Discover and read the best of Twitter Threads about #mortgage

Most recents (24)

#ES flirted with 4,115 again after that great intraday $HYG reversal portended downside #volatility when cyclicals didn‘t really point higher.

The day ended with a profound deterioration in market breadth and unappealing sectoral overview.

THREAD 👇

The day ended with a profound deterioration in market breadth and unappealing sectoral overview.

THREAD 👇

2. #tech upswing invited selling interest, while #value and especially $IWM turned strongly south.

#ES though had been relatively resilient given both #manufacturing and #retailsales hits, and today‘s data in #housing weren‘t slated to bring a disaster.

The figures are

#ES though had been relatively resilient given both #manufacturing and #retailsales hits, and today‘s data in #housing weren‘t slated to bring a disaster.

The figures are

Now some company #earnings

THREAD 👇

1. After correct predictions of $TSLA, $AAPL earnings (market impact), I was asked about $WMT and $TGT – on a company level, I of course expect $WMT to do considerably better than $TGT.

Note though $XRT weak chart posture, and how

THREAD 👇

1. After correct predictions of $TSLA, $AAPL earnings (market impact), I was asked about $WMT and $TGT – on a company level, I of course expect $WMT to do considerably better than $TGT.

Note though $XRT weak chart posture, and how

2. relatively well $XLY is still doing. Therefore, I‘m looking for especially $WMT beat on profits, less so on revenue (if volume sales are taken into account) and darkening guidance – these earnings won‘t send #ES lower while $TGT effect would be more neutral.

3. As for $HD, this one could be weaknest out of the three tickers mentioned, no matter how well $XHB is doing. I‘m looking for the relative calm in #realestate to go as it‘s impossible to the supply to be brought into the market when favorable #mortgage rates

A better solution doesn't exist, but here is a short 🧵on why looking at "Average Mortgage Rates" can be misleading in today's world.

#HomeBuyers or wanna-be #HomeSellers - pay close attention! Don't get discouraged running payments on your computer...talk to a professional!

#HomeBuyers or wanna-be #HomeSellers - pay close attention! Don't get discouraged running payments on your computer...talk to a professional!

Conventional Loans are tough to price out these days. The #FHFA has a complicated pricing grid that requires points (upfront $$ - one point = 1% of your loan amount in a cash fee) to be collected based on certain loan parameters, LTV, Credit Score, etc

singlefamily.fanniemae.com/media/9391/dis…

singlefamily.fanniemae.com/media/9391/dis…

These fees are historically absorbed in modestly higher rates. However, the mortgage bond market is not trading well these days so the profit in higher rates to absorb those fees doesn't exist. As a result, "Zero Point" loans can be quite high!

Wondering about latest news 📰 in the #realestate #housingmarket 🏡💵 with pricing, #interestrates, etc.? Here's an updated thread for January 23' that includes all the latest macro/market data... 🧵/👇🏼

📊h/t @RealEstateCafe

📊h/t @RealEstateCafe

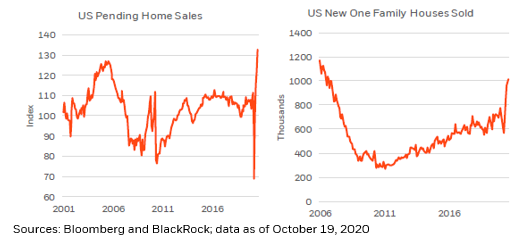

1/🧵 "44% year/year drop in @MBAMortgage

Purchase Index is largest decline on record." 🇺🇸📉

📊h/t @LizAnnSonders @bloomberg

#realestate #realestateinvesting #FederalReserve #interestrates #macro #realator #mortgagerates

Purchase Index is largest decline on record." 🇺🇸📉

📊h/t @LizAnnSonders @bloomberg

#realestate #realestateinvesting #FederalReserve #interestrates #macro #realator #mortgagerates

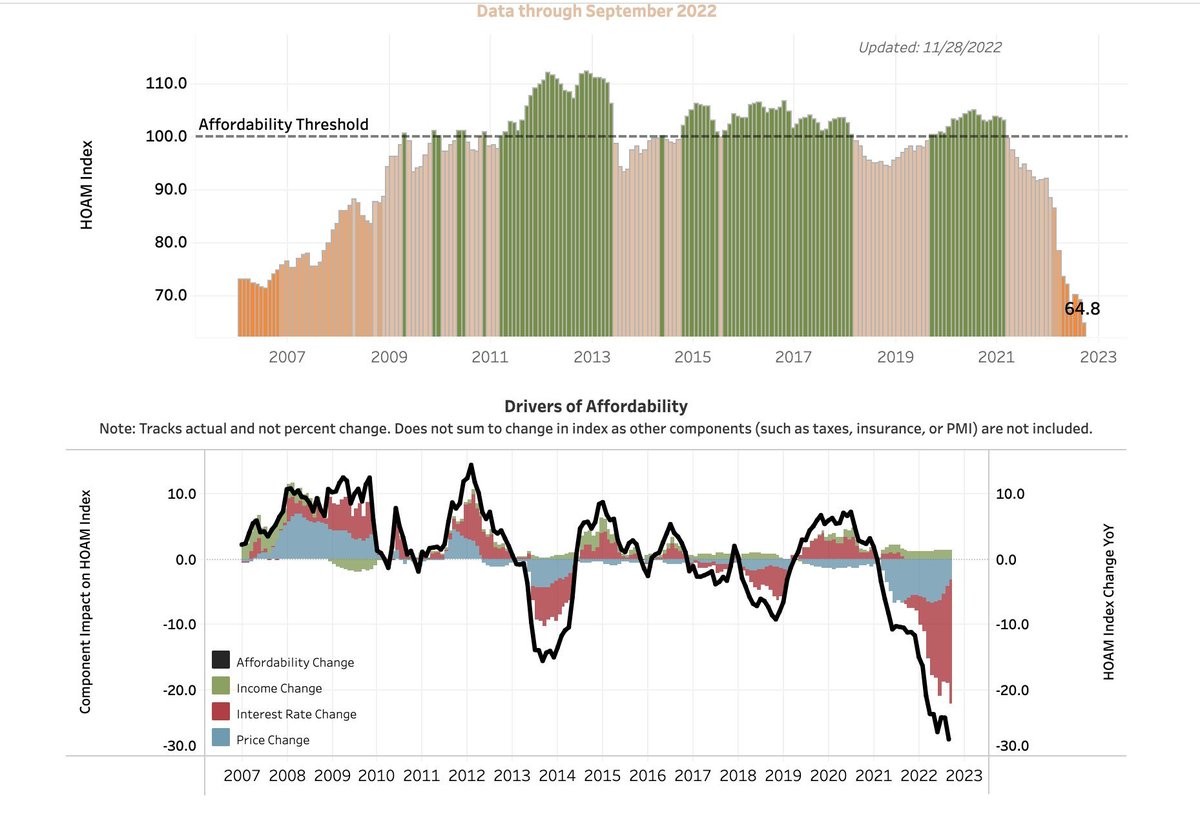

2/🧵 Affordability "threshold" for housing, via the @AtlantaFed 🏡

📊h/t @NewsLambert

#realestate #realestateinvesting #FederalReserve #interestrates #macro #realator #mortgagerates

📊h/t @NewsLambert

#realestate #realestateinvesting #FederalReserve #interestrates #macro #realator #mortgagerates

As we kickoff 23', here's a thread w/ the latest data 🏦💵🖨 on #StockMarket liquidity, credit, & financial conditions within the broader markets... 🧵/👇🏼

📊 h/t @crossbordercap

#FederalReserve #interestrates #stockmarket #Crypto #GDP $DXY $TLT $SPY $ES $SPX $QQQ $DIA $IWM

📊 h/t @crossbordercap

#FederalReserve #interestrates #stockmarket #Crypto #GDP $DXY $TLT $SPY $ES $SPX $QQQ $DIA $IWM

1/🧵 One of the indicators we watch is the @federalreserve 'Net Liquidity' as this tracks the markets very closely....

📊 h/t @fkronawitter1

#FederalReserve #interestrates #stockmarket #Crypto #GDP $DXY $TLT $SPY $ES $SPX $QQQ $DIA $IWM

📊 h/t @fkronawitter1

#FederalReserve #interestrates #stockmarket #Crypto #GDP $DXY $TLT $SPY $ES $SPX $QQQ $DIA $IWM

2/🧵 In addition to this, investors also have to look past the @federalreserve as global Central Banks 🏦 have joined in QT against the #inflation backdrop...

📊 h/t @LanceRoberts @ISABELNET_SA @topdowncharts @insidefinance

📊 h/t @LanceRoberts @ISABELNET_SA @topdowncharts @insidefinance

🇺🇸 (1/10) | As I already warned several times, the #housing #recession has gained traction since July as prices started dropping ⬇

christophe-barraud.com/10-tweets-that…

christophe-barraud.com/10-tweets-that…

🇺🇸 (2/10) Today’s figures (Corelogic CS and FHFA) confirmed this assumption. Looking ahead, latest proxies already point to a larger drop in August.

🇺🇸 (3/10) In addition, the recent bounce of #mortgage rates implies that sales’ cancellations will rise, and demand (at least from 1st time buyers) will collapse. As a result, downward pressures are expected to intensify from September.

#RealEstate sales are cyclical - millions of transactions worth trillions of USD processed per annum globally

Settlement times can be lengthy/laborious

#Blockchain & #NFTs solve this through immutability and fractional ownership

This @OriginsNFT article takes a closer look👇🧵

Settlement times can be lengthy/laborious

#Blockchain & #NFTs solve this through immutability and fractional ownership

This @OriginsNFT article takes a closer look👇🧵

INDUSTRY BACKGROUND:

According to @Savills last valuation, the global real estate property valuation was around $326.5T in 2020

The real estate market can be broken up into three segments:

According to @Savills last valuation, the global real estate property valuation was around $326.5T in 2020

The real estate market can be broken up into three segments:

Focusing on the largest segment (residential) - according to @CoreLogicInc there were 7 million residential units sold in 2021, totalling $2.8T of transaction volume

Today is an hot day, not only for temperatures, but also for economic data.

Follow me meanwhile I unroll all the new prints we had today

Super important thread on #inflation and the #housing #market

Lot of metrics to cover, get comfortable and get ready

🤓🧵

Follow me meanwhile I unroll all the new prints we had today

Super important thread on #inflation and the #housing #market

Lot of metrics to cover, get comfortable and get ready

🤓🧵

#CPI prints:

#UK YoY

Actual

9.4%

Forecast

9.3%

Previous

9.1%

#UK MoM

Actual

0.8%

Forecast

0.7%

Previous

0.7%

#Canada YoY

Actual

8.1%

Forecast

8.4%

Previous

7.7%

#Canada MoM

Actual

0.7%

Forecast

0.9%

Previous

1.4%

Let's unpack it briefly

#UK YoY

Actual

9.4%

Forecast

9.3%

Previous

9.1%

#UK MoM

Actual

0.8%

Forecast

0.7%

Previous

0.7%

#Canada YoY

Actual

8.1%

Forecast

8.4%

Previous

7.7%

#Canada MoM

Actual

0.7%

Forecast

0.9%

Previous

1.4%

Let's unpack it briefly

With a 9.4% UK finds itself on the firsts European (continent) Countries that are approaching double digits #inflation, and with the lack of haste in interventions on the #monetary #policies side, the #peak #inflation seems still far away. Let alone the MoM momentum, still high

Quick thread on Price-to-Rent Ratio?

The price-to-rent ratio can be helpful for gauging whether or not an area is “fairly” priced, or if it’s in bubble territory.

To determine the price-to-rent ratio in a given area, divide the median home price by the median annual rent.

The price-to-rent ratio can be helpful for gauging whether or not an area is “fairly” priced, or if it’s in bubble territory.

To determine the price-to-rent ratio in a given area, divide the median home price by the median annual rent.

Generally, a price-to-rent ratio higher than 21 means it’s cheaper to rent in that area.

As of 2019, the price-to-rent ratio in San Francisco is over 50, the highest in the US.

For every $1,000 you’d spend in rent, you’d have to pay $601,362 to buy something comparable.

As of 2019, the price-to-rent ratio in San Francisco is over 50, the highest in the US.

For every $1,000 you’d spend in rent, you’d have to pay $601,362 to buy something comparable.

e.g. a place that rents for $4,000/mo. would cost roughly $2.4M to buy.

At that rate, it’s cheaper to rent than to own, as the estimated monthly mortgage payment would be around $10,000.

At that rate, it’s cheaper to rent than to own, as the estimated monthly mortgage payment would be around $10,000.

Looking forward to an august panel discussion on how the economy can be reshaped to help better deliver on our #NetZero and #LevellingUp agendas #NEFBriefing

.@Miatsf opens the panel by welcoming the progress that has been made to date in getting finance more interested in #NetZero & #LevellingUp, but there is still progress to be made - for example, low levels of investment in #SMEs despite them being drivers of growth #NEFBriefing

First speaker @JosephEStiglitz discusses how to use the credit system to accelerate a green transition. Says historically financial institutions have made "strong statements" about wanting a green portfolio, but critics fear this may just be "greenwashing" #NEFBriefing

🏗 Real estate boom will continue, capitalization of developers will grow, according to RDV sources.

Need for families in #Russia for real estate is so much higher than supply of #developers that prices for square meters will inexorably rise.

$SMLT $PIKK $LSRG $ETLN

Thread 🧵👇

Need for families in #Russia for real estate is so much higher than supply of #developers that prices for square meters will inexorably rise.

$SMLT $PIKK $LSRG $ETLN

Thread 🧵👇

The volume of the #RealEstate market in 2020 amounted to more than 17 trillion rubles - this is the second consumer market in #Russia.

Growth potential of share of top 5 #developers is 250% - up to level of consolidation of #grocery retail market comparable in size. Along with growth of share of large players, their revenue is growing. Top 5 public developers include #Samolet, #PIK and #LSR.

$SMLT $PIKK $LSRG

$SMLT $PIKK $LSRG

🛑New Article ALERT!!! 🛑 Free up cash and save money using your mortgage .

📌Having a mortgage doesn't have to mean the end of your savings.

Check it out: timidbee.com/post/free-up-c…

#timidbee #mondaymotivation #mondaythoughts #finance #COVID19 #Cryptocurency #DigitalMarketing

📌Having a mortgage doesn't have to mean the end of your savings.

Check it out: timidbee.com/post/free-up-c…

#timidbee #mondaymotivation #mondaythoughts #finance #COVID19 #Cryptocurency #DigitalMarketing

📌What are the mortgages types?

💢PRINCIPAL AND INTEREST MORTGAGE

💢INTEREST ONLY MORTGAGE

💢REVERSE MORTGAGE

Details here: timidbee.com/post/free-up-c…

What mortgage type do you prefer? Let us know in the comments⬇️⬇️ .

#timidbee #Finance #WisdomWednesday #money #investment #cash

💢PRINCIPAL AND INTEREST MORTGAGE

💢INTEREST ONLY MORTGAGE

💢REVERSE MORTGAGE

Details here: timidbee.com/post/free-up-c…

What mortgage type do you prefer? Let us know in the comments⬇️⬇️ .

#timidbee #Finance #WisdomWednesday #money #investment #cash

Having a mortgage doesn't have to mean the end of your savings. Use it to free up cash and save money: timidbee.com/post/free-up-c…

#timidbee #finance #mondaythoughts #MotivationMonday #money #SundayMorning #COVID19 #cryptotrading #investment #Monday

#timidbee #finance #mondaythoughts #MotivationMonday #money #SundayMorning #COVID19 #cryptotrading #investment #Monday

Fitting data (?):

Lumber price vs home price

#home #housing #RealEstate #mortgage #property #CaseShiller

Lumber price vs home price

#home #housing #RealEstate #mortgage #property #CaseShiller

Lumber Prices Are Soaring. Why Are Tree Growers Miserable?

Sawmill operators harvest gains while Southern landowners struggle with tree surplus; ‘I’m not making anything’

wsj.com/articles/lumbe…

Sawmill operators harvest gains while Southern landowners struggle with tree surplus; ‘I’m not making anything’

wsj.com/articles/lumbe…

Mortgage Companies Want In on the IPO Boom. Investors Aren’t Convinced.

Initial public offerings for mortgage lenders haven’t worked out the way all the companies were hoping

wsj.com/articles/mortg… #realestate #rates #home #housing #credit

Initial public offerings for mortgage lenders haven’t worked out the way all the companies were hoping

wsj.com/articles/mortg… #realestate #rates #home #housing #credit

#Kushner wasn't "successful" til he got a WH job. He & #Ivanka owed $1.4 BILLION on their #mortgage til foreign investors prepaid nearly a century in rent. They got a self-serving taxcut into law & raked in $90 mil from undisclosed overseas sources, most Saudi Arabian. >thread

By the time #Jared & #Ivanka became White House Senior Advisers, they were a little late on their #mortgage. The Washington Post reported that by March 1, 2018, they owed $1.4 billion on 666 5th Avenue.

That's a B. >2 washingtonpost.com/politics/jared…

That's a B. >2 washingtonpost.com/politics/jared…

2 months after WashPost reported #Kushner owed $1.4 billion, a company "swooped in & agreed to take a 99-year lease on the building, paying a near-century’s worth of rent upfront." The #Qatar Investment Authority was a leading investor in the company. >3 nytimes.com/2018/05/17/nyr…

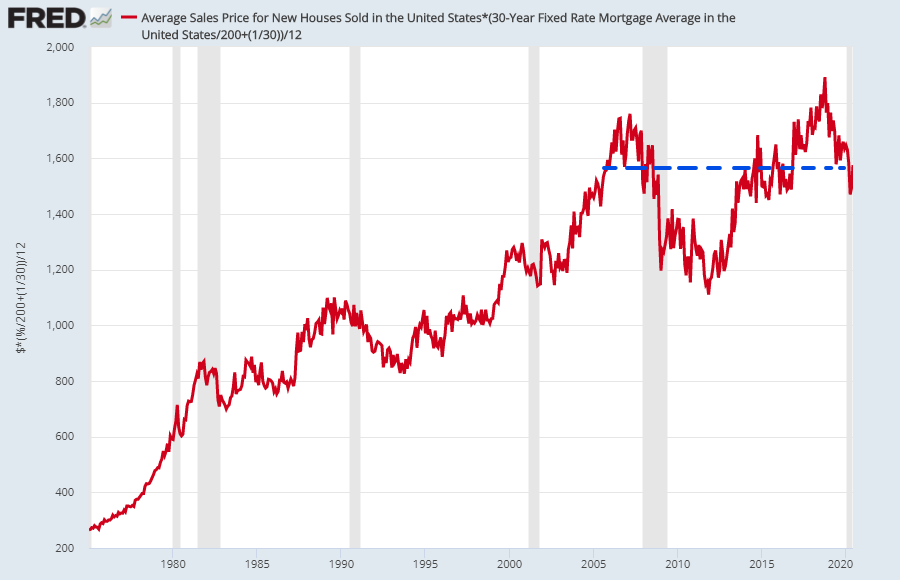

As we head into the U.S. #election, there will continue to be a lot of noise that may lead to near-term #market #volatility, particularly since (as we’ve long argued) #markets appear to be able to only focus on one thing at a time!

Still, at times like this it’s crucial to focus on more consequential factors that will drive #markets in the years ahead: in this case, the powerful combination of @federalreserve #monetarypolicy and #fiscal rescue measures intended to keep the #economic engine on track.

And, those good ole #FederalReserve policies again mean the monthly cost of an average #NewHome (approximated here) is back where it was 15 years ago...

#housing #QE

#housing #QE

The #UKGovernment Torture Report

This is a very short overview of what the #UKAuthorities have done in the case.

#PraiseTheLORD #PraiseGod #Borisjohnson #Downingstreet #PritiPatel #UKParliament #Dailymail

This is a very short overview of what the #UKAuthorities have done in the case.

#PraiseTheLORD #PraiseGod #Borisjohnson #Downingstreet #PritiPatel #UKParliament #Dailymail

In 2005, I set up a business selling CDs, namely mixtape CDs after graduating from Uni.

In 2006, my home was raided & my business was stopped. They said the CDs I was selling were in breach of copyright.

In 2006, my home was raided & my business was stopped. They said the CDs I was selling were in breach of copyright.

It was a complete shock as the exact same CDs I was selling were prevalent on most high streets and supermarkets. They were selling in their thousands in places such as #Tesco & #HMV. And #Woolworths were the actual UK Distributor of these CDs.

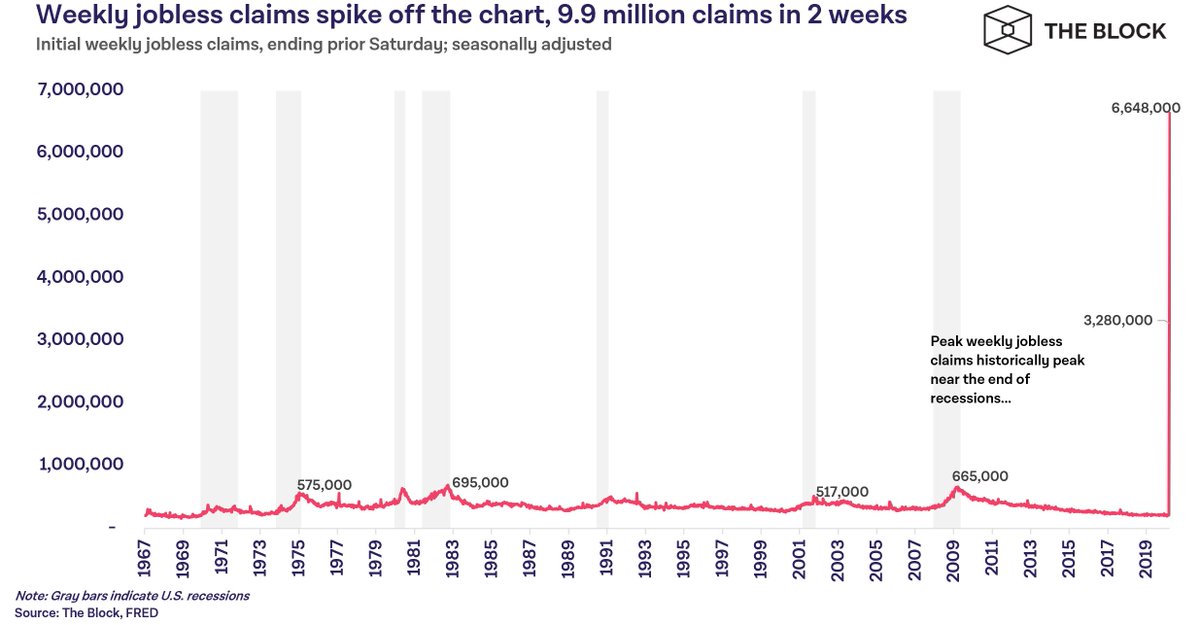

A lot of people are worried about their #mortgage in the wake of #COVID19 and rightfully so.

Optimists say that since rates are super low that we won't have any issues. I want to dispel that myth. Let's explore what's going on and what happens moving forward.

Thread

Optimists say that since rates are super low that we won't have any issues. I want to dispel that myth. Let's explore what's going on and what happens moving forward.

Thread

The major factor is unemployment. This excellent graph from @TheBlock__ shows the speed and magnitude of what #COVID19's slowdown is doing. 10 million unemployed in 2 weeks means a lot of folks will be stressed when it comes time to pay rent/mortgage.

It's unprecedented.

It's unprecedented.

To understand what's going on now I need to take you back a little first. Let's explore the past year.

In short, lenders have been stressed due to high demand, and lag times are hurting those waiting for their refinancing loans to close.

In short, lenders have been stressed due to high demand, and lag times are hurting those waiting for their refinancing loans to close.

This will not have the impact on #housing that you think that it might. This is insufficient.

...“we can still get evicted after that moratorium is lifted if we're so behind on everything, that we don't have all of the back #rent ready? What if the landlord doesn't want to work with the tenant on paying them back in increments..?"

Recent actions by the @federalreserve have been awe-inspiring; I’m not sure what words would be stronger than that- but they’re required.

ABD tahvillerini takip eden #mortgage oranları yıllık %3'ün altına yönelmiş. Başka deyişle; aylık %0.20 ile 30 yıl vadeli kredi alabilsek, peşinatı da %10'da tutsak... metropollerde emlak fiyatlarına ne olurdu acaba 😈

Bu şartlarda TL borçlanıp #reel varlık almak tatlı bir ümit şimdilik. Hayal bulutlarını üfleyip gerçeğe dönelim. Bu oranlarla borçlananlar 30 yıl boyunca TL değil #dolar geri ödeyecekler. Bizde 0.20 olmasa da 0.40'lı oranlardan JPY ve CHF cinsi ev kredisi alanlara ne oldu peki 🤔

Borçlu mu kazanacak, alacaklı mı?

Resesyon mu, enflasyon mu?

Reel varlık mı, kağıt para mı?

Biriktirmek mi, saklamak mı?

Sorular zor. Sorular düşündürücü. Neyseki dolar ülkesinde yaşamıyoruz da cevaplar bize kolay... farkları fark edebilene 😎

Resesyon mu, enflasyon mu?

Reel varlık mı, kağıt para mı?

Biriktirmek mi, saklamak mı?

Sorular zor. Sorular düşündürücü. Neyseki dolar ülkesinde yaşamıyoruz da cevaplar bize kolay... farkları fark edebilene 😎

Acquiring your house with the FMBN Mortgage Loan.

1. Be a contributor to the NHF;

2. Get an offer letter in your property of interest;

3. Open an account with a PMB (Preferably @FHAmortgage_ )

4. Fulfill the terms for FHA to make a loan application on your behalf @FMBNigeria

1. Be a contributor to the NHF;

2. Get an offer letter in your property of interest;

3. Open an account with a PMB (Preferably @FHAmortgage_ )

4. Fulfill the terms for FHA to make a loan application on your behalf @FMBNigeria

5. Your application is processed by FMBN ( board sits 4 times annually);

6. Approval will be communicated to @FHAmortgage_ which will in turn request that you meet some pre-disbursement conditions;

7. Upon meeting these conditions, your submissions are sent to @FMBNigeria

6. Approval will be communicated to @FHAmortgage_ which will in turn request that you meet some pre-disbursement conditions;

7. Upon meeting these conditions, your submissions are sent to @FMBNigeria

8. You submissions go through their internal processes like IRO, Credit/ Risk Analysis, Legal etc;

9. Subsequently, a draw down ( terms for disbursement) is generated and communicated to you via FHA;

10. Funds ( your load) will be released into your FHA account;

9. Subsequently, a draw down ( terms for disbursement) is generated and communicated to you via FHA;

10. Funds ( your load) will be released into your FHA account;

Thanks to those that made comments on my tweet on the possibility of Nigerians getting mortgage loans for home ownership. It’s really not about the banks as it appears. It’s more about the structure of our politics and our economy. #mortgage

2. The banks are also victims of a system where a few use political power to control economic resources to benefit themselves to the detriment of the majority, though the banks are also controlled by members of the elite class. #mortgage

3. It is not just that the elite class does not care, it is that it does not want the current structure to change because it has access to the commonwealth and finds it easy to manipulate a hungry citizenry. #mortgage