Discover and read the best of Twitter Threads about #mutualfundssahihai

Most recents (24)

▪️ If Adani shares are overvalued by 85%, how much is the Indian stock market overvalued?

▪️ What keeps the bubble going?

▪️ Should you stay invested?

Long thread Warning! I hope it will be worth it.

(1/n)

▪️ What keeps the bubble going?

▪️ Should you stay invested?

Long thread Warning! I hope it will be worth it.

(1/n)

म्युच्युअल फंडांच्या एक्सपेन्स रेशोवर सेबीची नजर

म्युच्युअल फंडामध्ये आपण जे पैसे गुंतवतो त्यातील काही पैसे या फंडांकडून त्यांचा मार्केटिंग, रिसर्च, कमिशन यासाठी होणारा खर्च भरून काढण्यासाठी वापरले जातात. #म #मराठी #mutualfund #MutualFundsSahiHai

म्युच्युअल फंडामध्ये आपण जे पैसे गुंतवतो त्यातील काही पैसे या फंडांकडून त्यांचा मार्केटिंग, रिसर्च, कमिशन यासाठी होणारा खर्च भरून काढण्यासाठी वापरले जातात. #म #मराठी #mutualfund #MutualFundsSahiHai

Old or new?

Which tax regime is better after Budget 2023-24.

Read the thread to know more ⬇️

#BudgetSession #Budget2023

Which tax regime is better after Budget 2023-24.

Read the thread to know more ⬇️

#BudgetSession #Budget2023

2/

If your annual income is up to Rs 7 lakh-

Under new tax regime: No tax

Under the old tax regime: No tax.

But, you'd have to claim standard deduction of Rs 50,000 and 80C benefit of Rs 1.5 lakh.

If your annual income is up to Rs 7 lakh-

Under new tax regime: No tax

Under the old tax regime: No tax.

But, you'd have to claim standard deduction of Rs 50,000 and 80C benefit of Rs 1.5 lakh.

1/

The country is moving towards the new tax regime, but removing incentives to invest is a most unfortunate side-effect.

The country is moving towards the new tax regime, but removing incentives to invest is a most unfortunate side-effect.

2/

It’s true that the new tax regime has lower rates and drastically few exemptions, which is better in theory and practice.

But it can impact people's savings and investment habits.

It’s true that the new tax regime has lower rates and drastically few exemptions, which is better in theory and practice.

But it can impact people's savings and investment habits.

Today I'll make a thread on how i chose my 5 mutual funds.

I am a retailer and i am learning slowly but the evidence way.

Like in medicine we practice evidence based, same principles i apply to investing.

To learn from Data & evidence.

To understand that #MutualFundsSahiHai

I am a retailer and i am learning slowly but the evidence way.

Like in medicine we practice evidence based, same principles i apply to investing.

To learn from Data & evidence.

To understand that #MutualFundsSahiHai

First of all, as a retailer and a non finance background person we really need to understand what are mutual funds and why they are so important for a salaried person who wants to develop a big corpus over the long run

This one video by @PranjalKamra is 👏

This one video by @PranjalKamra is 👏

I think i relate a lot with @PranjalKamra who talks in simple terms and tries to explain how can we find out the best ones for us.

I also did a course by @rachana_ranade ma'am who's my first guru of financial literacy journey.🙏

Nothing wrong with buying a Mercedes or doing a Rs 50K SIP. Or using SIP money to buy a Merc.

Your money. Your goals. Your decision.

But since there is a lot of noise about Mercs & SIP today, here is what a Rs 50K SIP can do for you.

A very short thread 🧵 (again!) 😉

👇👇👇

Your money. Your goals. Your decision.

But since there is a lot of noise about Mercs & SIP today, here is what a Rs 50K SIP can do for you.

A very short thread 🧵 (again!) 😉

👇👇👇

At 12% returns, this is what a Rs 50,000 monthly in SIP can do over the years -

5 years of Rs 50,000 monthly SIP = Rs 42 lakh

10 years of Rs 50,000 monthly SIP = Rs 1.1 Cr

15 years of Rs 50,000 monthly SIP = Rs 2.5 Cr

20 years of Rs 50,000 monthly SIP = Rs 4.8 Cr

5 years of Rs 50,000 monthly SIP = Rs 42 lakh

10 years of Rs 50,000 monthly SIP = Rs 1.1 Cr

15 years of Rs 50,000 monthly SIP = Rs 2.5 Cr

20 years of Rs 50,000 monthly SIP = Rs 4.8 Cr

I know Twitter Screenshot Guys already buy a Mercedes daily with their profit screenshots 😉🤣

But..

But..

Why ‘Mutual Fund Sahi Hai’ is more relevant than ever !!!

Fall in price Direct stock Equity MF

-10% n more 91%stock 97% MF

-20% n more 82%stock 86% MF

-30% n more 58%stock 0% MF

-40% n more 29%stock 0% MF

-50% n more 11%stock 0% MF (1/3)

Fall in price Direct stock Equity MF

-10% n more 91%stock 97% MF

-20% n more 82%stock 86% MF

-30% n more 58%stock 0% MF

-40% n more 29%stock 0% MF

-50% n more 11%stock 0% MF (1/3)

Front running or no front running! Investing in IPOs or not investing in IPOs. Equity MF remained and will continue to remain the most powerful tool for wealth creation.

It’s only problem is that it’s very easy and simple. But great things in life and also easy and simple.(2/3)

It’s only problem is that it’s very easy and simple. But great things in life and also easy and simple.(2/3)

The greatest thing to drink is warm waters but one cannot post on social media saying ”had great time drinking warm water on beaches in Goa”!!!

No bragging rights !!!!! (3/3) @amfiindia #MutualFundsSahiHai

No bragging rights !!!!! (3/3) @amfiindia #MutualFundsSahiHai

#Inflation will always be one of the prime reason of making #investments in #Equities. Rest depends up on #investors behavior, asset allocation & the #goals. Focus on 'Real Return' not marketing gimmicks. #SaarthiZarooriHai

& #PlanZarooriHai with #MasterMindFinnAsset (1/n)

& #PlanZarooriHai with #MasterMindFinnAsset (1/n)

#Investment decisions contribute in a big way to inflation-proofing your #mutualfund portfolio. Frequent churning, performance chasing & exiting at the first sign of volatility lead to sub-optimal gains. (2/n) #MutualFundsSahiHai #investing #investors #StockMarketIndia

Avoid making impulsive #investing decisions based on predicted short-term changes in the #economy. Make sure any strategies you use to hedge against #inflation align with your overall #FinancialFreedom plan & assists to meet your #financial #goals. (3/n) #goalsetting #investing

#Investors should avoid knee-jerk reaction as the investigation is still underway & @AxisMutualFund has already sacked the concerned officials from their responsibilities.

Impacted #mutualfund schemes (image enclosed) haven't been recommended by us at #MasterMindFinnAsset (1/n)

Impacted #mutualfund schemes (image enclosed) haven't been recommended by us at #MasterMindFinnAsset (1/n)

Extent of notional losses that may have occurred to the #investors in these schemes can only be estimated after the probe. Investors may have to wait for further action, disclosures & announcements from the fund house & the regulator around this matter.(2/n) #axismutualfund

Unfortunately @AxisMutualFund is witnessing knee-jerk reaction of #investors via redemptions or stoppage of SIPs/ STPs. Focus of facts not rumors about the management. Such rumors have been there from past 2 years for @FTIIndia as well. (3/n)

Know your MF - A series explaining various important MF regulations that make them really sahi🙂

1st in this series let's understand one very recent regulation for debt mutual funds that classify their Potential Risk Class based on thier credit and interest rate risk.🚫

1/n

1st in this series let's understand one very recent regulation for debt mutual funds that classify their Potential Risk Class based on thier credit and interest rate risk.🚫

1/n

Lets start with Debt MF 101📝

Debt funds have mainly 2 risks - Interest rate risk and credit risk🚫

Credit risk comes from downgrade or default in a bond amd impacts NAV📉

Interest rate risk arises from changing yields explained in more depth👇

2/n

Debt funds have mainly 2 risks - Interest rate risk and credit risk🚫

Credit risk comes from downgrade or default in a bond amd impacts NAV📉

Interest rate risk arises from changing yields explained in more depth👇

2/n

Imagine you have invested in a short term fund which has a portfolio modified duration of 2.3 years and 100% investments in AAA rated bonds.

After 3 months you went and checked the portfolio and your were surprised😧 to see 30% exposure in AA rated bonds.

3/n

After 3 months you went and checked the portfolio and your were surprised😧 to see 30% exposure in AA rated bonds.

3/n

Mutual Fund & Investment Basic- Part 2

Part - 1 இங்க படிங்க: tamilhollywoodreviews.com/2021/11/mutual…

இந்த முறை Direct #MutualFund வாங்குவது எப்படி என்பதை பற்றிய போஸ்ட் போடலாம் என நினைத்தேன்

ஆனால் மார்க்கெட் மற்றும் அதைப் பற்றிய அடிப்படை விஷயங்களை தெரிந்து கொள்ளாமல்

#MutualFundsSahiHai

Part - 1 இங்க படிங்க: tamilhollywoodreviews.com/2021/11/mutual…

இந்த முறை Direct #MutualFund வாங்குவது எப்படி என்பதை பற்றிய போஸ்ட் போடலாம் என நினைத்தேன்

ஆனால் மார்க்கெட் மற்றும் அதைப் பற்றிய அடிப்படை விஷயங்களை தெரிந்து கொள்ளாமல்

#MutualFundsSahiHai

நேரடியாக இன்வெஸ்ட்மென்ட் செய்ய ஆரம்பிப்பது நல்லது கிடையாது. அதுக்கு முன்னாடி கொஞ்சம் அடிப்படை விஷயங்களை தெரிந்து கொள்ளலாம்.

எப்பவுமே உங்களுடைய #stocks and #MutualFund unit களை #DEMAT அக்கௌன்ட்ல வைப்பது நல்லது. ஆனால் #stocks வாங்கனும்னா கண்டிப்பாக #DEMAT account இருக்க வேண்டும்.

எப்பவுமே உங்களுடைய #stocks and #MutualFund unit களை #DEMAT அக்கௌன்ட்ல வைப்பது நல்லது. ஆனால் #stocks வாங்கனும்னா கண்டிப்பாக #DEMAT account இருக்க வேண்டும்.

#MutualFund ஆரம்பிக்க #DEMAT அக்கௌன்ட் அவசியம் இல்லை .

ஆனால் நான் #Zerodha வில் அக்கௌன்ட் வைத்து உள்ளேன் மற்றும் #MutualFund களை அதனுடைய #coin App வழியாக வாங்குவதால் நேரடியாக #DEMAT account ல் கிரடிட் ஆகிவிடும். மற்ற ஆஃப்கள் எப்படி என்று தெரியவில்லை.

ஆனால் நான் #Zerodha வில் அக்கௌன்ட் வைத்து உள்ளேன் மற்றும் #MutualFund களை அதனுடைய #coin App வழியாக வாங்குவதால் நேரடியாக #DEMAT account ல் கிரடிட் ஆகிவிடும். மற்ற ஆஃப்கள் எப்படி என்று தெரியவில்லை.

One would never plant an oak tree ... just to dig it up once a quarter to see how the roots are. When it compounds ... let it compound & the same is true in #MutualFunds. (1/n) @MFSahiHai @NileshShah68 @MFBALA @mohanty_swarup @iRadhikaGupta @fifaindiaorg @bsindia @ETMutualFunds

Oaktree roots grow from an acorn to a taproot system, similary #wealth is created via #MutualFunds. Primary root would grow horizontally into the soil. Later on, would transform into an extensive root system alongside maturation of the plant i.e. Magic of Compounding (2/n)

Only 1 in 10,000 acorns grow up to be an oak tree, and the same is true for #mutualfund #investors - only 1 out of many stay put to see the magic of compounding. One of such living legend is @Raamdeo (Mr. Raamdeo Agarwal - Chairman & Co-Founder @MotilalOswalLtd) 👇 (3/n)

Many new Twitter followers are (understandably) asking questions that I've answered sometime in the past.

Hence, I hope this collection of threads and posts will be useful. I intend to keep this updated over time.

//THREAD// 👇

Hence, I hope this collection of threads and posts will be useful. I intend to keep this updated over time.

//THREAD// 👇

About me: In 40s, achieved #FinancialIndependence in Oct 2020 through a regular 9-to-5 large corporate job and disciplined investing in Mutual Funds & Index ETFs over 2 decades.

Worked more years in India than abroad, if that matters.

Worked more years in India than abroad, if that matters.

How much money is needed for #FinancialIndependence in India?

Spoiler: It is more than 25x current annual expenses.

Read More:

Spoiler: It is more than 25x current annual expenses.

Read More:

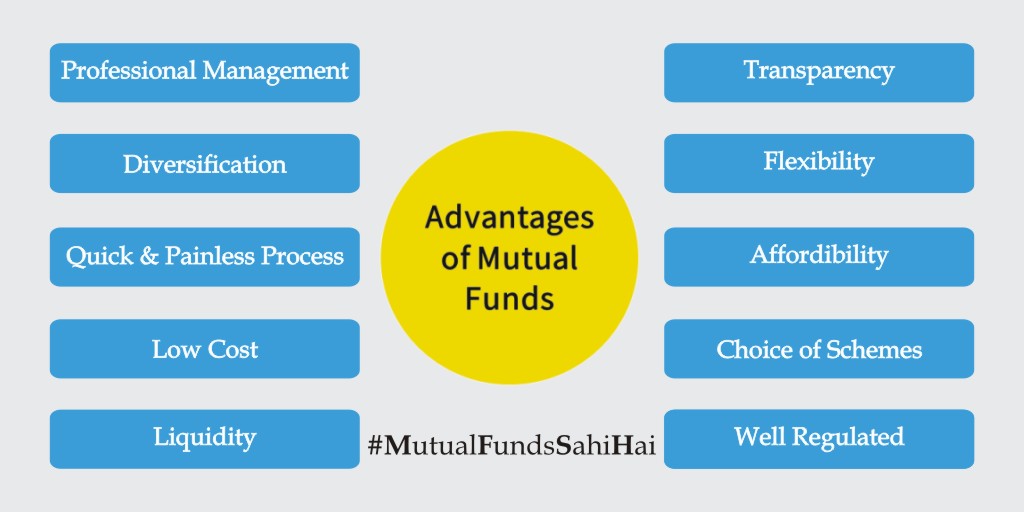

Thread 🧵 on Advantages of #Investing in #MutualFunds ...

🌟Must read for everyone, especially those who do not understand #Equities and have not yet invested significant amount in Mutual Funds as well.🌟

#MutualFundsSahiHai

@invest_mutual @dmuthuk views invited 🙏

🌟Must read for everyone, especially those who do not understand #Equities and have not yet invested significant amount in Mutual Funds as well.🌟

#MutualFundsSahiHai

@invest_mutual @dmuthuk views invited 🙏

1⃣ Professional Management:

#MutualFunds use services of experienced & skilled professionals, backed by a dedicated investment research team that analyses performance & prospects of companies and selects suitable investments to achieve objectives of scheme.

#MutualFundsSahiHai

#MutualFunds use services of experienced & skilled professionals, backed by a dedicated investment research team that analyses performance & prospects of companies and selects suitable investments to achieve objectives of scheme.

#MutualFundsSahiHai

2⃣ Diversification:

#MutualFunds invest in a number of companies across a broad spectrum of industries & sectors. This diversification reduces risk because seldom do all stocks decline at same time and in same proportion.

#MutualFundsSahiHai

#MutualFunds invest in a number of companies across a broad spectrum of industries & sectors. This diversification reduces risk because seldom do all stocks decline at same time and in same proportion.

#MutualFundsSahiHai

Thread 🧵#StockMarket #Tips For Beginners 🇮🇳

In this thread find some stock market tips for beginners, especially those who have joined market recently during #COVID19 #lockdown and have only seen one-sided rally.

(If you like then please re-tweet to maximize reach)

#BSE #NSE

In this thread find some stock market tips for beginners, especially those who have joined market recently during #COVID19 #lockdown and have only seen one-sided rally.

(If you like then please re-tweet to maximize reach)

#BSE #NSE

1⃣ Save Regularly & Initially Invest Small Amounts 👇

#Investing in #StockMarket is comparatively risky as compared to investing in other avenues. Hence start with small amount and it should ideally be the amount which you can afford to loose.

#BSE #NSE

#Investing in #StockMarket is comparatively risky as compared to investing in other avenues. Hence start with small amount and it should ideally be the amount which you can afford to loose.

#BSE #NSE

2⃣ Initially invest via #MutualFunds 👇

It is the best thing to do initially, if you lack knowledge about #StockMarket #investing, start investing via mutual funds and only after learning the basics slowly jump to direct equity investing.

#MutualFundsSahiHai #MF

It is the best thing to do initially, if you lack knowledge about #StockMarket #investing, start investing via mutual funds and only after learning the basics slowly jump to direct equity investing.

#MutualFundsSahiHai #MF

#ShareMarket

#MutualFundsSahiHai

सगळीकडे आज टीव्ही वर, रेडिओ वर, वर्तमान पत्रामध्ये, सिनेमा गृहमध्ये "Mutual fund सही है" ही जाहिरात चालू आहे.

"#MutualFund सही है" हे कळतंय पण अजून #MutualFund आणि #SIP म्हणजे नेमके काय? यात खूप गोंधळ उडाला आहे.

#MutualFundsSahiHai

सगळीकडे आज टीव्ही वर, रेडिओ वर, वर्तमान पत्रामध्ये, सिनेमा गृहमध्ये "Mutual fund सही है" ही जाहिरात चालू आहे.

"#MutualFund सही है" हे कळतंय पण अजून #MutualFund आणि #SIP म्हणजे नेमके काय? यात खूप गोंधळ उडाला आहे.

आज गुंतवणूक क्षेत्रात काम करत असताना खूप बरे-वाईट अनुभव येतात, त्यातील एक म्हणजे खुपजण मला SIP मध्ये गुंतवणूक करायची आहे म्हणून गुंतवणूक करायला येतात, त्यांच्यासाठी खासकरून आजचा लेख👇👇👇

#SIP हा कोणता गुंतवणुकीचा पर्याय नाही तर गुंतवणुकीचा प्रकार आहे.

हे लक्षात घ्या.

स्वतःला आणि आपल्या समाजाला आर्थिक साक्षरतेत पुढे घेऊन चला.

हे लक्षात घ्या.

स्वतःला आणि आपल्या समाजाला आर्थिक साक्षरतेत पुढे घेऊन चला.

The Fact is simple #franklintempleton has tried & is trying hard in the larger interest of #investors since day one. (1)

@bsindia @livemint @EconomicTimes @ETNOWlive @thetribunechd @DainikBhaskar @AmarUjalaNews @businessline @BloombergQuint @CNBC_Awaaz @CNBCTV18Live @NDTVProfit

@bsindia @livemint @EconomicTimes @ETNOWlive @thetribunechd @DainikBhaskar @AmarUjalaNews @businessline @BloombergQuint @CNBC_Awaaz @CNBCTV18Live @NDTVProfit

Time & again most #MFDs & FT itself letting Actual Investors of these 6 schemes know that even in times of #COVID they have accumulated more than ₹11000 crores without #monetization but still few people are having unnecessary doubts. (2)

I personally believe that if #History will be written, the #historians will focus on the solution not on the problem.

Saying Yes, to both Winding Up Consent & Active #Monetization is only & solely in the best possible move for #investors. (3)

Saying Yes, to both Winding Up Consent & Active #Monetization is only & solely in the best possible move for #investors. (3)

#StockMarket #MutualFundsSahiHai #mutualfunds

Year after year majority of mutual fund managers are fooling innocent retailers.

S&P Dow Jones Indices compiles a report on active fund performance versus benchmarks over various periods, from 1 to 10 years.

Year after year majority of mutual fund managers are fooling innocent retailers.

S&P Dow Jones Indices compiles a report on active fund performance versus benchmarks over various periods, from 1 to 10 years.

The report for December 2019 , the latest available, showed that only 35% of large-cap funds managed to beat their benchmark indices over the last 10 years.

souce- livemint

souce- livemint

Their logic is simple

If you made money, we are the reason

If you lose money feel free to chose from our laundry list of excuses for why it was a difficult and why next year will surely be different.

If you made money, we are the reason

If you lose money feel free to chose from our laundry list of excuses for why it was a difficult and why next year will surely be different.

Inter Scheme Transfer Norms will benefit the #investors & the change will lead to enhanced accountability of fund house & fund management team of both the transferor & transferee scheme. #mutualfunds #MutualFundsSahiHai #SaarthiZarooriHai @bsindia @livemint @ET_Wealth (1/3)

This will ensure to employ better #RiskManagement systems at scheme & AMC level, ensure better responsibility while purchasing & liquidating a security & thus lower instances of defaults & downgrades. #MutualFundsSahiHai #mutualfunds #SaarthiZarooriHai @livemint @bsindia (2/3)

#Investors should recall current #economic condition where the spate of downgrades & defaults are expected to rise, it is important to be extra-cautious while making #Investment in #debt #mutualfunds. Remember #SaarthiZarooriHai #PlanZarooriHai @livemint @ET_Wealth @bsindia (3/3)

(1/n) Today we will discuss the BAF model of @EdelweissAMC called Edelweiss Balanced Advantage Fund.

Fund Manager – Bhavesh Jain, Bharat Lahoti and Gautam Kaul

AUM – 1429 crores

Fund Manager – Bhavesh Jain, Bharat Lahoti and Gautam Kaul

AUM – 1429 crores

(2/n) The scheme follows a pro cyclical investment approach where the fund managers allocate more to equity in a bull market and reduce equity in bear market cycle. The in-house propriety model takes into account quantitative factors along with fundamentals.

(3/n) The fund consists of a core equity portfolio and a high qualitive debt portfolio or special situation ideas. Currently the equity exposure is around 50-60% of the portfolio.

determine the unhedged equity allocation.

determine the unhedged equity allocation.

(1/n) 23 Apr 2020, rcvd this email from @FTIIndia which suggested that my investment with them are accessible anytime anywhere, although the public places are inaccessible. On 24th Apr I recvd another mail from @FTIIndia which said that my money with them has been frozen...

(2/n) who m I ? I am one of those unlucky 300,000 Indian investors who were risk averse and chose debt funds over equity to park my hard earned money with this fund @FTIIndia . Now the entire money has been frozen since 24th Apr with no communication on timelines by fund house..

(3/n) I would rather say a mismanaged fund house who mails you in the morning that your money is safe but you receive another mail 3am next day which says that you cant access your money now and even we don't know when you can access it..

Arbitrage seems to be good alternative to investors pulling out their money from debt mutual funds. Investors need to know that arbitrage funds can give negative returns in short term and approx. 6% annualized return if held for a year

#mutualfunds #mutualfundssahihai

(1/4)

#mutualfunds #mutualfundssahihai

(1/4)

These category gives tax advantage as compared to a debt fund, for those who want to invest for less than 3 years.

Arbitrage is an equity oriented scheme with returns similar to a debt fund. So, it will long term if held for more than 1 year.

(2/4)

Arbitrage is an equity oriented scheme with returns similar to a debt fund. So, it will long term if held for more than 1 year.

(2/4)

Long term capital gain in arbitrage is 10% if gain is more than 1 lac for that particular year.

Whereas for debt funds it is 20% with indexation after 3 years and as per tax slab if redeemed before 3 years.

(3/4)

Whereas for debt funds it is 20% with indexation after 3 years and as per tax slab if redeemed before 3 years.

(3/4)

Franklin has shut down 6 debt mutual fund schemes due to illiquidity in market stopping buy/sell of units in these funds. Doesn't it put q on experts who suggest to hold just 3-4 scheme in portfolio. True saying - Never keep all eggs in one basket. #mutualfunds #market #franklin

Put together, almost 26000 crore rupees of investors are stuck in these 6 schemes. These all belong to debt schemes so higher chances that most of the money stuck belongs to retail investors. (2/n)

All these 6 funds are rated with 5 stars by Morningstar rating agency. In 2008 crisis all mortgages and CDO were triple ace rated by S&P, Moody's & Fitch. History repeats itself and average customer is trapped. Sad story #MutualFundsSahiHai ? #franklintempleton #mutualfunds (3/n)

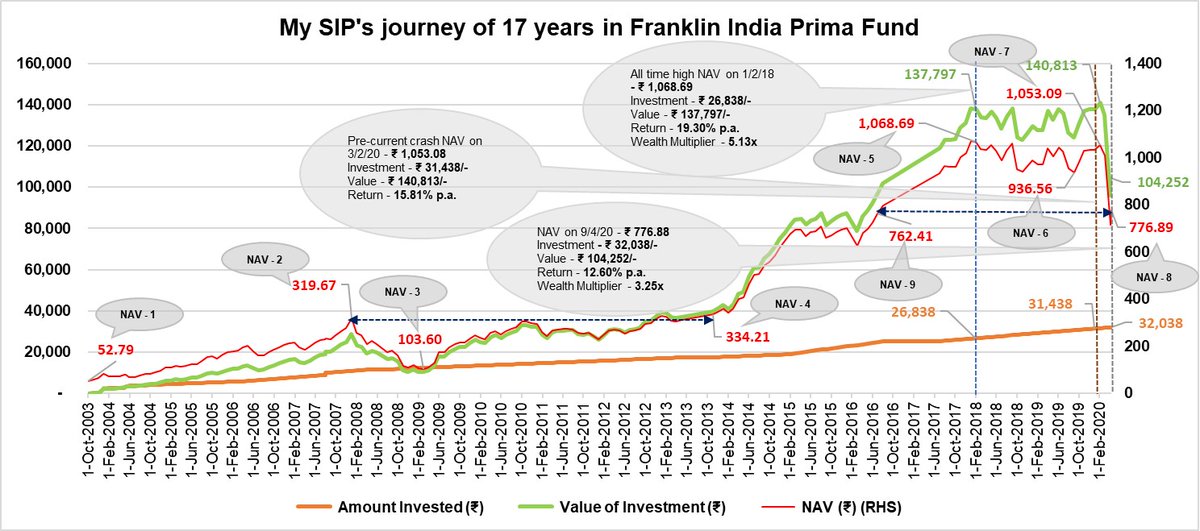

Today when Equity Markets have crashed & SIP investors esp. ones who started in last 5 years & are seeing the investments in red are worried. This is an effort to address them through a first-hand story of my SIP in Franklin India Prima Fund. @FTIIndia @Anand_1969 @Sanjay_69 1/21

I started this SIP on 1/10/20013 & the investment values are re based to Rs. 100/- as on that date. There have been 198 months since then & I invested on 186 out of these. There were only 3 small lump-sum investments done outside the SIP installments in these 18 years. 2/21

The 1st installment went in at the NAV of ₹ 52.79 (NAV – 1 in the chart) & the market continued to rise continuously for the next 4.5 years with the Fund hitting an all-time high NAV of ₹ 319.66 (NAV – 2) on 31/12/2007 (reference to my transactions only), a rise of 506%. 3/21