Discover and read the best of Twitter Threads about #htafc

Most recents (24)

West Bromwich Albion’s 2020/21 accounts covered a season when they finished 19th in the Premier League, leading to relegation to the Championship. Coach Slaven Bilic replaced by Sam Allardyce in December 2020, subsequently succeeded by Valerien Ismael, then Steve Bruce #WBA

#WBA swung from £23m pre-tax loss to a small £0.1m profit, as revenue almost doubled from £54m to £107m following promotion to the Premier League, though profit on player sales fell £25m to £4m and operating expenses rose £4m (4%) in the top flight.

Main driver of #WBA £53m revenue increase was broadcasting, up £56m from £41m to £97m, due to the more lucrative Premier League TV deal, though commercial also grew £2m (21%) to £10m. This offset the COVID driven reduction in gate receipts, down £4.8m (98%) to just £74k.

Huddersfield Town’s 2020/21 accounts cover a season when they finished 20th in the Championship, thus narrowly avoiding relegation. However, matters on the pitch were much better last season, when Carlos Corberan’s team reached the play-off final. Some thoughts follow #HTAFC

Since these accounts, it has been reported that former owner Dean Hoyle has almost completed a takeover of #HTAFC by acquiring the 75% controlling stake he sold to Phil Hodgkinson in 2019. As Hoyle had kept 25%, he would have full ownership if the deal is finalised.

Hodgkinson’s main company had been placed into administration in November 2021, so there was concern that this would cause problems for #HTAFC, though the club was not directly affected. So, there has been much change, but the 2020/21 accounts are still of interest.

🧵 I try to watch as much of the Chelsea Loanees as I can, but I can't watch every minute, so I reached out to one fan of every club with a Chelsea Loanee, to get the best opinion on their season...

Here we go: [A THREAD] 🪡

Here we go: [A THREAD] 🪡

Nathan Baxter: 8.5/10

After starting as 2nd choice, Baxter came in & solidified a nervy defence.

Natural communicator, good with his feet & excellent shot-stopper, Baxter quickly became a fan favourite.

His ball playing ability, short & long, was crucial to our system. #hcafc

After starting as 2nd choice, Baxter came in & solidified a nervy defence.

Natural communicator, good with his feet & excellent shot-stopper, Baxter quickly became a fan favourite.

His ball playing ability, short & long, was crucial to our system. #hcafc

Nathan Baxter (continued): 8.5/10

Baxter has a great future.

He has the potential to become Chelsea No. 1 in the future, but I’m not sure how long he will wait. #CFC

He seems very ambitious & he wants to play. If he found the right club, I think he'd leave his boy hood team.

Baxter has a great future.

He has the potential to become Chelsea No. 1 in the future, but I’m not sure how long he will wait. #CFC

He seems very ambitious & he wants to play. If he found the right club, I think he'd leave his boy hood team.

scoutreportrb.com/post/scout-rep…

A contract expiring this summer and many championship clubs being linked. Read to find out why I think Kasumu could be an exciting player to recruit👀

RTs and Feedback massively appreciated

(Data viz below)

#Mkdons #Swans #BristolCity #htafc #ncfc

A contract expiring this summer and many championship clubs being linked. Read to find out why I think Kasumu could be an exciting player to recruit👀

RTs and Feedback massively appreciated

(Data viz below)

#Mkdons #Swans #BristolCity #htafc #ncfc

I have some free time this afternoon, so I think I'll live tweet some of my tactics thoughts on the first leg of Luton Town - Huddersfield

I'll just keep adding tweets to this thread each time I've got something 👍

#LUTHUD | #COYH | #HTAFC

I'll just keep adding tweets to this thread each time I've got something 👍

#LUTHUD | #COYH | #HTAFC

Should be 3-5-2 vs 3-5-2, will be an interesting one.

The noise coming through my headphones is nuts. Something special about low capacity stadiums

The noise coming through my headphones is nuts. Something special about low capacity stadiums

#WatfordFC 2020/21 financial results covered a season when they finished 2nd in the Championship, securing immediate promotion back to the Premier League. Head coach Vladimir Ivic was replaced by Xisco, since succeeded by Claudio Ranieri and Roy Hodgson. Some thoughts follow.

Despite impact of relegation and COVID, #WatfordFC pre-tax loss reduced from £36m to £22m, even though revenue fell £63m (52%) from £120m to £57m, as profit on player sales shot up from £18m to £56m and expenses were cut £35m (21%). Other income included £2.5m insurance claim.

Main driver of #WatfordFC revenue decrease was broadcasting, down £45m (48%) from £95m to £50m, as TV deal is much more lucrative in the Premier League, though also big falls in commercial, down £13m (76%) from £17m to £4m, and match day, down £5.7m (78%) to £1.6m.

Coventry City’s 2020/21 accounts covered a “very positive” season under manager Mark Robins, as they finished a creditable 16th to retain their Championship status after winning League One the previous season #PUSB

Coventry loss widened from £3.4m to £4.7m, which club said was “not unexpected”, due to increased investment in the squad after promotion. Revenue rose £6.7m from £5.1m to £11.8m, despite COVID impact, but expenses increased £6.5m and profit on player sales halved to £1.9m #PUSB

Coventry revenue increase was mainly due to higher broadcasting money in the Championship. This rose £7.2m from £1.7m to £8.9m, while commercial was also up £0.8m (44%) from £1.9m to £2.7m. Playing behind closed doors meant match day fell £1.2m from £1.5m to just £0.3m #PUSB

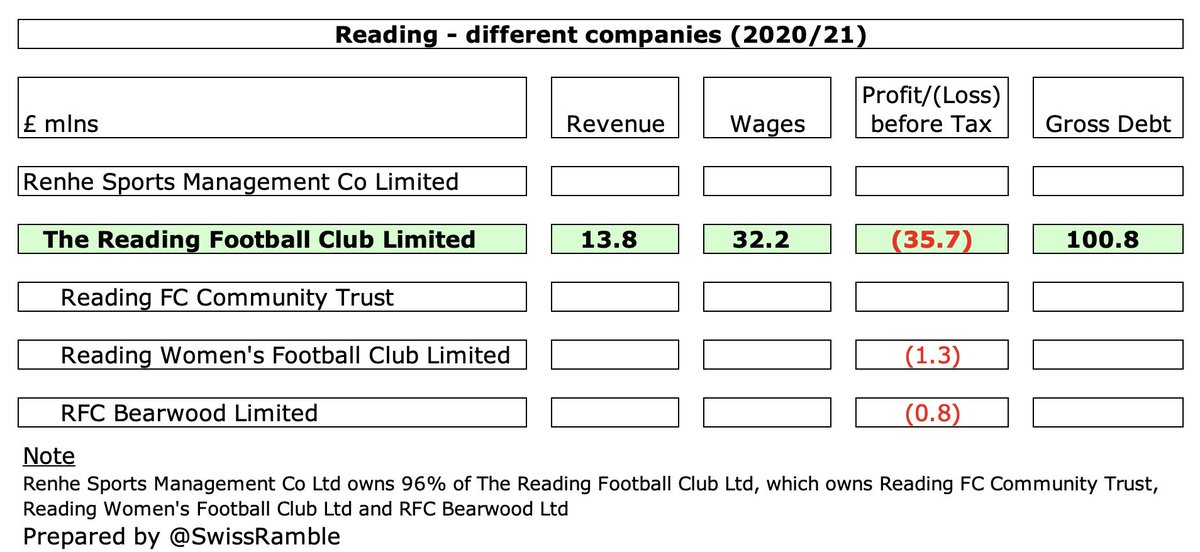

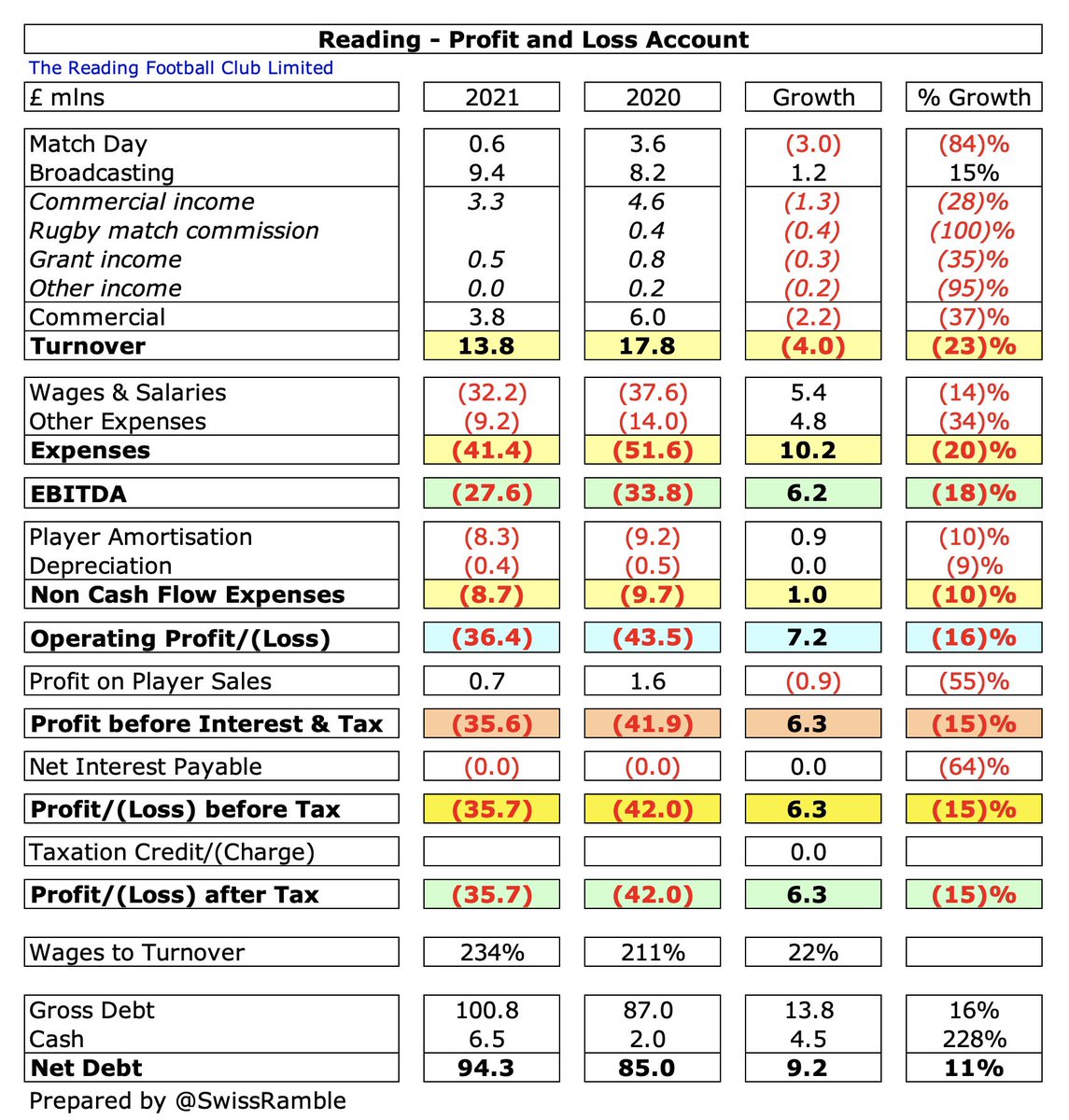

#ReadingFC 2020/21 financial results covered a season when the #Royals finished 7th in the Championship, just missing out on the play-offs under Veljko Paunovic, since replaced by Paul Ince and Michael Gilkes (interim managers). Some thoughts in the following thread.

This was the fourth season that #ReadingFC were under the control of Chinese businessman Dai Yongge (and his sister Dai Xiu Li), who own 96% via Renhe Sports Management Co Ltd. However, in that time the club has struggled both on the pitch and with Financial Fair Play rules.

#ReadingFC loss narrowed from £42m to £36m, despite revenue dropping £4.0m (23%) from £17.8m to £13.8m and profit on player sales falling £0.9m to £0.7m, thanks to an £11.2m (18%) reduction in operating expenses from £61.3m to £50.2m.

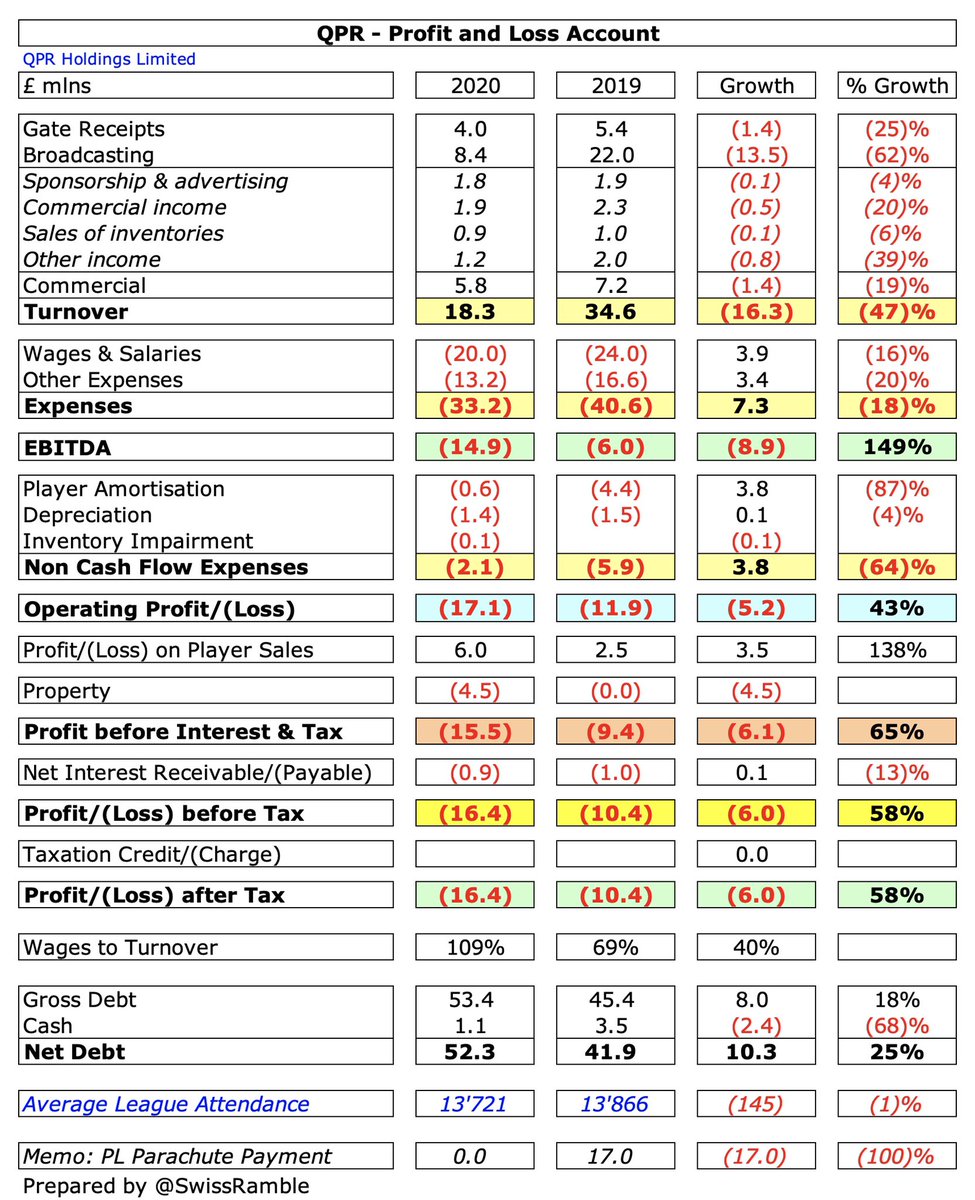

Queens Park Rangers 2020/21 financial results covered a season when they finished a creditable 9th under Mark Warburton, their highest in the Championship since 2013/14, though the campaign was badly disrupted by COVID. Some thoughts in the following thread #QPR

#QPR pre-tax loss narrowed from £16.4m to £4.5m, despite revenue falling £3.8m (21%) from £18.3m to £14.5m, as profit on player sales rose £11.7m to £17.6m and there was no repeat of prior year’s £4.5m write-off of previous training ground development.

#QPR £3.8m revenue reduction was entirely due to the COVID driven £3.8m fall in match day income from £4.0m to just £207k. Broadcasting rose £0.1m (2%) to £8.6m, including iFollow streaming income, while commercial was flat at £5.8m, thanks to furlough payments.

Brentford’s 2020/21 financial results covered a “momentous” season when they were promoted to the Premier League following victory in the Championship play-off final and also reached the Carabao Cup semi-final. Some thoughts in the following thread #BrentfordFC

#BrentfordFC pre-tax loss slightly improved from £9.1m to £8.5m (£2.4m after tax), as profit from player sales rose £19m to £44m and revenue grew £1.4m (10%) from £13.9m to a club record £15.3m. Largely offset by operating expenses, up £22m (46%), including £12m promotion bonus.

#BrentfordFC revenue increase was driven by broadcasting, up £3.4m (47%) from £7.3m to £10.7m, partly due to deferred TV money from 2019/20, with commercial also up £0.9m (26%) to £4.5m, which offset COVID driven reduction in match day, down £2.9m (95%) to just £155k.

#BristolCity 2020/21 financial results cover a season when they finished a “disappointing” 19th in the Championship with Nigel Pearson replacing head coach Dean Holden in February. Owner Steve Lansdown described COVID-impacted losses as “horrific”. Some thoughts follow.

#BristolCity pre-tax loss widened from £10.1m to £38.4m, mainly due to profit on player sales falling £19.4m from £25.6m to £6.2m, while revenue dropped £10.5m (39%) from £27.2m to £16.7m. Only slightly offset by a small expenses decrease of £0.6m (1%) to £62.9m.

#BristolCity revenue decrease largely driven by COVID (games played behind closed doors & stadium lockdown), as commercial fell £6.1m (44%) to £7.7m and match day dropped £4.0m (85%) to £0.7m. Broadcasting also down £0.4m (5%) to £8.2m. Government grants up £1.0m to £1.6m.

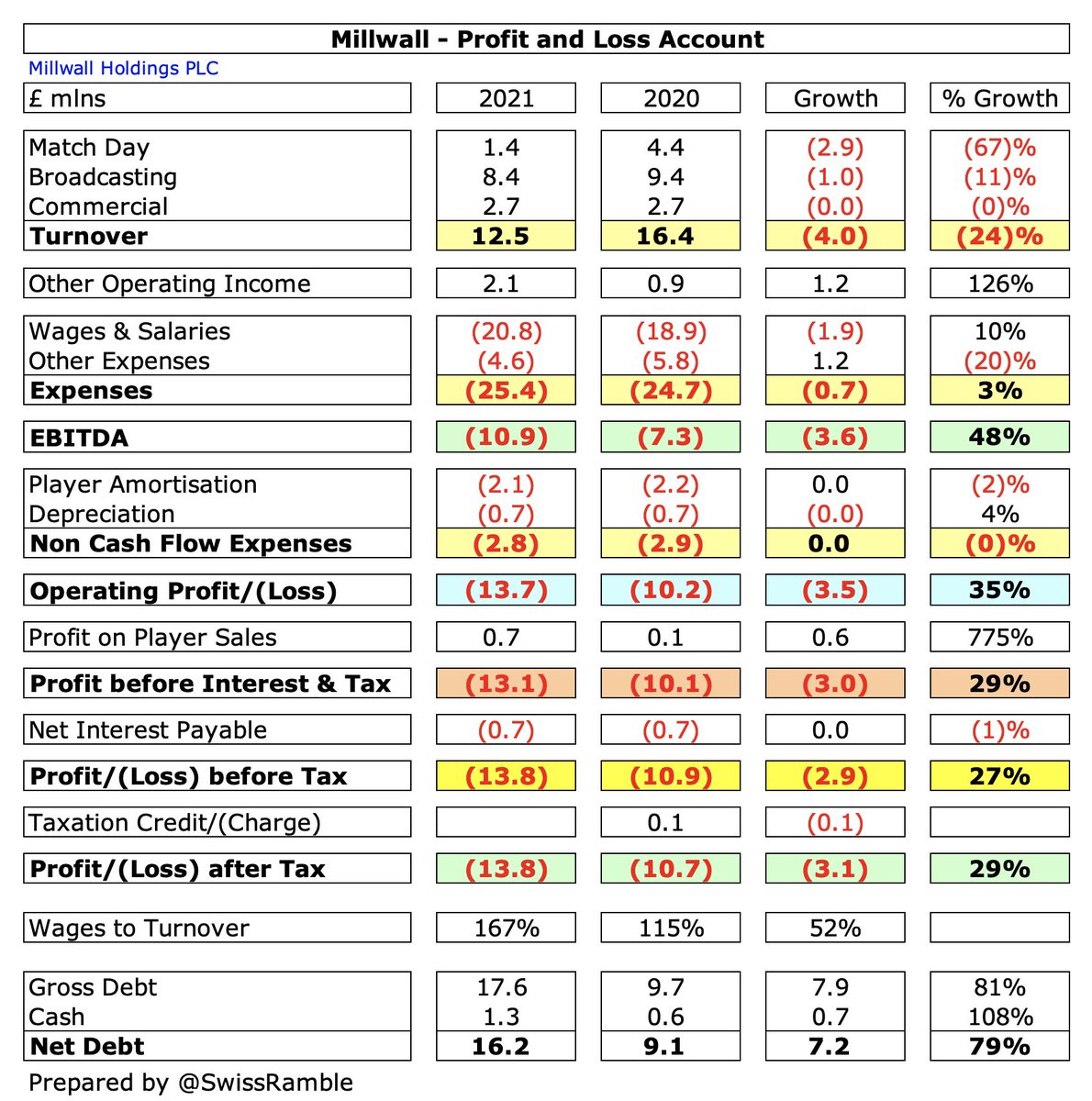

#Millwall 2020/21 financial results covered “a strong season, despite the challenges of the COVID-19 pandemic”, when they finished 11th in the Championship and reached the fourth round of the FA Cup and third round of the Carabao Cup. Some thoughts in the following thread.

#Millwall pre-tax loss widened from £10.9m to £13.8m, largely due to revenue falling £3.9m (24%) from £16.4m to £12.5m, though operating expenses were up £0.7m (3%). Partly offset by profit on player sales increasing £0.6m to £0.7m and other income rising £1.2m to £2.1m.

#Millwall £4.0m revenue decrease was largely driven by match day falling £3.0m (67%) from £4.4m to £1.4m, as COVID meant games being played behind closed doors, while broadcasting also decreased £1.0m (11%) from £9.4m to £8.4m. Commercial income held steady at £2.7m.

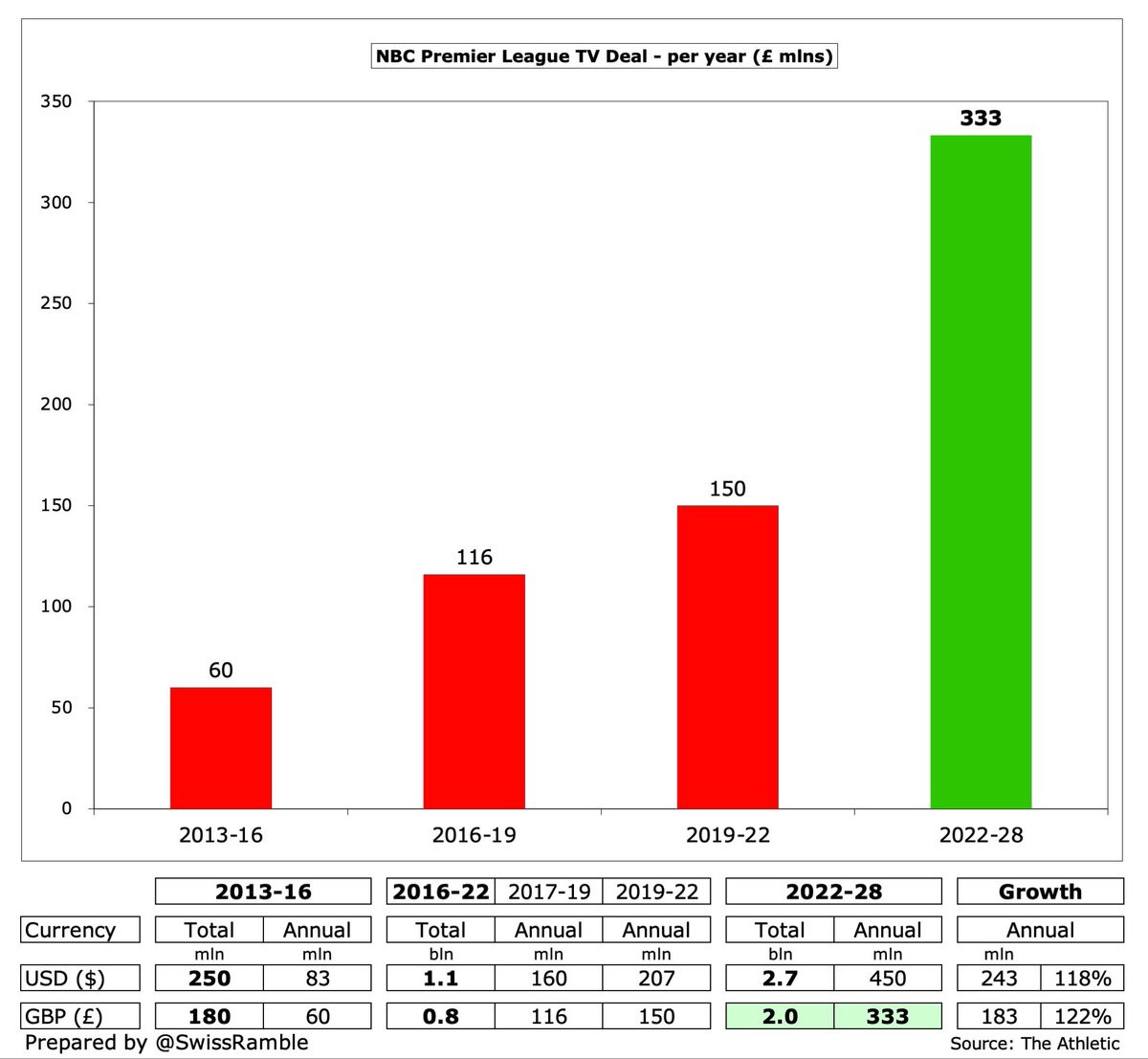

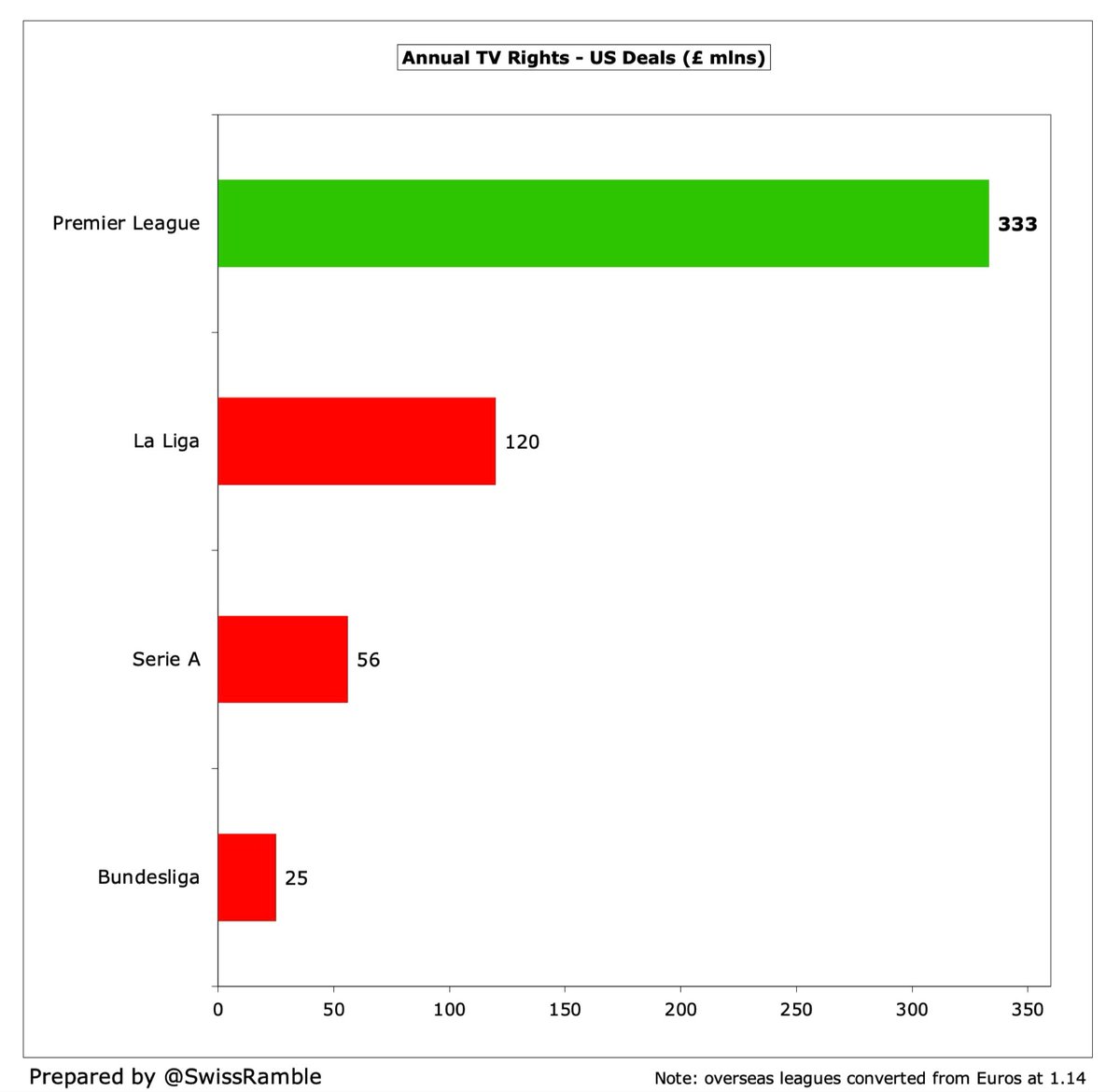

In light of the announcement of a blockbuster Premier League TV deal with American broadcaster NBC, I thought it might be interesting to look at the growing importance of overseas rights to England’s top flight, especially as the value of domestic rights has seemingly plateaued.

After I put together a thread looking at the financial trends in the Premier League over the last 10 years from 2011 to 2020, a few people asked me if I could do the same for the EFL Championship. So here are the finances for England’s second tier over the last decade.

This analysis comes with caveats, as not all Championship clubs published accounts in the last decade, e.g. Derby County in 2019 and 2020. Also no accounts for clubs in administration, e.g. Portsmouth (2011 & 2012), Bolton Wanderers (2018 & 2019) and Wigan Athletic (2020).

Nevertheless, the themes and trends can still be highlighted, including the impact of COVID in the last three months of 2020. We will also feature some comparisons with the Premier League to illustrate the immense differences between England’s top two divisions.

Norwich City’s 2020/21 accounts covered a “challenging period” for the club due to the financial impact of COVID, but they did win the Championship, securing immediate promotion back to the Premier League. Some thoughts in the following thread #NCFC

Despite the impact of relegation and the pandemic, #NCFC pre-tax profit increased from £2.1m to £21.5m (post-tax £15.7m), even though revenue fell £62m (52%) from club record £119m to £57m, as profit on player sales shot up from £2m to £60m and operating expenses were cut £23m.

As a technical aside, the #NCFC 2020/21 accounts only covered 11 months up to 30 June 2021, while the 2019/20 accounts were extended by a month to match the longer Premier League season, so covered a 13-month period. This presents “the best comparable financial information”.

Charlton Athletic’s 2019/20 accounts covered a season in the Championship following promotion from League One, but they were then relegated after finishing 22nd. New owner Tomas Sandgaard said it was “a difficult one for fans, as they feared for the future of the club.” #CAFC

#CAFC have faced many ownership issues, starting with the deeply unpopular Roland Duchâtelet, who bought the club in 2014. Six years later he sold Charlton to East Street Investments Limited, though it was not long before their owners, Tahnoon Nimer and Matt Southall, fell out.

EFL said that the ESI takeover was not approved and imposed a transfer embargo due to funding issues. In June 2020 ESI was taken over by a consortium led by Paul Elliott, but they failed the Owners and Directors test, leading to Thomas Sandgaard acquiring #CAFC in September 2020.

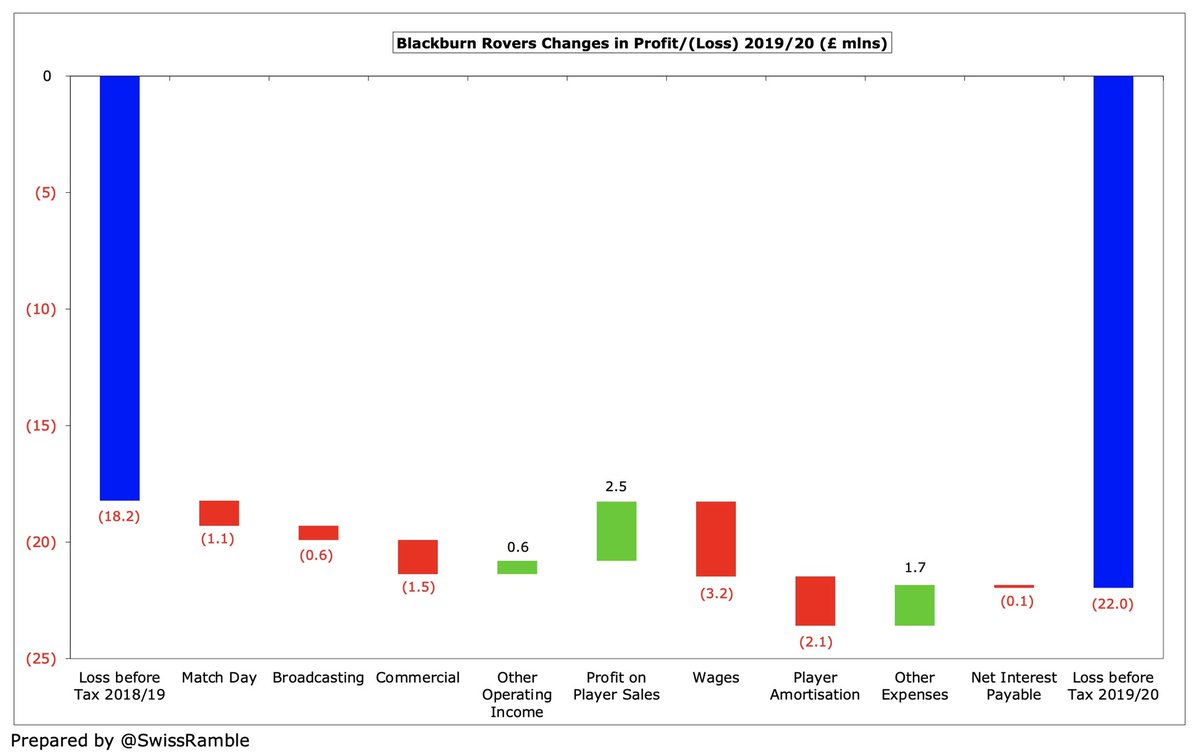

Blackburn Rovers’ financial results for 2019/20 cover a season when they finished 11th in the Championship under Tony Mowbray, the “longest serving manager in the division”. Figures adversely impacted by the COVID-19 pandemic. Some thoughts in the following thread #Rovers

#Rovers loss widened by £4m from £18m to £22m, as revenue fell £3.2m (19%) from £16.7m to £13.2m, while operating expenses grew £3.6m (10%), partly offset by profit on player sales rising £2.5m to £3.1m and £0.6m government furlough income.

All three #Rovers revenue streams were lower, mainly due to COVID: commercial dropped £1.5m (27%) from £5.5m to £4.0m; match day fell £1.0m (29%) from £3.7m to £2.7m; and broadcasting was down £0.6m (8%) from £7.4m to £6.8m.

Sheffield Wednesday’s financial results for 2019/20 cover a season when they finished 16th in the Championship, though they have since been relegated to League One. Manager Garry Monk since replaced by Tony Pulis, in turn succeeded by Darren Moore. Some thoughts follow #SWFC

#SWFC swung from £19m profit to £24m loss, largely due to prior year including £38m profit from selling the stadium and a £6.5m “confidential settlement payment”. Revenue fell £1.9m (8%) from £22.8m to £20.9m, while expenses were flat. Profit on player sales rose £3.4m to £6.2m.

#SWFC match day fell £2.0m (23%) from £8.6m to £6.6m, while commercial was down £0.4m (7%) from £6.1m to £5.7m, but broadcasting rose £0.5m (6%) from £8.0m to £8.5m. Note: match day and broadcasting not separated in accounts, so I have estimated these based on similar clubs.

Fulham’s financial results for 2019/20 cover a season when they were promoted to the Premier League after just a single year in the Championship, finishing 4th, then winning the play-off under manager Scott Parker. Some thoughts in the following thread #FFC

#FFC pre-tax loss widened from £20m to £48m, as revenue fell £80m (58%) from £138m to £58m, due to relegation to the Championship and the impact of COVID, partly offset by profit on player sales rising £23m to £25m, while expenses were cut £29m (18%). Loss after tax was £45m.

#FFC £80m revenue fall was largely driven by broadcasting’s £65m (60%) decrease from £109m to £44m, due to lower TV money in Championship, though commercial also dropped £9m (52%) from £18m to £9m and match day fell £5m (48%) from £11m to £6m.

#CardiffCity 2019/20 accounts cover a season when they finished 5th in the Championship following relegation from the PL, losing in the play-off semi-final. Manager Neil Warnock was replaced by Neil Harris in November 2019, since succeeded by Mick McCarthy. Some thoughts follow.

#CardiffCity swung from £3m profit to £12m loss, as revenue fell £79m (63%) from £125m to £46m due to relegation and COVID, partly offset by profit on player sales rising £12m to £14m, while expenses were down £33m and no repeat of prior year £20m provision for the Sala transfer.

#CardiffCity £79m revenue fall was largely driven by broadcasting’s £70m (66%) decrease from £107m to £37m, due to lower TV money in Championship, though commercial also dropped £5m (48%) from £10m to £5m and match day fell £4m (53%) from £8m to £4m.

Huddersfield income ⬇️ £66m in 2019/20 following relegation. Club has gone from a £1m profit to a £22.7m loss, although player sales reduced this by £18m. Interest on loans over £80,000 a week. #HTAFC

Stoke City’s 2019/20 financial results covered a season when they finished 15th in the Championship, two years after relegation from the Premier League. Manager Nathan Jones was replaced by Michael O’Neill in November 2019. Some thoughts in the following thread #SCFC

#SCFC pre-tax loss widened from £15m to £88m, as revenue dropped £21m (29%) from £71m to £50m and profit from player sales fell £15m (83%) from £18m to £3m. Total expenses increased £37m, mainly due to £43m impairment charge (reducing player values). Loss after tax was £86m.

The main reason for #SCFC £21m revenue reduction was broadcasting, which dropped £20m (39%) from £51m to £31m, mainly due to lower parachute payment, though match day also fell £1.6m (25%) from £6.4m to £4.8m. In contrast, commercial rose £0.9m (7%) from £12.9m to £13.8m.

#BarnsleyFC 2019/20 accounts covered the club’s first season back in the Championship following promotion from League One, when they narrowly avoided relegation by finishing 21st. Head coach Daniel Stendel was replaced by Gerhard Struber, since succeeded by Valerien Ismael.

#BarnsleyFC are owned by a group of international investors, led by Chien Lee of NewCity Capital and Paul Conway of Pacific Media Group, who follow the “Moneyball” approach of fellow investor, Billy Beane. They bought 80% from former custodian, Patrick Cryne, in December 2017.

Following promotion to the Championship, #BarnsleyFC reduced their loss from £3.4m to just £0.3m, as revenue increased £6.4m (83%) from £7.8m to £14.2m and profit on player sales rose £2.0m to £5.8m, partly offset by expenses growing £5.6m (37%) to £20.5m.

Queens Park Rangers 2019/20 financial results covered a season when they finished 13th in the Championship, an improvement on the previous year’s 19th place, though the campaign was disrupted by COVID-19. Some thoughts in the following thread #QPR

#QPR loss widened from £10m to £16m, as revenue fell £16m (47%) from £34m to £18m, though expenses were cut £11m (24%) and profit on player sales increased £3m to £6m. Also impacted by £4.5m write-off of previous training ground development.

The main reason for #QPR £16m revenue reduction was broadcasting, which dropped £14m (62%) from £22m to £8m, as parachute payments stopped, though gate receipts were also down £1.4m (25%) from £5.4m to £4.0m, while commercial fell £1.4m (19%) from £7.2m to £5.8m.