Discover and read the best of Twitter Threads about #es

Most recents (24)

NEXT WEEK

The Bear's Take:

•USA #recession is coming

•Bearish daily candlesticks on $SPX and $NDX

• #NDX negative divergences with classic Indis

•Leaders are overextended and some are starting to break

• #JPM collar will stop any #SPX advance at 4320

#SPX #ES_F $SPX $SPY

The Bear's Take:

•USA #recession is coming

•Bearish daily candlesticks on $SPX and $NDX

• #NDX negative divergences with classic Indis

•Leaders are overextended and some are starting to break

• #JPM collar will stop any #SPX advance at 4320

#SPX #ES_F $SPX $SPY

NEXT WEEK

The Bulls' Take

•Breakout of 4200 confirmed

•Momentum is bullish

•Market breadth improved

• $SPX now in official bull market

•Dealers increased their long positions again

• #Gamma is positive

- #CPI will be lower

- #Fed to pause

#ES #SPX $SPY #0dte #options

The Bulls' Take

•Breakout of 4200 confirmed

•Momentum is bullish

•Market breadth improved

• $SPX now in official bull market

•Dealers increased their long positions again

• #Gamma is positive

- #CPI will be lower

- #Fed to pause

#ES #SPX $SPY #0dte #options

NEXT WEEK

Our Take

• Markets are at strong resistance levels, we are expecting a pullback

• Volatile week ahead

• A likely visit to 4220

• Expecting 4320 to stop any $SPX advance

•Expecting #smallcaps to outperform

• #CPI maybe higher, but downtrending

#SPX $SPY $ES_F

Our Take

• Markets are at strong resistance levels, we are expecting a pullback

• Volatile week ahead

• A likely visit to 4220

• Expecting 4320 to stop any $SPX advance

•Expecting #smallcaps to outperform

• #CPI maybe higher, but downtrending

#SPX $SPY $ES_F

Rising volume in $XLK, $VTV, and good enough $SMH transparently prepared the ground for improving #ES market breadth – but the one factor that made me reconsider the requisites of the medium-term (bearish) outlook, was this.

Financials.

LONG THREAD 👇

Financials.

LONG THREAD 👇

#ES flirted with 4,115 again after that great intraday $HYG reversal portended downside #volatility when cyclicals didn‘t really point higher.

The day ended with a profound deterioration in market breadth and unappealing sectoral overview.

THREAD 👇

The day ended with a profound deterioration in market breadth and unappealing sectoral overview.

THREAD 👇

2. #tech upswing invited selling interest, while #value and especially $IWM turned strongly south.

#ES though had been relatively resilient given both #manufacturing and #retailsales hits, and today‘s data in #housing weren‘t slated to bring a disaster.

The figures are

#ES though had been relatively resilient given both #manufacturing and #retailsales hits, and today‘s data in #housing weren‘t slated to bring a disaster.

The figures are

#ES close almost 4,149 resistance, $RSP $IWM improvements are key bullish achievements, but I doubt would be confirmed by rising #bonds.

Bit of a daily rotation into #cyclicals say that would be hard.

Key today - #retailsales

Quote from Sunday:

THREAD 👇

Bit of a daily rotation into #cyclicals say that would be hard.

Key today - #retailsales

Quote from Sunday:

THREAD 👇

2. "I'm ooking for a meaningful undershoot on Tuesday, especially in core #retailsales turning even slightly negative".

Look at China's uneven recovery (18% vs 21% expected retail sales YoY), and compare then to situations when fiscal and monetary policy work in opposite ways.

Look at China's uneven recovery (18% vs 21% expected retail sales YoY), and compare then to situations when fiscal and monetary policy work in opposite ways.

3. Looking at the relative $XLY direction, I'm afraid #discretionaries are starting to lose their leading shine.

It's rather $XLC $XLV $XLU that are either leading or improving while $XLK deteriorates under the surface (also in terms of #NDX market breadth) just like $XLY.

It's rather $XLC $XLV $XLU that are either leading or improving while $XLK deteriorates under the surface (also in terms of #NDX market breadth) just like $XLY.

Now some company #earnings

THREAD 👇

1. After correct predictions of $TSLA, $AAPL earnings (market impact), I was asked about $WMT and $TGT – on a company level, I of course expect $WMT to do considerably better than $TGT.

Note though $XRT weak chart posture, and how

THREAD 👇

1. After correct predictions of $TSLA, $AAPL earnings (market impact), I was asked about $WMT and $TGT – on a company level, I of course expect $WMT to do considerably better than $TGT.

Note though $XRT weak chart posture, and how

2. relatively well $XLY is still doing. Therefore, I‘m looking for especially $WMT beat on profits, less so on revenue (if volume sales are taken into account) and darkening guidance – these earnings won‘t send #ES lower while $TGT effect would be more neutral.

3. As for $HD, this one could be weaknest out of the three tickers mentioned, no matter how well $XHB is doing. I‘m looking for the relative calm in #realestate to go as it‘s impossible to the supply to be brought into the market when favorable #mortgage rates

Joe Biden said the greatest threat in America is white supremacy. Really?👇

“In 2022, domestic extremists killed at least 25 people in the U.S., in 12 separate incidents. This represents a decrease from the 33 extremist-related murders documented in 2021.” adl.org/resources/repo…

“In 2022, domestic extremists killed at least 25 people in the U.S., in 12 separate incidents. This represents a decrease from the 33 extremist-related murders documented in 2021.” adl.org/resources/repo…

A greater threat to America is the scorch of fatherlessness in the USA:

40% of Americans are born w/out a father married to a mother

70% of Blacks

50% of Hispanics

25% of Whites

Democrats have declared war on the American nuclear family and the hetero sexual reproductive

40% of Americans are born w/out a father married to a mother

70% of Blacks

50% of Hispanics

25% of Whites

Democrats have declared war on the American nuclear family and the hetero sexual reproductive

relationship. Trans rights have stomped on Women’s rights and children are being enabled to change their gender before they become adults. American population is tanking, USA is crumbling from w/in. It’ll take a big man our adversaries respect to restore

The Chinese Gov’t Is Dishing Out The Dirt On The Bidens

BREAKING: Chinese Bank Voluntarily Gives Republicans Damaging New Financial Records On Hunter Biden

trendingpoliticsnews.com/breaking-chine…

BREAKING: Chinese Bank Voluntarily Gives Republicans Damaging New Financial Records On Hunter Biden

trendingpoliticsnews.com/breaking-chine…

2/“China sent a warning to Joe Biden on Tuesday after the Chinese-American bank, Cathay Bank, provided Senate Republicans with records revealing millions of dollars transferred from Chinese firms to Hunter Biden and James Biden.”

3/““In my mind, it’s the Chinese government telling Joe Biden, ‘We got the goods on you, buddy, and we’re willing to dish it up,’” Sen. Johnson told The Washington Times.

The records show deep financial ties between the president’s son and brother and the now-defunct CEFC China

The records show deep financial ties between the president’s son and brother and the now-defunct CEFC China

Forget the ICT Market Structure Shift 📈

Use Intermediate Term High and Lows instead

These are highs and lows that fill a FvG 🎯

3 Min intermediate term MSS then enter on a 1 min Fvg or ITOB 💥

Straight Fire 🔥🔥 You will be profitable with this strategy!!!!!

Use Intermediate Term High and Lows instead

These are highs and lows that fill a FvG 🎯

3 Min intermediate term MSS then enter on a 1 min Fvg or ITOB 💥

Straight Fire 🔥🔥 You will be profitable with this strategy!!!!!

You will know when the trend is changing 📉

3 MIN ITL and ITH are almost never broken until there is a change in direction that lasts for a few hours .

#ES and #NQ this strategy is almost idiot proof

3 MIN ITL and ITH are almost never broken until there is a change in direction that lasts for a few hours .

#ES and #NQ this strategy is almost idiot proof

2.) You only need to mark out the possible liquidity 🧲 on HTF ( EQH , EQL, PDH, PDL ) Just so you know of possible reversal incoming .

HOW TO MAKE DECISIONS BASED ON ECONOMIC NEWS 🗞📈📉

I'm going to be talking about decision making process before/during/after the news utilizing economic calendar and traditional characteristics of economic news.

THREAD 🧵...

I'm going to be talking about decision making process before/during/after the news utilizing economic calendar and traditional characteristics of economic news.

THREAD 🧵...

1- The Speech of Central Bank Governers 🏦

Making decisions, before speech of central bank governers is kind of hard. If we don't have quite obvious draw on liquidity as a target, it's always better to stay at sidelines in these highly manipulative conditions.

Making decisions, before speech of central bank governers is kind of hard. If we don't have quite obvious draw on liquidity as a target, it's always better to stay at sidelines in these highly manipulative conditions.

It's tradable condition for traders, who utilize HTF PD arrays with the context extracted from monthly-weekly-daily sequential and/or COT report analysis.

(For swing traders and short term traders, including OSOK trades)

(For swing traders and short term traders, including OSOK trades)

$SPX has been trapped in a Noise Box for the past 14 days

As at other times patience pays: whichever side SPX breaks out of the box will be followed by a big move

A great trading opportunity

👁️👁️Volume has been higher on bullish days and SPX closed above 20DMA

#SPX #ES $SPY

As at other times patience pays: whichever side SPX breaks out of the box will be followed by a big move

A great trading opportunity

👁️👁️Volume has been higher on bullish days and SPX closed above 20DMA

#SPX #ES $SPY

Market Commentary-

Disclaimer: I don't claim to know everything, as I have MUCH MORE learning left to do.

That said, I think beginners need to see bigger 🖼️ of markets instead of thinking ⬆️⬇️

#SPY , #SPX , #ES

ELI5 friendly. Info derived from @jam_croissant

See below:

Disclaimer: I don't claim to know everything, as I have MUCH MORE learning left to do.

That said, I think beginners need to see bigger 🖼️ of markets instead of thinking ⬆️⬇️

#SPY , #SPX , #ES

ELI5 friendly. Info derived from @jam_croissant

See below:

1/

Market has gone essentially NOWHERE from November 10th onwards. We've been stuck in a range anywhere from 3850 - 4100 on $SPX (~385 - ~410 $SPY) for the past month. A day trader's dream.

A perma 🐻 and perma 🐂worst nightmare.

Indecisive, rangebound, sideways market.

⬆️⬇️?

Market has gone essentially NOWHERE from November 10th onwards. We've been stuck in a range anywhere from 3850 - 4100 on $SPX (~385 - ~410 $SPY) for the past month. A day trader's dream.

A perma 🐻 and perma 🐂worst nightmare.

Indecisive, rangebound, sideways market.

⬆️⬇️?

2/

What if I told you that there's a structural "method behind the madness?"

That structure is 🦍 aka "Gary" aka Dealers/MM (and in this context: specific to implied vol positioning)!

Now, you may be asking:

"WTF does that have to do with markets being in a range?"

EVERYTHING.

What if I told you that there's a structural "method behind the madness?"

That structure is 🦍 aka "Gary" aka Dealers/MM (and in this context: specific to implied vol positioning)!

Now, you may be asking:

"WTF does that have to do with markets being in a range?"

EVERYTHING.

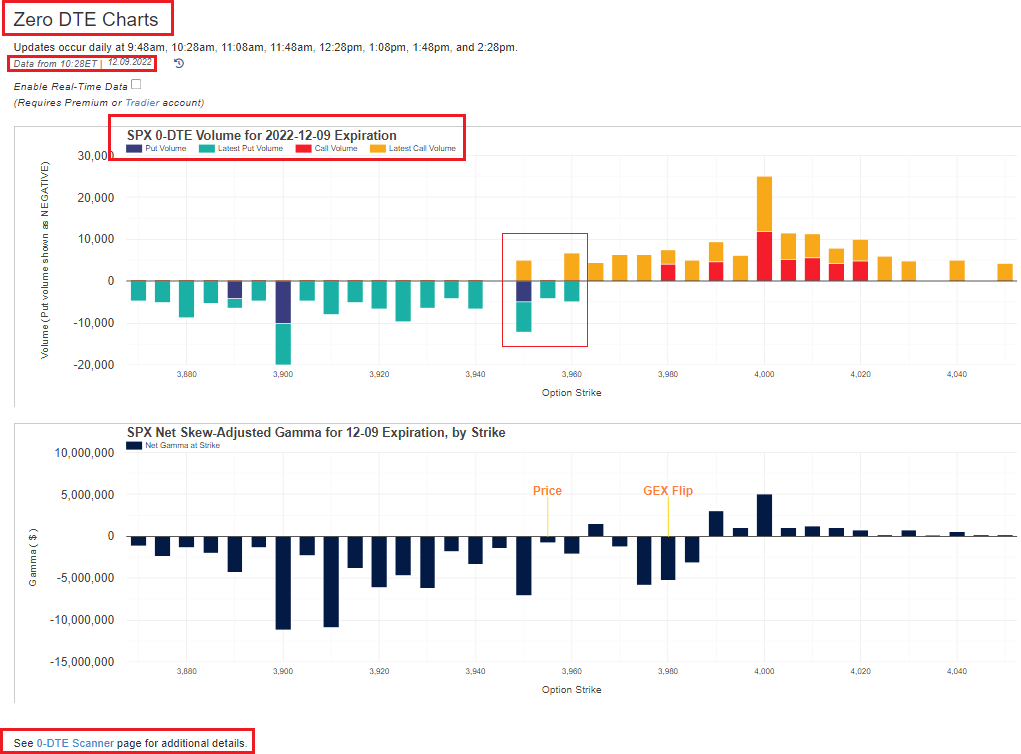

$SPX #0DTE scanner and $GEX charts from @TradeVolatility

3900 puts and 4000 calls continue to attract the highest number of bets

4000 call has the largest volume change

The struggle area now: 3950/3960

The safest 0DTE play is selling the 3900/4000 strangle for $1.50

#SPX #ES

3900 puts and 4000 calls continue to attract the highest number of bets

4000 call has the largest volume change

The struggle area now: 3950/3960

The safest 0DTE play is selling the 3900/4000 strangle for $1.50

#SPX #ES

We are going to sell the 3935/4000 strangle for $4.25

*Price went lower since the screenshot

#ES_F #trading #options #daytrading #futures

*Price went lower since the screenshot

#ES_F #trading #options #daytrading #futures

Our weekly NEXT WEEK, The Bear's take, The Bull's take, Our take is here

For more info read our newsletter coming out tomorrow morning before the open

Subscribe for Free

pointblanktrading.substack.com

#SPX $SPY $ES $SPX #ES_F $GAMMA $GEX #GAMMA #GEX $QQQ #QQQ

$DIA $IWM #trading

For more info read our newsletter coming out tomorrow morning before the open

Subscribe for Free

pointblanktrading.substack.com

#SPX $SPY $ES $SPX #ES_F $GAMMA $GEX #GAMMA #GEX $QQQ #QQQ

$DIA $IWM #trading

NEXT WEEK

The Bear's take:

•High rates, inflation, dollar

•Powell, and 8 more FEDs are coming

•Geopolitical tensions

• $VIX, $VVIX extremely oversold

• $FAANG struggling with 50DMA

• #Nasdaq rejected at 100DMA

• $RUT under 200DMA

• Short sellers at $SPX 200DMA

$ES_F

The Bear's take:

•High rates, inflation, dollar

•Powell, and 8 more FEDs are coming

•Geopolitical tensions

• $VIX, $VVIX extremely oversold

• $FAANG struggling with 50DMA

• #Nasdaq rejected at 100DMA

• $RUT under 200DMA

• Short sellers at $SPX 200DMA

$ES_F

Czas by napisać jakiś dłuższy wątek🧵 z szerszym spojrzeniem na rynki akcji, bo wygląda to ciekawie. Zacznijmy od indeksu #DJIA (Dow Jones Industrial Avg). Uwaga techniczna: wykresy indeksów w USA na zamknięcie 23.11, pozostałe - na zamknięcie 24.11 /1

DJIA, najsilniejszy z indeksów flagowych w USA, dotarł do oporu, jaki stanowi szczyt z 16.08.22. Wyjdzie jeszcze wyżej? Moim zdaniem tak, a jego celem zdaje się być luka (gap) z kwietnia '22. Kto nie wierzy w siłę przyciągania/odpychania starych, nie zamkniętych luk, powinien /2

Our weekly NEXT WEEK, The Bear's take, The Bull's take, Our take is here

For more info read our newsletter coming out tomorrow morning before the open

Subscribe for Free

pointblanktrading.substack.com

#SPX $SPY $ES $SPX #ES_F $GAMMA $GEX #GAMMA #GEX $QQQ #QQQ

$DIA $IWM #trading

For more info read our newsletter coming out tomorrow morning before the open

Subscribe for Free

pointblanktrading.substack.com

#SPX $SPY $ES $SPX #ES_F $GAMMA $GEX #GAMMA #GEX $QQQ #QQQ

$DIA $IWM #trading

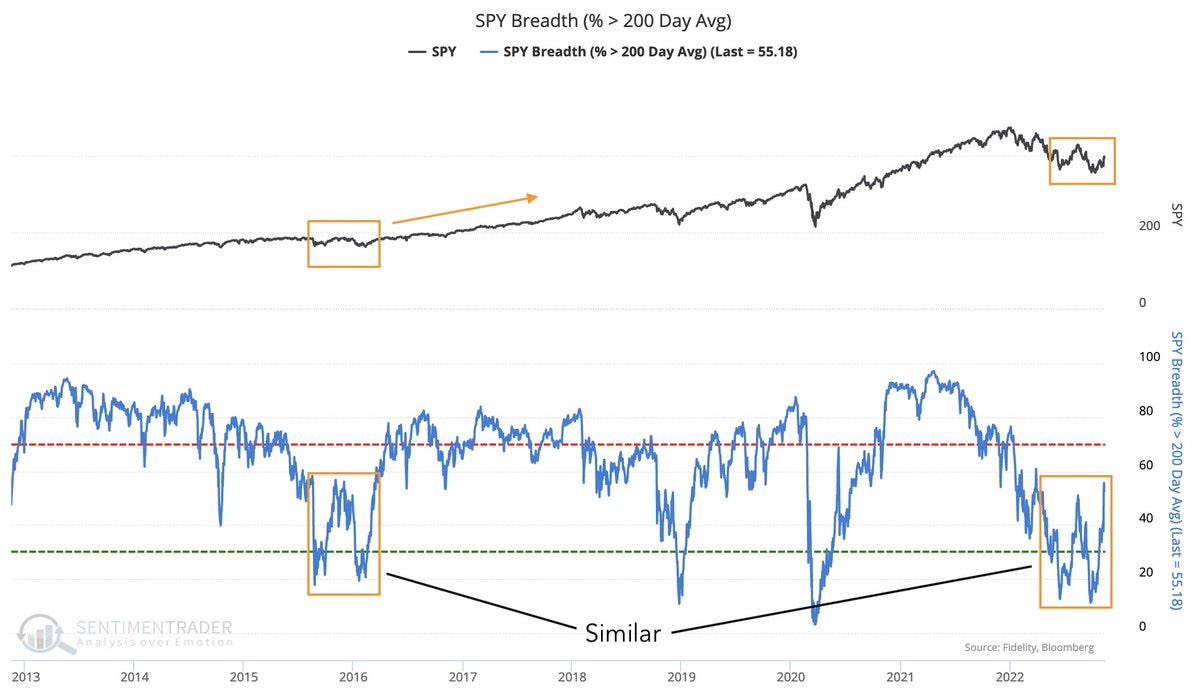

This chart is shows current market breadth. Note that macro setup was very different in 2015/16 ; massive stimulus outside US and the Fed paused after 1 hike. We narrowly avoided recession, and inflation was not an issue (deflation was).

This is very different from what we have now so don’t draw any hasty parallels and stay vigilant. #ES #investing

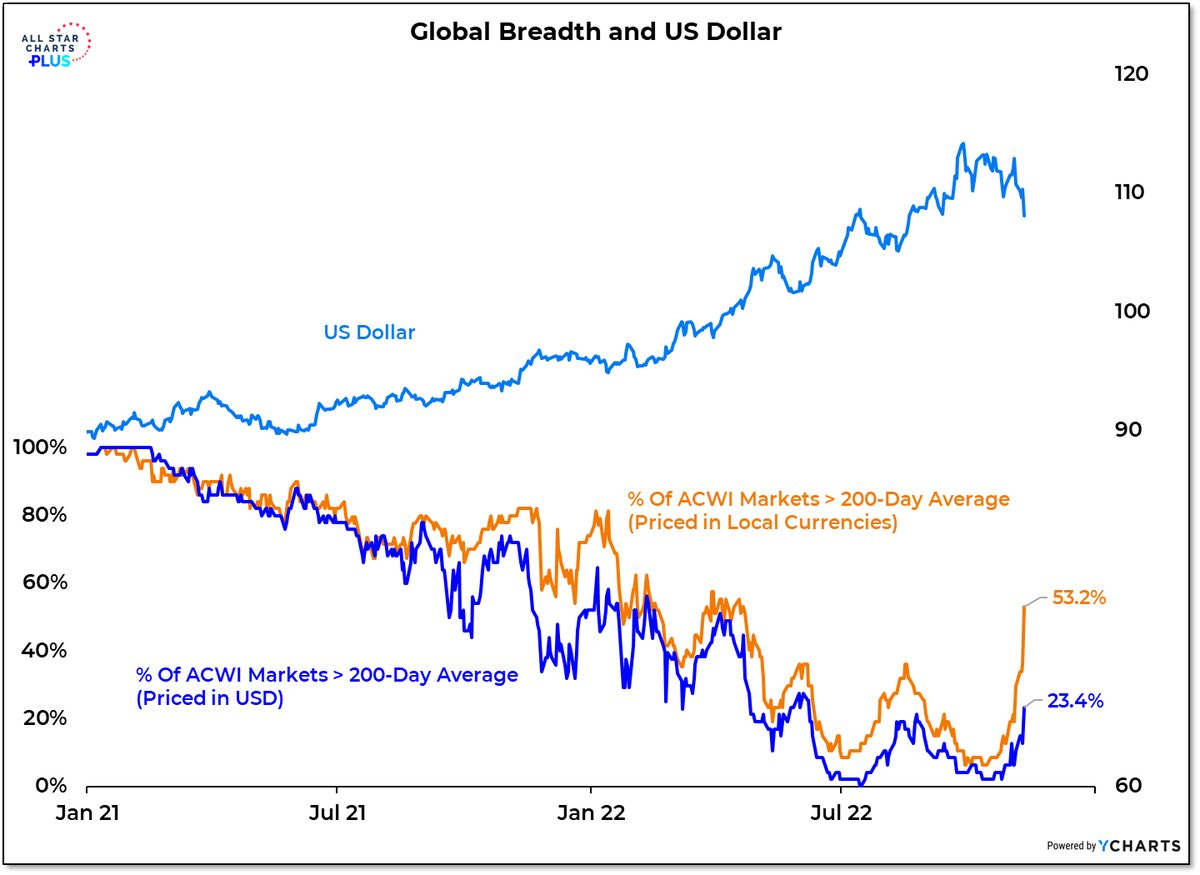

The key STILL is the dollar. Weaker dollar means less pressure on world economy means higher stock prices and good for Bitcoin. I wish it were that easy. To me it looks like #markets got ahead of themselves since October 1.

NEXT WEEK

The Bear's take:

•High inflation, and high dollar

•Rising Interest rates

•Recession

•Geopolitical tensions

•FMOC

• $VIX $ $VVIX near important support

•Indices are near important resistance levels

•Earnings won't be good

#SPX $SPY $ES $SPX #trading #ES_F

The Bear's take:

•High inflation, and high dollar

•Rising Interest rates

•Recession

•Geopolitical tensions

•FMOC

• $VIX $ $VVIX near important support

•Indices are near important resistance levels

•Earnings won't be good

#SPX $SPY $ES $SPX #trading #ES_F

It's here...

Our usual "NEXT WEEK, The Bear's Opinion, The Bull's Opinion, Our Opinion."

For more info read our newsletter, will be out tonight

$Gamma, $VIX, $SPX, $DJI, $DXY, $FAANG, Sectors and more

Subscribe for free

pointblanktrading.substack.com

Our usual "NEXT WEEK, The Bear's Opinion, The Bull's Opinion, Our Opinion."

For more info read our newsletter, will be out tonight

$Gamma, $VIX, $SPX, $DJI, $DXY, $FAANG, Sectors and more

Subscribe for free

pointblanktrading.substack.com

Late, but it's here:

Our usual "NEXT WEEK, The Bear's Opinion, The Bull's Opinion, Our Opinion."

To learn more, read our newsletter, coming out tomorrow at noon.

Our usual "NEXT WEEK, The Bear's Opinion, The Bull's Opinion, Our Opinion."

To learn more, read our newsletter, coming out tomorrow at noon.

NEXT WEEK

The Bear's take:

•High inflation, and high dollar

•Rising Interest rates

•Recession

•Geopolitical tensions

•Technical destruction of index charts

•Negative $Gamma regime

•VIX and VVIX uptrend

•Island reversal pattern

#SPX $SPY $ES $SPX #trading

#inflation #ES

The Bear's take:

•High inflation, and high dollar

•Rising Interest rates

•Recession

•Geopolitical tensions

•Technical destruction of index charts

•Negative $Gamma regime

•VIX and VVIX uptrend

•Island reversal pattern

#SPX $SPY $ES $SPX #trading

#inflation #ES

NEXT WEEK

The Bull's take

•Commodities are down

•Oil is down

•Extreme readings on many sentiment/broad indicators

• $SPX and $QQQ sitting in the 200WDMA

•Weekly bullish inverted hammer candle (all indices)

•Some indicators show positive divergence

•FAANG is holding

$SPY

The Bull's take

•Commodities are down

•Oil is down

•Extreme readings on many sentiment/broad indicators

• $SPX and $QQQ sitting in the 200WDMA

•Weekly bullish inverted hammer candle (all indices)

•Some indicators show positive divergence

•FAANG is holding

$SPY

$SPX

Our usual "NEXT WEEK" is here

"The Bear's take , The Bull's take, Our Take"

Subscribe to our Free newsletter for more info on Gamma, Regression analysis, CL, DXY, FAANG stocks etc

pointblanktrading.substack.com

Our usual "NEXT WEEK" is here

"The Bear's take , The Bull's take, Our Take"

Subscribe to our Free newsletter for more info on Gamma, Regression analysis, CL, DXY, FAANG stocks etc

pointblanktrading.substack.com

NEXT WEEK

The Bear's take:

•High inflation, and high dollar

•Rising Interest rates

•Recession

•Geopolitical tensions

•Technical destruction of index charts

•Negative $Gamma regime

•Bearish weekly candles

•Violation of June lows

#SPX $SPY $ES $SPX #trading

#inflation

The Bear's take:

•High inflation, and high dollar

•Rising Interest rates

•Recession

•Geopolitical tensions

•Technical destruction of index charts

•Negative $Gamma regime

•Bearish weekly candles

•Violation of June lows

#SPX $SPY $ES $SPX #trading

#inflation

Note: This👇is standard US propaganda, a vital arm of the Pentagon and US MIC to misinform the American people in the service of Washington’s strategic interests & policy:

North Korea’s Missile Tests Are Part of a Political Warfare and Blackmail Strategy - 19fortyfive.com/2022/09/north-…

North Korea’s Missile Tests Are Part of a Political Warfare and Blackmail Strategy - 19fortyfive.com/2022/09/north-…

2/Plain and simply, Washington has utterly failed to keep up w/ and understand the evolution of DPRK's nuclear policy. It's abject failure to factor in Kim Yo Jong's July 10, 2020 press statement and properly assimilate DPRK's updated Sept 2022 Nuclear Law

3/ - which is also lost on analysts & the media - leads to completely ineffective US North Korea policy that will endlessly grope in the dark like a blind man in the noonday sun. If the article👆reflects Washington's POV then US policy will continue to

📣Faltam 14 dias!

Divulgamos 214 candidaturas progressistas a #federal e #estadual de TODAS as 27 UFs, sendo

123 mulheres

94 pessoas negras

7 indígenas

Pra ficar mais fácil de achar os fios de cada UF, agrupamos todos aqui neste meta-fio

Favoritem e compartilhem!🥹🙏

Bora?🧶

Divulgamos 214 candidaturas progressistas a #federal e #estadual de TODAS as 27 UFs, sendo

123 mulheres

94 pessoas negras

7 indígenas

Pra ficar mais fácil de achar os fios de cada UF, agrupamos todos aqui neste meta-fio

Favoritem e compartilhem!🥹🙏

Bora?🧶

Siga este fio👇 para as candidaturas a #estadual e a #federal de #AC

Federais:

@perpetua_acre

@leodebritoac

Estadual:

@cesarioAC

#ViradaProgressista

Federais:

@perpetua_acre

@leodebritoac

Estadual:

@cesarioAC

#ViradaProgressista

Siga este fio para as candidaturas a #estadual e a #federal de #AL.

Estaduais:

@drvalmirPT

@CiceroFilho65

@AlagoasElida

Débora Marcolino

Federal:

@paulaodopt

#ViradaProgressista

Estaduais:

@drvalmirPT

@CiceroFilho65

@AlagoasElida

Débora Marcolino

Federal:

@paulaodopt

#ViradaProgressista

American fascism👇

AG Garland issues memo on DOJ communications with Congress after retirements, whistleblower reports

"Attorney General Merrick Garland reiterated the DOJ's policy that personnel are prohibited from communicating with members of Congress"

foxnews.com/politics/ag-ga…

AG Garland issues memo on DOJ communications with Congress after retirements, whistleblower reports

"Attorney General Merrick Garland reiterated the DOJ's policy that personnel are prohibited from communicating with members of Congress"

foxnews.com/politics/ag-ga…

2/Too harsh of a criticism?

Fascism: “2 : a tendency toward or actual exercise of strong autocratic or dictatorial control”

“Garland said all communication with Congress must be handled by the Office of Legislative Affairs (OLA). Per DOJ policy, "no department employee may

Fascism: “2 : a tendency toward or actual exercise of strong autocratic or dictatorial control”

“Garland said all communication with Congress must be handled by the Office of Legislative Affairs (OLA). Per DOJ policy, "no department employee may

3/"communicate with Senators, Representatives, congressional committees, or congressional staff without advance coordination, consultation, and approval by OLA.””

What’s the first thing an American fascist does? “Accuse the other side of that which you are guilty.”

The Democratic

What’s the first thing an American fascist does? “Accuse the other side of that which you are guilty.”

The Democratic