Discover and read the best of Twitter Threads about #impinv

Most recents (16)

Just as twitter crumbles, I'm beyond happy that my 1st PhD paper just got published @EconSocJournal, studying emergence of impact investing in UK.

Main argument: financial agency involves creating social conditions for the exercise of financial power 1/11

tandfonline.com/doi/full/10.10…

Main argument: financial agency involves creating social conditions for the exercise of financial power 1/11

tandfonline.com/doi/full/10.10…

Creating new financial assets is key to the expansion of financialized capitalism. #Assetization enables rent extraction and thus creates economic winners and losers. Losers include gov de-risking, or non financial firms. Why do they participate nevertheless? 2/11

Clearly power is key here, but for assets in their ideational stage & requiring de-risking to be enacted, it's difficult to assume ex-ante unilateral power differences.

My argument: financial actors first need to make #assetization alluring to heterogeneous audiences. 3/11

My argument: financial actors first need to make #assetization alluring to heterogeneous audiences. 3/11

I have been on the job market for more than 3 years now. So, I am beyond thrilled to share I will join ESCP Business School in Paris as a tenure-track Assistant Professor of Sustainability in June!

Lessons--not perseverance pays--in separate 🧵. But now 🍾!

Lessons--not perseverance pays--in separate 🧵. But now 🍾!

Very excited to work with the fantastic #sustainability scholars of @ESCP_bs @ESCPknowledge @carboneval @aacquier @FrankFigge!

I will continue to work with @Tiresia_Polimi @KelloggOx @jonathan_michie @EuclidNetwork! Lots of synergies on @socent #socialinnovation #impact #impinv #policy #startups to expect!

#SriAgenda abt to start 💥 #Nov25 10am CET

The 20th anniversary of @ItaSIF: past, present and future of #sustainablefinance | #SettimanaSRI Final Day

finanzasostenibile.it/eventi/20-anni…

@SriEvent Twitter Media Partner

#sri #esg #responsibleinvestment @SRI_Natives @SriEvent_It @andytuit

The 20th anniversary of @ItaSIF: past, present and future of #sustainablefinance | #SettimanaSRI Final Day

finanzasostenibile.it/eventi/20-anni…

@SriEvent Twitter Media Partner

#sri #esg #responsibleinvestment @SRI_Natives @SriEvent_It @andytuit

@ItaSIF @SRI_Natives @SriEvent_It @andytuit getting ready...

#SettimanaSRI Final Day

#Milan @meetcenter @PietroNegri6

#SettimanaSRI Final Day

#Milan @meetcenter @PietroNegri6

@ItaSIF @SRI_Natives @SriEvent_It @andytuit @meetcenter @PietroNegri6 welcome remarks by @sergio_urbani Managing Director @FondCariplo, introduced by moderator @EliSoglio

#SettimanaSRI Final Day @FondCariplo @CorriereBN

#SettimanaSRI Final Day @FondCariplo @CorriereBN

#SriAgenda abt to start 💥 #Nov17 at 10am CET

🟢 Italian #SMEs and #sustainability #reporting | w/in #SettimanaSRI by @ItaSIF

finanzasostenibile.it/eventi/pmi-ita…

#sustainablefinance #sri #esg #responsibleinvestment #greenfinance #impinv @SRI_Natives @SriEvent_It @andytuit

🟢 Italian #SMEs and #sustainability #reporting | w/in #SettimanaSRI by @ItaSIF

finanzasostenibile.it/eventi/pmi-ita…

#sustainablefinance #sri #esg #responsibleinvestment #greenfinance #impinv @SRI_Natives @SriEvent_It @andytuit

@ItaSIF @SRI_Natives @SriEvent_It @andytuit #SriAgenda just started ⚡ #Nov17

about 700 people are attending this webinar, that proves today's topic is crucial, says @fbicciato1 Secretary General @ItaSIF in his opening remarks

finanzasostenibile.it/eventi/pmi-ita…

#sustainablefinance #sri #esg #responsibleinvestment #greenfinance

about 700 people are attending this webinar, that proves today's topic is crucial, says @fbicciato1 Secretary General @ItaSIF in his opening remarks

finanzasostenibile.it/eventi/pmi-ita…

#sustainablefinance #sri #esg #responsibleinvestment #greenfinance

@ItaSIF @SRI_Natives @SriEvent_It @andytuit @fbicciato1 congratulations for sharing the knowledge and raising awareness of #sustainablefinance, the 20th anniversary @ItaSIF is celebrating this year is impressive, says Ulla Hudina-Kmetic, Deputy Head of Unit, DG GROW

#SettimanaSRI #sri #esg #responsibleinvestment #greenfinance

#SettimanaSRI #sri #esg #responsibleinvestment #greenfinance

My term as @DafneHQ chair ends. A huge thanks to all who helped bring both community #PEXforum and advocacy @PhilanthropyEU to the next level! In the spirit of brevity, allow me to share six reflections.

1. Philanthropy has such a vast, untapped potential: Online giving and #impinv are only getting started, a huge intergenerational wealth transfer is ongoing, and >99% of people are yet to be involved.

2. The inconvenient truth: #Foundations are stagnating while top-end wealth skyrockets. Closing the gap may require tackling unproductive endowments, high overheads, lack of diversity, top-down culture. This current crisis could be an opportunity for renewal.

1/ With financial innovations such as #sustainablefinance and #impactinvesting increasingly viewed as key to the solution of current social and environmental crises, let’s take a look at how we got here, what might be problematic about that and what to do about it. 👇

2/ This is a thread about the empirical part of my book that traces the history of #socinv in the UK. I’ll leave the theoretical argument based on Fligstein & McAdam’s strategic action field theory & pragmatist action theory for another time.

springer.com/gp/book/978303…

springer.com/gp/book/978303…

now Father Augusto Zampini @azd21 Co-Secretary @VaticanIHD joins the webinar as Keynote Speaker

#fossilfuel #divestment @OperationNoah @CathClimateMvmt @trocaire @popesprayernet @faithinvest1 @Ecojesuit

#fossilfuel #divestment @OperationNoah @CathClimateMvmt @trocaire @popesprayernet @faithinvest1 @Ecojesuit

@azd21 @VaticanIHD @OperationNoah @CathClimateMvmt @trocaire @popesprayernet @faithinvest1 @Ecojesuit we don't want a financial system that rules, we want a financial system that serves, says @azd21 recalling Pope Francis' words

@azd21 @VaticanIHD @OperationNoah @CathClimateMvmt @trocaire @popesprayernet @faithinvest1 @Ecojesuit we need to divest from what is damaging and invest in what is not damaging, in what makes a positive social and enviromental #impact, as people of faith we should push for #impactinvestment, says @azd21

@sirronniecohen @cliffprior @franseegull @durreen @klugesan #impinv

@sirronniecohen @cliffprior @franseegull @durreen @klugesan #impinv

#SriAgenda today | #Sep22 10am CEST

#SINVEurope part 4 "@Climate_Action_ @UNEP_FI

#sustainablefinance #responsibleinvestment #impinv @MardiMcB @ElodieFeller1 @IvelinaStef @GeedaHaddad @MartinSpolc @SasjaBeslik @bencaldecott @EricPUsher @cliffprior @NickHenry_CA

#SINVEurope part 4 "@Climate_Action_ @UNEP_FI

#sustainablefinance #responsibleinvestment #impinv @MardiMcB @ElodieFeller1 @IvelinaStef @GeedaHaddad @MartinSpolc @SasjaBeslik @bencaldecott @EricPUsher @cliffprior @NickHenry_CA

@Climate_Action_ @UNEP_FI @MardiMcB @ElodieFeller1 @IvelinaStef @GeedaHaddad @MartinSpolc @SasjaBeslik @bencaldecott @EricPUsher @cliffprior @NickHenry_CA #SriAgenda just started 🔘 #Sep22

welcome speech and opening remarks by Professor @bencaldecott

#SINVEurope #Part4 @TheSmithSchool @UniofOxford @GFI_green @susfinalliance #sustainablefinance #climatecrisis #sri #esg #climaterisks #greenfinance #responsibleinvestment

welcome speech and opening remarks by Professor @bencaldecott

#SINVEurope #Part4 @TheSmithSchool @UniofOxford @GFI_green @susfinalliance #sustainablefinance #climatecrisis #sri #esg #climaterisks #greenfinance #responsibleinvestment

@Climate_Action_ @UNEP_FI @MardiMcB @ElodieFeller1 @IvelinaStef @GeedaHaddad @MartinSpolc @SasjaBeslik @bencaldecott @EricPUsher @cliffprior @NickHenry_CA @TheSmithSchool @UniofOxford @GFI_green @susfinalliance #SINVEurope #Part4

@MartinSpolc talking abt the next steps of #sustainablefinanceEU renewed strategy in conversation w/ @bencaldecott

@EU_Finance @EU_ScienceHub #sustainablefinance @Climate_Action_ @UNEP_FI

@MartinSpolc talking abt the next steps of #sustainablefinanceEU renewed strategy in conversation w/ @bencaldecott

@EU_Finance @EU_ScienceHub #sustainablefinance @Climate_Action_ @UNEP_FI

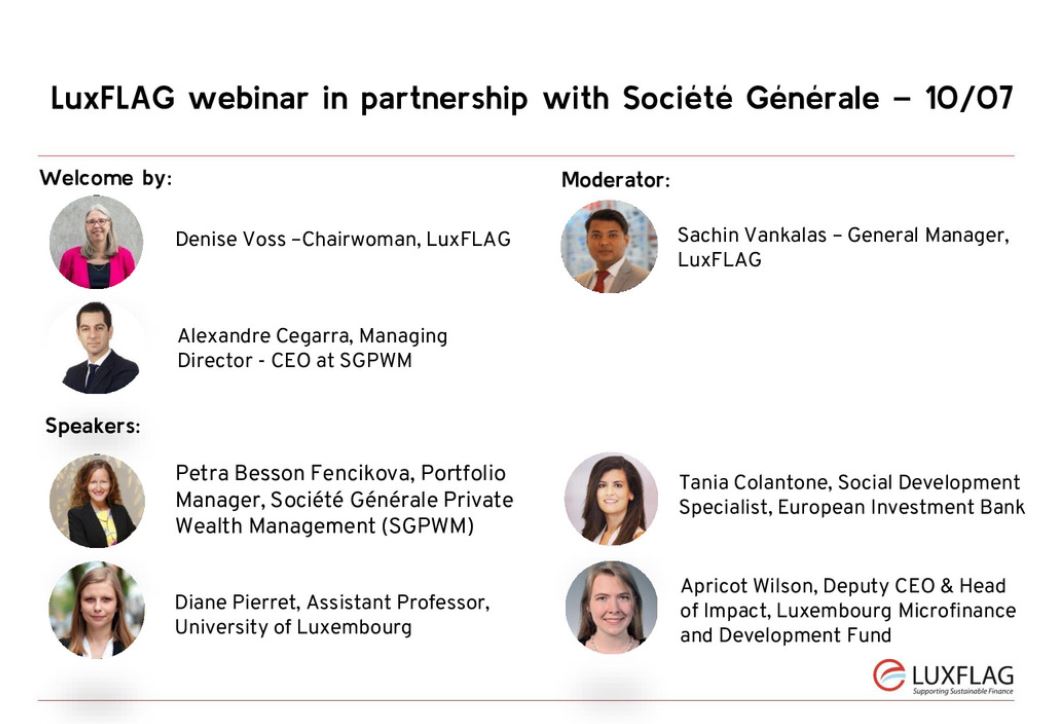

#SriAgenda in 15min 🔔 #July10

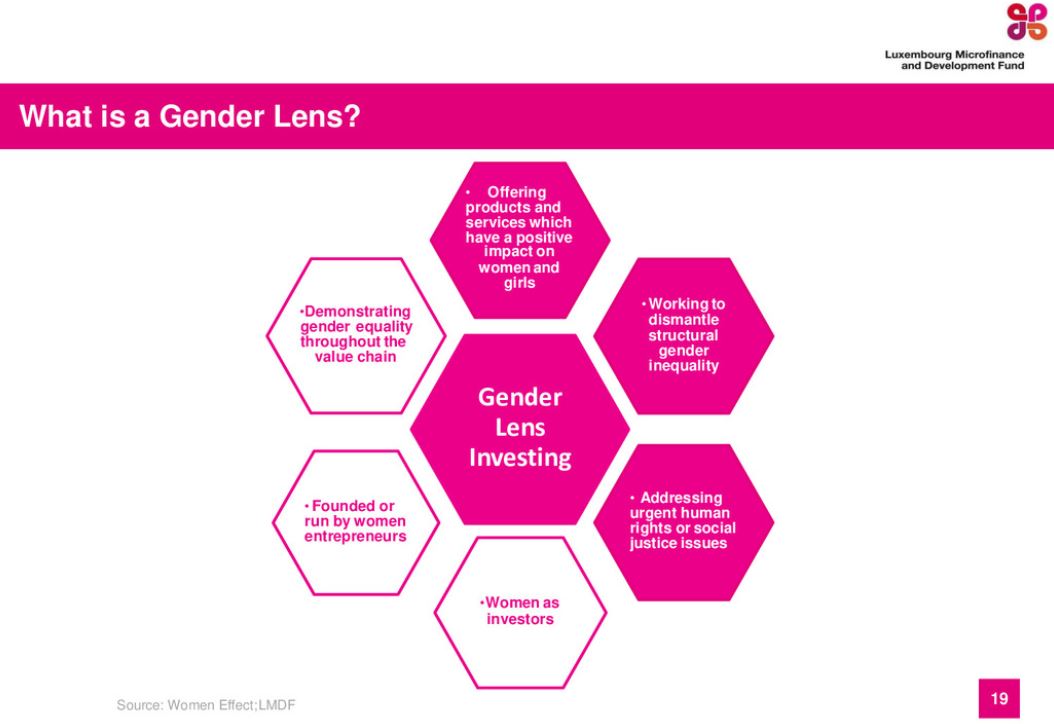

#GenderLens - an important but often forgotten criterion to cover while doing #SustainableInvesting "@LuxFLAG @SocieteGenerale

bit.ly/2BuURgp

#sustainablefinance #sri #esg #responsibleinvestment @SRI_Natives @SriEvent_It @andytuit

#GenderLens - an important but often forgotten criterion to cover while doing #SustainableInvesting "@LuxFLAG @SocieteGenerale

bit.ly/2BuURgp

#sustainablefinance #sri #esg #responsibleinvestment @SRI_Natives @SriEvent_It @andytuit

@LuxFLAG @SocieteGenerale @SRI_Natives @SriEvent_It @andytuit #SriAgenda just started 💥 #July10

#GenderLens - an important but often forgotten criterion to cover while doing #SustainableInvesting "@LuxFLAG @SocieteGenerale

bit.ly/2BuURgp

#sustainablefinance #sri #esg #responsibleinvestment

#GenderLens - an important but often forgotten criterion to cover while doing #SustainableInvesting "@LuxFLAG @SocieteGenerale

bit.ly/2BuURgp

#sustainablefinance #sri #esg #responsibleinvestment

@LuxFLAG @SocieteGenerale @SRI_Natives @SriEvent_It @andytuit you can use #genderlens investing to address urgent #socialneeds, says Apricot Wilson, Deputy CEO & Head of Impact at #Luxembourg #Microfinance and Development Fund

#sustainableinvesting #sustainablefinance #impinv @IforD_LMDF @EMNMicrofinance @MFC_Network @e_MFP @CGAP

#sustainableinvesting #sustainablefinance #impinv @IforD_LMDF @EMNMicrofinance @MFC_Network @e_MFP @CGAP

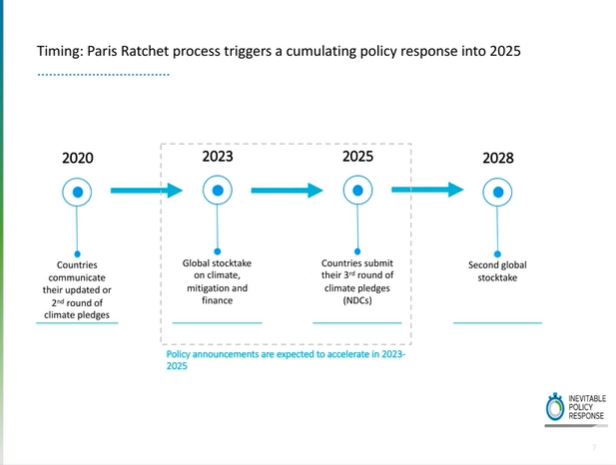

#SriAgenda abt to start 🔔 #June11 at 4pm CEST

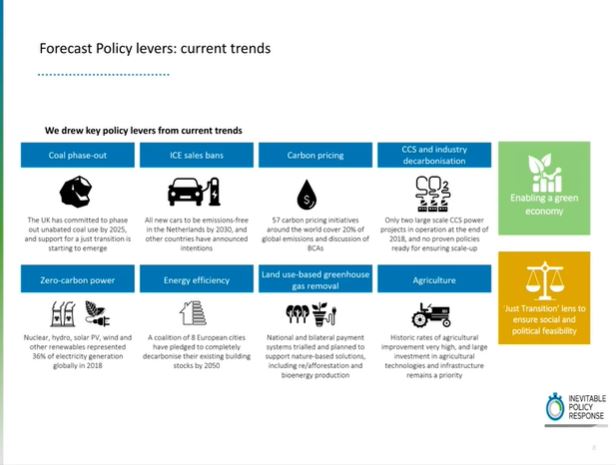

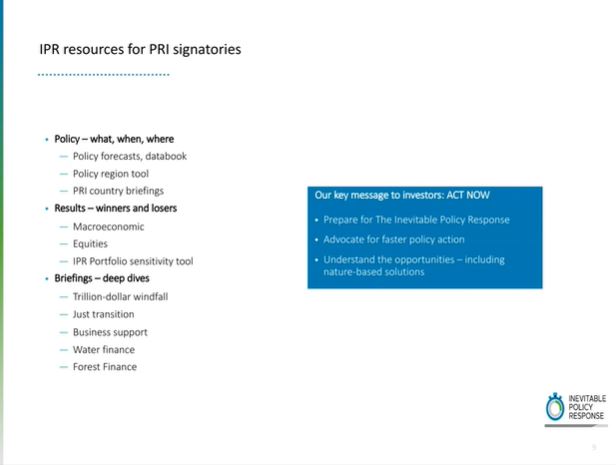

The #InevitablePolicyResponse - The value of #NatureBasedSolutions "@PRI_News @VividEconomics

brighttalk.com/webcast/17701/…

#sustainablefinance #sri #esg #responsibleinvestment @andytuit @SRI_Natives @CsrEvent

The #InevitablePolicyResponse - The value of #NatureBasedSolutions "@PRI_News @VividEconomics

brighttalk.com/webcast/17701/…

#sustainablefinance #sri #esg #responsibleinvestment @andytuit @SRI_Natives @CsrEvent

@PRI_News @VividEconomics @andytuit @SRI_Natives @CsrEvent #SriAgenda just started 💥

#InevitablePolicyResponse #NatureBasedSolutions

#InevitablePolicyResponse #NatureBasedSolutions

@PRI_News @VividEconomics @andytuit @SRI_Natives @CsrEvent there's a clear nexus btw #publichealth, #deforestation and #climatechange, says Sagarita Chatterjee from @PRI_News in her opening remarks, and our key message to investors is: ACT NOW, she says

#InevitablePolicyResponse #NatureBasedSolutions #climatecrisis #sustainablefinance

#InevitablePolicyResponse #NatureBasedSolutions #climatecrisis #sustainablefinance

(THREAD) @ImpactAlpha challenges #impact investors to scale up their efforts 10X. To which I say: Yes! #Investors can do more, but there’s also #policy and #civics to consider. I want to share some ways at @_BlueHaven we’re addressing the #pandemic.

1/ On the #investment side, we’re checking in with #entrepreneurs and orgs we support, helping them keep their teams intact, thinking through costs, etc. (Check out @LaurenSCochran’s conversation with @annefieldonline: bit.ly/2XSdX8D)

2/ Bridge loans to #impact companies can also help. We’re excited about our investment in the Open Road Alliance Fund (@openroadtweets), which offers these to orgs affected by #COVID19 all over the world. bit.ly/2yavbUt

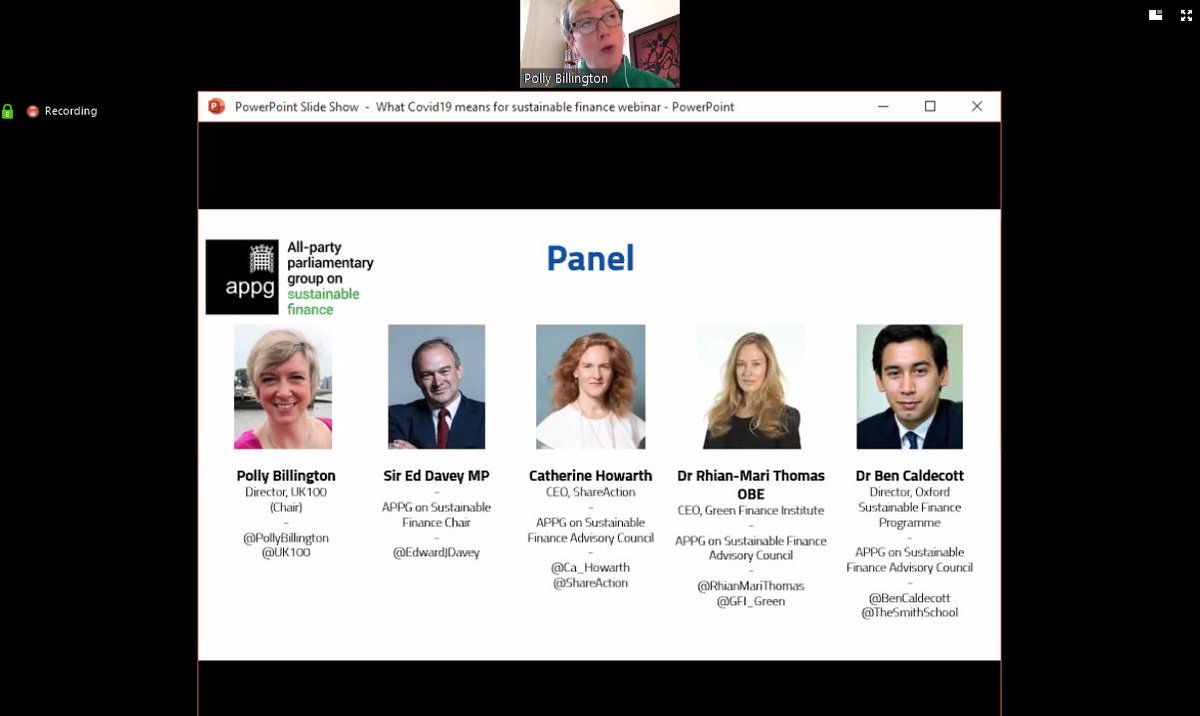

#SriAgenda abt to start 🔔 #Apr28 5pm CEST

#greenfinancecovid19 - What Covid-19 means for #sustainablefinance "@APPGSustFin 1st official event #APPGSustFin

#sri #esg #responsibleinvestment #greenfinance #greenbonds @SRI_Natives @andytuit

#greenfinancecovid19 - What Covid-19 means for #sustainablefinance "@APPGSustFin 1st official event #APPGSustFin

#sri #esg #responsibleinvestment #greenfinance #greenbonds @SRI_Natives @andytuit

@APPGSustFin @SRI_Natives @andytuit #SriAgenda just started 💥 #Apr28

#greenfinancecovid19 - What Covid-19 means for #sustainablefinance "@APPGSustFin 1st official event #APPGSustFin

w/ @PollyBillington @RhianMariThomas @ca_howarth @EdwardJDavey @bencaldecott

#greenfinancecovid19 - What Covid-19 means for #sustainablefinance "@APPGSustFin 1st official event #APPGSustFin

w/ @PollyBillington @RhianMariThomas @ca_howarth @EdwardJDavey @bencaldecott

Alors, je vous présente… our findings about (1) what academic #research already exists about UK charities & #philanthropy and (2) the topics on which UK charities & donors say that they would like more academic #research.

(Thread)

#charity #impact #eval #impinv

(Thread)

#charity #impact #eval #impinv

2/ Combined, the results are a ‘gap analysis’ which can inform future research. Both studies were funded by @Charity_Futures, re its work establishing an Institute of Charity at Oxford University. But the findings can inform the agenda of any researchers in this terrain.

3/ Full findings are here: giving-evidence.com/2019/07/02/sup…

Summary is here: givingevidence.files.wordpress.com/2019/01/press-…

Summary is here: givingevidence.files.wordpress.com/2019/01/press-…

1/

“The inherent vice of capitalism is the unequal sharing of blessings.” - Churchill

Thesis: how an enterprise shares profits determines the depth of its social mission.

Discuss.

“The inherent vice of capitalism is the unequal sharing of blessings.” - Churchill

Thesis: how an enterprise shares profits determines the depth of its social mission.

Discuss.

2/

“The inherent virtue of socialism is the equal sharing of miseries” - Churchill

Thesis: the profit motive is the most powerful misery-alleviation mechanism man has yet invented.

Discuss.

“The inherent virtue of socialism is the equal sharing of miseries” - Churchill

Thesis: the profit motive is the most powerful misery-alleviation mechanism man has yet invented.

Discuss.

Perhaps one of the essential challenges of defining #impinv lies not in defining the impact, but rather in figuring out how to equitably share an enterprise’s profits without introducing regulatory overreach?

Last month a friend asked me "what's the best resource you've read thus far on human decision-making?" 1/

After thinking about it, I decided to recommend her one of the first such resources I ever encountered, seven years ago: Doug Hubbard (@hubbardaie)'s How to Measure Anything. 2/ amazon.com/How-Measure-An…

While I don't agree with every word of it, How to Measure Anything is quite possibly the most important and useful book I've ever read on any topic. Here's why. 3/

Just landed in #Thailand & looking forward to speaking at the @AfiForum. At the event? Come say hello. #AFIF2019.

500+ of the world’s leading #investors & #FI will explore investment opportunities to foster inclusive financial markets across #AsiaPacific

afiforum.com

500+ of the world’s leading #investors & #FI will explore investment opportunities to foster inclusive financial markets across #AsiaPacific

afiforum.com

#Davos #WEF19 or here at the Asia Financial Institutions Forum @AfiForum #AFIForum 2019 in #Bangkok: something to ponder this #MLKDay weekend & beyond. #microfinance #accessstocapital #fintech #finance #inequality

No, not #Davos. Warmer! Welcome to #Bangkok! Let’s get this #hashtag trending too…

#WEF19👉#AFIF2019

@AfiForum @SongbaeLee @calvertimpcap @TriodosIM @GOGLAssociation @BlueOrchardLtd @FMO_development

@nexusfordev @LauraSundblad #impinv #accesstocapital #financialinclusion

#WEF19👉#AFIF2019

@AfiForum @SongbaeLee @calvertimpcap @TriodosIM @GOGLAssociation @BlueOrchardLtd @FMO_development

@nexusfordev @LauraSundblad #impinv #accesstocapital #financialinclusion