Discover and read the best of Twitter Threads about #gst

Most recents (24)

1/15 📢 BREAKING: The Calcutta High Court just issued a landmark judgment impacting GST claimants nationwide. Case: Gargo Traders v. State Tax, West Bengal. Judgment delivered on June 12, 2023. #CalcuttaHighCourt #GSTJustice #GargoTraders

2/15 ⚖️ Gargo Traders, a registered taxable person, contested an order that rejected their Input Tax Credit (ITC) claim, a decision that was based on the retrospective cancellation of their supplier's GST registration. #ITC #GST

3/15 🚫 The Tax Department dismissed their ITC claim, alleging that Global Bitumen, Gargo Traders' supplier, was fake and non-existent, leading to the retrospective cancellation of its GST registration. #GlobalBitumen

💥🚨 Very Important Judgement giving support to genuine buyer to avail Input Tax Credit (ITC) based on his tax invoice issued by supplier.

Read Compete Judgement Below: ⬇️

#GST #GSTwithBimalJain #a2ztaxcorpllp #InputTaxCredit #GSTITC

1/7

Read Compete Judgement Below: ⬇️

#GST #GSTwithBimalJain #a2ztaxcorpllp #InputTaxCredit #GSTITC

1/7

1/38. Today is the eighth day of the #BonnClimateConference (#SB58) and it saw the closing plenary of the Technical Dialogue of the #GST, discussions on the #SantiagoNetwork, the continuation of the #NCQG’s 6th Technical Expert Dialogue and the first stocktaking plenary. 🧵

2/38. Today also saw a focus on #HumanRights with a number of side events and an action drawing attention to the key message that “there can be no #ClimateJustice without #HumanRights”.

3/38. Joining "No #ClimateJustice without #CivicSpace and #HumanRights: zooming in on the @UNFCCC process"* with @ciel_tweets, @amnesty and @350, we heard important messages on the need for safe #CivicSpace under the @UNFCCC so that we can make our #LossAndDamage demands heard!

📍💥Important Update: 2 Factor Authentication will be made mandatory from July 15, 2023 for all taxpayers with AATO above 100cr

#GST #GSTeWayBill #gstwithbimaljain #a2ztaxcorpllp #einvoice

Read the Complete Update below 👇🏻

#GST #GSTeWayBill #gstwithbimaljain #a2ztaxcorpllp #einvoice

Read the Complete Update below 👇🏻

To enhance the security of e-Way Bill/e-Invoice System, NIC is introducing 2-Factor Authentication for logging in to e-Way Bill/e-Invoice system. In addition to username and password, OTP will also be authenticated for login.

There are 3 different ways of receiving the OTP. You may enter any of the OTP and login to system. The various modes of generating OTP are explained below:

💥📍Important #GST updates for this week:

Eligibility of input tax credit (ITC) for works contract services and materials used for the foundation and structural supports of machinery

[Colourband Dyestuff P Ltd ., In re]

1/5

#GSTwithBimalJain #a2ztaxcorpllp #GSTUpdates

Eligibility of input tax credit (ITC) for works contract services and materials used for the foundation and structural supports of machinery

[Colourband Dyestuff P Ltd ., In re]

1/5

#GSTwithBimalJain #a2ztaxcorpllp #GSTUpdates

Issuing separate invoices for different tasks, despite being mentioned in a single contract agreement, cannot be considered a 'composite supply'

[PES Engineers Private Limited ., In re]

2/5

[PES Engineers Private Limited ., In re]

2/5

More steps needed to weed out fake ITC generators from GST system: CBIC member

Read More at: a2ztaxcorp.com/more-steps-nee…

3/5

Read More at: a2ztaxcorp.com/more-steps-nee…

3/5

🔎Unlocking the Mysteries of Section 60: Provisional Assessment! 🧵

💡 Are you struggling to determine the value or rate of tax for goods or services? Fear not! Section 60 of the GST Act offers a solution: provisional assessment. Let's dive into the key points:

📝 If you find yourself in this predicament, write a formal request to the proper officer, explaining why you need to pay tax on a provisional basis

Gst On Renting of Immovable Property🧵

In this thread we will discuss renting of both commercial & residential property 🕵️ (1/4)

#gst #tax #incometax #tds #gstn

In this thread we will discuss renting of both commercial & residential property 🕵️ (1/4)

#gst #tax #incometax #tds #gstn

1. Renting of Residential Dwelling.🏡

A) If residential dwelling is used for commercial purpose then GST is payable on Forward charge basis.(office etc)

B) If residential dwelling is used for personal purpose then the service is exempt for both registered & unregistered. (2/4)

A) If residential dwelling is used for commercial purpose then GST is payable on Forward charge basis.(office etc)

B) If residential dwelling is used for personal purpose then the service is exempt for both registered & unregistered. (2/4)

C) If Residential dwelling used for commercial purpose but as a residence i.e Guest house etc. by registered person then it's taxable under RCM.

D) If Residential dwelling used for commercial purpose but as a residence i.e Guest house etc. by unregistered then it is exempt.(3/4)

D) If Residential dwelling used for commercial purpose but as a residence i.e Guest house etc. by unregistered then it is exempt.(3/4)

🧵Demystifying GST Audits: Section 65 & Rule 101. Understanding Both Sides of the Audit Journey! 💼🔍

Read this thread to gain a complete understanding of GST audits, covering Section 65 and Rule 101.

#GST #TaxAudit #DemystifyingAudits

Read this thread to gain a complete understanding of GST audits, covering Section 65 and Rule 101.

#GST #TaxAudit #DemystifyingAudits

🔸The Commissioner or any officer authorized by him, may undertake audit of any registered person for a financial year or part thereof or multiples thereof at such frequency and in such manner as may be prescribed

🔸The officers referred above may conduct audit at the place of business of the registered person or in their office

1/9 As an Practitioner in Indian #GST laws, I'm sharing a simple yet comprehensive guide on the procedures involved in physical verification as per Rule 25.

A vital process to maintain transparency and ensure legitimacy. #TaxLaw #GSTLaw

A vital process to maintain transparency and ensure legitimacy. #TaxLaw #GSTLaw

Key Points of CBIC's Automated Return Scrutiny Module (ARSM) for GST returns

The CBIC has rolled out an Automated Return Scrutiny Module (ARSM) for GST returns. Learn more about this new tool and how it can help improve GST compliance in India

#GST #Compliance #Taxation #India

The CBIC has rolled out an Automated Return Scrutiny Module (ARSM) for GST returns. Learn more about this new tool and how it can help improve GST compliance in India

#GST #Compliance #Taxation #India

Automated GST Scrutiny

The Central Board of Indirect Taxes and Customs (CBIC) has rolled out an Automated Return Scrutiny Module (ARSM) for GST returns.

The Central Board of Indirect Taxes and Customs (CBIC) has rolled out an Automated Return Scrutiny Module (ARSM) for GST returns.

The ARSM is a non-intrusive means of compliance verification that allows tax officers to scrutinize GST returns of Centre Administered Taxpayers (CATs) selected on the basis of data analytics and risks identified by the system.

Independent India has always been a vibrant democracy, except for the #Emergency years of #IndiraGandhi from 1975-77. That it has taken a decisive turn to religious majoritarianism under the #BJP and under #Modi since 2014 doesn't change that fact. (1/)

Democracy is not necessarily congruent with liberal values or even human rights. #Slavery was legal both in the democracy of Great Britain as well as the USA for almost a hundred years since the US' formation. Even a White woman was not considered equal to a man in America. (2/)

Union Finance Minister Smt. @nsitharaman met Mr. Hayashi Nobumitsu, Governor, Japan Bank for International Cooperation #JBIC, on the sidelines of the 56th #ADBAnnualMeeting, in Incheon, today. (1/5)

@IndiainROK

@IndiainROK

FM Smt. @nsitharaman encouraged engagement of JBIC with Indian financial institutions such as Exim Bank @IndiaEximBank, NIIF and lending banks to leverage the strength and complementarities of both countries for facing local, regional and global financial challenges. (2/5)

FM spoke of GoI intiatives towards facilitating #investment, like #PLIs scheme, #NIP, reforms in #GST & Insolvency & Bankruptcy Code #IBC, among others & hoped JBIC will use this enabling environment as an opportunity to expand marine products & seaweed processing in India. (3/5)

1 The data on #GST revenues arrives on the first of every month. And, every month, the Indian media - financial as well as general - hypes the numbers, nodding in agreement with the sarkar that it has touched a new "record". Here is a Thread based on April GST collections

2 There is neither context that anchors the latest numbers to some reference point, which could be either in terms of comparison to the previous year or in relation to the size of the economy (GDP at current prices, for instance).

3 Since GST revenues (all taxes for that matter) are always in current prices, and since we know that prices have been on a wild upswing in the last year, context also requires that revenues be compared to prices. Otherwise, revenues would be exaggerated by a “price effect”.

⚖️ Court dismisses writ petition in a tax evasion case involving a registered dealer, transporter, and misuse of E-Way Bills. Find out how multiple transactions were made with the same documents and vehicle, leading to the dismissal. #TaxEvasion #GST #EWayBill

Facts & Timeline:

Facts & Timeline:

• On 08.04.2018, the petitioner, a registered dealer, sold 300 bags of Pan Masala valued at Rs.33,81,000 to a dealer in Meghalaya, generating a tax invoice and E-Way Bill under the IGST Act, charging 28% IGST and 60% Cess.

• The goods were handed over to transporter M/s Bombay Kandla Transport Pvt. Ltd. for transport via Truck No.NL01N/6504

• The vehicle was used for transporting fruits and vegetables to West Bengal on 07.04.2018, and then for transporting rice to Darbhanga (Bihar) on 12.04.2018

• The vehicle was used for transporting fruits and vegetables to West Bengal on 07.04.2018, and then for transporting rice to Darbhanga (Bihar) on 12.04.2018

As a business owner, it's important to understand the process of claiming Input Tax Credit (ITC) in Indian GST.

Here's a step-by-step guide to help you claim ITC correctly and in compliance with the latest laws. 🧵👇

Here's a step-by-step guide to help you claim ITC correctly and in compliance with the latest laws. 🧵👇

1/ Maintaining accurate records is key to claiming ITC. Ensure that all invoices and receipts are properly filed and organized. Any discrepancy in the details provided can lead to rejection of ITC.

2/ Check if the supplier has filed their GSTR-1 and GSTR-3B returns correctly. This is important because if the supplier has not filed the returns properly, the ITC claimed by you will not be allowed.

Brasil e China 🇧🇷 🇨🇳 soltam declaração climática conjunta. Meus comentários em forma de 🧵:

1. O comunicado fala que responder q crise climática é uma oportunidade de construir prosperidade comum. ✅

gov.br/mma/pt-br/assu…

1. O comunicado fala que responder q crise climática é uma oportunidade de construir prosperidade comum. ✅

gov.br/mma/pt-br/assu…

2. Ha linguagem sobre equidade, termo sempre presente nas declarações do BASIC. Isso remete ao ponto de que economias desenvolvidas já usaram boa parte do “orçamento de carbono” com suas emissões passadas e que agora “seria a vez” dos países em desenvolvimento.

Não é bem assim.

Não é bem assim.

3. Brasil e a China enfatizam a urgência da ação climática com a erradicação da pobreza e da fome, “sem deixar ninguém para trás”.

Vale lembrar que manos os países fizeram esforços gigantescos para tirar milhões de pessoas da linha da pobreza. E que o desafio permanece.

Vale lembrar que manos os países fizeram esforços gigantescos para tirar milhões de pessoas da linha da pobreza. E que o desafio permanece.

Delhi High Court upholds government notifications levying Goods and Services Tax (GST) on auto rickshaws booked through e-commerce operators like Uber and Ola

#DelhiHighCourt @Olacabs @Uber_India #GST

#DelhiHighCourt @Olacabs @Uber_India #GST

Court: Classification as a class of service providers separate and distinct is recognised in the provisions of the Act. The classification has a rational nexus with the object sought to be achieved.

#DelhiHighCourt @Olacabs @Uber_India #GST

#DelhiHighCourt @Olacabs @Uber_India #GST

Court: In view of this, the petitioner's submission is incorrect. This court has thus held that respondents can exclude the said class from exemption.

#DelhiHighCourt @Olacabs @Uber_India #GST

#DelhiHighCourt @Olacabs @Uber_India #GST

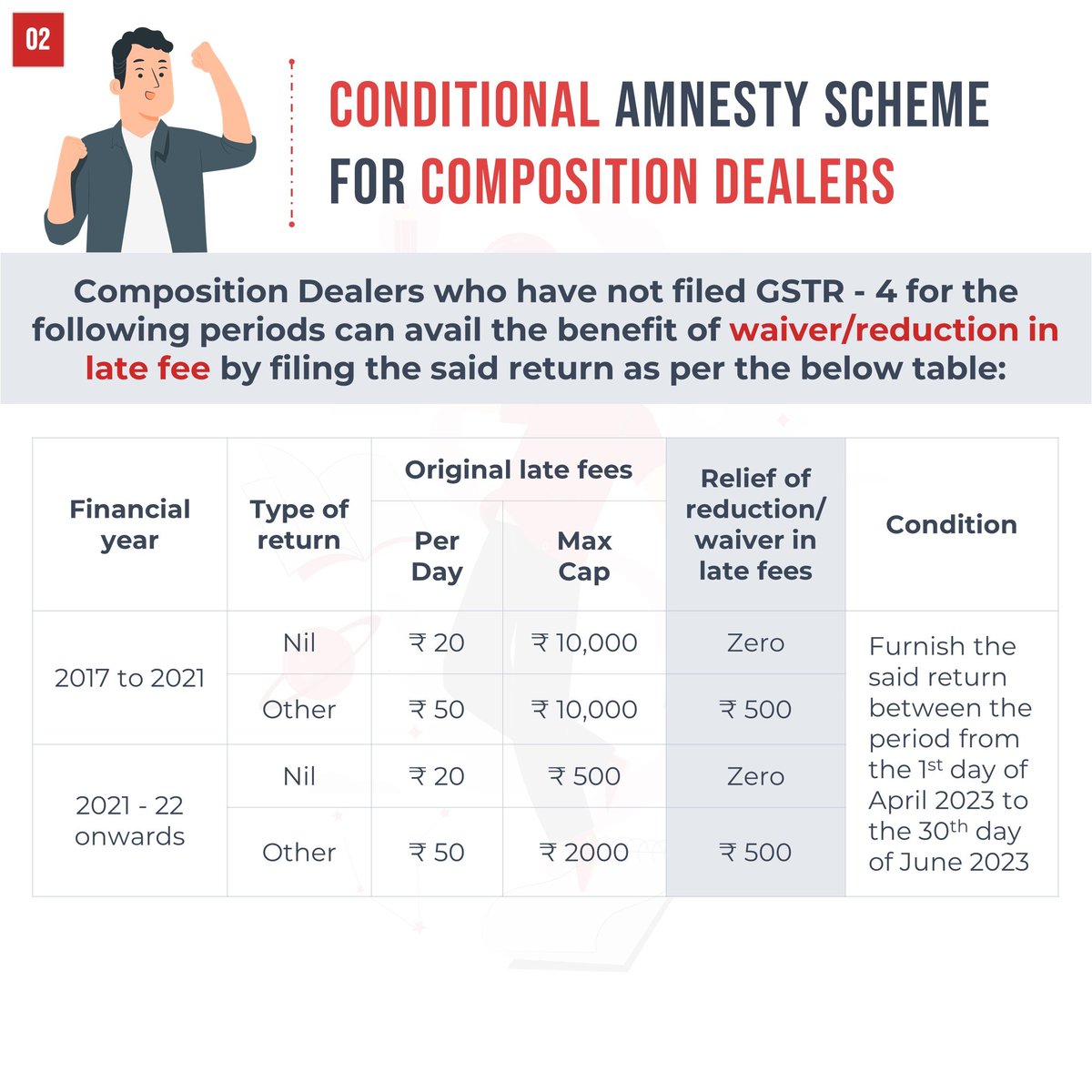

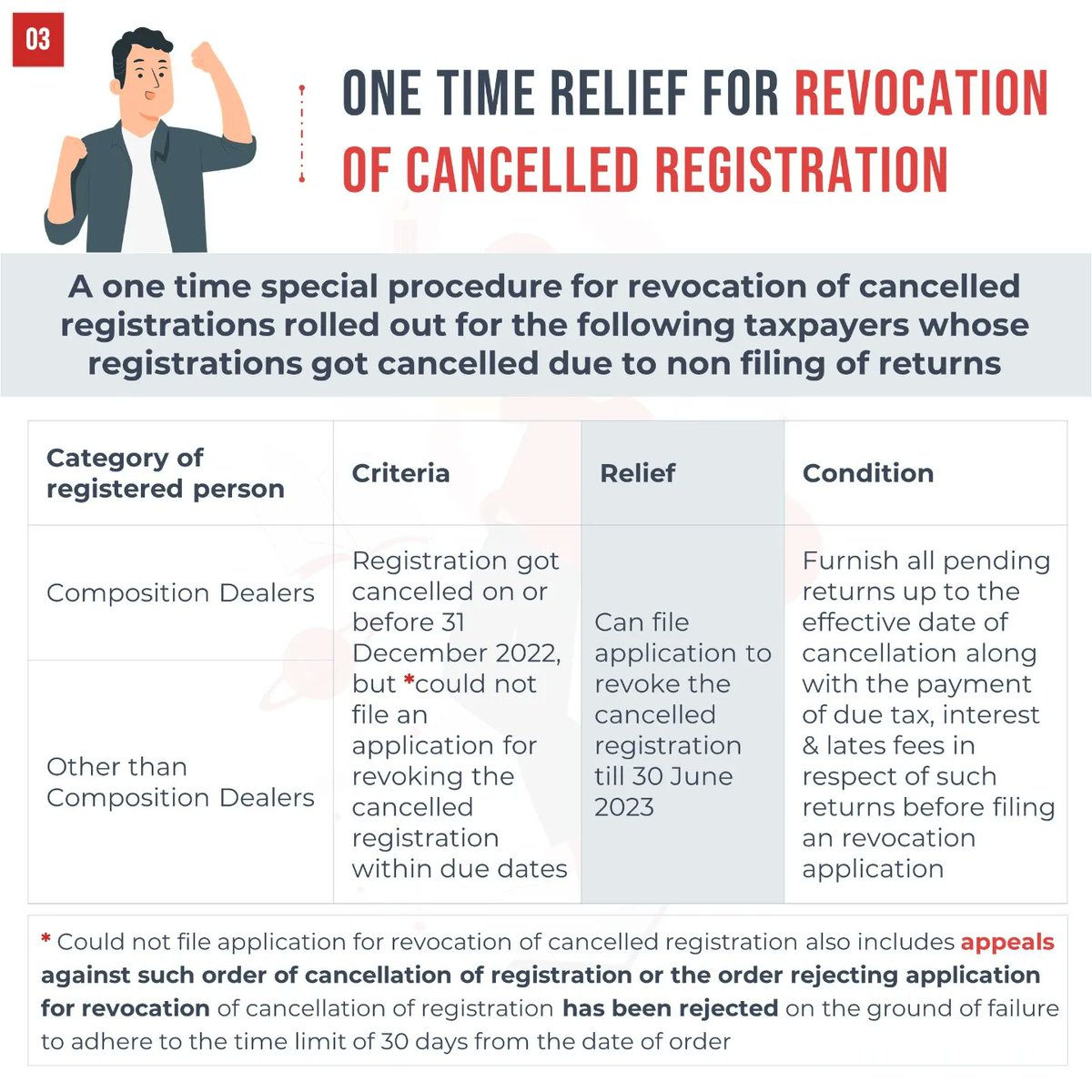

𝗚𝗦𝗧 𝘂𝗽𝗱𝗮𝘁𝗲 𝗼𝗻 𝘃𝗮𝗿𝗶𝗼𝘂𝘀 𝗻𝗼𝘁𝗶𝗳𝗶𝗰𝗮𝘁𝗶𝗼𝗻 𝗶𝘀𝘀𝘂𝗲𝗱 𝗯𝘆 𝗖𝗕𝗜𝗖 𝗼𝗻 𝟯𝟭 𝗠𝗮𝗿𝗰𝗵 𝟮𝟬𝟮𝟯.

Please follow @GSTinSHORT to learn 𝗚𝗦𝗧 in a 𝗦𝗛𝗢𝗥𝗧, 𝗦𝗜𝗠𝗣𝗟𝗘 and 𝗘𝗔𝗦𝗬 𝗧𝗢 𝗨𝗡𝗗𝗘𝗥𝗦𝗧𝗔𝗡𝗗 manner

(1/9)

#gstinshort

#gstinoneslide

Please follow @GSTinSHORT to learn 𝗚𝗦𝗧 in a 𝗦𝗛𝗢𝗥𝗧, 𝗦𝗜𝗠𝗣𝗟𝗘 and 𝗘𝗔𝗦𝗬 𝗧𝗢 𝗨𝗡𝗗𝗘𝗥𝗦𝗧𝗔𝗡𝗗 manner

(1/9)

#gstinshort

#gstinoneslide

📒 Gist of further amendments relating to Indirect taxes proposed in Finance Bill, 2023

1. The amendments relating to Customs and Goods and Services Tax (GST) shall come into effect from the date to be appointed by the Central Government through notification

>> a Thread>> 👇 twitter.com/i/web/status/1…

1. The amendments relating to Customs and Goods and Services Tax (GST) shall come into effect from the date to be appointed by the Central Government through notification

>> a Thread>> 👇 twitter.com/i/web/status/1…

2. The deferment of duties in respect of goods imported under Manufacture and Other Operations in Warehouse Regulations (MOOWR) is now being restricted to duties other than IGST & compensation cess. In other words, IGST and Cess are payable on import of goods under MOOWR

3. Provisions of compulsory registration will not apply only where the person is exempted from obtaining registration through a notification issued under section 23(2) of Central Goods and Services Tax Act, 2017. #GST #Budget2023

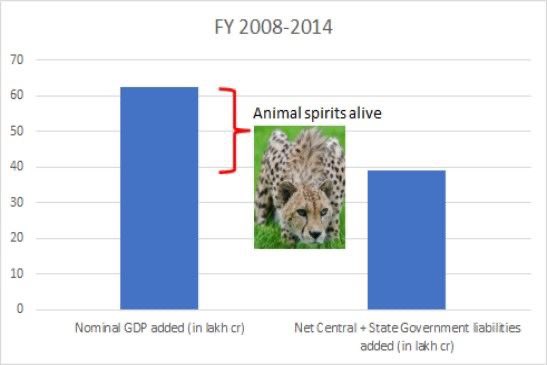

#BRILLIANT CHARTS showing India’s GDP Growth - A Notable #ACHIEVEMENT by #Modinomics

Let’s look at India's nominal GDP that matters to Households & Businesses

EXCLUDING government borrowing & spending) Indians Households & Business Experience ~ZERO GROWTH since 2014-22

Let’s look at India's nominal GDP that matters to Households & Businesses

EXCLUDING government borrowing & spending) Indians Households & Business Experience ~ZERO GROWTH since 2014-22

This contrasts with the period FY 2008-14 when non-government component of GDP accounted for 38% of nominal growth.

Economists believe these animal spirits to be a vital ingredient for high growth of #SMEs & #Businesses

Economists believe these animal spirits to be a vital ingredient for high growth of #SMEs & #Businesses

But you might argue that lots of STARTUPS have created jobs and lots of govt data shows lots of New Business Registrations since 2017

BOTH ARE TRUE but

During these yrs #Farmers, #Unorganised Biz & #SMEs LOST a total of #45-60 MILLION JOBS. So 1-2 Million Startup jobs is a drop

BOTH ARE TRUE but

During these yrs #Farmers, #Unorganised Biz & #SMEs LOST a total of #45-60 MILLION JOBS. So 1-2 Million Startup jobs is a drop

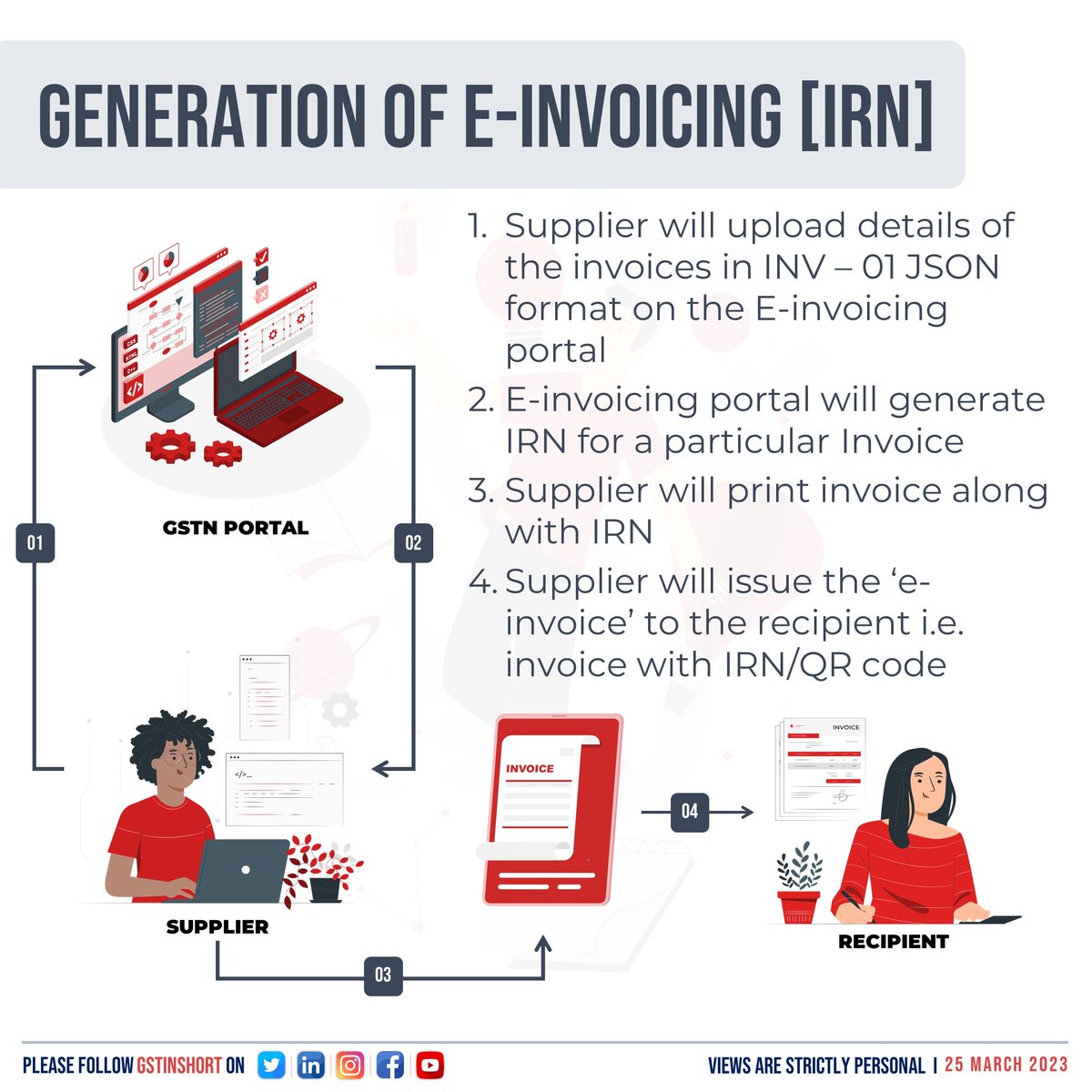

𝗨𝗻𝗱𝗲𝗿𝘀𝘁𝗮𝗻𝗱𝗶𝗻𝗴 𝗼𝗳 𝗘-𝗶𝗻𝘃𝗼𝗶𝗰𝗶𝗻𝗴 𝘂𝗻𝗱𝗲𝗿 𝗚𝗦𝗧

(1/5)

Please follow @GSTinSHORT to learn 𝗚𝗦𝗧 in a 𝗦𝗛𝗢𝗥𝗧, 𝗦𝗜𝗠𝗣𝗟𝗘 and 𝗘𝗔𝗦𝗬 𝗧𝗢 𝗨𝗡𝗗𝗘𝗥𝗦𝗧𝗔𝗡𝗗 manner

#gstcompliance

#gstinshort

#gst

#gstinoneslide

#GSTupdates

(1/5)

Please follow @GSTinSHORT to learn 𝗚𝗦𝗧 in a 𝗦𝗛𝗢𝗥𝗧, 𝗦𝗜𝗠𝗣𝗟𝗘 and 𝗘𝗔𝗦𝗬 𝗧𝗢 𝗨𝗡𝗗𝗘𝗥𝗦𝗧𝗔𝗡𝗗 manner

#gstcompliance

#gstinshort

#gst

#gstinoneslide

#GSTupdates

GST relief for hotels, and restaurants soon? Govt to change GST structure?

Know Here ⬇⬇

1/5

#GST #GSTITC #GSTcredit #Restaurant #Hotel #GSTwithBimalJain #a2ztaxcorpllp

Know Here ⬇⬇

1/5

#GST #GSTITC #GSTcredit #Restaurant #Hotel #GSTwithBimalJain #a2ztaxcorpllp

Sources says:

➡️ Hotel and restaurant industry may soon get relief on GST

➡️ Finance Ministry is considering their demand to change current GST structure

➡️ GST on Hotels/Restaurants may be increased to 12% from 5% with ITC benefit

2/5

➡️ Hotel and restaurant industry may soon get relief on GST

➡️ Finance Ministry is considering their demand to change current GST structure

➡️ GST on Hotels/Restaurants may be increased to 12% from 5% with ITC benefit

2/5

Source says:

➡️ Alert: At present Hotels/Restaurants attracts 5% GST without input tax credit

➡️ Finance Ministry has sent the proposal to the fitment committee of the GST council

3/5

➡️ Alert: At present Hotels/Restaurants attracts 5% GST without input tax credit

➡️ Finance Ministry has sent the proposal to the fitment committee of the GST council

3/5

Orissa HC held that tax, interest, penalty, fine, and fees due need to be paid for the revocation of cancellation of GST Registration by the assessee.

1/5

#GST #GSTwithBimalJain #a2ztaxcorpllp #GSTregistration

1/5

#GST #GSTwithBimalJain #a2ztaxcorpllp #GSTregistration

The learned counsel appearing for the Petitioner relied on the judgment of M/s. Durga Raman Patnaik v. Additional Commissioner of GST [W.P.(C) No.7728 of 2022 dated August 4, 2022],

2/5

2/5

where the Petitioner opted for applying for revocation of the cancellation by complying with all the other requirements of depositing all the tax, penalty and interest due as payable and other formalities as required by law.

3/5

3/5

𝘼𝙧𝙚 𝙮𝙤𝙪 𝙖𝙬𝙖𝙧𝙚 𝙤𝙛 𝙩𝙝𝙚𝙨𝙚 𝙮𝙚𝙖𝙧 𝙨𝙩𝙖𝙧𝙩 𝙘𝙤𝙢𝙥𝙡𝙞𝙖𝙣𝙘𝙚𝙨 𝙪𝙣𝙙𝙚𝙧 𝙂𝙎𝙏?

Please follow @GSTinSHORT for more such GST related updates.

(1/𝟭𝟬)

#gst

#gstupdate

#gstcompliance

#gstinshort

#gstinoneslide

Please follow @GSTinSHORT for more such GST related updates.

(1/𝟭𝟬)

#gst

#gstupdate

#gstcompliance

#gstinshort

#gstinoneslide