Discover and read the best of Twitter Threads about #realestateinvesting

Most recents (9)

1/10 *Thread* 🧵

🚀 US Labor Market: May payrolls rise by 339K, surpassing the 190K Dow Jones estimate, and marking the 29th straight month of positive job growth. Unemployment rate increases slightly to 3.7% - still near the lowest since 1969. #LaborMarket #JobGrowth

🚀 US Labor Market: May payrolls rise by 339K, surpassing the 190K Dow Jones estimate, and marking the 29th straight month of positive job growth. Unemployment rate increases slightly to 3.7% - still near the lowest since 1969. #LaborMarket #JobGrowth

2/10

📈 This surge in job creation reveals a resilient labor market despite various challenges. Average hourly earnings, a key inflation indicator, rose 0.3% for the month, and wages increased 4.3% annually. #EconomicGrowth #Inflation

📈 This surge in job creation reveals a resilient labor market despite various challenges. Average hourly earnings, a key inflation indicator, rose 0.3% for the month, and wages increased 4.3% annually. #EconomicGrowth #Inflation

3/10

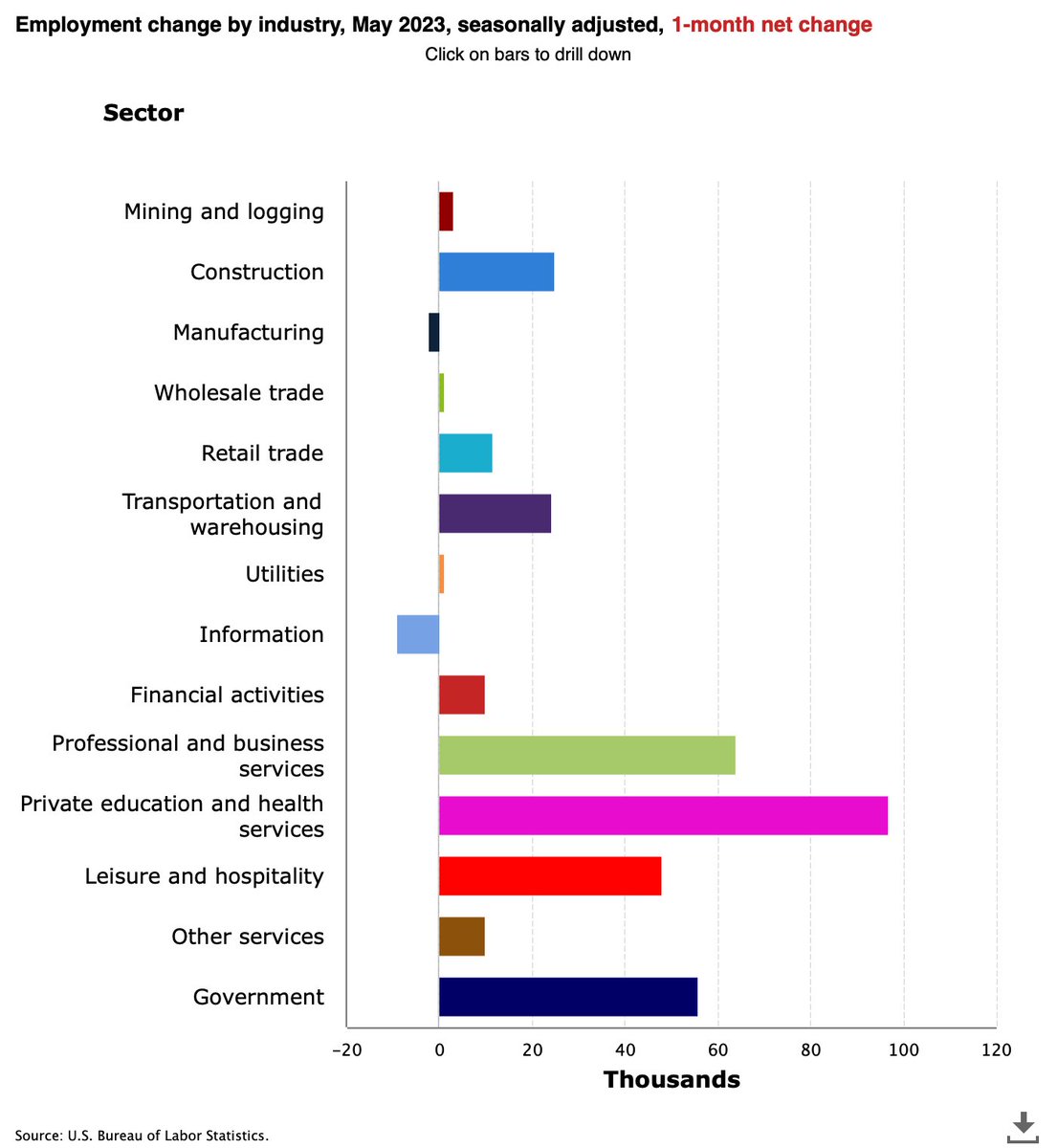

💼 Job creation is led by professional and business services (64K new hires), followed by government (56K) and healthcare (52K). Other notable sectors include leisure and hospitality (48K), construction (25K), and transportation and warehousing (24K). #JobCreation

💼 Job creation is led by professional and business services (64K new hires), followed by government (56K) and healthcare (52K). Other notable sectors include leisure and hospitality (48K), construction (25K), and transportation and warehousing (24K). #JobCreation

1/15 *Thread*🧵US Housing Market 2023: An investors outlook🏠

Key trend: Low supply, strong demand. Let's explore why investing in this market cycle could yield strong returns.

#USHousingMarket #RealEstateInvesting #EconomicTrends

Key trend: Low supply, strong demand. Let's explore why investing in this market cycle could yield strong returns.

#USHousingMarket #RealEstateInvesting #EconomicTrends

2/15

US added 339,000 jobs in May '23, surpassing predictions of 190,000. Unemployment rate is at a near 50-year low despite being up to 3.7%, above the 3.5% forecast. A robust labor market is fundamental to a thriving housing market.

#JobsReport #Unemployment

US added 339,000 jobs in May '23, surpassing predictions of 190,000. Unemployment rate is at a near 50-year low despite being up to 3.7%, above the 3.5% forecast. A robust labor market is fundamental to a thriving housing market.

#JobsReport #Unemployment

3/15 Interest rates are rising fast, yet the labor market is holding strong. The strong labor market translates into steady demand for housing, maintaining a positive outlook for property investors.

#InterestRates #LaborMarket

#InterestRates #LaborMarket

Today's #CRE term spotlight: Equity Multiple. It's a less common measure but an important counter to the typical IRR standard used in many real estate transactions. Let's dive in! #realestateinvesting

The Equity Multiple represents the gross return an investor receives compared to their initial investment, regardless of time. It's a simple way to gauge overall returns based on the total distributions received relative to capital invested.

Example: An investor seeking a minimum equity multiple of 1.50x on a $1,000,000 investment would require a return of $1,500,000. This indicates that for every dollar invested, they expect to get $1.50 back in gross returns. So why is this used?

Hivi Kuna Asiyejua Kama Ardhi ni Utajiri.

Au Asiyetambua Kama Akiba ya Kweli ni Ardhi.

Jiulize, Kwa Nini Mazao, Maji, Mafuta na Madini Vyote Vinapatikana Kwenye Ardhi ?..

#RealEstateInvesting

#PropertyForSale

#HomeBuying

#DreamHomes

Nisikuchoshe Sana

Madini Time

⬇️

Au Asiyetambua Kama Akiba ya Kweli ni Ardhi.

Jiulize, Kwa Nini Mazao, Maji, Mafuta na Madini Vyote Vinapatikana Kwenye Ardhi ?..

#RealEstateInvesting

#PropertyForSale

#HomeBuying

#DreamHomes

Nisikuchoshe Sana

Madini Time

⬇️

Utaskiaje Ukifanikiwa Kumiliki Heka 5 ,10 au 50 Kabisa?

Hiyo Siyo Ndoto Inawezekana

Nimekusogezea Habari ya Shamba Lenye Uwezo wa Kutimiza Malengo Ndoto na Malengo Yako Leo

Kisa Hiki ni cha Shamba Lilipo Kata ya Kiwangwa Wilaya Bagamoyo

Umbali wa Kilometa 7 Tu Kutoka

⬇️

Hiyo Siyo Ndoto Inawezekana

Nimekusogezea Habari ya Shamba Lenye Uwezo wa Kutimiza Malengo Ndoto na Malengo Yako Leo

Kisa Hiki ni cha Shamba Lilipo Kata ya Kiwangwa Wilaya Bagamoyo

Umbali wa Kilometa 7 Tu Kutoka

⬇️

Barabara ya Lami Kijiji cha Bago

Timu Yetu Ilifika Mpaka Kijijini na Kustaajabu Baada ya Kukuta Shamba Linauzwa Kwa Bei ya Sawa na Bure Kabisa

Unajua Linauzwaje?

Bei ya Awali Kwa Heka 1 Ilikuwa ni Laki 6.99.9 Tu❌

Timu Yetu Ikakataa

Ikabidi Tupewe Bei ya Ofa

Ambayo

⬇️

Timu Yetu Ilifika Mpaka Kijijini na Kustaajabu Baada ya Kukuta Shamba Linauzwa Kwa Bei ya Sawa na Bure Kabisa

Unajua Linauzwaje?

Bei ya Awali Kwa Heka 1 Ilikuwa ni Laki 6.99.9 Tu❌

Timu Yetu Ikakataa

Ikabidi Tupewe Bei ya Ofa

Ambayo

⬇️

Soko la Mali Isiyohamishika

(Real Estate) Lipoje Kwa Sasa

Dar es salaam?...

#RealEstateInvesting

#PropertyForSell

#HomeBuying

#DreamHome

The Market Report

⬇️

(Real Estate) Lipoje Kwa Sasa

Dar es salaam?...

#RealEstateInvesting

#PropertyForSell

#HomeBuying

#DreamHome

The Market Report

⬇️

Kuongezeka kwa Thamani ya Mali Isiyohamishika Katika Eneo la Masaki.

Kumekuwa na Ongezeko Kubwa la Thamani ya Mali Isiyohamishika Katika Eneo la Masaki Jijini Dar es Salaam.

Eneo Hili Linajulikana kwa Kuwa na Majengo ya Kifahari, Huduma Bora za Kijamii, na Usalama Mzuri.

⬇️

Kumekuwa na Ongezeko Kubwa la Thamani ya Mali Isiyohamishika Katika Eneo la Masaki Jijini Dar es Salaam.

Eneo Hili Linajulikana kwa Kuwa na Majengo ya Kifahari, Huduma Bora za Kijamii, na Usalama Mzuri.

⬇️

Wondering about latest news 📰 in the #realestate #housingmarket 🏡💵 with pricing, #interestrates, etc.? Here's an updated thread for January 23' that includes all the latest macro/market data... 🧵/👇🏼

📊h/t @RealEstateCafe

📊h/t @RealEstateCafe

1/🧵 "44% year/year drop in @MBAMortgage

Purchase Index is largest decline on record." 🇺🇸📉

📊h/t @LizAnnSonders @bloomberg

#realestate #realestateinvesting #FederalReserve #interestrates #macro #realator #mortgagerates

Purchase Index is largest decline on record." 🇺🇸📉

📊h/t @LizAnnSonders @bloomberg

#realestate #realestateinvesting #FederalReserve #interestrates #macro #realator #mortgagerates

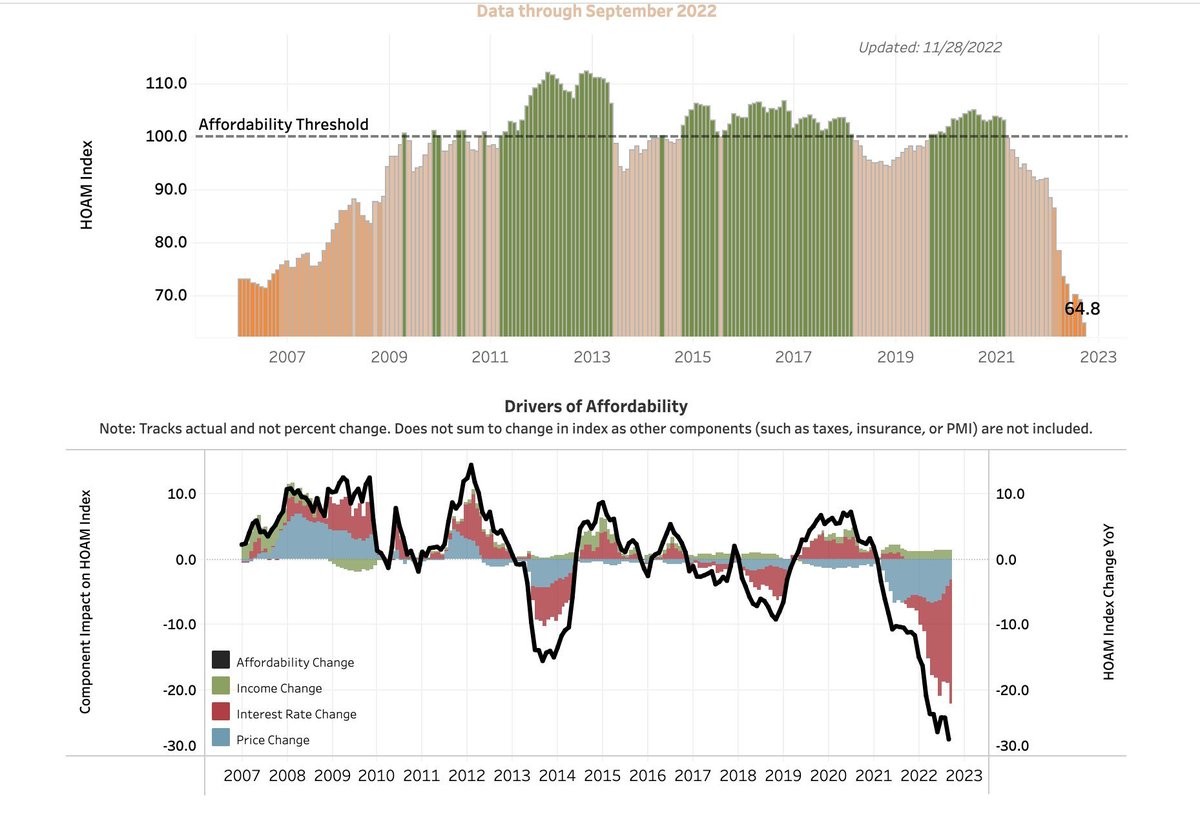

2/🧵 Affordability "threshold" for housing, via the @AtlantaFed 🏡

📊h/t @NewsLambert

#realestate #realestateinvesting #FederalReserve #interestrates #macro #realator #mortgagerates

📊h/t @NewsLambert

#realestate #realestateinvesting #FederalReserve #interestrates #macro #realator #mortgagerates

Thread on #office buildings:

Office remains the asset class with the least certain future. However, not all office space is created equal. For example, life science office is in a steadier position since lab work generally can't be performed remotely. 1/n

Office remains the asset class with the least certain future. However, not all office space is created equal. For example, life science office is in a steadier position since lab work generally can't be performed remotely. 1/n

Given persistent demand to lease life science office space, occupancy rates in this specialized asset class remain quite high. As one data point, Alexandria Real Estate, a publicly traded REIT that specializes in life science office space, reported... 2/n

...occupancy rates of 95% in their North American properties in 2Q of this year: sec.gov/ix?doc=/Archiv…

Another way to compare subcategories of office assets urban or central business district (CBD) vs suburban locations. Historically... 3/n

Another way to compare subcategories of office assets urban or central business district (CBD) vs suburban locations. Historically... 3/n

Are you ready to scale up your real estate business for Good?

1. Start small - 1 unit of a not too expensive property option and put it to work

2. Reinvest the yield/profit to a bigger opportunity. Bigger could mean a different environment or yield opportunity

#RealEstate

1. Start small - 1 unit of a not too expensive property option and put it to work

2. Reinvest the yield/profit to a bigger opportunity. Bigger could mean a different environment or yield opportunity

#RealEstate

3. Switch into multi unit opportunities- could be residential or retail. Controlling more units means more profits with literally the same effort.

4. Upgrade into owning your own building or property fully. This is easier and more viable with mixed use commercial units.

4. Upgrade into owning your own building or property fully. This is easier and more viable with mixed use commercial units.

Because you can now have your offices within the building at almost no cost to you.

If you choose to do same with residential units, it might be worthwhile to also live in one of the units

#realestateinvesting

#Property

#investing

#rental

#commercialrealestate

#business

If you choose to do same with residential units, it might be worthwhile to also live in one of the units

#realestateinvesting

#Property

#investing

#rental

#commercialrealestate

#business

[thread] The real reason why Indian real estate is suffering: by @babablahblah_

India's youth does not want to buy a house. period

India's youth does not want to buy a house. period

@babablahblah_ 1/ The younger generations (read millennials) don't see why they should make a 30+ year commitment to a single investment which end up rooting them to a single location.

@babablahblah_ 2/ It's hard to justify to them why they should invest money into real estate (which is highly complex and illiquid) instead of buying mutual funds or investing into SIPs (which are easy to understand, can be traded with an app and provide instant liquidity).