Discover and read the best of Twitter Threads about #taxation

Most recents (24)

🔎Unlocking the Mysteries of Section 60: Provisional Assessment! 🧵

💡 Are you struggling to determine the value or rate of tax for goods or services? Fear not! Section 60 of the GST Act offers a solution: provisional assessment. Let's dive into the key points:

📝 If you find yourself in this predicament, write a formal request to the proper officer, explaining why you need to pay tax on a provisional basis

Key Points of CBIC's Automated Return Scrutiny Module (ARSM) for GST returns

The CBIC has rolled out an Automated Return Scrutiny Module (ARSM) for GST returns. Learn more about this new tool and how it can help improve GST compliance in India

#GST #Compliance #Taxation #India

The CBIC has rolled out an Automated Return Scrutiny Module (ARSM) for GST returns. Learn more about this new tool and how it can help improve GST compliance in India

#GST #Compliance #Taxation #India

Automated GST Scrutiny

The Central Board of Indirect Taxes and Customs (CBIC) has rolled out an Automated Return Scrutiny Module (ARSM) for GST returns.

The Central Board of Indirect Taxes and Customs (CBIC) has rolled out an Automated Return Scrutiny Module (ARSM) for GST returns.

The ARSM is a non-intrusive means of compliance verification that allows tax officers to scrutinize GST returns of Centre Administered Taxpayers (CATs) selected on the basis of data analytics and risks identified by the system.

Step by step process for computation of total income and tax payable (with respect to an individual assessee)

New practicing CAs and professionals may also use this.

#usefulsummary #icai #caintermediate #castudents #taxation #incometax #icaiexams #caexams #superradacademy

New practicing CAs and professionals may also use this.

#usefulsummary #icai #caintermediate #castudents #taxation #incometax #icaiexams #caexams #superradacademy

Figure 1 reference for residential status

It is difficult for new startup founders to understand GST system.

We have simplified it below:

#startups

We have simplified it below:

#startups

GST (Goods and Services Tax) is a tax system in India that requires businesses to file their tax returns electronically.

There are different types of GST returns, including GSTR-1, GSTR-2B, and GSTR-3B. Here's a brief explanation of how each one works:

#GSTsimplified

There are different types of GST returns, including GSTR-1, GSTR-2B, and GSTR-3B. Here's a brief explanation of how each one works:

#GSTsimplified

GSTR-1: This return is filed by businesses to report their outward supplies of goods or services.

In simple terms, it means the sales made by the business.

The return needs to be filed monthly or quarterly, depending on the turnover of the business.

#founders

In simple terms, it means the sales made by the business.

The return needs to be filed monthly or quarterly, depending on the turnover of the business.

#founders

Here is this Week’s Market Wrap

'The Times Get Taxing' written by @shyamsek

A Thread (1/n)

#tax #investing #taxbenefits #marketwrap

'The Times Get Taxing' written by @shyamsek

A Thread (1/n)

#tax #investing #taxbenefits #marketwrap

Investment decisions can be taken based on tax implications. There is a natural tendency among investors to be drawn to investments where they feel taxes are lower. (2/n)

#taxes #investments #investors

#taxes #investments #investors

When the tax concessions are withdrawn for certain investments, they tend to look less attractive to investors. (3/n)

#taxconcession #investing

#taxconcession #investing

8 ways to save taxes on your Salary🤑

A Thread🧵⤵️

Hit retweet🔁to reach the maximum taxpayers!

#taxation #investing

A Thread🧵⤵️

Hit retweet🔁to reach the maximum taxpayers!

#taxation #investing

Be it taxes on salary, bonus or business income, nobody likes paying a part of their income to govt.

So, here are some of the ways through which you can save your taxes⤵️

So, here are some of the ways through which you can save your taxes⤵️

▣ Interest on Savings Account:

Section: 80TTA

Interest on savings accounts held in post offices, banks, etc., is taxable under “income from other sources”, but no TDS is deducted.

The max of Rs 10,000 can be claimed as a deduction.

Section: 80TTA

Interest on savings accounts held in post offices, banks, etc., is taxable under “income from other sources”, but no TDS is deducted.

The max of Rs 10,000 can be claimed as a deduction.

Entrepreneurs, are you tired of paying hefty taxes?

Don't worry! We got you covered!

Check out these top tax-saving tips that can benefit your business and your bottom line. (1/n)

#entrepreneurs #taxes #taxsavings #taxtips

Don't worry! We got you covered!

Check out these top tax-saving tips that can benefit your business and your bottom line. (1/n)

#entrepreneurs #taxes #taxsavings #taxtips

#1 Hire Family Members & Relatives:

You can reduce your tax liability by paying salaries to family members, which are tax-deductible. Their income may also be below the taxable threshold. (2/n)

#tax #taxexemption #taxliability

You can reduce your tax liability by paying salaries to family members, which are tax-deductible. Their income may also be below the taxable threshold. (2/n)

#tax #taxexemption #taxliability

#2 Deduct Business Expenses for Travel & Accommodation:

Business travel expenses such as tickets and accommodation can be deducted from your taxable income, thus reducing your tax liability.

(3/n)

#taxliability #businessexpenses #deductions

Business travel expenses such as tickets and accommodation can be deducted from your taxable income, thus reducing your tax liability.

(3/n)

#taxliability #businessexpenses #deductions

1.

Infra gets boost:

- Highest ever capital outlay of Rs. 2.40 lakh crores for Railways

- 50-year interest-free loans to states one more year for infra spends

Infra gets boost:

- Highest ever capital outlay of Rs. 2.40 lakh crores for Railways

- 50-year interest-free loans to states one more year for infra spends

2.

Agri & Fisheries to benefit:

- Agricultural accelerator fund to promote agri-startups

- 10,000 bio-input resource centres in next 3 yrs to promote natural farming

- 6000 Cr outlay for Animal husbandry, dairy, and fisheries

Agri & Fisheries to benefit:

- Agricultural accelerator fund to promote agri-startups

- 10,000 bio-input resource centres in next 3 yrs to promote natural farming

- 6000 Cr outlay for Animal husbandry, dairy, and fisheries

🇸🇴 The #Somali Islamist group, #alShabaab, is the ‘largest, wealthiest and most deadly’ al-Qaeda affiliate remaining in the world.

🔴 Despite losing territory since 2011, the group has remained dominant, exerting control and power far beyond areas it physically controls.

🔴 Despite losing territory since 2011, the group has remained dominant, exerting control and power far beyond areas it physically controls.

💰 #AlShabaab’s continued resilience can largely be attributed to their checkpoint #taxation apparatus it has established throughout southern #Somalia.

The group categorizes its #tax system into four streams:

🚚 Transit

📦 Goods

🌾 Agricultural produce

🐐 Livestock

The group categorizes its #tax system into four streams:

🚚 Transit

📦 Goods

🌾 Agricultural produce

🐐 Livestock

⚠️ Despite the group’s #checkpoints and #tax officials routinely targeted by government and international forces, #AlShabaab can easily adapt by relocating those checkpoints and replacing the tax collectors.

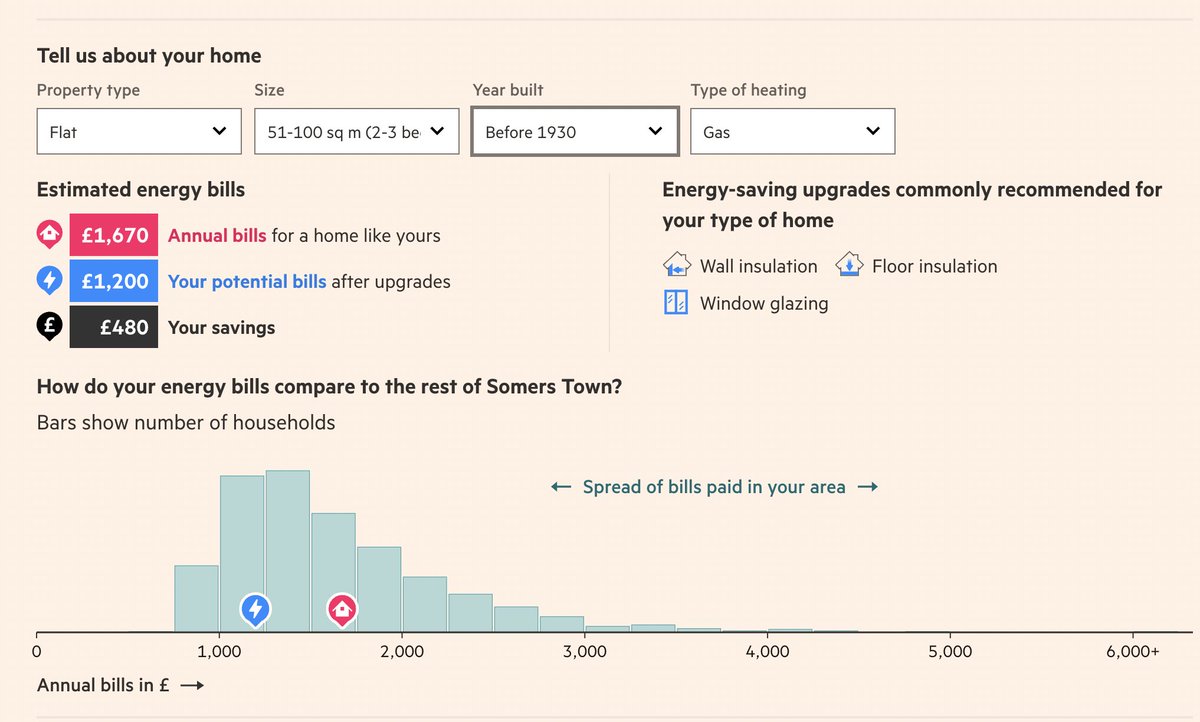

After 5 months of intense work the @FT published this piece that involved a ton of hands-on work. Check it out ➡️ ig.ft.com/uk-energy-effi…. It looks sleek but I do want to raise a few further points that I think could be discussed differently

#EnergyCrisis #EnergyBills #energy

#EnergyCrisis #EnergyBills #energy

Point 1: We provided bill estimates under multiple price scenarios. Treating the #EnergyPriceGuarantee as the "price" I find problematic. The EPG implies a #EnergySubsidy benefitting mostly the well off that we all need to fund through #austerity and/or higher #taxation. So this

does not represent the full economic cost. It also ignores carbon prices which we all need should be MUCH higher. Using estimates based on the Oct 2022 Ofgem price cap ~ £3500 per year which is inline with predictions for most of 2023 (see forecasts from @CornwallInsight).

To all of you who are new to the workforce… Congratulations!!! You have secured your first job.

But are you confused about how to best use your current salary? (1/n)

#salary #cashflow #payday #money

But are you confused about how to best use your current salary? (1/n)

#salary #cashflow #payday #money

Most people complicate things. It is only natural when there are so many investment products to choose from. That need not be the case.

Here are some simple tips for someone just starting! (2/n)

#equity #fixedincome #gold #realestate

Here are some simple tips for someone just starting! (2/n)

#equity #fixedincome #gold #realestate

#1 Start Building an Emergency Fund

This should be your first priority. In case of emergencies, you shouldn't be left empty-handed.

Having 3-6 months of expenses set aside will be optimal. (3/n)

#emergencyfund #savings

This should be your first priority. In case of emergencies, you shouldn't be left empty-handed.

Having 3-6 months of expenses set aside will be optimal. (3/n)

#emergencyfund #savings

So, @Jeremy_Hunt now did a full and welcome u-turn on the #minibudget2022. And they are starting to tackle another policy that needs fixing, the #EnergyPriceguarantee #EPG. Why should this happen? This is a story that can ultimately be summarised in these two pictures.... 1/..

Thread 🧵on Advance Tax.

Applicability, Consequences of Non Payment, Calculations, How to Make Payment etc.

#advancetax

Retweet for maximum reach 🙏

Applicability, Consequences of Non Payment, Calculations, How to Make Payment etc.

#advancetax

Retweet for maximum reach 🙏

Q. What is an advance tax?

In simple term paying taxes in "Installments" rather than in lump sum while filing ITR. Tax amount paid before 31st March of respective FY is considered as an advance tax.

Tax is to be paid before certain due dates given by @IncomeTaxIndia

In simple term paying taxes in "Installments" rather than in lump sum while filing ITR. Tax amount paid before 31st March of respective FY is considered as an advance tax.

Tax is to be paid before certain due dates given by @IncomeTaxIndia

Q. Applicability of Advance Tax ?

Advance tax applicable to all assesses whose tax liability in a year exceeds Rs.10,000

Assessees include Salaried people, Businesses, Freelancers, Traders etc. This means all assesses.

Advance tax applicable to all assesses whose tax liability in a year exceeds Rs.10,000

Assessees include Salaried people, Businesses, Freelancers, Traders etc. This means all assesses.

*How #SriLanka got ruined*

Lankans voted for #Rajapakshas knowing very well what they did in the past, including corruption, selling out national assets to #China, #dynastic politics and all.

They still voted for them because Rajapakshas promised things they could not refuse.

Lankans voted for #Rajapakshas knowing very well what they did in the past, including corruption, selling out national assets to #China, #dynastic politics and all.

They still voted for them because Rajapakshas promised things they could not refuse.

1. Their #GST, called VAT Tax, on all products was reduced to 8%, thus making everything cheaper in one stroke. (It also killed the govt revenue). People loved things getting cheaper.

2. The minimum #incometax threshold was changed from 5 Lakhs per annum to 30 Lakhs! Very few earned more than 30L!

A very large part of the population became #tax exempt. This was very popular among the salaried class.

A very large part of the population became #tax exempt. This was very popular among the salaried class.

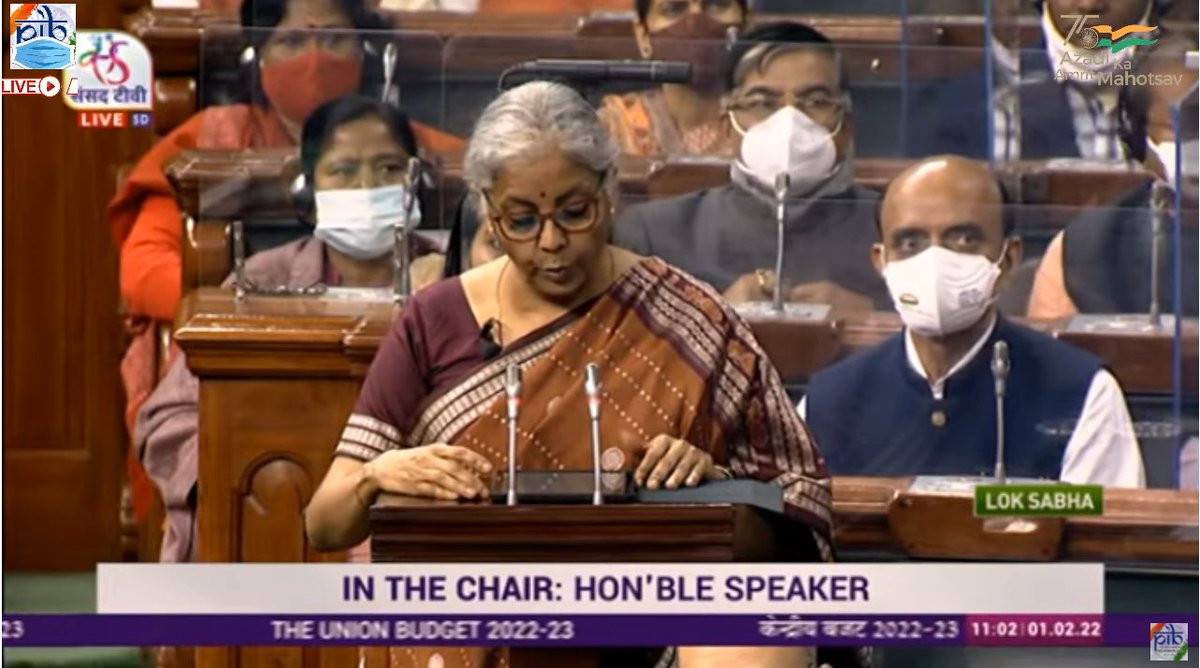

📡LIVE NOW📡

Finance Minister @nsitharaman is presenting the Union Budget 2022-23 in Parliament

#AatmanirbharBharatKaBudget #Budget2022

Watch here📺 twitter.com/i/broadcasts/1…

Finance Minister @nsitharaman is presenting the Union Budget 2022-23 in Parliament

#AatmanirbharBharatKaBudget #Budget2022

Watch here📺 twitter.com/i/broadcasts/1…

Union Finance Minister @nsitharaman rises to present #Budget2022 in Parliament

Watch 📡LIVE📡:

Stay tuned for updates

#AatmanirbharBharatKaBudget

Watch 📡LIVE📡:

Stay tuned for updates

#AatmanirbharBharatKaBudget

FM @nsitharaman begins presentation of #Budget2022 by expressing empathy with those who had to bear adverse health and economic affects of #COVID19 #Pandemic

Overall sharp rebound and recovery of the economy is reflective of 🇮🇳India's strong resilience

Overall sharp rebound and recovery of the economy is reflective of 🇮🇳India's strong resilience

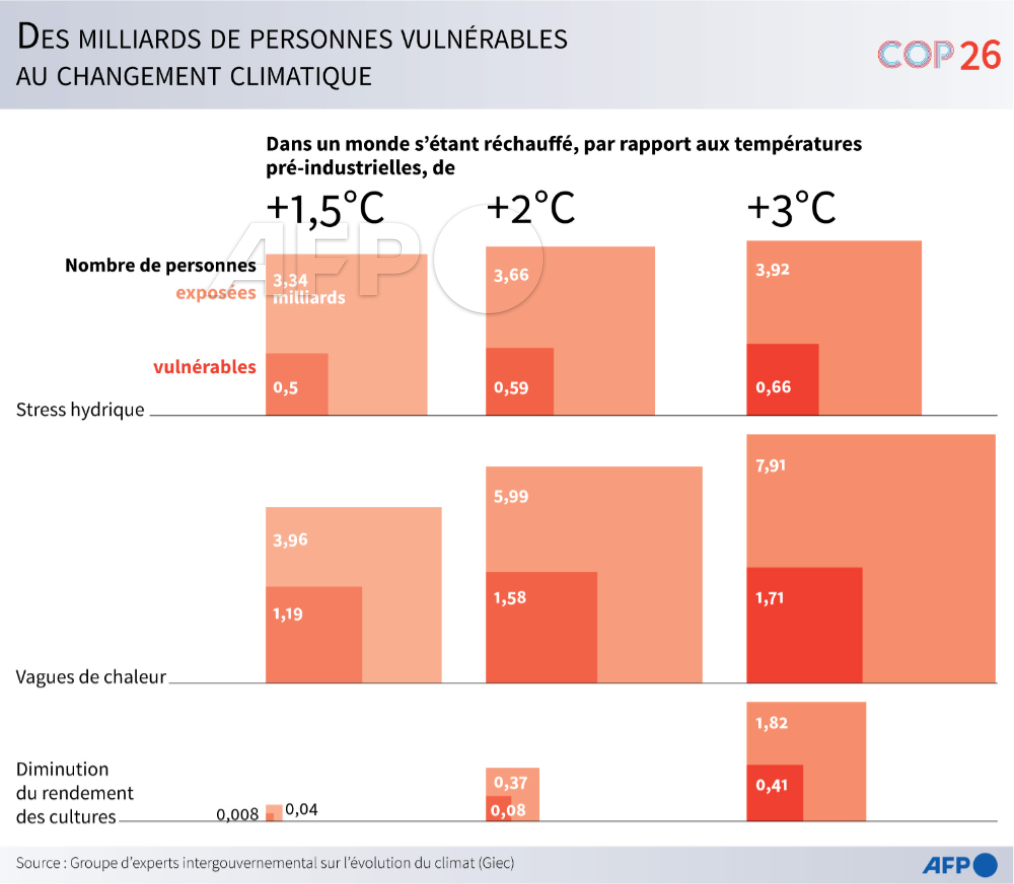

#G20 #AFP

Voici un tour d'horizon des principaux points du communiqué publié aujourd'hui à l'issue d'une réunion de deux jours à Rome 1/6

Voici un tour d'horizon des principaux points du communiqué publié aujourd'hui à l'issue d'une réunion de deux jours à Rome 1/6

#Climat

Le G20 réaffirme l'objectif de l'accord de Paris, à savoir "maintenir l'augmentation moyenne des températures bien en-dessous de 2 degrés et poursuivre les efforts pour la limiter à 1,5 degré au-dessus des niveaux pré-industriels" 2/6

Le G20 réaffirme l'objectif de l'accord de Paris, à savoir "maintenir l'augmentation moyenne des températures bien en-dessous de 2 degrés et poursuivre les efforts pour la limiter à 1,5 degré au-dessus des niveaux pré-industriels" 2/6

Daily Bookmarks to GAVNet 10/06/2021 greeneracresvaluenetwork.wordpress.com/2021/10/06/dai…

The Future of Cities After the Pandemic

urbanland.uli.org/development-bu…

#architecture #UrbanDesign #OfficeBuildings #PandemicResponse

urbanland.uli.org/development-bu…

#architecture #UrbanDesign #OfficeBuildings #PandemicResponse

LET’S POLITICIZE COST-BENEFIT ANALYSIS

lpeproject.org/blog/lets-poli…

#CostBenefitAnalysis #applications

lpeproject.org/blog/lets-poli…

#CostBenefitAnalysis #applications

Chairperson announced in #RajyaSabha today morning that he has admitted notice for discussion on #FarmersProtests

[even though he mentioned that he received notices on other issues also]

But as soon as MPs demanded, '#Pegasus, Pegasus', the House was adjourned till 12pm.

[even though he mentioned that he received notices on other issues also]

But as soon as MPs demanded, '#Pegasus, Pegasus', the House was adjourned till 12pm.

#RajyaSabha resumes at 12pm, only to be adjourned again immediately till 2pm.

Doesn't work for even a minute.

#SansadNothingToWatch

Doesn't work for even a minute.

#SansadNothingToWatch

#RajyaSabha resumes

Minister for Parliamentary Affairs announces that Supplementary List of Business is issued, Taxation amendment Bill listed

Derek O'Brien objects, states that 30 Bills passed at 10 minutes per Bill, only 11% of Bill scrutinized by Committees, PM answered 0 Qs

Minister for Parliamentary Affairs announces that Supplementary List of Business is issued, Taxation amendment Bill listed

Derek O'Brien objects, states that 30 Bills passed at 10 minutes per Bill, only 11% of Bill scrutinized by Committees, PM answered 0 Qs

Daily Bookmarks to GAVNet 06/06/2021 greeneracresvaluenetwork.wordpress.com/2021/06/06/dai…

The Birth of the Administrative State: Where It Came From and What It Means for Limited Government

heritage.org/political-proc…

#AdministrativeState #OrganizationDesign #constitution #government

heritage.org/political-proc…

#AdministrativeState #OrganizationDesign #constitution #government

Doom: The Politics of Catastrophe—A Review

quillette.com/2021/05/06/doo…

#BookReview #politics #catastrophes #causes #consequences #responses #history

quillette.com/2021/05/06/doo…

#BookReview #politics #catastrophes #causes #consequences #responses #history

Daily Bookmarks to GAVNet 03/31/2021 greeneracresvaluenetwork.wordpress.com/2021/03/31/dai…

Statistical Consequences of Fat Tails: Real World Preasymptotics, Epistemology, and Applications

researchers.one/articles/20.01…

#MathematicalStatistics #FatTails #ProbabilityTheory

researchers.one/articles/20.01…

#MathematicalStatistics #FatTails #ProbabilityTheory

𝐓𝐚𝐱𝐚𝐭𝐢𝐨𝐧 𝐟𝐨𝐫 𝐒𝐭𝐨𝐜𝐤 𝐌𝐚𝐫𝐤𝐞𝐭 & 𝐌𝐮𝐭𝐮𝐚𝐥 𝐅𝐮𝐧𝐝 𝐈𝐧𝐯𝐞𝐬𝐭𝐨𝐫𝐬

1. 𝘓𝘛𝘊𝘎 (𝘗𝘦𝘳𝘪𝘰𝘥 𝘰𝘧 𝘏𝘰𝘭𝘥𝘪𝘯𝘨 > 1 𝘺𝘦𝘢𝘳) : Equity, Equity MF – 0% for first Rs 1 lac, 10% on exceeding Rs 1 lac, Debt MF: 20% after indexation benefit

1. 𝘓𝘛𝘊𝘎 (𝘗𝘦𝘳𝘪𝘰𝘥 𝘰𝘧 𝘏𝘰𝘭𝘥𝘪𝘯𝘨 > 1 𝘺𝘦𝘢𝘳) : Equity, Equity MF – 0% for first Rs 1 lac, 10% on exceeding Rs 1 lac, Debt MF: 20% after indexation benefit

2. 𝘚𝘛𝘊𝘎 (𝘗𝘦𝘳𝘪𝘰𝘥 𝘰𝘧 𝘏𝘰𝘭𝘥𝘪𝘯𝘨 < 1 𝘺𝘦𝘢𝘳) subject to Total Income exceeding 2.5 lacs : Equity: 15%, Equity MF: 15%, Debt MF: as per individual tax slab

3. If you have bought and sold the same shares multiple times then use 𝐅𝐈𝐅𝐎 methodology to calculate the holding period and Capital gains

4. Long term capital loss can be setoff only against long term capital gain.

4. Long term capital loss can be setoff only against long term capital gain.

Daily Bookmarks to GAVNet 03/27/2021 greeneracresvaluenetwork.wordpress.com/2021/03/27/dai…

Why a West Chester board member removed his shirt during a recent town hall

fox19.com/2021/03/25/why…

#AsianAmericans #patriotism #discrimination

fox19.com/2021/03/25/why…

#AsianAmericans #patriotism #discrimination

Daily Bookmarks to GAVNet 02/03/2021 greeneracresvaluenetwork.wordpress.com/2021/02/03/dai…

Sustainability benchmarks for plastics recycling and redesign

phys.org/news/2021-02-s…

#sustainability #benchmarks #plastic #recycling #redesign

phys.org/news/2021-02-s…

#sustainability #benchmarks #plastic #recycling #redesign

A brief & simple thread on a long & complicated #Taxation Bill💶💷

This sees aspects of NI/IRL #Protocol brought into effect

TL;DR The Irish Sea is now a #customs border.

What this means in practice depends on UK-EU deal + details of y'day's JC agmt

bills.parliament.uk/bills/2811

1/8

This sees aspects of NI/IRL #Protocol brought into effect

TL;DR The Irish Sea is now a #customs border.

What this means in practice depends on UK-EU deal + details of y'day's JC agmt

bills.parliament.uk/bills/2811

1/8

#TaxationBill is infamous:

To push agmt on the #Protocol, UKG threatened to use this Bill to breach it [I'm aware that sounds nonsensical]

What UKG wd hv broken was the need for *joint* UK-EU decisions on how to implement the Protocol.

We're told they have these ready now.

2/8

To push agmt on the #Protocol, UKG threatened to use this Bill to breach it [I'm aware that sounds nonsensical]

What UKG wd hv broken was the need for *joint* UK-EU decisions on how to implement the Protocol.

We're told they have these ready now.

2/8