Discover and read the best of Twitter Threads about #eurusd

Most recents (24)

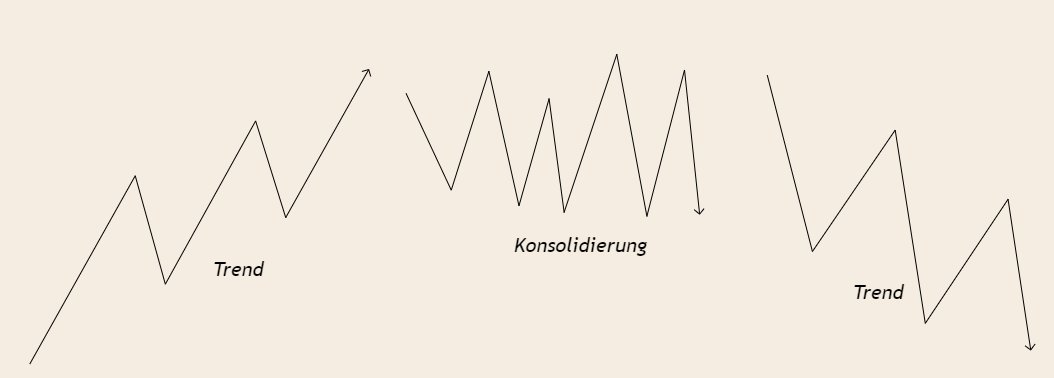

Es geht weiter in unserer Twitter - Tradingschule mit der Marktstruktur. Bearish, mit dem Trend etc. pp....viele Wörter die dieselbe Sache beschreiben.

Warum ihr noch nicht profitabel seid, weil ihr sie nicht respektiert und wie ihr sie nutzen könnt, erfahrt ihr hier... 🧵👇

Warum ihr noch nicht profitabel seid, weil ihr sie nicht respektiert und wie ihr sie nutzen könnt, erfahrt ihr hier... 🧵👇

ICT Silver Bullet 2023 GEM

Live examples 🧵

#ict #silverbullet #nwog #ndog #forextrading #forextrader #indices

Live examples 🧵

#ict #silverbullet #nwog #ndog #forextrading #forextrader #indices

Tóm tắt siêu gọn cho ae lười đọc về FOMC đêm qua: Fed nhấn mạnh thị trường lao động vẫn quá tốt và đồng ý rằng việc tăng lãi suất như vậy là "hơi nhanh", phát đi tín hiệu rằng ls đã có đỉnh + theo dữ liệu cpi mà xem xét khi nào cần tái nới lỏng 💸💵💰

đáy của tài sản rủi ro đã có hay chưa thì ko thể khẳng định, việc Fed tăng thêm ls sẽ khó xảy ra, điều quan trọng đó là mức ls này sẽ đc duy trì trong bao lâu. Dữ liệu kinh tế tệ hại của Mỹ đang khiến dòng tiền ko ngừng chảy từ dollar vào tài sản an toàn

#MarketReport 2023/04

1) In this thread, I'll cover comparative performance of

📌 #Stock Indices

📌 #Exchange Rates

📌 Treasury #Bills and Government #Bonds

both for April and since pandemic.

1) In this thread, I'll cover comparative performance of

📌 #Stock Indices

📌 #Exchange Rates

📌 Treasury #Bills and Government #Bonds

both for April and since pandemic.

#ChartStorm: 1/17

🗓️ March Performance of ...

🇺🇸 #SPX #IXIC #DJI 🇯🇵 #NI225 🇩🇪 #DAX 🇹🇷 #XU100

#DXY #EURUSD #GBPUSD #CADUSD #JPYUSD #TRYUSD

#TreasuryBills #GovernmentBonds #Yields

🗓️ March Performance of ...

🇺🇸 #SPX #IXIC #DJI 🇯🇵 #NI225 🇩🇪 #DAX 🇹🇷 #XU100

#DXY #EURUSD #GBPUSD #CADUSD #JPYUSD #TRYUSD

#TreasuryBills #GovernmentBonds #Yields

2) Here I'll cover 6 stock market indices in 4 countries:

In order to compare the relative performances, I've chosen a pre-pandemic basis, which is 31/12/2019 closing values.

As Nasdaq, S&P500 and DJI are denominated in US dollars, but the others not, returns are misleading.

In order to compare the relative performances, I've chosen a pre-pandemic basis, which is 31/12/2019 closing values.

As Nasdaq, S&P500 and DJI are denominated in US dollars, but the others not, returns are misleading.

3) I have adjusted the data, and now all are denominated in US dollars.

#BIST returns are still amazing with its 30.4%, but not striking as above. Besides it is positive only after Sep'22. #Nasdaq is leading with 36.2% return. #Nikkei225 is the only index below pandemic level.

#BIST returns are still amazing with its 30.4%, but not striking as above. Besides it is positive only after Sep'22. #Nasdaq is leading with 36.2% return. #Nikkei225 is the only index below pandemic level.

THREAD 🧵COT DATAS RELEASED !!!

1- EURO FUTURES #EURUSD

Net positions of commercials is ranging, while open interest rises, which indicates they predominantly open positions compared to closing contracts. Also, opened long and short contracts are equal, in terms of amount.

1/9

1- EURO FUTURES #EURUSD

Net positions of commercials is ranging, while open interest rises, which indicates they predominantly open positions compared to closing contracts. Also, opened long and short contracts are equal, in terms of amount.

1/9

We observe huge drop in open interest, during consolidation market, as the net positions of commercial were increasing. This is cleary seen in the blue box.

2/9

2/9

Huge drop (15% or more) in open interest during consolidation market is the big indication of where smart money reset themselves, in terms of hedging programs. SMT inbetween them robustly supports this idea. Meaning that FX is verye likely bullish, till the next quarter

3/9

3/9

#DXY #USD #EURUSD #trading

I removed 33% of my longs on the EURUSD @ 1.0666-1.0693.

USD net long 67%

I removed 33% of my longs on the EURUSD @ 1.0666-1.0693.

USD net long 67%

I removed another 15% of my longs on the EURUSD @ 1.0702.

USD net long 50%

My tweet on Mar 10 "USD net long 67%" should read as follows "USD net long 33%".

USD net long 50%

My tweet on Mar 10 "USD net long 67%" should read as follows "USD net long 33%".

I removed another 15% of my longs on the EURUSD @ 1.0725. USD net long 65%.

Here's a Step-by-Step guide on how I trade High Probability CHoCH 💯

Once you master it, your trading will improve by 67% (guaranteed)

A short thread 🧵 🪡

🖤 & RT for others

Once you master it, your trading will improve by 67% (guaranteed)

A short thread 🧵 🪡

🖤 & RT for others

In the next 3 minutes (or more),

I'll show you how exactly to trade the highest probability CHoCH with high R:R

But before we begin, do me a favour:

Kindly Retweet the first tweet for other to see.

Done? You're my comrade 👊

Now let's dive 👇

I'll show you how exactly to trade the highest probability CHoCH with high R:R

But before we begin, do me a favour:

Kindly Retweet the first tweet for other to see.

Done? You're my comrade 👊

Now let's dive 👇

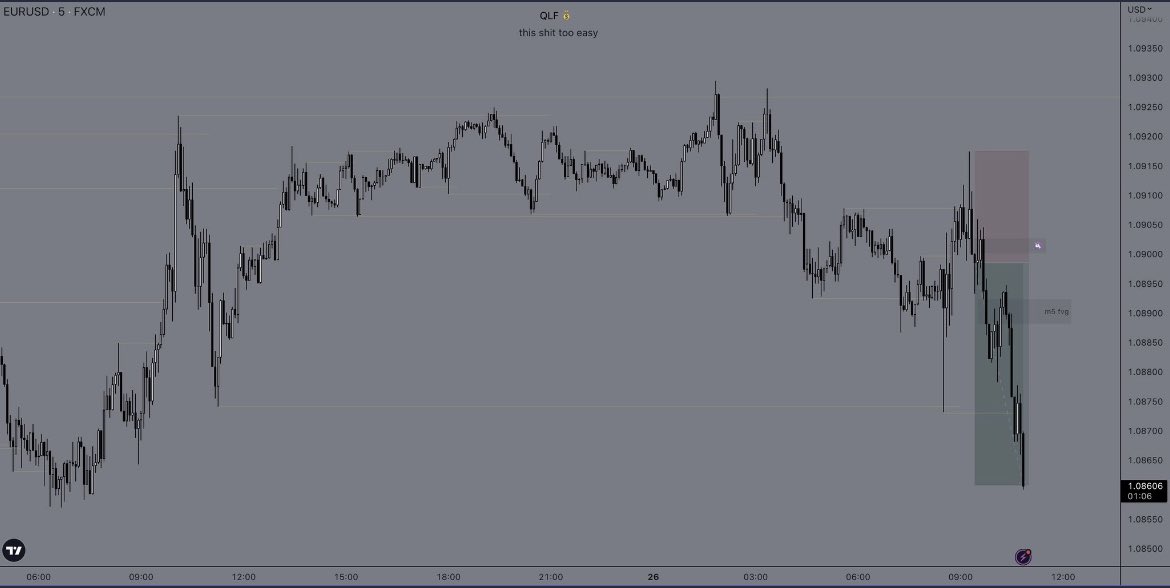

How I made 23R trading forex in 2 days risking only 1R per trade?

Sharing my 2 forex setups & exemples from today 🔥

Setup 1

- htf fu (liquidity sweep), m5 bos, ltf fu into bb / of (breaker block / order flow), m5 or m1 bos, bos / fvg / ob entry, 2R

🧵1/…

#forextrading

Sharing my 2 forex setups & exemples from today 🔥

Setup 1

- htf fu (liquidity sweep), m5 bos, ltf fu into bb / of (breaker block / order flow), m5 or m1 bos, bos / fvg / ob entry, 2R

🧵1/…

#forextrading

Model 2

- htf fu, ltf fu right away, m5 or m1 bos, bos / fvg / ob entry, 2R

These 2 model setups combined with a 2R fixed TP are lethal 🎯

(I do sometimes target higher RR when I identify clear LRLR - low risk liquidity runs and / or MMXM)

Here are some exemples

🧵 2/…

- htf fu, ltf fu right away, m5 or m1 bos, bos / fvg / ob entry, 2R

These 2 model setups combined with a 2R fixed TP are lethal 🎯

(I do sometimes target higher RR when I identify clear LRLR - low risk liquidity runs and / or MMXM)

Here are some exemples

🧵 2/…

From today’s trades that I SHARED HERE ON TWITTER IN REAL TIME as they were happening and I was entering them - NOT IN HINDSIGHT

(You can check all of my tweets from these past weeks to verify my claim - no 🧢)

Exemple 1:

#EURUSD : htf fu, bos, ltf fu into bb…

🧵 3/…

(You can check all of my tweets from these past weeks to verify my claim - no 🧢)

Exemple 1:

#EURUSD : htf fu, bos, ltf fu into bb…

🧵 3/…

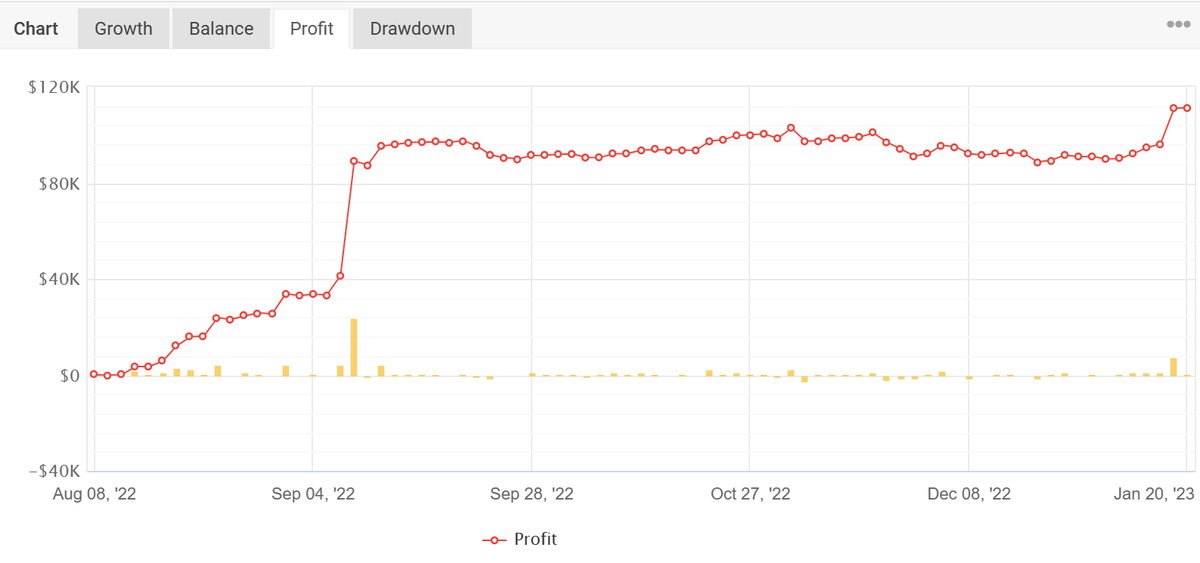

🚀Degen Strategy🚀

💰How I turned $2048 into $100,000 in 1 month, and NOT losing it all back.

👉 No bullshit, at the end of the thread, there is a link for you guys to verify trade record on @Myfxbook

🆘This is NOT AN EASY STRATEGY.🆘

#forex #crypto

💰How I turned $2048 into $100,000 in 1 month, and NOT losing it all back.

👉 No bullshit, at the end of the thread, there is a link for you guys to verify trade record on @Myfxbook

🆘This is NOT AN EASY STRATEGY.🆘

#forex #crypto

1⃣ A High Conviction View.

$DXY (USD Index) was trading around 105, a hard support, which if it holds, I have high conviction it will bounce to 110 in a short time, aka, bullish continuation bias.

With that view, I chose to short #EURUSD and Long #USDJPY

$DXY (USD Index) was trading around 105, a hard support, which if it holds, I have high conviction it will bounce to 110 in a short time, aka, bullish continuation bias.

With that view, I chose to short #EURUSD and Long #USDJPY

2⃣ Money Management (MM) is 🔑

I deposited $2048 on 08.08.2022, with that fund, I can trade up to 100 lot #EURUSD. But my trade size is only 0.1 to 0.5 lot.

First trade was a loss, neverminded, I tried again the next day and started making some small wins.

I deposited $2048 on 08.08.2022, with that fund, I can trade up to 100 lot #EURUSD. But my trade size is only 0.1 to 0.5 lot.

First trade was a loss, neverminded, I tried again the next day and started making some small wins.

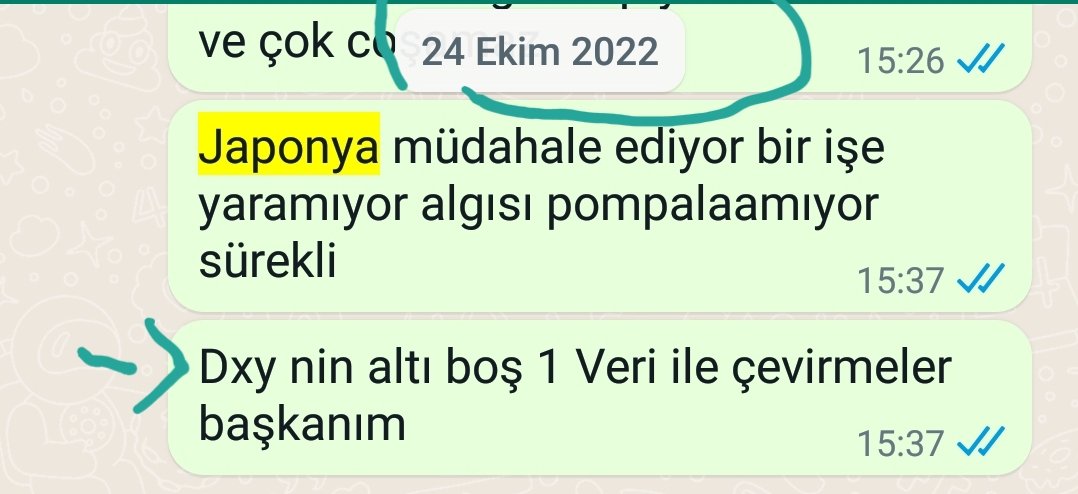

Tv 'de izliyorum Japon yeni dolar'a karşı güçleniyor deniyor. Geçen aylarda nasıldı ? Japonya ne yaparsa yapsın değer kaybını önleyemiyor.

😎

😎

Algı işleri hep.. #DXY Ekimden beri düşüyor.

EURUSD High Probability Trades - A Thread 🧵

We are going to have a look at how we can identify:

1. The correct days to look for a trade

2. The direction we should trade in

3. Where to look for entries on a set and forget basis

4. Where to look for the high r/r trades

#eurusd

We are going to have a look at how we can identify:

1. The correct days to look for a trade

2. The direction we should trade in

3. Where to look for entries on a set and forget basis

4. Where to look for the high r/r trades

#eurusd

#EURUSD fvg delievered as expected

TP 1 hit (4R)

50% off and would move SL to BE if i was in

but unluckily for me and my Account i need to practice Patience and discipline

So no trade for me after my win in the morning

TP 1 hit (4R)

50% off and would move SL to BE if i was in

but unluckily for me and my Account i need to practice Patience and discipline

So no trade for me after my win in the morning

outlined before it happen

Narrative for the Trade Idea

Daily Currency 🧵- Nov 11th, 2022

$DXY #DXY

Huge moves happening, some that require attention. Starting with the dollar, we saw this blow through momo yesterday and continue to fall this morning. To get a solid trend shift, we're going to need to see some components shift too!

$DXY #DXY

Huge moves happening, some that require attention. Starting with the dollar, we saw this blow through momo yesterday and continue to fall this morning. To get a solid trend shift, we're going to need to see some components shift too!

Daily Currency 🧵- Nov 10th, 2022

$DXY #DXY

The dollar is holding a bid ahead of the CPI print today. Remember, it's bullish trend until it isn't. Lower VAMP AND momo MUST hold for the trend to remain intact.

$DXY #DXY

The dollar is holding a bid ahead of the CPI print today. Remember, it's bullish trend until it isn't. Lower VAMP AND momo MUST hold for the trend to remain intact.

Daily Currency 🧵- Nov 9th, 2022

$DXY #DXY

The dollar seems to continue to hold above momo and lower VAMP. These levels would need to break before we can talk about a confirmed dollar top / "peak dollar".

$DXY #DXY

The dollar seems to continue to hold above momo and lower VAMP. These levels would need to break before we can talk about a confirmed dollar top / "peak dollar".

DISCLAIMER : This is for educational purpose and not financial advise.

Monthly market analysis Oct 31, 2022

#StockMarket #DowJones best month since 1976

Let's look at more closely 🧵👇

Monthly market analysis Oct 31, 2022

#StockMarket #DowJones best month since 1976

Let's look at more closely 🧵👇

1. After technical oversold and very negative sentiment in Sep month, #StockMarket was finally able to reverse direction this month. $DJIA had the best month since 1976 (+14%). $NDX was underperformed (5%) compared to $SPX (8.8%), $RUT(11%).

2. Let's look at US 10Y #Bond Yield price action. It was very volatile and tested 4.3% Jun'08 high before reversing -9.8% to the end of the month. This month it finished up 5.7%. RSI did not make new high at Oct 21 when it reached peak 4.33% (bearish reversal)

#StockMarket

#StockMarket

DISCLAIMER : This is for educational purpose and not financial advise.

Monthly market analysis Sep 30, 2022

#StockMarket Worst week, worst month, and worst quarter of the year since Financial crisis and dot-com bubble. Why it happened?

Let's look at more closely 🧵👇

Monthly market analysis Sep 30, 2022

#StockMarket Worst week, worst month, and worst quarter of the year since Financial crisis and dot-com bubble. Why it happened?

Let's look at more closely 🧵👇

1. After making reversal at H/S neckline in early Aug, US 10Y Yield #bond broke out from Feb'11 high 3.73% and have held up strongly for about a week. This month, yield has gone up +20%, bad for risk and long duration assets

#StockMarket

#StockMarket

2. US 02Y Yield #bond broke out resistance 3.7% and past 4% strongly after Fed Reserve hawkish announcement and never look back. This month yield has gone up more than +22%

#StockMarket

#StockMarket

1/6 Busy day today in the markets,

Since I'm the type of trader who guides himself by the Price Action mainly, I prefer the phrase "show me the charts and I'll tell you the news" by Bernand Baruch.

Some thoughts below about #EURUSD #DXY .

CC: @JLinWins @deerpointmacro

Since I'm the type of trader who guides himself by the Price Action mainly, I prefer the phrase "show me the charts and I'll tell you the news" by Bernand Baruch.

Some thoughts below about #EURUSD #DXY .

CC: @JLinWins @deerpointmacro

2/6 Pre-Powell speech we had some headlines from #ECB officials signaling a potential 75bps rate hike due to #inflation and problems in the #EURO zone.

This caused $EURUSD to tap the supply area and perform a beautiful liquidity grab before resuming the current trend.

This caused $EURUSD to tap the supply area and perform a beautiful liquidity grab before resuming the current trend.

3/6 After losing the 1.00 / parity area, $EURUSD buyers must defend the $0.995 level. If we see that level taken out on a daily closing basis the target for this "bearish flag" pattern is $0.96 area, a -3.46% give or take.

#analysis #10YRUS #DXY #crypto #SP500 #EURUSD #Bitcoin #ETH #EGLD

1/16 Good evening everyone,

All eyes where on the CPI, Core CPI and PPI reports this week. The slowdown in inflation is actually a confirmation that FED's demand destruction program starts to be felt by markets.

1/16 Good evening everyone,

All eyes where on the CPI, Core CPI and PPI reports this week. The slowdown in inflation is actually a confirmation that FED's demand destruction program starts to be felt by markets.

#EURUSD 4hr Update

1/3

GA on FOMC day!

Watch for blue TL break. As long as PA is above this we can squeeze/spike higher b4 sell off resumes. We need a 4hr candle close below this TL b4 sellers come back in.

New fib ext drawn below. If we spike higher I will simple redraw

1/3

GA on FOMC day!

Watch for blue TL break. As long as PA is above this we can squeeze/spike higher b4 sell off resumes. We need a 4hr candle close below this TL b4 sellers come back in.

New fib ext drawn below. If we spike higher I will simple redraw

2/3

with new TL. New fib ext drawn as we had 2 green candle retracement during Asia WITHOUT completing 2 red candle closes below the previous swing lows at 0130. Complete candlestick structure requires 2 red candle closes below the swing low. If this doesn't occur and retraces

with new TL. New fib ext drawn as we had 2 green candle retracement during Asia WITHOUT completing 2 red candle closes below the previous swing lows at 0130. Complete candlestick structure requires 2 red candle closes below the swing low. If this doesn't occur and retraces

3/3

as we did during Asia with 2 green candles then we redraw the fib ext as above. If you aren't in a swing from above as I am and you are day trading... then good luck. If in swing positions shorts are still looking good and have not been invalidated.

GL and don't get chopped

as we did during Asia with 2 green candles then we redraw the fib ext as above. If you aren't in a swing from above as I am and you are day trading... then good luck. If in swing positions shorts are still looking good and have not been invalidated.

GL and don't get chopped

Ehi there #Crypto and #macro Twitter

Time for #market analysis #Number12!

"Quiet, before the storm"

I will explain here what happened since last week, and cover the broader #economy as it breaks

I will start from #onchain #BTC, going into #Technical Analysis + #macro🧵

Time for #market analysis #Number12!

"Quiet, before the storm"

I will explain here what happened since last week, and cover the broader #economy as it breaks

I will start from #onchain #BTC, going into #Technical Analysis + #macro🧵