Discover and read the best of Twitter Threads about #futures

Most recents (24)

Thing to note: 👇🏼

#CPI usually inputs a minimum 1%+ move on $SPY $SPX whether that is to the upside or downside on $SPY $SPX $ES_F

#CPI usually inputs a minimum 1%+ move on $SPY $SPX whether that is to the upside or downside on $SPY $SPX $ES_F

Thing to note: 👇🏼

#CPI usually inputs a minimum 1%+ move on $SPY $SPX whether that is to the upside or downside on $SPY $SPX $ES_F

#CPI usually inputs a minimum 1%+ move on $SPY $SPX whether that is to the upside or downside on $SPY $SPX $ES_F

#Ethereum's #revenue sees fourth consecutive monthly increase, reaching $208m, but underperforms compared to #Bitcoin as global #crypto market faces #bearish trends. 🧵👇

Sub to our TG for the latest: t.me/matrixportupda…

Sub to our TG for the latest: t.me/matrixportupda…

From #bearish to #bullish: #crypto trends signal a potential buying opportunity at $27,500 for #Bitcoin and #Ethereum outperformance 🧵🧵

Sub to our TG for the latest: t.me/matrixportupda…

Sub to our TG for the latest: t.me/matrixportupda…

#Crypto #sentiment has cooled off, with our #Bitcoin Greed & Fear Index dropping to 44 (for #Ethereum, 46). Buying half a position at $27,500 could be a good re-entry level, with the possibility of the price dropping to $25,000 for the second half.

The decline in #stablecoin #marketcap suggests money is leaving the ecosystem, with #USDC and #BUSD dropping below $30bn and $6.5bn, respectively. Negative #funding rates for #Binance #BNB could indicate potential negative news.

New iOS in #Markets

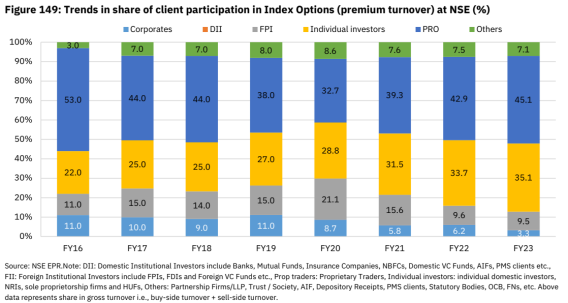

Indian #Options Speculators.

There has been a huge surge in #Retail and #Proprietary trading in #Options and more specifically in #Index Options.

The Data & Charts below are just #Crazy and getting crazier.

Indian #Options Speculators.

There has been a huge surge in #Retail and #Proprietary trading in #Options and more specifically in #Index Options.

The Data & Charts below are just #Crazy and getting crazier.

Zaczynamy tydzień #GEM.

Na początek jak przy każdej szanującej się pracy lecimy z BHP. Czyli jakich zasad należy się trzymać, żeby nie zostać dawcom kapitału. To będzie długi wątek! Zapraszam!

1/🧵

Na początek jak przy każdej szanującej się pracy lecimy z BHP. Czyli jakich zasad należy się trzymać, żeby nie zostać dawcom kapitału. To będzie długi wątek! Zapraszam!

1/🧵

2/🧵

1. DEFINICJA

Dla większości Polskiej sceny TT, #GEM to po prostu gównoCoin z niskim MC, najważniejsze kryterium które musi spełniać to mieć znanego naganiacza. Takie ‘rarytaski’ właśnie wrzucają Wam pseudo znawcy którzy nie uczą Was jak znaleźć klejnot.

1. DEFINICJA

Dla większości Polskiej sceny TT, #GEM to po prostu gównoCoin z niskim MC, najważniejsze kryterium które musi spełniać to mieć znanego naganiacza. Takie ‘rarytaski’ właśnie wrzucają Wam pseudo znawcy którzy nie uczą Was jak znaleźć klejnot.

3/🧵

Sprzedają byleco znalezione na zagranicznym TT zaraz po tym jak sami się zapakują. Zero wiedzy, zero researchu.

#GEM’s których ja szukam i których nauczyć szukać chcę Was, to projekty z potencjałem, rozwiązujące konkretny problem bądź wnoszące coś nowego do swojej narracji.

Sprzedają byleco znalezione na zagranicznym TT zaraz po tym jak sami się zapakują. Zero wiedzy, zero researchu.

#GEM’s których ja szukam i których nauczyć szukać chcę Was, to projekty z potencjałem, rozwiązujące konkretny problem bądź wnoszące coś nowego do swojej narracji.

$SPX

Our weekly "NEXT WEEK, The Bear's take, The Bull's take, Our take" is here

For more info read our newsletter

The new issue will be out in the morning before the open

Stay ahead, subscribe for Free

pointblanktrading.substack.com

#SPX $SPY $ES #options #Futures

@UnrollHelper

Our weekly "NEXT WEEK, The Bear's take, The Bull's take, Our take" is here

For more info read our newsletter

The new issue will be out in the morning before the open

Stay ahead, subscribe for Free

pointblanktrading.substack.com

#SPX $SPY $ES #options #Futures

@UnrollHelper

NEXT WEEK

The Bear's take:

•Market is in decreasing weekly volume

•High yields

•Looming #Recession

•Geopolitical and geo-economic tensions are on the rise

•Valuations are high

• #Inflation is sticky

•Higher rates for longer

•Small-caps are lagging behind

#ES_F #SPX

The Bear's take:

•Market is in decreasing weekly volume

•High yields

•Looming #Recession

•Geopolitical and geo-economic tensions are on the rise

•Valuations are high

• #Inflation is sticky

•Higher rates for longer

•Small-caps are lagging behind

#ES_F #SPX

$SPX

Our weekly "NEXT WEEK, The Bear's take, The Bull's take, Our take" is here

For more info read our newsletter

The new issue will be out tomorrow before the open

Stay ahead, subscribe for Free

pointblanktrading.substack.com

#SPX $SPY $ES #options #Futures $Gamma

@UnrollHelper

Our weekly "NEXT WEEK, The Bear's take, The Bull's take, Our take" is here

For more info read our newsletter

The new issue will be out tomorrow before the open

Stay ahead, subscribe for Free

pointblanktrading.substack.com

#SPX $SPY $ES #options #Futures $Gamma

@UnrollHelper

NEXT WEEK

The Bear's take:

•Market is up in decreasing weekly volume

•Market is overbought

•High yields

•Looming #Recession

•Geopolitical and geo-economic tensions are on the rise

• #Inflation is sticky

•Higher rates for longer

•Small-caps are lagging behind

#ES_F #SPX

The Bear's take:

•Market is up in decreasing weekly volume

•Market is overbought

•High yields

•Looming #Recession

•Geopolitical and geo-economic tensions are on the rise

• #Inflation is sticky

•Higher rates for longer

•Small-caps are lagging behind

#ES_F #SPX

Somehow our pinned tweet disappeared, so here it is again

This is a thread with information we think valuable:

1) Our Compact Guide to Understanding #Gamma

2) $SPX $Gamma structure Cheat Sheet

3) Our Compact Guide to Options Strategies

4) 2023 Options Calendar... and more

🧵

This is a thread with information we think valuable:

1) Our Compact Guide to Understanding #Gamma

2) $SPX $Gamma structure Cheat Sheet

3) Our Compact Guide to Options Strategies

4) 2023 Options Calendar... and more

🧵

The Nifty Financial Services Index, also known as the #FinNifty, is an index that tracks the performance of the financial services sector in India. @bbrijesh explains about the index in detail.

#FinNifty is an index that tracks the performance of the financial services sector in India, which includes #banks, #insurance companies, #housingfinance, and Non-Banking Financial Companies (NBFCs). #FinancialServicesSector #India

The financial services sector in India is one of the largest and most diverse in the world, and FinNifty provides a way to track the performance of this sector. #FinancialServicesSector #GrowthPotential

Get ready for another #Bitcoin rally!🚀

Get all the deets in our 🧵⏬

Also, it's best to sub to our TG

t.me/matrixportupda…

#bitcoin #cryptocurrency #investing

Get all the deets in our 🧵⏬

Also, it's best to sub to our TG

t.me/matrixportupda…

#bitcoin #cryptocurrency #investing

$SPX

Our weekly "NEXT WEEK, The Bear's take, The Bull's take, Our take" is here

For more info read our newsletter

Today's issue will be out in the morning

Subscribe for Free

pointblanktrading.substack.com

#SPX $SPY $ES $SPX #ES_F $GAMMA #GEX $QQQ #QQQ $DIj #trading #options #Futures

Our weekly "NEXT WEEK, The Bear's take, The Bull's take, Our take" is here

For more info read our newsletter

Today's issue will be out in the morning

Subscribe for Free

pointblanktrading.substack.com

#SPX $SPY $ES $SPX #ES_F $GAMMA #GEX $QQQ #QQQ $DIj #trading #options #Futures

$SPX

Our weekly "NEXT WEEK, The Bear's take, The Bull's take, Our take" is here

For more info read our newsletter

Today's issue will be out tonight

Subscribe for Free

pointblanktrading.substack.com

#SPX $SPY $ES $SPX #ES_F $GAMMA #GEX $QQQ #QQQ

$DIA $IWM #trading #options #Futures

Our weekly "NEXT WEEK, The Bear's take, The Bull's take, Our take" is here

For more info read our newsletter

Today's issue will be out tonight

Subscribe for Free

pointblanktrading.substack.com

#SPX $SPY $ES $SPX #ES_F $GAMMA #GEX $QQQ #QQQ

$DIA $IWM #trading #options #Futures

$SPX

Our weekly "NEXT WEEK, The Bear's take, The Bull's take, Our take" is here

For more info read our newsletter (It will be out tomorrow)

Subscribe for Free

pointblanktrading.substack.com

#SPX $SPY $ES $SPX #ES_F $GAMMA #GAMMA #GEX $QQQ #QQQ

$DIA $IWM #trading #options #Futures

Our weekly "NEXT WEEK, The Bear's take, The Bull's take, Our take" is here

For more info read our newsletter (It will be out tomorrow)

Subscribe for Free

pointblanktrading.substack.com

#SPX $SPY $ES $SPX #ES_F $GAMMA #GAMMA #GEX $QQQ #QQQ

$DIA $IWM #trading #options #Futures

$SPX

Our weekly "NEXT WEEK, The Bear's take, The Bull's take, Our take" is here

For more info read our newsletter (It will be out tomorrow)

Subscribe for Free

pointblanktrading.substack.com

#SPX $SPY $ES $SPX #ES_F $GAMMA #GAMMA #GEX $QQQ #QQQ

$DIA $IWM #trading #options #Futures

Our weekly "NEXT WEEK, The Bear's take, The Bull's take, Our take" is here

For more info read our newsletter (It will be out tomorrow)

Subscribe for Free

pointblanktrading.substack.com

#SPX $SPY $ES $SPX #ES_F $GAMMA #GAMMA #GEX $QQQ #QQQ

$DIA $IWM #trading #options #Futures

The Bear's take:

•Recession is just around the corner

• Rates and valuations are high

• Geopolitical tensions

• Friday, stocks rise on low volume

• Earnings will be low

•China Covid shutdown hurt earnings

• Market is overbougth

• #VVIX is rising

#SPX #ES_F $SPX #options

•Recession is just around the corner

• Rates and valuations are high

• Geopolitical tensions

• Friday, stocks rise on low volume

• Earnings will be low

•China Covid shutdown hurt earnings

• Market is overbougth

• #VVIX is rising

#SPX #ES_F $SPX #options

NEXT WEEK

The Bull's take

• Inflation/Commodities/Oil/$ are ↓

• $DJI chart is very bullish. $DJT and $IWM also look good

•Up week on increasing volume

• $VIX and #DXY in strong donwtrend

•Breadth indicators are strong

•Positive divergence from CCI, RSI, ROC, Stochastics

The Bull's take

• Inflation/Commodities/Oil/$ are ↓

• $DJI chart is very bullish. $DJT and $IWM also look good

•Up week on increasing volume

• $VIX and #DXY in strong donwtrend

•Breadth indicators are strong

•Positive divergence from CCI, RSI, ROC, Stochastics

If you haven't read it

From our newsletter:

$DJI

"Last Friday it managed - just like the $DJT and $IWM - to make a solid upward breakout... did so on high volume... close above the 20, 50, 100 and 200DMA.

All indicates that this will most likely be the way forward for the #SPX"

From our newsletter:

$DJI

"Last Friday it managed - just like the $DJT and $IWM - to make a solid upward breakout... did so on high volume... close above the 20, 50, 100 and 200DMA.

All indicates that this will most likely be the way forward for the #SPX"

" #DJT made an excellent breakout and closed above 20 and 100DMA. It closed right at its 50DMA. Bullish action from a leading indicator. $DJT will have to surpass the conjunction of 50DMA and 200DMA next week, in order to validate more upward moves"

It did that yesterday

#ES_F

It did that yesterday

#ES_F

$QQQ

"A follow up rally is expected to allow it to break out of the Noise Box and break above at least the 20DMA.

On Monday it broke above the Noise Box, yesterday above the 20DMA, today above the 50DMA"

#QQQ #NDX #TradingSignals #bearmarket #SPX #ES_F #trading #SPX

"A follow up rally is expected to allow it to break out of the Noise Box and break above at least the 20DMA.

On Monday it broke above the Noise Box, yesterday above the 20DMA, today above the 50DMA"

#QQQ #NDX #TradingSignals #bearmarket #SPX #ES_F #trading #SPX

$SPX has been trapped in a Noise Box for the past 14 days

As at other times patience pays: whichever side SPX breaks out of the box will be followed by a big move

A great trading opportunity

👁️👁️Volume has been higher on bullish days and SPX closed above 20DMA

#SPX #ES $SPY

As at other times patience pays: whichever side SPX breaks out of the box will be followed by a big move

A great trading opportunity

👁️👁️Volume has been higher on bullish days and SPX closed above 20DMA

#SPX #ES $SPY

Fud này có hợp thức hóa việc MM kill market thêm 1 lần nữa trước thềm Shanghai?

Thread đọc phần dưới

#BTC #BNB #ETH #Shanghai #Altcoin #CZ #Futures #Fud #Gemini #Geminiearn #DCG #Greyscale

Thread đọc phần dưới

#BTC #BNB #ETH #Shanghai #Altcoin #CZ #Futures #Fud #Gemini #Geminiearn #DCG #Greyscale

1, Gemini earn ( GE ) => users tham gia để earn với APY 8% => Gemini đem cho Genesistrading vay 1.7B => Đem cho DCG => Greyscale vay => Buy the dip BTC, 3AC => Khoản nợ chưa thể thu hồi => GUSD ( Gemini USD) => Gemini ngừng nạp rút => Yêu cầu Genesistrading trả nợ

2, Genesis cắt giảm nhân sự lên đến 30%, và đang có nguy cơ phá sản cao. Việc nguy cơ phá sản sẽ công bố sau vụ kiện. Nếu không đủ khả năng chi trả thì sẽ có đệ đơn phá sản Chappter 11

Explaining open interest in simple terms …

#OpenInterest is a measure of the number of outstanding #derivative contracts in a particular market.

#OpenInterest is a measure of the number of outstanding #derivative contracts in a particular market.

It reflects the number of contracts that have not been closed or settled, and helps to show the level of activity in a market.

When open interest increases, it can indicate that new #money is entering the market.

TODAY IN THE MARKETS

$VIX

Down day for the #SPX, and the #VIX closed down -6.26% and below 20DMA

Yesterday: large bearish engulfing candle

Today: Continuation

Despite the lack of sync this looks like a bullish development for $SPX

#ES_F #trading $SPY $ES #options #VIX $VVIX

$VIX

Down day for the #SPX, and the #VIX closed down -6.26% and below 20DMA

Yesterday: large bearish engulfing candle

Today: Continuation

Despite the lack of sync this looks like a bullish development for $SPX

#ES_F #trading $SPY $ES #options #VIX $VVIX

$XLF

#XLF was rejected at 20DMA

The sector remains above the 200DMA, and near support

For the October #SPX rally to continue it's necessary for #XLF to hold above $34.40

#trading #banks #options #ES_F $SPX $SPY $ES #DayTrading #Futures #inflation #ratehikes #Fed #Financial

#XLF was rejected at 20DMA

The sector remains above the 200DMA, and near support

For the October #SPX rally to continue it's necessary for #XLF to hold above $34.40

#trading #banks #options #ES_F $SPX $SPY $ES #DayTrading #Futures #inflation #ratehikes #Fed #Financial

TODAY IN THE MARKETS

$SPX

A low #CPI triggered a 114-point jump that took it above the dominant trendline. At the open, sell orders above that level initiated a pullback that took it 126 points down to the 20DMA

Not what we would call a 1-day reversal, more upside to come

#SPX

$SPX

A low #CPI triggered a 114-point jump that took it above the dominant trendline. At the open, sell orders above that level initiated a pullback that took it 126 points down to the 20DMA

Not what we would call a 1-day reversal, more upside to come

#SPX

Today in the markets

$SPX

An unexpected rally pushed #SPX 50 points higher today on increased volume

We can say it was a successful retest or bounce from the 100DMA

It closed at 20DMA and is now in the "pinch". Tomorrow we'll know which side #SPX is going to come out on

#SPX

$SPX

An unexpected rally pushed #SPX 50 points higher today on increased volume

We can say it was a successful retest or bounce from the 100DMA

It closed at 20DMA and is now in the "pinch". Tomorrow we'll know which side #SPX is going to come out on

#SPX

$DIA

Another rally on higher volume

Today closed above the 20DMA, somewhat bullish if it is able to hold that ground.

Big impulsive green candle, indicating further upside

$DJI #DIA #DIJ $DJIA #industrial $SPX #SPX

#DowJones

Another rally on higher volume

Today closed above the 20DMA, somewhat bullish if it is able to hold that ground.

Big impulsive green candle, indicating further upside

$DJI #DIA #DIJ $DJIA #industrial $SPX #SPX

#DowJones

Thing to note: 👇🏼

#CPI usually inputs a minimum 1%+ move on $SPY $SPX whether that is to the upside or downside on $SPY $SPX $ES_F

#CPI usually inputs a minimum 1%+ move on $SPY $SPX whether that is to the upside or downside on $SPY $SPX $ES_F

Our weekly NEXT WEEK, The Bear's take, The Bull's take, Our take is here

For more info read our newsletter coming out later today

Subscribe for Free

pointblanktrading.substack.com

#SPX $SPY $ES $SPX #ES_F $GAMMA $GEX #GAMMA #GEX $QQQ #QQQ

$DIA $IWM #trading

For more info read our newsletter coming out later today

Subscribe for Free

pointblanktrading.substack.com

#SPX $SPY $ES $SPX #ES_F $GAMMA $GEX #GAMMA #GEX $QQQ #QQQ

$DIA $IWM #trading

NEXT WEEK

The Bear's take:

• Rates, inflation, dollar, employment ↑

• Geopolitical tensions

• $VIX above TL and 20DMA

• All indices broke below 20DMA

• Negative #Gamma regime

• Dealers are now net short

•Quadruple witching: large negative stack at 3900

$ES_F $SPX $SPY

The Bear's take:

• Rates, inflation, dollar, employment ↑

• Geopolitical tensions

• $VIX above TL and 20DMA

• All indices broke below 20DMA

• Negative #Gamma regime

• Dealers are now net short

•Quadruple witching: large negative stack at 3900

$ES_F $SPX $SPY