Discover and read the best of Twitter Threads about #exports

Most recents (24)

🇺🇸 President Trump made America energy independent🛢️💪

The Biden administration sabotaged that achievement.

Come November 5, 2024, America will reclaim its independence.

(1/21)

The Biden administration sabotaged that achievement.

Come November 5, 2024, America will reclaim its independence.

(1/21)

1/ For the first time in nearly 70 years, the United States became a net energy exporter, unleashing oil and natural gas potential.

America became the world's number one producer of oil and natural gas! 📈🌍 #EnergyIndependence #USA

#MintPlainFacts | Every Friday, Plain Facts publishes a compilation of data-based insights, complete with easy-to-read charts, to help you delve deeper into the stories reported by Mint in the week gone by.

Read here: livemint.com/industry/retai…

Read here: livemint.com/industry/retai…

#MintPlainFacts | India’s retail #inflation eased to a 15-month low of 5.66% in March, data released on Wednesday showed.

This is the first time in three months that inflation has come in below #RBI's upper tolerance limit of 6%.

Read here: livemint.com/industry/retai…

This is the first time in three months that inflation has come in below #RBI's upper tolerance limit of 6%.

Read here: livemint.com/industry/retai…

#MintPlainFacts | The automobile industry recovered the majority of its lost ground in 2022-23, with sales of retail vehicles jumping by 21%.

Read here: livemint.com/industry/retai……

Read here: livemint.com/industry/retai……

"IF I WERE PRESIDENT, THE RUSSIA/UKRAINE WAR WOULD NEVER HAVE HAPPENED, BUT EVEN NOW, IF PRESIDENT, I WOULD BE ABLE TO NEGOTIATE AN END TO THIS HORRIBLE AND RAPIDLY ESCALATING WAR WITHIN 24 HOURS. SUCH A TRAGIC WASTE OF HUMAN LIFE!!!"

gab.com/realdonaldtrum…

gab.com/realdonaldtrum…

#Trump ‘not far away from #truth’ on #Ukraine – #Kremlin | Jan 27

- “Indeed, should the US President wish to put an end to this conflict, he could do it very quickly, using the opportunity to simply give instructions to the #Kiev regime,” #Peskov on Friday

graviolat.blogspot.com/p/trump-not-fa…

- “Indeed, should the US President wish to put an end to this conflict, he could do it very quickly, using the opportunity to simply give instructions to the #Kiev regime,” #Peskov on Friday

graviolat.blogspot.com/p/trump-not-fa…

Google Hides The Main #Reason For America"s #Arming Of #Ukraine | Jan 28

- Google’s censorship policy removes links to #SouthFront for 2 years. #Twitter and #FB also began to delete links to SF articles long before any sanctions against SF were introduced

archive.vn/Hw3Sg

- Google’s censorship policy removes links to #SouthFront for 2 years. #Twitter and #FB also began to delete links to SF articles long before any sanctions against SF were introduced

archive.vn/Hw3Sg

. @StateBank_Pak has released disaggregated #trade data for #Pakistan, for the first half of FY23. Some analysis on main trends in 🧵👇👇

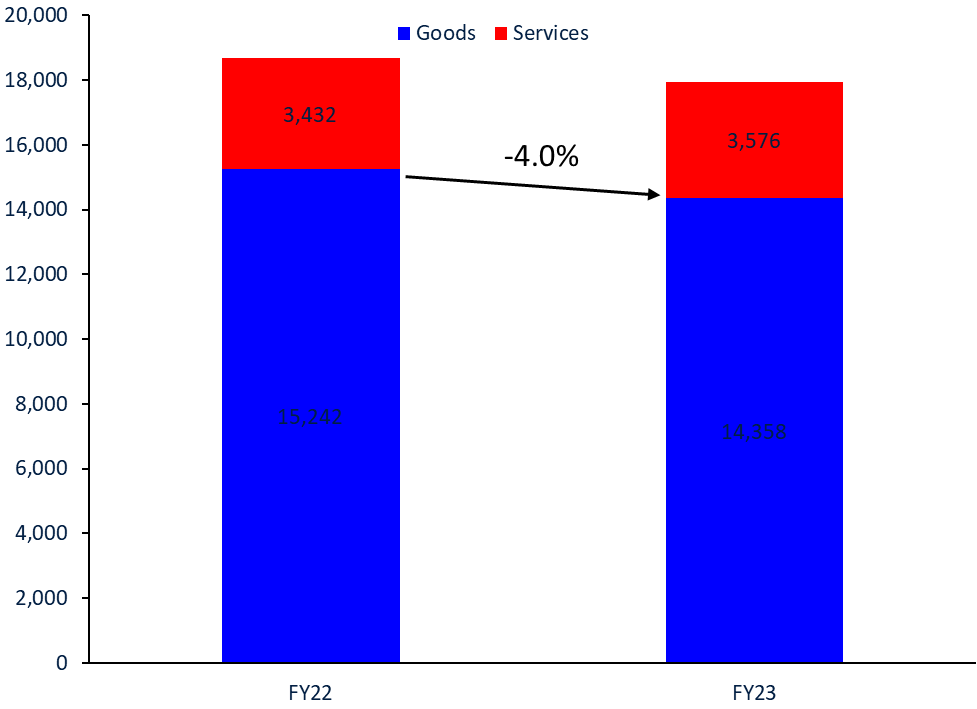

1) #Pakistan's #exports have declined in H1 FY23 relative to H1 FY22 by 4%. The fall is driven by goods #exports that fell by 5.8%.

2) By #destination, the largest #export contractions are observed to the USA, China, the UK and the UAE.

#Pakistan

#Pakistan

#Pakistan is going thru a complex #macro situation. At its heart is one symptom: the #CAD. Because the CAD has been perennial, this long-standing symptom translated into large foreign liabilities. Short 🧵👇

A confluence of unprecedented events in 2022 weakened asset prices across all markets. (1/n)

#assetallocation #investing #personalfinance #throwback #thread

#assetallocation #investing #personalfinance #throwback #thread

The Fed’s pivot to a less aggressive monetary policy is likely to set the tone for the markets in 2023. (2/n)

#FED #FederalReserve #monetarypolicy

#FED #FederalReserve #monetarypolicy

It is expected that global inflation will continue to be higher in this decade, in combination with a significant slowdown of the U.S. economy. (3/n)

#inflation #interestrates #globalmarket

#inflation #interestrates #globalmarket

#Siionisti'en bravuuri on junailla #goyim'en tuhoa niiden omalla kustannuksella.

#WEF -ideologia lahtaa yritykset ...kaasulla.

#Gasgrid Imatra #Räikkölä vs. #Korsakov.

- Korsakov on #LNG -satamakaupunki #Venäjä'n

#Sahalin'in alueella.

fi.m.wikipedia.org/wiki/Korsakov_…

#WEF -ideologia lahtaa yritykset ...kaasulla.

#Gasgrid Imatra #Räikkölä vs. #Korsakov.

- Korsakov on #LNG -satamakaupunki #Venäjä'n

#Sahalin'in alueella.

fi.m.wikipedia.org/wiki/Korsakov_…

‘#India buying #Russian #crude oil is good economics, don’t bring #politics into it’ | Jan 12

- India is among the world's top crude oil importers. The Asian nation has been largely purchasing Russian oil

firstpost.com/world/india-bu…

- India is among the world's top crude oil importers. The Asian nation has been largely purchasing Russian oil

firstpost.com/world/india-bu…

#EUSanctions #Hoax #EnergyWar

#India’s breaking all records for buying #Russian #oil, but who is the surprise buyer? | Jan 15

- The #US Is Snapping Up Refined #PetroleumProducts From India Made From #RussianCrude Oil

telegraphindia.com/business/india…

#India’s breaking all records for buying #Russian #oil, but who is the surprise buyer? | Jan 15

- The #US Is Snapping Up Refined #PetroleumProducts From India Made From #RussianCrude Oil

telegraphindia.com/business/india…

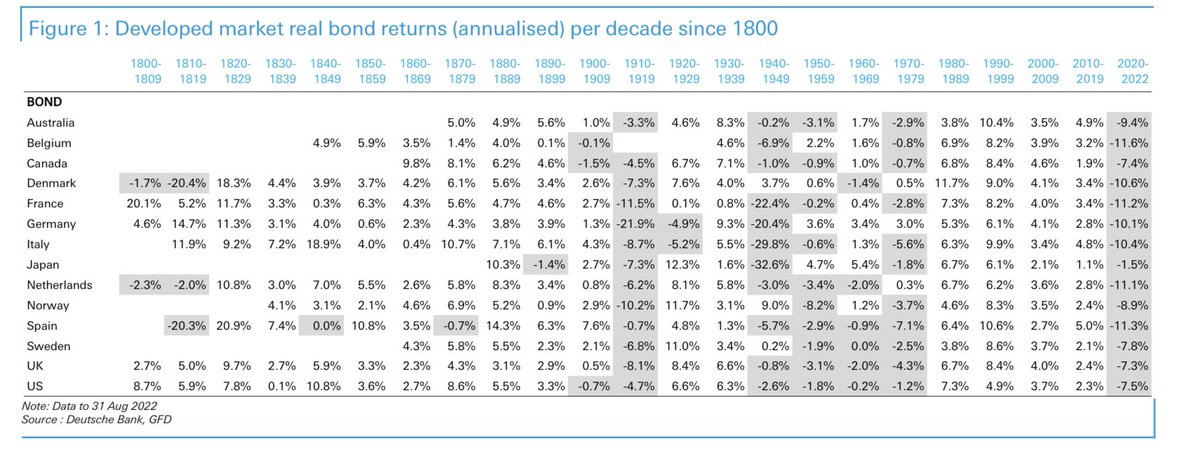

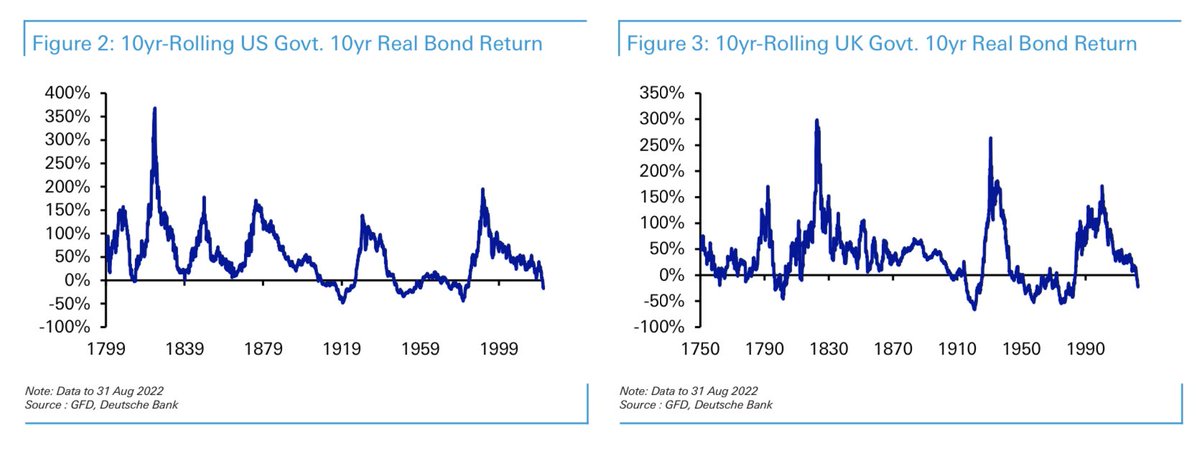

Long term charts vía DB. 2022 first global beat market in 70 years. Rollomt 10yr real government bond return for the US, UK, FR & DE. This year has turned negative for all of these countries for the first time since 1984, 1983, 1983, and 1958, respectively. #bonds #history

LT (over last 100 yrs) US returns:

– equities: +7.2% p.a. real) ****

– 10yr bonds/ +2.0% p.a.

– Corporate bonds: +2.7% p.a.

– T-bills (cash proxy): +0.4% p.a.

– gold: +1.6% p.a.

– oil: +0.5% p.a.

– US housing (prices only): +1.1% p.a.

#financial #markets #history

– equities: +7.2% p.a. real) ****

– 10yr bonds/ +2.0% p.a.

– Corporate bonds: +2.7% p.a.

– T-bills (cash proxy): +0.4% p.a.

– gold: +1.6% p.a.

– oil: +0.5% p.a.

– US housing (prices only): +1.1% p.a.

#financial #markets #history

Pakistan's exports to the Middle East declined by 5.57% YoY to $951.78m in the first five months of FY23, with the majority of this decline attributed to a drop in exports to the UAE.

Despite some growth in exports to Saudi Arabia, Qatar, and Bahrain, overall exports to the region were mixed. The UAE is the largest market for Pakistani exports, accounting for 65% of the region's total exports.

Major exports to the UAE include rice, bovine carcasses, and cotton ensembles. Meanwhile, exports to Saudi Arabia have remained stagnant at around $500m over the past decade, with top exports including rice, bovine carcasses, and tents.

⚡China's Jan-Nov surplus (in USD terms) $802.04 billion

#Imports +2.0% y/y

#Exports +9.1% y/y

1/ thread #trade #import #export #economy 🇨🇳 🇺🇸

#Imports +2.0% y/y

#Exports +9.1% y/y

1/ thread #trade #import #export #economy 🇨🇳 🇺🇸

Since #WWII, #USA has used #USdollar hegemony to transfer domestic crises, harvest world #wealth and undermine the economic and financial stability of other countries through armed conflicts, financial wars, and trade wars. To maintain US dollar is to maintain US world hegemony.

Since March 2022, #FederalReserve has raised interest rates 6X. On 2 Nov, its 75-point rate hike and sharp #USdollar appreciation caused global #currency depreciation, capital outflows, rising debt servicing costs, hiked imported inflation and currency/debt crises of countries.

⚡

China October trade balance(in USD term) $85.15bln; Est. $95.97bln, Prev. $84.75 bln;

#Imports -0.7% y/y ; Est. +0.0%, Prev.+0.3%;

#Exports -0.3% y/y ; Est. +4.5%, Prev.+5.7%.

1/ thread #trade #import #export #economy 🇨🇳 🇺🇸

China October trade balance(in USD term) $85.15bln; Est. $95.97bln, Prev. $84.75 bln;

#Imports -0.7% y/y ; Est. +0.0%, Prev.+0.3%;

#Exports -0.3% y/y ; Est. +4.5%, Prev.+5.7%.

1/ thread #trade #import #export #economy 🇨🇳 🇺🇸

#China October Yuan-denominated trade data

Trade balance +586.81 bln yuan; Prev.+573.57 bln yuan;

Imports +6.8% y/y, Est.+10.0%, Prev.+5.2%.

Exports +7.0% y/y, Est.+12.7%, Prev.+10.7%.

2/ thread #trade #import #export #econtwitter 🇨🇳

Trade balance +586.81 bln yuan; Prev.+573.57 bln yuan;

Imports +6.8% y/y, Est.+10.0%, Prev.+5.2%.

Exports +7.0% y/y, Est.+12.7%, Prev.+10.7%.

2/ thread #trade #import #export #econtwitter 🇨🇳

China September trade balance(in USD term) $84.75bln; Est. $80.3 bln, Prev. $79.39 bln;

#Imports +0.3% y/y ; Est. +0.0%, Prev.+0.3%;

#Exports +5.7% y/y ; Est. +4.0%, Prev.+7.1%.

1/ thread #trade #import #export #economy 🇨🇳 🇺🇸

#Imports +0.3% y/y ; Est. +0.0%, Prev.+0.3%;

#Exports +5.7% y/y ; Est. +4.0%, Prev.+7.1%.

1/ thread #trade #import #export #economy 🇨🇳 🇺🇸

#China September Yuan-denominated trade data

Trade balance +573.57 bln yuan; Est.+564.30 bln yuan, Prev.+535.91 bln yuan;

Imports +5.2% y/y, Est.+8.4%, Prev.+4.6%.

Exports +10.7% y/y, Est.+11.3%, Prev.+11.8%.

2/ thread #trade #import #export #econtwitter 🇨🇳

Trade balance +573.57 bln yuan; Est.+564.30 bln yuan, Prev.+535.91 bln yuan;

Imports +5.2% y/y, Est.+8.4%, Prev.+4.6%.

Exports +10.7% y/y, Est.+11.3%, Prev.+11.8%.

2/ thread #trade #import #export #econtwitter 🇨🇳

CHINA JAN.-SEPT. IMPORTS RISE 4.1% Y/Y, EXPORTS +12.5%.

3/Thread #trade #import #export #econtwitter 🇨🇳

3/Thread #trade #import #export #econtwitter 🇨🇳

In #India, #imports continue to rise faster than #exports, and the foreign exchange reserves have dropped from around $641 billion to $532 billion in the last 12 months.

A country accumulates foreign exchange reserves when its revenue generated from exports is greater than the expenditure incurred from imports. Crude, other mineral fuels and waxes constitute 27% of our total imports.

And China is our biggest import destination, whereas the USA is the country we export the most.

Can India turn the trend of falling #reserves?

Research : @Investywise

Can India turn the trend of falling #reserves?

Research : @Investywise

JUST IN:

China August trade balance(in USD term) $79.39 bln; Est. $92.40 bln, Prev. $101.26 bln;

#Imports +0.3% y/y ; Est. +1.20%, Prev.+2.3%;

#Exports +7.1% y/y ; Est. +13.0%, Prev.+18.0%.

1/ thread #trade #import #export #economy 🇨🇳 🇺🇸

China August trade balance(in USD term) $79.39 bln; Est. $92.40 bln, Prev. $101.26 bln;

#Imports +0.3% y/y ; Est. +1.20%, Prev.+2.3%;

#Exports +7.1% y/y ; Est. +13.0%, Prev.+18.0%.

1/ thread #trade #import #export #economy 🇨🇳 🇺🇸

JUST IN:

#China August Yuan-denominated trade data

Trade balance +535.91 bln yuan, Prev.+682.69 bln yuan.

Imports +4.6% y/y, Est. +6.3%, Prev.+7.4%.

Exports +11.8% y/y, Est. +18.5%, Prev.+23.9%.

2/ thread #trade #import #export #econtwitter 🇨🇳

#China August Yuan-denominated trade data

Trade balance +535.91 bln yuan, Prev.+682.69 bln yuan.

Imports +4.6% y/y, Est. +6.3%, Prev.+7.4%.

Exports +11.8% y/y, Est. +18.5%, Prev.+23.9%.

2/ thread #trade #import #export #econtwitter 🇨🇳

CHINA JAN.-AUG.IMPORTS RISE 5.2% Y/Y, EXPORTS +14.2%, TRADE SURPLUS 3.66 TRILLION YUAN.-CUSTOMS

3/Thread #trade #import #export #econtwitter 🇨🇳

3/Thread #trade #import #export #econtwitter 🇨🇳

Now we have dissaggregated @StateBank_Pak data on #Pakistan's #trade performance for the full of the FY22.

This thread will show performance in #values. not #volumes. Keep in mind FY22 was extraordinary in terms of high #prices, both for #imports and #exports. 👇👇👇🧵

This thread will show performance in #values. not #volumes. Keep in mind FY22 was extraordinary in terms of high #prices, both for #imports and #exports. 👇👇👇🧵

It’s Wednesday, which means it’s time to take stock of the week so far, draw on reserves, and soldier on (and uncover some facts while at it). Today, we dissect the RBI’s recent move to allow & encourage #foreigntrade payments to be made in INR. (1/8)

It’s a long-term plus for the Indian #economy and good news for the long-term investor. So, grab that coffee from the break room, and let’s delve into the long and short of it. (2/8)

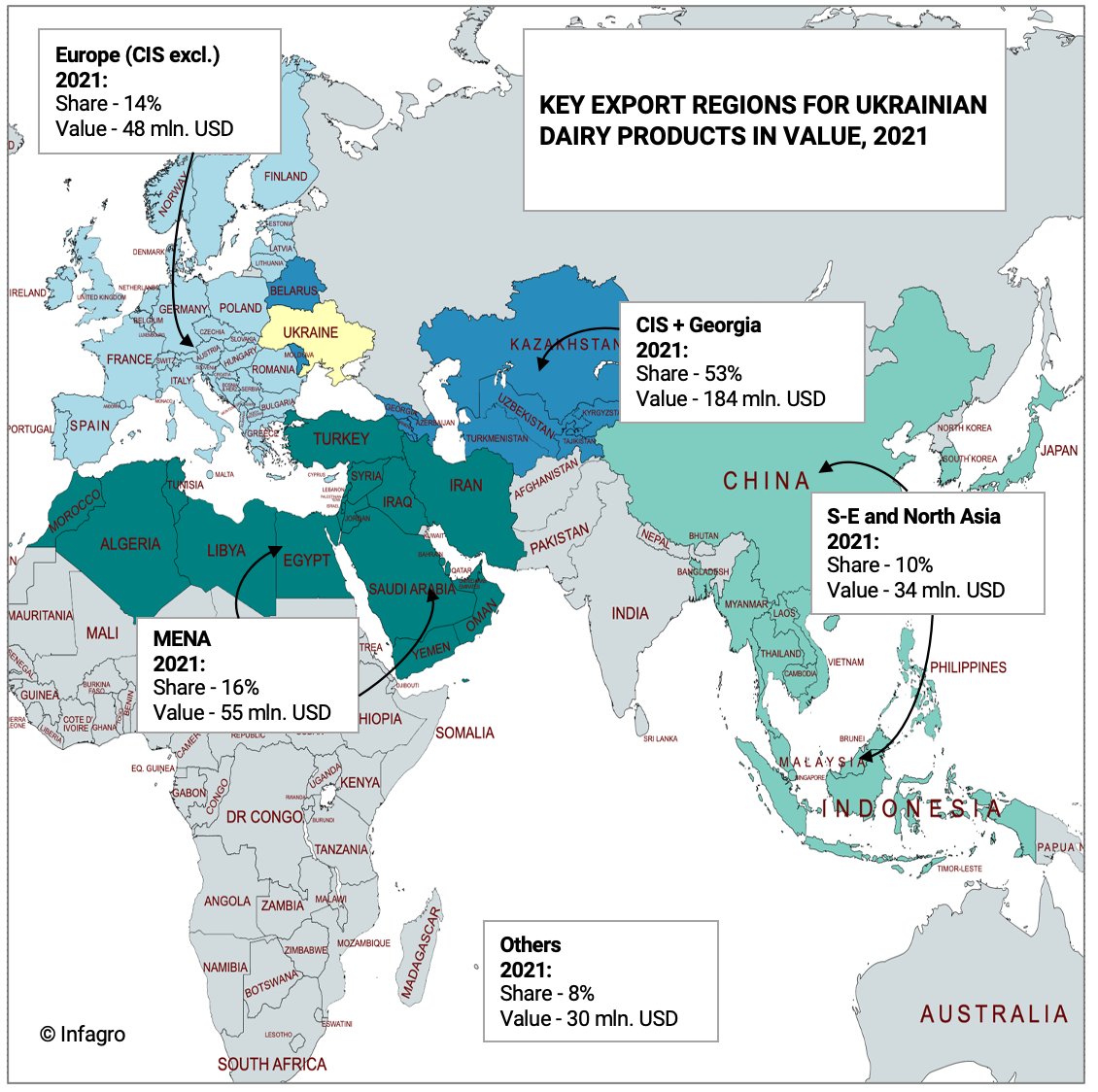

#Ukraine #Dairy #export during the #war 🧵1/ The war has made especially big impact on dairy exports. The developed logistics supply chains to traditional markets of the post-Soviet countries were broken. It is now impossible to load goods through our seaports.

What factors to look for to understand which direction are #interestrates headed:

1. Total Credit in the system

2. Which gets divided into External and Internal

3. External focuses on #CAD

4. Internal: Private & Govt

5. Private - #CreditOfftake

6. Govt - #FiscalDeficit

1. Total Credit in the system

2. Which gets divided into External and Internal

3. External focuses on #CAD

4. Internal: Private & Govt

5. Private - #CreditOfftake

6. Govt - #FiscalDeficit

3. External :

#CAD (Current Account Deficit - difference between country's #Imports & #Exports) goes up, #imports become expensive, rupee depreciates, bringing in imported #inflation

- interest rate tend to go up

#CAD (Current Account Deficit - difference between country's #Imports & #Exports) goes up, #imports become expensive, rupee depreciates, bringing in imported #inflation

- interest rate tend to go up

4. Internal Credit

5. #PrivateSector - #Creditofftake goes up interest rates rise

6. Govt - #FiscalDeficit goes up interest rates rise

5. #PrivateSector - #Creditofftake goes up interest rates rise

6. Govt - #FiscalDeficit goes up interest rates rise

A month ago I wrote this 🧵 on why #import duties were not the answer to #Pakistan's Balance of Payments constraints. #ImportBans are certainly not the answer either. Rather, they exacerbate the underlying problem. Five thoughts. 🧵👇

1\ The usual: CAD results from a macro imbalance (Saving too low relative to investment, so foreign saving needed (borrowing) (CAD is the mirror image of borrowing from the rest of the world (financial account of BOP)). Fixing the CAD takes increasing saving (cool off demand).

2\ The #importban in #Pakistan reduces #imports (does it? see point 3\ below), but not the CAD, because it also reduces #exports.

profit.pakistantoday.com.pk/2022/05/01/imp…

profit.pakistantoday.com.pk/2022/05/01/imp…

#MCProOpinion: Banks’ results for the March quarter have been excellent, but operating profit growth has hit a soft patch. What can boost their profits in FY23? 🤔

Find out ⏬

moneycontrol.com/news/opinion/i…

by @aparnaviyer02 | #Economy #Bank

Find out ⏬

moneycontrol.com/news/opinion/i…

by @aparnaviyer02 | #Economy #Bank

#MCProOpinion: The Rupee can weaken further in the near term, but there is something that can save the day over the medium term.

Read at:

moneycontrol.com/news/opinion/r…

#Rupee #Inflation

Read at:

moneycontrol.com/news/opinion/r…

#Rupee #Inflation

#MCProOpinion: The impact on the global economy due to China’s zero-COVID policy is just a preview of the disruptions ahead. And that will happen once the economic slowdown in China starts to bite.

Read at: moneycontrol.com/news/opinion/t…

by @SaibalDasgupta | #China #Economy #Lockdown

Read at: moneycontrol.com/news/opinion/t…

by @SaibalDasgupta | #China #Economy #Lockdown

Citing the previous tweet

and adding more information hoping to help get a clear panoramic on increasing #foodprices and the increasingly looming narrative of #recession 👇

and adding more information hoping to help get a clear panoramic on increasing #foodprices and the increasingly looming narrative of #recession 👇

A massive backlog of #grains is piling up in #Ukraine to the tune of nearly 25 million tons due to "#infrastructure challenges" and blocked #ports in the #BlackSea, including #Mariupol - @Reuters reports 📰

reuters.com/world/europe/u…

reuters.com/world/europe/u…

#Ukraine was the fourth-largest corn exporter in the 2020/21 season and the sixth-largest #wheat exporter in the world, according to the #IGC (International #Grains Council).

igc.int/en/downloads/2…

igc.int/en/downloads/2…

Thank you for the feedback, dear Yousuf. If you read the article carefully, you will see this is specific & data driven. A short thread to explain. 👇👇👇

Figure 2 in the article is built from a careful analysis combining micro-level *data* from all listed firms in Pakistan, & effective rates of protection (calculated based on FBR data on import duties and the latest input output *data* from IFPRI. It conveys the key message. 👇

Figure 3 comes from a careful econometric analysis we did w/@StefaniaLovo in which we recover markups from the data, and estimated systematic effects of changes in #import duties on these markups. It conveys the key message. 👇