Discover and read the best of Twitter Threads about #options

Most recents (24)

🚨 #FOMC Trade Thread 🚨

How To Trade #FOMC $SPY $SPX

THIS STRATEGY IS 96% ACCURATE PAST 26 FOMC’S (Only One Non-Event Move) 💰

Please ❤️ & ♻️

How To Trade #FOMC $SPY $SPX

THIS STRATEGY IS 96% ACCURATE PAST 26 FOMC’S (Only One Non-Event Move) 💰

Please ❤️ & ♻️

This strategy has made 60-140+ POINT MOVES in $SPX which equates to around $5-$15 Moves in $SPY ITSELF!

There is 1 way on how to trade this strategy and to also state #FOMC is very risky to trade with #SPY #SPX #Options due to the #volatility

There is 1 way on how to trade this strategy and to also state #FOMC is very risky to trade with #SPY #SPX #Options due to the #volatility

👇🏼HOW TO TRADE #FOMC 👇🏼

You FADE the INITIAL REACTION on $SPY at 2PM EST once the Rates are given out and you PLAY the opposite when Powell Speaks at 2:30PM EST.

ITS THAT SIMPLE.

You FADE the INITIAL REACTION on $SPY at 2PM EST once the Rates are given out and you PLAY the opposite when Powell Speaks at 2:30PM EST.

ITS THAT SIMPLE.

Thing to note: 👇🏼

#CPI usually inputs a minimum 1%+ move on $SPY $SPX whether that is to the upside or downside on $SPY $SPX $ES_F

#CPI usually inputs a minimum 1%+ move on $SPY $SPX whether that is to the upside or downside on $SPY $SPX $ES_F

NEXT WEEK

The Bear's Take:

•USA #recession is coming

•Bearish daily candlesticks on $SPX and $NDX

• #NDX negative divergences with classic Indis

•Leaders are overextended and some are starting to break

• #JPM collar will stop any #SPX advance at 4320

#SPX #ES_F $SPX $SPY

The Bear's Take:

•USA #recession is coming

•Bearish daily candlesticks on $SPX and $NDX

• #NDX negative divergences with classic Indis

•Leaders are overextended and some are starting to break

• #JPM collar will stop any #SPX advance at 4320

#SPX #ES_F $SPX $SPY

NEXT WEEK

The Bulls' Take

•Breakout of 4200 confirmed

•Momentum is bullish

•Market breadth improved

• $SPX now in official bull market

•Dealers increased their long positions again

• #Gamma is positive

- #CPI will be lower

- #Fed to pause

#ES #SPX $SPY #0dte #options

The Bulls' Take

•Breakout of 4200 confirmed

•Momentum is bullish

•Market breadth improved

• $SPX now in official bull market

•Dealers increased their long positions again

• #Gamma is positive

- #CPI will be lower

- #Fed to pause

#ES #SPX $SPY #0dte #options

NEXT WEEK

Our Take

• Markets are at strong resistance levels, we are expecting a pullback

• Volatile week ahead

• A likely visit to 4220

• Expecting 4320 to stop any $SPX advance

•Expecting #smallcaps to outperform

• #CPI maybe higher, but downtrending

#SPX $SPY $ES_F

Our Take

• Markets are at strong resistance levels, we are expecting a pullback

• Volatile week ahead

• A likely visit to 4220

• Expecting 4320 to stop any $SPX advance

•Expecting #smallcaps to outperform

• #CPI maybe higher, but downtrending

#SPX $SPY $ES_F

Turning $5,000 -> $84,000 in 3 months with Futures

I am going to RESTART THIS CHALLENGE with YOU

This is how I started off with a small account not trading #options

Here is my A to Z Guide🧵👇

I am going to RESTART THIS CHALLENGE with YOU

This is how I started off with a small account not trading #options

Here is my A to Z Guide🧵👇

I traded $SPY using futures contracts #ES_F #MES_F

Why Futures?

1 - No Decay

2 - Ability to enter trades overnight and after hours

3 - Cheaper taxes

4 - Ability to scale up fast

Full Course:

Why Futures?

1 - No Decay

2 - Ability to enter trades overnight and after hours

3 - Cheaper taxes

4 - Ability to scale up fast

Full Course:

The KEY to GROWING a small account is executing a ROUTINE over and over again with LOW risk and HIGH reward

This is the EXACT routine I used to take 5k to 84k trading $SPY I show everything here no strings attached for FREE

This is the EXACT routine I used to take 5k to 84k trading $SPY I show everything here no strings attached for FREE

NEXT WEEK

The Bear's take:

•Unresolved Debt ceiling

•Friday's negative day and bearish candlesticks

• Several neg. divergences

•Leading stocks reversed

• #VVIX bullish engulfing candle and #VIX1D daily higher highs higher lows points to more vol ahead

•GDP maybe ↓

$SPX

The Bear's take:

•Unresolved Debt ceiling

•Friday's negative day and bearish candlesticks

• Several neg. divergences

•Leading stocks reversed

• #VVIX bullish engulfing candle and #VIX1D daily higher highs higher lows points to more vol ahead

•GDP maybe ↓

$SPX

NEXT WEEK

The Bull's take

• Indices up week on high volume

•Buy the dip: Bullish action

•Volatility indicators are subdued

• $NDX, $FAANG, $SMH in good health

• $SPX, $NDX higher highs and higher lows

•Market broke out above resistance

•Breadth thrust last Wednesday

#SPX

The Bull's take

• Indices up week on high volume

•Buy the dip: Bullish action

•Volatility indicators are subdued

• $NDX, $FAANG, $SMH in good health

• $SPX, $NDX higher highs and higher lows

•Market broke out above resistance

•Breadth thrust last Wednesday

#SPX

Thing to note: 👇🏼

#CPI usually inputs a minimum 1%+ move on $SPY $SPX whether that is to the upside or downside on $SPY $SPX $ES_F

#CPI usually inputs a minimum 1%+ move on $SPY $SPX whether that is to the upside or downside on $SPY $SPX $ES_F

🚨 #FOMC Trade Thread 🚨

How To Trade #FOMC $SPY $SPX

THIS STRATEGY IS 96.1% ACCURATE PAST 26 FOMC’S (Only One Non-Event Move) 👇

Please ❤️ & ♻️

How To Trade #FOMC $SPY $SPX

THIS STRATEGY IS 96.1% ACCURATE PAST 26 FOMC’S (Only One Non-Event Move) 👇

Please ❤️ & ♻️

This strategy has made 60-140+ POINT MOVES in $SPX which equates to around $5-$15 Moves in $SPY ITSELF!

There is 1 way on how to trade this strategy and to also state #FOMC is very risky to trade with #SPY #SPX #Options due to the #volatility

There is 1 way on how to trade this strategy and to also state #FOMC is very risky to trade with #SPY #SPX #Options due to the #volatility

HOW TO TRADE #FOMC

You FADE the INITIAL REACTION on $SPY at 2PM EST once the Rates are given out and you PLAY the opposite when Powell Speaks at 2:30PM EST.

Example: If initially the market falls at 2PM you would go long at 2:25-2:35 once he starts to speak &this can be… twitter.com/i/web/status/1…

You FADE the INITIAL REACTION on $SPY at 2PM EST once the Rates are given out and you PLAY the opposite when Powell Speaks at 2:30PM EST.

Example: If initially the market falls at 2PM you would go long at 2:25-2:35 once he starts to speak &this can be… twitter.com/i/web/status/1…

🚨 #FOMC Trade Thread 🚨

How To Trade #FOMC $SPY $SPX

THIS STRATEGY IS 96.1% ACCURATE PAST 26 FOMC’S (Only One Non-Event Move) 💰

Please ❤️ & ♻️ 👇🏼

How To Trade #FOMC $SPY $SPX

THIS STRATEGY IS 96.1% ACCURATE PAST 26 FOMC’S (Only One Non-Event Move) 💰

Please ❤️ & ♻️ 👇🏼

This strategy has made 60-140+ POINT MOVES in $SPX which equates to around $5-$15 Moves in $SPY ITSELF!

There is 1 way on how to trade this strategy and to also state #FOMC is very risky to trade with #SPY #SPX #Options due to the #volatility

There is 1 way on how to trade this strategy and to also state #FOMC is very risky to trade with #SPY #SPX #Options due to the #volatility

👇🏼HOW TO TRADE #FOMC 👇🏼

You FADE the INITIAL REACTION on $SPY at 2PM EST once the Rates are given out and you PLAY the opposite when Powell Speaks at 2:30PM EST.

Example: If initially the market falls at 2PM you would go long at 2:25-2:35 once he starts to speak &this can be… twitter.com/i/web/status/1…

You FADE the INITIAL REACTION on $SPY at 2PM EST once the Rates are given out and you PLAY the opposite when Powell Speaks at 2:30PM EST.

Example: If initially the market falls at 2PM you would go long at 2:25-2:35 once he starts to speak &this can be… twitter.com/i/web/status/1…

If you want to find a serious team about #options + #derivatives trading. I highly recommend @CruizeFinance

Their LGE on @RamsesExchange will be rewarding every participant handsomely with the biggest ones going to early birds

LGE is live now!

launchpad.ramses.exchange/?ref=3

Thread🧵

Their LGE on @RamsesExchange will be rewarding every participant handsomely with the biggest ones going to early birds

LGE is live now!

launchpad.ramses.exchange/?ref=3

Thread🧵

1⃣ Before reading on, read my previous thread to learn general knowledge about the protocol!

2⃣ Rewards for Participants

🔹As an LGE participant, you'll receive bonus rewards in the form of rebates & $ARMADA #Airdrops based on your contribution

🔹The earlier you contribute, the bigger the rewards! 🎉

🔹As an LGE participant, you'll receive bonus rewards in the form of rebates & $ARMADA #Airdrops based on your contribution

🔹The earlier you contribute, the bigger the rewards! 🎉

NEXT WEEK

The Bear's take:

•Upward momentum is lost

•Negative divergences and sell signals from classic indicators

•Big weekly bullish enfulfing candle on $VVIX

•Weekly bearish haramis on major indices

•Inflation is sticky, higher rates coming

• #Recession is here

#ES_F

The Bear's take:

•Upward momentum is lost

•Negative divergences and sell signals from classic indicators

•Big weekly bullish enfulfing candle on $VVIX

•Weekly bearish haramis on major indices

•Inflation is sticky, higher rates coming

• #Recession is here

#ES_F

New iOS in #Markets

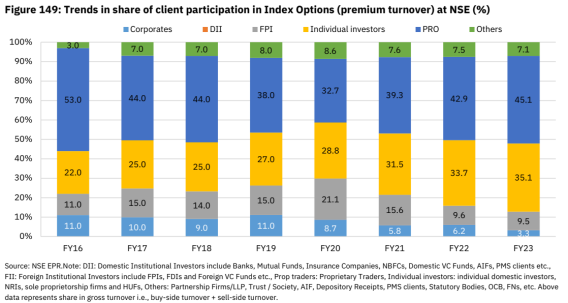

Indian #Options Speculators.

There has been a huge surge in #Retail and #Proprietary trading in #Options and more specifically in #Index Options.

The Data & Charts below are just #Crazy and getting crazier.

Indian #Options Speculators.

There has been a huge surge in #Retail and #Proprietary trading in #Options and more specifically in #Index Options.

The Data & Charts below are just #Crazy and getting crazier.

Well, time to explain what we do with coins and why we deposit most of them on exchanges. Even #floki holders believe that we dump all the purchased coins, because we bought 81B #floki from and send them to exchanges. We just sent 57B floki to the on-chain wallet. @RealFlokiInu

The rest sit across exchanges, because as MM we must provide liquidity 24/7. Link to the wallet, feel free to check. bscscan.com/address/0x073A…

$SPX

Our weekly "NEXT WEEK, The Bear's take, The Bull's take, Our take" is here

For more info read our newsletter

The new issue will be out in the morning before the open

Stay ahead, subscribe for Free

pointblanktrading.substack.com

#SPX $SPY $ES #options #Futures

@UnrollHelper

Our weekly "NEXT WEEK, The Bear's take, The Bull's take, Our take" is here

For more info read our newsletter

The new issue will be out in the morning before the open

Stay ahead, subscribe for Free

pointblanktrading.substack.com

#SPX $SPY $ES #options #Futures

@UnrollHelper

NEXT WEEK

The Bear's take:

•Market is in decreasing weekly volume

•High yields

•Looming #Recession

•Geopolitical and geo-economic tensions are on the rise

•Valuations are high

• #Inflation is sticky

•Higher rates for longer

•Small-caps are lagging behind

#ES_F #SPX

The Bear's take:

•Market is in decreasing weekly volume

•High yields

•Looming #Recession

•Geopolitical and geo-economic tensions are on the rise

•Valuations are high

• #Inflation is sticky

•Higher rates for longer

•Small-caps are lagging behind

#ES_F #SPX

$SPX

Our weekly "NEXT WEEK, The Bear's take, The Bull's take, Our take" is here

For more info read our newsletter

The new issue will be out tomorrow before the open

Stay ahead, subscribe for Free

pointblanktrading.substack.com

#SPX $SPY $ES #options #Futures $Gamma

@UnrollHelper

Our weekly "NEXT WEEK, The Bear's take, The Bull's take, Our take" is here

For more info read our newsletter

The new issue will be out tomorrow before the open

Stay ahead, subscribe for Free

pointblanktrading.substack.com

#SPX $SPY $ES #options #Futures $Gamma

@UnrollHelper

NEXT WEEK

The Bear's take:

•Market is up in decreasing weekly volume

•Market is overbought

•High yields

•Looming #Recession

•Geopolitical and geo-economic tensions are on the rise

• #Inflation is sticky

•Higher rates for longer

•Small-caps are lagging behind

#ES_F #SPX

The Bear's take:

•Market is up in decreasing weekly volume

•Market is overbought

•High yields

•Looming #Recession

•Geopolitical and geo-economic tensions are on the rise

• #Inflation is sticky

•Higher rates for longer

•Small-caps are lagging behind

#ES_F #SPX

🌐 Traders! We're thrilled to announce that Gamma Swap is now officially LIVE on #DeriProtocol @arbitrum !

Get ready for a game-changing experience in the world of #DeFi. 🎉🎉🧵💙🧡

👉deri.io/#/trade/gamma/

#GammaSwap $BTC #hedge #volatility #Options #Gamma $ETH #Arbitrum

Get ready for a game-changing experience in the world of #DeFi. 🎉🎉🧵💙🧡

👉deri.io/#/trade/gamma/

#GammaSwap $BTC #hedge #volatility #Options #Gamma $ETH #Arbitrum

❓What’s Gamma Swap?

Gamma Swap is a financial instrument where buyers (who take the long side) can obtain Gamma exposure of an underlying asset, while sellers (who take the short side) can earn funding fees for providing that exposure. Longing Gamma Swap has the following PnL👇

Gamma Swap is a financial instrument where buyers (who take the long side) can obtain Gamma exposure of an underlying asset, while sellers (who take the short side) can earn funding fees for providing that exposure. Longing Gamma Swap has the following PnL👇

Dive in: docs.deri.io/library/academ…

This is the start of Drip Drops Knowledge!

Remember to hit that follow button if you like the content.

#SPY #SPX $ES_F #QQQ #futurestrading #OptionsTrading #options

Remember to hit that follow button if you like the content.

#SPY #SPX $ES_F #QQQ #futurestrading #OptionsTrading #options

The first official Knowledge Drop. $GME reported earnings last night and is up over 50% this morning. A short float of 24% (as reported by #Ortex) might have something to do with that. Breakdown in slide, follow me for weekly Knowledge Drops!

#GME #ShortSqueeze

#GME #ShortSqueeze

Last week, I discussed the concept of a “short squeeze.” This week let’s look at the dynamics of dealer hedging and the concept of a “gamma squeeze.”

#ShortSqueeze #GammaSqueeze #SPY #SPX $ES

#ShortSqueeze #GammaSqueeze #SPY #SPX $ES

Somehow our pinned tweet disappeared, so here it is again

This is a thread with information we think valuable:

1) Our Compact Guide to Understanding #Gamma

2) $SPX $Gamma structure Cheat Sheet

3) Our Compact Guide to Options Strategies

4) 2023 Options Calendar... and more

🧵

This is a thread with information we think valuable:

1) Our Compact Guide to Understanding #Gamma

2) $SPX $Gamma structure Cheat Sheet

3) Our Compact Guide to Options Strategies

4) 2023 Options Calendar... and more

🧵

Find business insurance Massachusetts #companies & coverage #options for business auto, commercial property, & general liability at Lunova Insurance.

lunovainsurance.com

lunovainsurance.com/commercial/

twitter.com/lunovainsurance

zeemaps.com/map?group=4517…

brownbook.net/business/51075…

#business

lunovainsurance.com

lunovainsurance.com/commercial/

twitter.com/lunovainsurance

zeemaps.com/map?group=4517…

brownbook.net/business/51075…

#business

At #LunovaInsurance, you #cansecurepolicyrates & coverage with #our 2023 "MA cheap small business owners policy insurance", online with "BOP Insurance Company & #AgencyRates at Lunova Insurance", locally & #online:

lunovainsurance.com/commercial/bus…

lunovainsurance.com/contact

#BusinessOwners

lunovainsurance.com/commercial/bus…

lunovainsurance.com/contact

#BusinessOwners

Massachusetts Small #Business Insurance Agency LunovaInsurance.com can "help you find insurance for your company".

More on our #Localmap on #Google for "Small Business Liability, Property & Auto Massachusetts Insurance Agency Rates, Lunova Insurance".

google.com/maps/d/viewer?…

More on our #Localmap on #Google for "Small Business Liability, Property & Auto Massachusetts Insurance Agency Rates, Lunova Insurance".

google.com/maps/d/viewer?…

The Nifty Financial Services Index, also known as the #FinNifty, is an index that tracks the performance of the financial services sector in India. @bbrijesh explains about the index in detail.

#FinNifty is an index that tracks the performance of the financial services sector in India, which includes #banks, #insurance companies, #housingfinance, and Non-Banking Financial Companies (NBFCs). #FinancialServicesSector #India

The financial services sector in India is one of the largest and most diverse in the world, and FinNifty provides a way to track the performance of this sector. #FinancialServicesSector #GrowthPotential

Are you afraid of a bear market? I do. So how to protect my #Ethereum profits without selling the asset? Using @lyrafinance . It's not financial advice, it's just how I do it. Let's go! 👇🧵 #lyra #options #OptionsTrading

Meanwhile, in this 3d I am referring only to the situation in which we have the #asset that will concern the option in the wallet.

Let's get down to business.

👉We own 1 #ETH purchased at an average load price of $1400

Let's get down to business.

👉We own 1 #ETH purchased at an average load price of $1400

After the current pump we are obviously in profit and we are fond of our asset, so we are at a crossroads:

👉either I separate from the asset by making take profit, or I find a way to protect myself.

👉either I separate from the asset by making take profit, or I find a way to protect myself.

1/7

@ryskfinance is a decentralized finance (DeFi) platform that offers uncorrelated, competitive yields in all market conditions through its innovative financial engineering solutions. #RyskFinance #DeFi #crypto #blockchain #Staking

@ryskfinance is a decentralized finance (DeFi) platform that offers uncorrelated, competitive yields in all market conditions through its innovative financial engineering solutions. #RyskFinance #DeFi #crypto #blockchain #Staking

2/7

The platform leverages the power of its Dynamic Hedging Vault (DHV), a self-governing #options vault, to generate delta-neutral #yield for its liquidity providers.

The platform leverages the power of its Dynamic Hedging Vault (DHV), a self-governing #options vault, to generate delta-neutral #yield for its liquidity providers.

3/7

With its clear #transparency on the risks involved, @ryskfinance enables its users to access high yields with #confidence and clear boundaries, how much you can lose and how much you can earn.

With its clear #transparency on the risks involved, @ryskfinance enables its users to access high yields with #confidence and clear boundaries, how much you can lose and how much you can earn.

$SPX

Our weekly "NEXT WEEK, The Bear's take, The Bull's take, Our take" is here

For more info read our newsletter

Today's issue will be out in the morning

Subscribe for Free

pointblanktrading.substack.com

#SPX $SPY $ES $SPX #ES_F $GAMMA #GEX $QQQ #QQQ $DIj #trading #options #Futures

Our weekly "NEXT WEEK, The Bear's take, The Bull's take, Our take" is here

For more info read our newsletter

Today's issue will be out in the morning

Subscribe for Free

pointblanktrading.substack.com

#SPX $SPY $ES $SPX #ES_F $GAMMA #GEX $QQQ #QQQ $DIj #trading #options #Futures

If you own crypto or NFTs and don’t sell options, you might be leaving money on the table 💵

Decentralized Speculation is arriving on Feb 6th 2023👀

Below are 4 ways you can utilize selling NFT options to help you realize profitability

#Options #NFTFi #NFTcommunity

🧵👇

Decentralized Speculation is arriving on Feb 6th 2023👀

Below are 4 ways you can utilize selling NFT options to help you realize profitability

#Options #NFTFi #NFTcommunity

🧵👇

💎Options Can Generate Passive Income💎

Selling options contracts can be a great way to generate income for your portfolio.

By selling or creating options, you collect a premium when someone purchases your options contract.

Selling options contracts can be a great way to generate income for your portfolio.

By selling or creating options, you collect a premium when someone purchases your options contract.

💎Reduce Risk in Your Portfolio💎

Selling options can also help to reduce risk in your portfolio. When you sell an option, you're taking on the obligation to sell (or buy) an underlying asset at a specified price.

This can help to offset potential losses in other investments🧠

Selling options can also help to reduce risk in your portfolio. When you sell an option, you're taking on the obligation to sell (or buy) an underlying asset at a specified price.

This can help to offset potential losses in other investments🧠

This strategy has made 60-140+ POINT MOVES in $SPX which equates to around $5-$15 Moves in $SPY ITSELF! 🚀

There is 1 way on how to trade this strategy and to also state #FOMC is very risky to trade with #SPY #SPX #Options due to the #volatility