Discover and read the best of Twitter Threads about #smallcaps

Most recents (24)

NEXT WEEK

The Bear's Take:

•USA #recession is coming

•Bearish daily candlesticks on $SPX and $NDX

• #NDX negative divergences with classic Indis

•Leaders are overextended and some are starting to break

• #JPM collar will stop any #SPX advance at 4320

#SPX #ES_F $SPX $SPY

The Bear's Take:

•USA #recession is coming

•Bearish daily candlesticks on $SPX and $NDX

• #NDX negative divergences with classic Indis

•Leaders are overextended and some are starting to break

• #JPM collar will stop any #SPX advance at 4320

#SPX #ES_F $SPX $SPY

NEXT WEEK

The Bulls' Take

•Breakout of 4200 confirmed

•Momentum is bullish

•Market breadth improved

• $SPX now in official bull market

•Dealers increased their long positions again

• #Gamma is positive

- #CPI will be lower

- #Fed to pause

#ES #SPX $SPY #0dte #options

The Bulls' Take

•Breakout of 4200 confirmed

•Momentum is bullish

•Market breadth improved

• $SPX now in official bull market

•Dealers increased their long positions again

• #Gamma is positive

- #CPI will be lower

- #Fed to pause

#ES #SPX $SPY #0dte #options

NEXT WEEK

Our Take

• Markets are at strong resistance levels, we are expecting a pullback

• Volatile week ahead

• A likely visit to 4220

• Expecting 4320 to stop any $SPX advance

•Expecting #smallcaps to outperform

• #CPI maybe higher, but downtrending

#SPX $SPY $ES_F

Our Take

• Markets are at strong resistance levels, we are expecting a pullback

• Volatile week ahead

• A likely visit to 4220

• Expecting 4320 to stop any $SPX advance

•Expecting #smallcaps to outperform

• #CPI maybe higher, but downtrending

#SPX $SPY $ES_F

NEXT WEEK

The Bear's Take:

•Germany is in recession

• #USA #recession is coming

•Spinning top on Nasdaq

• #NDX negative divergences with classic indis

•Leading stocks are overextended

•Breadth Negative divergences

•4300 is strong resistance

#SPX #ES_F $SPX $SPY #0dte

The Bear's Take:

•Germany is in recession

• #USA #recession is coming

•Spinning top on Nasdaq

• #NDX negative divergences with classic indis

•Leading stocks are overextended

•Breadth Negative divergences

•4300 is strong resistance

#SPX #ES_F $SPX $SPY #0dte

NEXT WEEK

The Bulls's Take

•Daily, weekly and monthly bullish candlestick with high volume

•Big bullish action on Friday, with Breadth Thrust

• $SPX broke important levels on high volume

•Bullish momentum

•Dealers increased their long positions

•Positive #Gamma

#SPX $SPX

The Bulls's Take

•Daily, weekly and monthly bullish candlestick with high volume

•Big bullish action on Friday, with Breadth Thrust

• $SPX broke important levels on high volume

•Bullish momentum

•Dealers increased their long positions

•Positive #Gamma

#SPX $SPX

NEXT WEEK

Our Take

•Momentum is bullish, but indices are near resistance

•A likely visit to 4220 in the next two weeks is expected

•Hard to see a solid break above 4300 this week

•Expecting good performance from the #smallcaps this week

#SPX $SPY $ES_F $SPY #trading

Our Take

•Momentum is bullish, but indices are near resistance

•A likely visit to 4220 in the next two weeks is expected

•Hard to see a solid break above 4300 this week

•Expecting good performance from the #smallcaps this week

#SPX $SPY $ES_F $SPY #trading

Rising volume in $XLK, $VTV, and good enough $SMH transparently prepared the ground for improving #ES market breadth – but the one factor that made me reconsider the requisites of the medium-term (bearish) outlook, was this.

Financials.

LONG THREAD 👇

Financials.

LONG THREAD 👇

Every setup/patterns performance is quite different in weak or strong cycle. Different enough that it impacts edge to high degree.

#smallcaps #trading

Thread:

1.

#smallcaps #trading

Thread:

1.

For example parabolic squeezes they just don't happen in weak cycles. In strong cycles you will have few of them and one of those will be picture perfect one. Significant "show up" rate difference for pattern between the cycles.

2.

2.

Type1s in weak cycles don't squeeze past HOD much usually. Even if they do the price returns to prior HOD level soon. In strong cycles they often squeeze way past. To think this doesn't affect your risk management on short trades is mistake.

3.

3.

Al igual que Bruce Willis en El Sexto Sentido, el rebote de las bolsas desde octubre está muerto solo que él aún no lo sabe.

Veamos por qué.

Va 🧵

Veamos por qué.

Va 🧵

Para mí ésta es una realidad tan claramente observable que no es necesario recurrir a ningún tipo de dato exotérico. Lo voy a demostrar con herramientas tan sencillas que hasta están al alcance del operador más torpe.

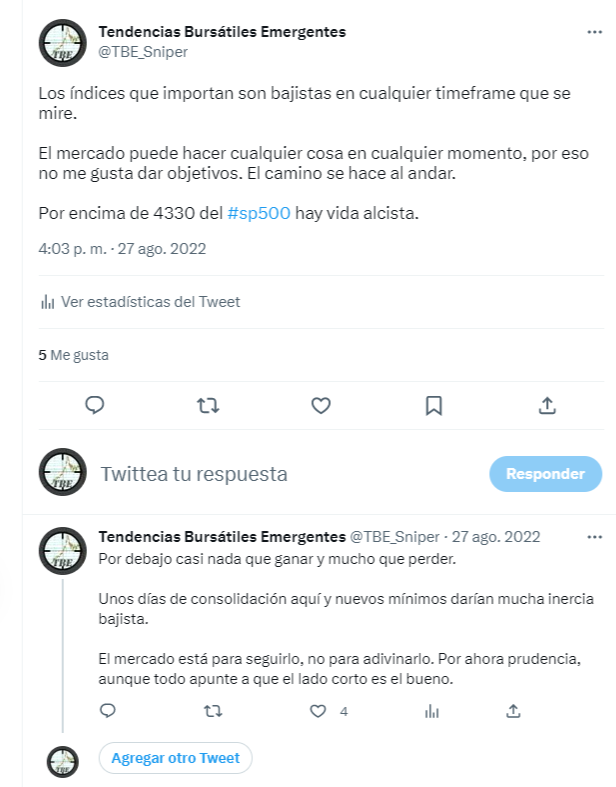

Para empezar, el 27 de agosto pasado comenté que las opciones alcistas pasaban por superar el 4330 en el #sp500 y que por debajo había mucho que perder y casi nada a ganar.

Por debajo de ese nivel solo habrá ruido hasta que se vea una verdadera capitulación de mercado.

Por debajo de ese nivel solo habrá ruido hasta que se vea una verdadera capitulación de mercado.

Tracking cycles is the most helpful method in any market including #smallcaps. No indicator or single point reason will ever provide as much clues as cycles recognition can. Here are some tips on daily routines for tracking:

#trading

1.

#trading

1.

Start tracking tickers performances.

-EOD close green or red

-intraday range % max

Note down are closes and ranges expanding/improving or decreasing for tickers on the day.

2.

-EOD close green or red

-intraday range % max

Note down are closes and ranges expanding/improving or decreasing for tickers on the day.

2.

Every strong cycle begins the same way. There is uptick for three days on stronger green closes (vs where gapping tickers open), ranges expand by 30-50%.

Tracking uptick/downticks in cycle flows every 3 days (if significant) can provide insight before things explode.

3.

Tracking uptick/downticks in cycle flows every 3 days (if significant) can provide insight before things explode.

3.

Behavior of #smallcaps is significantly different between strong and weak cycles. One has to track the cycles accurately because expectations can shift so much that any mistake made in strong cycle can get multiplied many times if risk is not respected which is common.

1.

1.

For example there are no strong AH runners in most of times except in strong cycles where big % AH runs are common. You only have to make one mistake of being sloppy on swing shorts without being aware of how cycles impact you and it can be enough to give back plenty gains.

2.

2.

There are no type4 patterns or fake breakouts reclaims to high degree in most cycles except in strong cycles. Which means that one has to be extra careful shorting breakdowns or rejects above HOD there.

3.

3.

Because the ranges are often limited the RR is tied and limited too. The weaker the cent range the less RR by default. If you try to place two, three, four+ trades on single ticker that impacts you. If you take only single big swing trade it doesn't.

2.

2.

Many traders try to extract multiple separate trades from the movements of single ticker. This exposes you to behaviors. The weaker your read is the more you are impacted over long run negatively. Low RR trades and weak read leads to difficulty.

3.

3.

📜👀My rules for small caps 2023

Long #smallcaps:

1) after a bear trap, shorts trapped

2) on pullback (9EMA, JLINES, VWAP)

3) on a support with absorption

4) on fake vwap bdown open/mid morning

5) on a halt reclaim + fake washout

6) on day 2 on reclaim of main level

Long #smallcaps:

1) after a bear trap, shorts trapped

2) on pullback (9EMA, JLINES, VWAP)

3) on a support with absorption

4) on fake vwap bdown open/mid morning

5) on a halt reclaim + fake washout

6) on day 2 on reclaim of main level

🚨Short #smallcaps:

1) on stuffs

2) at levels of premarket high

3) at daily levels

4) at fibonacci levels

5) after a bull trap, longs trapped

6) on JSLIM pattern

7) on hod fakeout

8) on halt pop and fail

1) on stuffs

2) at levels of premarket high

3) at daily levels

4) at fibonacci levels

5) after a bull trap, longs trapped

6) on JSLIM pattern

7) on hod fakeout

8) on halt pop and fail

🪪 Patters #smallcaps

1) Gap & Crap

2) Gap & Extension

3) Extensions

4) Halt & go

5) Halt pop & fail

6) Late day fade

7) Bear trap Long

8) Parabolic moves

9) Overextended plays

10) Afternoon volume reclaim long

1) Gap & Crap

2) Gap & Extension

3) Extensions

4) Halt & go

5) Halt pop & fail

6) Late day fade

7) Bear trap Long

8) Parabolic moves

9) Overextended plays

10) Afternoon volume reclaim long

If you are seriously trading Small Caps, read this!

4⃣⏲️⌛️ The 4 phases of a Pump & Dump

Often #smallcaps have Zero revenue, negative balance, high cash burning ratio.

They will raise $ through offerings and in order to do this they will sistematically run into a process.

4⃣⏲️⌛️ The 4 phases of a Pump & Dump

Often #smallcaps have Zero revenue, negative balance, high cash burning ratio.

They will raise $ through offerings and in order to do this they will sistematically run into a process.

1. The pre pump 🗞️

These are so called shell companies.

The charts of these companies look almost all the same. Weekly downtrending charts with few daily spikes.

The company, big hands, insiders will often acquire the stock shares before putting out a press release.

These are so called shell companies.

The charts of these companies look almost all the same. Weekly downtrending charts with few daily spikes.

The company, big hands, insiders will often acquire the stock shares before putting out a press release.

2. The promotion 📰

They will start an offering, S-1/3, Warrants, ATM, etc and the'll wait to send out a press release. This is called "the stock promotion". The news can often be a fast track designation, license agreement, contract, etc. They will use every kind of news.

They will start an offering, S-1/3, Warrants, ATM, etc and the'll wait to send out a press release. This is called "the stock promotion". The news can often be a fast track designation, license agreement, contract, etc. They will use every kind of news.

Shorting stuffed moves requires anticipation. For example ydays short on $BWEN 10:55, you need to focus on painted ranges (rigged) and be ready on what you need to see on tape to extract edge out of play like that (high tape velocity surge).

#smallcaps

1.

#smallcaps

1.

This brings us to another point, the edge in tape:

-its not the size

-its velocity changes

Strong changes in velocity for few minutes reveal large participant agenda. Size of one big order does not reveal consistency or aggression persistence. It can easily be a spoof.

2.

-its not the size

-its velocity changes

Strong changes in velocity for few minutes reveal large participant agenda. Size of one big order does not reveal consistency or aggression persistence. It can easily be a spoof.

2.

Single order can always be a spoof, velocity change cannot be spoofed. Hard data priority. Another reason why you should always pay more attention to speed changes and absorbing rather than what sits on bid or ask.

3.

3.

$BIOR fails to do HOD clearout

$BWEN completes HOD clearout

Same type1 setup, different delivery. Recognizing the pattern is only first small step, edge extraction goes far beyond just pattern recognition and it's why it's a multi-year process often:

#smallcaps #trading

1.

$BWEN completes HOD clearout

Same type1 setup, different delivery. Recognizing the pattern is only first small step, edge extraction goes far beyond just pattern recognition and it's why it's a multi-year process often:

#smallcaps #trading

1.

In smallcaps more than other markets you often have smaller ranges present which makes it more difficult on edge because the max RR is more capped. Details on how you execute setups start to matter a lot more because of that. This is absolutely key to understand.

2.

2.

Figuring out through details which setup is bit more likely to fail vs the other matters because of low ranges. 5-10% add on failure recognition might matter over long run. It doesn't matter on high time frame setups where liquidity and range is great, but intraday...yes.

3.

3.

Thread🧵of Sector Analysis

Covers #TechnicalAnalysis of most #sectors.

Courtesy : @YTA_School

Retweet🔁Like❤️to spread learning with all.

@KommawarSwapnil / @caniravkaria (Views Invited)

Covers #TechnicalAnalysis of most #sectors.

Courtesy : @YTA_School

Retweet🔁Like❤️to spread learning with all.

@KommawarSwapnil / @caniravkaria (Views Invited)

1⃣ Why Sector Analysis is Must ?

Read these 2 Pages from the Book 📘 "Relative Strength With Technical Analysis by @YTA_School

📘available on Amazon👉 amzn.to/3RJLYkd

#StockMarket #tradingcards

Read these 2 Pages from the Book 📘 "Relative Strength With Technical Analysis by @YTA_School

📘available on Amazon👉 amzn.to/3RJLYkd

#StockMarket #tradingcards

2⃣ NIFTY 50

Nifty was trading in short term downtrend channel. On 21 December it gave breakdown on lower end & after than nifty started correcting even more, losing more than 3.5% in just 3 trading days.

Next support is around 17650 – 17400.

#Nifty #Nifty50 #TechnicalAnalysis

Nifty was trading in short term downtrend channel. On 21 December it gave breakdown on lower end & after than nifty started correcting even more, losing more than 3.5% in just 3 trading days.

Next support is around 17650 – 17400.

#Nifty #Nifty50 #TechnicalAnalysis

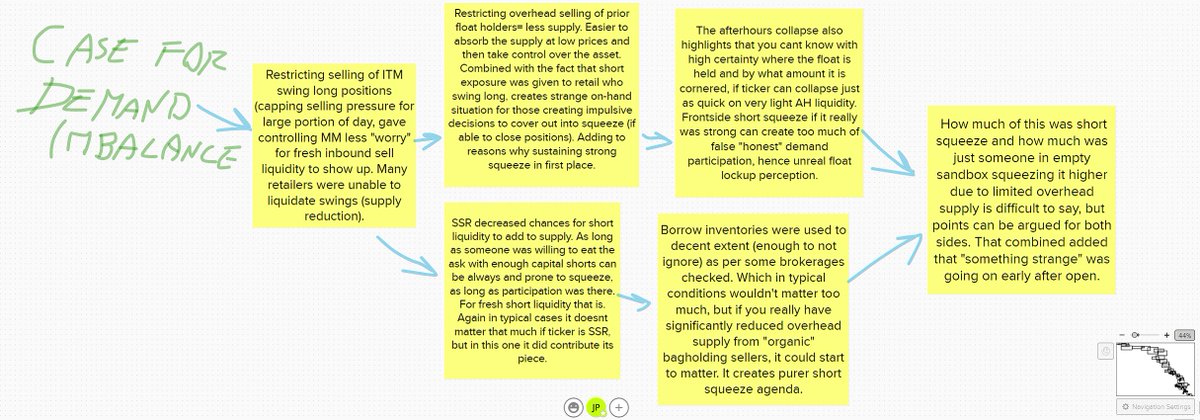

Most #smallcaps do not reverse split after being recent multiday runners. Typical R/S goes like BIMI, nothing going on month prior to the split. $COSM had a lot of swing carry positions at the tail end of multiday runner adjusted into split. Exploration opp for MMs.

1.

1.

Whether there really was failure to adjust the split correctly before market open or it was done intentionally it doesnt matter. Due to selling restrictions by many, the supply was limited. It created purer fresh squeeze agenda, and less overhead participation.

2.

2.

Restrictions on selling by many brokers added to the fact that float was more "pure" and untouched. Overhead reduced. Whoever decided to corner the float had less overhead selling presence, easier to market-make and drive out fresh shorts on SSR also.

3.

3.

End of the week recap for cycle flows in #smallcaps. Regardless of $COSM action the overall message is still quite clear, weakness incorporated.

Thread:

1.

Thread:

1.

Big picture:

Strong cycle in August followed by weak cycles more or less into December followed by strong cycle that exhausted very quickly. One prior short lived strong cycle in Sept also ended the same.

Longer lasting weak cycles combined with short lived strong cycles.

2.

Strong cycle in August followed by weak cycles more or less into December followed by strong cycle that exhausted very quickly. One prior short lived strong cycle in Sept also ended the same.

Longer lasting weak cycles combined with short lived strong cycles.

2.

For example ADFs showed up very early into this strong cycle, just three days into it heavy ADF mode.

Same as in last one. All tickers that tried to take the lead position (AMAM etc) had no d2 or d3 followthroughs. Early exhaustion.

3.

Same as in last one. All tickers that tried to take the lead position (AMAM etc) had no d2 or d3 followthroughs. Early exhaustion.

3.

1/ Catch up

“Cymat Technologies is an innovative materials technology company”

#smallcaps #canadiancompany

“Cymat Technologies is an innovative materials technology company”

#smallcaps #canadiancompany

2/ Financials

Their sales for the quarter were approximately $1.1M

in comparison to $0.9M for the comparable quarter of the last fiscal year.

Read the full report here:

prnewswire.com/news-releases/…

Their sales for the quarter were approximately $1.1M

in comparison to $0.9M for the comparable quarter of the last fiscal year.

Read the full report here:

prnewswire.com/news-releases/…

If you are short every single day, every ticker and sized you will need to develop good read on cycle flows to avoid heavy losses when strong cycle swipes in. Watching many traders over years this is pattern that happens due to over-exposure:

#smallcaps #trading

Thread:

1.

#smallcaps #trading

Thread:

1.

If you find reason to be short on everything, it means you will also be then short things that will squeeze heavy. Lack of selectivity and over-engagement math dictates this will happen. This is where volatility comes into play and does the damage.

2.

2.

As you get winners in weak cycles those are X amount of R units. When volatility expands in strong cycle and you stack just few surprising big losses it eats up entire weak cycle gains because you underestimated how volatility and non-vol adjusted sizing will impact you.

3.

3.

Years of research, studying, mentoring traders to find out that majority of traders fail for these reasons.

The top 4 points:

1⃣ Traders are indisciplined. They have a strategy, create a plan but often they won't respect it, getting highjacked by a thought, a friend, a feeling

The top 4 points:

1⃣ Traders are indisciplined. They have a strategy, create a plan but often they won't respect it, getting highjacked by a thought, a friend, a feeling

2⃣ Traders have no patience. They will anticipate a trade because they want to be part of the party no matter what. They will be late and still take the trade because they won't want to miss it as if that's the only opportunity in their lives.

3⃣ Traders will lack confidence. Without confidence a trader cannot use size and confidence is made by having consistency and consistency comes from:

- experience

- backtesting your strategy

- practice

- experience

- backtesting your strategy

- practice

Thread🧵of Sector Analysis

Covers #TechnicalAnalysis of most #sectors.

Courtesy : @YTA_School

Retweet🔁Like❤️to spread learning with all.

@KommawarSwapnil @caniravkaria

Covers #TechnicalAnalysis of most #sectors.

Courtesy : @YTA_School

Retweet🔁Like❤️to spread learning with all.

@KommawarSwapnil @caniravkaria

1⃣ Why Sector Analysis is Must ?

Read these 2 Pages from the Book 📘 "Relative Strength With Technical Analysis by @YTA_School

Read these 2 Pages from the Book 📘 "Relative Strength With Technical Analysis by @YTA_School

2⃣ NIFTY 50

An inverted head and shoulder pattern was seen on chart few days back. If the index comes to retest and gives a strong bullish setup, we are looking for a strong upside move in nifty in coming months.

#Nifty #Nifty50 #TechnicalAnalysis

An inverted head and shoulder pattern was seen on chart few days back. If the index comes to retest and gives a strong bullish setup, we are looking for a strong upside move in nifty in coming months.

#Nifty #Nifty50 #TechnicalAnalysis

Prolonged contraction of ranges and volatility brings strong expansion after. But since contraction can last for very long (2 months) the key is identifying those little clues that suggest expansion this time really might happen.

Weak-strong ignition.

#smallcaps

Thread:

1.

Weak-strong ignition.

#smallcaps

Thread:

1.

Day2 liquidity increase is something I track closely. SMMT had two days ago significant increase in d2 liquidity and squeeze unlike majority of past tickers for entire month. Disconnect of theme. Significant factor.

Warning 1.

2.

Warning 1.

2.

Type4 patterns increased. They went from non-existent for entire 3 weeks to all sudden being present on $SMMT two days ago. Type4s never show up randomly. They are mostly present in early stages of strong cycle, they are liquidity hunting patterns for MMs.

Warning 2.

3.

Warning 2.

3.

🔎 How to trade #smallcaps

1) $AMAM has his own structure which is categorized as explained in watchlist into ssr + high volume premarket.

The fact it does not have any overhead volume resistance lowers the forecast for a short into a 50:50. Then we have to consider the play

1) $AMAM has his own structure which is categorized as explained in watchlist into ssr + high volume premarket.

The fact it does not have any overhead volume resistance lowers the forecast for a short into a 50:50. Then we have to consider the play

2) $AMAM SWITCH BIAS

The first pattern to look for is always a pop and fail at the gate because we are trading #smallcaps. If this level of premarket high holds then you have no reason to short and you have to be able to reverse to long as in the pic shown before.

The first pattern to look for is always a pop and fail at the gate because we are trading #smallcaps. If this level of premarket high holds then you have no reason to short and you have to be able to reverse to long as in the pic shown before.

3) $AMAM POSITION

The main patterns at this point is buying dips. Shorts are trapped at premarket high and lower, volume is high and for $1stocks this means above 800K x minute. This is a 🔑 parameters backtesting 3 years of data for this category. The play becomes a runner.

The main patterns at this point is buying dips. Shorts are trapped at premarket high and lower, volume is high and for $1stocks this means above 800K x minute. This is a 🔑 parameters backtesting 3 years of data for this category. The play becomes a runner.

Doing manual test to confirm misconceptions is important to refine your knowledge of markets. Many ask: Are whole round numbers important in #smallcaps #trading?

Run simple exercise to see significance vs noise:

1.

Run simple exercise to see significance vs noise:

1.

Collect 200 smallcap charts, find how many run on fresh frontside into whole round number and what happens to price there. For example first push from 4.2 to 5.00.

Run it for multiple % levels not just one: 2, 4, 5 etc. First touch-test only.

2.

Run it for multiple % levels not just one: 2, 4, 5 etc. First touch-test only.

2.

Is reject followed often (by 30c) or does many times price swipe straight over? Remember what you seek is significance vs randomness. If sometimes it works but many times it does not respect level at all, the answer is hidden in finding right complimentary situations.

3.

3.

The market today:

$SPX / $SPY / $ES

It closed below the key 20DMA in higher volume than yesterday

It's still in its upward trending channel

It bounced from channel support

#SPX #ES_F #trading #options #futures #daytrading #TradingSignals

$SPX / $SPY / $ES

It closed below the key 20DMA in higher volume than yesterday

It's still in its upward trending channel

It bounced from channel support

#SPX #ES_F #trading #options #futures #daytrading #TradingSignals

$DIA / $DJI / $YM

It closed below the key 20DMA in higher volume than yesterday

It's still in its upward trending channel

It bounced from channel support

#DIA #DJIA #DowJones #trading #options #Futures #OptionsTrading #DayTrading #TradingSignals #YM_F

It closed below the key 20DMA in higher volume than yesterday

It's still in its upward trending channel

It bounced from channel support

#DIA #DJIA #DowJones #trading #options #Futures #OptionsTrading #DayTrading #TradingSignals #YM_F

$QQQ / $NDX / $NQ

It closed below the key 20DMA in higher volume than yesterday

It's still in its short-term upward trending channel and its mid-term downward channel

It bounced near channel support

#QQQ #NASDAQ #IXIC #NDX #trading #OptionsTrading #Futures #NQ_F #daytrading

It closed below the key 20DMA in higher volume than yesterday

It's still in its short-term upward trending channel and its mid-term downward channel

It bounced near channel support

#QQQ #NASDAQ #IXIC #NDX #trading #OptionsTrading #Futures #NQ_F #daytrading

Some have lately stepped up educating about manipulation in #smallcaps. To highlight there is significant difference in only doing it in hindsight vs doing it with actionable insight realtime. Second one requires significant more exp and trickery mindset.

1.

1.

Key being if one can't do it realtime with forward warnings often the usecase is limited. Anyone can actually "educate" about rigged things in all games out there, because the complexity only is noticeable in realtime not hindsight. Why?

2.

2.

Becuase of difficulty of getting it right realtime. For anyone really doing it well realtime you would quickly realize it's not easy to hit good accuracy at all, even if in hindsight it all clicks "on the paper".

Educating about it and executing on it is very different.

3.

Educating about it and executing on it is very different.

3.