 🧠

🧵2/3

It can be plugged into any traditional system. 🌎🌐

DeFi, as simple as that. 🧠

🧵2/3

Assets currently accepted: $DUSD - $USDC - $USDT - $ETH - $DAI - $WBTC.

Want to know more about Bakery Finance? 🧑🍳

- Make sure to check our docs: docs.bakery.finance

- And to join us on Telegram: t.me/bakeryfin

$BKR #DeFi #realyield #arbitrum #lending

🧵3/3

Want to know more about Bakery Finance? 🧑🍳

- Make sure to check our docs: docs.bakery.finance

- And to join us on Telegram: t.me/bakeryfin

$BKR #DeFi #realyield #arbitrum #lending

🧵3/3

Co nás čeká tento týden na akciových trzích? 🚨

Pojďme se na to společně podívat 👇

#akcie #investice #earnings #stock

Pojďme se na to společně podívat 👇

#akcie #investice #earnings #stock

V první řadě to bude výsledková sezóna, kde jen během dneška zjistíme výsledky mnoha menších bank. V průběhu týdne tam pak máme výsledky Microsoftu, 3M, Tesla, Intel, Visa a řady dalších.

Služby/Výroba PMI (úterý)

Tyto údaje byly hybateli trhu v 2 polovině loňského roku a bude zajímavé sledovat, zda s nimi budou hýbat i tentokrát. S lepšími než očekávanými zprávami za poslední 2 měsíce je možné, že trend bude pokračovat a trhy by se mohly mírně vzpamatovat.

Tyto údaje byly hybateli trhu v 2 polovině loňského roku a bude zajímavé sledovat, zda s nimi budou hýbat i tentokrát. S lepšími než očekávanými zprávami za poslední 2 měsíce je možné, že trend bude pokračovat a trhy by se mohly mírně vzpamatovat.

6 Key Takeaways of "Bank of India" Q3 Result in this🧵

1) Banks make money by charging more interest on loans they give out than the interest they pay to people who save their money in the banks.

Interest Income = Interest Earned - Interest Expended

#bankofindia #earnings

1) Banks make money by charging more interest on loans they give out than the interest they pay to people who save their money in the banks.

Interest Income = Interest Earned - Interest Expended

#bankofindia #earnings

Hence, Interest income is an important number for a bank to look at.

Bank of India made 64% more money from interest income compared to last year which is a very big positive for the bank.

Interest Income stands at 5,596 crores.

Bank of India made 64% more money from interest income compared to last year which is a very big positive for the bank.

Interest Income stands at 5,596 crores.

2) Regardless of huge growth(64%) in interest income, Net Profit only grew up by 12% from last year to approx. 1,151 crores which is concerning.

Reasons:

▶️ Non- interest income declined by 22% YoY

▶️ More provisions for bad loans are accounted as compared to last year

Reasons:

▶️ Non- interest income declined by 22% YoY

▶️ More provisions for bad loans are accounted as compared to last year

Today's #blog covers why the #pain #trade is likely higher over the next few weeks as #sentiment improves and too much money is offside.

realinvestmentadvice.com/the-pain-trade…

realinvestmentadvice.com/the-pain-trade…

#Bullish optimism is building around:

- #Fed cutting rates

- #Economy will avoid #recession

- #Employment remains strong.

- #Earnings have corrected enough

Risk to that view remains a recession.

realinvestmentadvice.com/the-pain-trade…

- #Fed cutting rates

- #Economy will avoid #recession

- #Employment remains strong.

- #Earnings have corrected enough

Risk to that view remains a recession.

realinvestmentadvice.com/the-pain-trade…

It is called the “#paintrade” because it is the opposite of how #investors are currently positioned. Investor sentiment remains historically #bearish despite improvement since the October lows.

realinvestmentadvice.com/the-pain-trade…

realinvestmentadvice.com/the-pain-trade…

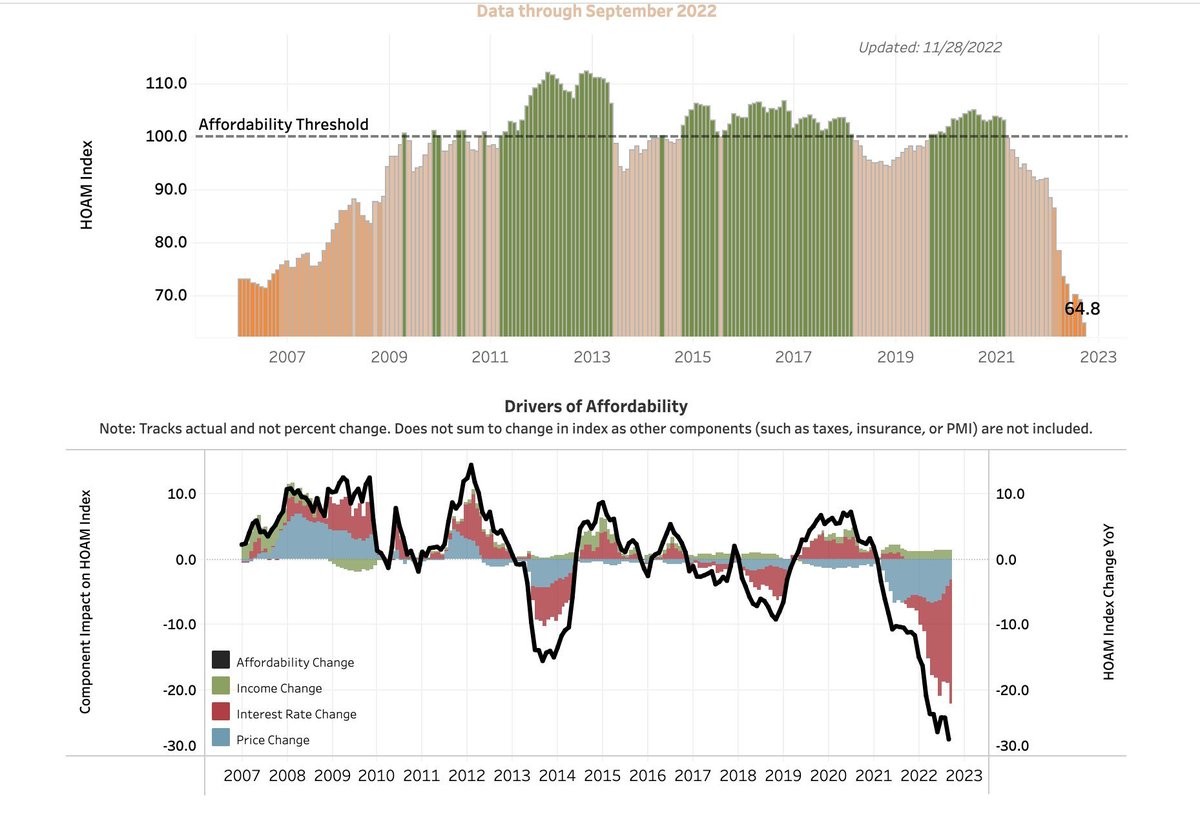

Wondering about latest news 📰 in the #realestate #housingmarket 🏡💵 with pricing, #interestrates, etc.? Here's an updated thread for January 23' that includes all the latest macro/market data... 🧵/👇🏼

📊h/t @RealEstateCafe

📊h/t @RealEstateCafe

1/🧵 "44% year/year drop in @MBAMortgage

Purchase Index is largest decline on record." 🇺🇸📉

📊h/t @LizAnnSonders @bloomberg

#realestate #realestateinvesting #FederalReserve #interestrates #macro #realator #mortgagerates

Purchase Index is largest decline on record." 🇺🇸📉

📊h/t @LizAnnSonders @bloomberg

#realestate #realestateinvesting #FederalReserve #interestrates #macro #realator #mortgagerates

2/🧵 Affordability "threshold" for housing, via the @AtlantaFed 🏡

📊h/t @NewsLambert

#realestate #realestateinvesting #FederalReserve #interestrates #macro #realator #mortgagerates

📊h/t @NewsLambert

#realestate #realestateinvesting #FederalReserve #interestrates #macro #realator #mortgagerates

@PwC @PwCUS just released their 2023 Annual Global CEO Survey — here's a thread of the top takeaways from the survey, including the fact that "40% of CEO's don't think their companies will be 'economically viable' in the next 10yrs"... 🧵/👇🏼

#macro #Stockmarket #DataAnalytics

#macro #Stockmarket #DataAnalytics

1/🧵 "Roughly 40% flagged the transition to new energy sources and supply chain disruption." @PwC @PwCUS

#macro #Stockmarket #DataAnalytics #commodities #supplychainmanagement #tech

#macro #Stockmarket #DataAnalytics #commodities #supplychainmanagement #tech

2/🧵 "#inflation and #macroeconomic volatility stand out more prominently than other key threats in the next 12 months than over the next five years." @PwC @PwCUS

#macro #Stockmarket #DataAnalytics #commodities #supplychainmanagement #tech #CPI

#macro #Stockmarket #DataAnalytics #commodities #supplychainmanagement #tech #CPI

📈Chart Update📉 Here's the latest "40-Bar Cycle" chart on $SPY — including analysis on MACD buy/sell signal(s), breakout of the consolidation range, major support/resistance levels, & more...

📊h/t @kylemusserco $SPX #stocks #stockmarket #earnings

tradingview.com/chart/SPY/cDUt…

📊h/t @kylemusserco $SPX #stocks #stockmarket #earnings

tradingview.com/chart/SPY/cDUt…

Watching closely support/resistance on the 50 & 200 SMA's (Daily, 4-Hour)... 👀

📊h/t @kylemusserco $SPY $SPX #stocks #stockmarket #earnings

📊h/t @kylemusserco $SPY $SPX #stocks #stockmarket #earnings