Discover and read the best of Twitter Threads about #skininthegame

Most recents (24)

Buffett’s comments about the FDIC are interesting because he’s apparently endorsing unlimited deposit insurance. @BeckyQuick — can you ask him if he supports *officially* lifting the $250K deposit insurance limit explicitly because that isn’t entirely clear.

Buffett wants to deal with moral hazard in banking by really punishing the executives. I don’t think this is realistic. The execs and directors of SVB and Signature will do fine and so will execs and directors of future bank failures.

No ceo is going to end up with a lifestyle similar to an assembly line worker at ford. We might want that to be the case but it ain’t happening in the world we live in.

#digiPH6, wir (@h_steinbeck und ich) kommen und freuen uns auf unseren morgigen Beitrag!

Für unseren kurzen Input mit dem kontroversen Titel "Massenvorlesungen 2.0" bereiten wir aber keine Folien vor, sondern nach dem Motto "Teaching with Browser Tabs"😉 diesen Twitter-Thread: 1/

Für unseren kurzen Input mit dem kontroversen Titel "Massenvorlesungen 2.0" bereiten wir aber keine Folien vor, sondern nach dem Motto "Teaching with Browser Tabs"😉 diesen Twitter-Thread: 1/

Unsere These ist:

Livestreams haben sich zur Unterhaltung und für informelle Bildung etabliert. Sie sind mittlerweile technisch einfach umzusetzen, flexibel und offen konsumierbar und bieten trotzdem viele Interaktionsmöglichkeiten - eignen sich als auch für formelle Bildung!? 2/

Livestreams haben sich zur Unterhaltung und für informelle Bildung etabliert. Sie sind mittlerweile technisch einfach umzusetzen, flexibel und offen konsumierbar und bieten trotzdem viele Interaktionsmöglichkeiten - eignen sich als auch für formelle Bildung!? 2/

Grob gegliedert sprechen wir bei der #digiPH6 über folgende Themen:

1. Live-Streaming und Netz-Kultur

2. Gute Gründe zum Streamen (auch für Lehrpersonen)

3. Motivationen zum Anschauen und Interagieren

4. Technische Umsetzungsszenarien

5. Formate

6. Interaktionsmöglichkeiten 3/x

1. Live-Streaming und Netz-Kultur

2. Gute Gründe zum Streamen (auch für Lehrpersonen)

3. Motivationen zum Anschauen und Interagieren

4. Technische Umsetzungsszenarien

5. Formate

6. Interaktionsmöglichkeiten 3/x

A Deep-Dive Thread on #RateGain 🧵🧵. Let's go!

Have you heard about the movie - The Bucket List? Jack Nicholson & Morgan Freeman portray the amazing story of two travelers in their final years, The main plot follows two terminally ill men on their road trip

Have you heard about the movie - The Bucket List? Jack Nicholson & Morgan Freeman portray the amazing story of two travelers in their final years, The main plot follows two terminally ill men on their road trip

with a wish list of things to do before they finally say goodbye to the world. No, this thread isn't about that movie, but decoding a company that's enabling the world's incessant desire to TRAVEL, especially that's in Turbo mode after the world being locked up for 2 years...

Hotels are striving hard to optimize costs, improve RoI and reduce the CAC (customer acquisition cost) by generating direct revenue through metasearch platforms, RateGain finds itself in a sweet spot - with its Tech stack offering.

#Vision

#Vision

I'm regularly talking to people who've managed to convince themselves they understand the mechanics of the economic machine & think their foresight is golden.

If you can predict it, why aren’t you rich from it?

A very simple heuristic to see who's full of you know what.

If you can predict it, why aren’t you rich from it?

A very simple heuristic to see who's full of you know what.

The smart ones fall victim to the illusion of knowledge bias as they don't respect the boundary of their own competence. Munger's cure:

“We know the edge of our competency better than most. That’s a very worthwhile thing. It’s not a competency if you don’t know the edge of it.”

“We know the edge of our competency better than most. That’s a very worthwhile thing. It’s not a competency if you don’t know the edge of it.”

If you're so sure where inflation, rates or GDP is headed next, why aren't you putting money where your mouth is?

So, another filter is the #skininthegame.

Despite enormous budgets, complex models & 100s of PhDs, not even the Fed, the Gov or the largest banks can figure it out.

So, another filter is the #skininthegame.

Despite enormous budgets, complex models & 100s of PhDs, not even the Fed, the Gov or the largest banks can figure it out.

1/12 #Part 2⃣: StarkWare Ecosystem

👉2/12 Overview

👉3-4/12 #StarkEx

👉5/12 #StarkNet

👉6-7/12 Who is building on #starkNet?

👉8/12 Skininthegame

👉9/12 Layer #3

👉10-11/12 Roadmap

👉12/12 Comparison

#Part 1⃣: Powerl of StarkWare (👉)

👉2/12 Overview

👉3-4/12 #StarkEx

👉5/12 #StarkNet

👉6-7/12 Who is building on #starkNet?

👉8/12 Skininthegame

👉9/12 Layer #3

👉10-11/12 Roadmap

👉12/12 Comparison

#Part 1⃣: Powerl of StarkWare (👉)

2/12. Overview

StarkWare is STARK Proof Pioneers, bringing scalability, security, and privacy to a blockchain.

#StarkWare = #StarkEx (Validium/Volition; App-Specific, Permissioned) + #StarkNet (zkRollup; General purpose, Composability, Permissionless)

StarkWare is STARK Proof Pioneers, bringing scalability, security, and privacy to a blockchain.

#StarkWare = #StarkEx (Validium/Volition; App-Specific, Permissioned) + #StarkNet (zkRollup; General purpose, Composability, Permissionless)

This #SkinInTheGame Update is painful.

And that's what makes it so important.

My portfolio hasn't looked this different in quite some time...

And that's what makes it so important.

My portfolio hasn't looked this different in quite some time...

First, how am I doing?

🤬YTD: (37%) vs. S&P's (13%)

😡1-YR: (25%) vs. (1%)

😐3-YR: 53% vs. 40%

😀5-YR: 183% vs. 73%

😁10-YR: 315% vs. 195%

This is down huge from all-time highs.

And yet, I'm just fine with this.

A few big changes yet to be made...

🤬YTD: (37%) vs. S&P's (13%)

😡1-YR: (25%) vs. (1%)

😐3-YR: 53% vs. 40%

😀5-YR: 183% vs. 73%

😁10-YR: 315% vs. 195%

This is down huge from all-time highs.

And yet, I'm just fine with this.

A few big changes yet to be made...

I haven't been able to:

🔴Sell my $DOCU shares

🟢Buy my $UPST shares

Additionally, I will be making incremental buys of $AXON and $SHOP for the portfolio @BrianFeroldi are running at @JoinCommonstock

commonstock.com/brianstoffel

But here's what I own now⤵️

🔴Sell my $DOCU shares

🟢Buy my $UPST shares

Additionally, I will be making incremental buys of $AXON and $SHOP for the portfolio @BrianFeroldi are running at @JoinCommonstock

commonstock.com/brianstoffel

But here's what I own now⤵️

1/ Alternative investments are becoming ever more popular.

With more sponsors looking to cash in on the trend, an overwhelming amount of deals have an unattractive alignment of interest and a clear principal-agent problem.

One way to fix this...

With more sponsors looking to cash in on the trend, an overwhelming amount of deals have an unattractive alignment of interest and a clear principal-agent problem.

One way to fix this...

2/ ... is by making agents (GPs) move closer to principals (LPs).

This requires a meaningful amount of #skininthegame (meaningful commitment as a % of the deal).

Forget industry standards like 0 to 3% commitments, which GPs often quote since it favors them (#confirmationbias).

This requires a meaningful amount of #skininthegame (meaningful commitment as a % of the deal).

Forget industry standards like 0 to 3% commitments, which GPs often quote since it favors them (#confirmationbias).

3/ Our job as LPs (HNWIs & FOs) is to look for anomalies and no-brainer opportunities — not 99% of the cookie-cutter deals.

On Twitter, it seems most GPs are in an #echochamber.

They spend all their time discussing what they prefer, without giving a second thought about LPs.

On Twitter, it seems most GPs are in an #echochamber.

They spend all their time discussing what they prefer, without giving a second thought about LPs.

Talvez eu passe vergonha com esse tweet, mas vou correr o risco.

#skininthegame

Nesse nível de preço o Inter (BIDI) é, para mim, uma baita oportunidade de compra a longo prazo.

E nesse thread vou explicar o porquê!

Continua 👇👇👇

#skininthegame

Nesse nível de preço o Inter (BIDI) é, para mim, uma baita oportunidade de compra a longo prazo.

E nesse thread vou explicar o porquê!

Continua 👇👇👇

Antes de começarmos a thread em si, um aviso:

2) Para aqueles que tiverem preguiça de ler, fiz um vídeo resumindo a análise. Segue o link:

...

2) Para aqueles que tiverem preguiça de ler, fiz um vídeo resumindo a análise. Segue o link:

...

Para começarmos essa thread (e se preparem que ela vai ser longa) vamos falar sobre o que o Inter faz brevemente.

Acho que todos conhecem ou pelo menos já ouviram falar, mas o Inter é basicamente um banco digital, com um modelo de negócios parecido com o NuBank.

...

Acho que todos conhecem ou pelo menos já ouviram falar, mas o Inter é basicamente um banco digital, com um modelo de negócios parecido com o NuBank.

...

Commitment to transparency and (sometimes painful) truth. Without it, no growth or evolution.

That applies to life and investing.

With that in mind, here's:

📊 Every stock I own (and how much)

📉 My investing results over time

🤔 What I plan to do

⤵️

That applies to life and investing.

With that in mind, here's:

📊 Every stock I own (and how much)

📉 My investing results over time

🤔 What I plan to do

⤵️

First my results:

🔴YTD: (21%) vs. S&P 500's (8%)

🔴1-Year: (11%) vs. 14%

That's a lot of under-performance. But here's why the 3-5 year time horizon is so important

🟢3-Year: 104% vs. 55%

🟢5-Year: 304% vs. 83%

🟢10-Year: 463% vs. 217%

My recent moves ⤵️

🔴YTD: (21%) vs. S&P 500's (8%)

🔴1-Year: (11%) vs. 14%

That's a lot of under-performance. But here's why the 3-5 year time horizon is so important

🟢3-Year: 104% vs. 55%

🟢5-Year: 304% vs. 83%

🟢10-Year: 463% vs. 217%

My recent moves ⤵️

None.

I was in Costa Rica 🇨🇷 on a "screen free" vacation.

Family got COVID, we had to stay longer. Everyone's fully recovered!

Thanks for all the well-wishes

.....

Here's everything I own TODAY⤵️

I was in Costa Rica 🇨🇷 on a "screen free" vacation.

Family got COVID, we had to stay longer. Everyone's fully recovered!

Thanks for all the well-wishes

.....

Here's everything I own TODAY⤵️

decades in weeks.

and the week UCU is on strike, so I cant comment the pluuuumbing :)

I can tweet about the @ucu strike fund - remember Maggie Thatcher gave employers the upper hand to confiscate pay for each strike day, so academics are taking home half of their pay this month.

I 'm reflecting on this since a while.

On markets today: on one hand we're seeing ultra-specific domain models (marketplaces) and on the other end very generic/horizontal contracting platforms, such as Haier's rendanheyi and its supporting software

On markets today: on one hand we're seeing ultra-specific domain models (marketplaces) and on the other end very generic/horizontal contracting platforms, such as Haier's rendanheyi and its supporting software

Haier's EMC (self-managed and self-defined multi-sided smart contracts aimed at creating a certain outcome) is a kind of *evolution* of a transaction: as transaction cost plummets complex (smart) contracts can become the new transactions, reducing the need to rely on scale.

In terms of evolution:

1. We started with complicated and dumb contracts = bureaucracies: amassing suppliers, contractualize them for the long term, the only part of the transaction that was left on the market was purchasing (consumer);

1. We started with complicated and dumb contracts = bureaucracies: amassing suppliers, contractualize them for the long term, the only part of the transaction that was left on the market was purchasing (consumer);

2021 has been a great year for our #BASON predictions @OraclumIS

Why?

Because in 2021, over a period of 22 weeks, we have made stunningly accurate predictions of the #markets, and made a whopping 107% return from these predictions!

A quick thread 🧵on how we did this 👇

Why?

Because in 2021, over a period of 22 weeks, we have made stunningly accurate predictions of the #markets, and made a whopping 107% return from these predictions!

A quick thread 🧵on how we did this 👇

1/ First, how does #BASON work?

We ask people where they & their friends think the markets will end up at the end of each week, while applying network analysis to control for their groupthink bias.

Here’s a video explaining it:

We ask people where they & their friends think the markets will end up at the end of each week, while applying network analysis to control for their groupthink bias.

Here’s a video explaining it:

Uipath Insider Trades $4.5M In Company Stock finance.yahoo.com/news/uipath-in… via @Yahoo || This seems the reason for today's $PATH drop. Similar #TOST drop last few days (although the #Toast insider selling agreement is a bit convoluted, at least to me :-)

I am thinking a balanced approach for insider (especially founder) selling. On one hand, they should be able to sell some stocks to maintain their lifestyle (this is same for everyone, not same level, I mean the need of cash for lifestyle). At the same time, I think they... /2

should have #skininthegame by owning most of their net-worth in the company stocks. A similar rationale for CEOs who get a lot of company stock options. But the game was usually rigged in the latter scenario because CEOs / companies' stock buyback to pop up stock price. /3

Todo lo que necesitas saber de Insider Trading en 50 Tweets

◾️ Qué es legal y qué no lo es

◾️ Casos reales

◾️ Mejores herramientas para seguir insiders

◾️ Evidencia de resultados

◾️ Alternativas para invertir con insiders

◾️ Mi opinión y algunas recomendaciones

¡Vamos allá!

◾️ Qué es legal y qué no lo es

◾️ Casos reales

◾️ Mejores herramientas para seguir insiders

◾️ Evidencia de resultados

◾️ Alternativas para invertir con insiders

◾️ Mi opinión y algunas recomendaciones

¡Vamos allá!

1. En 2001 ImClone se desplomó cuando se anunció que uno de sus medicamentos no había obtenido la aprobación de la FDA

Meses después la SEC denunció a múltiples empleados y familiares por vender acciones de la empresa justo antes de aquel anuncio

sec.gov/news/press/200…

Meses después la SEC denunció a múltiples empleados y familiares por vender acciones de la empresa justo antes de aquel anuncio

sec.gov/news/press/200…

2. En 2015 un empleado de Amazon compartió los resultados financieros de la empresa con un amigo antes de ser publicados.

Este amigo ganó $115,997 negociando acciones de Amazon gracias a esa información.

La SEC se enteró y también denunció los hechos.

sec.gov/litigation/lit…

Este amigo ganó $115,997 negociando acciones de Amazon gracias a esa información.

La SEC se enteró y también denunció los hechos.

sec.gov/litigation/lit…

Tesis sintetizada de inversión en solo 10 puntos.

¡Hoy hablaremos sobre Monster Beverage ( $MNST )!

Empresa ligera de activos, antifrágil ante la pandemia, con un capital allocation increíble y una de las líderes del mercado de bebidas energéticas a nivel global.

¡Comenzamos!

¡Hoy hablaremos sobre Monster Beverage ( $MNST )!

Empresa ligera de activos, antifrágil ante la pandemia, con un capital allocation increíble y una de las líderes del mercado de bebidas energéticas a nivel global.

¡Comenzamos!

1) El negocio

Comercializa, vende y distribuye bebidas energéticas y concentrados para bebidas energéticas para múltiples marcas por todo el mundo.

El 90% de ventas de la compañía provienen de sus marcas propias como son Monster, Reign, Burn... entre otras muchas.

Comercializa, vende y distribuye bebidas energéticas y concentrados para bebidas energéticas para múltiples marcas por todo el mundo.

El 90% de ventas de la compañía provienen de sus marcas propias como son Monster, Reign, Burn... entre otras muchas.

2.1) Su alianza con Coca Cola

La empresa no fabrica directamente el producto terminado, sino que subcontrata el proceso de fabricación a embotelladoras y empacadoras externas.

Esto hace que la empresa sea ligera de activos y mucho más rentable.

Por no hablar de su alianza...

La empresa no fabrica directamente el producto terminado, sino que subcontrata el proceso de fabricación a embotelladoras y empacadoras externas.

Esto hace que la empresa sea ligera de activos y mucho más rentable.

Por no hablar de su alianza...

Tesis sintetizada de inversión en solo 10 puntos.

¡Hoy hablaremos sobre Constellation Software ( $CSU.TO )!

Para mi, una de las mejores empresas del mundo por tener un CEO que es un fuera de serie y por ser una compañía antifrágil con un gran modelo de negocio.

¡Comenzamos!

¡Hoy hablaremos sobre Constellation Software ( $CSU.TO )!

Para mi, una de las mejores empresas del mundo por tener un CEO que es un fuera de serie y por ser una compañía antifrágil con un gran modelo de negocio.

¡Comenzamos!

1.1) El negocio

Su negocio principal es el de adquirir, administrar y construir negocios de software de mercado vertical (VMS en inglés).

Se centran en empresas que proporcionen soluciones críticas a sus clientes y que abordan necesidades especificas.

Su negocio principal es el de adquirir, administrar y construir negocios de software de mercado vertical (VMS en inglés).

Se centran en empresas que proporcionen soluciones críticas a sus clientes y que abordan necesidades especificas.

Here’s some clarity re #KR1’s share register:

Nominee co’s are set up by major brokers/custodians/etc. to aggregate individual sharehldgs, both large & small...eg in reality, Vidacos does NOT own a 25.5% stake.

And no, #WarrenBuffett does NOT have a direct/indirect hldg in KR1!

Nominee co’s are set up by major brokers/custodians/etc. to aggregate individual sharehldgs, both large & small...eg in reality, Vidacos does NOT own a 25.5% stake.

And no, #WarrenBuffett does NOT have a direct/indirect hldg in KR1!

This nominee system does NOT absolve individual/inst’l investors of req’t to report major 3%+ stakes & any significant chg in hldgs...which you can track via #KR1 RNS:

investegate.co.uk/Index.aspx?sea…

Ideally, KR1 wd also break out these stakes (on a look-through) basis for investors...

investegate.co.uk/Index.aspx?sea…

Ideally, KR1 wd also break out these stakes (on a look-through) basis for investors...

And I highlighted major #KR1 stakes in my Nov post:

wexboy.wordpress.com/2020/11/21/kr1…

Largest hldg belongs to KR1 team itself (& Smaller Co Capital)...tht’s 15%+ in KR1’s fully diluted share capital.

That does NOT inc. 80% of their 2020 bonus to be granted in shares...

#skininthegame

wexboy.wordpress.com/2020/11/21/kr1…

Largest hldg belongs to KR1 team itself (& Smaller Co Capital)...tht’s 15%+ in KR1’s fully diluted share capital.

That does NOT inc. 80% of their 2020 bonus to be granted in shares...

#skininthegame

La jugada de @GBMplus, Robinhood y otros brokers de limitar las acciones procurando "proteger" a sus usuarios solo puede terminar mal...

#AbroHilo

#AbroHilo

A ver, primero entendamos que el motivo de esto con #GameStop

y #wallstreetbets es un resentimiento general a los grandes jugadores del sistema por utilizar las reglas a su favor y conveniencia...

y #wallstreetbets es un resentimiento general a los grandes jugadores del sistema por utilizar las reglas a su favor y conveniencia...

También tenemos el hecho de que los fondos están en una situación de Asimetría Negativa: Tienen mucho que perder, los inversores individuales, NO.

MÁS INFO en este #Hilo

MÁS INFO en este #Hilo

A couple of days ago, Skallas wrote that true @nntaleb fans don’t quote his ideas all the time, but instead apply them to everyday life. A childish discussion, but I felt the need to say something about it because the “Taleb obsession” theme recurs often. This is my story. 👇

A few years ago, my father decided to begin manufacturing a liqueur made out of rose petals. In order to realize his idea, he took a couple of loans from the bank and became indebted to his business partners.

He had a good concept, but he failed to anticipate one small thing – that he would pass away. One afternoon while we were sitting at the table, he just died. At 53 years of age, it took only 3 minutes. An aneurism. #BlackSwan

#pensioen Pensioenakkoord is in grote lijnen uitgewerkt. Met de "standaardmethode" kunnen pensioenen worden omgezet in kapitalen. Klaar is kees! Waarom doet de polder nu ineens zo moeilijk?

Vallen de uitkomsten bij nader inzien tegen?

fd.nl/economie-polit… #FD #Pensioenen

Vallen de uitkomsten bij nader inzien tegen?

fd.nl/economie-polit… #FD #Pensioenen

Als buitenstaander probeer ik maar wat. De ouderen verwachten dat hun huidige pensioenniveau op peil blijft, dus géén kortingen maar wel een redelijke kans op indexatie. Moet kunnen, is hun verteld, zodra het nieuwe pensioenstelsel er is en die vervelende rekenrente weg is. >>

Maar bij een dekkingsgraad van zeg 90% krijgen ze elk bij overgang van het oude naar nieuwe stelsel een kapitaal van 90% van de waarde van hun pensioenen mee — tenminste, bij gebruik van de standaardmethode, die gebaseerd is op actuele marktwaardering.

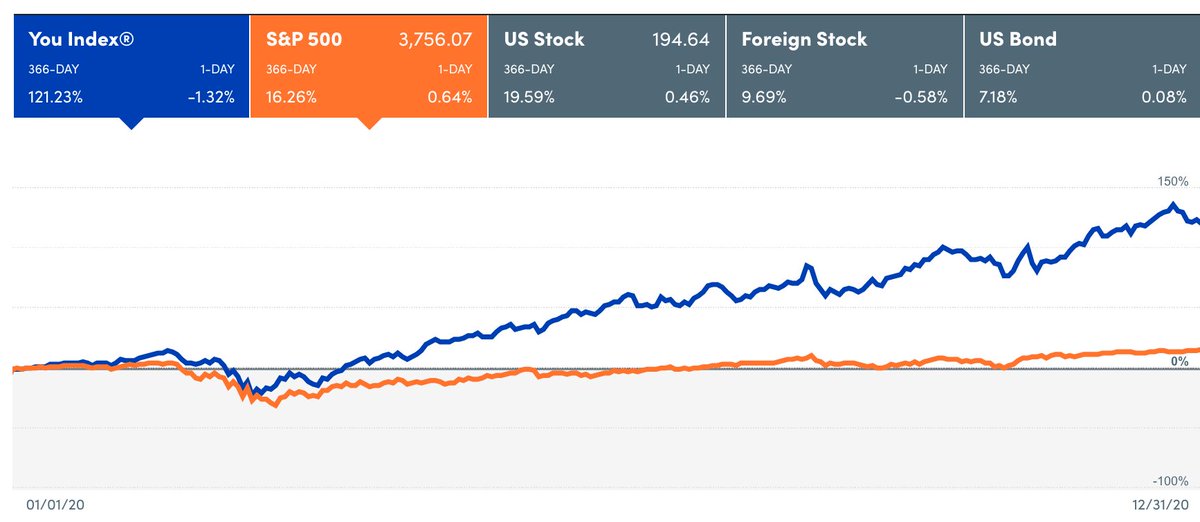

End 2020 Portfolio Update:

Performance Me/S&P

YTD: 121.23/16.24%

All Time: 208.19/34.08%

Top 10 (46.5%)

1 $SHOP 6.3%

2 $ZM 5.6%

3 $ETSY 5.6%

4 $TTD 5.6%

5 $TWLO 4.7%

6 $TDOC 4.4%

7 $TGT 4.3%

8 $SQ 4.3%

9 $WORK 2.9%

10 $OKTA 2.8%

Cash: 4.35%

All Holdings: bit.ly/3fRx9JT

Performance Me/S&P

YTD: 121.23/16.24%

All Time: 208.19/34.08%

Top 10 (46.5%)

1 $SHOP 6.3%

2 $ZM 5.6%

3 $ETSY 5.6%

4 $TTD 5.6%

5 $TWLO 4.7%

6 $TDOC 4.4%

7 $TGT 4.3%

8 $SQ 4.3%

9 $WORK 2.9%

10 $OKTA 2.8%

Cash: 4.35%

All Holdings: bit.ly/3fRx9JT

Q4 Transactions:

Add

$AAXN, $ADSK, $APPN, $BAC, $DIS, $DOCU, $FSLY, $MA, $NVDA, $OLLI, $PINS, $SLP, $SPCE, $SQ, $TEAM, $TCEHY, $TDOC, $TTD, $ZM

Drip

$AAPL, $BAC, $CTRE, $MA, $MRK, $NTDOY, $NVDA, $SLP, $SBUX, $TGT, $XLNX

Started

$ACUIF, $KHOTF, $KNSL, $U, $YSAC

Exited

$CGC, $LYFT

Add

$AAXN, $ADSK, $APPN, $BAC, $DIS, $DOCU, $FSLY, $MA, $NVDA, $OLLI, $PINS, $SLP, $SPCE, $SQ, $TEAM, $TCEHY, $TDOC, $TTD, $ZM

Drip

$AAPL, $BAC, $CTRE, $MA, $MRK, $NTDOY, $NVDA, $SLP, $SBUX, $TGT, $XLNX

Started

$ACUIF, $KHOTF, $KNSL, $U, $YSAC

Exited

$CGC, $LYFT

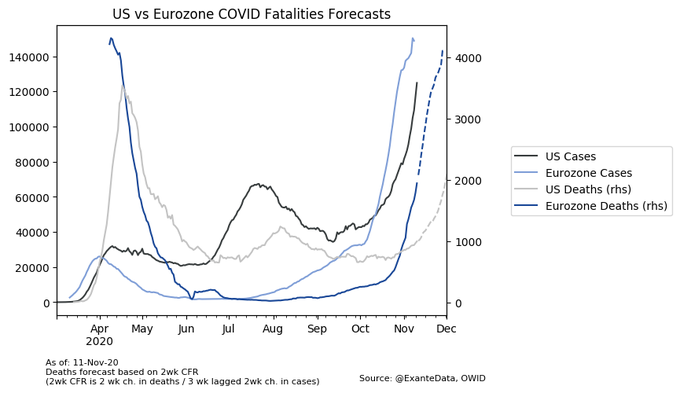

Back in March, ppl understood that its not current #'s but future trajectory that matters. Last month, infections in US & Europe rose so rapidly that daily deaths projected to double by Nov end. Action is required now, not in another 11 weeks with a new president. ht @ExanteData

Better treatment but w 'epidemic momentum' deaths will go past 2000 in wks.

"I expect the US to be reporting over 2000 deaths/day in 3 weeks time. Importantly, this doesn't assume any further increases in circulation & is essentially "baked into" currently reported cases"-@trvrb

"I expect the US to be reporting over 2000 deaths/day in 3 weeks time. Importantly, this doesn't assume any further increases in circulation & is essentially "baked into" currently reported cases"-@trvrb

China in January was in much the same situation as US T'giving. A larger migration of 400 million ppl that would have been a catastrophic superspreading event. But public health prevailed on politicians. Excellent comparative thread by an epidemiologist ⬇️

With the company's latest earnings report last week, Elon Musk satisfied the requirements for his 4th stock option tranche.

Here's how it all works...

[THREAD]

Here's how it all works...

[THREAD]

1/

At the beginning of 2018, Tesla filed a proxy statement, outlining the proposed comp plan for Musk.

He wouldn't receive a salary, options, RSUs, etc. Everything would rely on this comp plan.

Source:

sec.gov/Archives/edgar…

At the beginning of 2018, Tesla filed a proxy statement, outlining the proposed comp plan for Musk.

He wouldn't receive a salary, options, RSUs, etc. Everything would rely on this comp plan.

Source:

sec.gov/Archives/edgar…

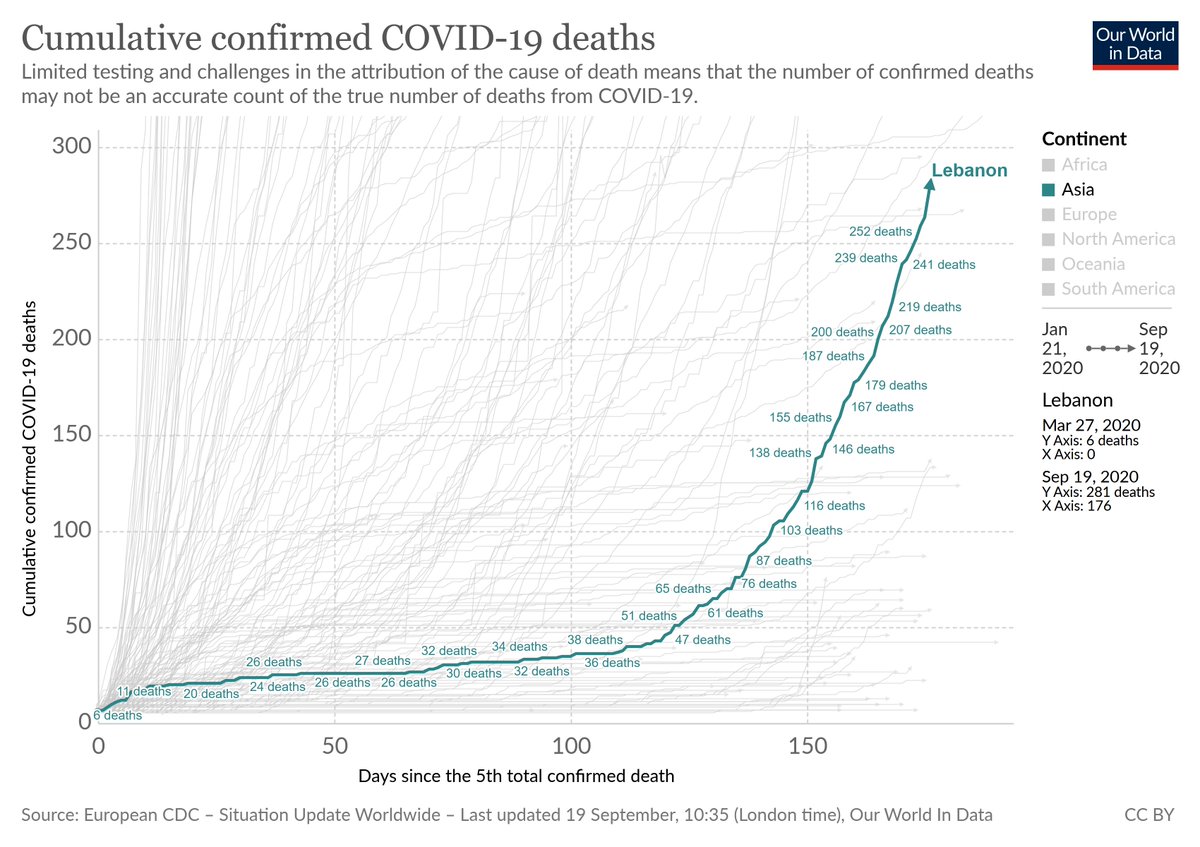

1. #Lebanon is entering a very dark period with #COVID19, as we expected. The next 2-3 weeks will have more regular daily deaths of 10-20 people. Little can be done to change that. If nothing new happens, the weeks after that will be even worse.

**What is to be done?**

**What is to be done?**

2. National lockdown? Ideal in some ways, but realistically unlikely. Compliance varies heavily, people exhausted by overlapping crises have limited compliance, central authorities have limited enforcement capacity.

Only alternative➡️Green Zone Strategy ...

Only alternative➡️Green Zone Strategy ...

3. Green-zoning would categorize Regions as Green/Yellow/Red, depending on #COVID19 community spread. Effectively, it means selectively imposing restrictions at sub-national level. Green zones have zero community transmission, life&work w.least restrictions, near-normal...