Discover and read the best of Twitter Threads about #tlt

Most recents (20)

Since the recent event with arguably the largest echo was the #FOMC decision, it's called - what else- "The Pause That Refreshes"

1/n

#FRB

#FederalReserve

1/n

#FRB

#FederalReserve

The first thing to notice is that goods prices have broadly stabilised and volumes are fairly flat - in other words, #NGDP has ceased its torrid pace of increase. Service prices are still elevated but #payroll cost increase is slowing.

2/n

2/n

The #ISM #PMI showed an uptick but is still below 50 which implies that revenue growth is NOT about to accelerate again. Again, slower #inflation & flatline volume = an end to the boom, but not yet a bust.

3/n

3/n

Have US Treasury yields finally peaked? 🧵 1/x

#TLT $TLT #bonds #Fed #recession #StockMarket #investing #trading #inflation

#TLT $TLT #bonds #Fed #recession #StockMarket #investing #trading #inflation

They may have, but there are still significant risks. The market has been driving yields lower by pricing in a Fed pivot, NOT recession. First, why is the market pricing in a Fed pivot? 2/x

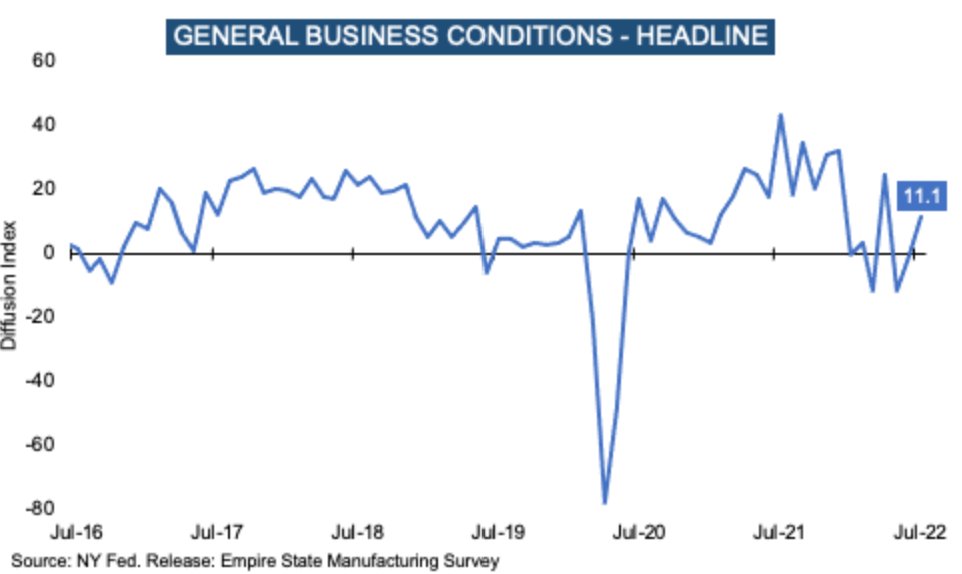

1- #Connectingthedots Today the NY Fed survey came out, which surveys local manufacturing businesses. The headline number, which is based on *current* view, looks benign. So "all is good"?

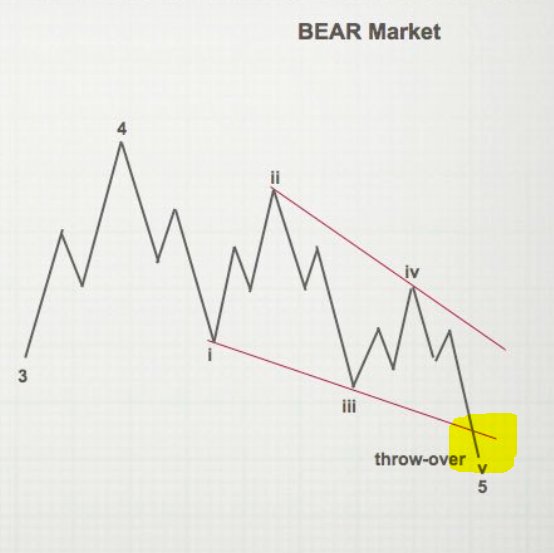

This is a MASSIVELY Bearish pattern. No question about it! #Gold can rally higher from here (yellow) or it can break from here. But there is nothing Bullish about this. And the speed by which this will be resolved.... whoa!! The resolve is for entire correctional move since 2015!

Good morning! 😀Fed is all in (again!!) - and this time there is a great confidence among traders (again!!) that Fed can has stopped deflation and supplied enough liquidity to the system. But is that really the case? Stay tuned for my perspectives #HZupdates

Let me start an nontraditional way - with a zoom in. This is #SP500 1 hour chart. I look for corrections and main directional moves. This is a correctional move - and it may have finalized! So - the main wave will soon set in again. Now - lets zoom out #HZupdates

Dear all 🙂Hope you enjoy the weekend! We are still in the Twilight Zone. Despite continued deteriorating economic fundamentals across the globe, US stock market continues to rally. But for how long...? Stay tuned for some #HZupdates

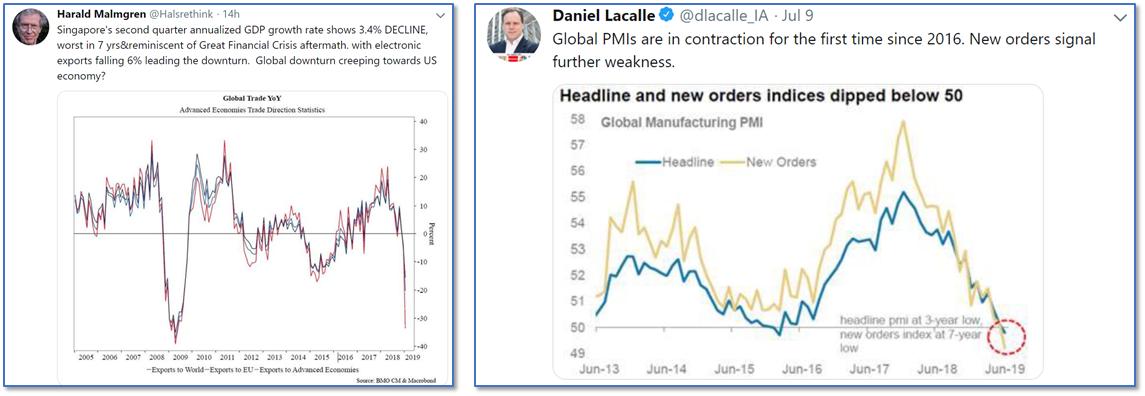

Indicators and signals across the globe continue to suggest economic slowdown - which slowly but surely spreads to all geographical regions and industries. It is my firm belief, that US will not decouple and US #equities will realize this at some point #HZupdates

#WTI sends clear signal from major Ending Diagonal. We may rally further in wave (B) - but soon we will see a reversal, which will send #Oil towards its LT-target of <20USD #HZupdates

Good morning all! 🙂 Morning in Copenhagen - listening to Ludovico while I'm updating analyses and family sleeps. Fantastic piece of music: #AllisGood

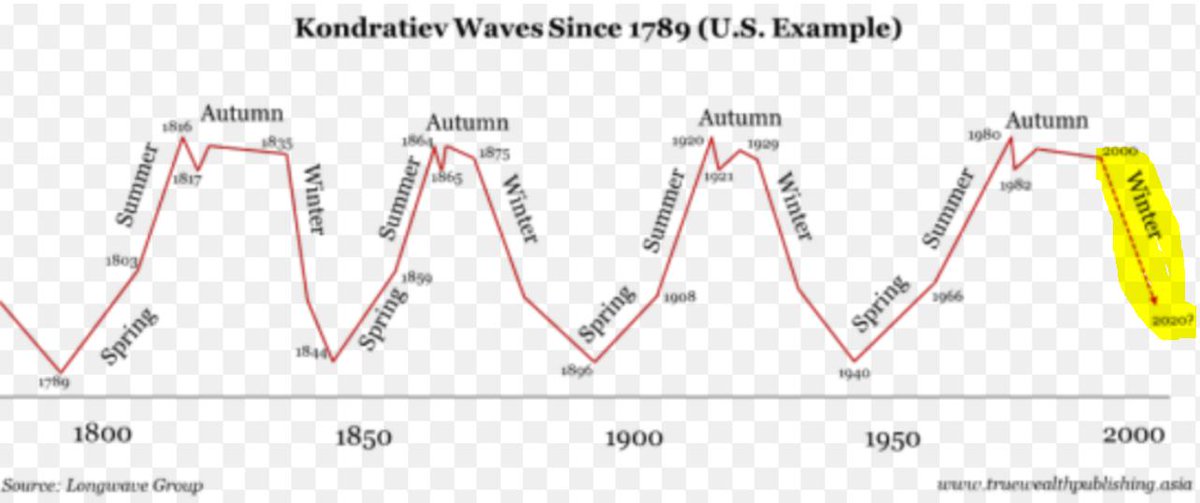

Time for some #HZupdates. Let's take a look at the market from the way I see it. Where is that deflation, I have been forecasting? Did CBs succeed to do their magic and eliminate that threat? What about the Kondratiev's winter - over/done? Stay tuned! 🙂

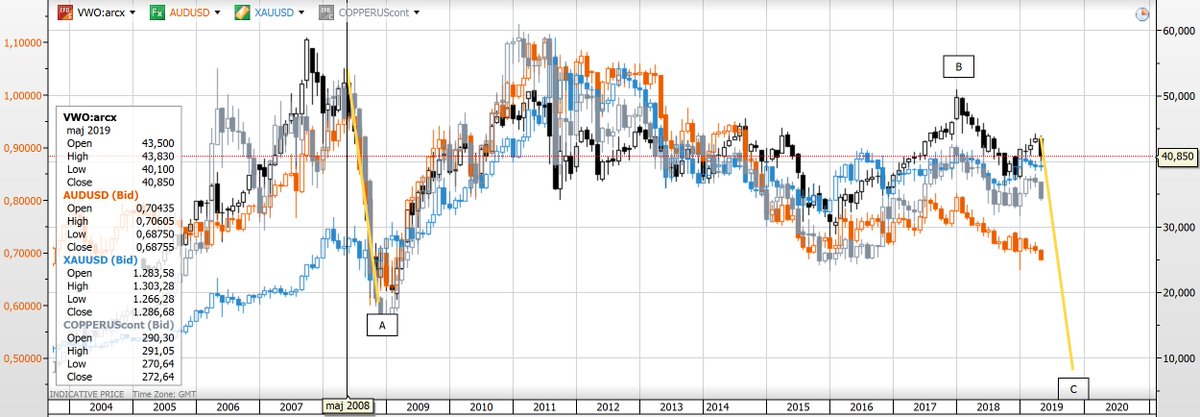

AUDUSD is inflation gauge. Rally=inflation up; Decline=inflation down. LT perspective looks like this. Decline in 2008 = wave A. Rally up to 2011 = wave B. We have since been in wave C. Wave 5 will take us to ~0.5. Note the horizontal line. When this goes -->free fall #HZupdates

#Emerging Markets look really bad here. Chart of #VWO below. We are about to see strong decline as wave C develops. Watch out below #HZupdates

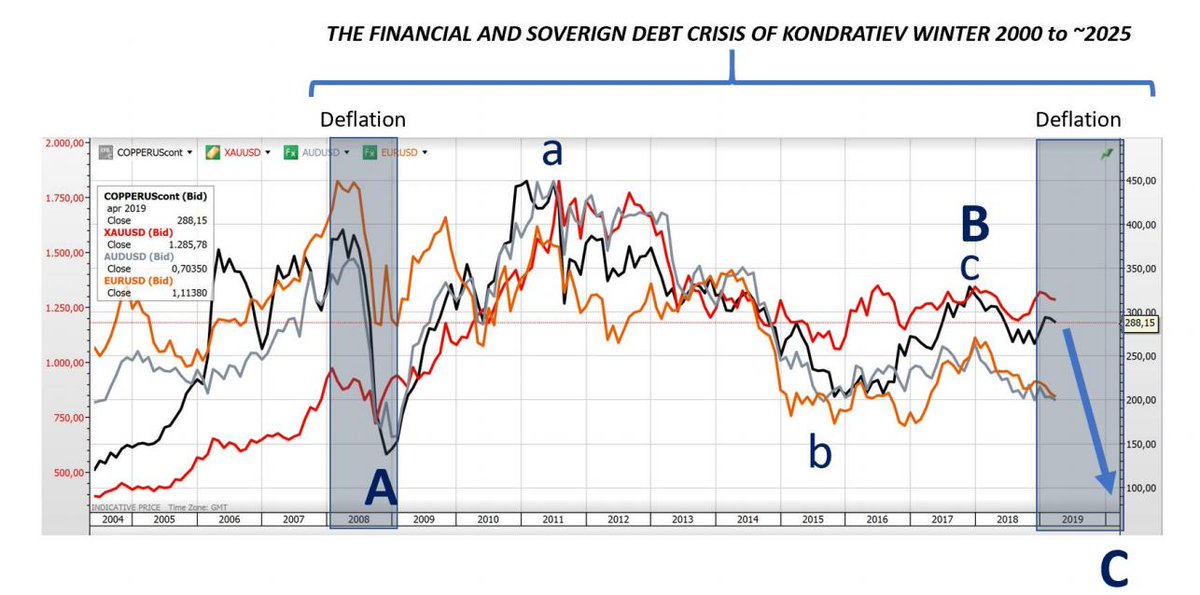

This is all you need to focus on #Copper, #EmergingMarkets #AUDUSD #GOLD. Let me spell it for you: D E F L A T I O N. We are time-wise around May-June of 2008 #HZupdates

TLT about to drop! I'm long term Bull - and will continue to be.... But - I think #TLT will turn down strong for months. This will send nom. up AND real rates soaring as we will also see strong decline in Oil #HZupdates

Hi #fintwit 😎 We are approaching a watershed moment in markets. Final deflationary phase of Kondratiev's winter is about to play out. Huge implications for #EUR, #Gold, #SP500, #DXY etc. I have some new interesting followers - hence something extra in this week's #HZupdates

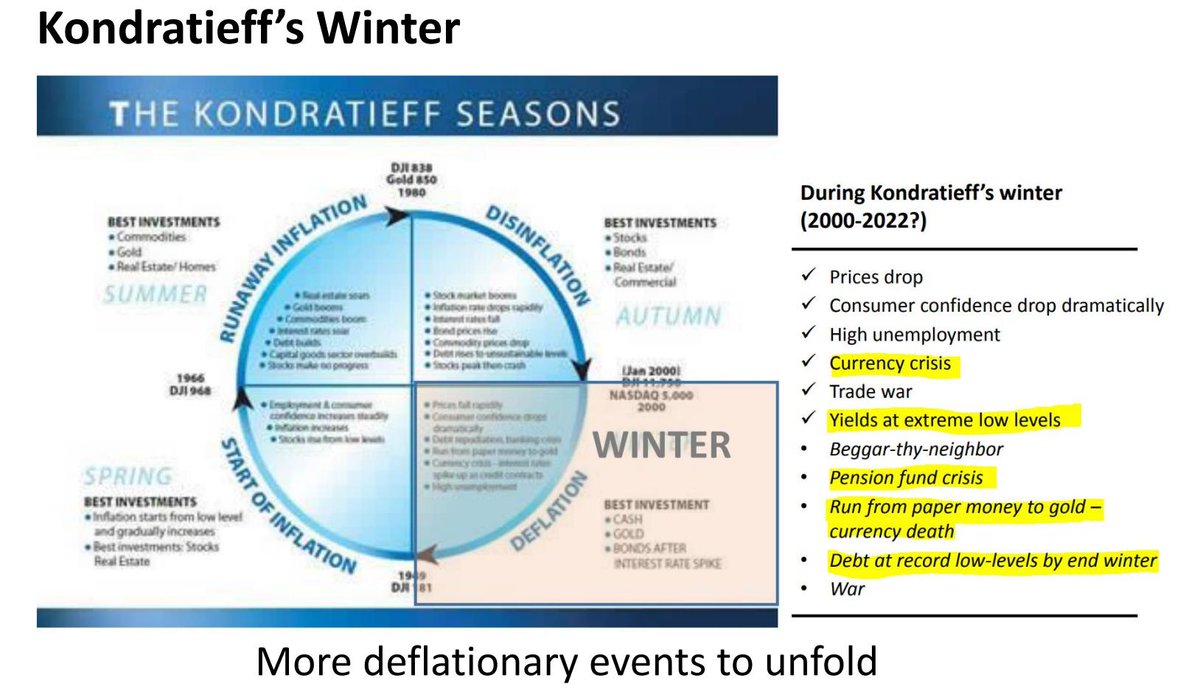

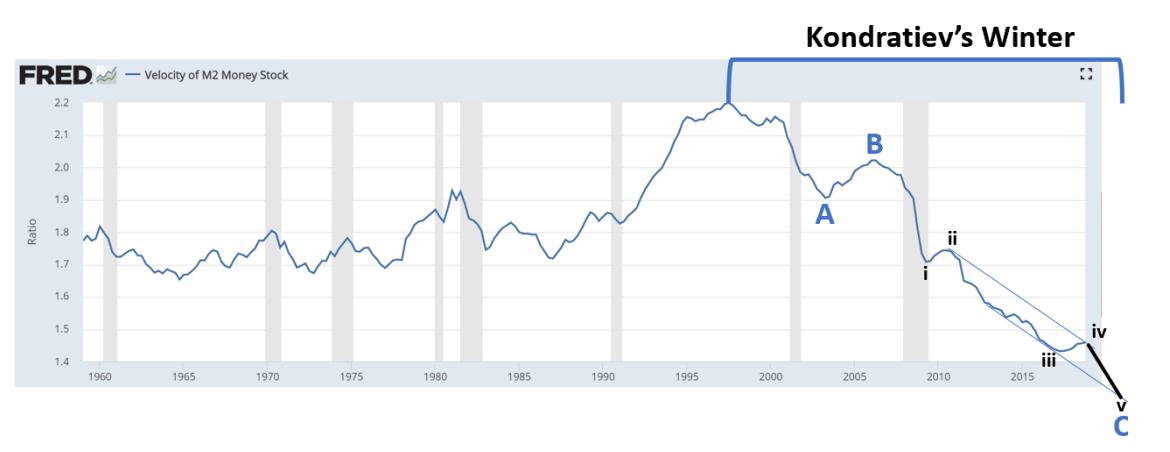

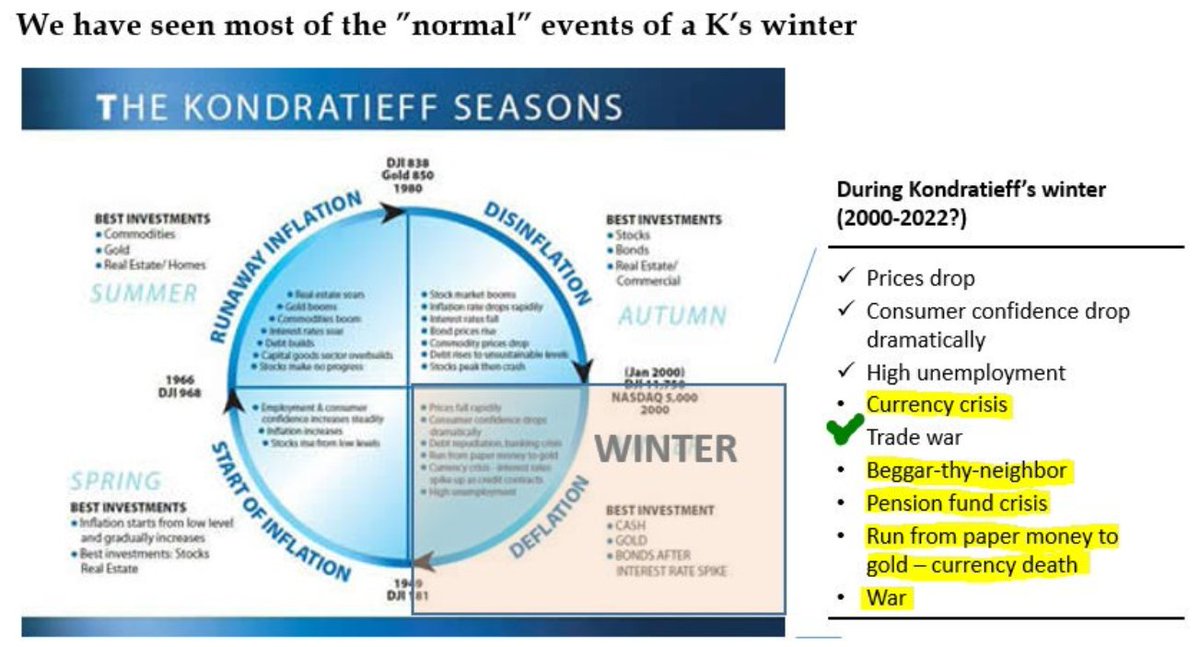

#Kondratiev's winter is a period where #Velocity of Money drops which creates a disinflationary economic environment, where growth is subdued due to #debt levels. Since ~2000 we have been in this winter - and are still to see a range of "major economic events" unfold #HZupdates

In fact, we have never left the #Financial #Crisis. We have only been bouncing in the great "Financial and Sovereign Debt Crisis" of this #Kondratiev's winter. This can be observed from the #Deflation Gauges #Copper, #XAU, AUD, EUR. We are about to see wave C develop #HZupdates

Hi all 😀Last week was unkind to Gold Bulls. I think we will see a lot more of this in April. Stay tuned for some #HZupdates 👍

So much for looking back at old forecasts. Now - some perspectives on what we will see ahead #HZupdates

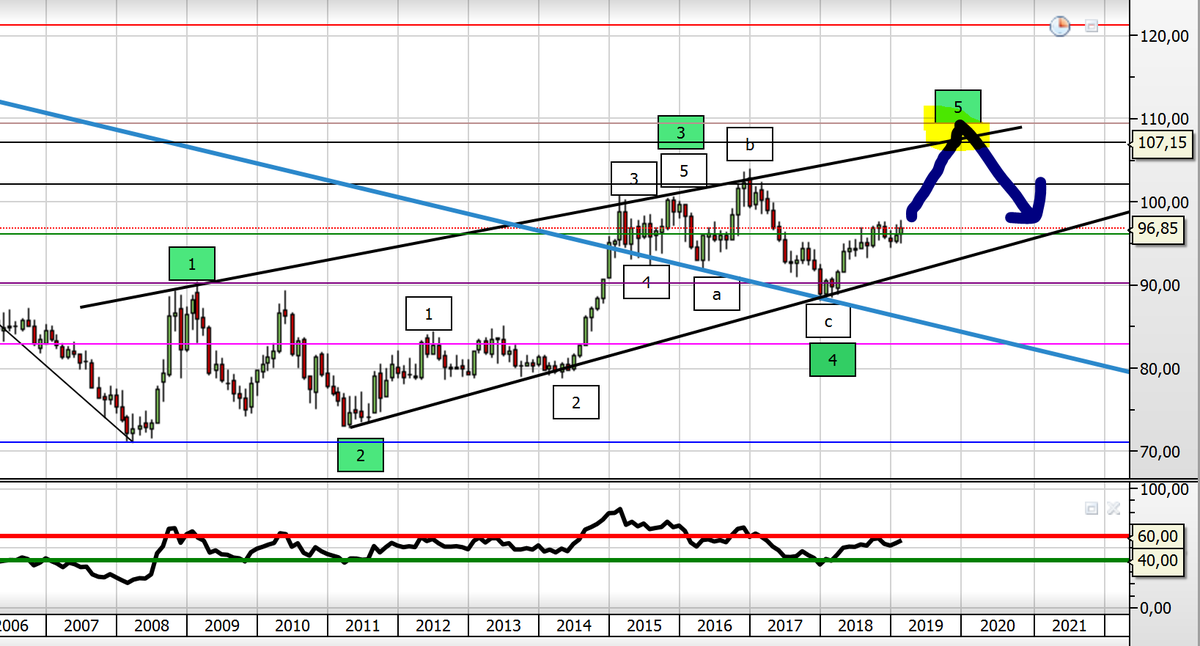

#DXY is about to soar. #USD bears will be annihilated in the coming rally. I think we may see my target of 107-109 before end 2019. During deflationary phase, cash (USD) is everything! #HZupdates

As you all know #deflation has been my theme for some time. It is obvious looking at charts like #Copper and #Oil. Here is #Oil. Ending Diagonal which will send Oil <23 USD during 2019/2020. This has been my call since top in 2018. It is >70% drop --> deflationary #HZupdates

#Copper shows same picture. #Deflation is coming. We are in wave 5 of C in expanding diagonal. Current bounce is wave 2 - will rally slightly higher - before major drop. I imagine this is what Powell starts getting indications on #HZupdates

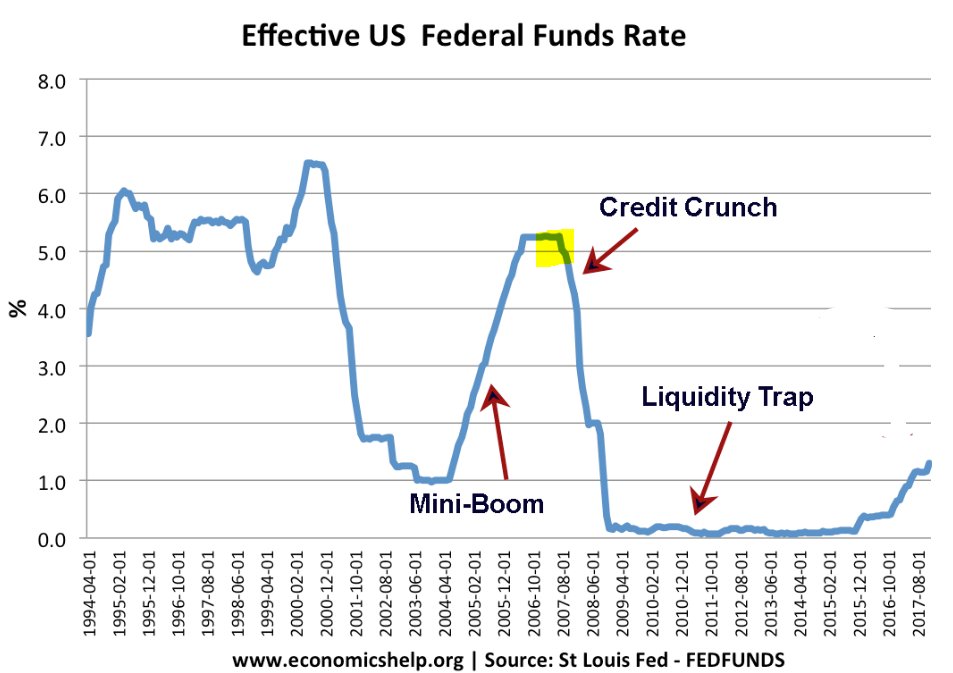

Notice 2008 Q1-Q3 - during last deflationary phase. Fed had been tightening up to Sept. 2007 - and started lowering rates. BUT damage had been done to economy. World rolled over and #deflation /disinflation. It was from Q1-Q3 2008. #Copper plunged. Same situation now! #HZupdates

#Equities #SP500 was rallying and the bulls are cheering. The excuse seems to be, that Powell has blinked. Remember 2007-09? Fed started lowering rates by September 07. Yet that did not prevent Financial markets to decline hard until March 2009 #HZupdates

The thing is, that when liquidity #crunch snowball gets rolling, some announcement from #Fed will not do the job. Down the line, Fed will need to scramble (QE or the like) to fight USD shortage. My LT #SP500 model remains like this. Major Bear market ABC-structure. #HZupdates

I will not reveal my EW-count for #SP500 here. That is reserved for subscribers and buyers of Weekly Update. Only say, that we have not seen an impulse wave since Sept high. I expect a MAJOR decline to set in rather soon, taking us to my bottom of wave A from LT-chart. #HZupdates

Good morning to all 😀Interesting weeks/months ahead of us as my deflationary scenario plays out. Will have massive consequences for currencies, gold, equities etc. I keep my subscribers updated closely on Daily/Weekly updates. But for now - stay tuned for some #HZupdates 👍

"#Deflation" or "#Disinflation" have been my call for a long time. We are not out of Kondratiev's winter yet. We haven't seen the all events which unfold during K's winter. Still to come Pension Funds Crisis, Currency Crisis, Run from Paper Money ...and War #HZupdates

And "#Deflation" outlook is clear in the charts imo. I look primarily to #AUDUSD and #Copper for guidance. Observe this chart of #Copper. Major ABC pattern. Length of C can be set by the irregular pattern indicating low in Copper below 2008-levels = deflation in 2019 #HZupdates

Hi all 😀It has been a good year! 2019 will be difficult for world economy. A lot of fall outs ahead from disinflationary environment. Get ready for last #HZupdates from the old year 👍

As I laid out at the beginning of 2018, we have seen a rally in #DXY. The USD rally is not over yet. I expect the rally to continuing into 2019 - reaching min. 107 before the rally is over, This will have deflationary consequences across various markets #HZupdates

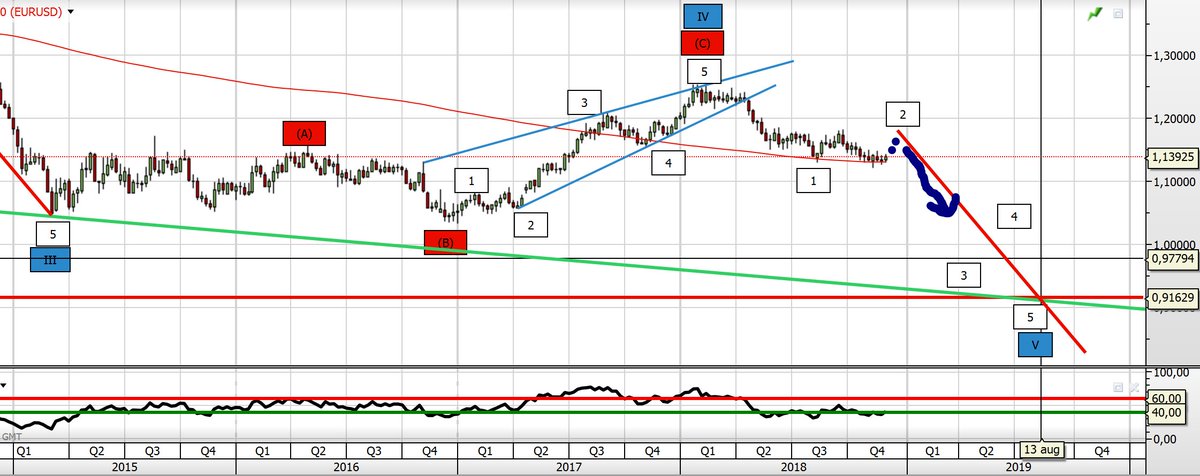

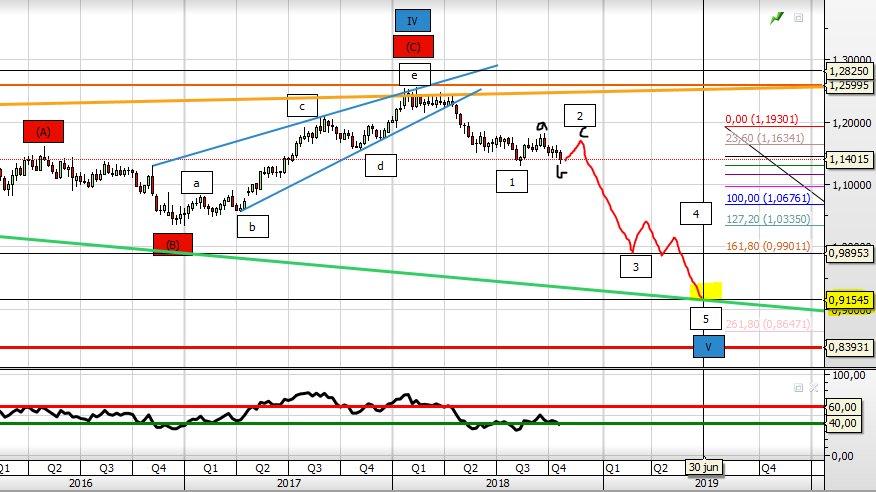

#EURUSD topped early 2018 and has dropped to a low of 1.121 by Nov. But - this is not the end of this major Bear market for Euro. LT-target remains 0.91 likely to be reached by Q2/Q3 2019 #HZupdates

Last week in markets was truly exciting! Some important signals were provided - which sets us up for some truly great trades 😀Before all leaves FinTwit to relax and enjoy during Christmas - I will provide you with some #HZupdates. Stay tuned! 👍

#EURUSD has been showing a lot of weakness. The LT-perspective is same as it has been for a very long time. Target of ~0.91 to be reached some time during 2019. Coming decline will bring about massive capitulation #HZupdates

#EURUSD - I have had 2 scenarios for how price will develop coming days/weeks. This scenario seems to hold most credibility. We could see small bounce next week - but soon EURUSD will crash in a strong wave lower. Great opportunity to go short is closing in #HZupdates

Hi all 😀Ready for some #HZupdates? I have had some busy weeks - however, I expect to post more regularly soon again. I'm also spending more time on my Whatsapp list for subscribers. Some great trades ahead. Stay tuned! 👍

#EURUSD No changes to LT-view. We are on the path towards 0.91. I do expect a bounce in EURUSD, before a crash will set in #HZupdates

#EURUSD Following the bounce, the decline will be forceful - comparable to the decline in 2014-15 in steepness. One small bounce on the way towards 0.91 will be wave 4 #HZupdates

Hi all 😀Great week in the market. Coming weeks will be very interesting - but likely decieving imo. Rally/drops in one direction only to shift direction again. Ready for some #HZupdates on #SP500, #EURUSD, #Gold, #Bonds etc.? Stay tuned!

Today I want to take on both #USD Bulls and Bears 😀 I hear a lot of either "USD hegemony is over" or "USD is going to soar for years to come". I think the truth is somewhat in between - but with a slight advantage to the Bull's side #HZupdates

Looking at the very long perspective, DXY has been in a decline. But - it has formed an ending diagonal, and the drop below trendline in 2008 was very likely THE bottom. Since it has been in wave 1 of the new Bull Market - which has formed a leading diagonal #HZupdates

#EURUSD rally is coming! I have been calling for this for few weeks, and we are getting closer. I expected it to begin >1.130. After breaker this level, I however think, we will see another low in EUR before the pair takes off. Hence, weakness (initially) before rally #HZupdates

Callings of crash in #EURUSD now. I have been of opinion, that we will see significant rally first taking us much higher than most traders anticipate. The rally is the last wave in wave 2. The last chance to get out before the EUR begins crash towards LT-target of 0.91 #HZupdates

Like EUR, #Gold #XAUUSD will also crash. However, we are about to set out for significant rally, which will bring Bulls back out with claims of USD 1500+. This will not be the case and when Gold tops, the decline will be strong. I have updated my LT-target to 750 USD #HZupdates

#EURUSD As expected weeks back, we have seen EUR weakness in current wave b in the correctional abc-structure of wave 2. This correction (wave 2) is not done yet! We still need wave c - which will be a strong rally. LT-target remains same: min. ~0.91 by mid-2019 #HZupdates

#XAUUSD ran ahead of EURUSD in the rally up towards it's wave 2 target. We are not quite there yet. Few more days (weeks?) before a major top for Gold. I cannot emphasize this enough. Now is the time you need to get out of Gold. Coming wave 3 down will be strong #HZupdates

#demographics #militaries #economies #currencies

#USA

- Best demographics

- Largest military

- Largest economy

- Most used currency

- Liquid financial markets

- Open capital account

- Rule of law

- Best geography

- Can be self sufficient if required

- Not trade dependent

#USA

- Best demographics

- Largest military

- Largest economy

- Most used currency

- Liquid financial markets

- Open capital account

- Rule of law

- Best geography

- Can be self sufficient if required

- Not trade dependent

#USA

Top trade partners as of 30 June 2018:

- China: 15.2% (strategic competitor)

- Canada: 15.1%

- Mexico: 14.6%

- Japan: 5.1%

- Germany: 4.4%

The next 10 years could result in the below:

- Mexico (25%)

- Canada (20%

- Japan (7%)

- South Korea (5%)

- Great Britain (4%)

Top trade partners as of 30 June 2018:

- China: 15.2% (strategic competitor)

- Canada: 15.1%

- Mexico: 14.6%

- Japan: 5.1%

- Germany: 4.4%

The next 10 years could result in the below:

- Mexico (25%)

- Canada (20%

- Japan (7%)

- South Korea (5%)

- Great Britain (4%)

#USA

Bring the manufacturing (jobs) home while negatively impacting China's economy.

forbes.com/sites/kenrapoz…

cebglobal.com/talentdaily/au…

irishtimes.com/business/econo…

Bring the manufacturing (jobs) home while negatively impacting China's economy.

forbes.com/sites/kenrapoz…

cebglobal.com/talentdaily/au…

irishtimes.com/business/econo…