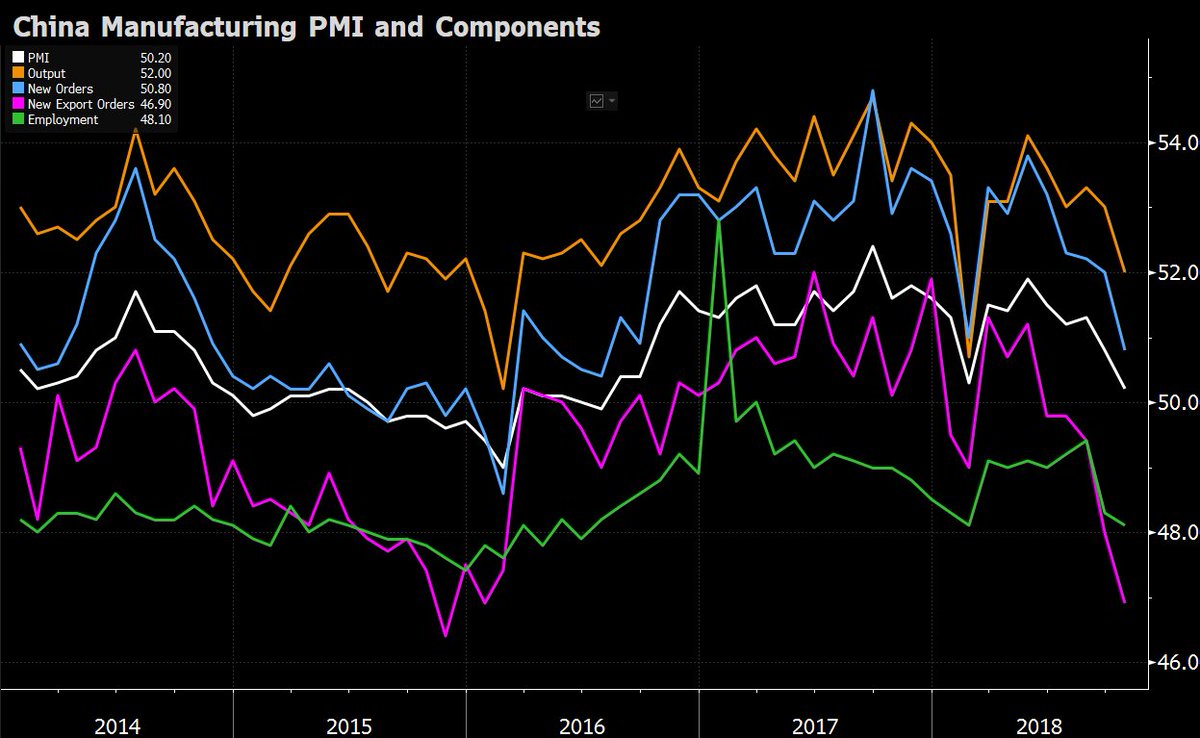

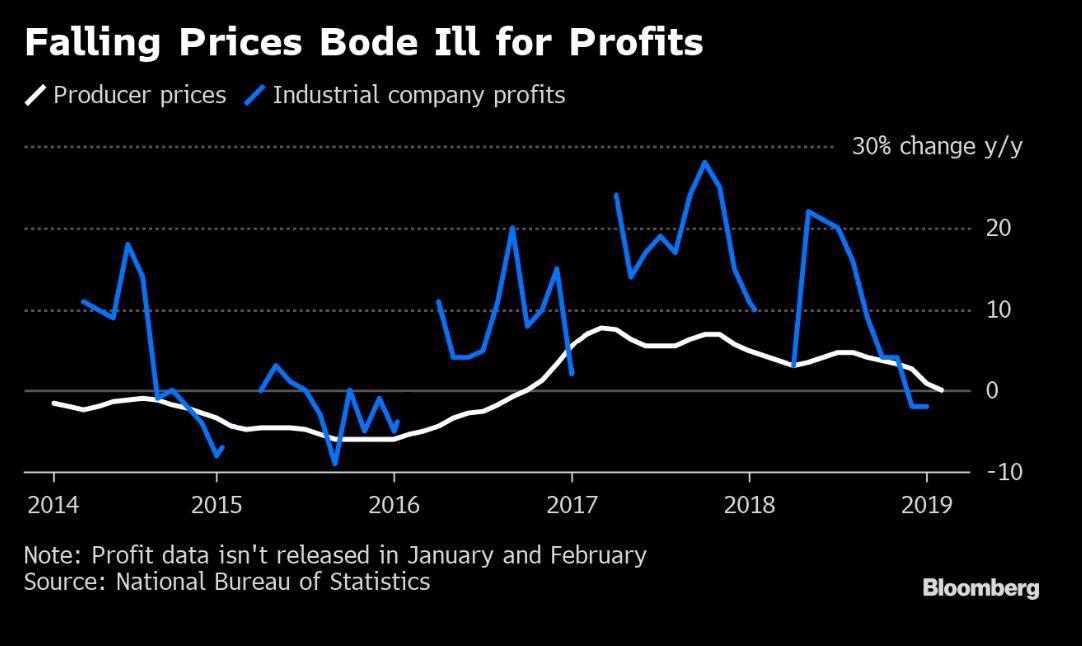

*NBS spokesman Mao Shengyong said that the international situation was bringing “downward pressure” on China.

*Link: bloom.bg/2RVX1ZA

*Statement: bit.ly/2EujhqH

bloomberg.com/news/articles/…

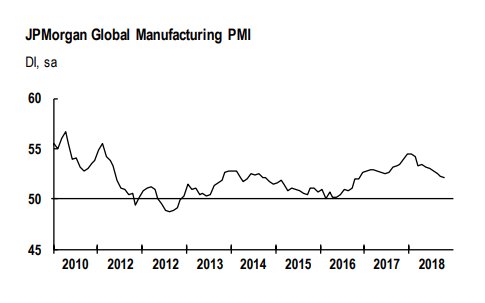

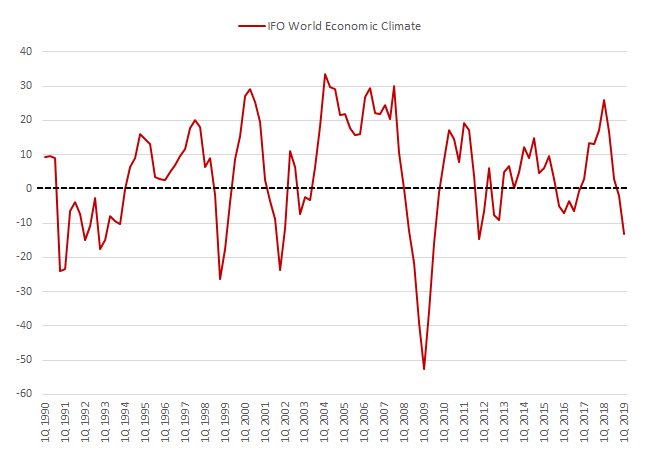

*The outlook for global growth in 2019 has dimmed for the 1st time, according to Reuters polls of economists who said the U.S.-#China #tradewar and tightening fin. conditions would trigger the next ⬇

reuters.com/article/us-glo…

*Link: bundesbank.de/en/tasks/topic…

See tweetstorm:

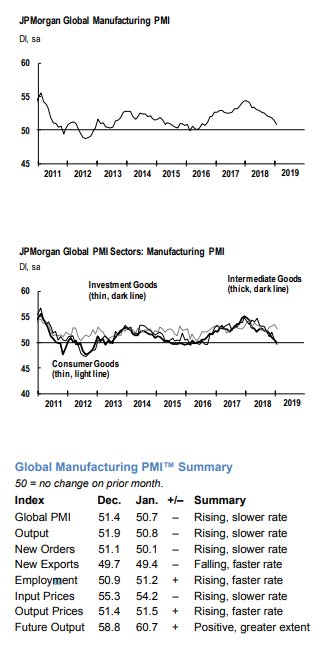

#Manufacturing new orders ⬇ at the fastest pace in three years in the quarter to October, reflecting ⬇ in both domestic and export orders.

cbi.org.uk/news/manufactu…

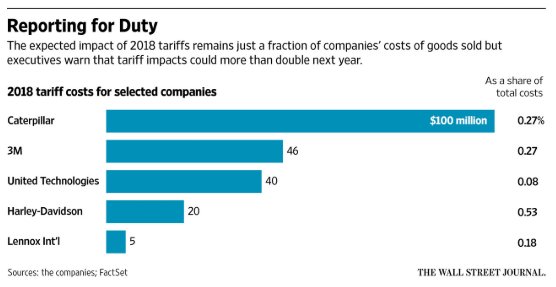

*Caterpillar’s tariff costs and 3M’s slower growth in #China threaten their outlooks

*Link: on.wsj.com/2D2hzLI

*Best hope, analysts say, is for pause on next wave of #tariffs

*Link: bloom.bg/2OJevud

ft.com/content/001c05…

*Link (Chinese): bit.ly/2D4JhYc

xinhuanet.com/english/2018-1…

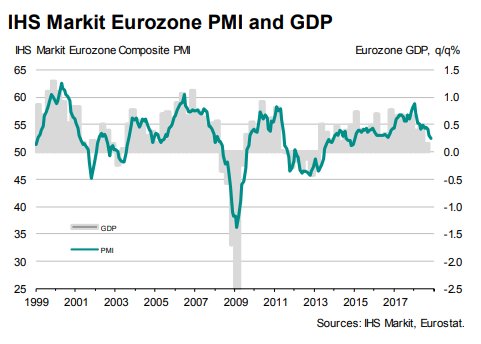

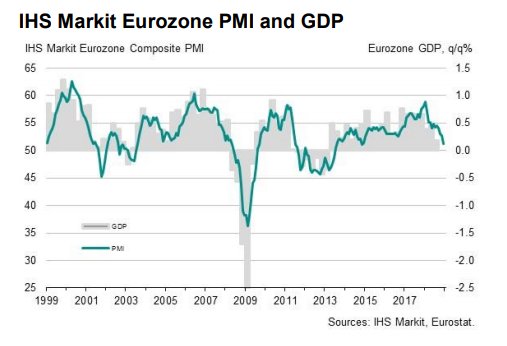

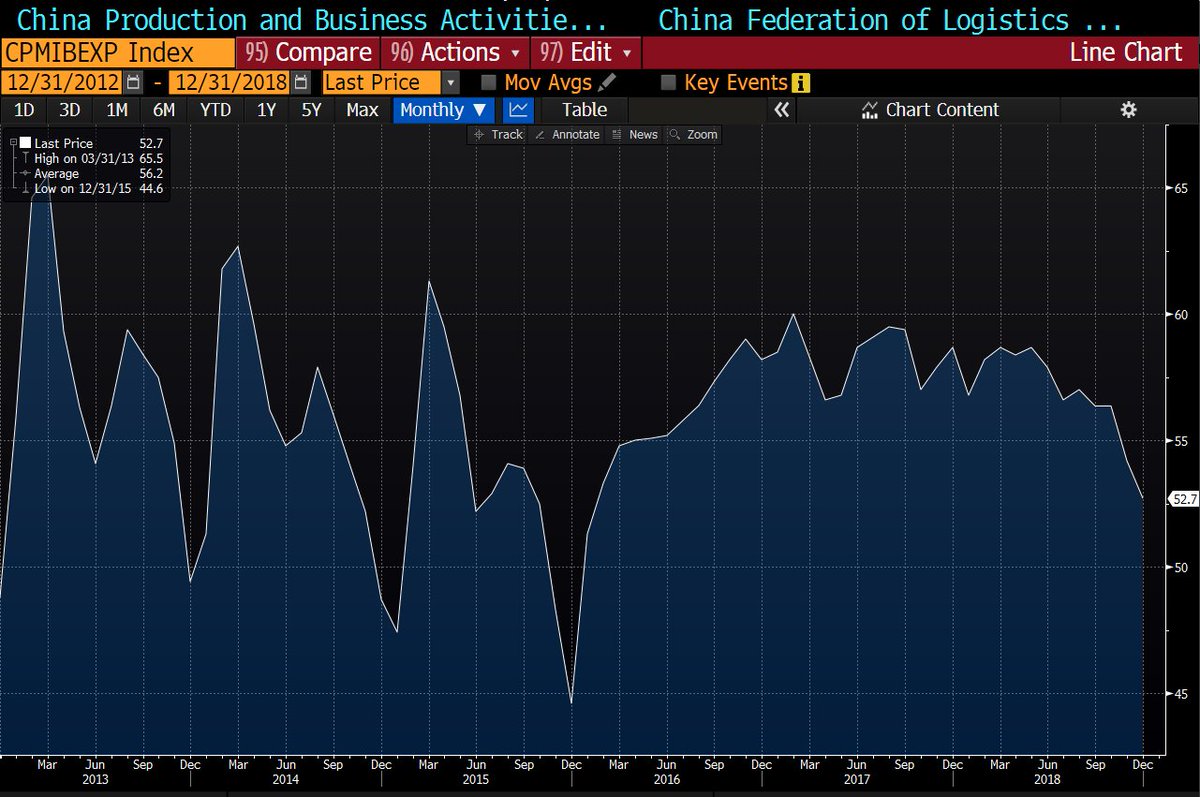

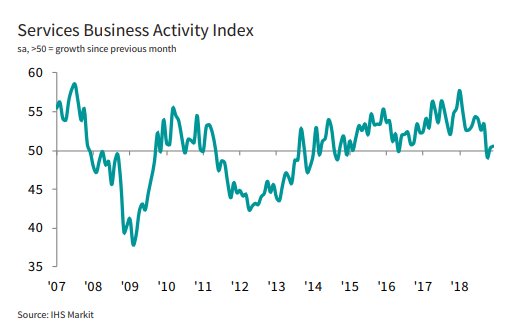

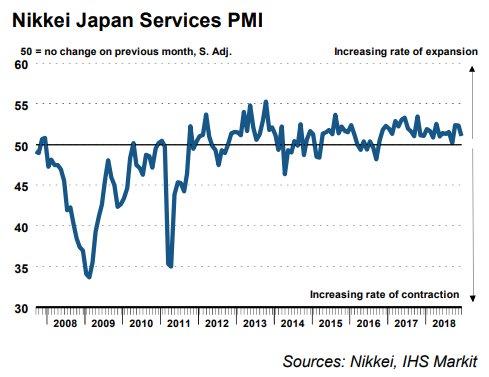

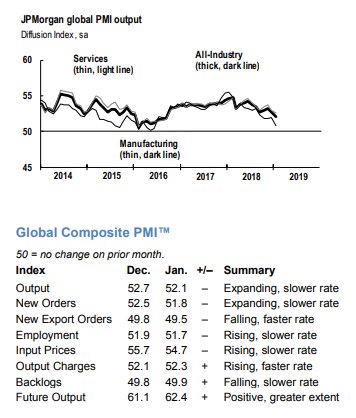

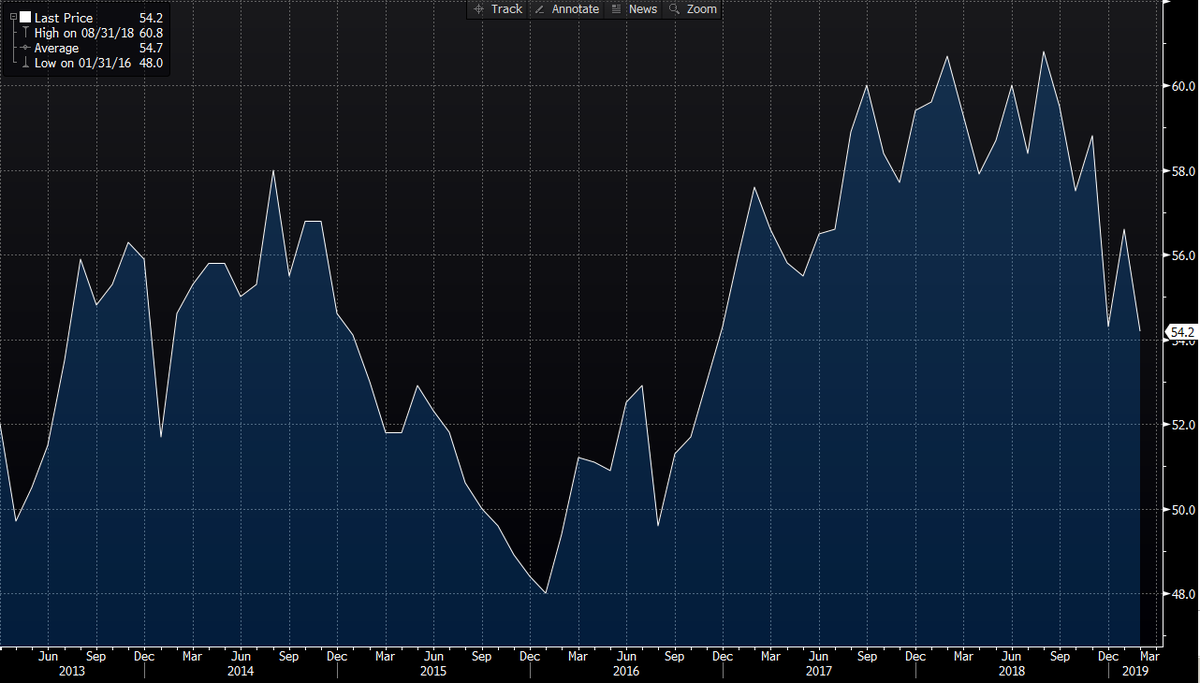

*Services PMI: 53.6 v 55.5e 63rd (5-month low)

*Composite PMI: 52.7 v 54.8e (41-month low)

*Link: bit.ly/2Pf6JrH

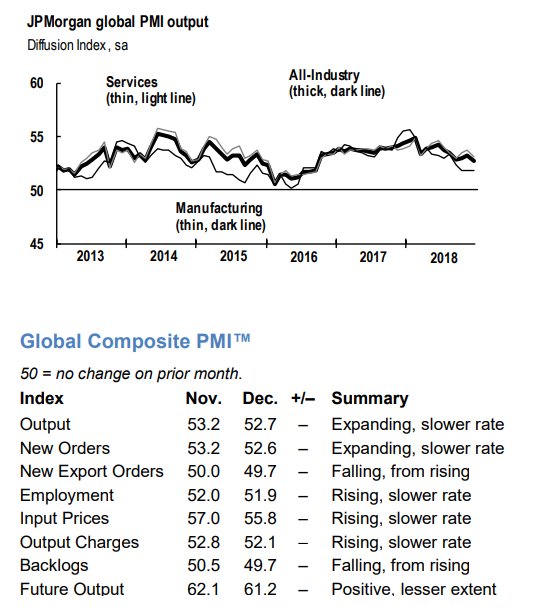

*New export orders for goods decreased for the first time since June 2013 ❗

*Services PMI: 53.3 v 54.5e (24-month low)

*Composite PMI: 52.7 v 53.9e (25-month low)

*Link: bit.ly/2Apmzrm

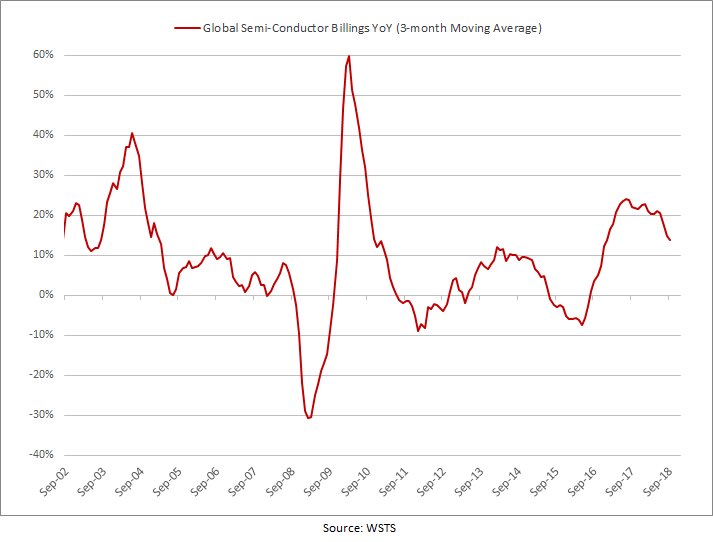

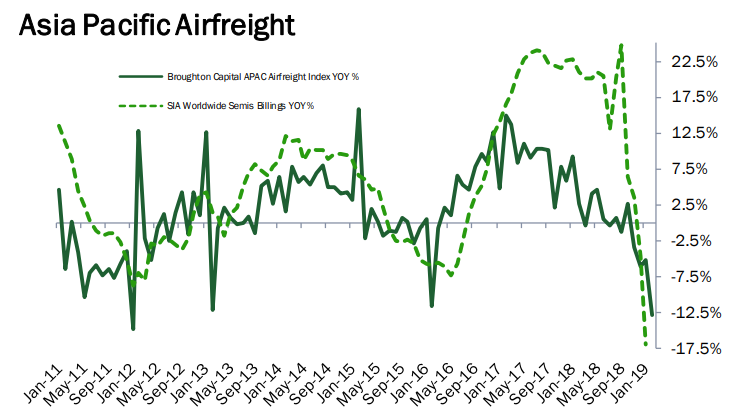

*Revenue from graphic chips disappoints as resellers cut orders

*Link: bloom.bg/2AqIVZo

*Link: bloom.bg/2O2WamV

wsj.com/articles/fed-r…

bloomberg.com/news/articles/…

reuters.com/article/us-usa…

bloomberg.com/news/articles/…

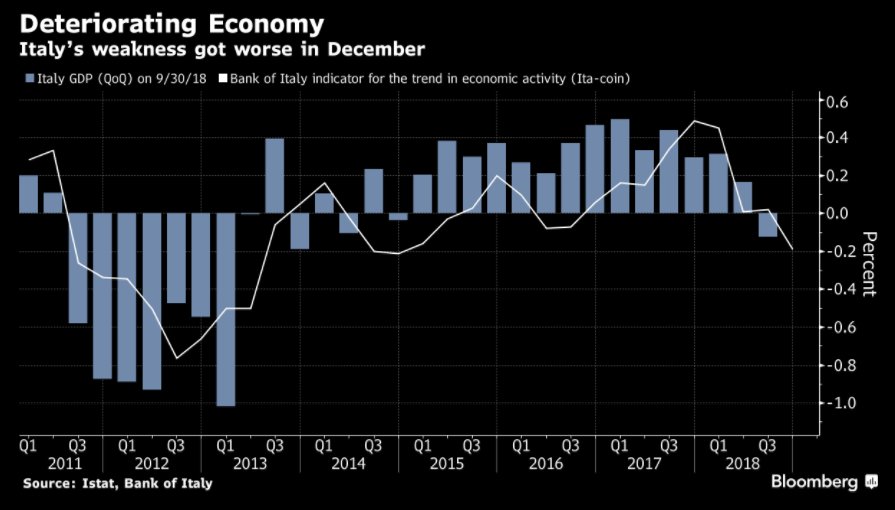

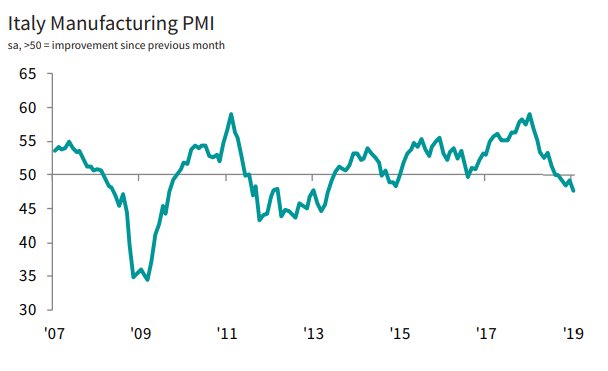

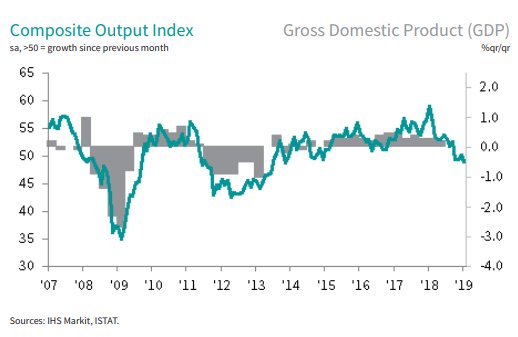

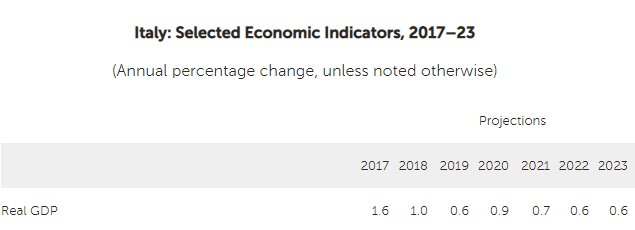

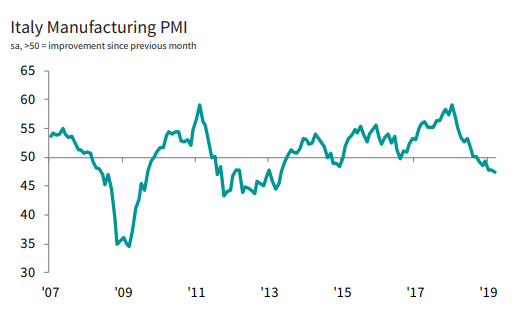

🇮🇹 #ITALY Q3 PRELIMINARY GDP Q/Q: 0.0% V 0.2%E; Y/Y: 0.8% V 1.0%E

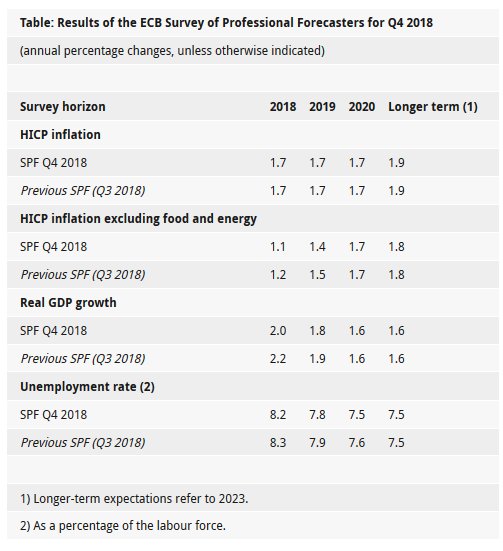

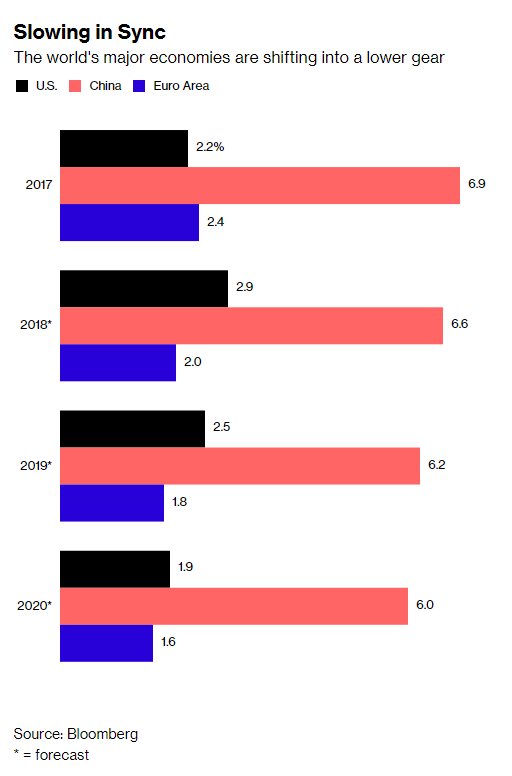

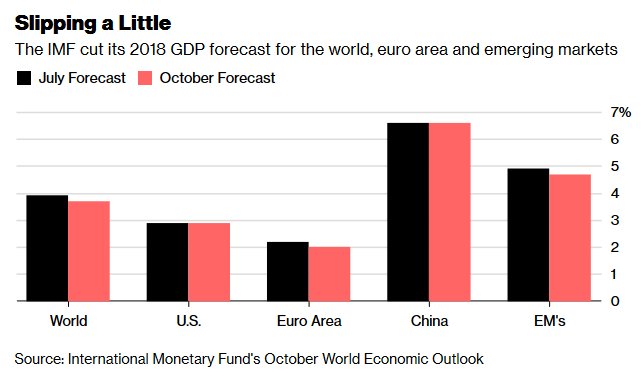

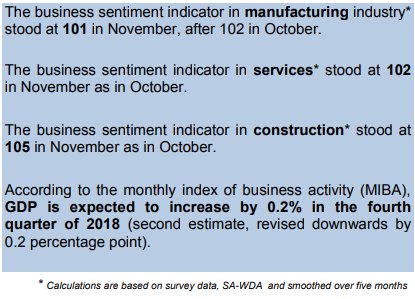

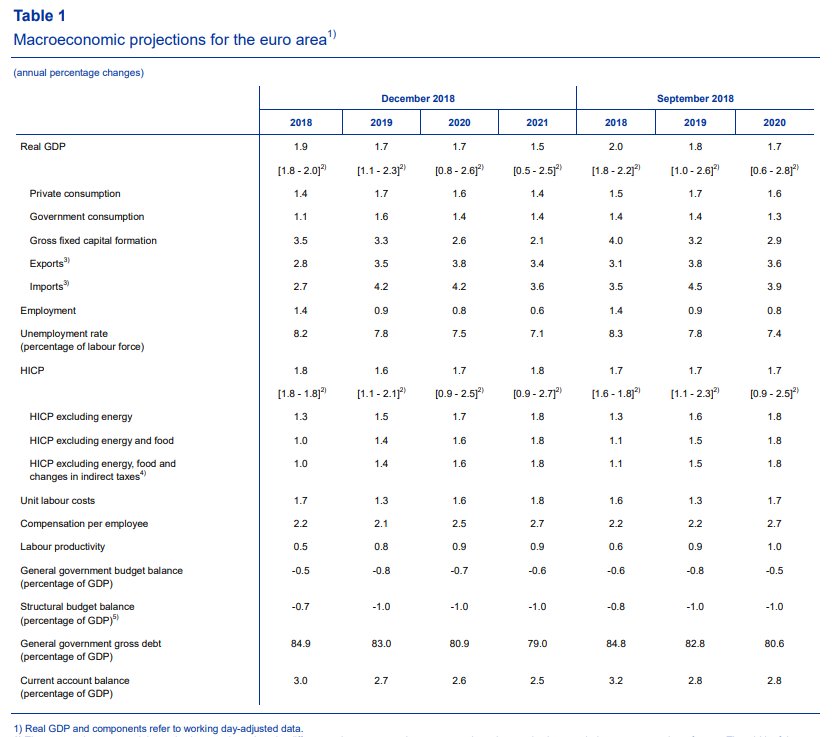

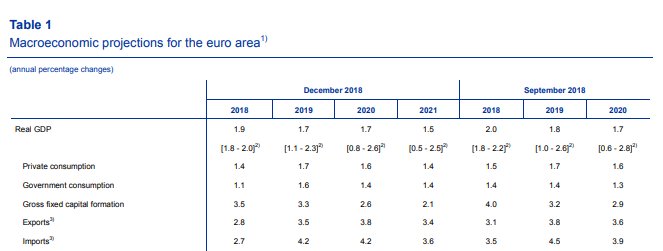

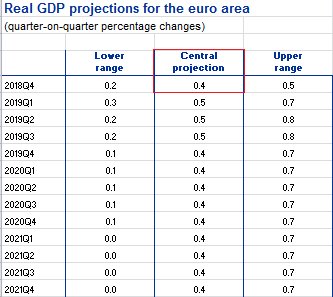

*As expected, most of economists should revise ⬇ their forecasts for 2018 and 2019 GDP in the coming days/weeks.

*ECB will do the same in Dec.

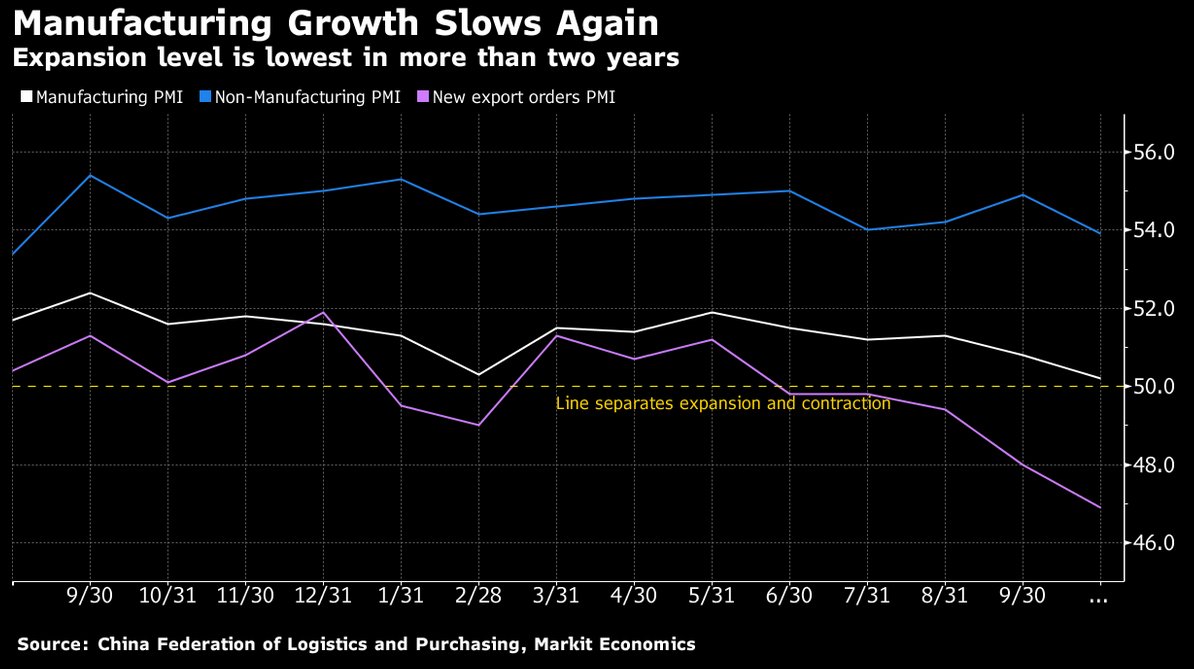

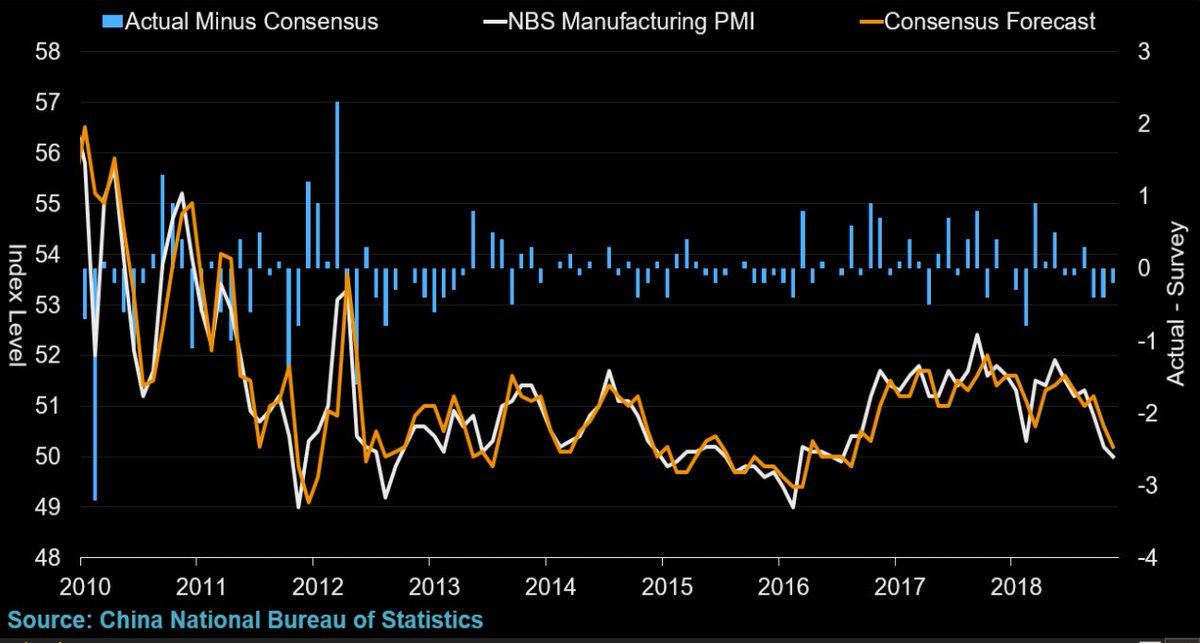

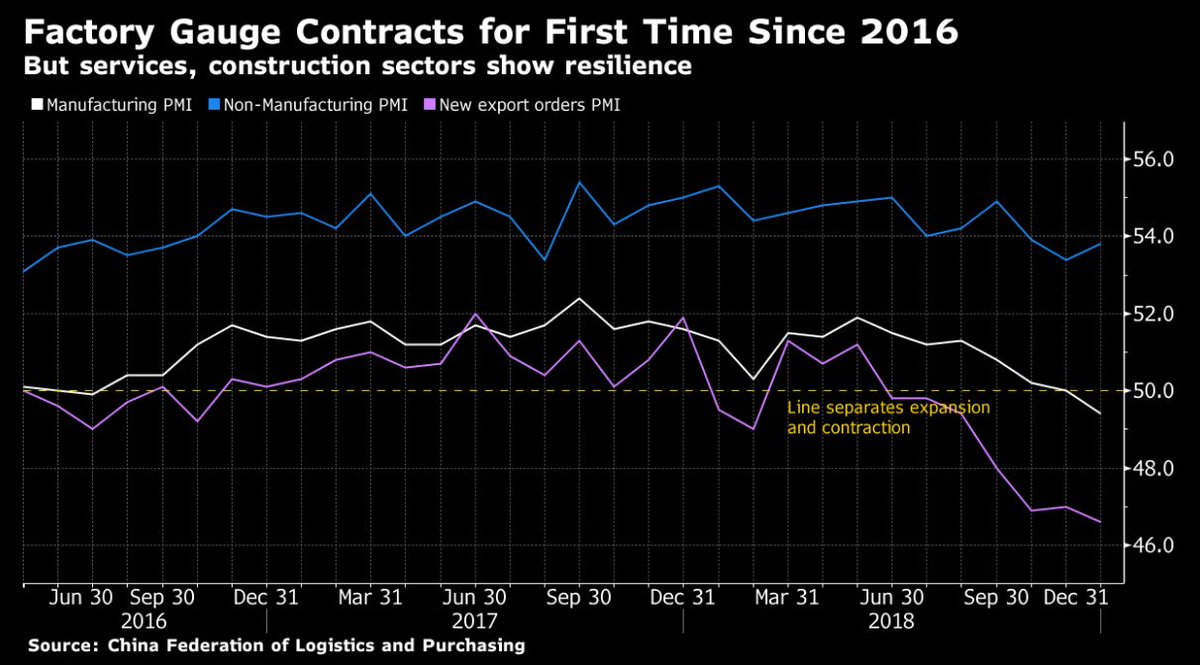

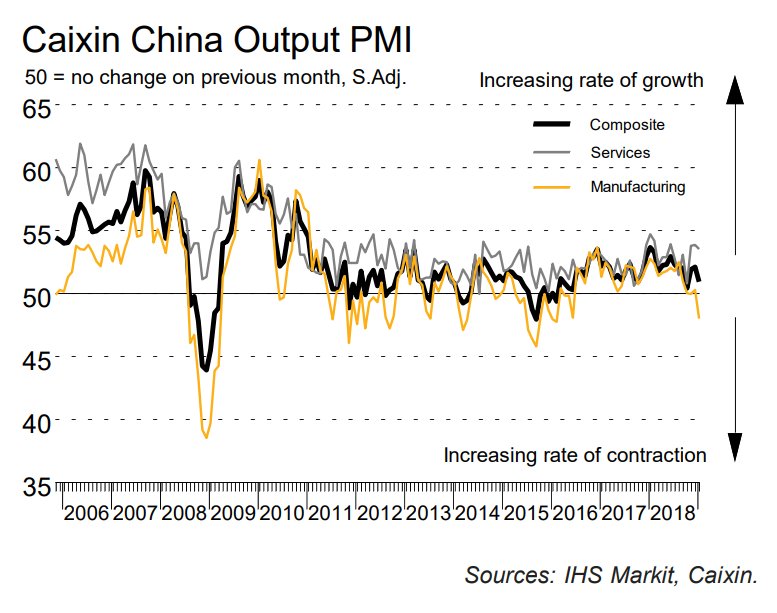

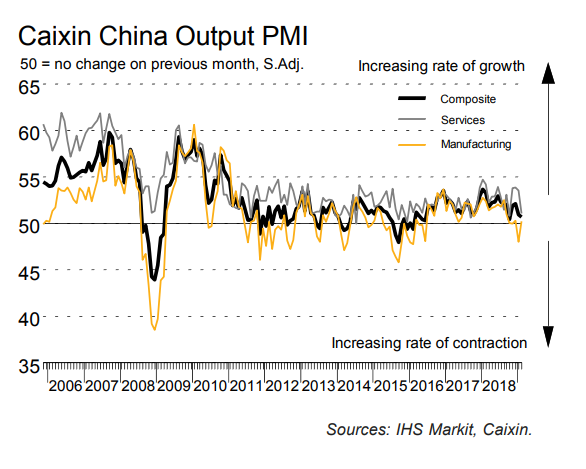

*Non-Manufacturing PMI: 53.9 v 54.6e (lowest since August 2017)

*Composite PMI: 53.1 v 54.1 prior (lowest since February 2018)

*NBS: PMIs affected by long holiday and external environment

*Link: bloom.bg/2CTm62t

*The #Shanghai government ordered construction sites in the city to shut down between Oct. 23 and Nov. 12 (bit.ly/2SALteu).

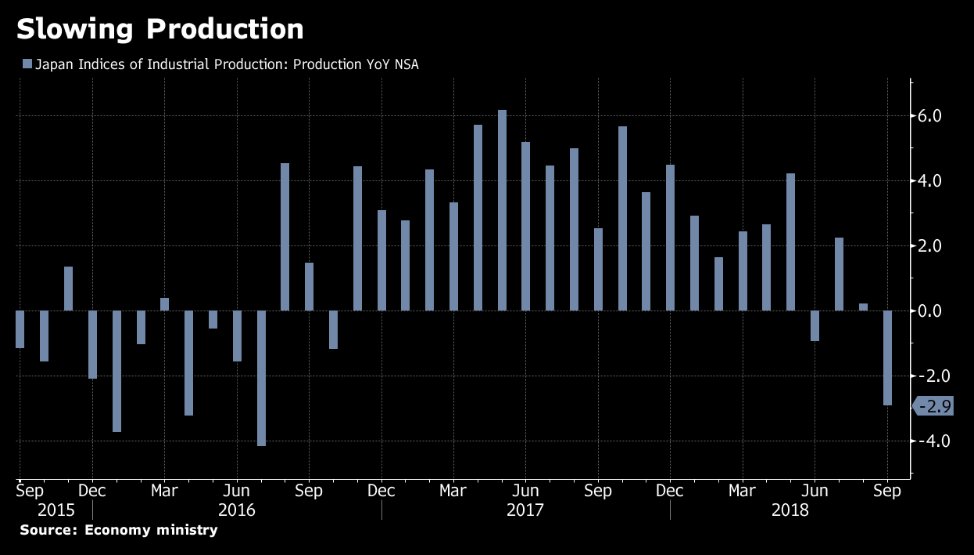

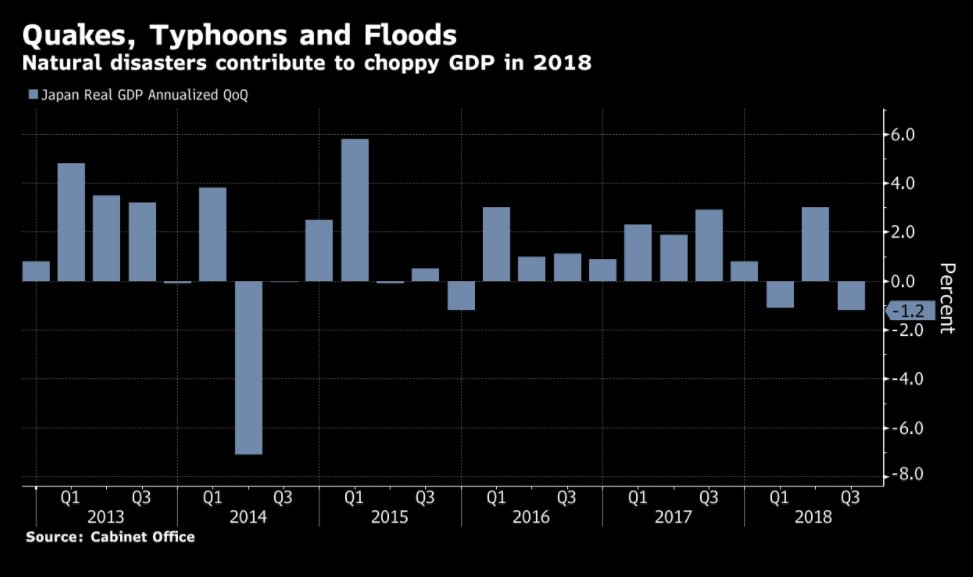

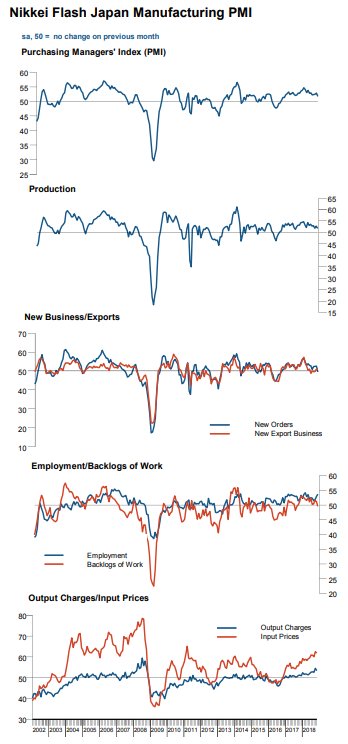

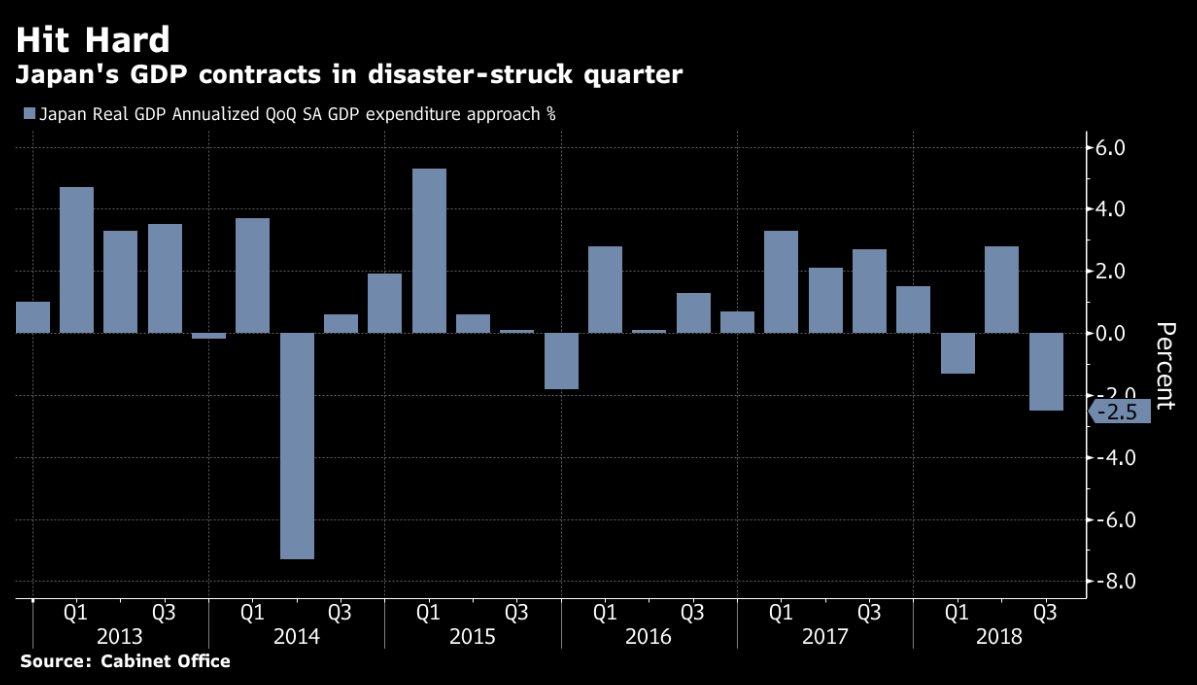

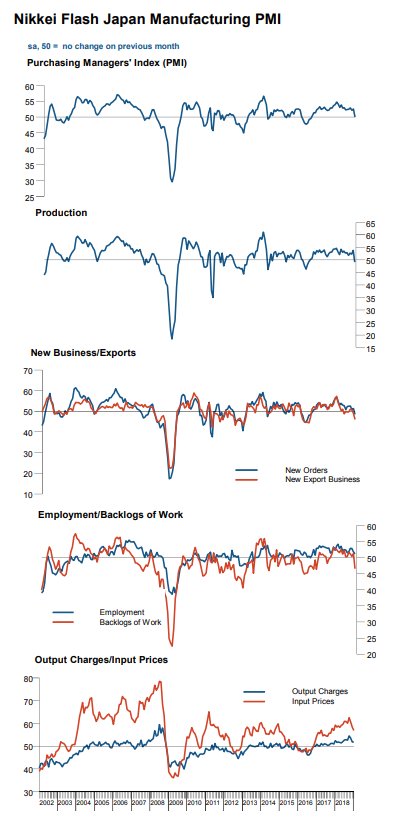

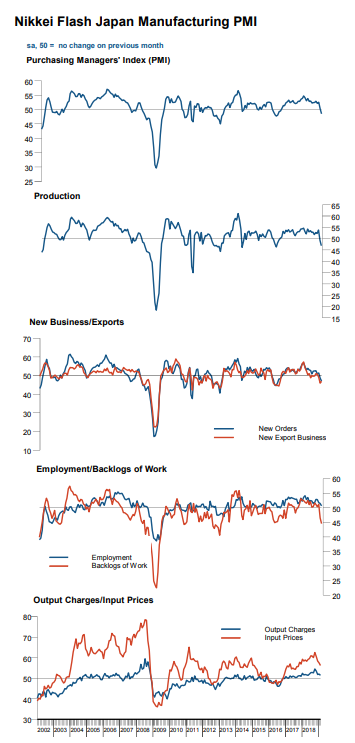

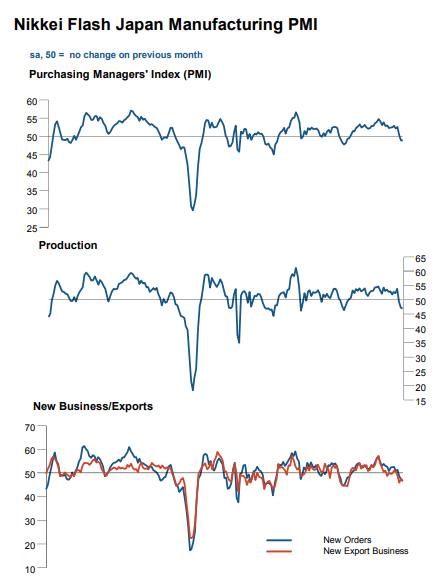

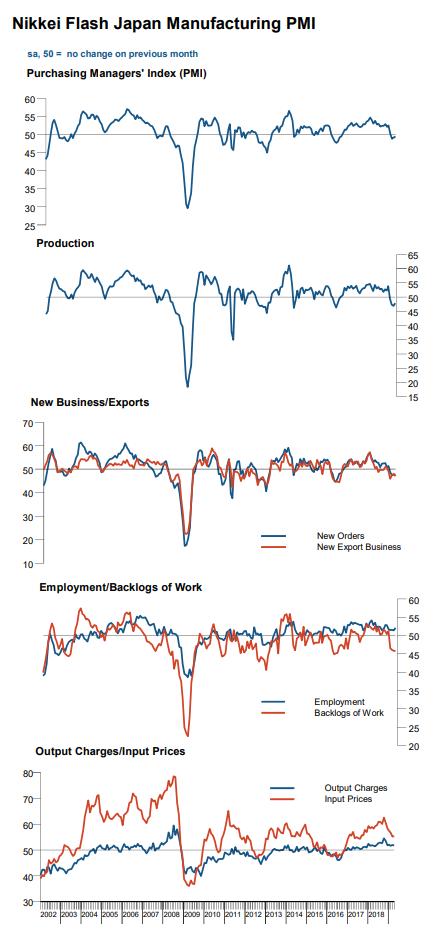

*Production was impacted by typhoons, earthquakes and the US/China #tradewar

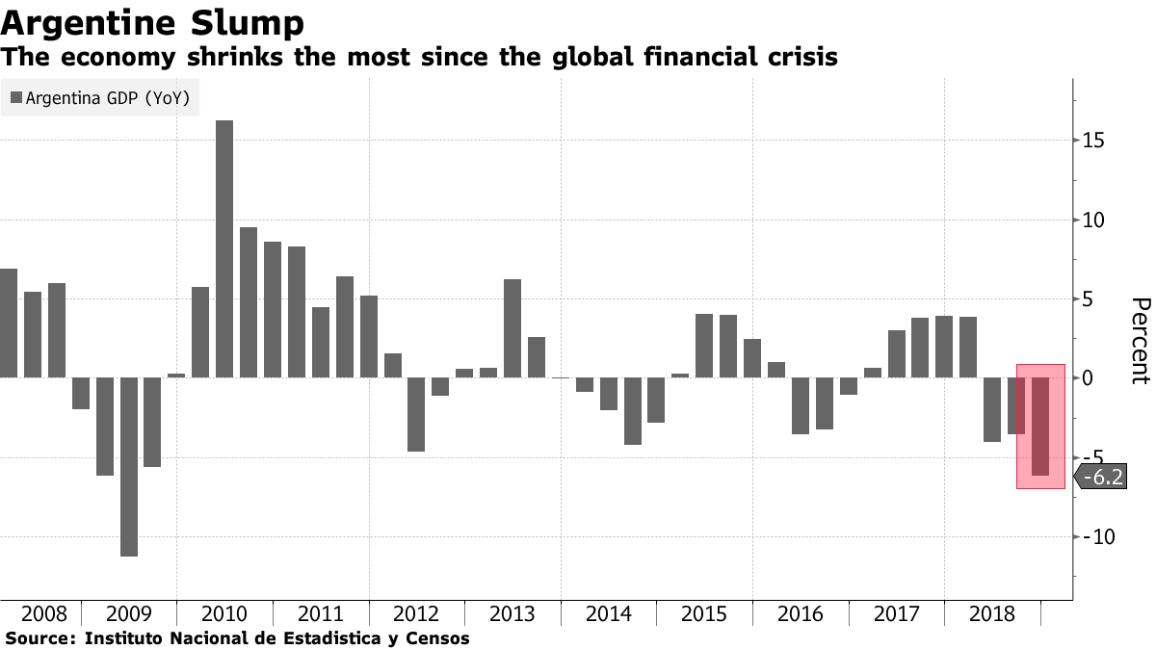

*As already discussed (bit.ly/2P4ImxG), 3Q GDP is likely to surprise ⬇.

*AGEB SEES GERMAN 2018 ENERGY CONSUMPTION DOWN 5% AT 12,900 PJ

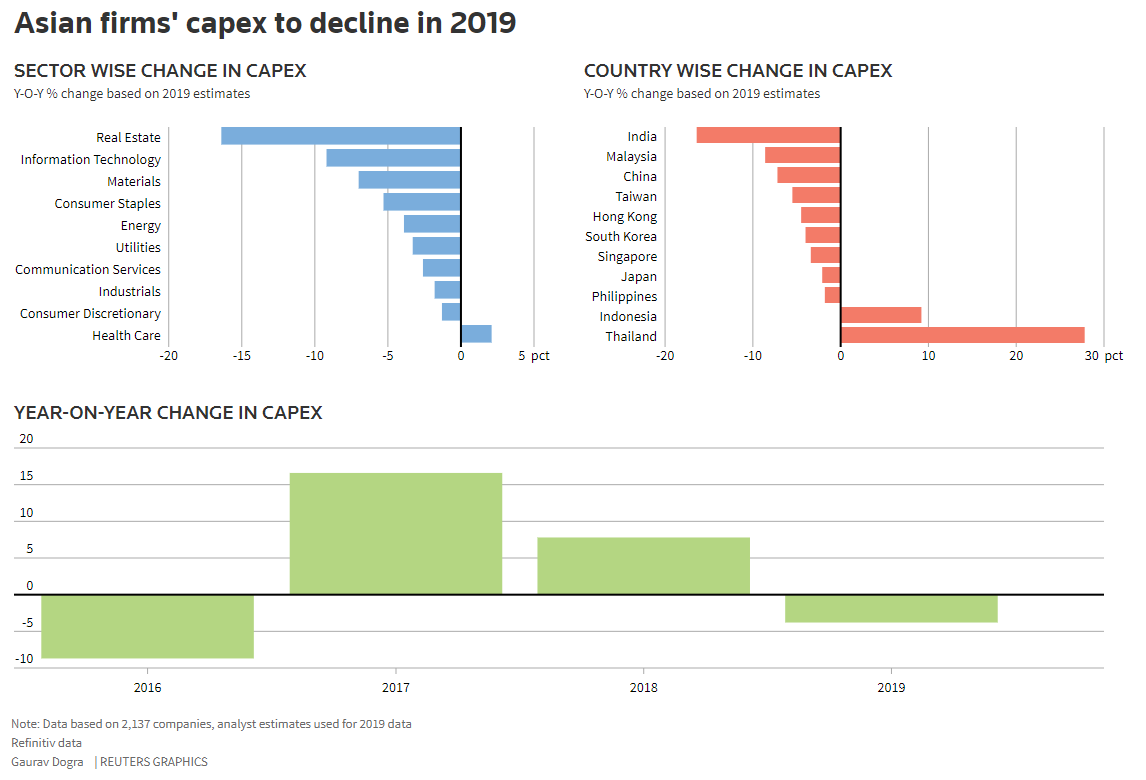

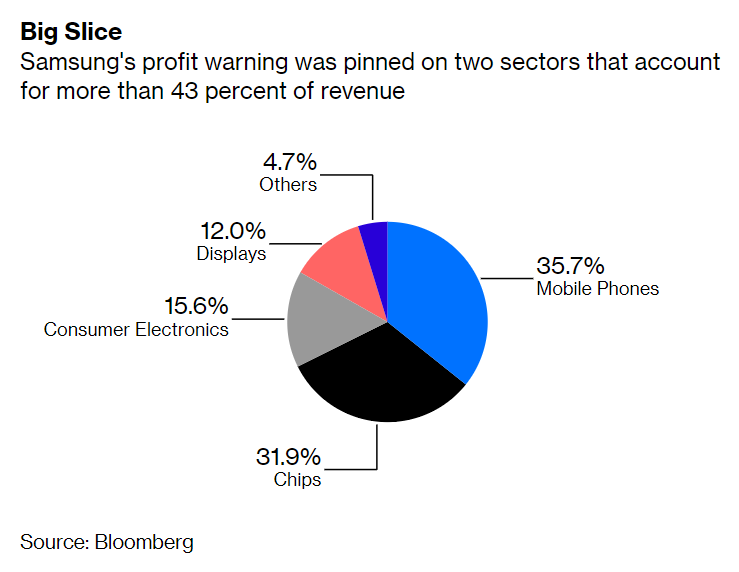

*Capex to drop to 31.8 trillion won in 2018, down 27%

bloomberg.com/news/articles/…

reuters.com/article/us-ger…

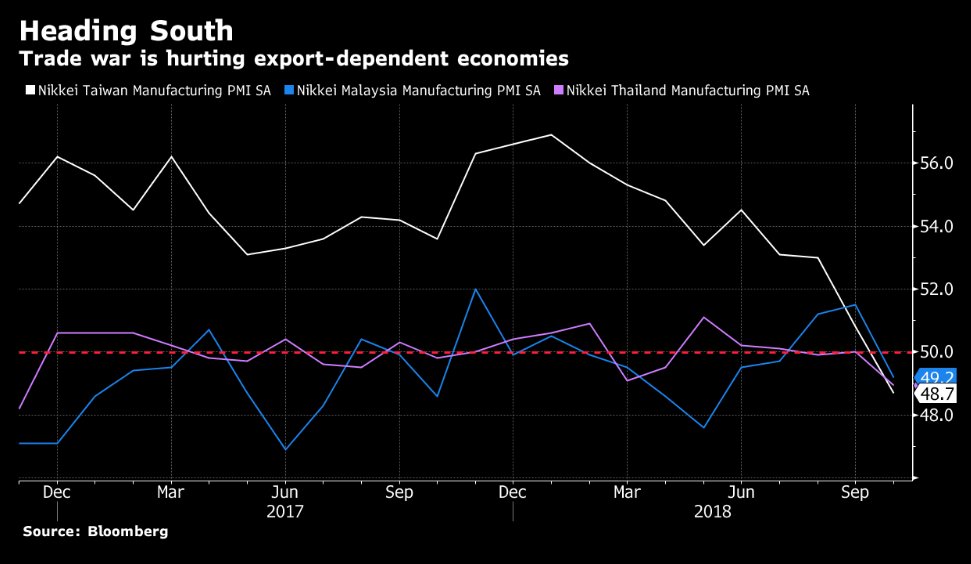

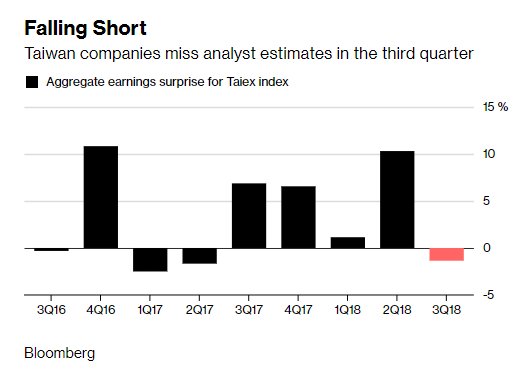

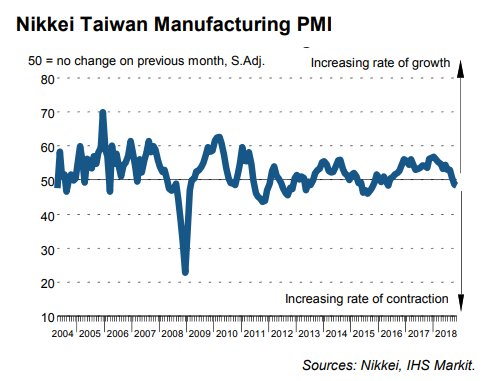

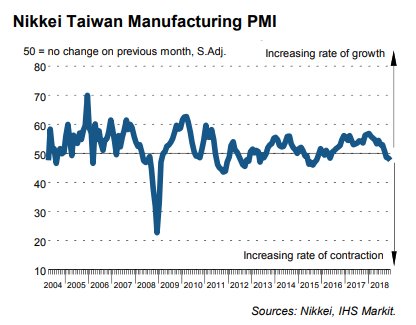

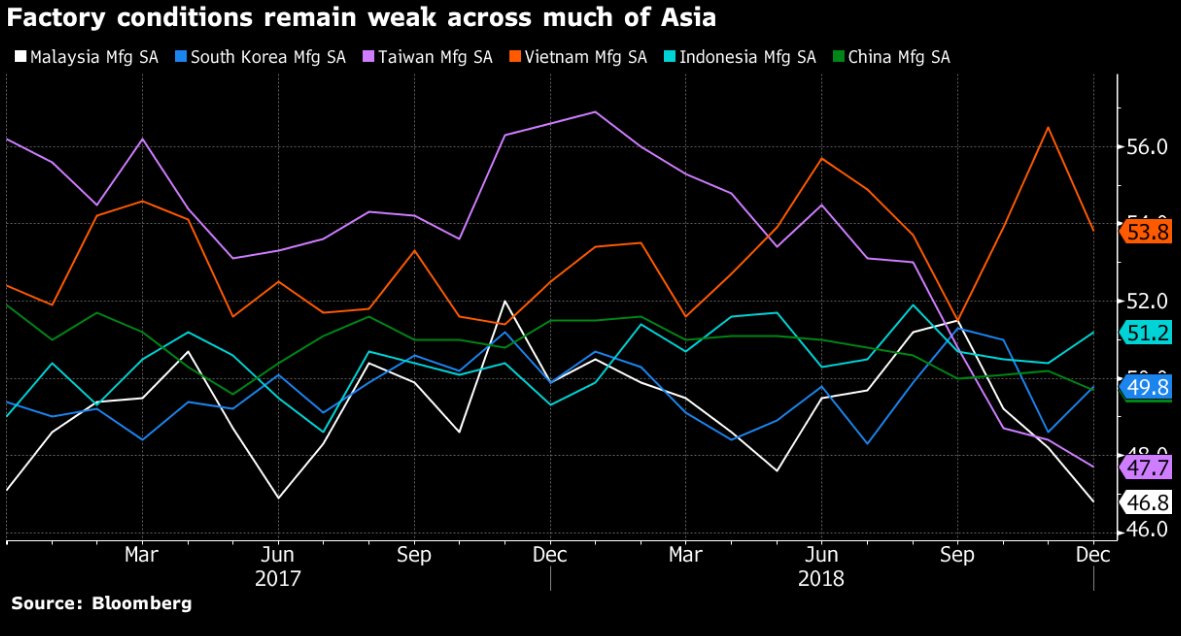

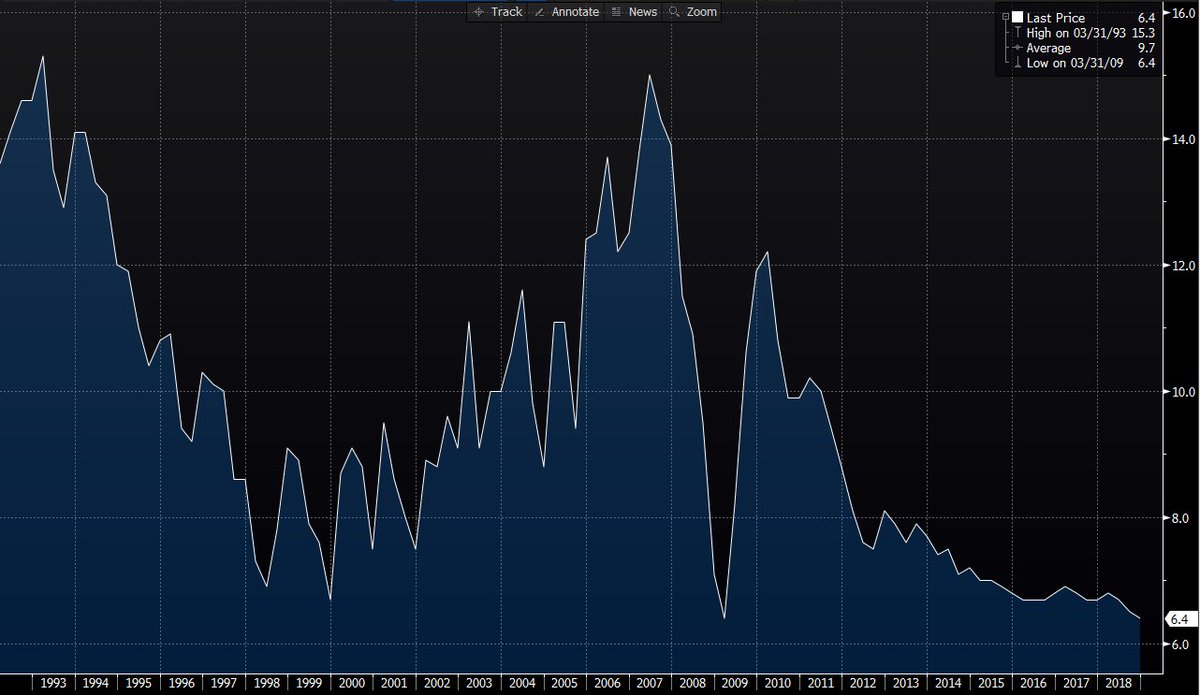

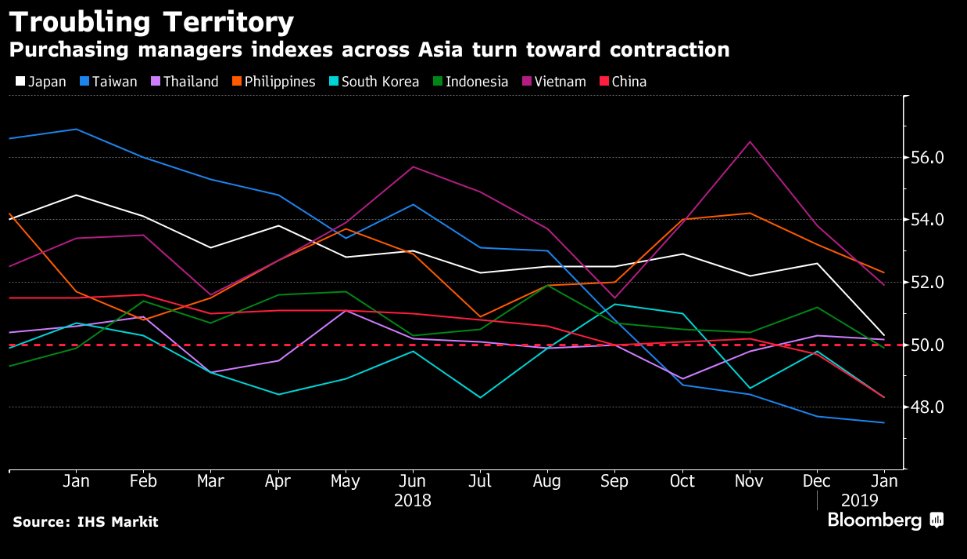

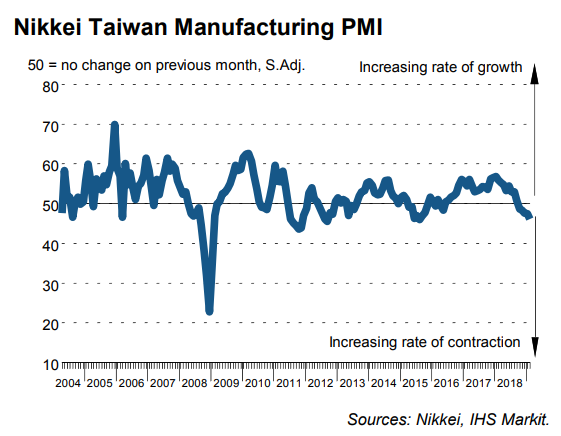

#Taiwan PMI: 48.7 from 50.8 (lowest since May 2016)

#Malaysia PMI: 49.2 from 51.5 (lowest since May 2018)

#Thailand PMI: 48.9 from 50.0 (lowest since Nov. 2016)

*Business outlook for output hit 11-month low

*The new export orders component surprisingly rose (48.8 vs 47.6 prior) but stayed below the 50 threshold for a seventh consecutive month.

*Link: bit.ly/2SyEZgx

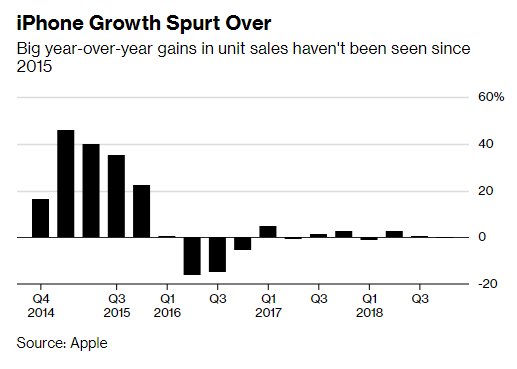

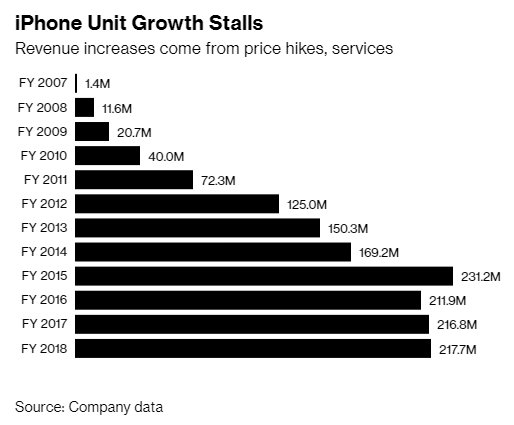

Analysts say company doesn’t want to disclose falling numbers

*Link: bloom.bg/2DkRB6g

*New orders: 51.9 vs 52.0 in Sept. (lowest since Sept. 2016.

*Link: bit.ly/2zlCu8f

economictimes.indiatimes.com/tech/hardware/…

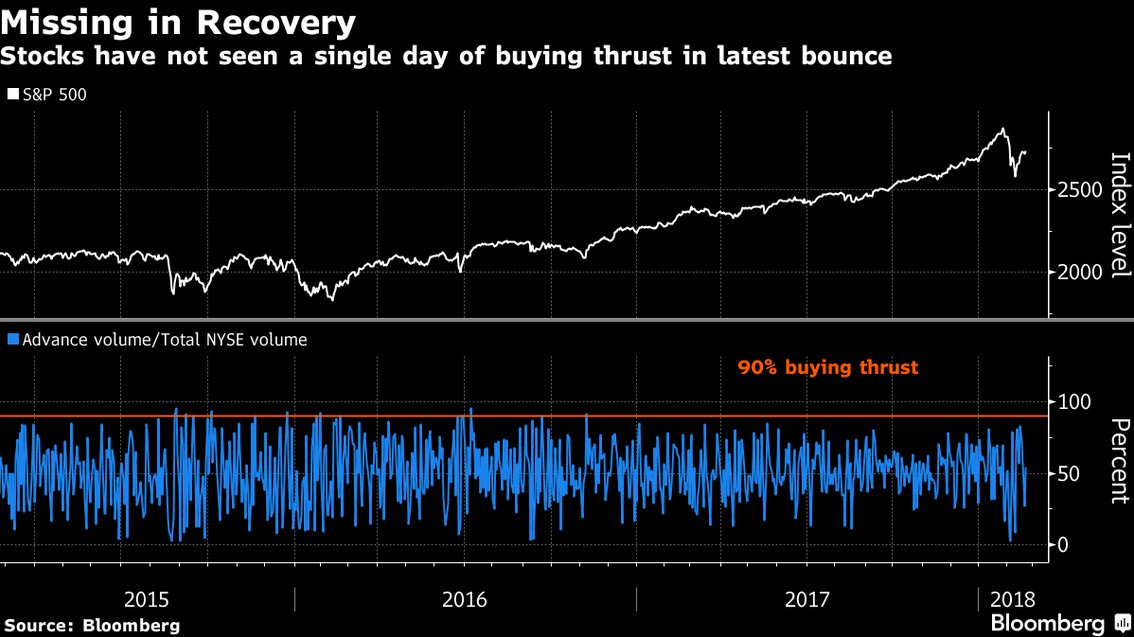

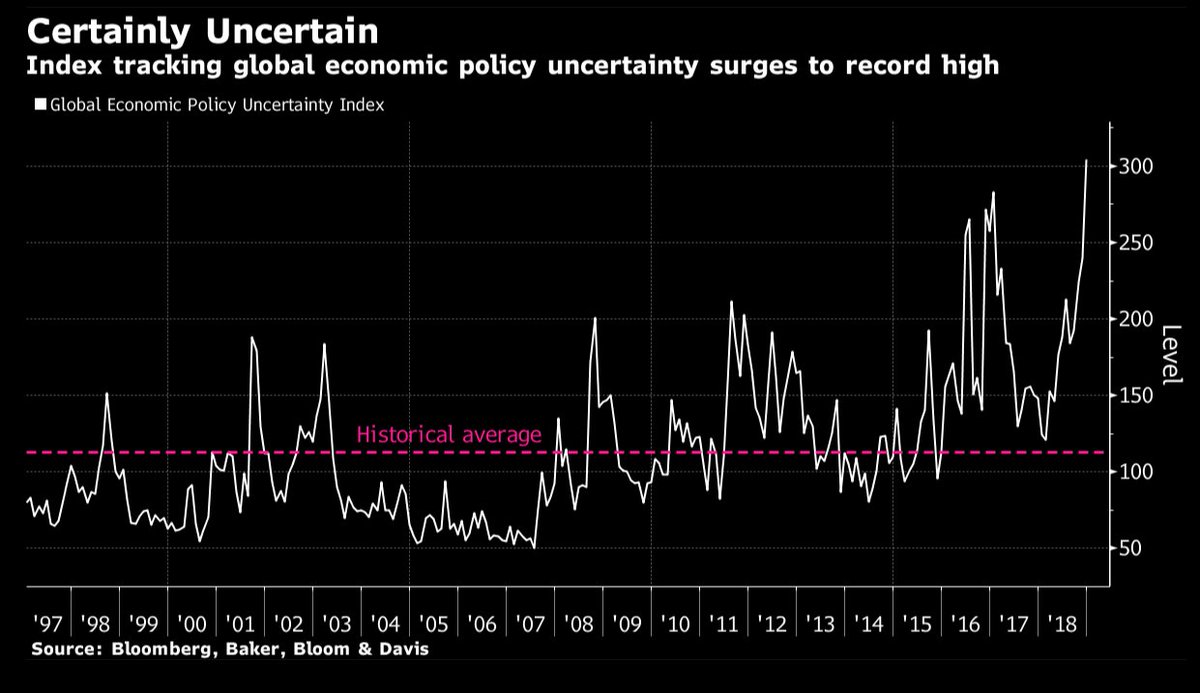

*Lengthening worry list stretches from trade to rising rates

*Link: bloom.bg/2QicL7U

*Domestic sales for the first half fell 20% on the year to 67,000 vehicles, according to preliminary figures.

*Worldwide production for the first half decreased 6% to 490,000 vehicles.

asia.nikkei.com/Business/Compa…

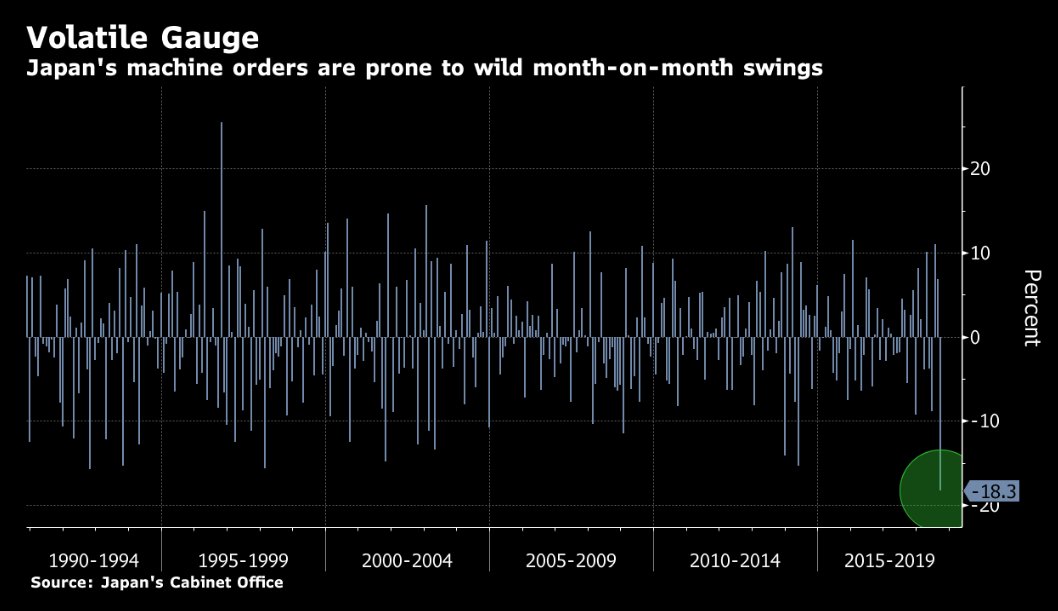

*"Shipment to China has slowed. Recent orders are down about 30% from a year earlier" Yoshimaro Hanaki, president of Japanese machine tool builder Okuma has said.

asia.nikkei.com/Economy/Trade-…

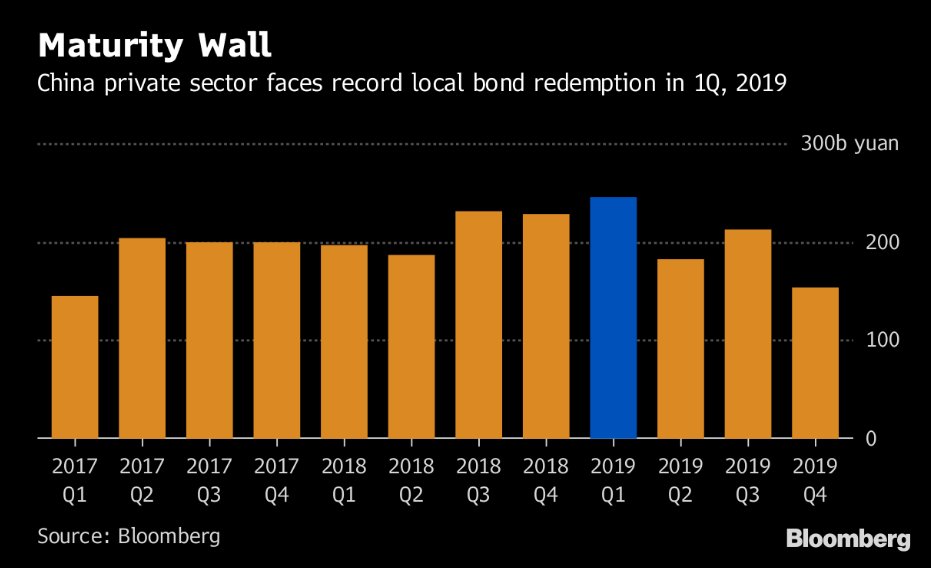

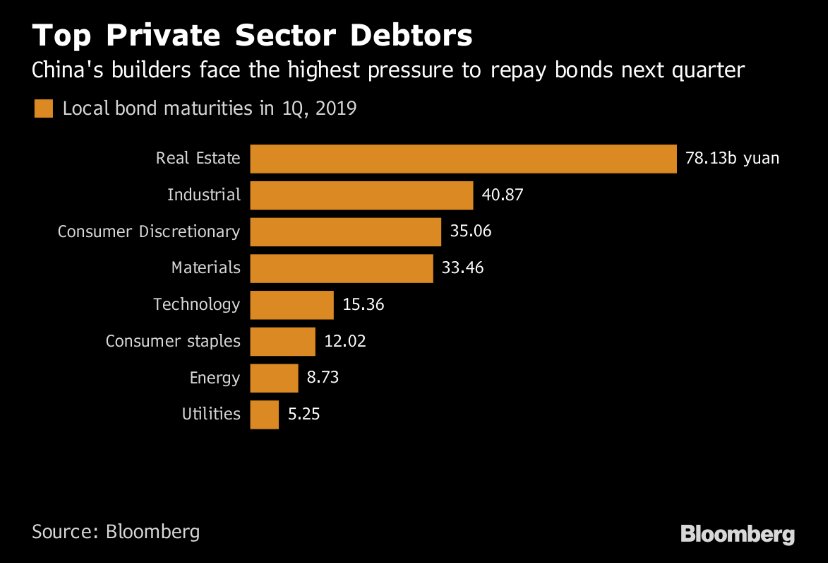

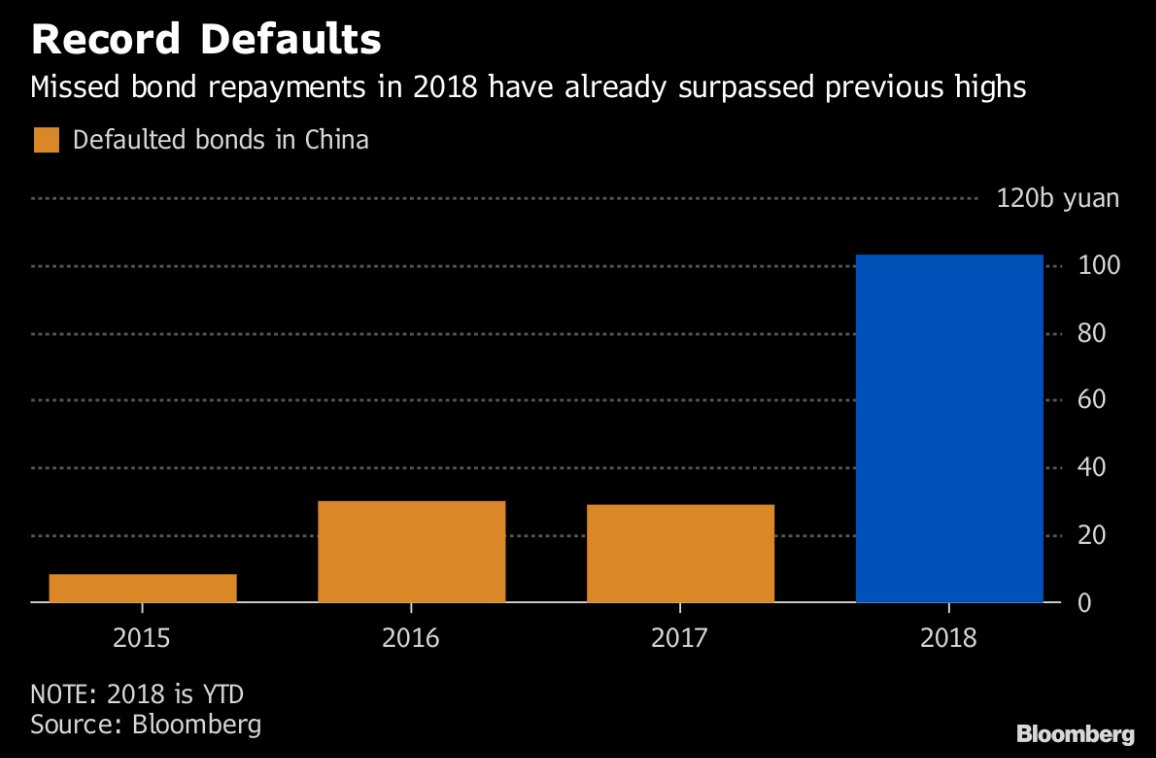

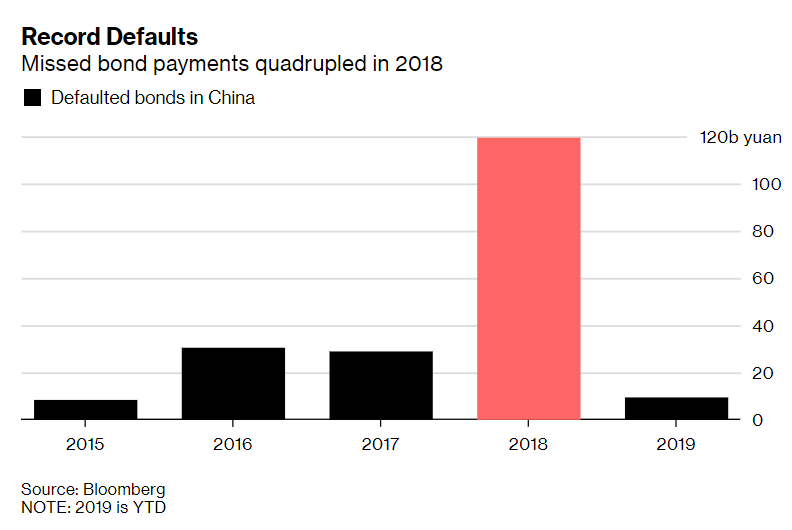

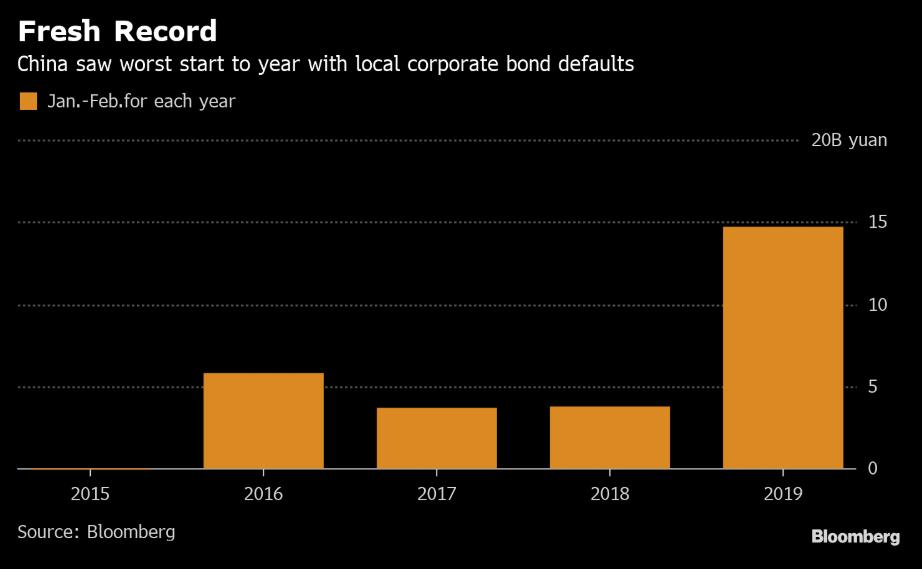

*At least 4 property-related firms defaulted on bonds in 2018

*S&P expects defaults to rise, asks investors to be cautious

*Link: bloom.bg/2DlU5Bs

*#China offshore corporate-bond defaults amounted to $2.53b this year, including 9 dollar-denominated bonds and one HK dollar-based note.

*Link: bit.ly/2zyzHst

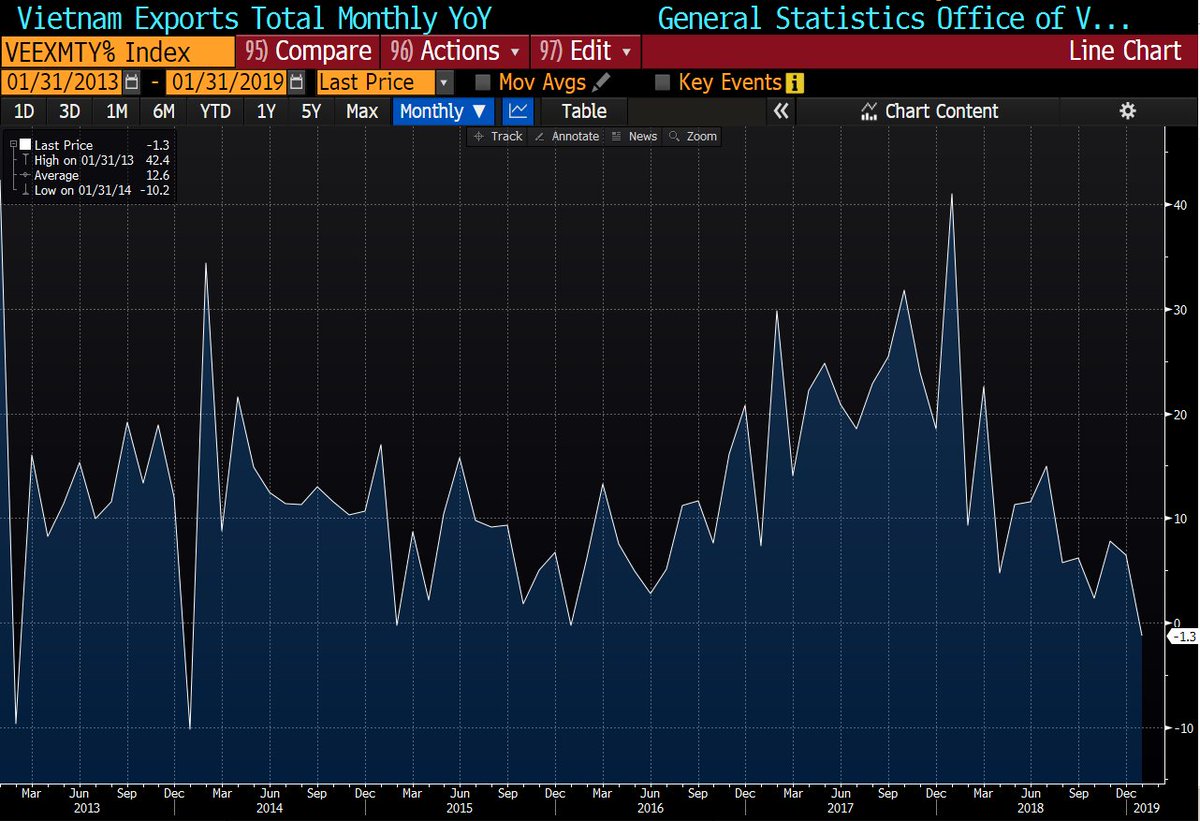

➡ It can be partially explained by adverse weather conditions.

*Excluding disasters, a global and Chinese economic slowdown likely weighted ⬇.

*🇯🇵 2018 GDP forecasts remain optimistic

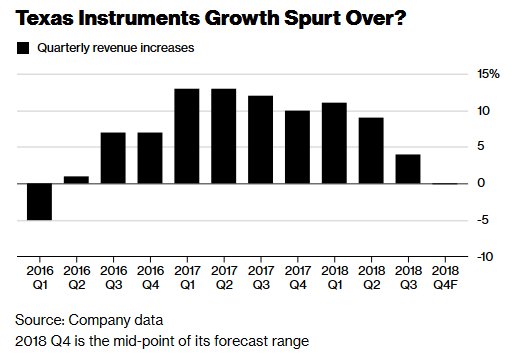

*Said demand was lower in general but expects that to reverse in 2H19 as new, fifth-generation or 5G, phone services and networks are deployed.

*Link: bloom.bg/2OxsX3M

*CHINA OCT. RETAIL PASSENGER VEHICLE SALES 1.98M UNITS

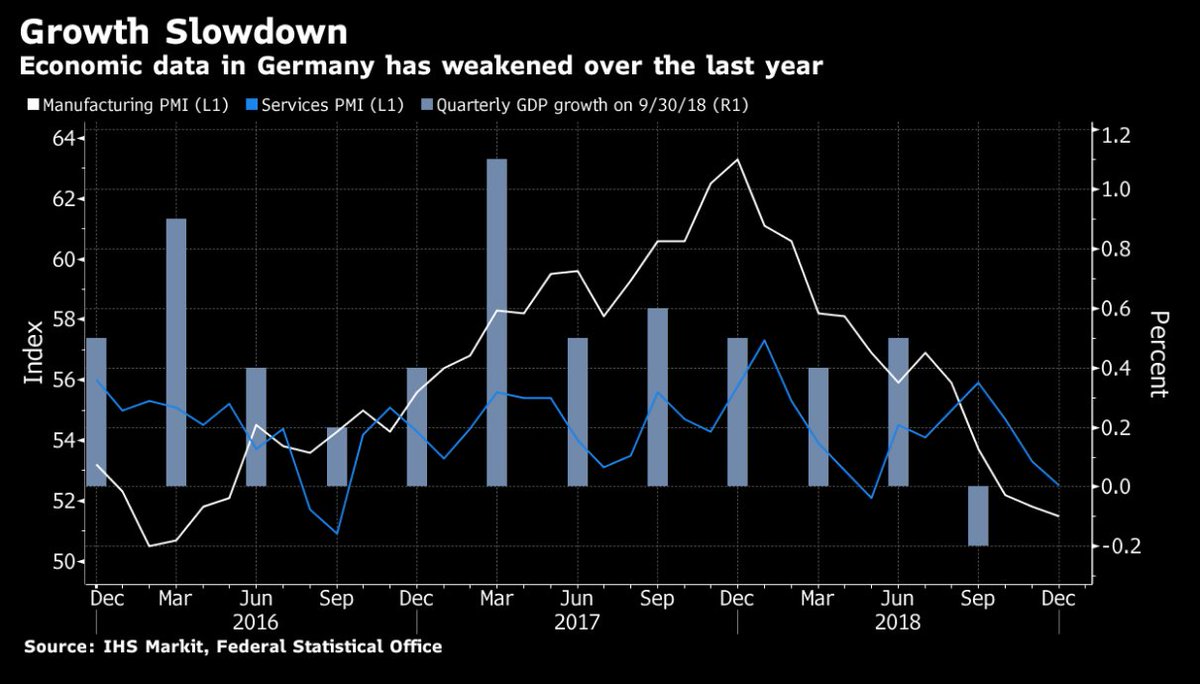

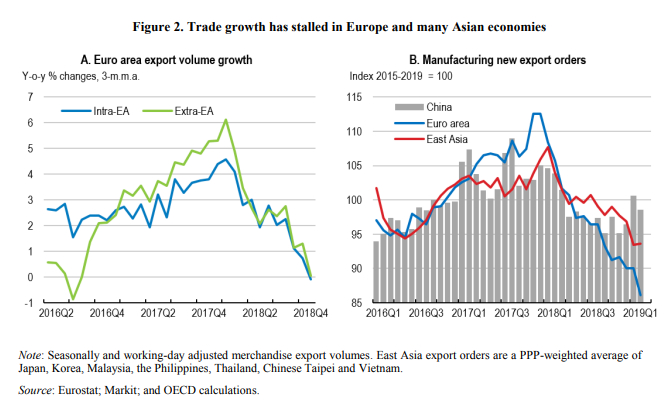

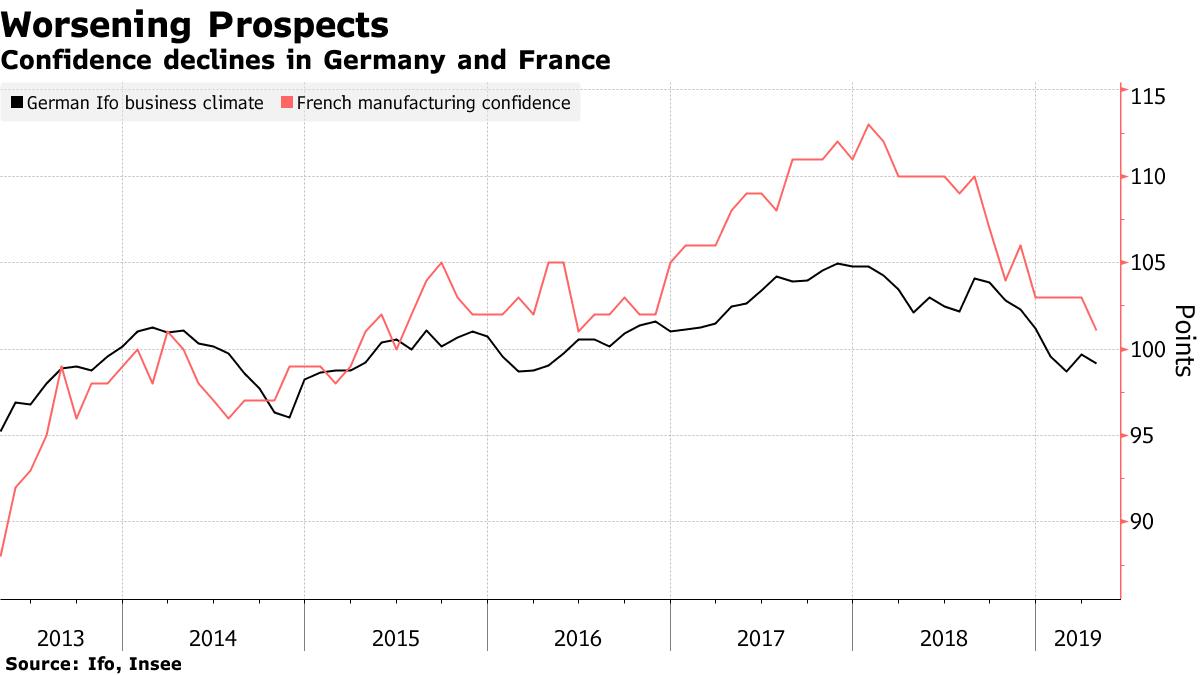

🇩🇪 Sept. Exports M/M: -0.8% v +0.4%e

🇫🇷 Sept. Exports: -1.8% v -0.2% prior

*Link: bit.ly/2RIgBHM

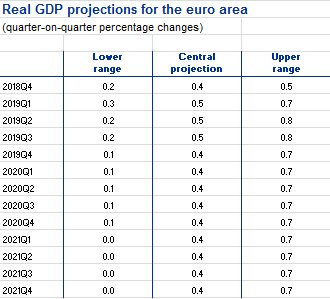

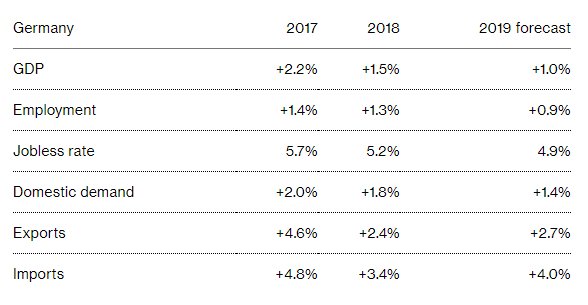

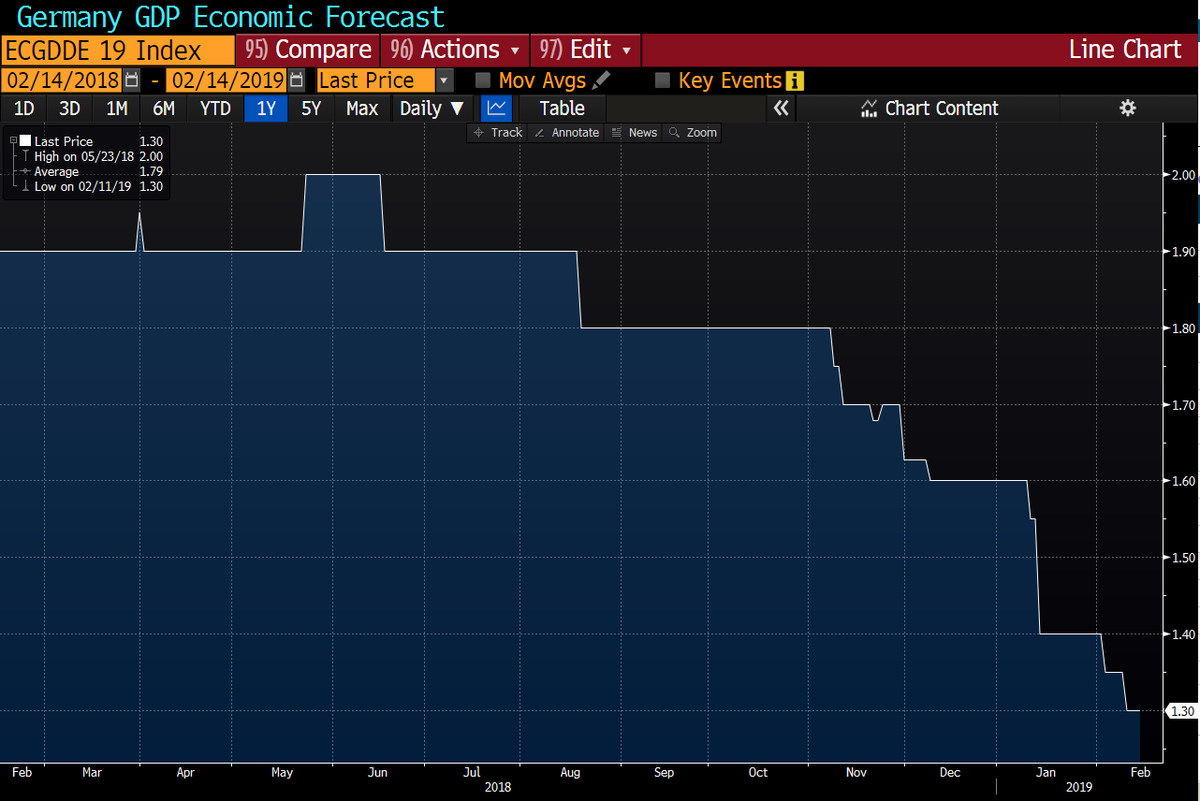

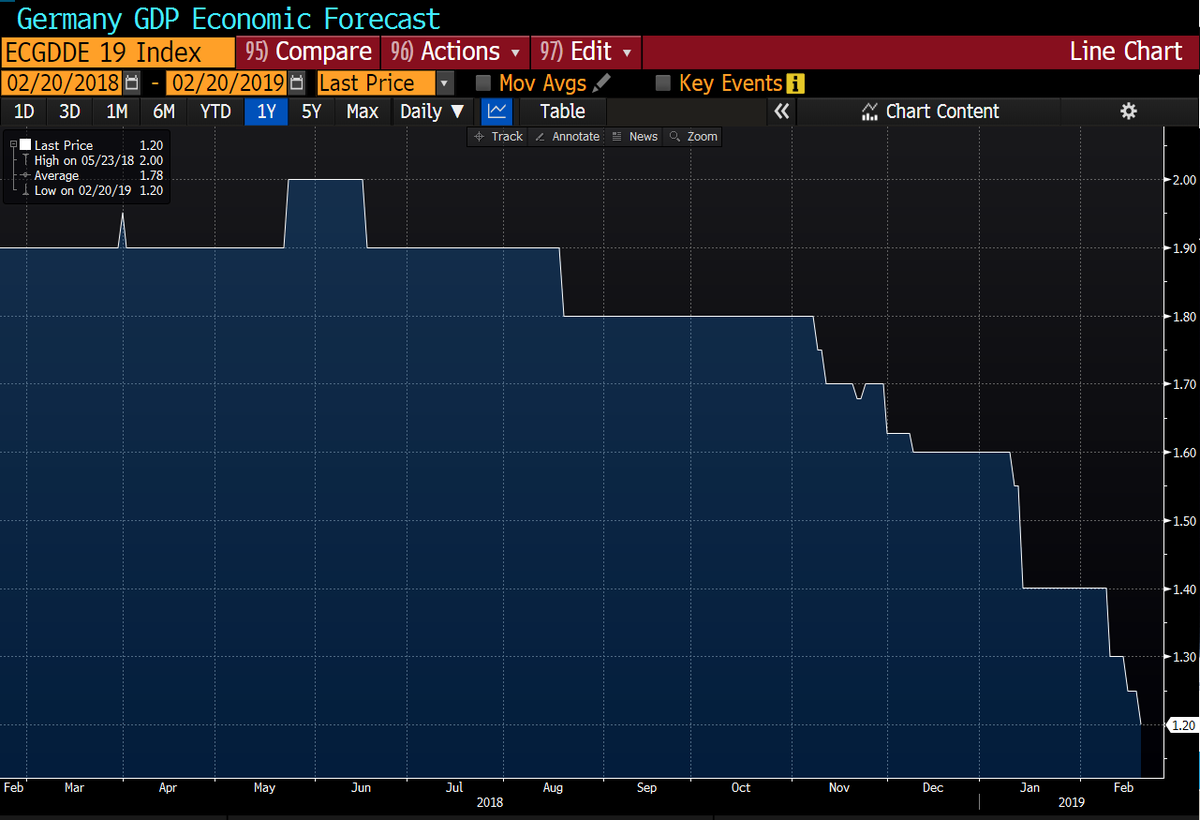

*It seems very optimistic. Sept. ECB forecast for 2018 was 2.0% but the central bank has already acknowledged that latest figures have been weaker than expected

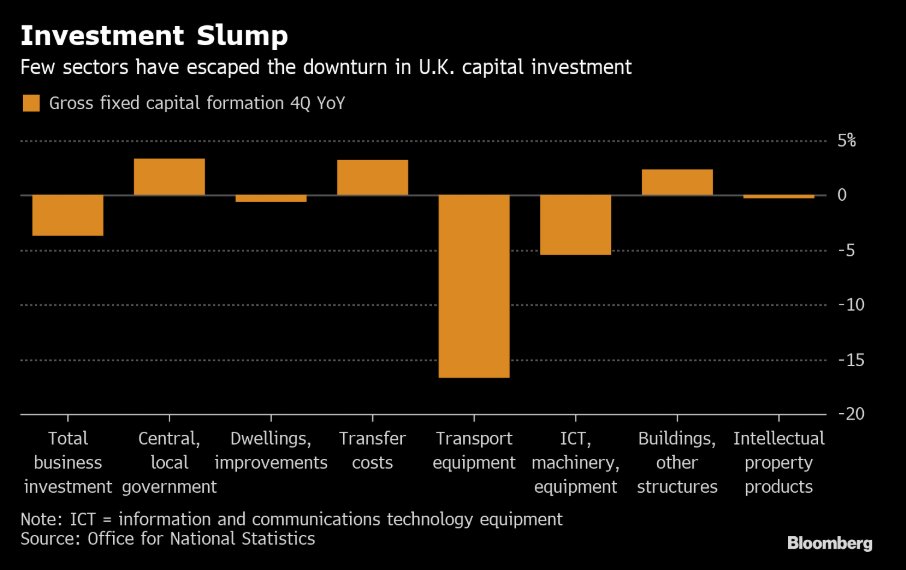

*BROADBENT: BREXIT UNCERTAINTY HITS PRODUCTIVITY, INVESTMENT

*BROADBENT: UNCERTAINTIES ON THINGS IN FORECASTS ARE MATERIAL

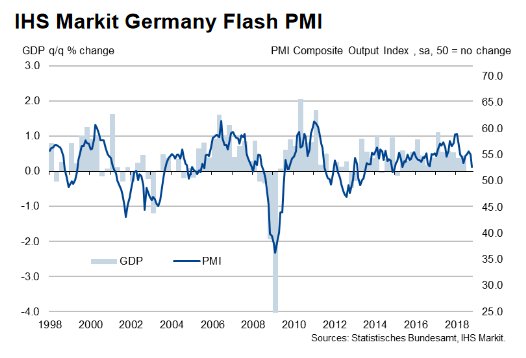

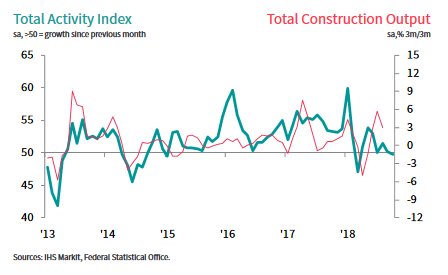

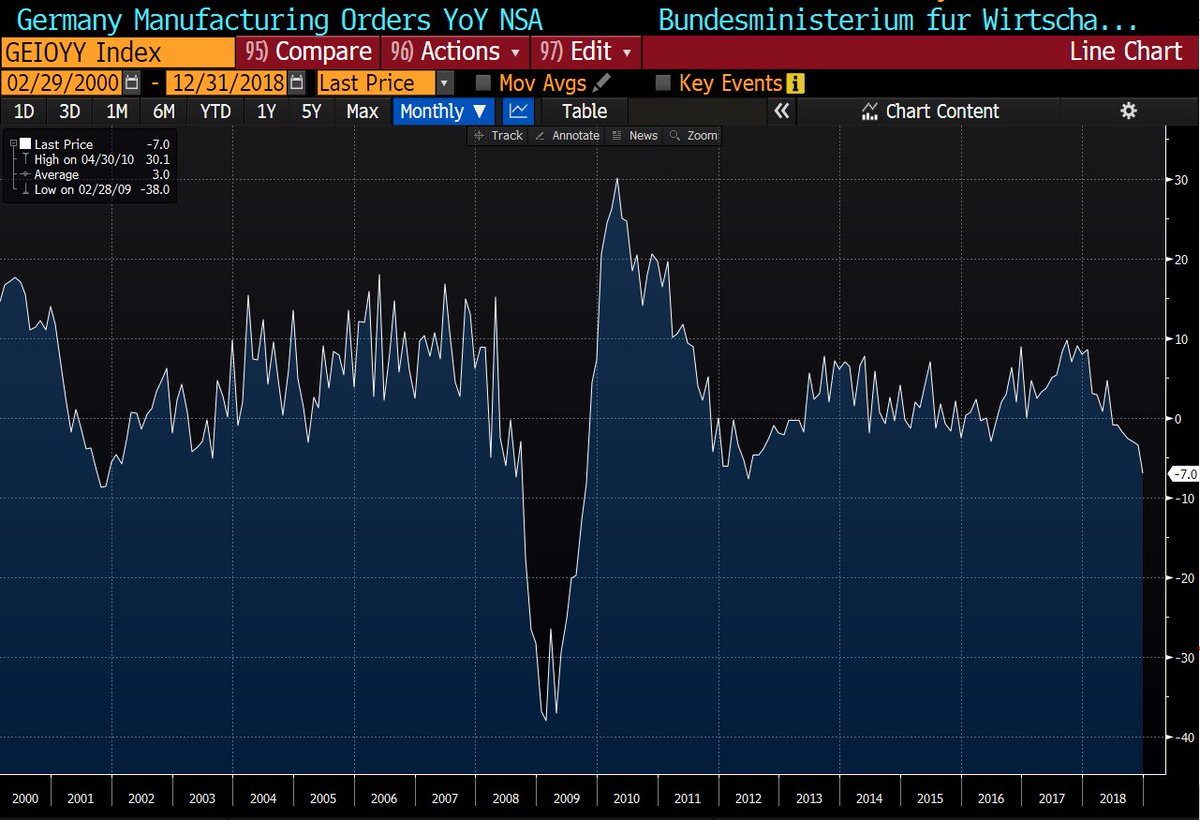

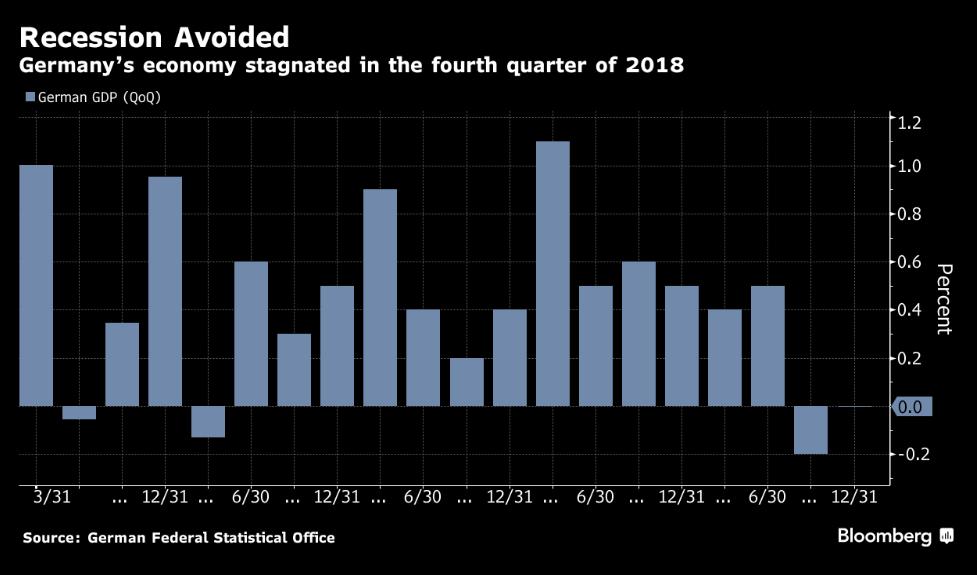

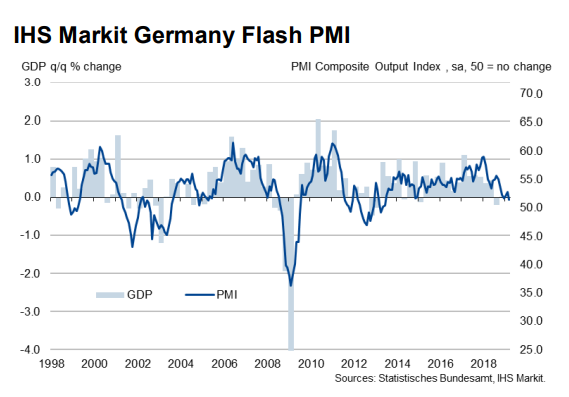

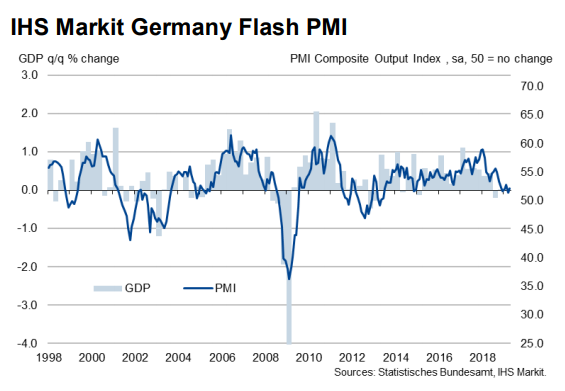

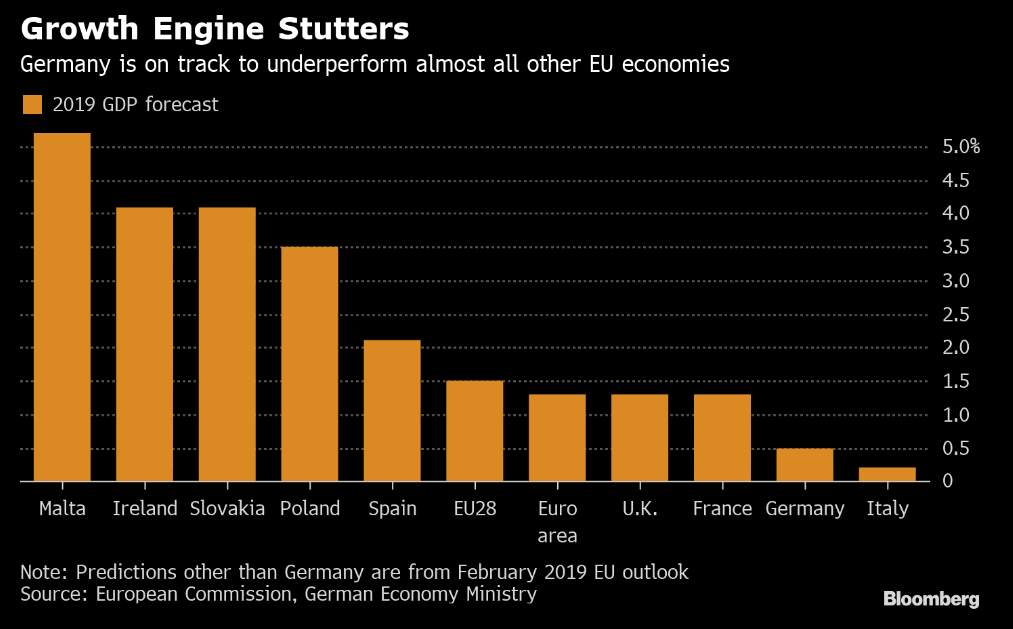

🇩🇪 #GERMANY Q3 PRELIMINARY GDP Q/Q: -0.2% V -0.1%E; GDP Y/Y: 1.1% V 1.3%E

bfmbusiness.bfmtv.com/mediaplayer/vi…

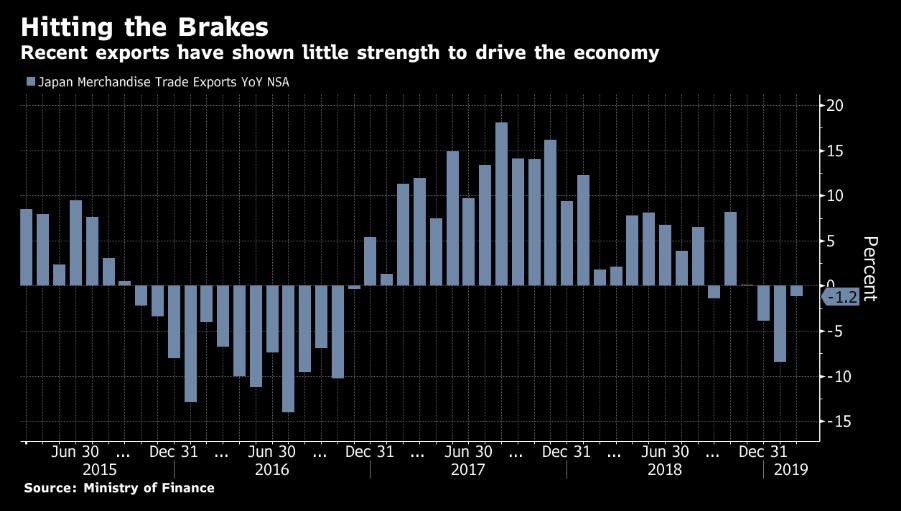

*Q3 PRELIM GDP ANNUALIZED Q/Q: -1.2% V -1.0%E

*Link: bloom.bg/2zbCLvk

*In recent weeks, Apple slashed production orders for all three iPhone models that it unveiled in September.

wsj.com/articles/apple…

*Apple suppliers including Hon Hai missed 3Q net income est.

*Link: bloom.bg/2A5Djmb

*Company has fewest positive analyst ratings among big #tech

*Link: bloom.bg/2OTUPiv

scmp.com/tech/big-tech/…

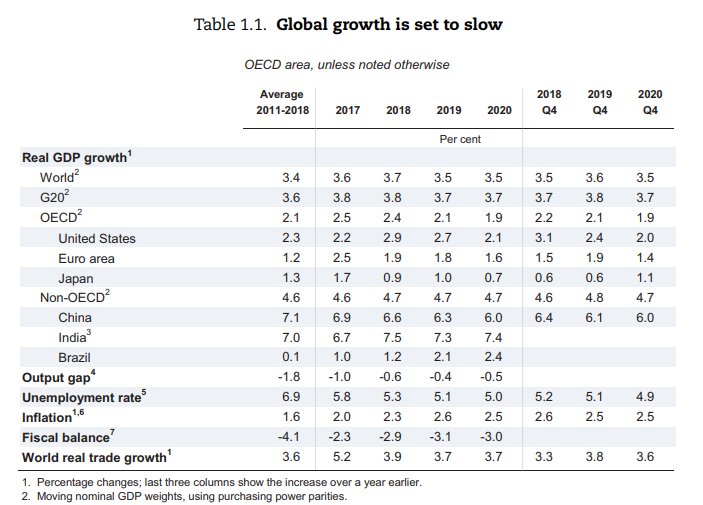

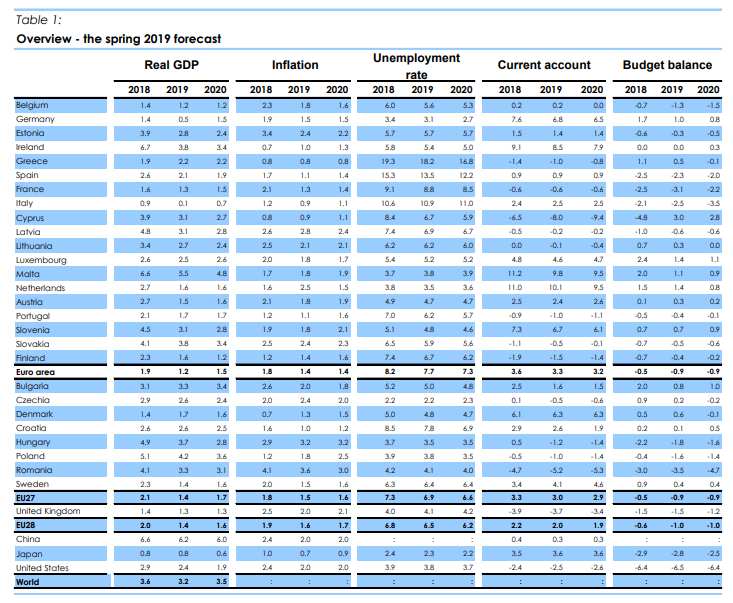

*OECD LOWERS EURO-AREA GROWTH FORECASTS FOR 2018, 2019

*OECD SAYS ‘DOWNSIDE RISKS ABOUND’ FOR GLOBAL ECONOMY

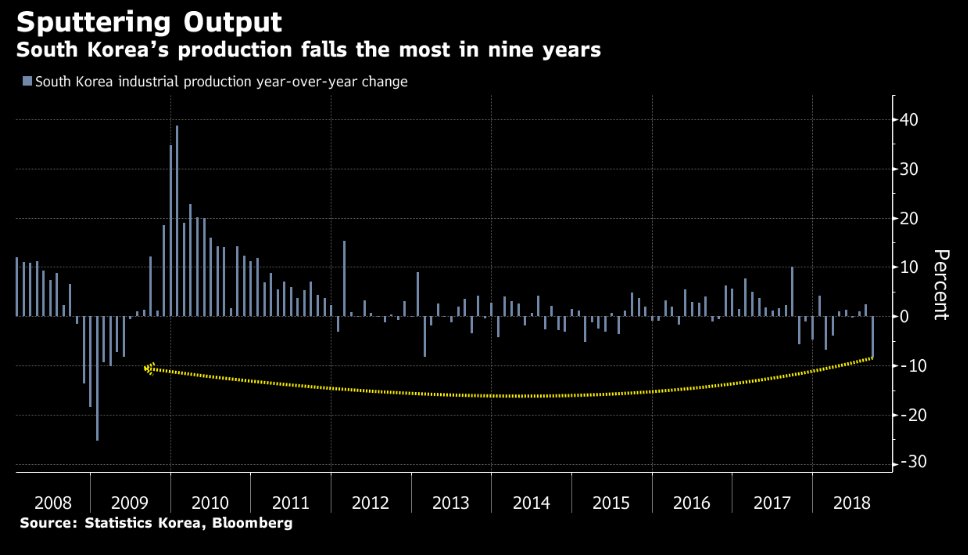

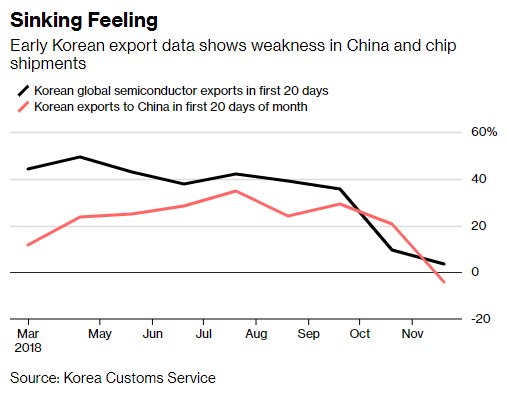

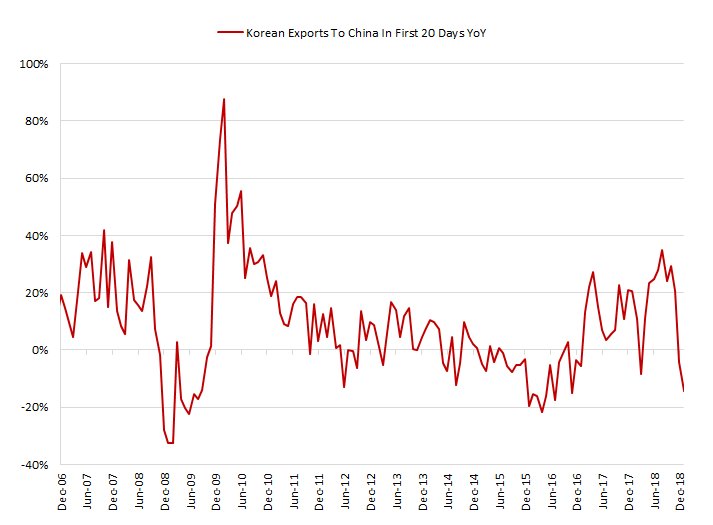

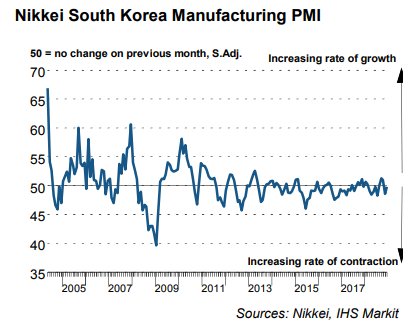

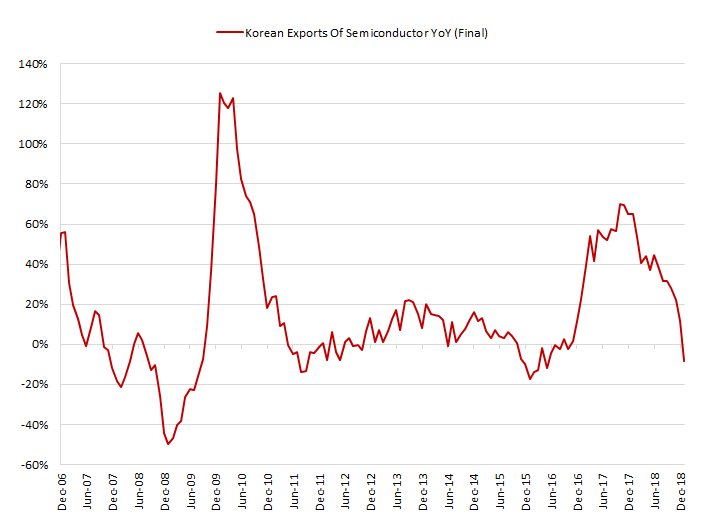

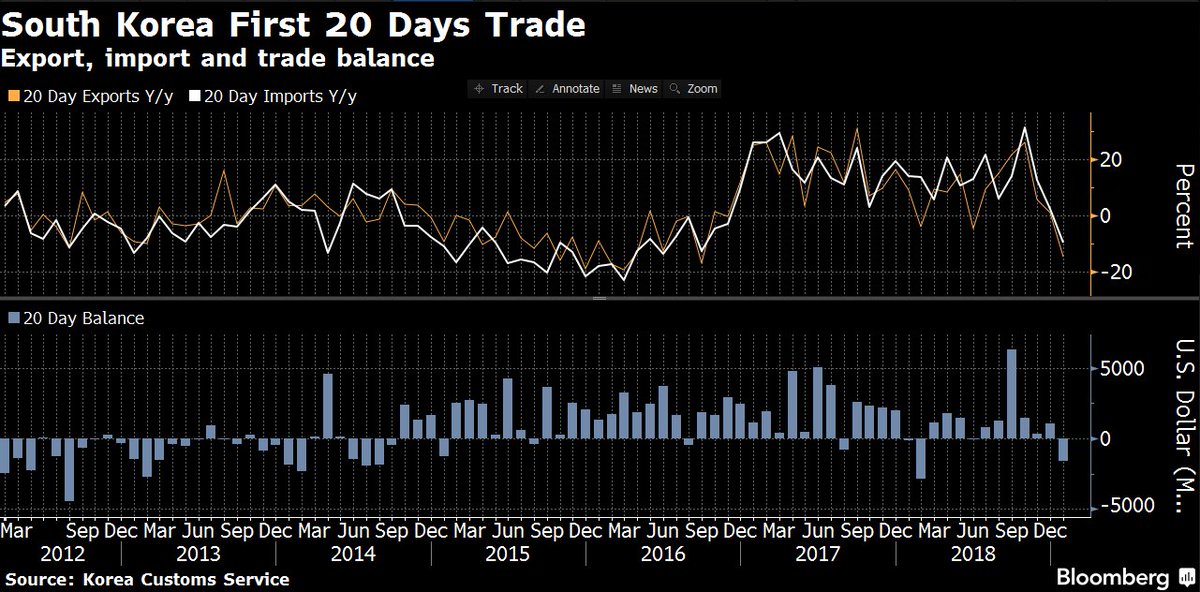

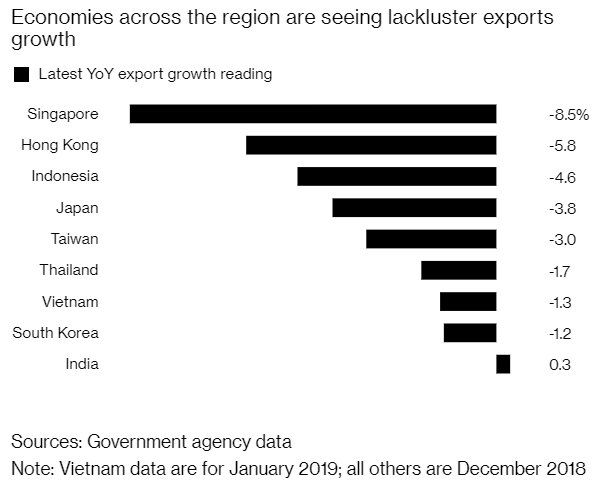

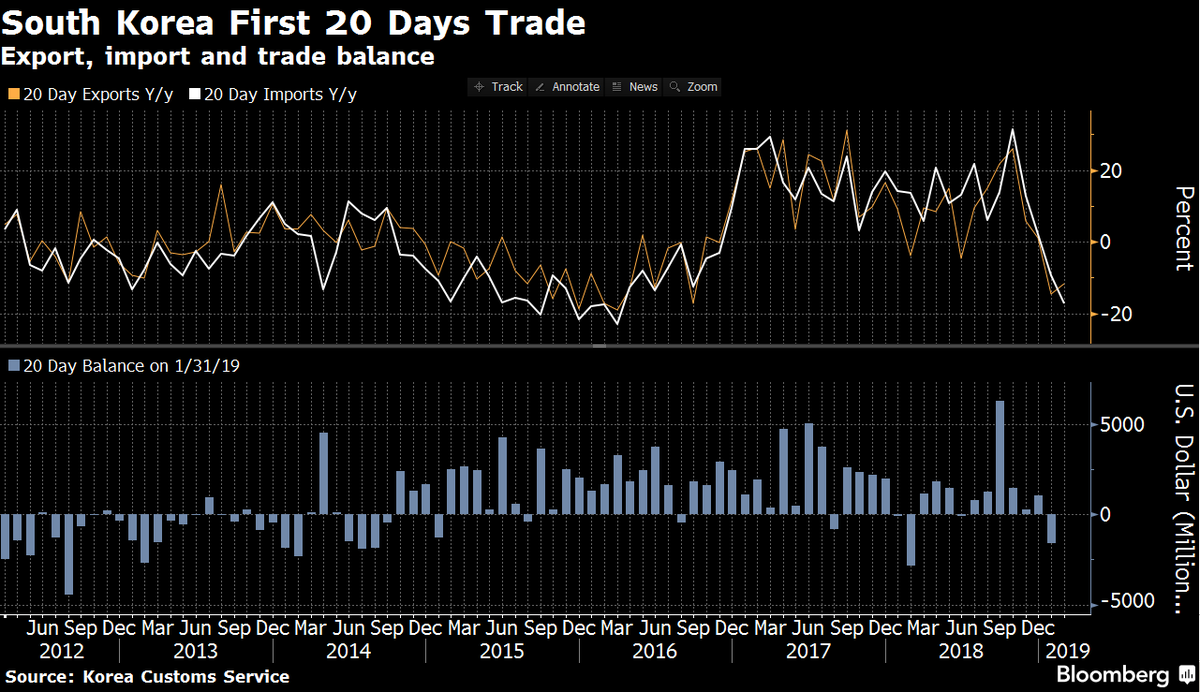

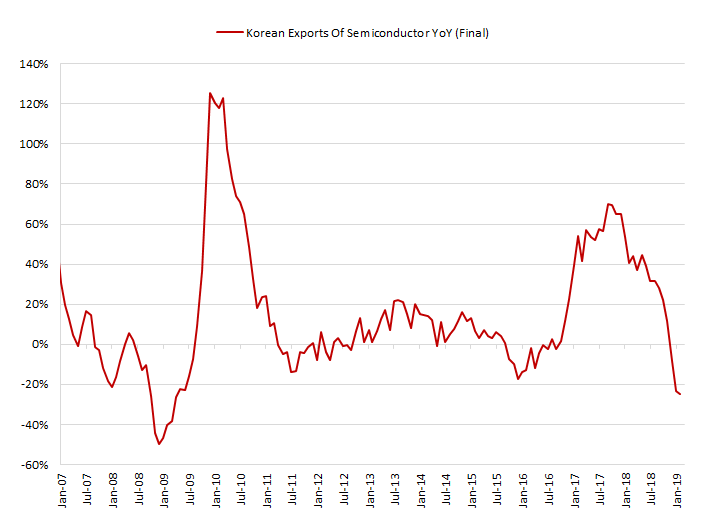

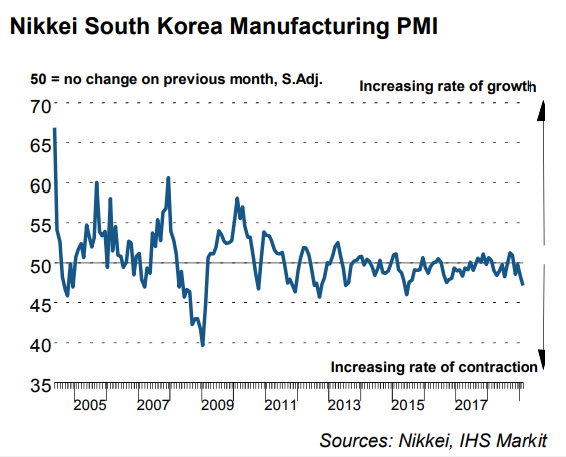

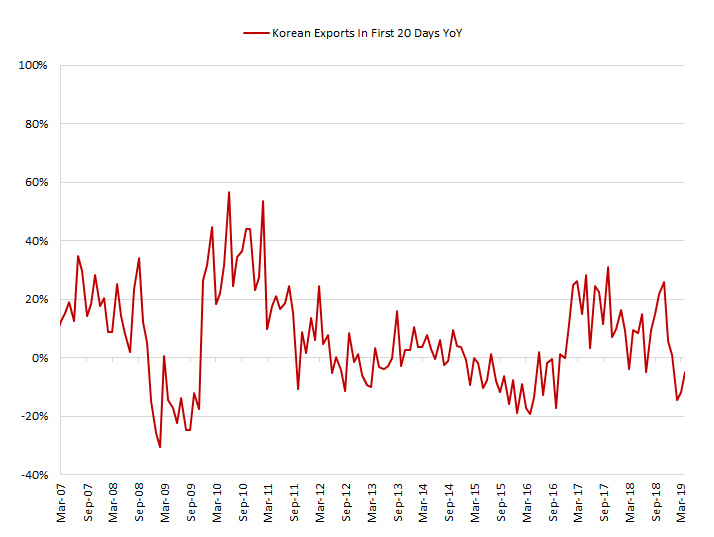

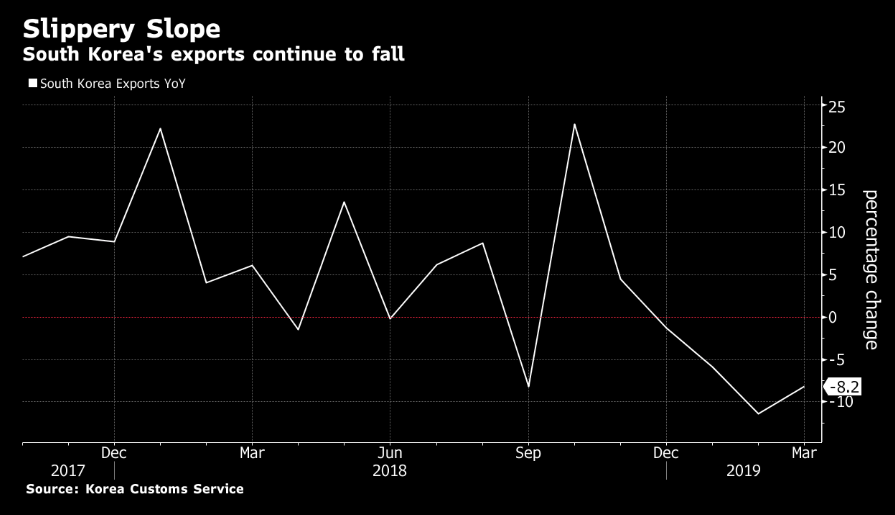

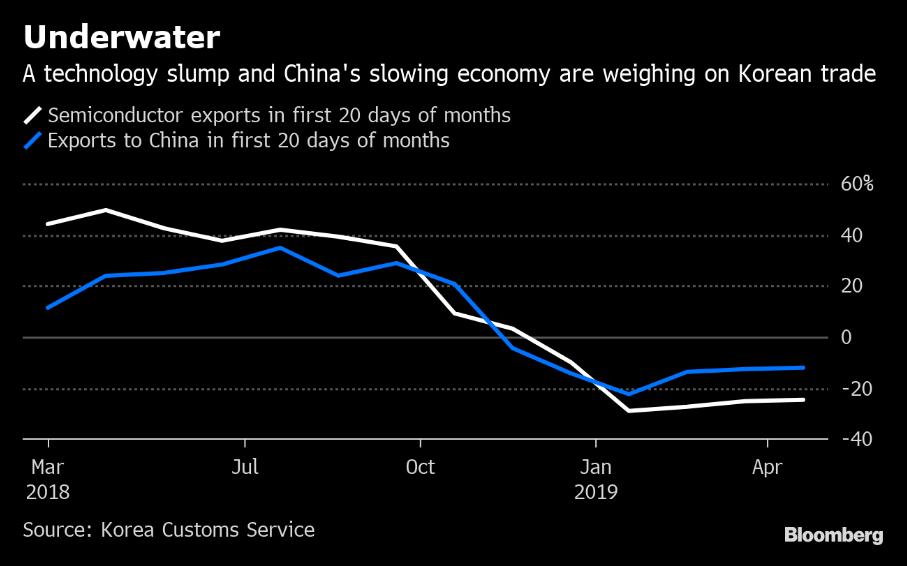

This morning, trade data for the first 20 days of Nov. showed a 4.3% ⬇ in 🇰🇷 exports to 🇨🇳, the first fall outside holiday-affected months since late 2016.

*Link (Korean): bit.ly/2DRGuSR

bloomberg.com/news/articles/…

*Euro Area 2018 at +1.9% (vs 2.0% for ECB and 2.1% for EU Commission)

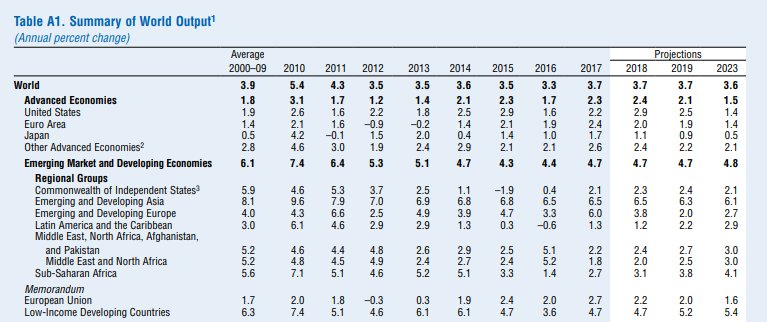

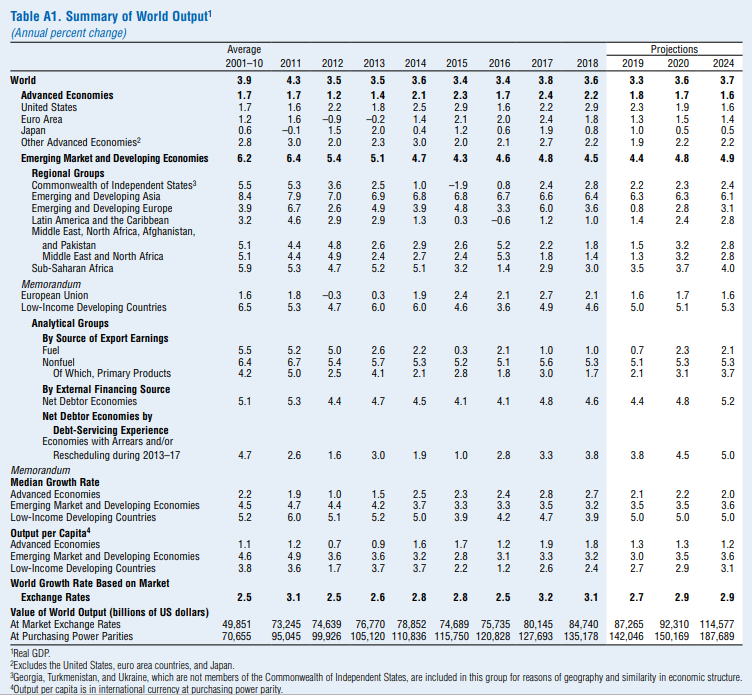

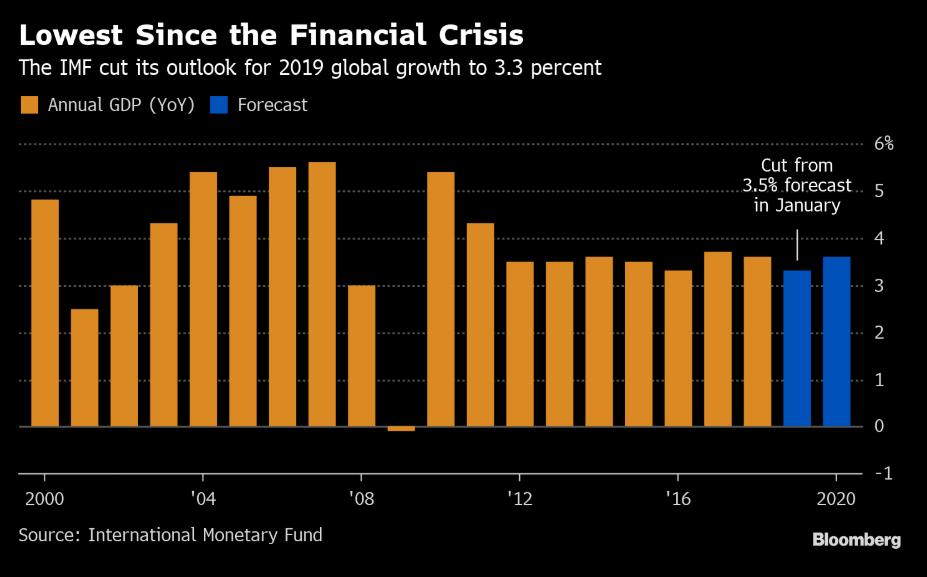

*Global GDP 2019 at 3.5% (vs 3.7% for the consensus)

*Link: bit.ly/2QbkeZM

reuters.com/article/us-g20…

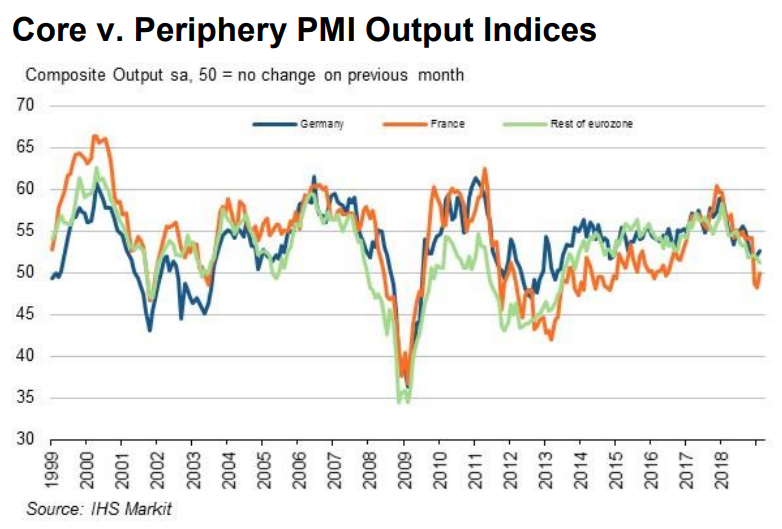

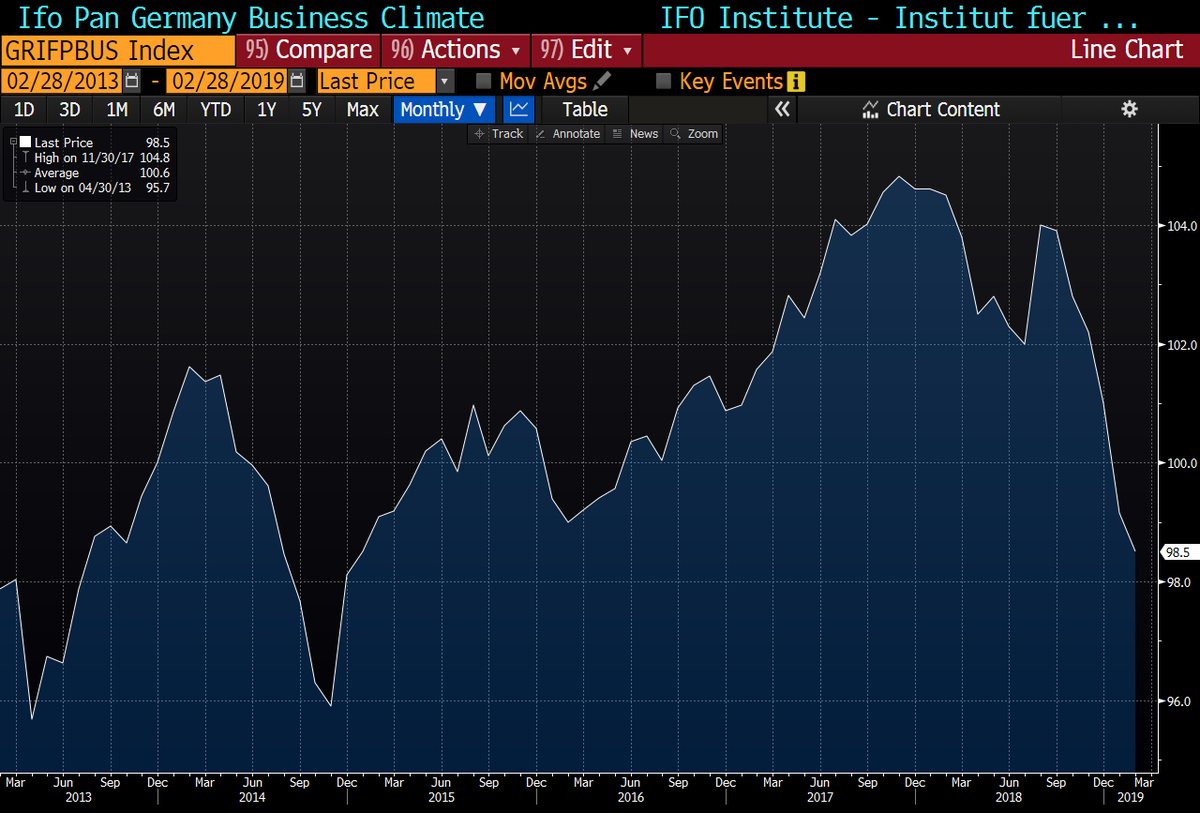

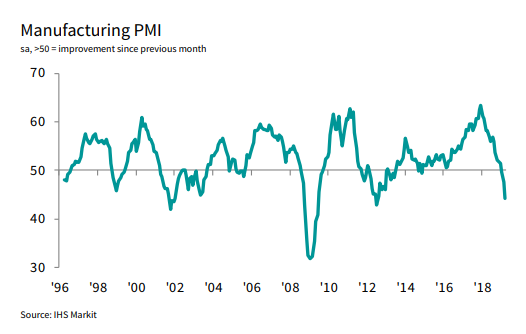

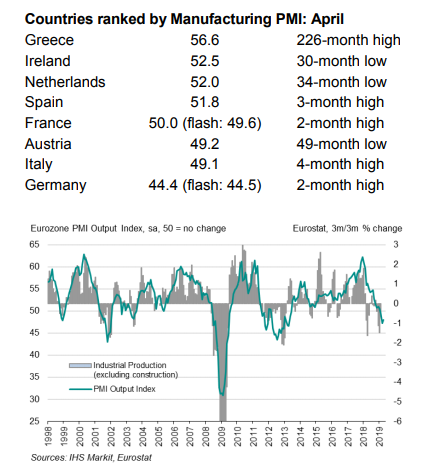

*#Germany PMI Composite Output Index ⬇ to a 47-month low.

*Link: bit.ly/2TBrltt

*Manufacturing order books fell for the second month running and to the greatest extent in four years.

*This largely reflected a solid and accelerated decline in goods exports orders.

*New Orders 48.9 v 49.8 prior (2nd straight contraction and lowest since Nov. 2014)

*Services PMI: 53.1 v 53.6e (25-month low)

*Composite PMI 52.4 v 53.0e (47-month low)

*Link: bit.ly/2Ks4f4h

*The weaker rise in business activity was linked to a 2nd successive monthly ⬇ in new export orders across the manufacturing and service sectors.

*The drop in exports was the largest seen in the 4-year history of this new survey indicator ❗

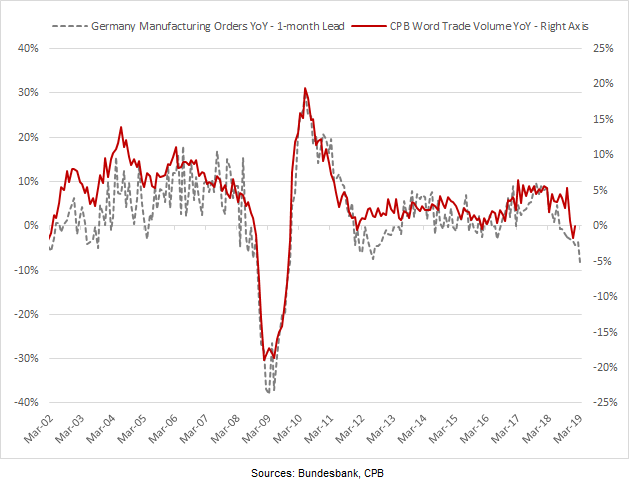

*Despite a drop in EUR, exports remain under pressure due to global trade growth slowdown.

*New orders contracted for the first time since Sept 2016 while new export orders showed expansion (though at a slower pace).

*Link: bit.ly/2DWu7ot

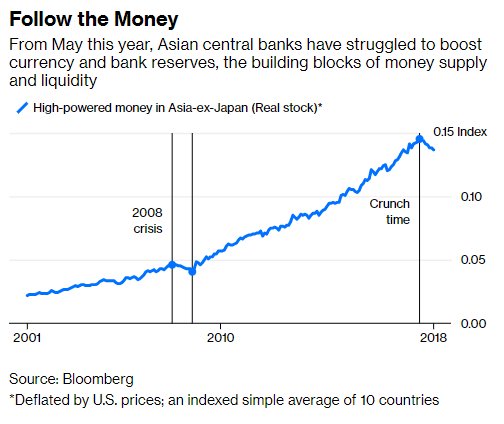

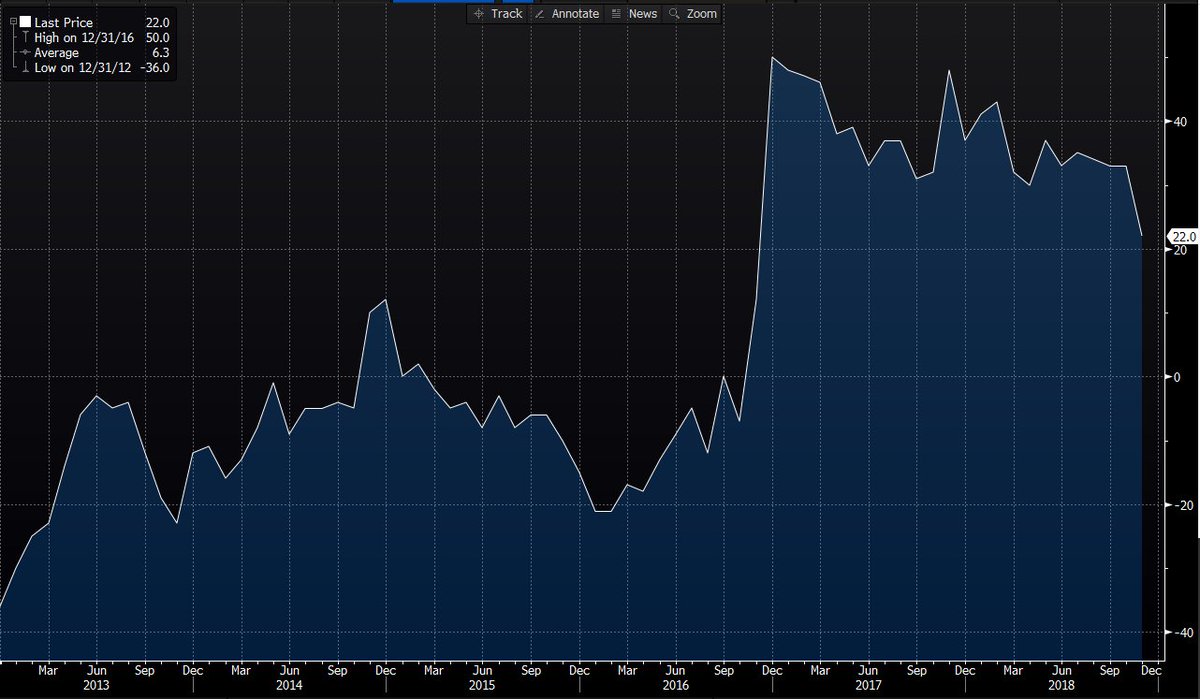

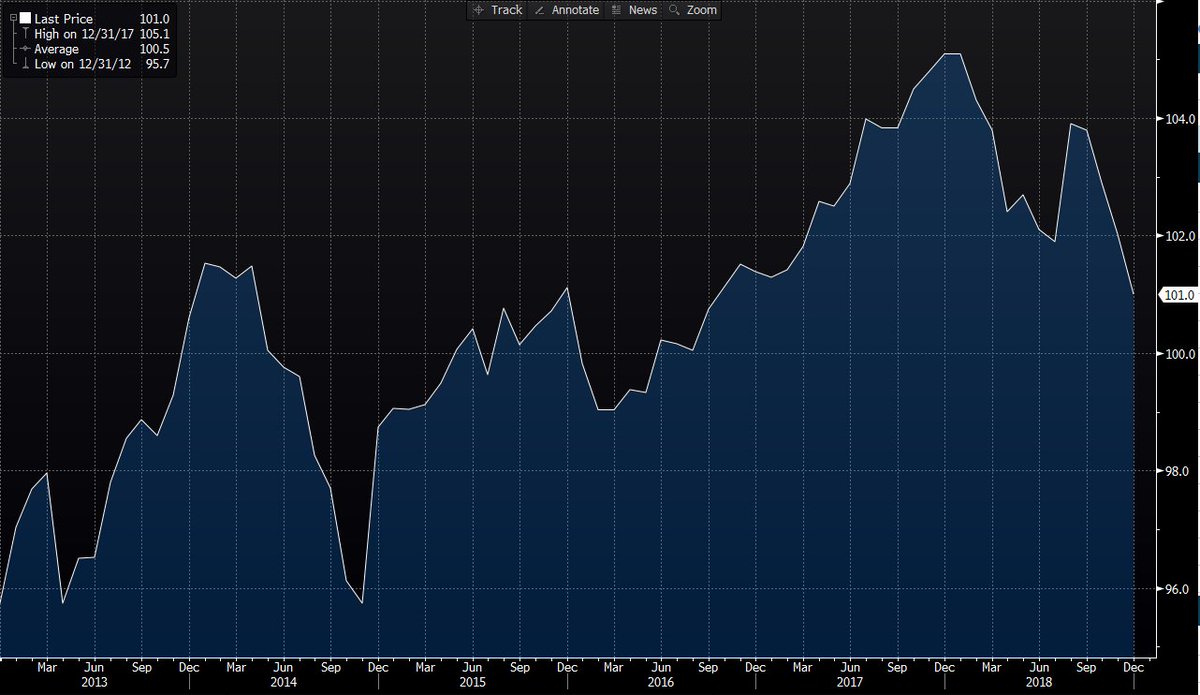

*Ex-Japan, central banks’ supply of currency plus bank reserves has ⬇ 7% in real terms since April.

*This is the steepest ⬇ in base money since the 11% ⬇ between Jan. and Oct. of 2008.

*Link: bloom.bg/2P55OGd

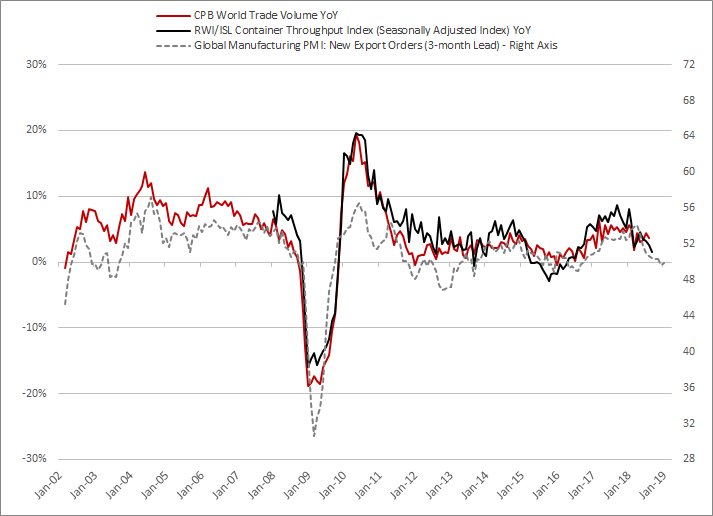

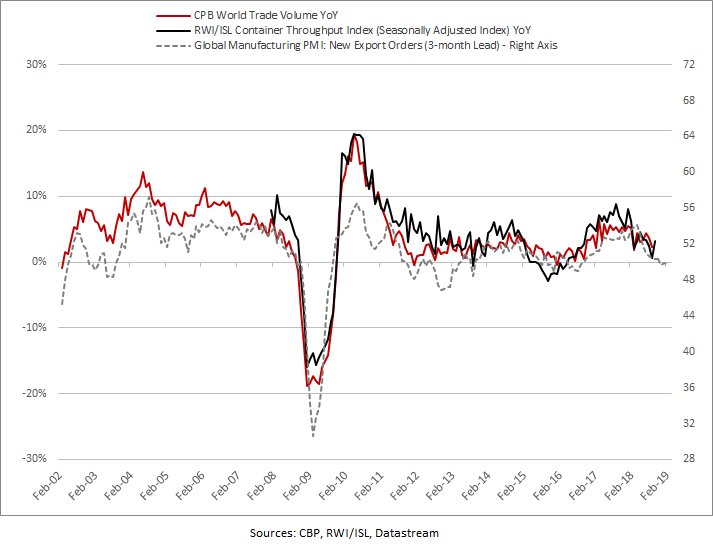

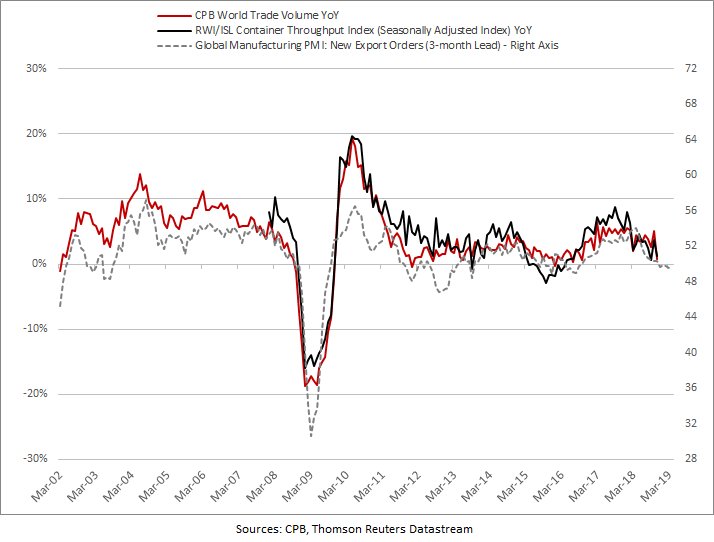

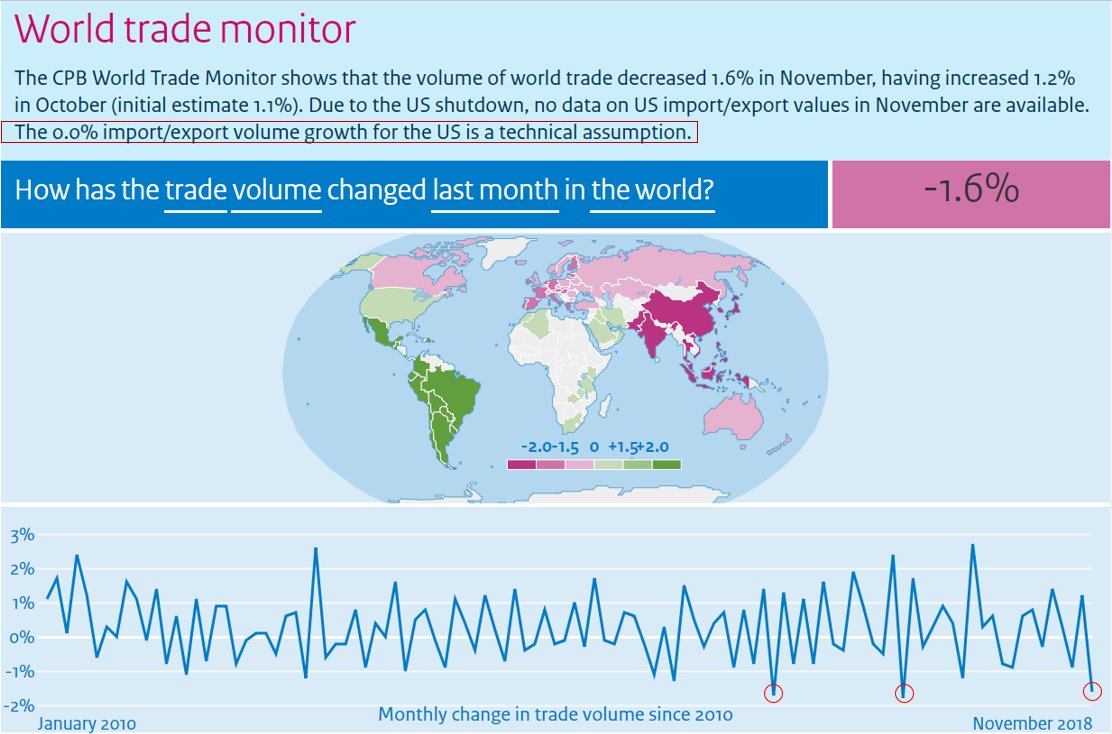

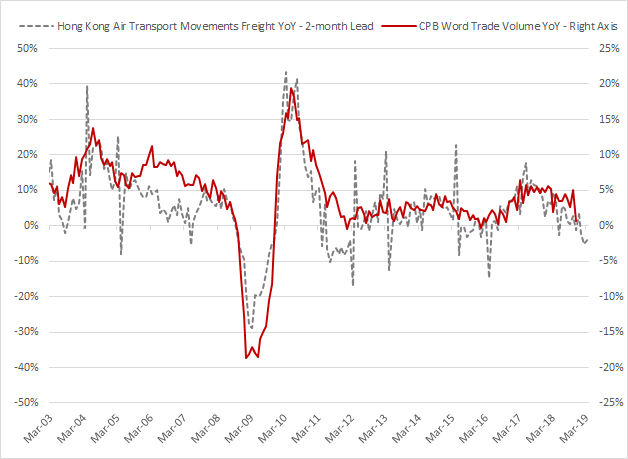

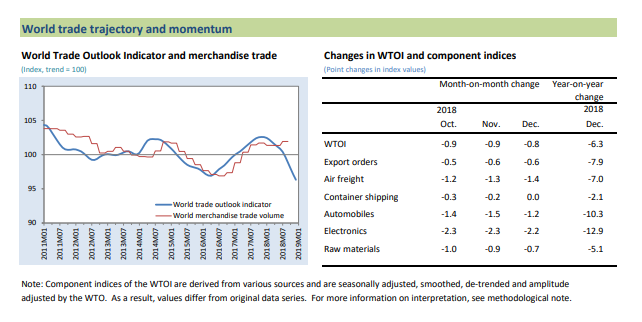

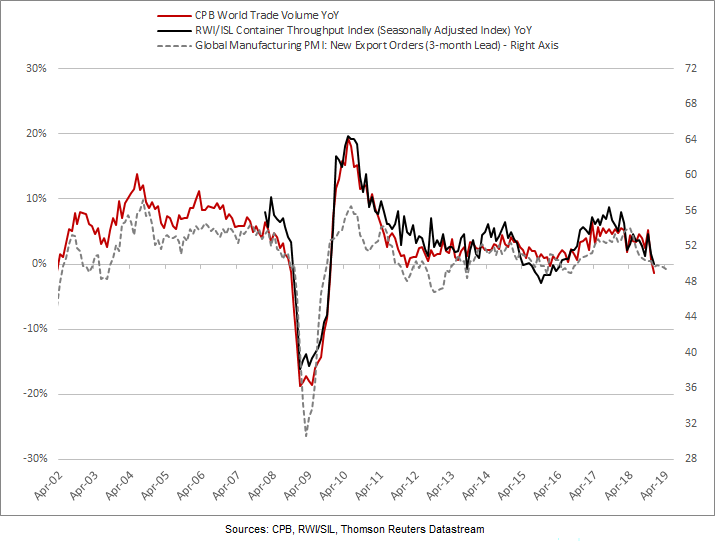

*DRAGHI: WORLD TRADE GROWTH MOMENTUM HAS SLOWED 'CONSIDERABLY' - BBG

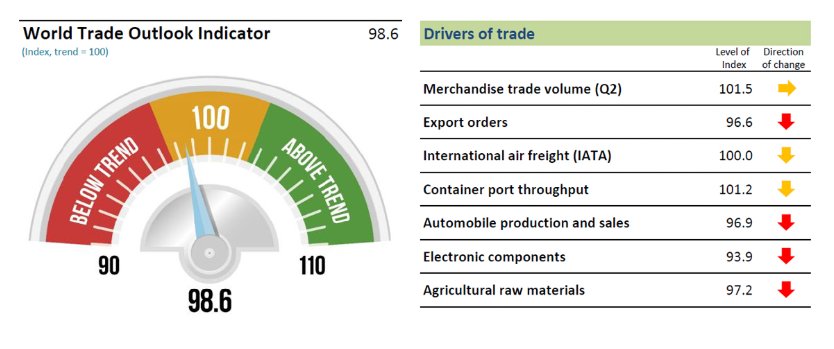

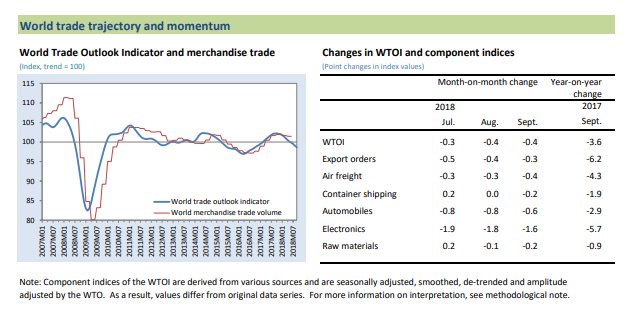

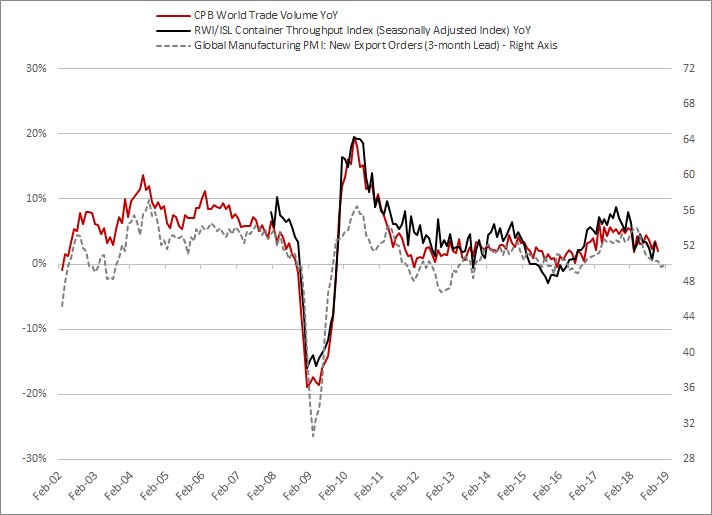

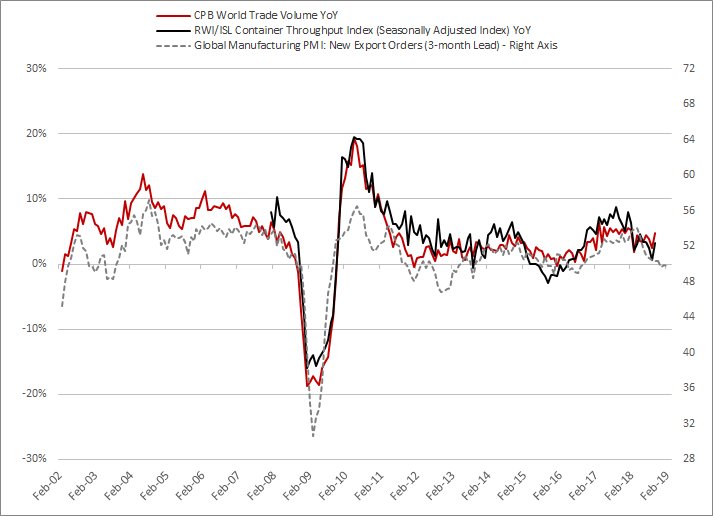

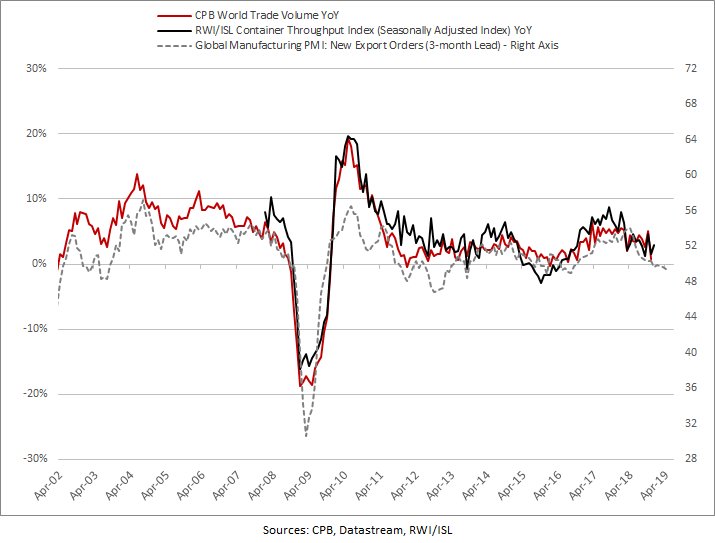

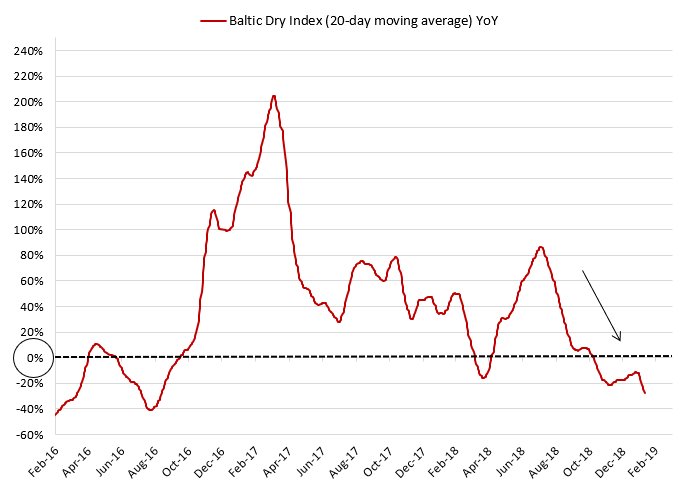

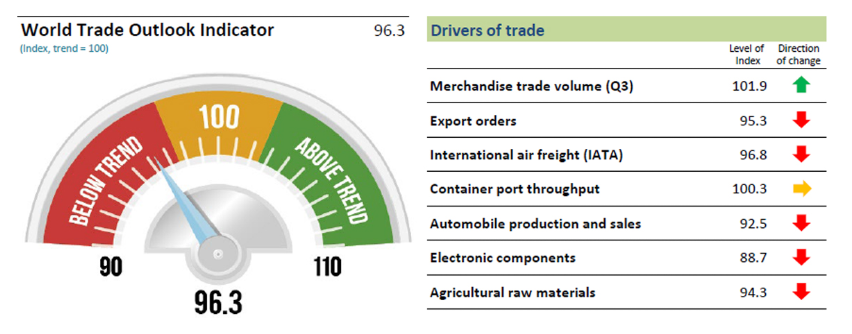

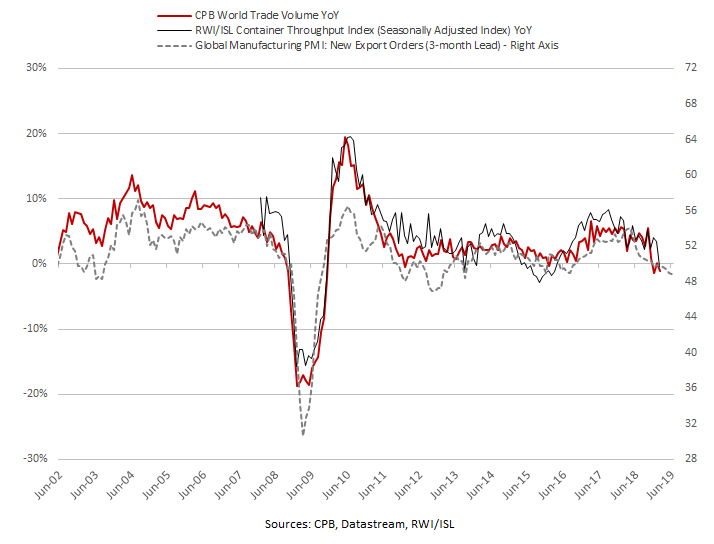

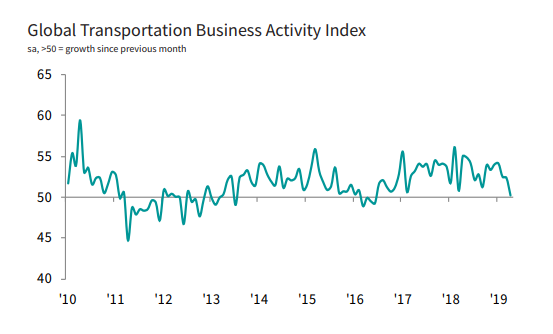

*The most recent WTOI reading of 98.6 is the lowest since October 2016 and reflects declines in all component indices.

*Link: bit.ly/2TGANf0

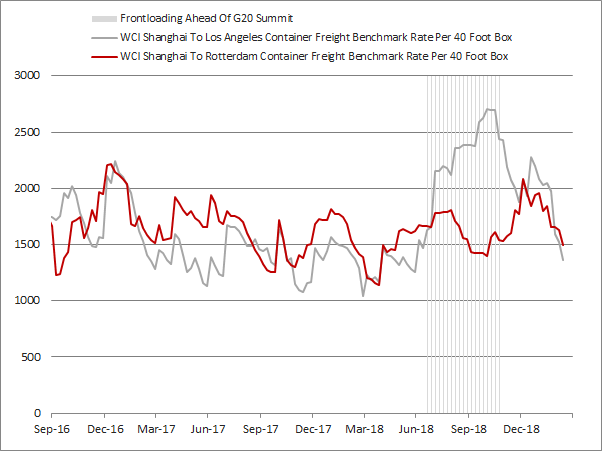

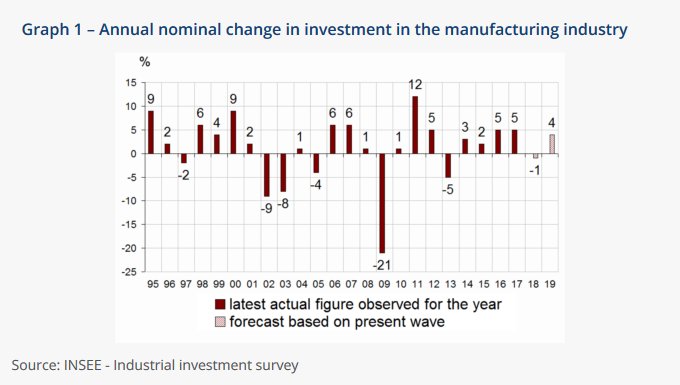

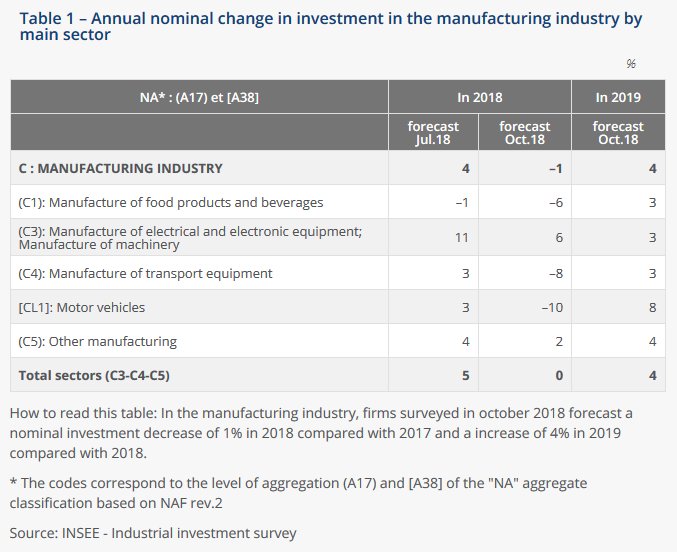

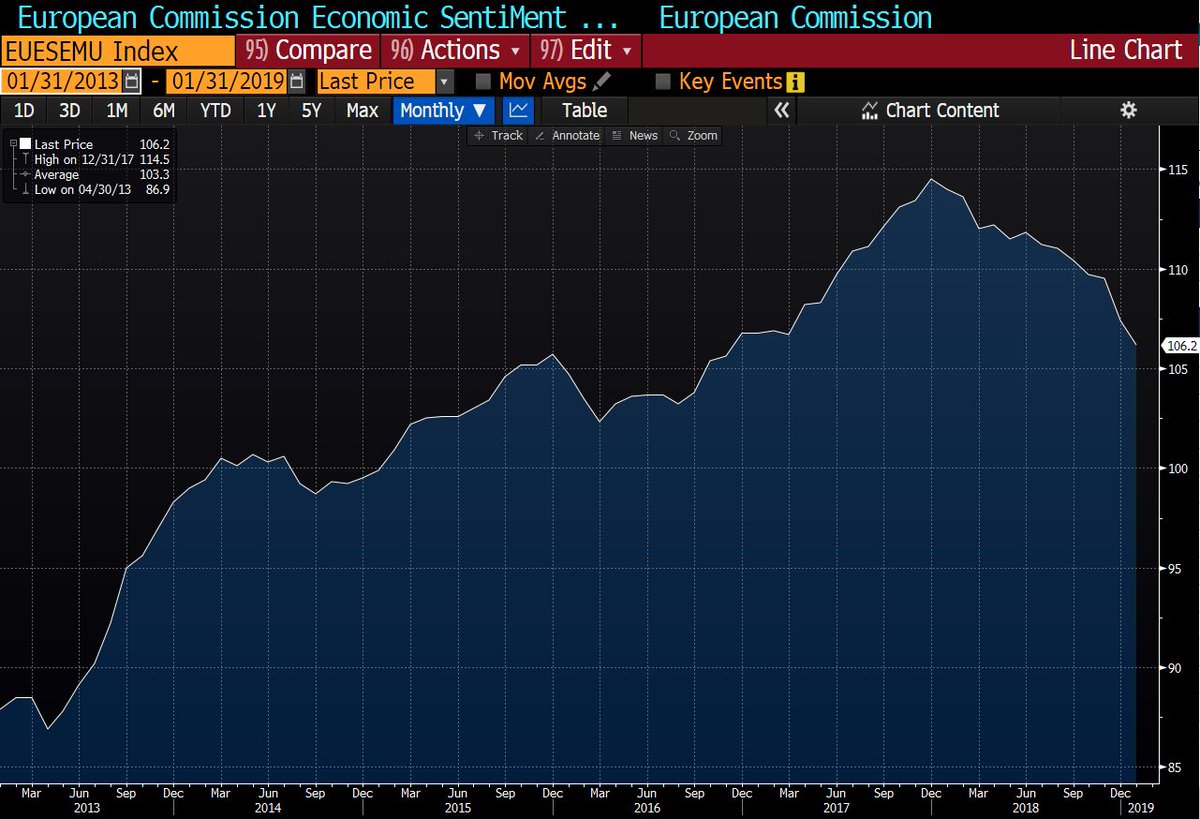

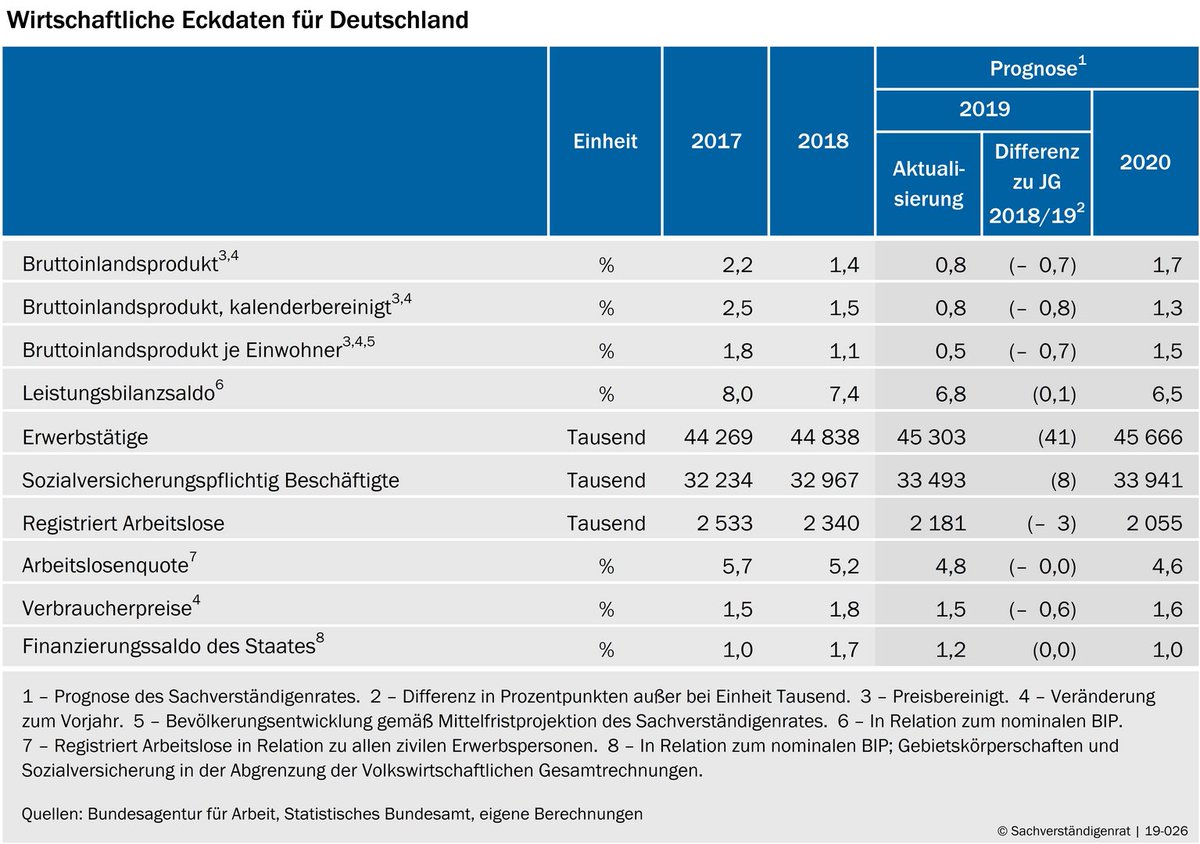

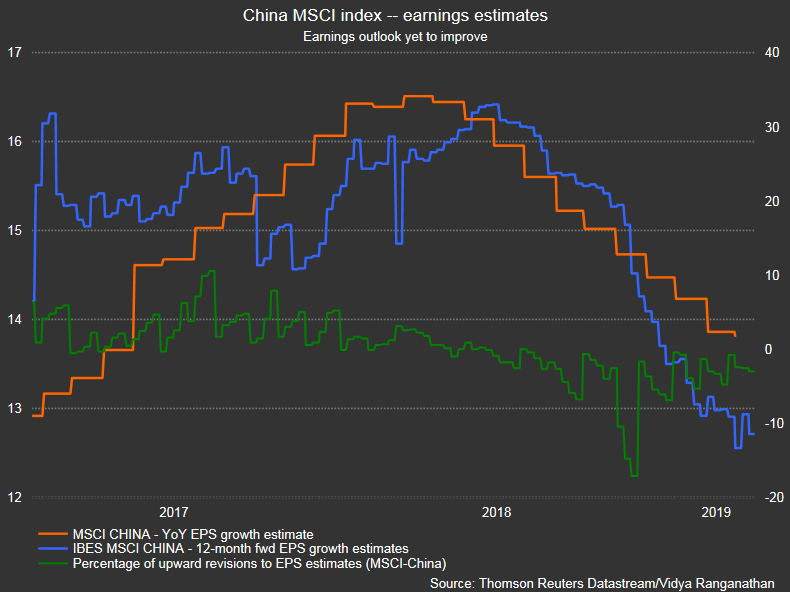

*Figures also suggest that the consensus is too much optimistic for 2018 and especially 2019.

*Link: bit.ly/2rJjz2d

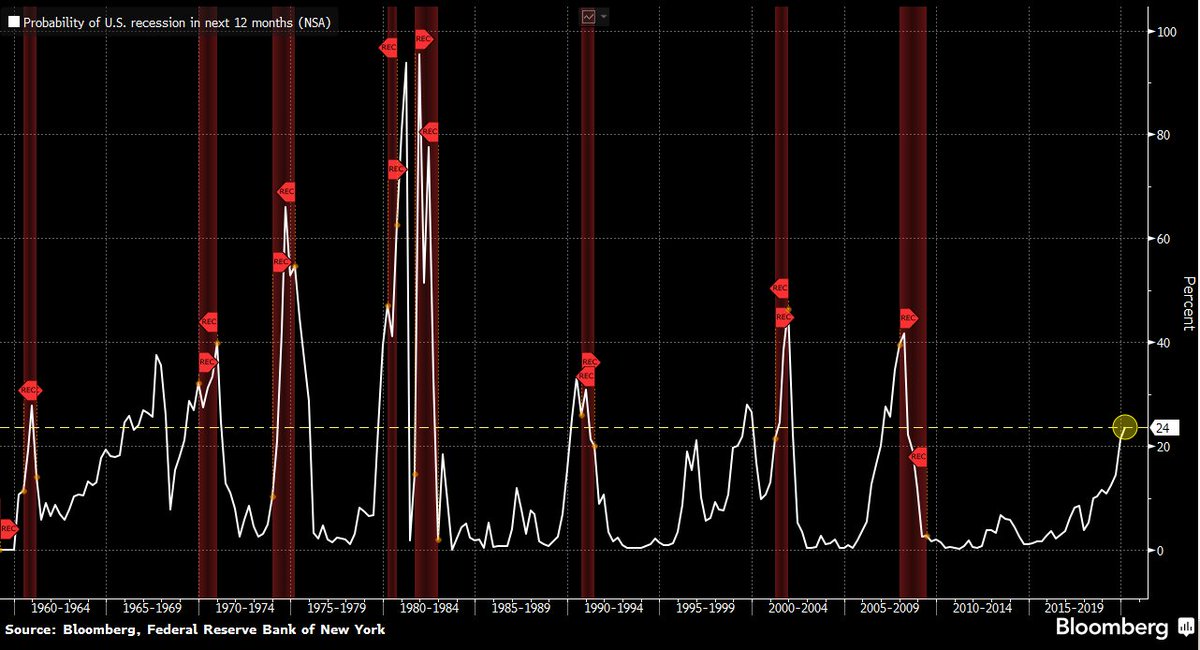

*It also means that the #Fed pause can take place sooner than I expect.

🇩🇪 Dec. (18-month low)

🇮🇹 Nov. (6-month low)

🇫🇷 Nov. (45-month low)

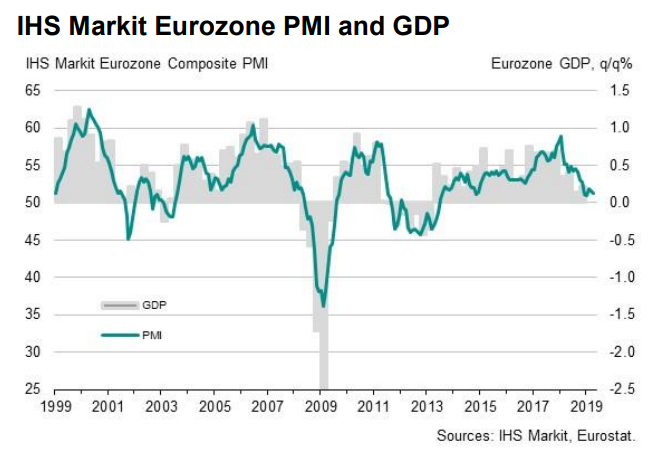

➡ #ECB will revise downward (again) its GDP forecasts (2018/2019) at next meeting

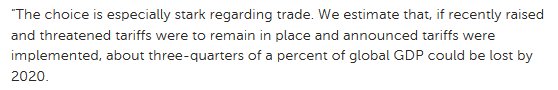

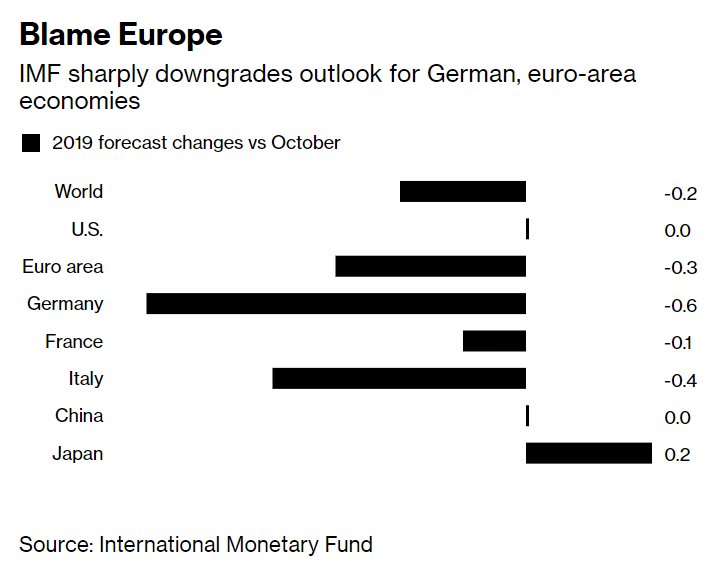

*In a report ahead of the #G20, the IMF noted that recent data suggest greater slowdown than thought last month.

*Link: bloom.bg/2rbzbgo

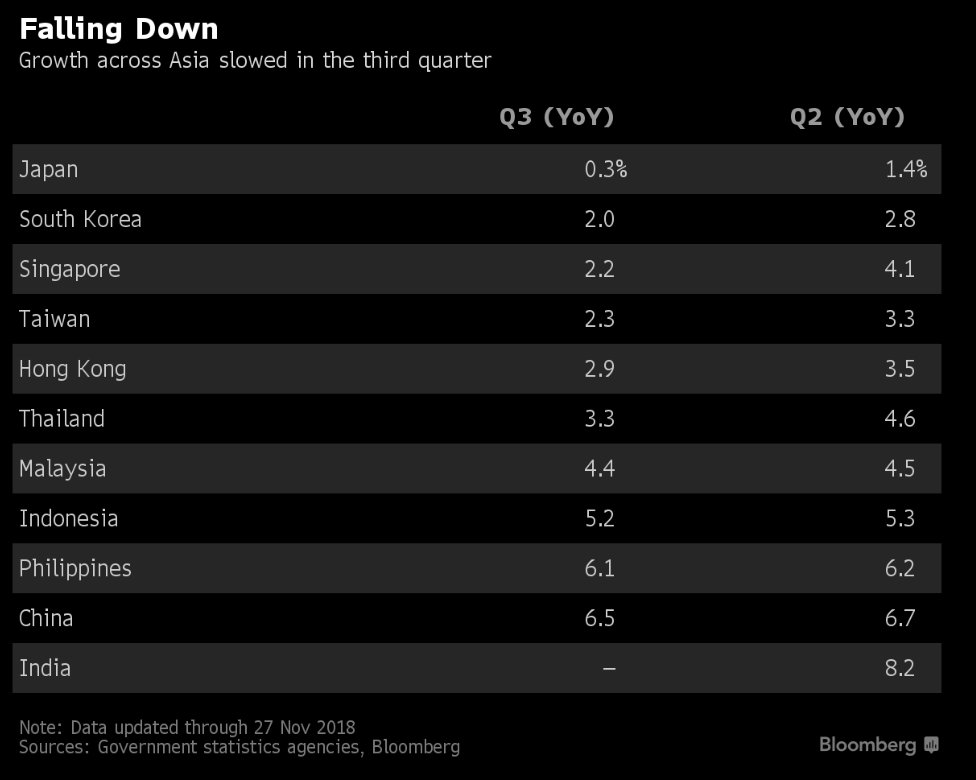

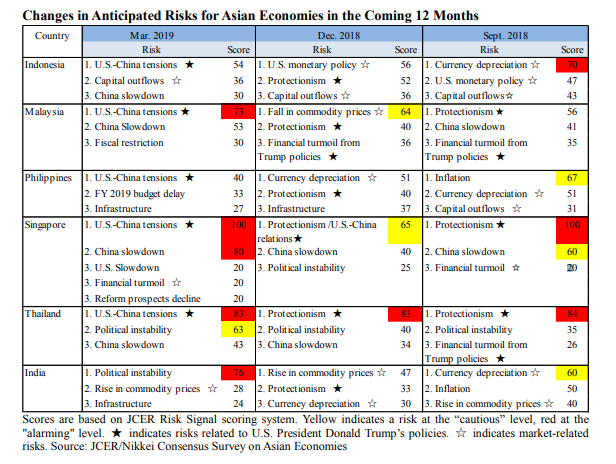

*Growth in #China, #Japan, Southeast #Asia was weaker last quarter

*Link: bloom.bg/2SoKopB

*Link: bloom.bg/2Q2dVsr

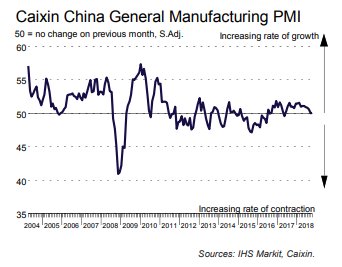

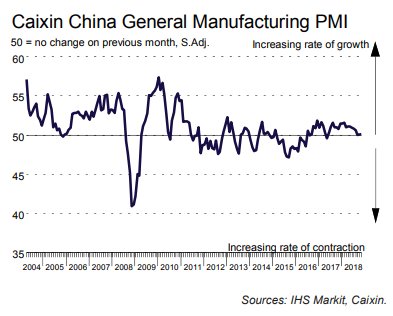

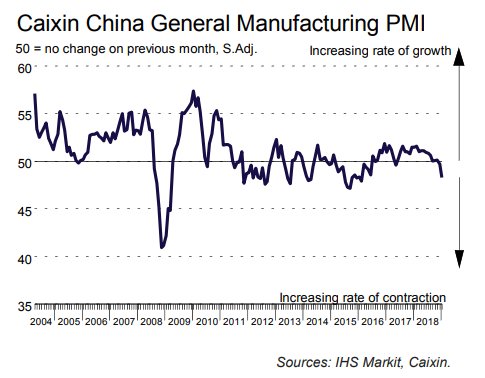

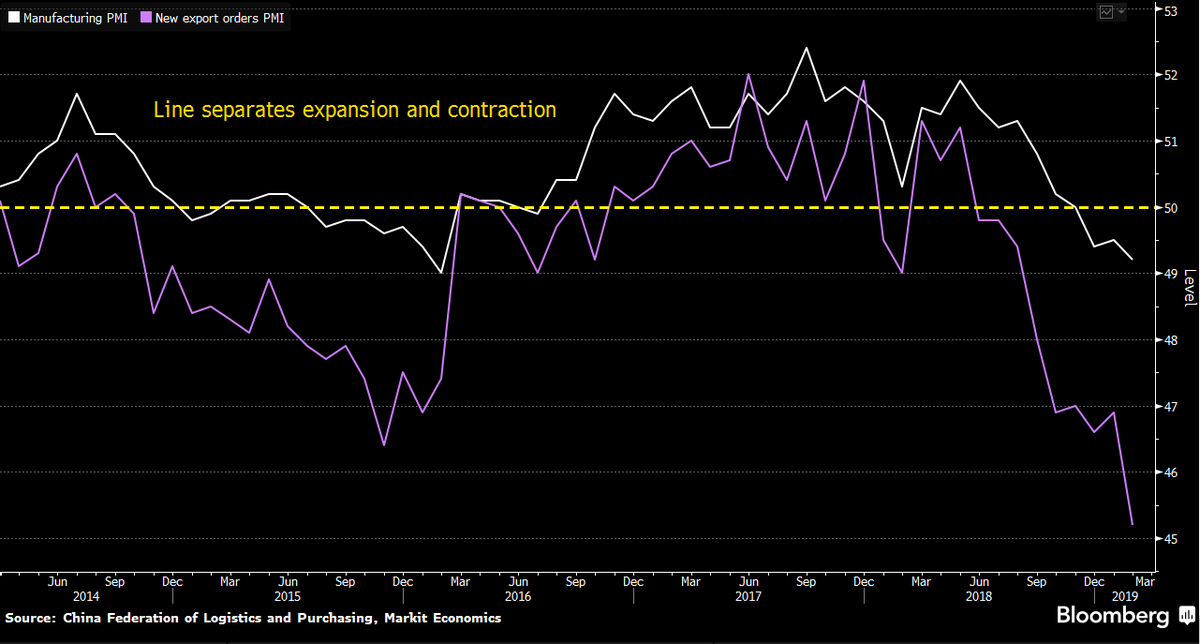

*The weakness was largely driven by domestic factors, reflected by ⬇ in the sub-components for imports (-0.5 to 47.1), new orders (-0.4 to 50.4) and output (-0.1 to 51.9).

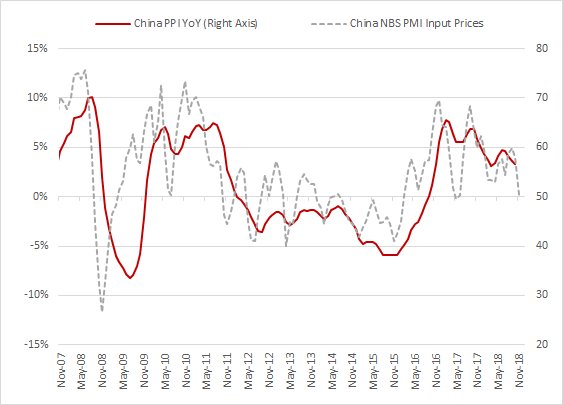

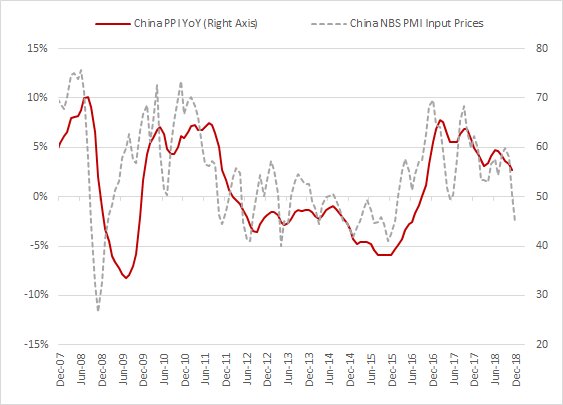

*Significant ⬇ in commodity prices weighted on input price index (-7.7 to 50.3) while output price index also fell (-5.6 to 46.4).

*The drop in input price index suggests that PPI YoY will slow.

*Indexes for imports (-0.5 to 47.1) and new export orders (+0.3 to 47.0) remained in contraction territory.

*LAGARDE: TRADE TENSIONS HAVING NEGATIVE IMPACT

*Link: bit.ly/2PdZw79

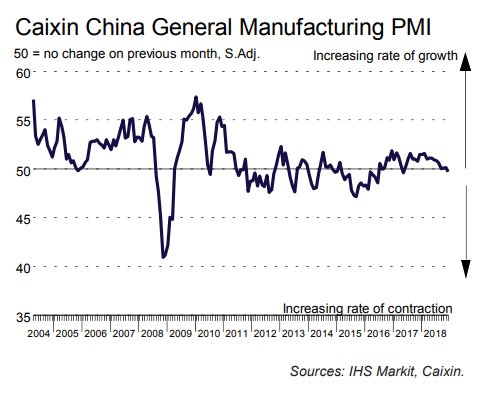

*New export orders 47.7 v 48.8 prior ❗

➡ Contrary to the official PMI, the survey highlights more external weakness.

*Link: bit.ly/2BNmTRe

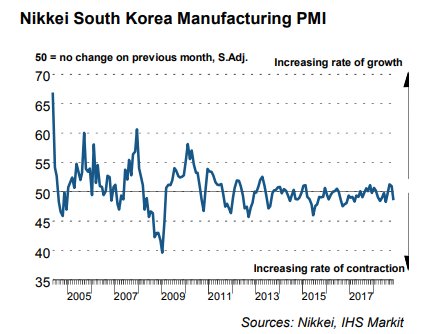

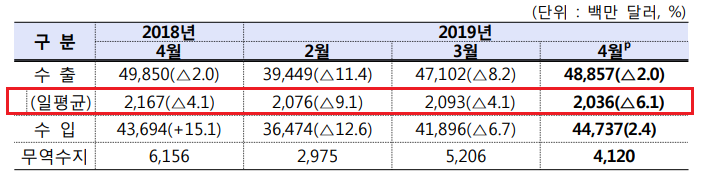

*#Manufacturing PMIs:

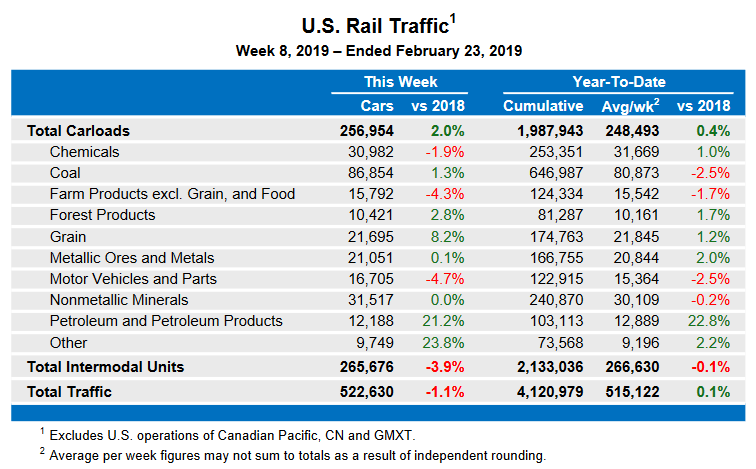

- SK: 48.6 (4-month low) v 51.0 prior

- TW: 48.4 (lowest since October 2015) v 48.7 prior

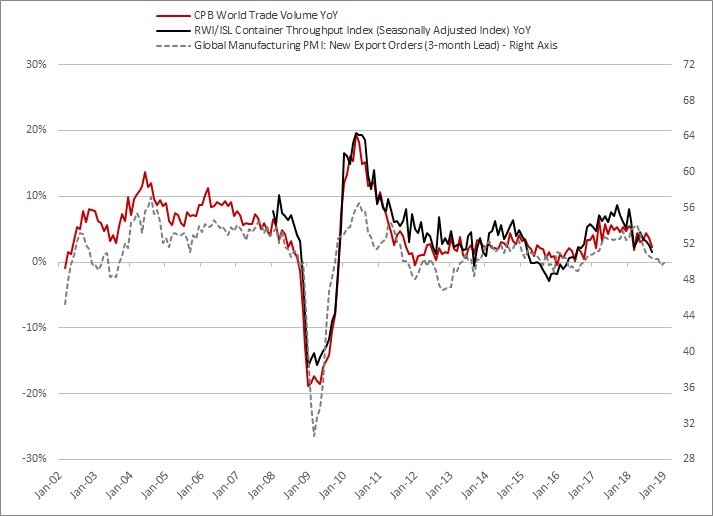

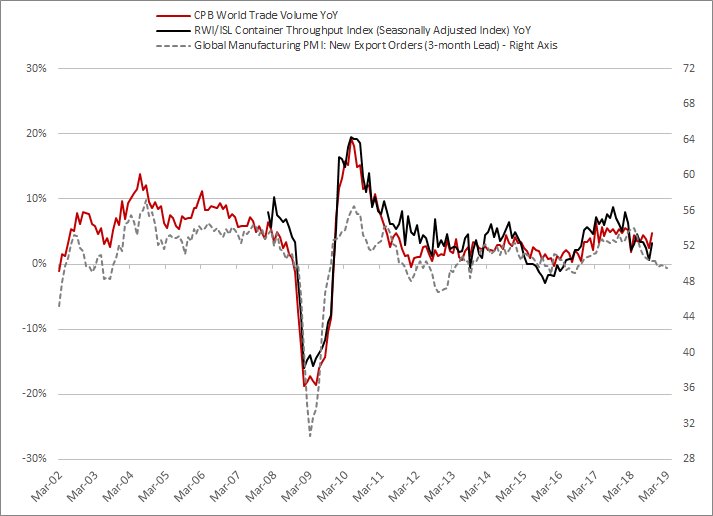

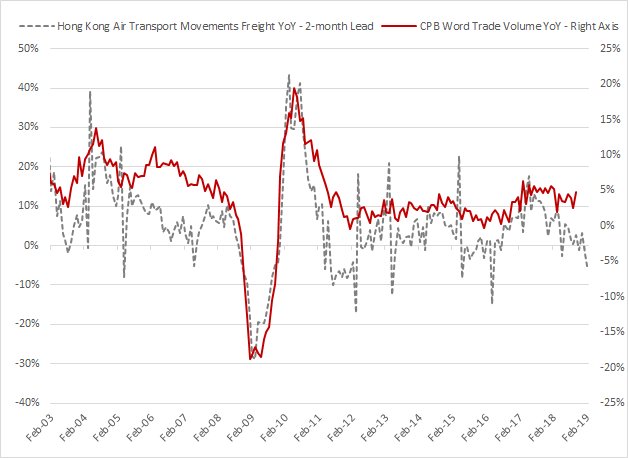

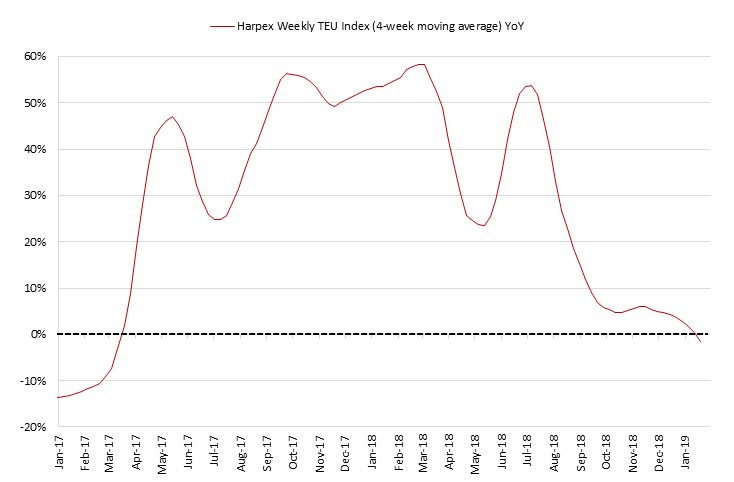

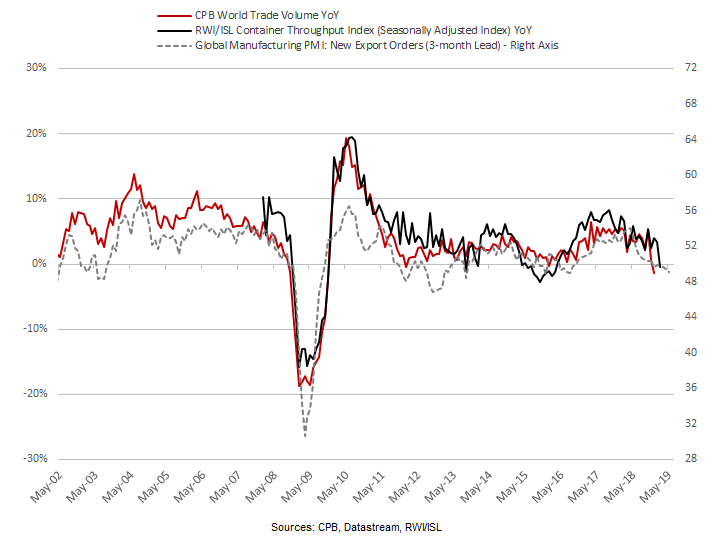

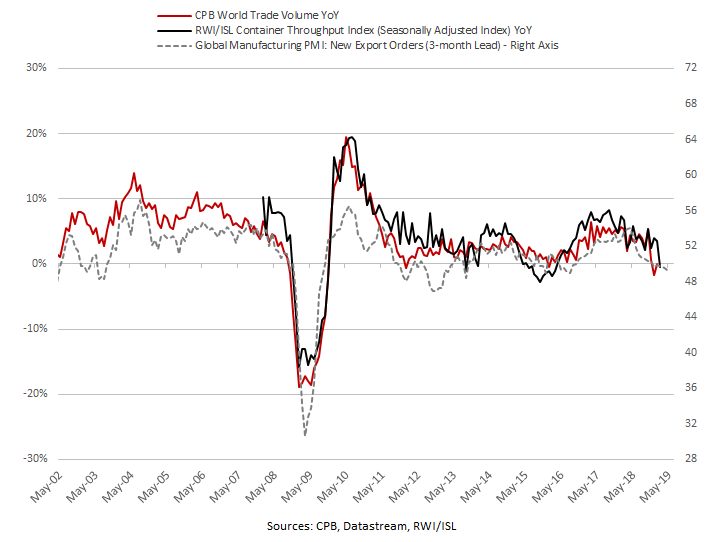

*Even if global trade growth YoY should rebound in Oct., then a normalization ⬇ is very likely.

*Link: bit.ly/2AYe4CT

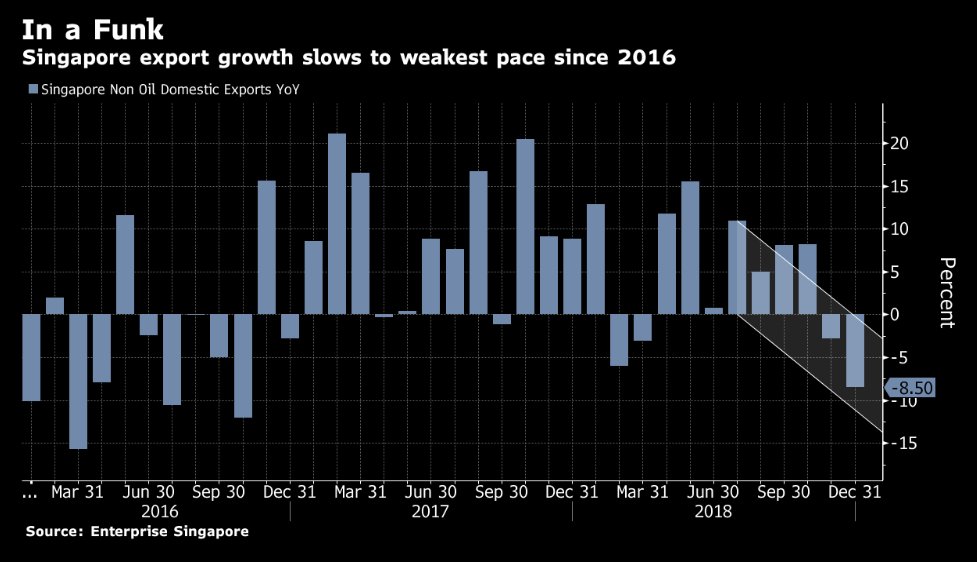

*Slowdown was partly due to unfavorable base effects, ⬇ oil prices

*Shipments to most regions slowed reflecting ⬇ global demand

*Link: bit.ly/2zTNGKt

*It reinforces my view that Eurozone 2018 GDP will be lower than the consensus expects.

*The #ECB will revise ⬇ its 2018 forecast next week.

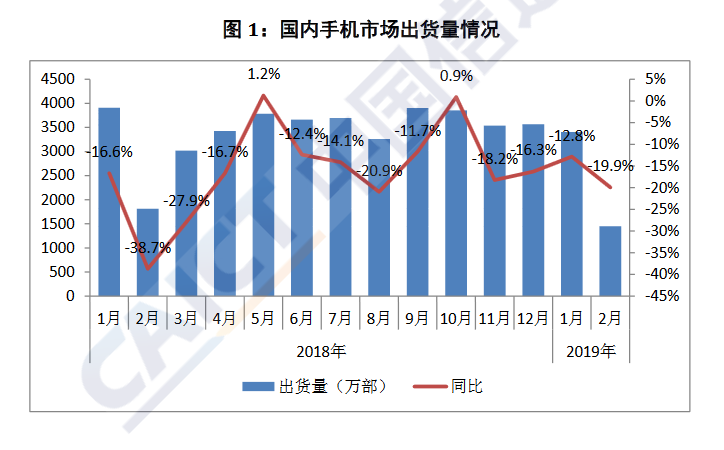

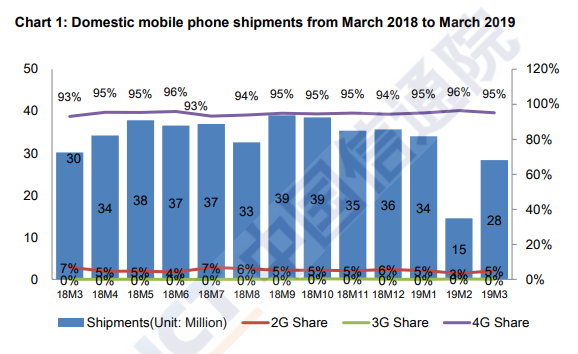

*Mobile phone shipments fell 8% MoM to 35.4m units in Nov.

*4G phone shipments down 17% YoY to 33.6m units

*39 new phone models were introduced in Nov., down 49% on year

*CHINA NOV. RETAIL PASSENGER VEHICLE SALES 2.05M UNITS

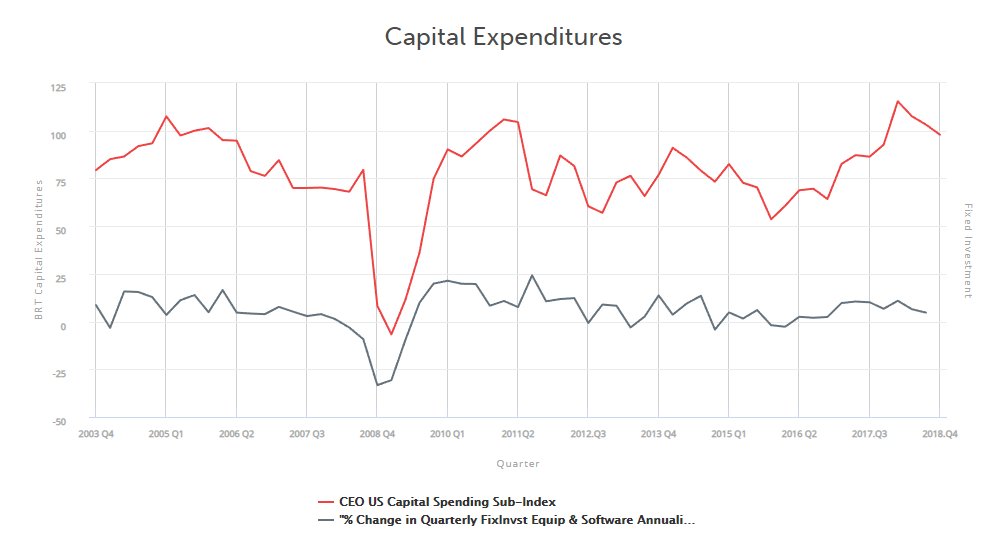

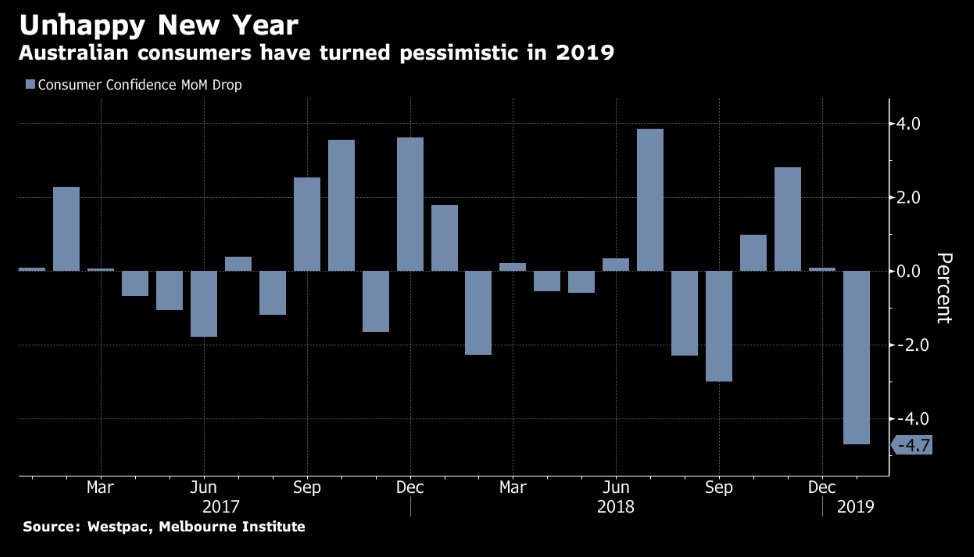

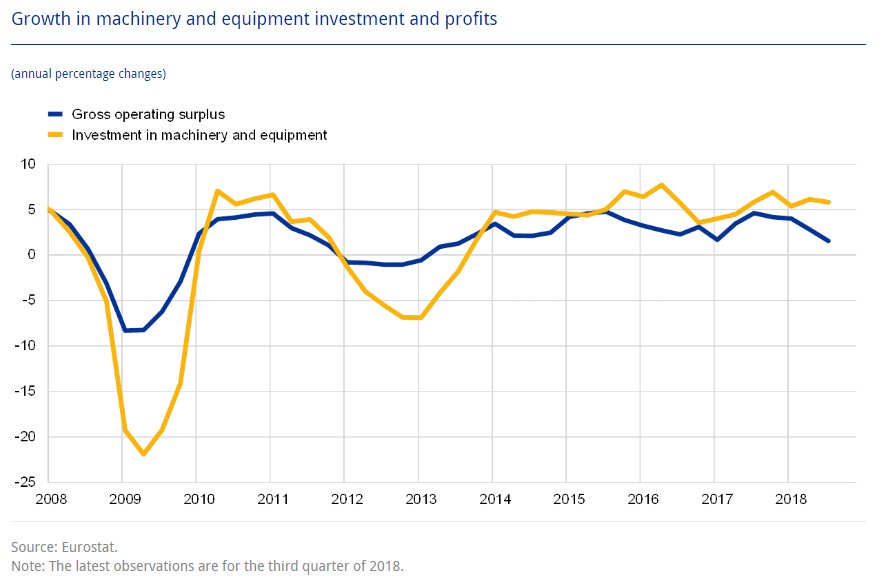

*Business investment slumps by the most in nine years

*Link: bloom.bg/2G5Vhej

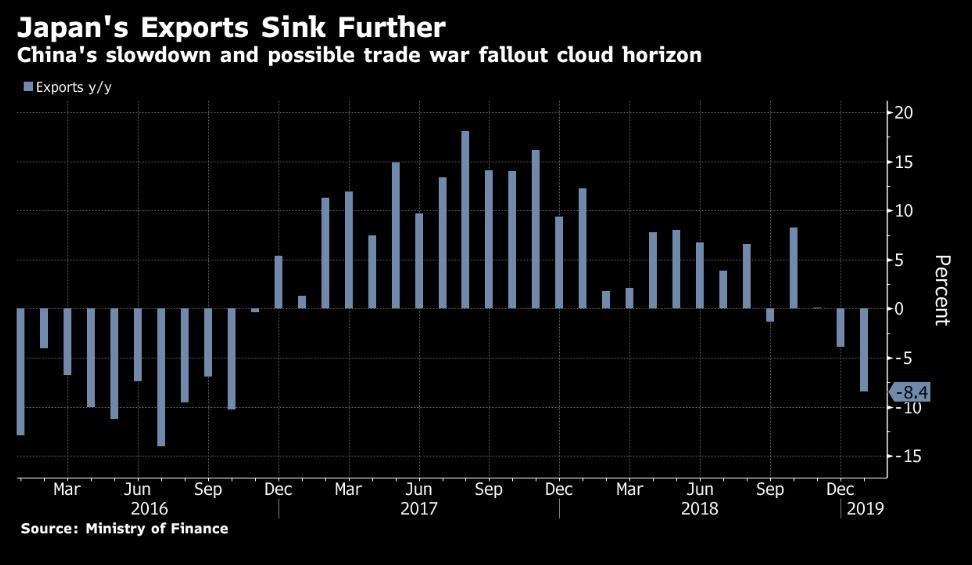

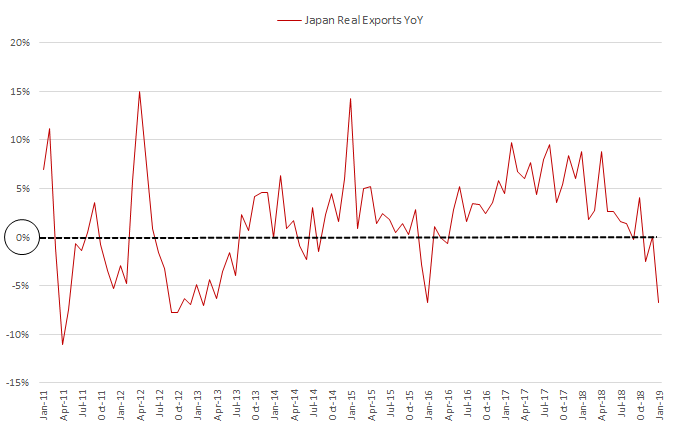

➡ Figures reinforce my view that Japanese 2018 GDP will be lower than the consensus expects (+1.0%e).

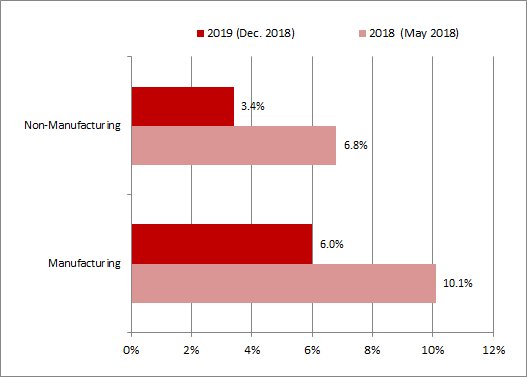

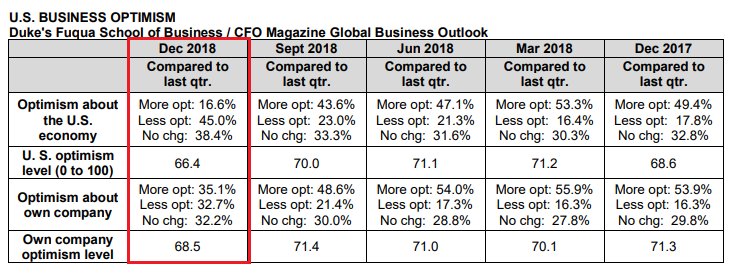

⬆ 6.0% in 2019 in manufacturing (below the 10.1% projection made for 2018 in May)

⬆ 3.4% in 2019 in services (below the 6.8% projection made for 2018 in May)

*Lin: bit.ly/2hf9khA

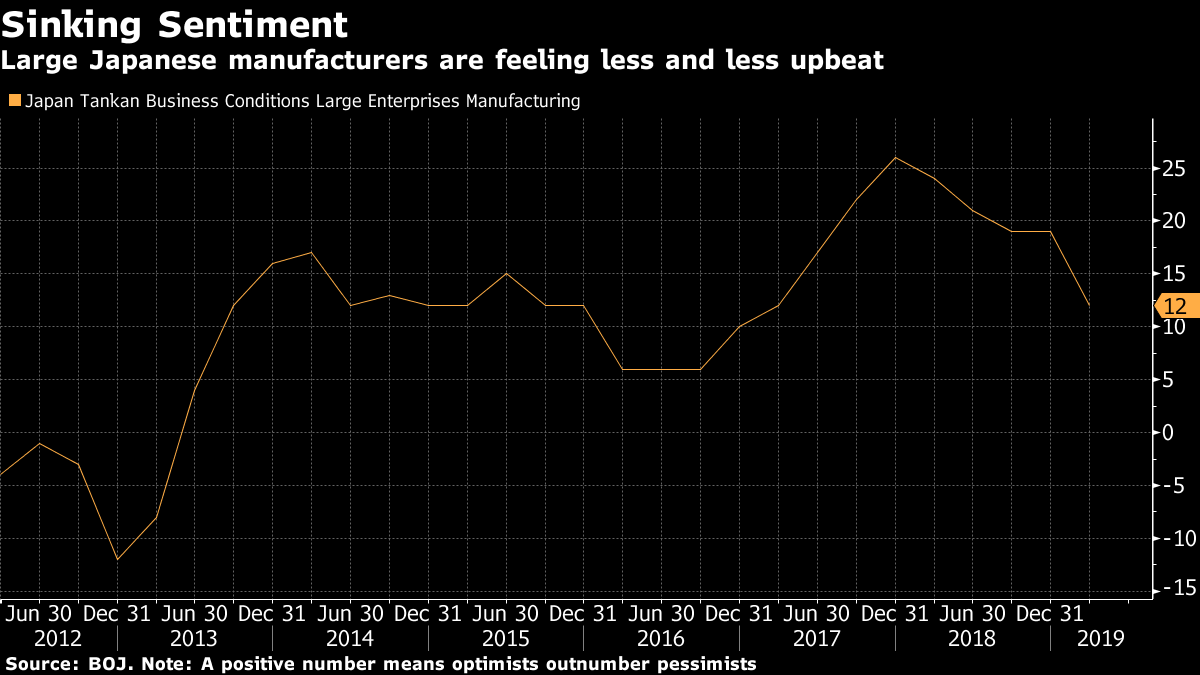

*Plans for capital investment and hiring and sales expectations all declined compared with the prior quarter.

*Link: bit.ly/2rxqJrY

cnbc.com/2018/12/10/cnb…

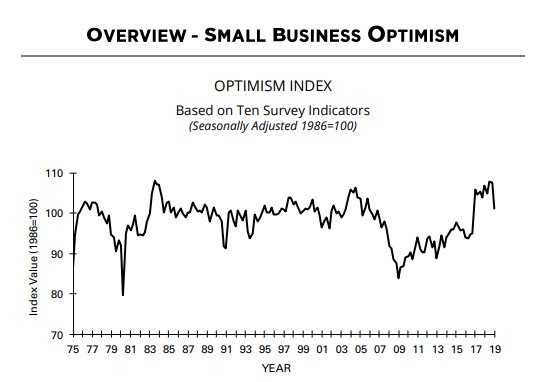

*Small business optimism: 104.8 (lowest since April 2018) vs 107.4 prior

*Link: bit.ly/Lg4Ndz

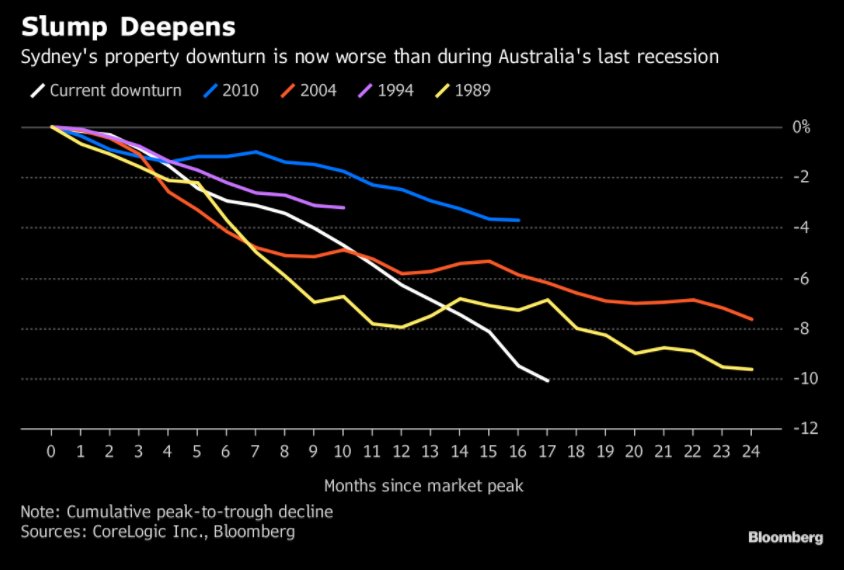

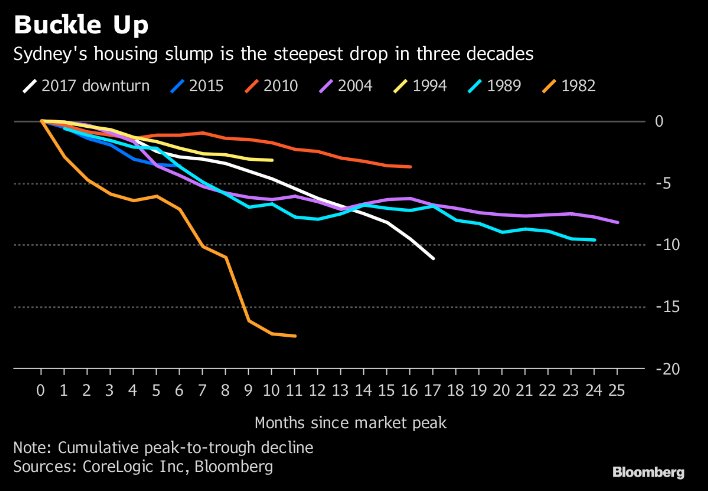

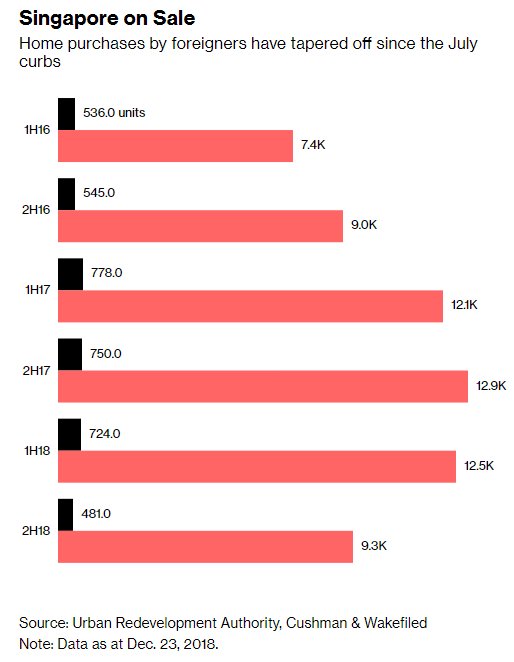

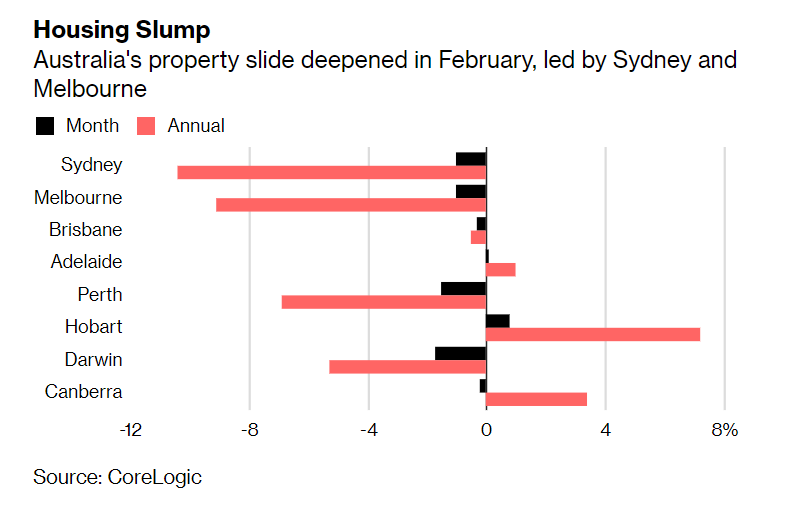

*Home values ⬇ 10.1% since their 2017 peak, surpassing the top-to-bottom ⬇ of 9.6% recorded between 1989 and 1991

*Link: bloom.bg/2L9WRe4

*Services PMI: 51.4 v 53.4e (49-month low)

*Composite PMI: 51.3 v 52.8e (49-month low)

*Link: bit.ly/2zZAwf8

*2018 (from 2.0% to 1.9%)

*2019 (from 1.8% to 1.7%)

*Link: bit.ly/2QB33SE

➡ 2018f is now in line with my view but 2019f looks a bit optimistic

*Concealment added to whispers that Beijing doctors figures

asia.nikkei.com/Economy/China-…

➡ Growth in retail sales slowed to +8.1% YoY in Nov. (the weakest reading since June 2003)

uk.reuters.com/article/uk-ecb…

asia.nikkei.com/Economy/Japan-…

en.yna.co.kr/view/AEN201812…

bloomberg.com/news/articles/…

reuters.com/article/us-bis…

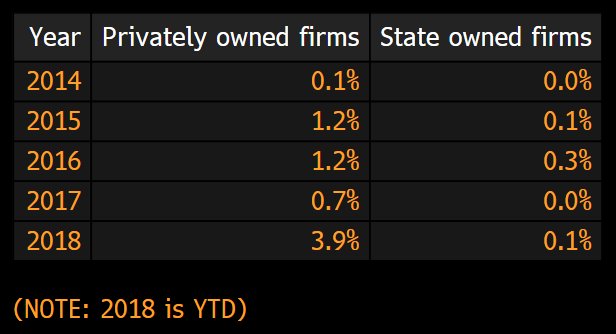

*Missed bond payments in 2018 have almost quadrupled the tally last year

*Link: bloom.bg/2QDU6YH

in.reuters.com/article/us-ger…

reuters.com/article/us-chi…

uk.reuters.com/article/uk-chi…

*Energy sector leads China’s record local bond default in 2018

*Private firms will face increasing liquidity pressure: S&P

*Link: bloom.bg/2Civxrs

*FY18 to 0.9% (vs 1.5% prior)

*FY19 to 1.3% (vs 1.5% prior)

➡ Both still look optimistic.

reuters.com/article/us-jap…

- Expectations Survey: 97.3 v 98.3e (lowest since Nov. 2014)

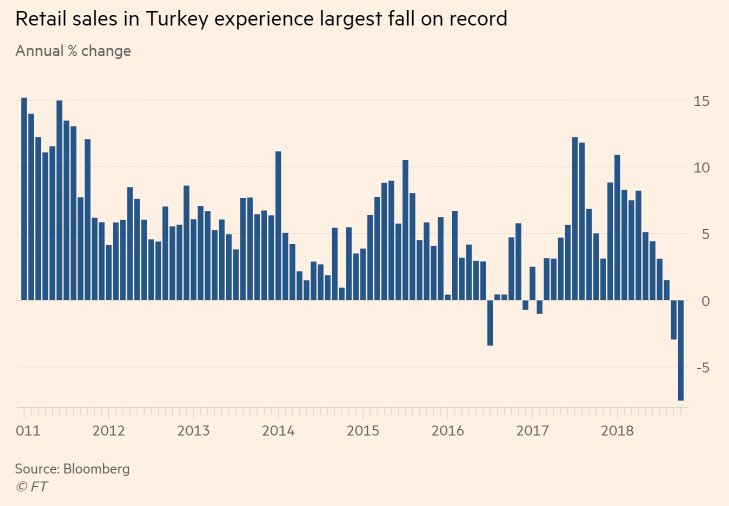

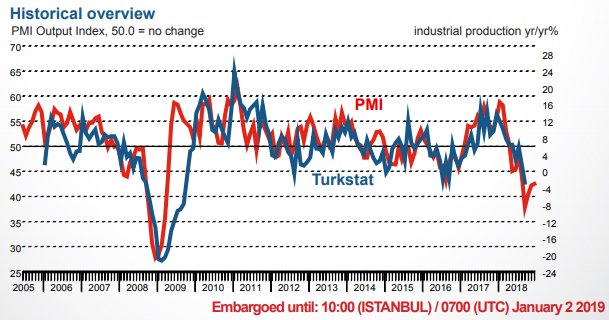

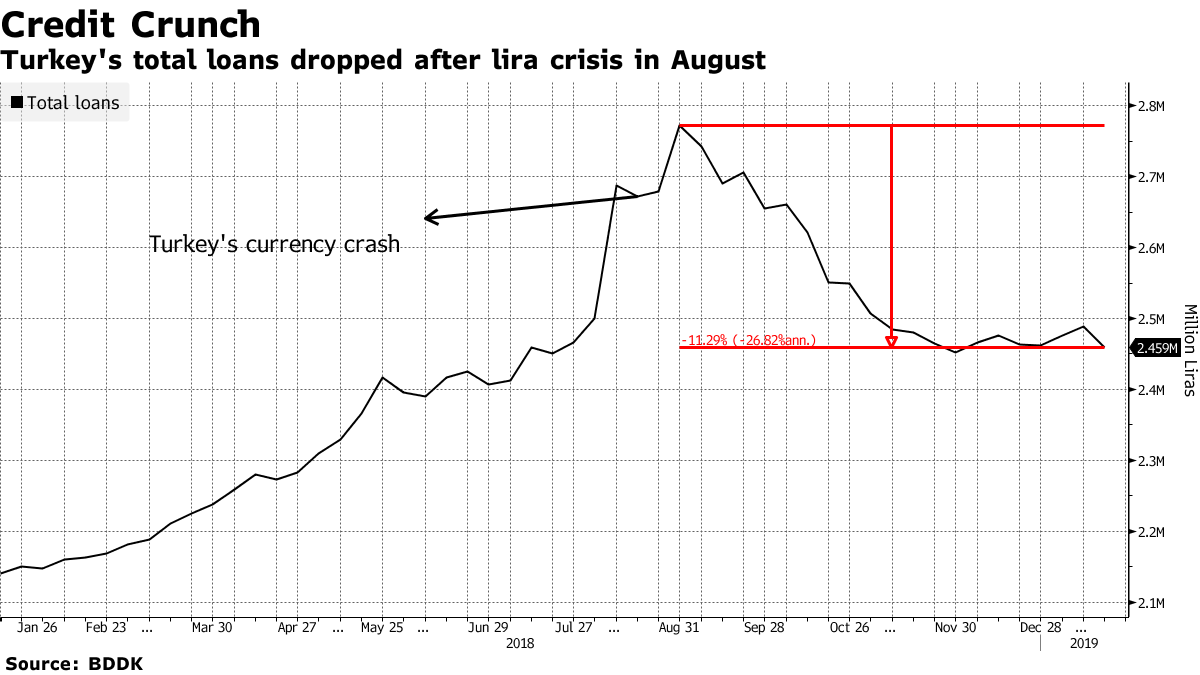

🇹🇷 #Turkey retail sales suffer worst drop on record - FT

*Sales volumes fell by 7.5% YoY in October, the sharpest decline since records began in 2010.

*It follows a 3% drop in Sept., the first annual contraction since Feb. 2017

*Link: on.ft.com/2A71tgR

xinhuanet.com/english/2018-1…

*Link: bloom.bg/2EEF7Hg

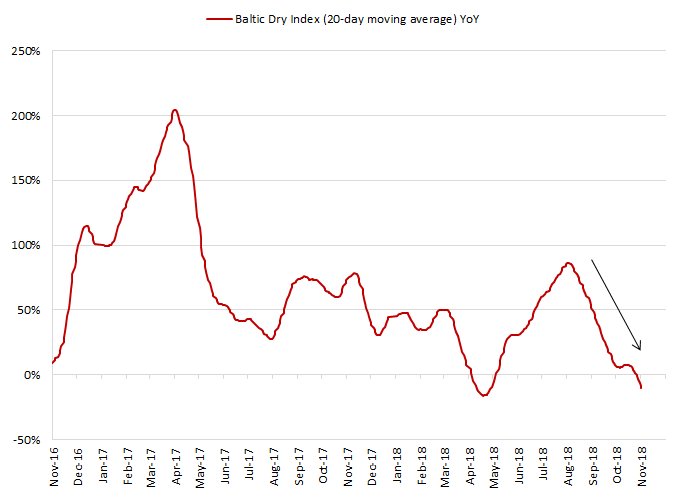

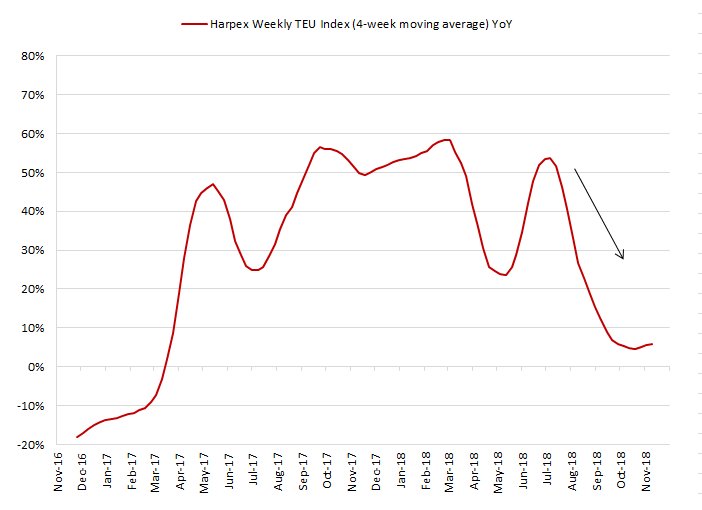

➡ As already discussed, my proxies pointed to more slowdown in the coming months.

➡ In detail, an uptick is very likely in Oct. before another sharp slowdown from Nov.

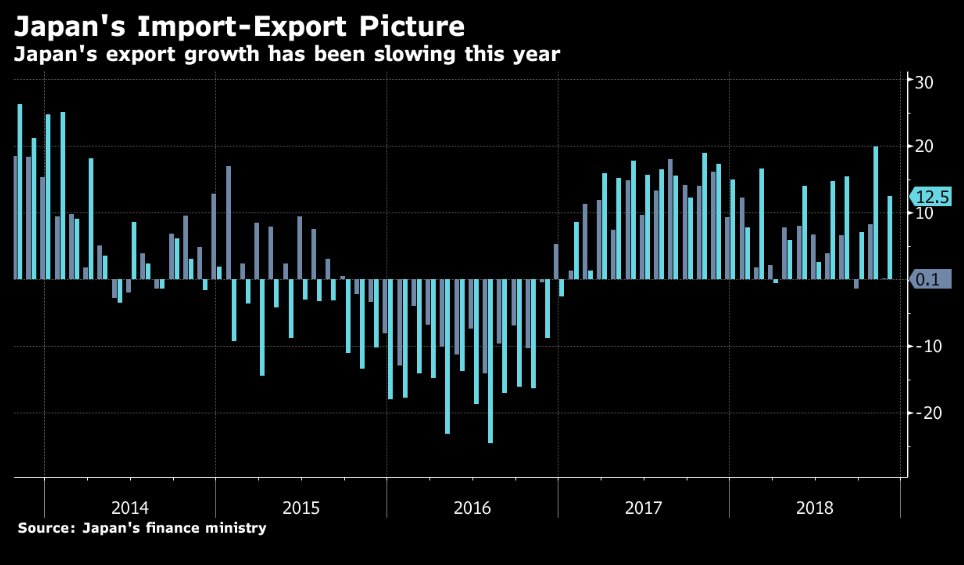

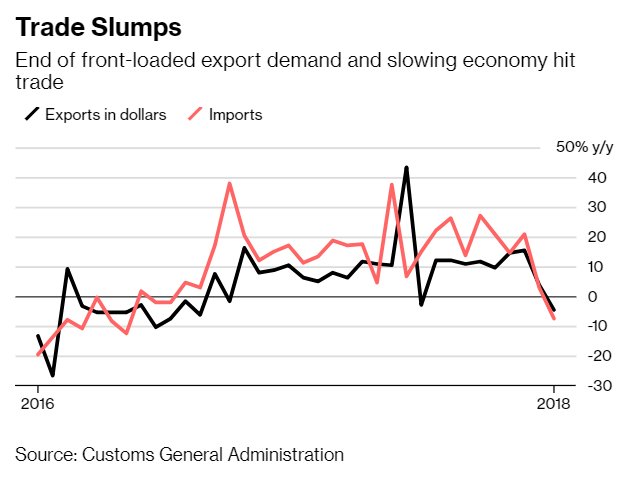

*Imports YoY: 12.5% vs 19.9% prior

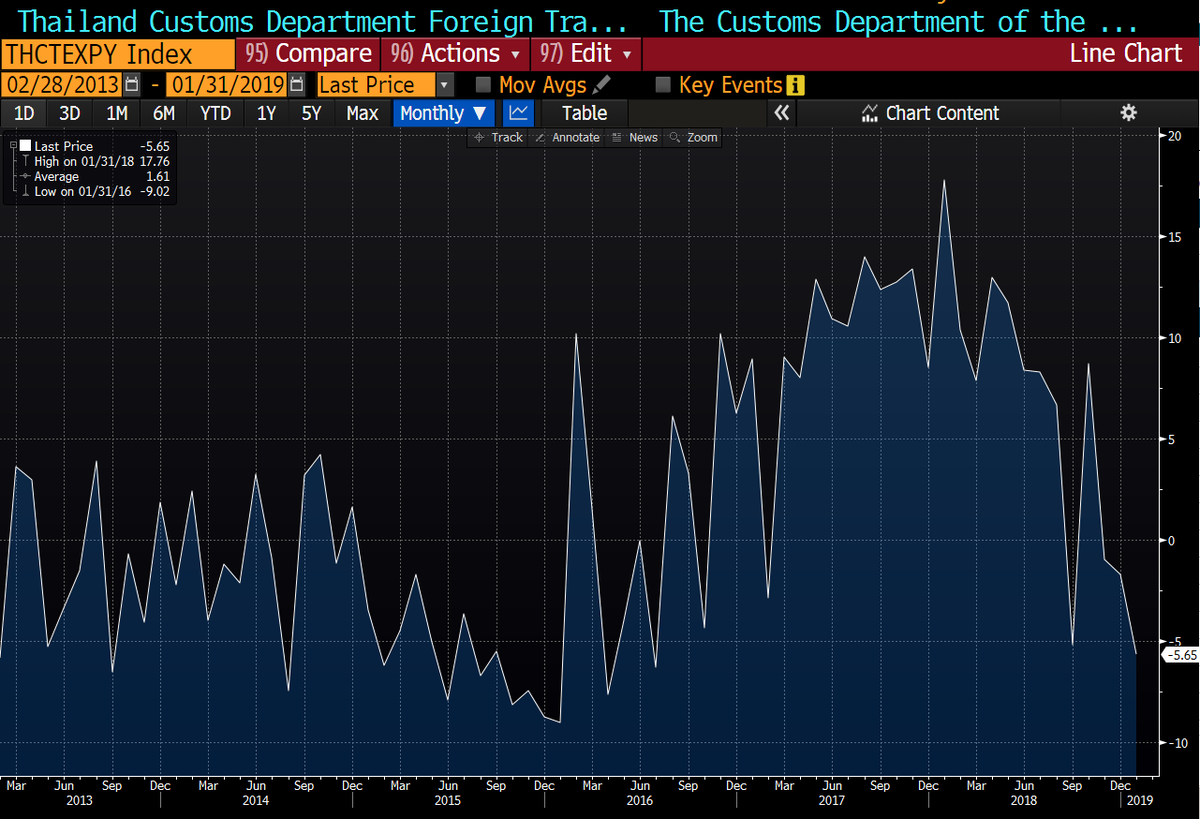

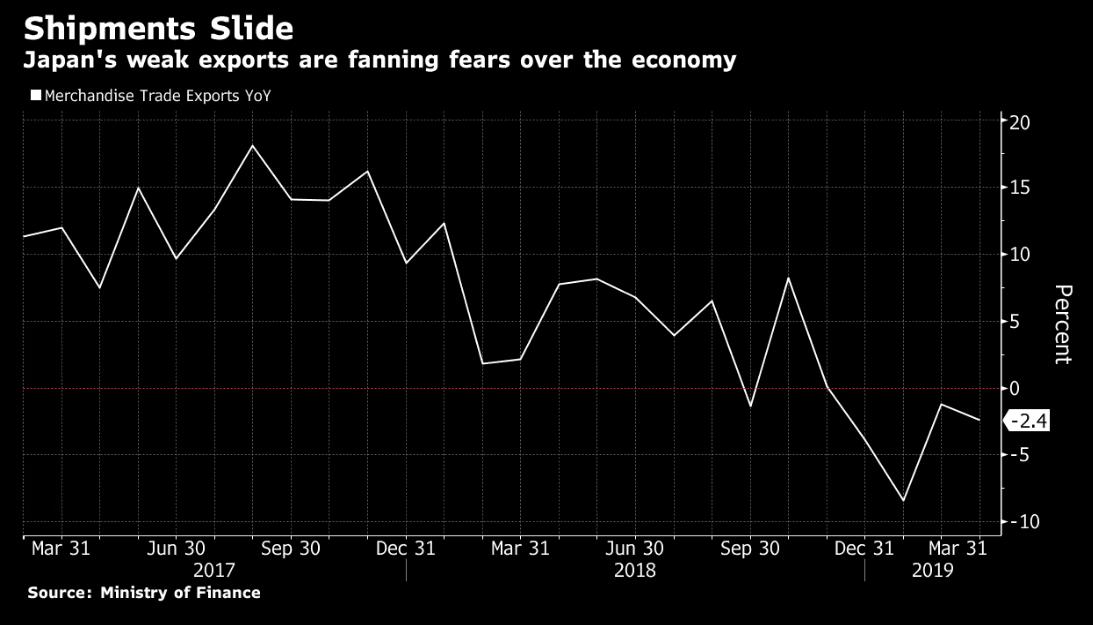

*Real exports YoY: -2.4% vs +6.3% (largest ⬇ since Jan. 2016)

*Link: bit.ly/2EBb8QJ

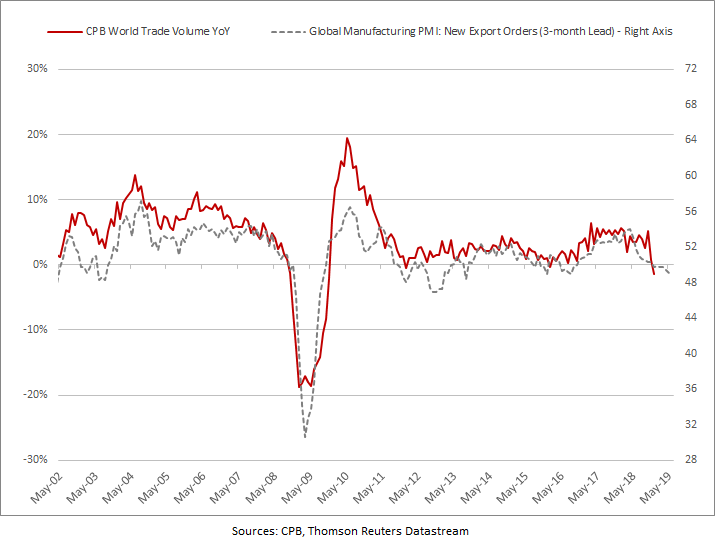

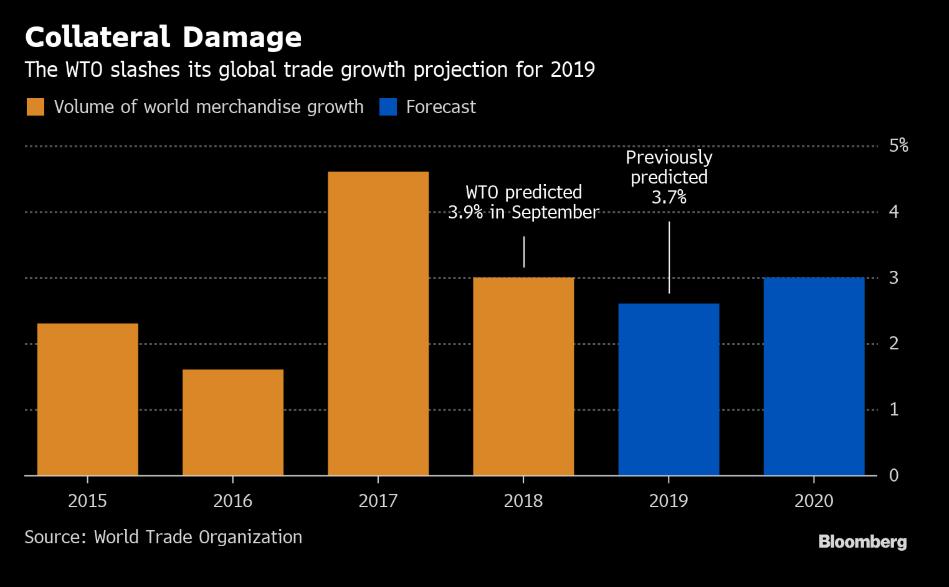

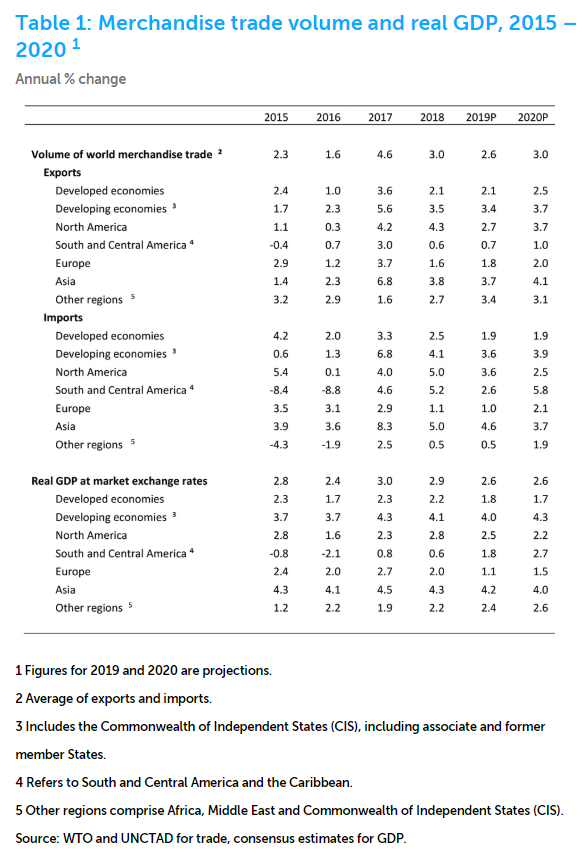

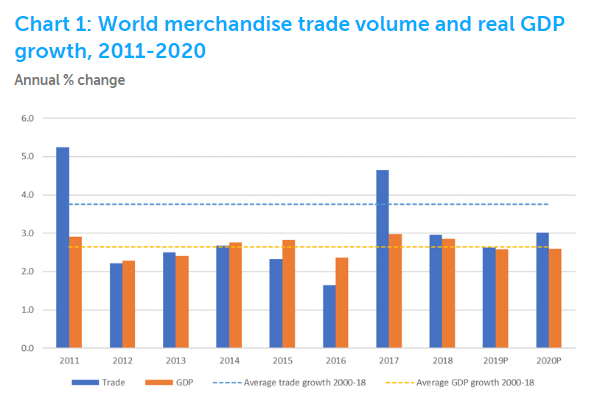

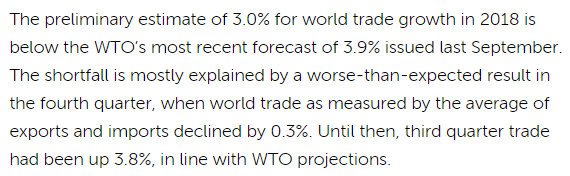

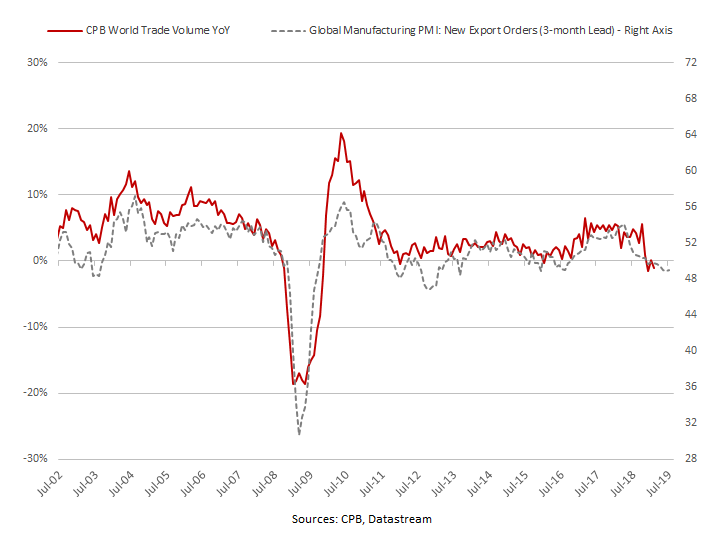

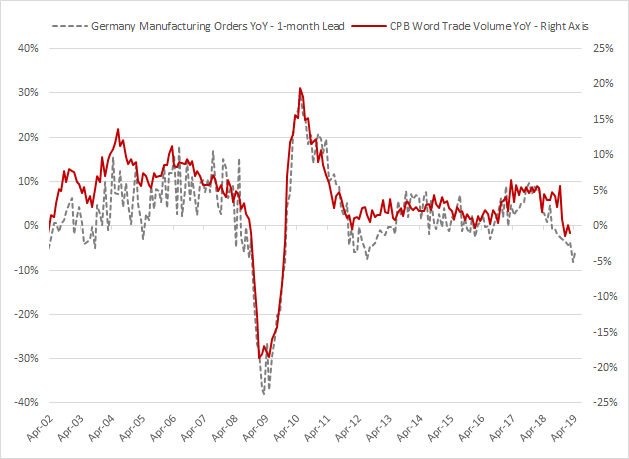

*The WTO in Sept. ⬇ its forecast for global trade growth, predicting the volume of goods moving around the world would expand by 3.9% this year and slow to 3.7% in 2019.

bloomberg.com/news/articles/…

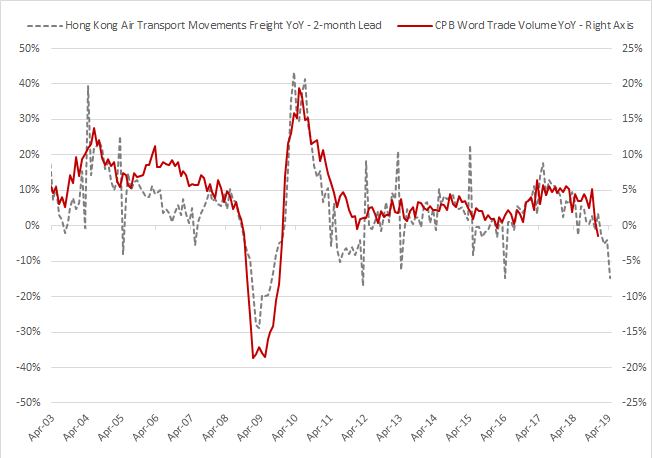

➡ My proxies suggest that world trade growth is set to moderate to ~+3.5% in 2018 and <3% in 2019.

*a 1.0% YoY ⬆ in total exports (6-month low; vs +5.7% in Nov.)

*a 14.2% YoY ⬇ in exports to #China (largest ⬇ since October 2016 vs -4.1% in Nov.)

*Link: bit.ly/2Ac6GUJ

bloomberg.com/news/articles/…

*Link: bit.ly/2T4KAum

➡ I still expect a sharp slowdown from Nov. amid ⬇ activity and negative base effect

*It would be down from 4.8% in 2017 but up compared to my previous forecast for 2018 (~+3.5%).

*Link (Japanese): nikkei.com/article/DGXMZO…

*Link: bloom.bg/2CD2uPh

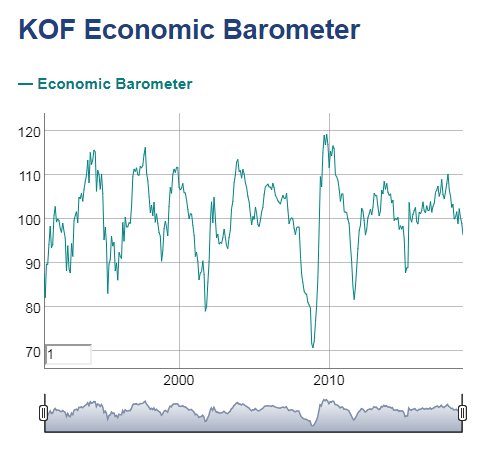

*More clearly than last month, the indicator lies below its long-term average.

*Link: bit.ly/2ETbTUz

- COMPOSITE PMI: 52.6 V 52.8 PRIOR (record low since records began in Jan. 2017)

*Link: bloom.bg/2RnCRdH

- The weakness was driven by domestic factors, reflected by the ⬇ in the sub-components for:

*new orders (-0.7 to 49.7; 1st contraction since Feb. 2016)

*output (-1.1 to 50.8; 10-month low)

*imports (-1.2 to 45.9; lowest since Feb. 2016)

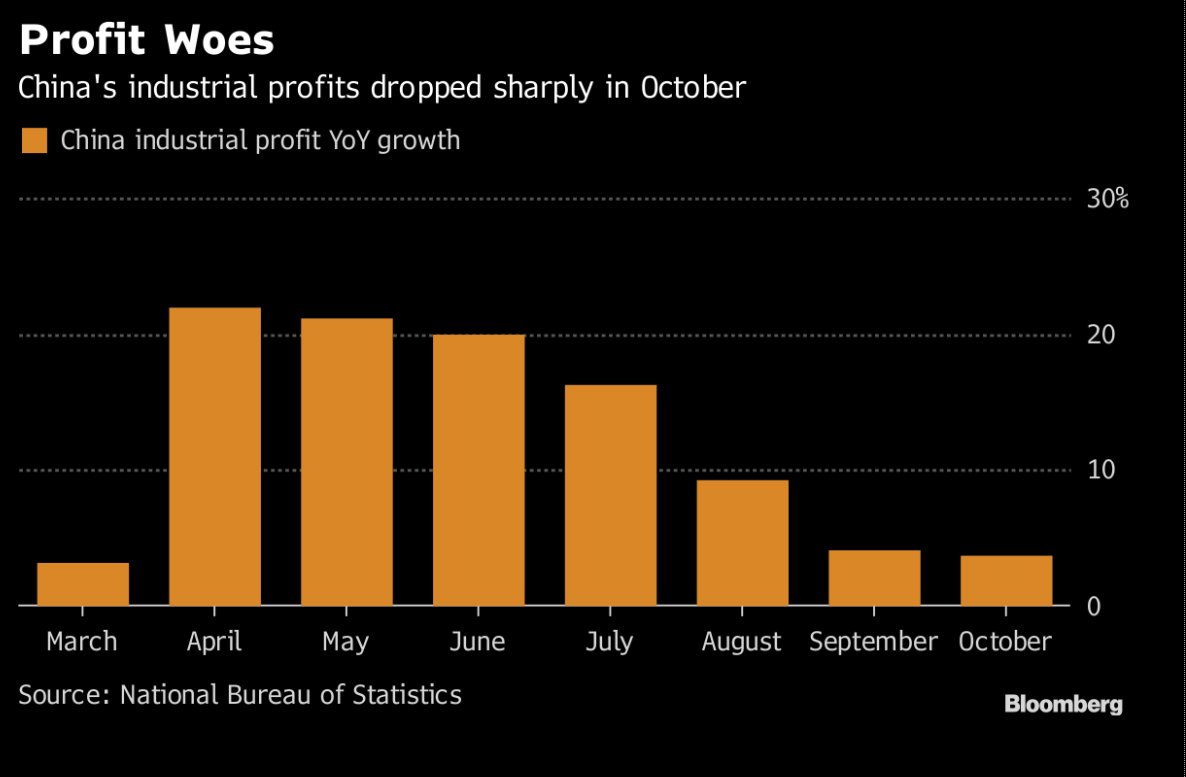

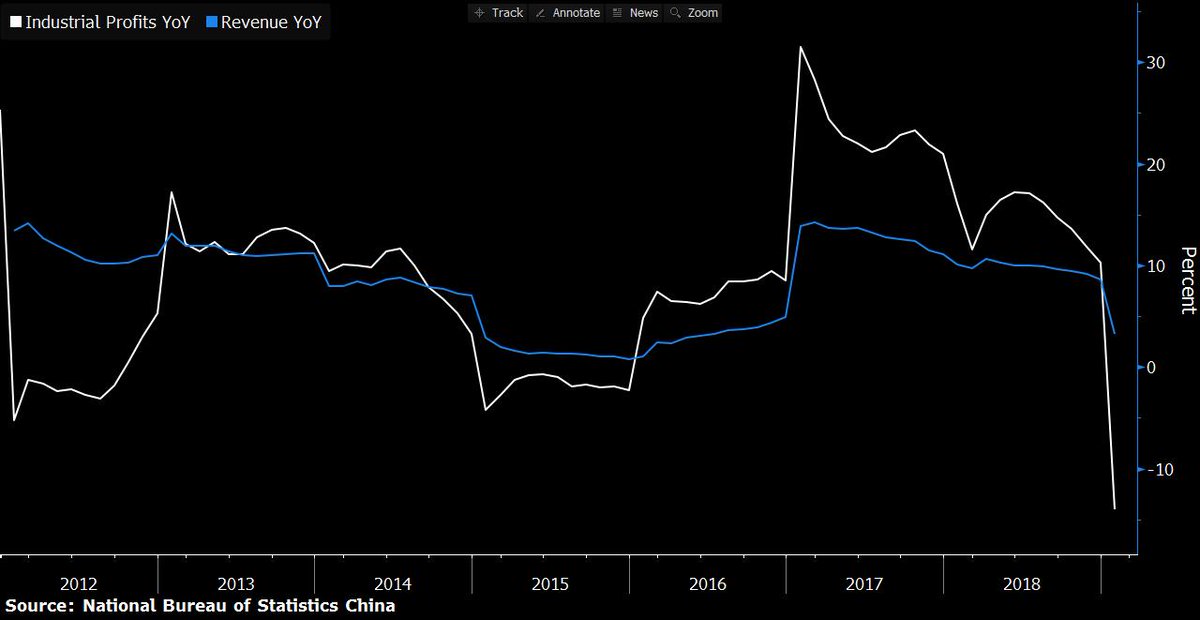

- The significant ⬇ in commodity prices weighted on input price index (-5.5 to 44.8; lowest since Nov. 2015) suggesting that:

*PPI YoY will ⬇

*Industrial profits will keep ⬇

- Other figures suggest that trade growth will remain under pressure:

*Indexes for imports (-1.2 to 45.9; lowest since Feb. 2016) and new export orders (-0.4 to 46.6; lowest since Nov. 2015) remained in contraction territory.

- Finally, the sub-component for business expectations tumbled 1.5 pts to 52.7. *While still a positive reading (>50), it was the lowest since January 2016.

*It was down from -1.0% in the first 20 days of Dec.

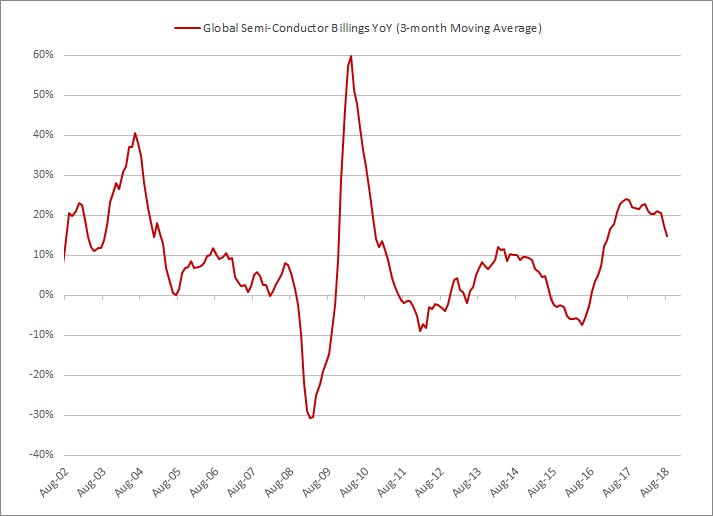

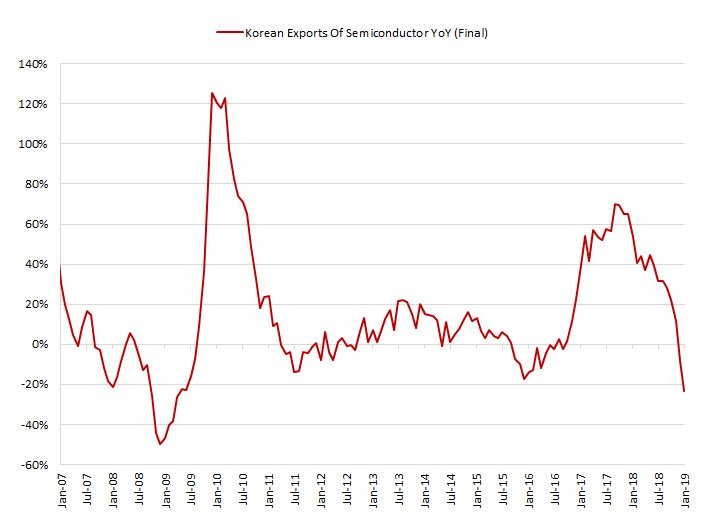

*Shipments of semiconductors, which dominate the country’s exports, fell 8.3% YoY (largest drop since April 2016).

bloomberg.com/news/articles/…

*New Orders index: 49.8 v 50.9 prior (first contraction since June 2016)

*New export orders ⬇for the 9th month in a row

*Link: bit.ly/2QeZRqI

*#Manufacturing PMIs:

- SK: 49.8 v 48.6 prior

- TW: 47.7 (lowest since September 2015) v 48.4 prior

*Link: bit.ly/2Apb56U

➡ Yesterday, data showed that exports contracted YoY over the same period.

*#Manufacturing oriented economies in Asia already feeling pain

*Link: bloom.bg/2AsbJjS

- Prior revised lower from 56.7 to 55.4

➡ Sweden PMI is often seen as a leading indicator for a broader slowdown in European manufacturing.

bloomberg.com/news/articles/…

*Link: bit.ly/2LMbftf

*Prices in #Australia’s largest city drop 11.1% from 2017 peak

*Link: bloom.bg/2SwkGQn

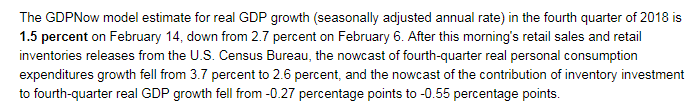

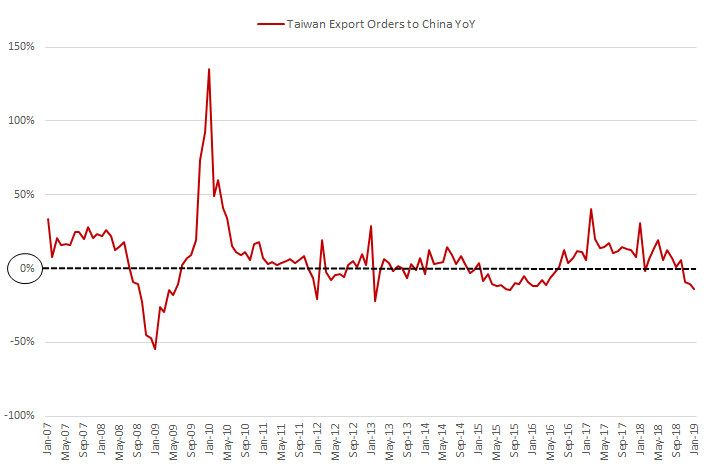

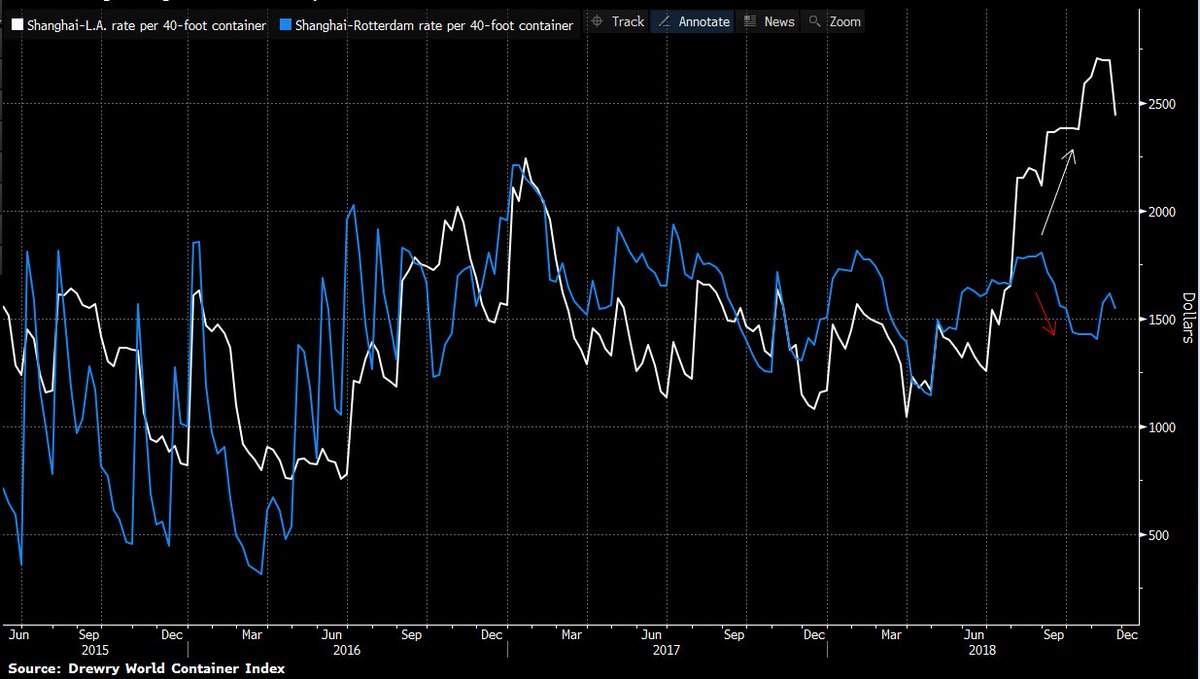

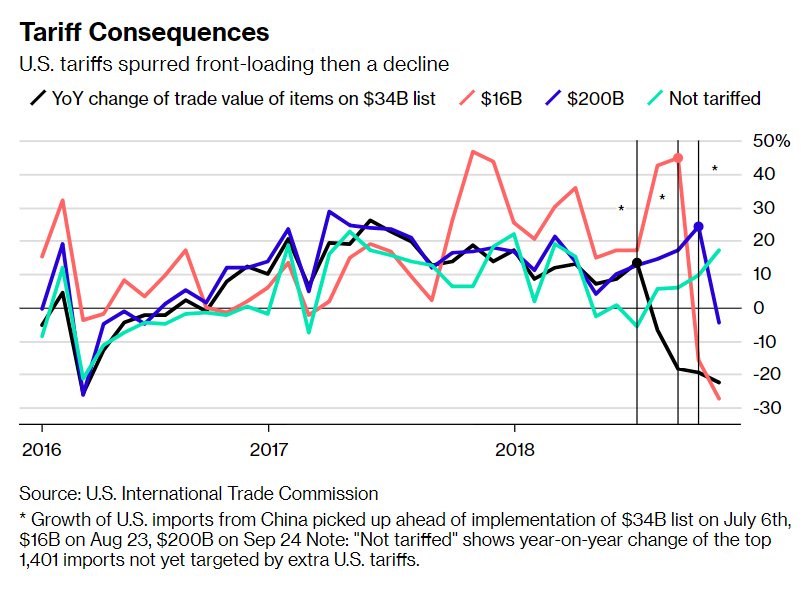

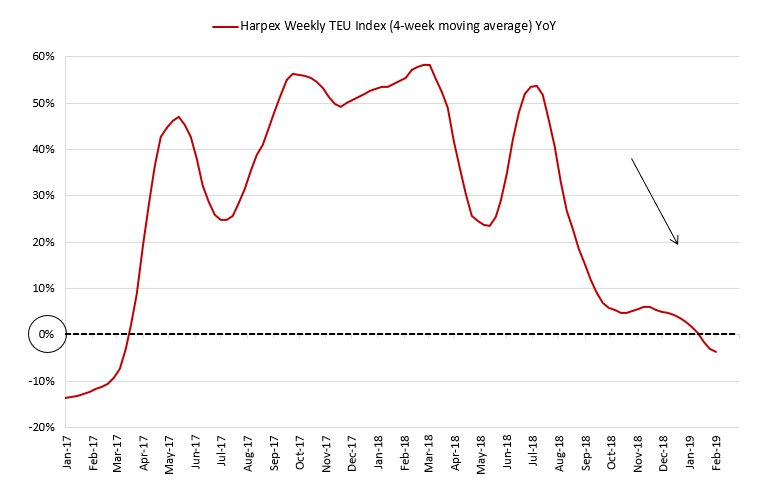

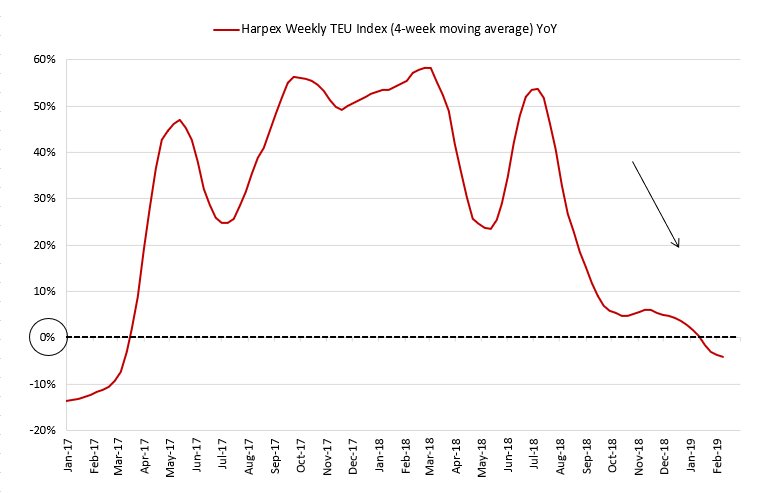

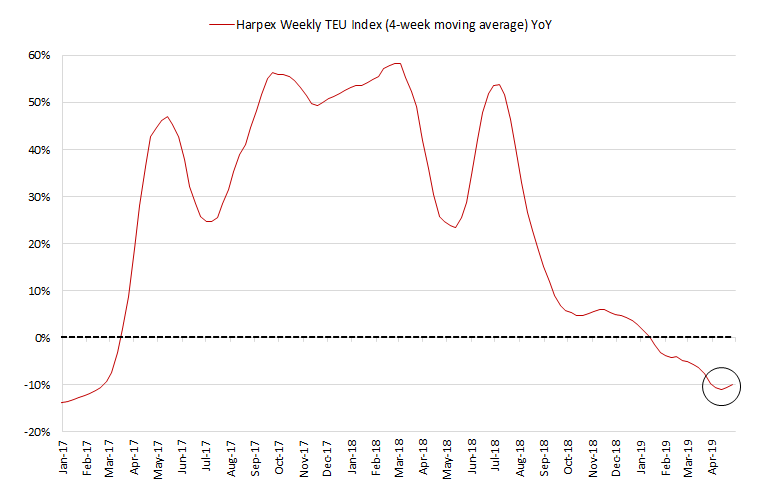

*⬇ activity

*negative base effect

*the end of frontloading (in line with the ⬇ normalization of #Shanghai-LA containers rate)

*Downward pressure comes from the China-US #tradewar, one-size-fits-all policies and inaction at some agencies.

*Note: 3Q GDP was up 6.5% YoY

*Link: globaltimes.cn/content/113437…

*New order growth was the weakest since August 2016.

*Link: bit.ly/2To631k

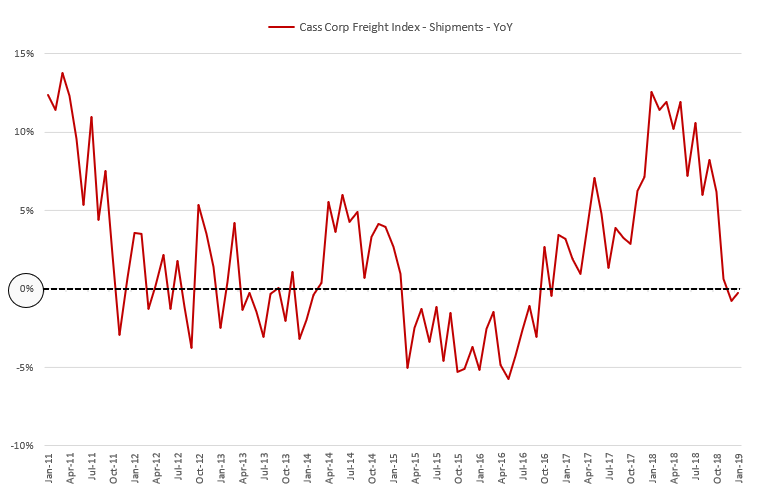

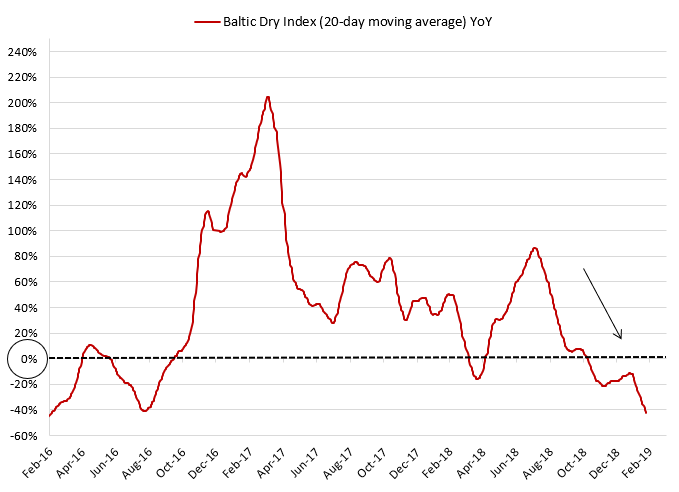

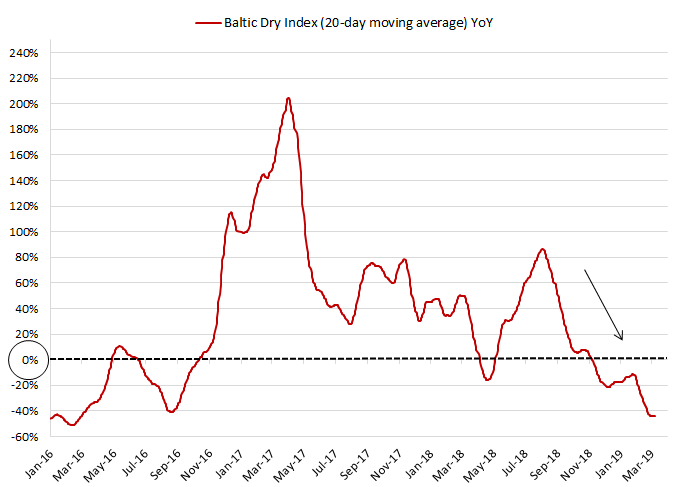

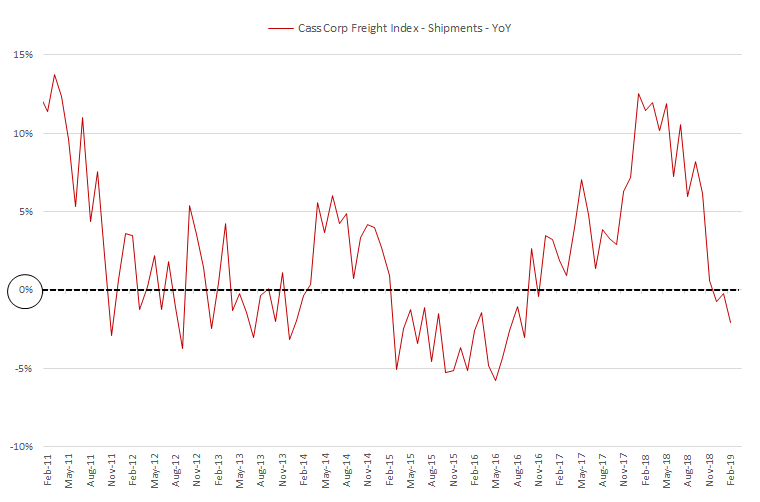

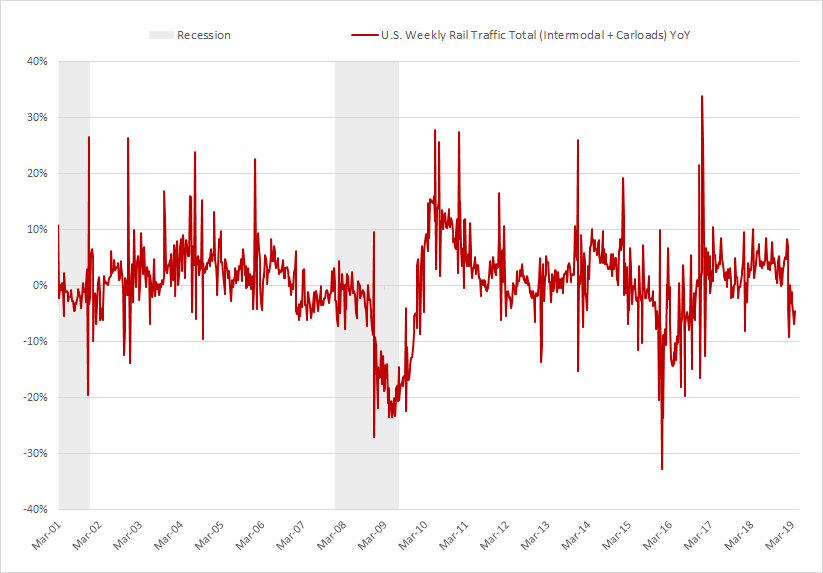

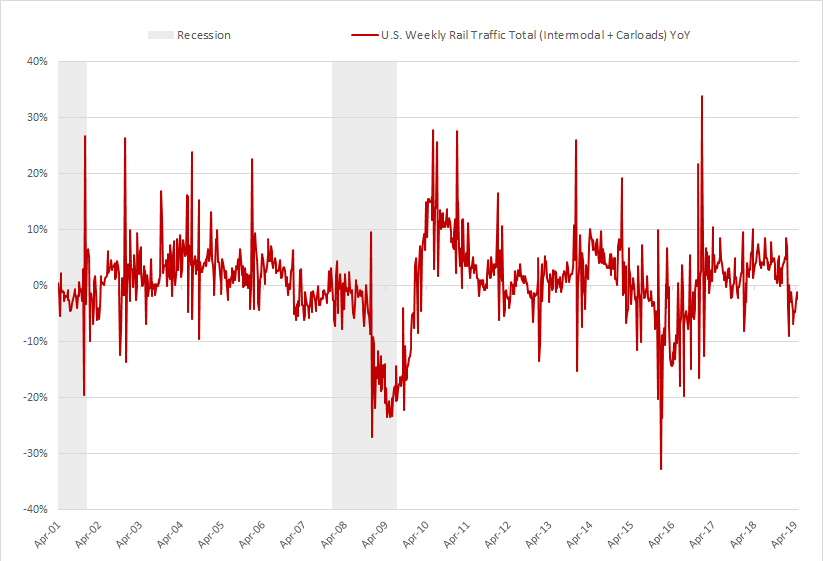

*As discussed (bit.ly/2GRnMgo), I expect a sharp slowdown of global trade growth from Nov.

*It was +4.8% in 2017 and likely ~3.6%/3.7% in 2018.

*The announcement sent shares down as much as 8.5 percent in extended trading.

*Letter from Cook to investors (apple.co/2TnIC8E)

bloomberg.com/news/articles/…

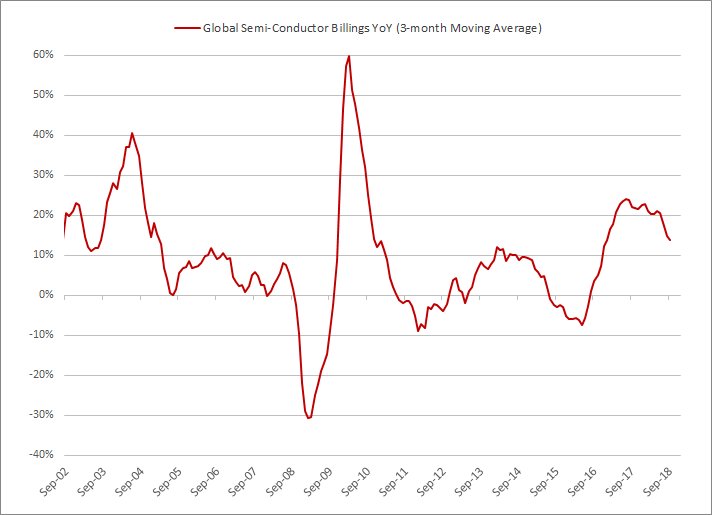

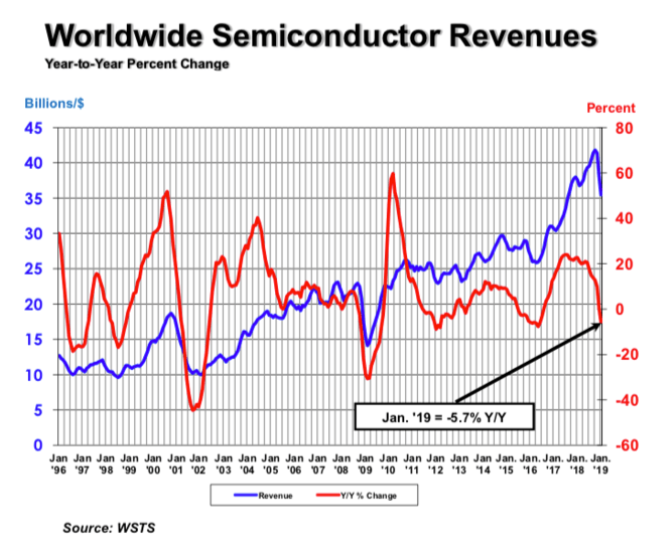

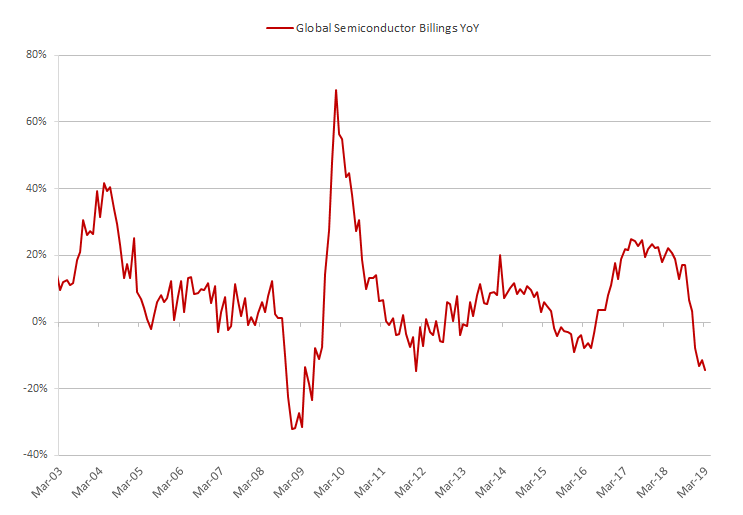

*A significant ⬇ in the semiconductor sector seen via 🇰🇷 exports (bit.ly/2LN3Wlj)

*A slowdown in #China (bit.ly/2AtDHMp)

*CHINA ECONOMY SLOWING, COULD BE RECESSION, HASSETT SAYS ON CNN

*Rising interest rates, volatile stocks have dented sentiment

*Link: bloom.bg/2BW1sMS

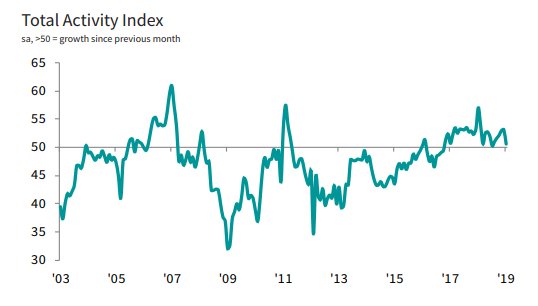

*Composite PMI: 50.0 v 49.3e (3-month high)

*Link: bit.ly/2Qm1y5I

➡ Dec. print was above expectations, yet, the Composite PMI reached 49.6 in 4Q suggesting another contraction (and therefore a technical recession)

*It fell to -11 in 4Q18 (lowest since 1Q15 and down from +2 in 3Q18)

*Link: bit.ly/2VnyIFP

*As I expected (bit.ly/2R8VkLP), 4Q GDP should be close to 0%.

*Output: 52.7 (27-month low) v 53.2 prior

*New Export Orders: 49.7 v 50.0 prior (2nd contraction during the past four months).

*Link: bit.ly/2sbRxOH

*An economics professor at Renmin University in #Beijing sparked a minor furore last month when he claimed a secret government research group had estimated growth could be as low as 1.67% in 2018

ft.com/content/5839f5…

*Earlier this month, JPMorgan forecasted revenue would ⬇ 1% in 2019.

*Analysts expect a ⬇ this month (would break a 29-month growth streak)

*PMI Composite: 52.0 v 52.4 prior (3-month low)

*Link: bit.ly/2LSpaOy

*Exports 47.1, -3.8 pts

*Prior YoY revised lower from -2.7% to -3.0%.

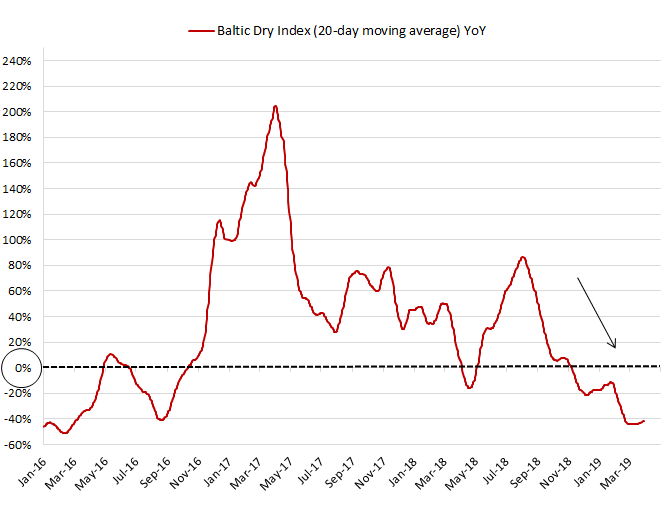

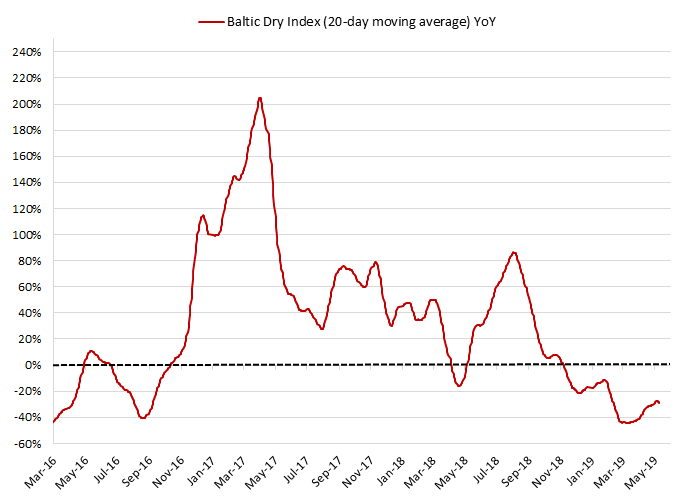

➡ It's a good leading indicator of global trade growth, which suggests more downside ahead.

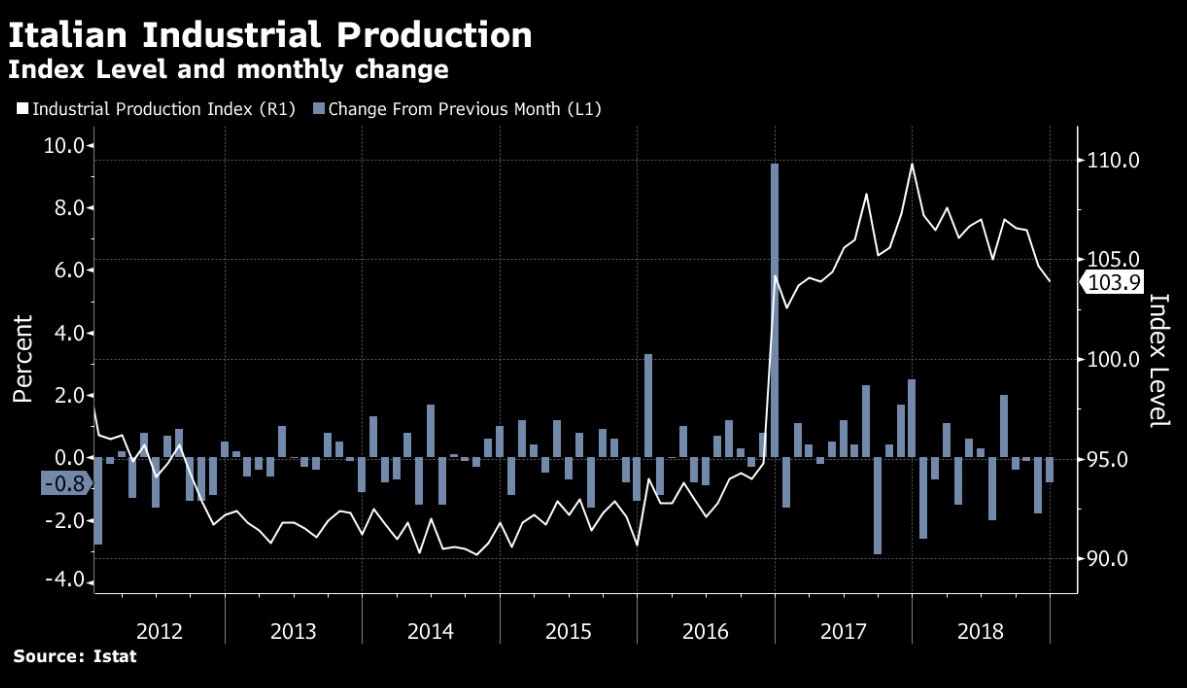

- Prior MoM revised lower from -0.5% to -0.8%

- Prior YoY revised lower from 1.6% to 0.5%

*Bloomberg consensus: +1.6%

*ECB: +1.7% (bit.ly/2QB33SE)

🇩🇪 *Note that 2018 German GDP will be released on Jan. 15.

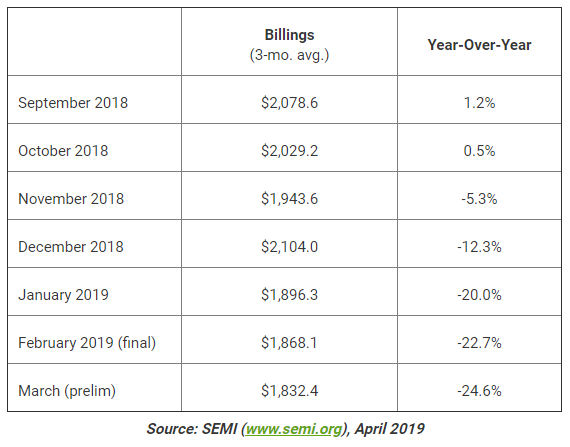

➡ It's coherent with macro data namely the sharp decline in Korean exports of semiconductor seen in Dec. (-8.3% YoY; largest contraction since Apr. 2016)

*Dec Economic Confidence: 107.3 v 108.2e (lowest since Dec. 2016; )

➡ Economic confidence slid for a 12th month in December ❗

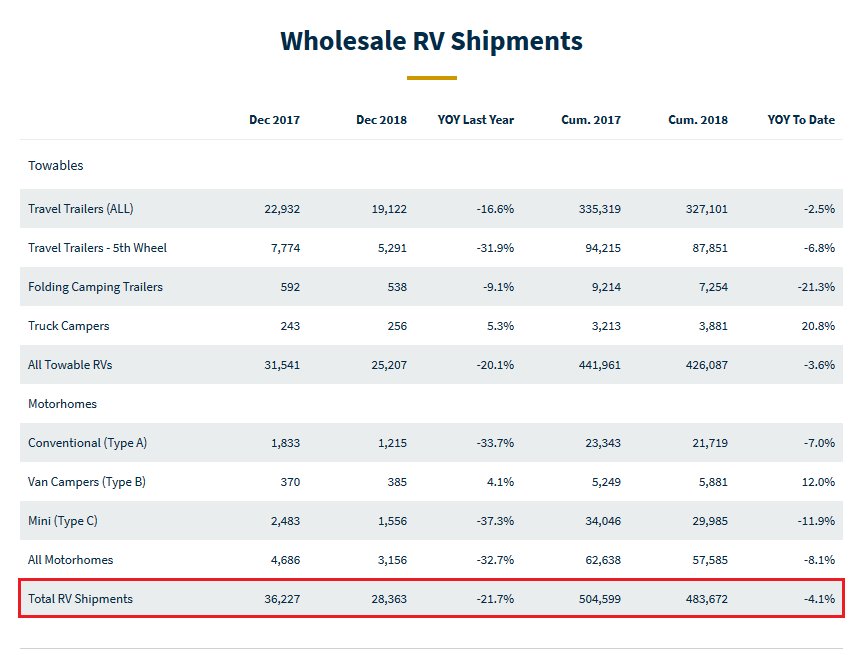

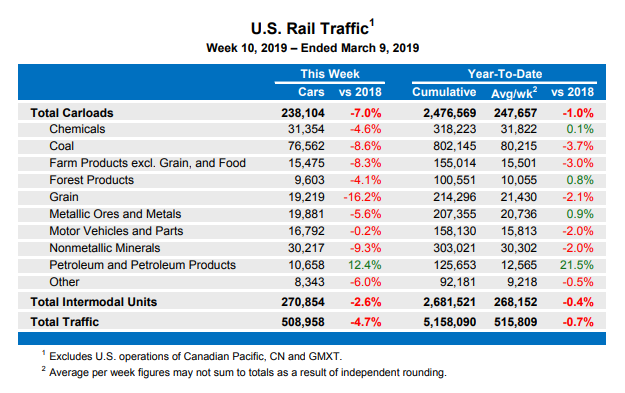

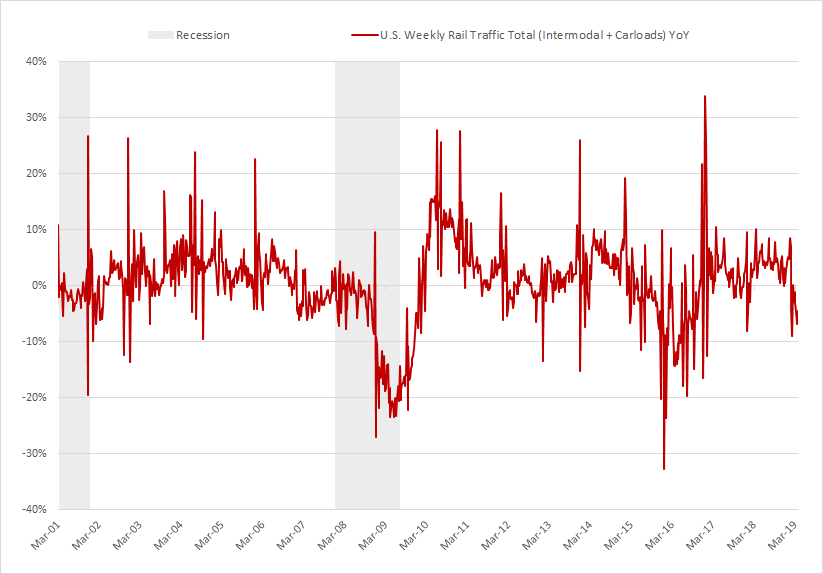

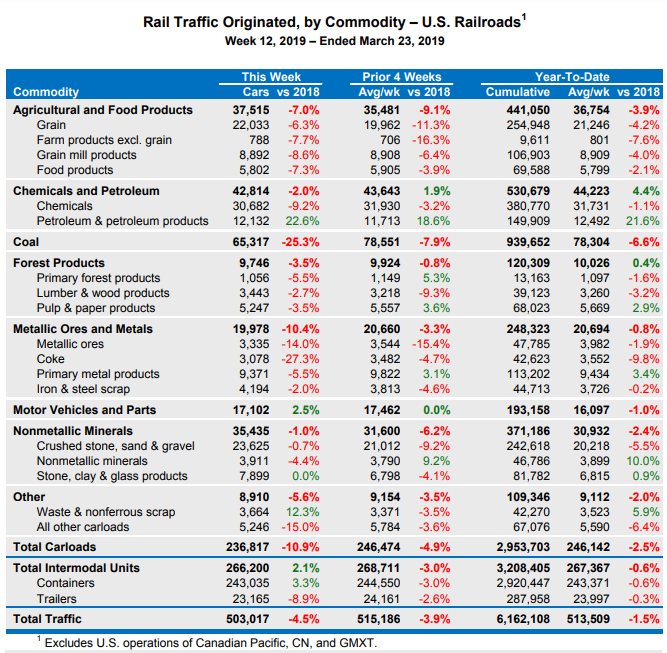

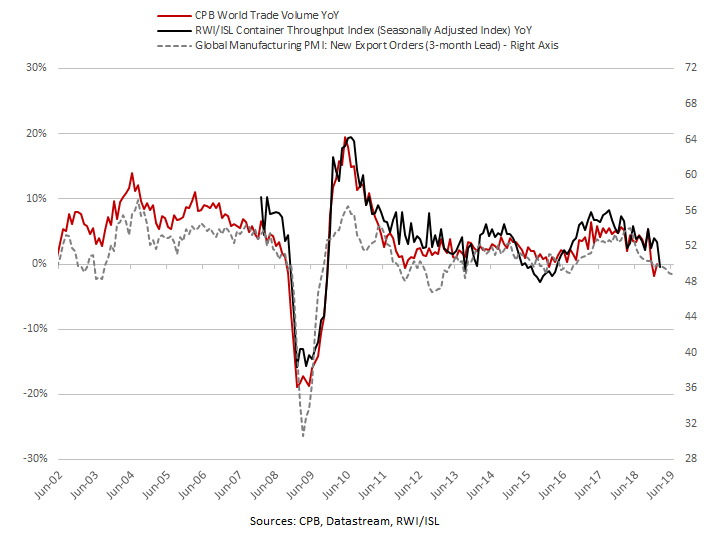

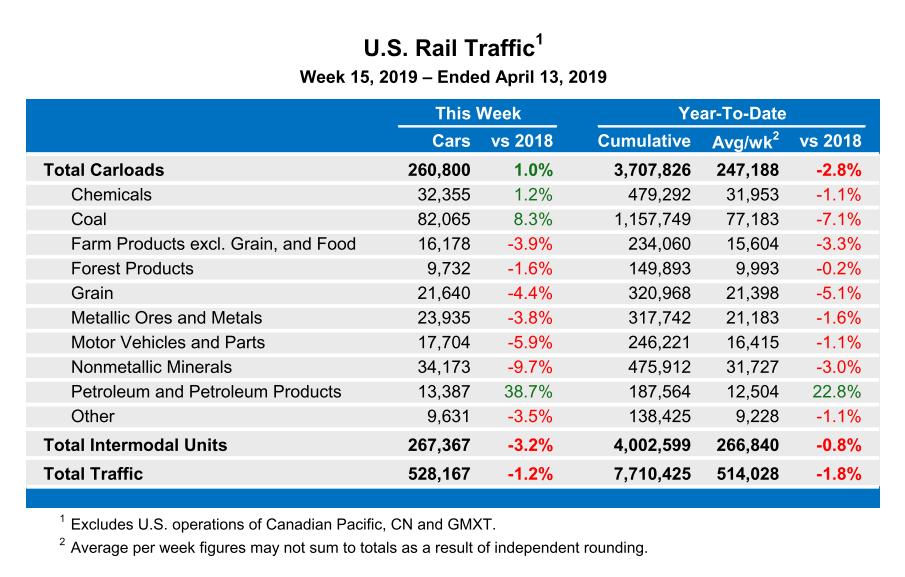

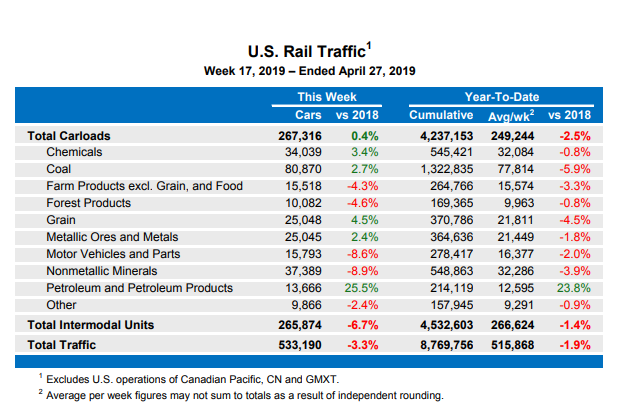

RWI/ISL Container Index rose only 1.3% YoY in Nov., down from +3.8% YoY in Oct.

*A part of the recent increase included a surge in empty containers being shipped back to Asia - Bloomberg

*Link: bloom.bg/2QXHMCQ

*January is forecast at 1.75 million TEU, down 0.9 percent from January 2018 ❗

*Link: bit.ly/2CX4zWr

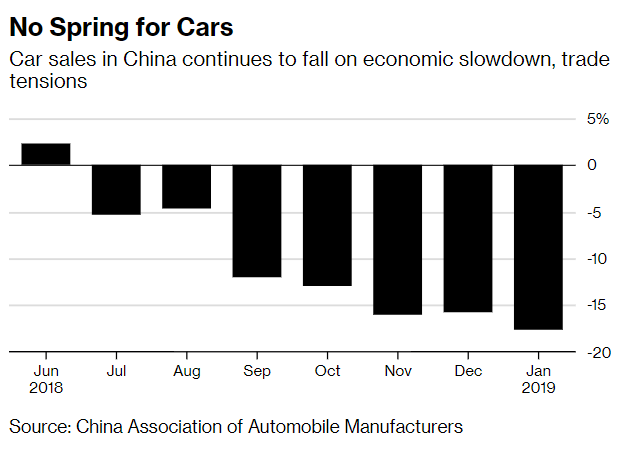

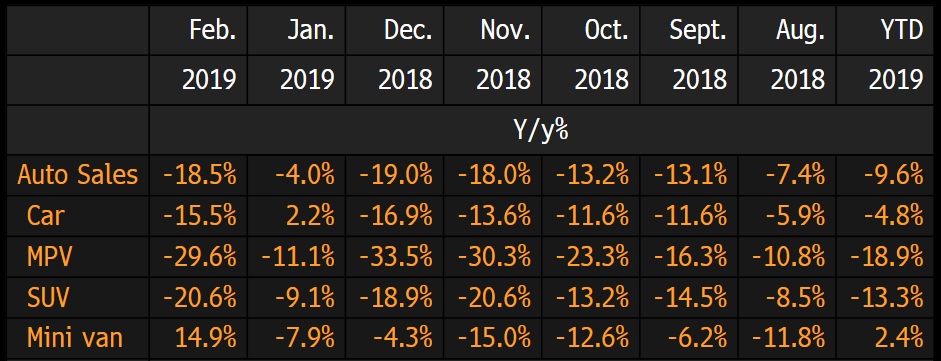

*CHINA 2018 RETAIL PASSENGER VEHICLE SALES FALL 6.0% ON YEAR

*CHINA CAR SALES HAVE FIRST ANNUAL DROP IN MORE THAN 2 DECADES

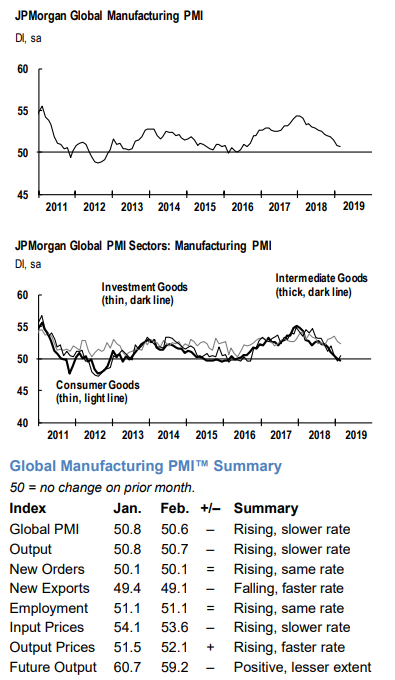

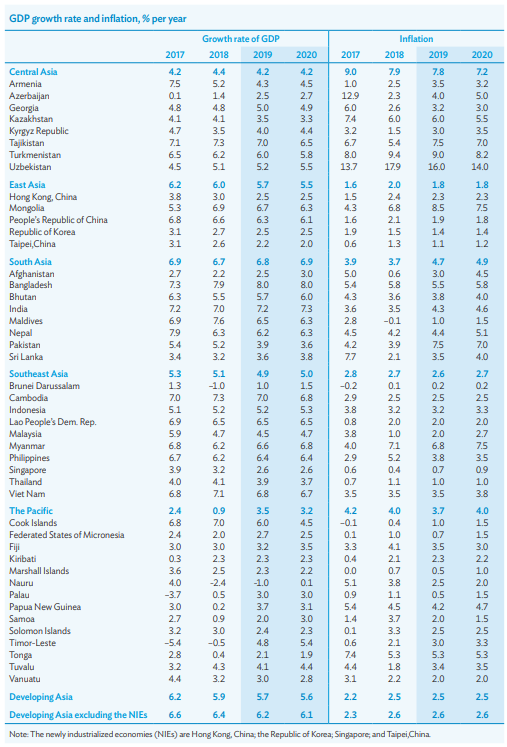

*Global GDP (PPP weights) from +3.8% to +3.5%

*World Trade Volume from +4.2% to +3.6%

*Link: bit.ly/1gIuEF3

➡ It still looks a bit optimistic especially for World Trade Volume growth.

uk.reuters.com/article/uk-ger…

reuters.com/article/us-jag…

*It adds concerns over corporate profitability.

*Dec. PPI Y/Y: 0.9% V 1.6%E

*SPAIN ECONOMY PROBABLY GREW 2.6% IN 2018, CALVINO SAYS

*SPAIN CUTTING GROWTH ESTIMATE ON TIGHTER FISCAL STANCE: CALVINO

*Link: bit.ly/2SHZsyW

*CHINA TO KEEP CONSUMER INFLATION TARGET AT 3% IN 2019: REUTERS

uk.reuters.com/article/uk-chi…

bloomberg.com/news/articles/…

fxstreet.com/news/ecbs-nowo…

*Link: bit.ly/2VNbFo0

*Bloomberg link: bloom.bg/2Ayvw1h

*Link: bit.ly/2SvU16q

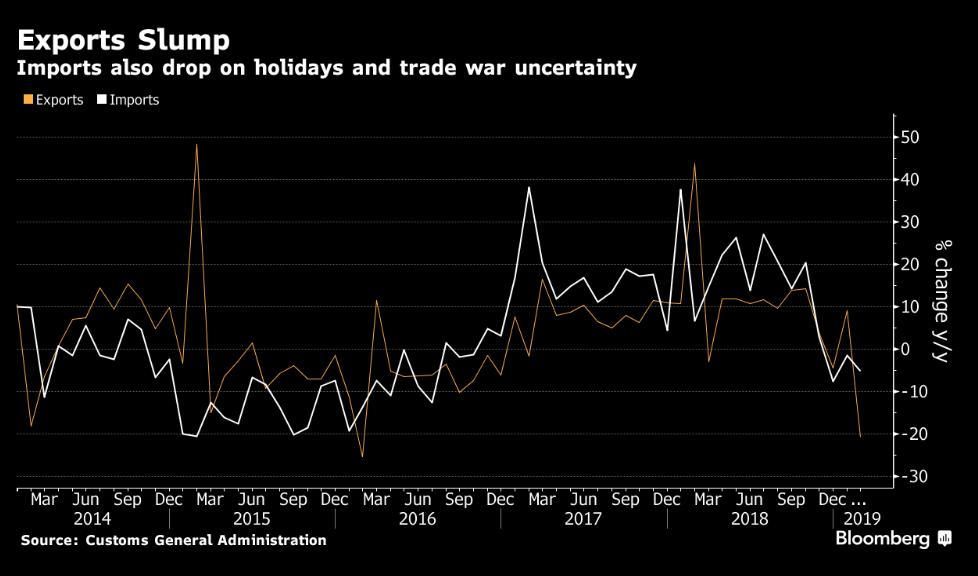

🇨🇳 #CHINA DEC. IMPORTS -7.6% Y/Y IN DOLLAR TERMS; EST. +4.5%

*Largest contraction since July 2016.

➡ Frontloading appears to be fading

*Imports YoY: -7.6% v 4.5%e (largest ⬇ since July 2016)

➡ It reflects ⬇ exports, weaker domestic demand and ⬇ commodity prices

*Link: bloom.bg/2AMMPLY

*Link: uk.reuters.com/article/uk-con…

*We'll see more ⬇ revisions in the coming weeks.

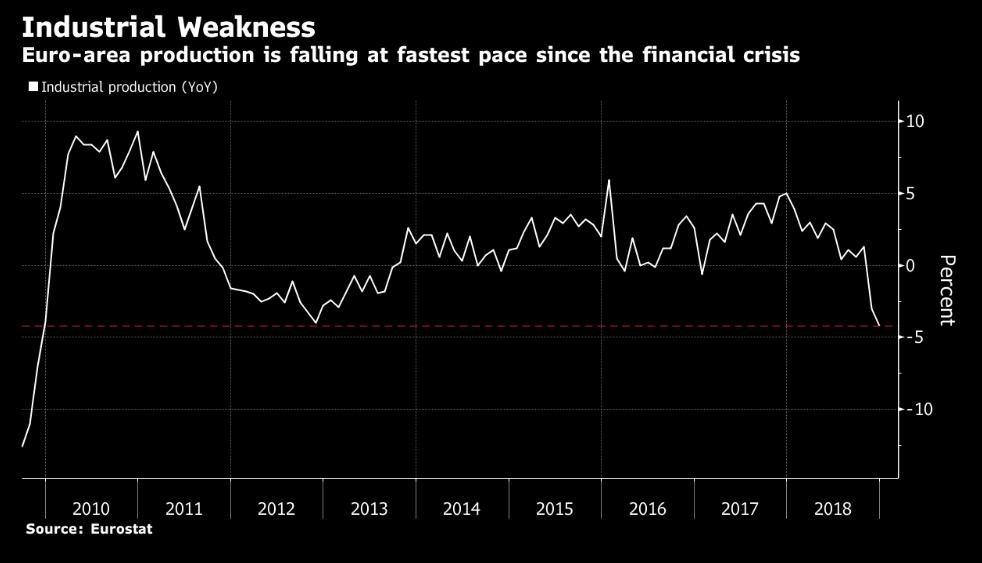

🇪🇺 Eurozone Nov Industrial Production M/M: -1.7% v -1.5%e; Y/Y: -3.3% v -2.1%e

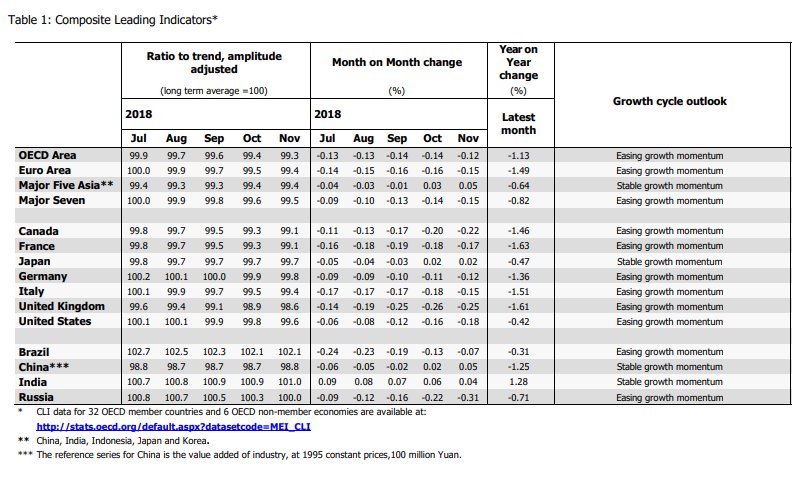

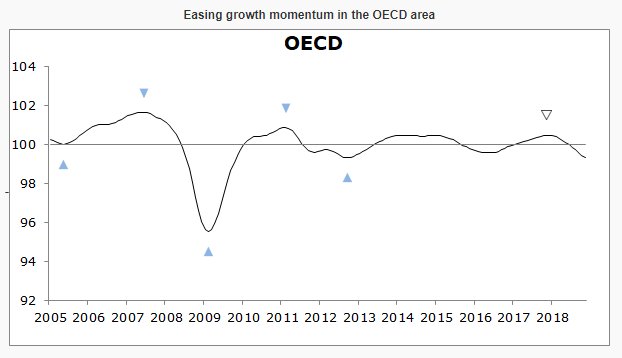

*Composite leading indicators, designed to anticipate turning points in economic activity relative to trend 6 to 9 months ahead, continue to point to ⬇ growth momentum.

*Link: bit.ly/2snBNZ6

➡ The limited rebound is lower than the consensus expected (+0.4%e for Bloomberg consensus) implying lower base effect for 2019.

*DRAGHI: UNCERTAINTIES, ESPECIALLY GLOBAL RISKS, STILL PROMINENT

*DRAGHI: NO ROOM FOR COMPLACENCY, SIGNIFICANT STIMULUS NEEDED

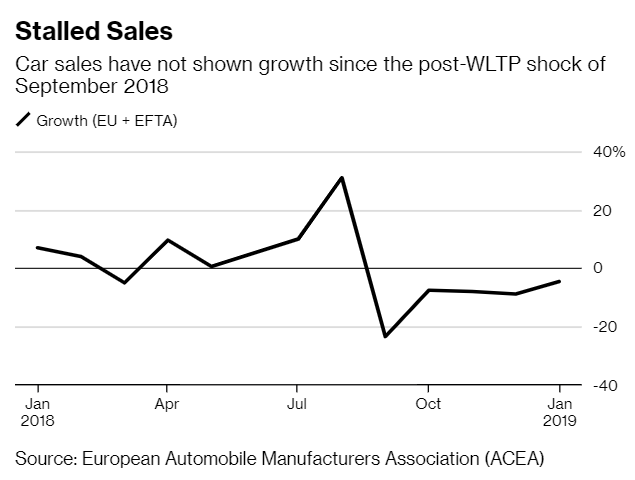

*EUROPEAN 2018 CAR SALES DROP 0.04%, FIRST DECLINE SINCE 2013

reuters.com/article/us-jap…

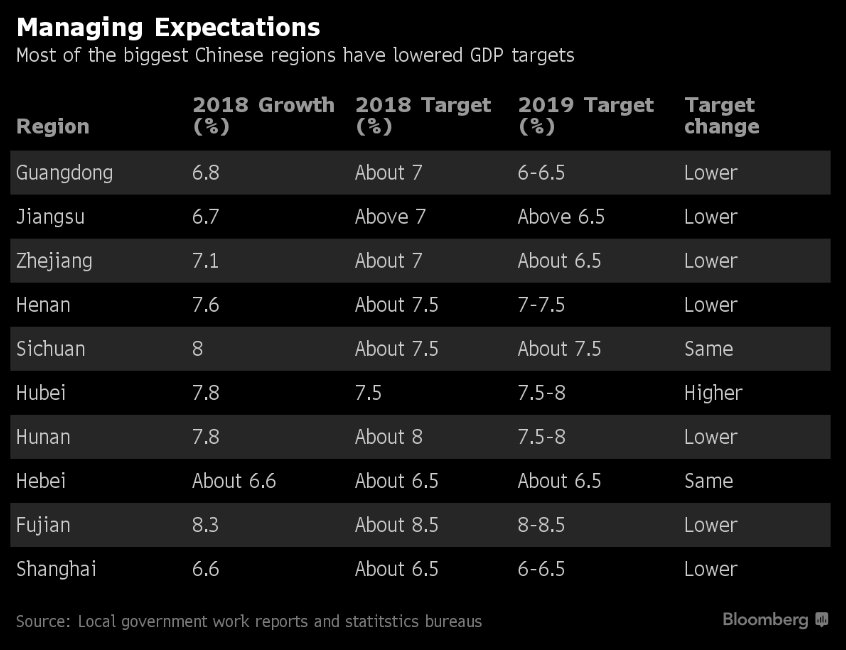

*#Henan is now targeting GDP growth of 6.5% (⬇ from ~7.5%)

*#Beijing sees growth in the 6-6.5% range (⬇ from 6.5%)

beta.scmp.com/economy/china-…

*Lenders reported that demand for secured lending for house purchase decreased significantly in Q4, and was expected to decrease further in Q1.

*Link: bit.ly/2TTnrvl

*As a reminder:

asia.nikkei.com/Business/Compa…

Several reports showed that "the protracted impasse threatens to add backups at US borders that would boost freight rates" - Business Times

businesstimes.com.sg/transport/us-s…

telegraph.co.uk/travel/news/us…

- Electronic Exports y/y: -11.2% v 4.3% prior (largest ⬇ since Feb. 2018)

*Trade-war side effects and cyclical weakness are tangled up in ugly economic data that continues to pile up across the board

bloomberg.com/news/articles/…

➡ In addition, it should also highlight that risks associated to its outlook are no longer "balanced".

*Link (French): bit.ly/2HitGat

➡ As I already noted (bit.ly/2U5xwWf), the consensus will keep adjusting ⬇ in the coming weeks.

- Current conditions: 110 v 116e

- Expectations: 78.3 v 86.5e

➡ The measures of current conditions and expectations both declined to the lowest since President Donald Trump's election in 2016.

*My other proxies also confirm that global trade growth has slowed sharply since Oct. 2018 (bit.ly/2GRnMgo)

*Data link: bit.ly/2AS2D0d

*Global Policy Uncertainty index reached a record high

*IMF will update its GDP forecasts on Monday.

*Link: bloom.bg/2sC3D3Y

➡ I expect sharp downgrades for 2019 especially for Eurozone.

➡ As a reminder, IMF chief Lagarde already made a warning in early Dec.

*Link: bloom.bg/2T1rPZ9

*Overall 2018 GDP Y/Y: 6.6% v 6.6%e (slowest since 1990)

*According to BBG, nominal GDP growth slowed to 8.1% YoY (down from 9.6% YoY in 3Q; weakest since 4Q16)

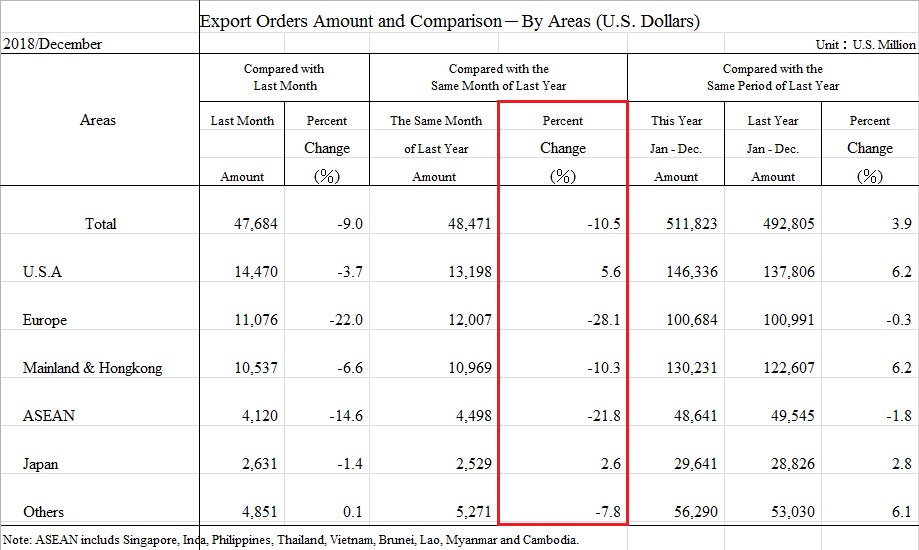

*Exports to HK and Mainland Y/Y: -10.3% vs -8.9% prior

*Exports to Europe Y/Y: -28.1% vs -5.7% prior

*MOEA SEES JAN. EXPORT ORDERS FALLING 11.8%-14.1% Y/Y ❗

*Link; bit.ly/2AULZgm

*Link: bloom.bg/2R3yj7W

bloomberg.com/news/articles/…

bloomberg.com/news/articles/…

af.reuters.com/article/commod…

reuters.com/article/us-eur…

*In Nov. (bit.ly/2RX57Rk, I already warned that forecasts were optimistic.

uk.reuters.com/article/uk-ita…

➡ First 4Q18 GDP estimate will be released on Jan. 31

*a 14.6% YoY ⬇ in total exports (largest ⬇ since September 2016; vs +1.0% in Dec.)

*a 9.5% YoY ⬇ in total imports (largest ⬇ since September 2016; vs +2.2% in Dec.)

*Link: bit.ly/2FNR3X0

*a 22.5% YoY ⬇ in exports to #China (largest ⬇ since Jan. 2009 vs -14.2% in Dec.)

*a 28.8 YoY ⬇ in semiconductor exports (vs -9.8% in Dec.)

*Link: bit.ly/2FNR3X0

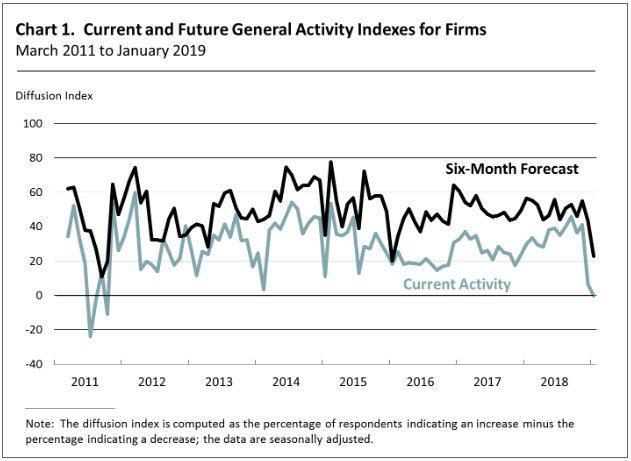

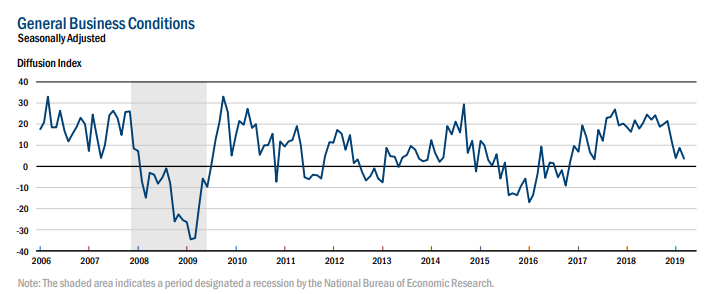

*The diffusion index for current general activity at the firm level fell from a revised reading of 6.4 in December to -0.2 in January (1st negative reading since October 2011)

*Link: bit.ly/2T9KiCQ

*Production ⬇ for first time since July 2016 (49.2 vs 54.0 prior)

*New export orders ⬇ at fastest pace since July 2016 ❗

*Link: bit.ly/2FKxsb1

*Services PMI: 53.1 v 52.1e (66th month of expansion)

*Composite PMI: 52.1 v 51.9e (2-month high)

*New export orders ⬇ at an accelerated rate ❗

*Link: bit.ly/2CHNNJw

*Services PMI: 50.8 v 51.5e (65-month low)

*Composite PMI: 50.7 v 51.4e (66-month low)

*Link: bit.ly/2RLFVBl

➡ #ECB is likely to acknowledge the situation.

bloomberg.com/news/articles/…

handelsblatt.com/politik/deutsc…

*COEURE: TOO EARLY TO DISCUSS WHETHER ECB WILL HIKE IN 2019

*COEURE: ECB MAY HAVE TO ADJUST RATE GUIDANCE AT SOME POINT

*COEURE: ECB WON'T OFFER NEW LOANS JUST FOR BANKS' NSFR RULES

*ECB'S VILLEROY: REDUCTION OF STIMULUS WILL BE VERY GRADUAL

*VILLEROY: ECB WILL PROBABLY DOWNGRADE GDP FORECAST IN MARCH - BBG

*VASILIAUSKAS SAYS ECB BALANCE OF RISKS HAS `NEGATIVE OUTLOOK'

*VASILIAUSKAS: NO REASON TO CHANGE ECB GUIDANCE `AT THIS POINT'

*VASILIAUSKAS: TLTROS COULD POTENTIALLY PLAY A ROLE

*Link: bit.ly/2FZjm4Y

*the end of frontloading

*weak underlying activity

*negative base effect

*My proxies for Dec. and Jan. suggest that the weakness will last and will probably result in a contraction YoY soon

*Link: bit.ly/2rJjz2d

*Regional figures confirm that exports YoY are crashing.

*Link: bloom.bg/2Tora48

*Two-biggest economies aim at 6-6.5 percent target for 2019

*Link: bloom.bg/2TorIXK

*At least 20 companies project worse earnings late Tuesday

*Link: bloom.bg/2sWzxZe

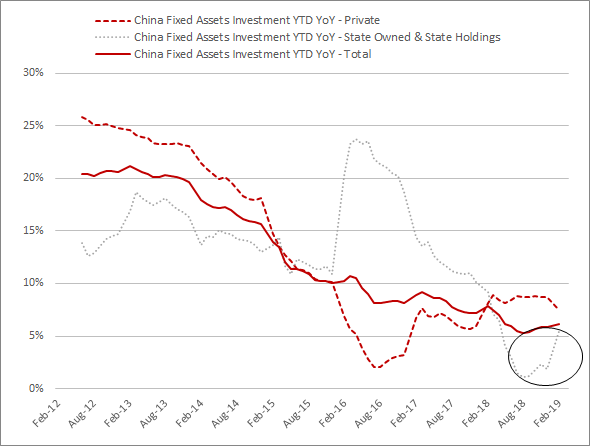

*Imports YoY YTD: 3.1% v 5.3% prior (lowest since April 2018)

*Economic Confidence: 106.2 v 106.8e (lowest since Nov. 2016)

*Industrial Confidence: 0.5 v 0.5e (lowest since Nov. 2016)

*Services Confidence: 11.0 v 11.5e (lowest since Sept. 2016)

*Economy to grow 1.0% compared with 1.8% October prediction

*Link: bloom.bg/2CSWOzD

*Contraction would mean Italy fell into "technical" recession in 4Q

*4Q GDP will be published tomorrow at 10:00 GMT

*Prior MoM revised higher from 1.4% to 1.6%

*Prior YoY revised higher from 1.1% to 1.9%

*Link: bit.ly/2sWINfZ

*New orders ⬇ further to 49.6 (lowest since Feb. 2016)

*New export orders ⬆ to 46.9 v 46.6 prior.

bloomberg.com/news/articles/…

cbi.org.uk/news/sentiment…

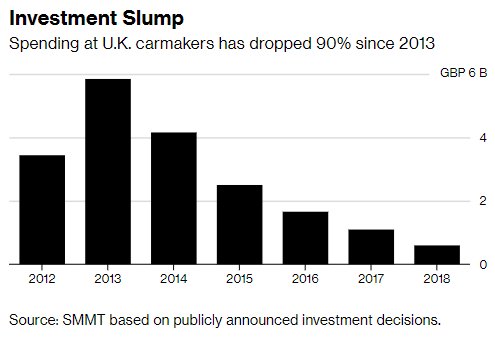

*Spending dropped below 1 billion pounds for the first time since 2012, when the group started compiling investment statistics, according to Hawes.

*Link: bloom.bg/2SmTCq0

*Prior GDP YoY revised lower from 0.7% to 0.6%

*He noted that #Germany’s economic slump will be longer than earlier thought and there is more bad news in the pipeline.

reuters.com/article/us-ecb…

*New orders 47.3 v 49.8 prior (lowest since Sep. 2015)

*Link: bit.ly/2MKZfIY

🇹🇼 🇰🇷🇮🇩 #Taiwan, #SouthKorea, and #Indonesia also posted PMI scores below 50, indicating a ⬇ in factory output.

🇯🇵 🇹🇭 🇵🇭 🇻🇳 *Indexes for #Japan, #Thailand, the #Philippines and #Vietnam weakened.

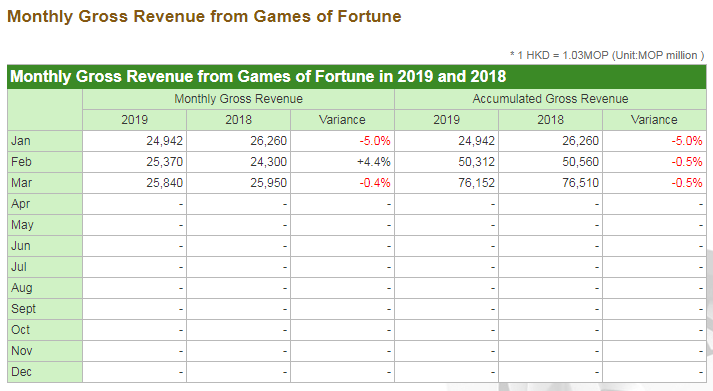

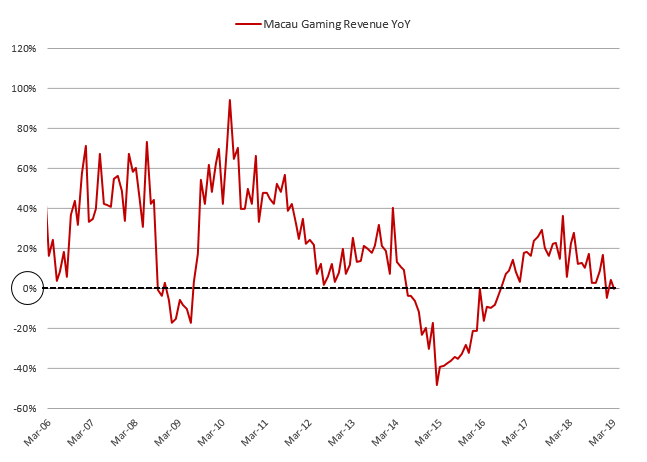

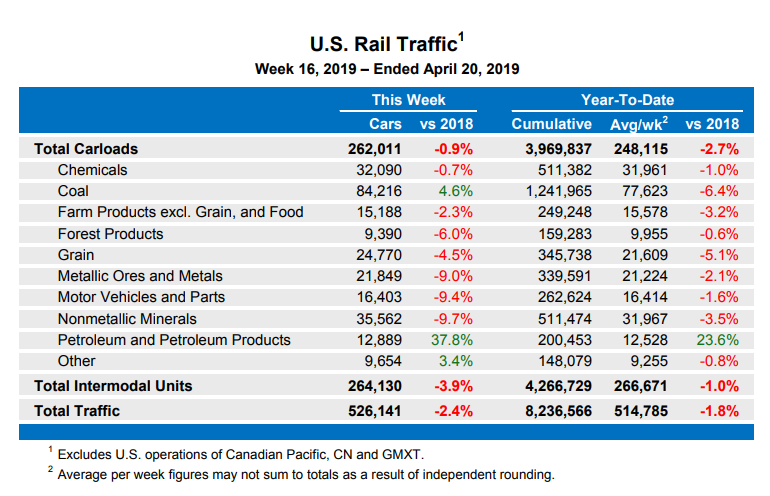

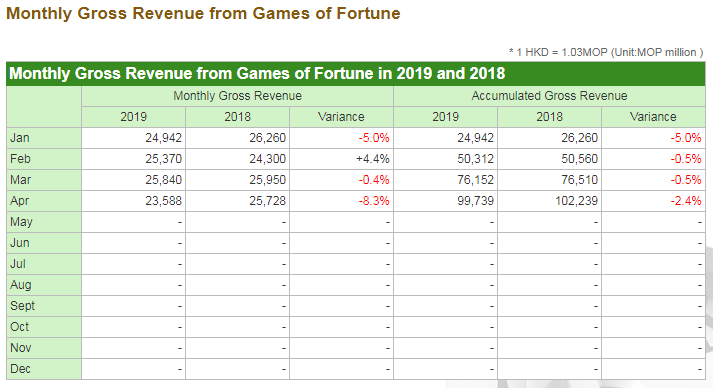

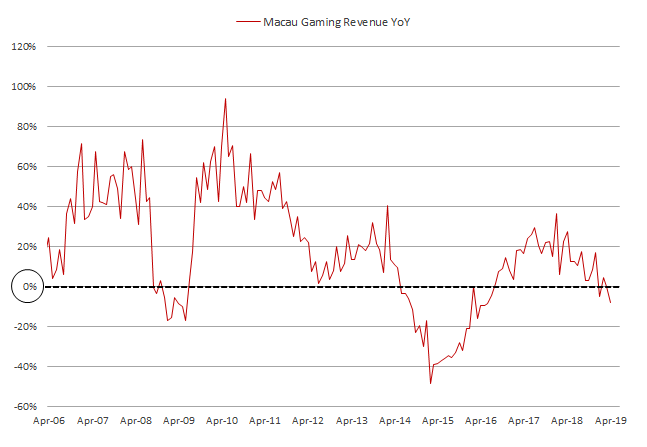

*The timing of this #China year’s Lunar New Year didn’t help Macau’s casino takings

*Casino revenue in Macau is expected to decline overall this year

*Link: bit.ly/2HIG0B3

*Exports to #China YoY: -19.1% v -14.0% (largest ⬇ since Jan. 2016)

*Exports of Semiconductor YoY: -23.3% v -8.3% prior (largest ⬇ since Apr. 2009)

*Link (Korean): bit.ly/2HKZlS6

*New Orders: 46.5 v 47.8 prior (6th straight contraction)

*Link: bit.ly/2TpP7Z1

*New Orders: 50.1 v 51.1 prior (it rose at the weakest pace during the current six-year sequence of expansion)

*Link: bit.ly/2TsvDTi

*As discussed (bit.ly/2SnOeTa), a contraction of global trade growth (on a YoY basis) could happen soon.

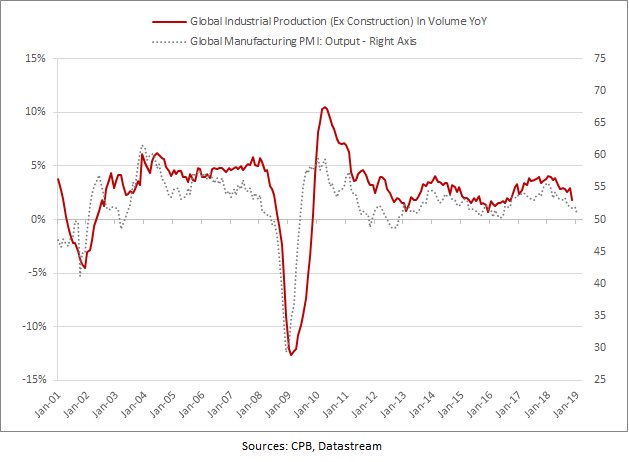

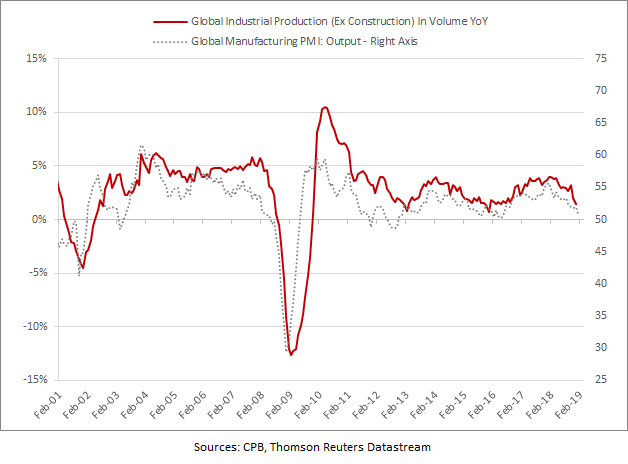

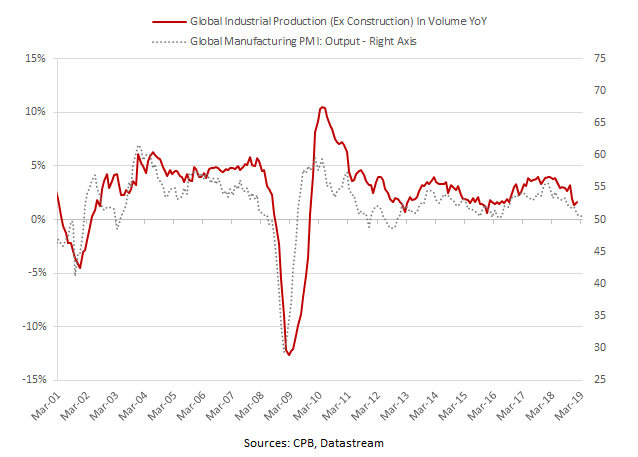

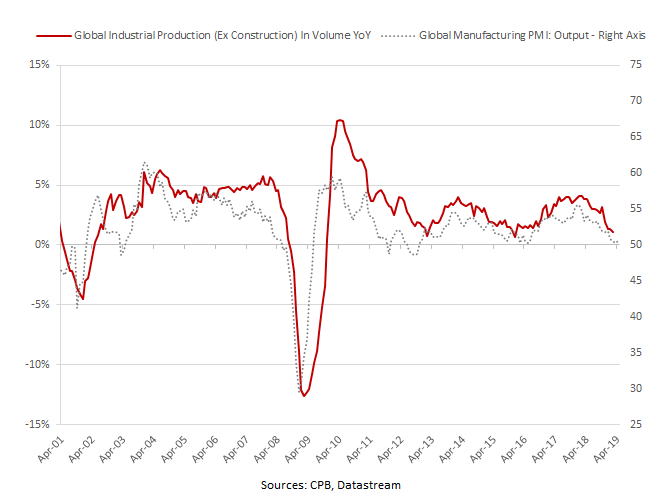

*It suggest that global production growth (ex construction) will keep weakening in the coming months.

*Bank of Italy head cautions on economic outlook for #Italy

*Weidmann, Villeroy offer similar assessments for euro area

bloomberg.com/news/articles/…

*Composite PMI: 50.9 v 52.2 (3-month low)

*Link: bit.ly/2D5jZa2

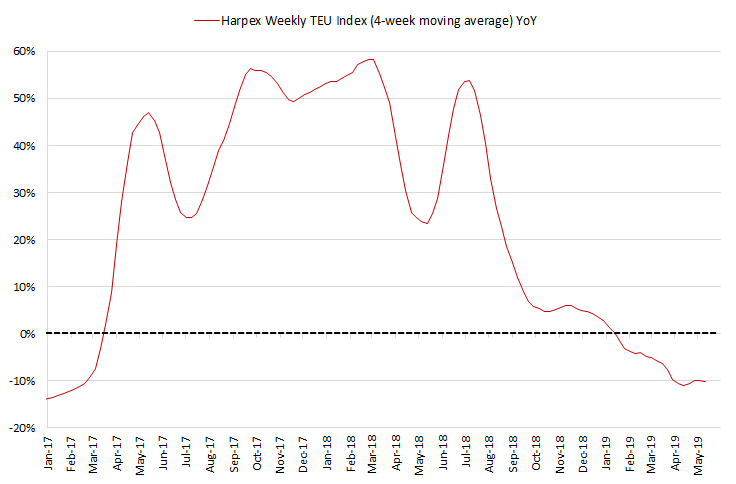

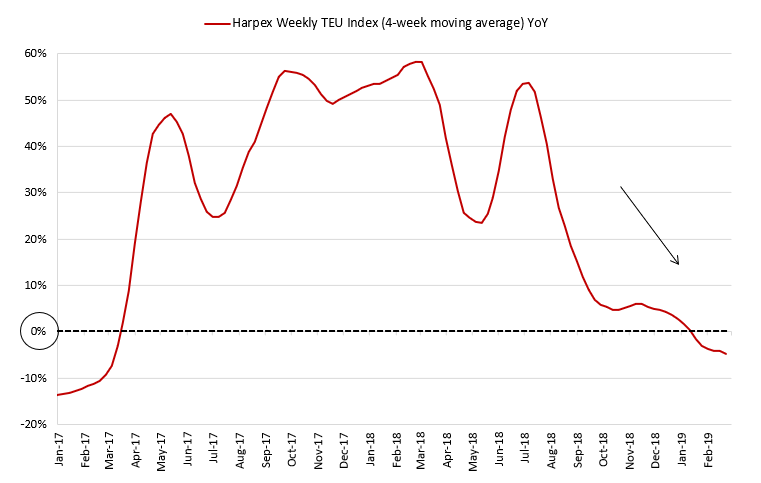

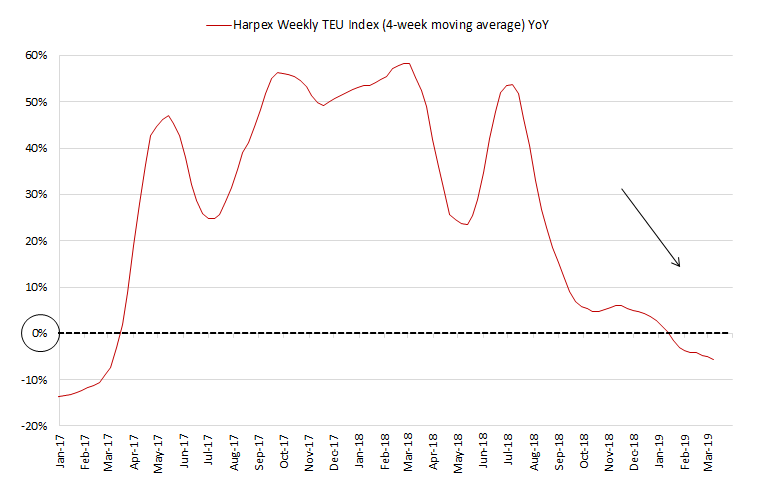

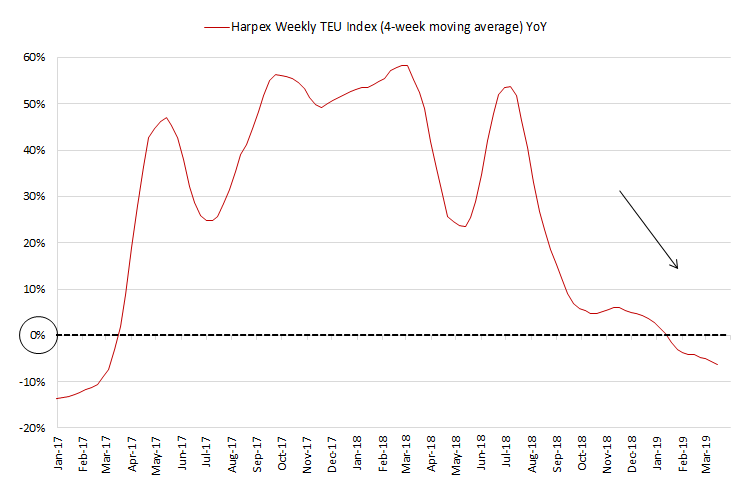

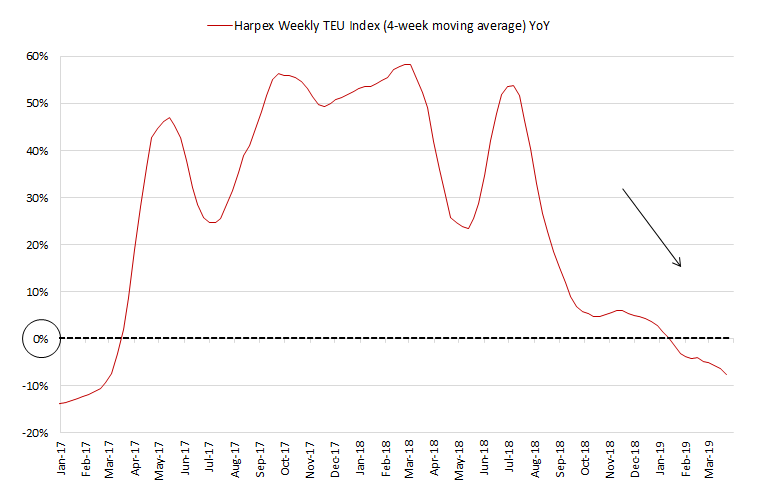

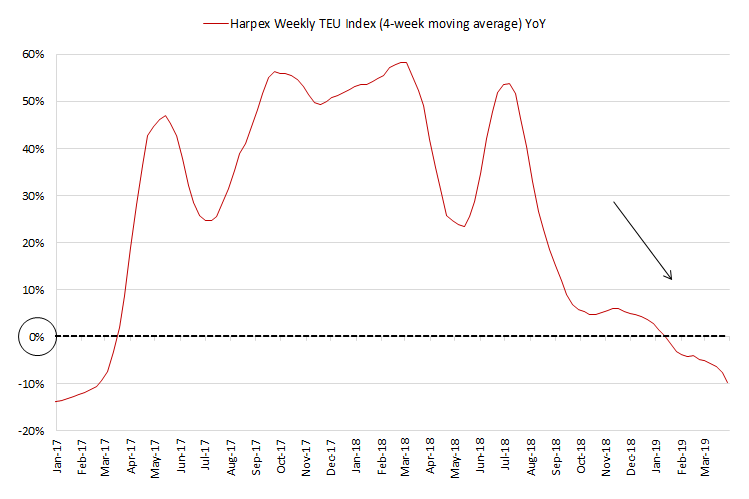

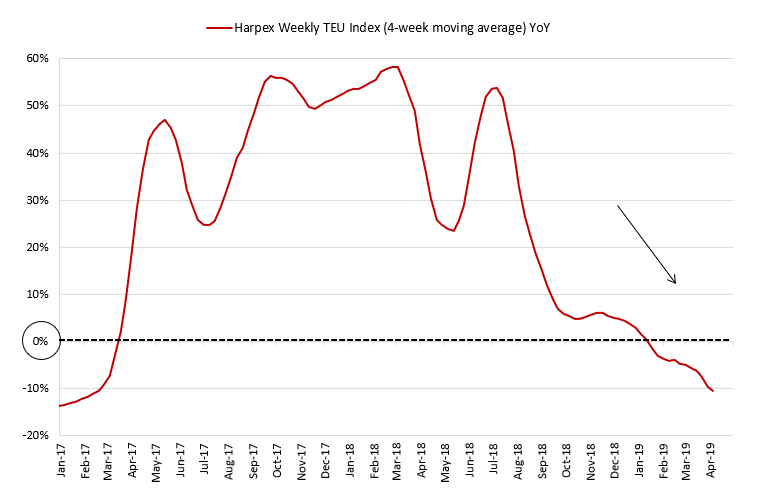

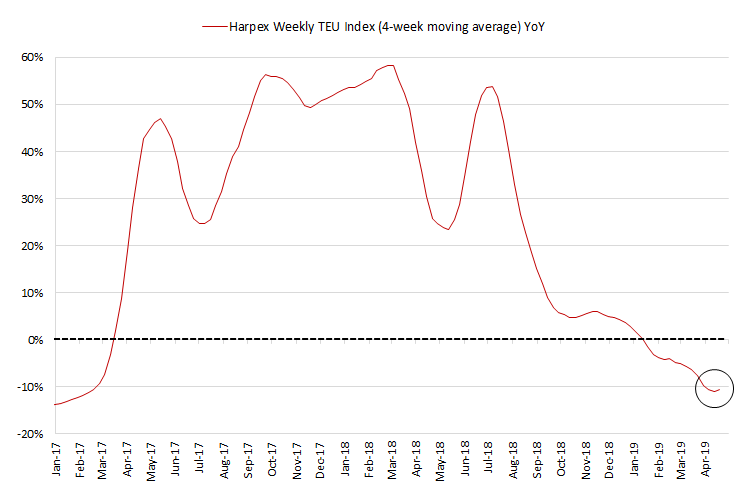

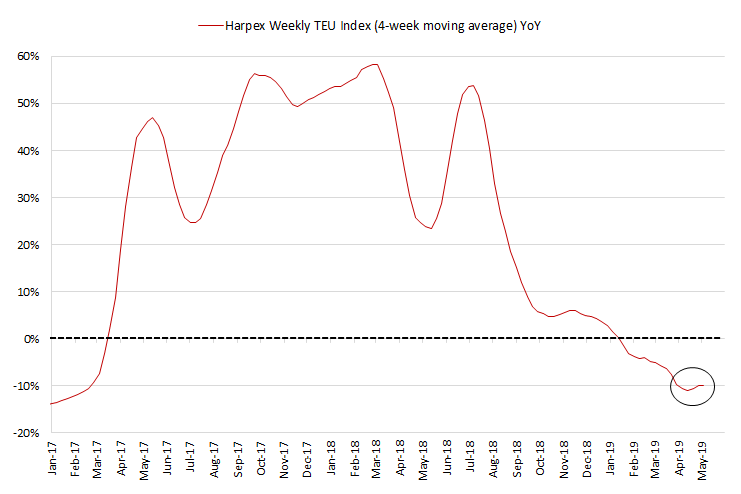

*On a YoY basis, the Harpex TEU Index turned negative in January.

*Link: bit.ly/2UzAbHN

*Net profit sank 9%, marking the first decline on a quarterly basis in two years and the largest drop since April-June 2016.

asia.nikkei.com/Business/Busin…

*The combined losses could total between CNY289Bn and CNY335Bn.

wsj.com/articles/corpo…

*Link: bit.ly/2SqxBGJ

*Composite PMI: 48.8 v 49.4e (lowest since Nov. 2013❗)

*Link: bit.ly/2DeuWGC

*M/M: -1.6% v 0.3%e (largest ⬇ since June 2018)

*Y/Y: -7.0% v -6.7%e (largest ⬇ since June 2012)

*Rates of expansion slowed in both the manufacturing (31-month low) and service (28-month low) sectors.

*Link: bit.ly/2Gm9xyl

*Firms recorded the slowest rise in new orders for four months, driven by a contraction in new work at French firms.

markiteconomics.com/Survey/PressRe…

*ANSA QUOTES EU SOURCES FOR GROWTH ESTIMATE CUT FOR ITALY

*EU ESTIMATES TAKE INTO ACCOUNT DECEMBER BUDGET MEASURES

*Cites remaining significant challenges such as real incomes per capita still near level of two decades ago, elevated poverty rates and public debt

*Link: bit.ly/2UJyfg4

*The 1,070 companies reporting a downturn in their December year-end results include more than 400 that expect to book a net loss

asia.nikkei.com/Economy/One-in…

scmp.com/economy/china-…

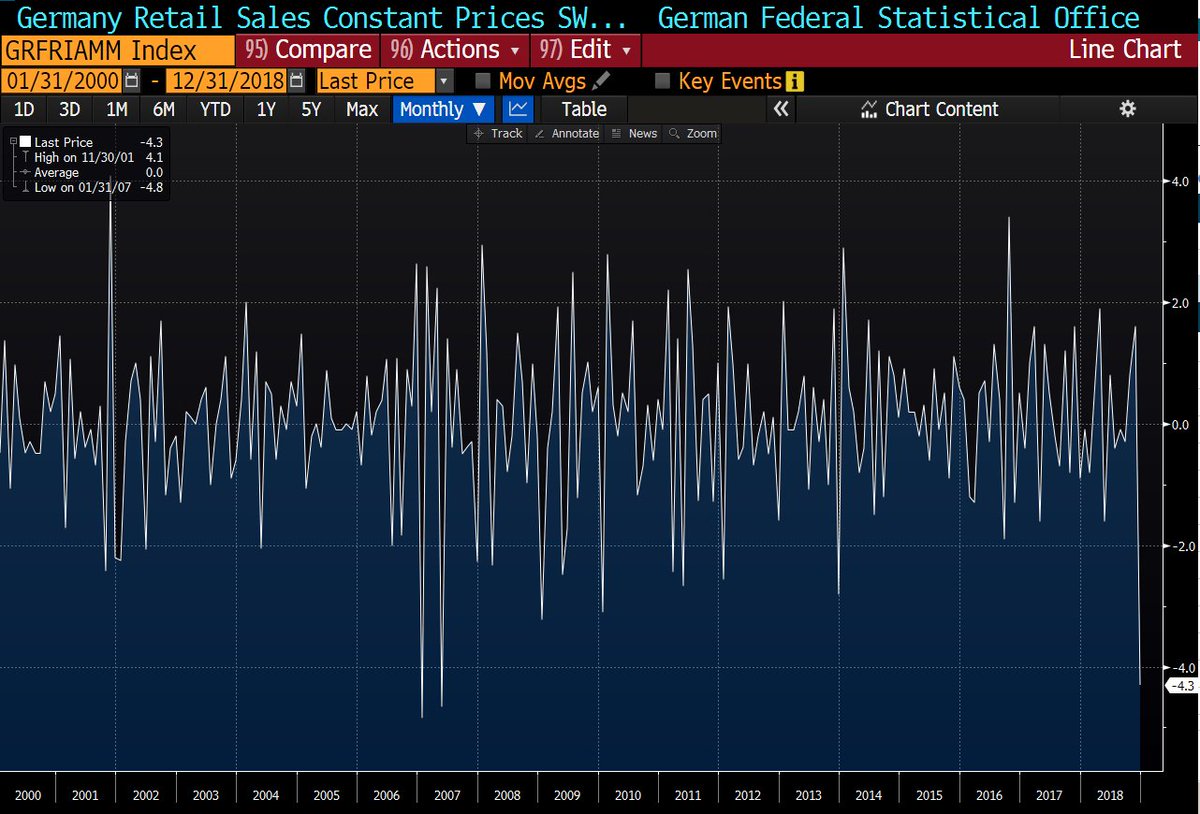

*M/M: -0.4% V 0.8%E (4th straight contraction)

*Y/Y: -3.9% V -3.4%E

- Prior MoM revised higher from -1.9% to -1.3%

- Prior YoY revised higher from -4.7% to -4.0%

*ECB: PRIVATE CONSUMPTION IS EXPECTED TO REGAIN MOMENTUM

*Link: bit.ly/2DZXCEH

*BOE CUTS 2019 GDP FORECAST TO 1.2% V 1.7%, 2020 1.5% V 1.7%

*M/M: -0.8% v +0.4%e;

*WDA Y/Y: -5.5% v -2.7%e

*Link: bloom.bg/2ROfoyv

*The Harpex TEU Index is now contracting at the fastest pace since March 2017.

*Link: bit.ly/2UzAbHN

*Link: bloom.bg/2g0FpYX

wsj.com/articles/free-…

*In the first quarter, the indicator dropped from -2.2 points to -13.1 points (lowest since 4Q 2011).

*Link: bit.ly/2GlrcqH

ft.com/content/0e0b0e…

#China's consumption growth likely to slow further in 2019: commerce ministry - Reuters

reuters.com/article/us-chi…

*The National Federation of Independent Business’s optimism index fell 3.2 points to 101.2, the lowest since November 2016.

*Link: bit.ly/2TJTFJR

Political uncertainty is weighing on businesses, with the group’s Uncertainty Index ⬆ 7 pts to 86 (highest since March 2017)

*The decline from a year earlier, the equivalent of nearly £2 billion ($2.6 billion) of lost spending, was the largest since the financial crisis a decade ago.

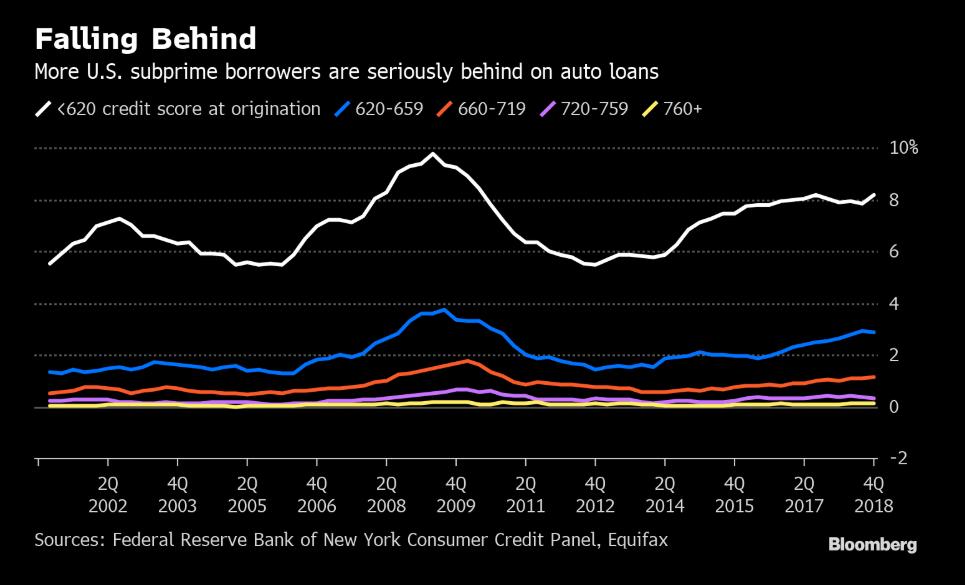

*It ⬆ to 4.47% of the total in 4Q18 (highest since 1Q12)

*The % of consumers with the weakest credit who fell seriously behind paying off their vehicle was the highest since 2Q10

*Production drops 0.9% on month, 4.2% from a year earlier (largest ⬇ since Nov. 2009).

*Link: bloom.bg/2N2ABE0

*It implies lower base effect for 2019. In other words, it would be a good performance if GDP grows by 1.0% (current gvt estimate)

*Link: bloom.bg/2TO6djn

uk.reuters.com/article/uk-chi…

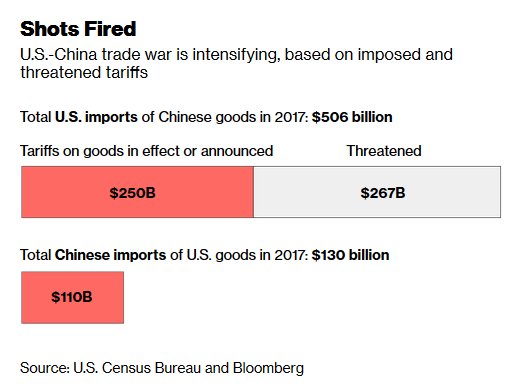

*It confirms that the tariffs had a significant impact.

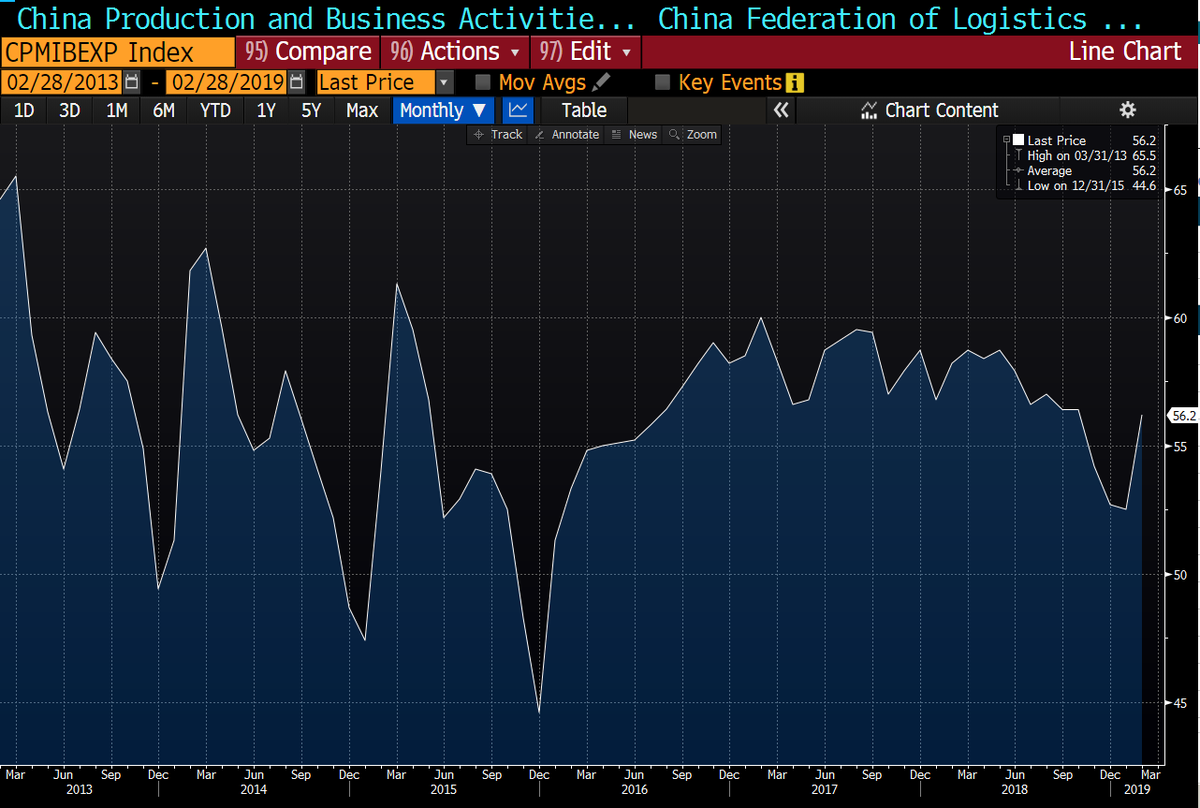

*The index contracts for a third straight month (1st time since Aug. 2015) despite frontloading activity ahead of the Lunar New Year shutdown.

*Link: bit.ly/2SvU16q

🇺🇸 NOV BUSINESS INVENTORIES: -0.1% V 0.2%E (1st decline since March 2018)

*Link: bit.ly/2tq4Sno

*In Jan., New-car registrations drop for fifth month in row (longest ⬇ straight since March 2013)

*Link: bloom.bg/2IcXB4A

*Producer price growth slows for seventh month to +0.1% YoY (slowest since Nov. 2016)

*Link: bloom.bg/2SUpv9t

*Holiday sales were up just 2.9% in 2018, the National Retail Federation said on Thursday while it had been calling for a rise between 4.3% and 4.8%.

cnbc.com/2019/02/14/hol…

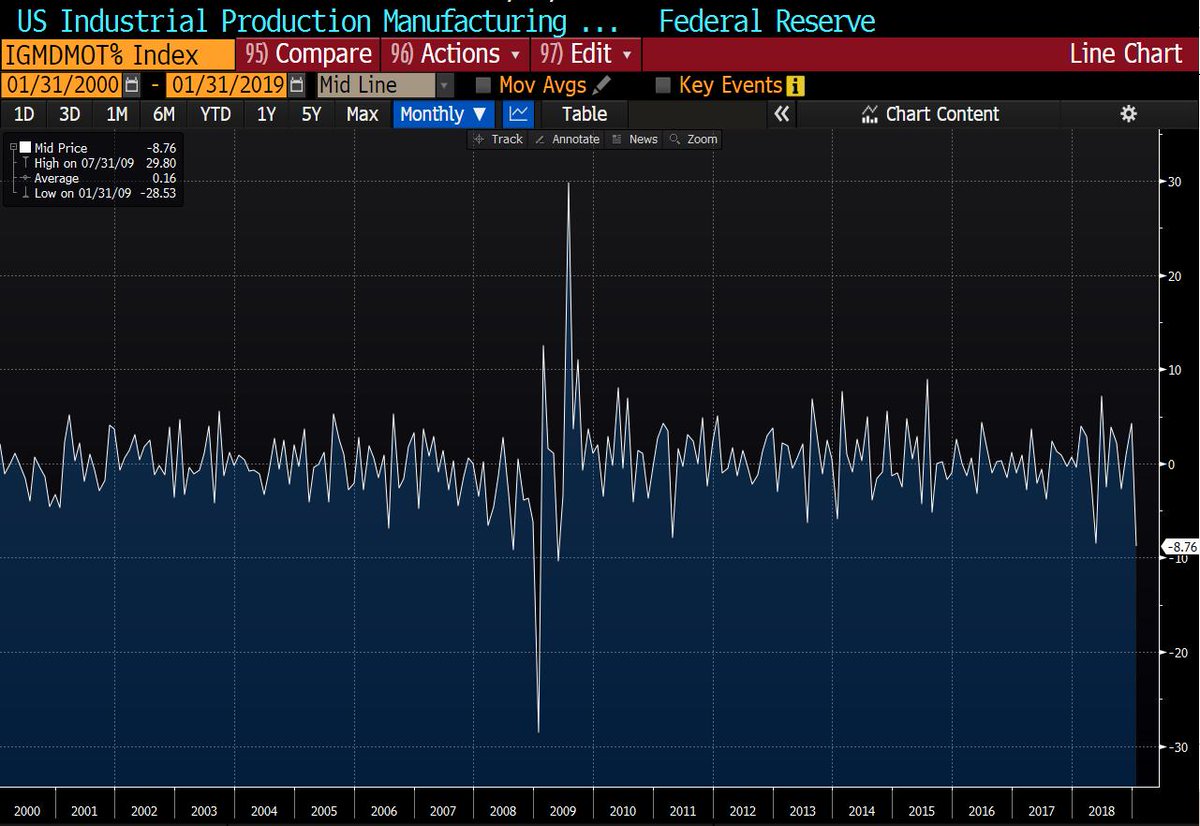

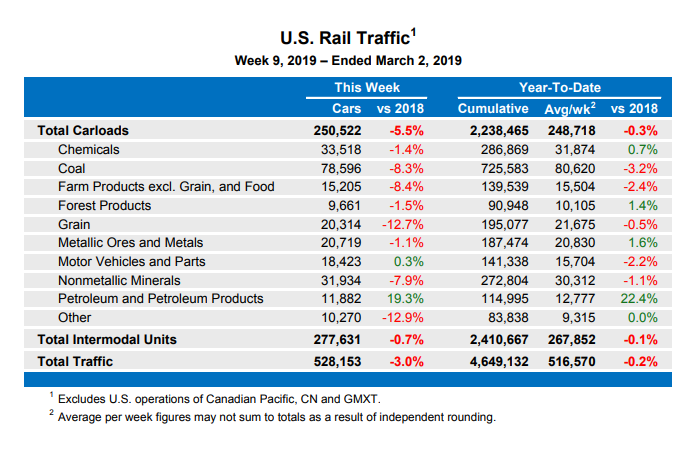

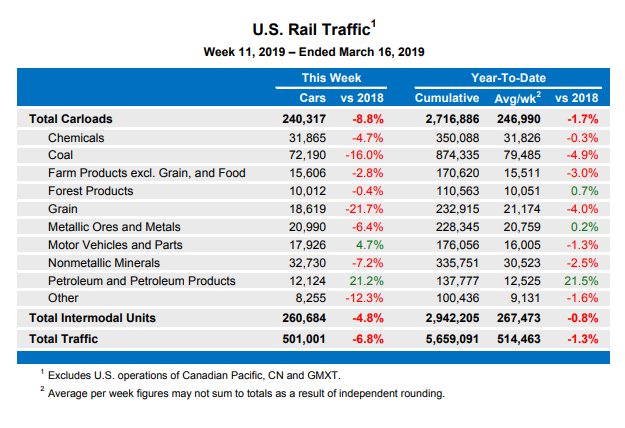

*The decline was driven by an 8.8% ⬇ in motor vehicles & parts (largest ⬇ since May 2009)

*Manufacturing, which makes up 75% of total industrial production, accounts for about 12% of the U.S. economy.

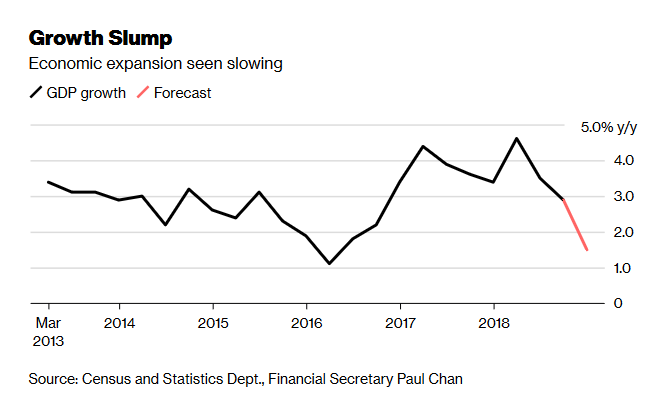

*The trade war between the U.S. and China and slowing retail sales dragged #HK’s economic growth down at the end of last year, with exports showing almost "zero growth."

*Link: bloom.bg/2tujHVH

*Electronic Exports y/y: -15.9% v -11.2% prior (largest ⬇ since June 2014)

*Personal Computer y/y: -34.3% v -20.5% prior (largest ⬇ since July 2016)

*Jan Passenger vehicle sales to dealerships Y/Y: -17.7% v -15.8% prior

*CAAM predicts another sharp drop in February

*Link: bloom.bg/2V43lPG

*But details also reveal a synchronized slowdown as non-oil exports to 🇲🇾, 🇭🇰, 🇯🇵, 🇲🇨, 🇹🇼 (key partners) were also down YoY and hit most of sectors.

uk.reuters.com/article/uk-ger…

reuters.com/article/us-hsb…

*Industrial Orders Y/Y: -5.3% (largest contraction since July 2016) v -2.0% prior

bloomberg.com/news/articles/…

*WTO trade assessment was the weakest since Mar. 2010

*Link: bit.ly/2DVCOwP

*Exports to #China (biggest trading partner) y/y; -17.4% (largest ⬇ since Jan. 2016)

*Link: bit.ly/13OjAW7

*Link: bit.ly/2EBb8QJ

reuters.com/article/us-jap…

*On 21st Jan., IMF already Cut 2019 German GDP Forecast to 1.3%

*Most economists/institutes are seeing German growth this year to be closer to 1.0%

*Link: reut.rs/2BI2UD6

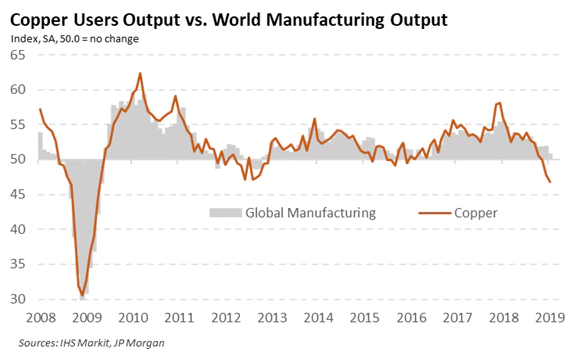

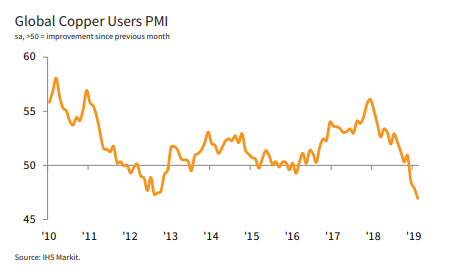

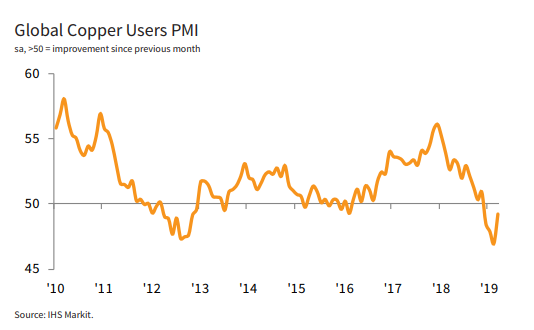

The Global Copper Users Output Index posted at 46.8 in January (lowest since April 2009)

*Link: bit.ly/2DWdiYn

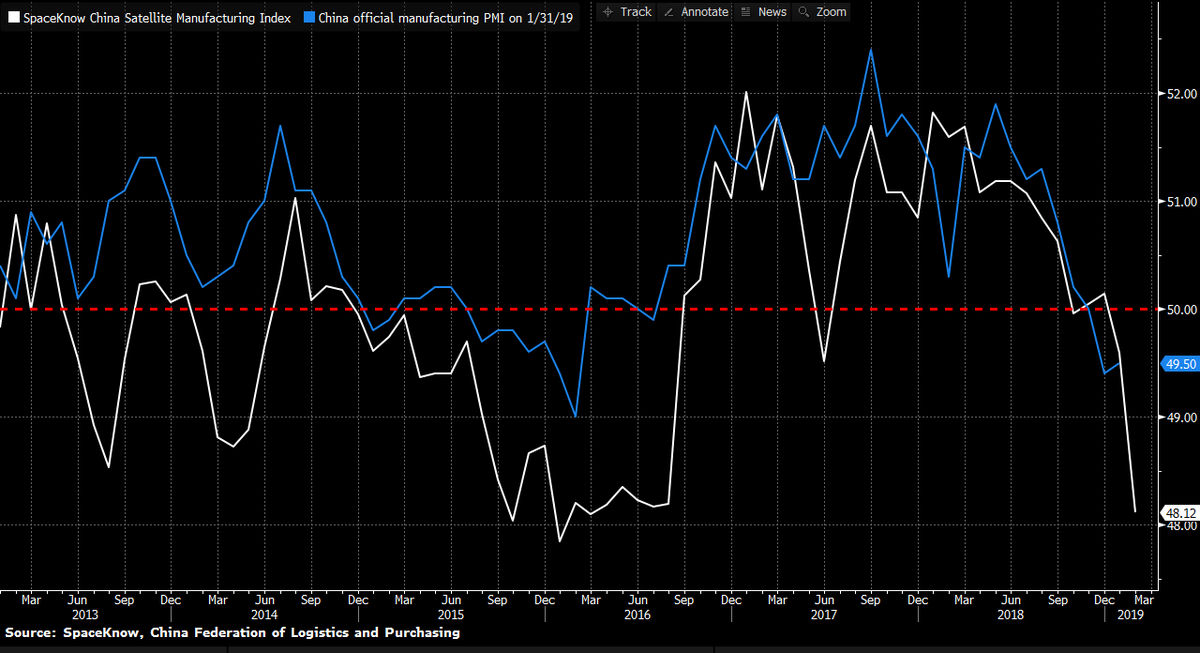

*The index fell to 48.12 (lowest since Mart. 2016) v 49.59 in Jan.

*New Orders (lowest since June 2016)

*Future output expectations turn ⬇ for the 1st time since Nov. 2012❗

*Link: bit.ly/2Ek4EnN

*a 11.7% YoY ⬇ in total exports (vs -14.6% in Jan.)

*a 17.3% YoY ⬇ in total imports (largest ⬇ since Mar. 2016; vs -9.5% in Jan.)

*Link: bit.ly/2SiGaPI

*a 13.6% YoY ⬇ in exports to #China (vs -22.5% in Jan.)

*a 27.7 YoY ⬇ in semiconductor exports (vs -28.8% in Jan.)

*Link: bit.ly/2SiGaPI

*Excluding this effect, exports remain under heavy pressure reflecting global synchronized slowdown and #tradewar.

*The headline index fell to 49.7 (v 51.3 in Jan.) amid reports of weaker demand in services and drought conditions.

*Link: bit.ly/2T2x2TR

*New Orders: 42.6 v 45.3 prior (lowest since Aug. 2012)

*New export orders fell to the greatest extent for over 6 years ❗

*Link: bit.ly/2V6rmp6

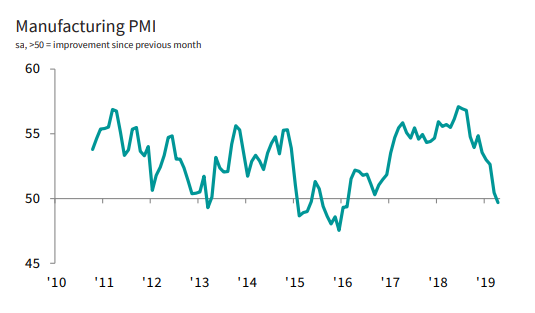

FEB PRELIMINARY #MANUFACTURING PMI: 51.4 V 51.0E (2nd straight expansion)

*Services PMI: 49.8 v 48.5e

*Link: bit.ly/2NkctN7

Trade tensions led to a lot of front-loading in 2018; that effect is now disappearing, which means that the fallout of #trade tensions will be bigger this year ❗

*New export orders fell at a faster pace than in Jan.

*Services PMI: 52.3 v 51.3e (3-month high)

*Link: bit.ly/2GQN7FH

1/ External demand is collapsing amid synchronized global slowdown and #tradewar

2/ Domestic demand is contained due to #Brexit, political uncertainties

3/ Excl 🇫🇷 and 🇩🇪, rest of the region is suffering its worst spell since late 2013.

*Link: bloom.bg/2EnWDOU

*Exports to #China Y/Y: -16.7% v -6.8% prior

*Link: bit.ly/2tZqnL5

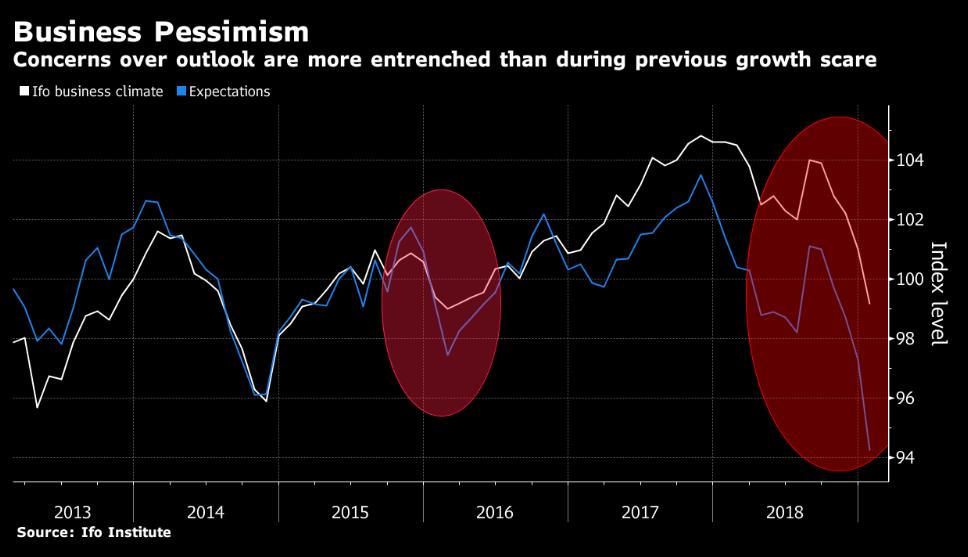

*CURRENT ASSESSMENT: 103.4 V 103.9E (lowest since Feb. 2017)

*Expectations Survey: 93.8 v 94.3e (lowest since Nov. 2012)

*Link: bloom.bg/2SnTsum

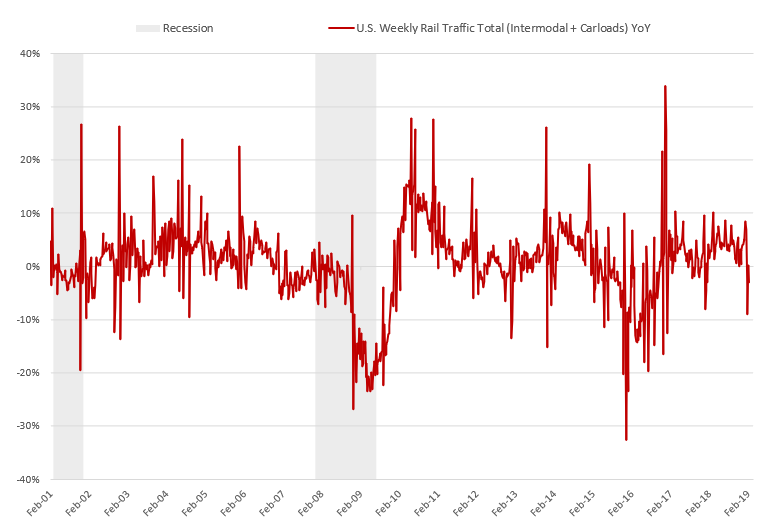

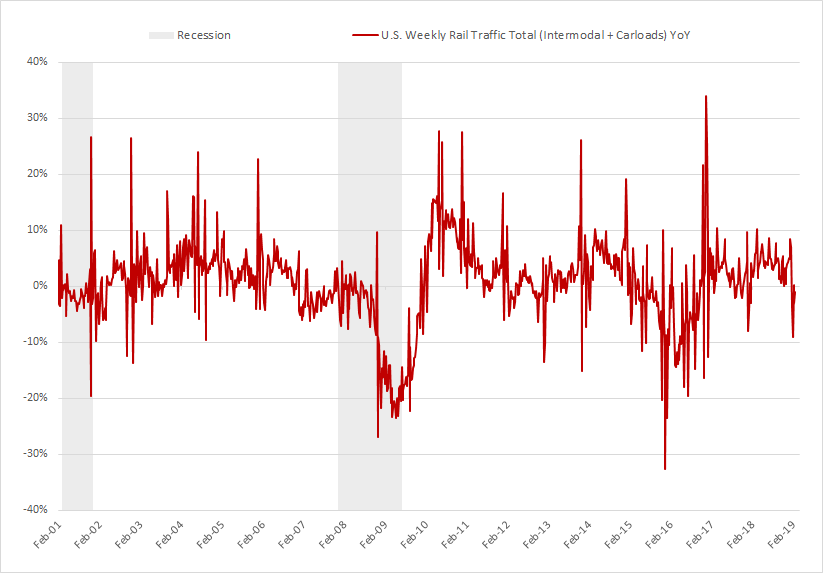

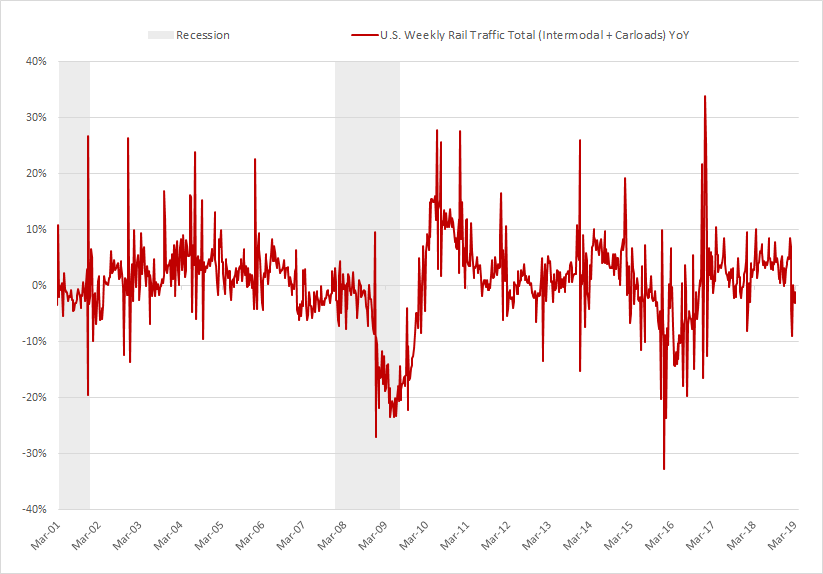

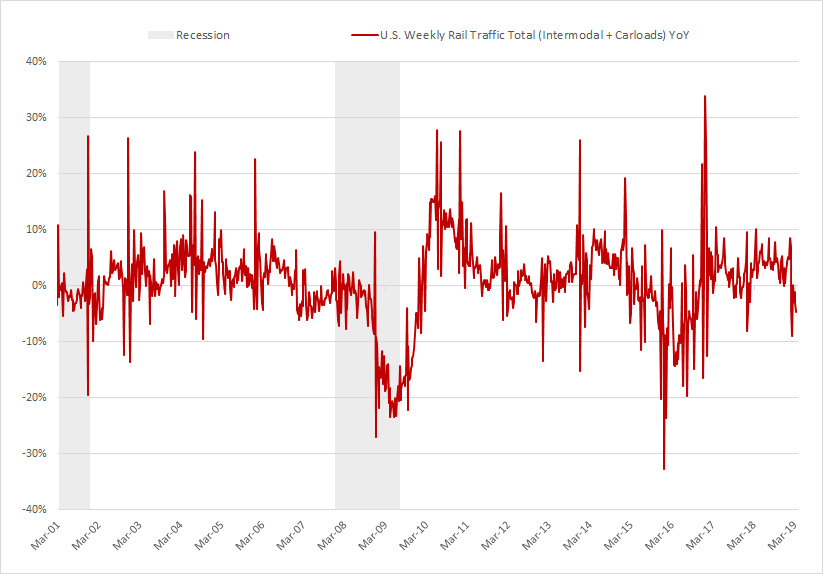

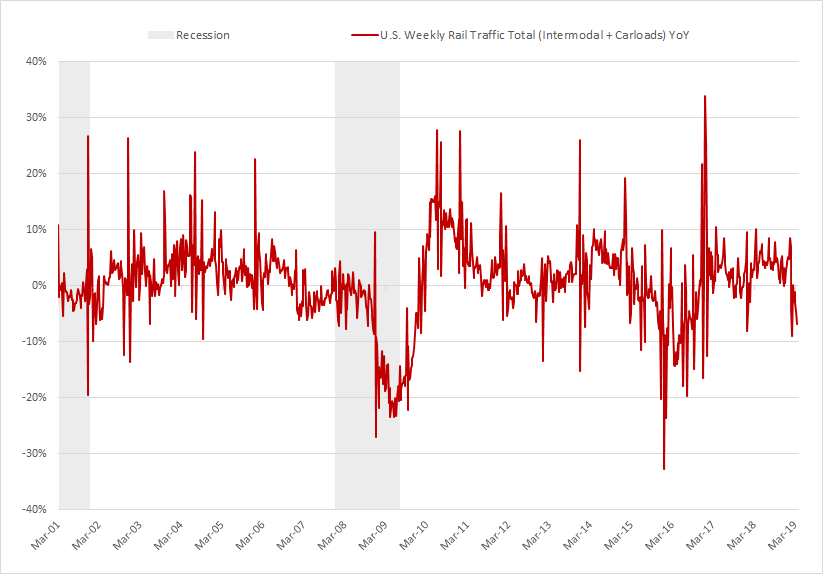

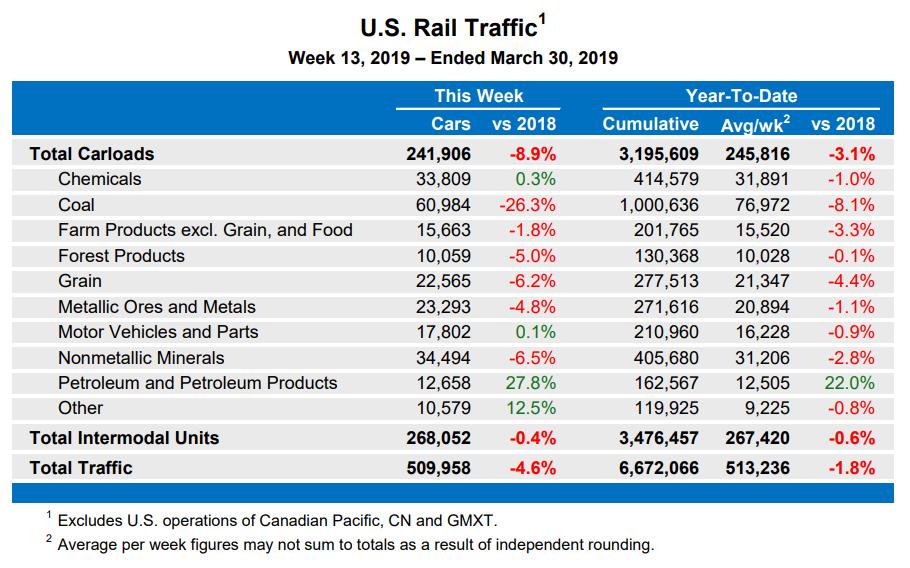

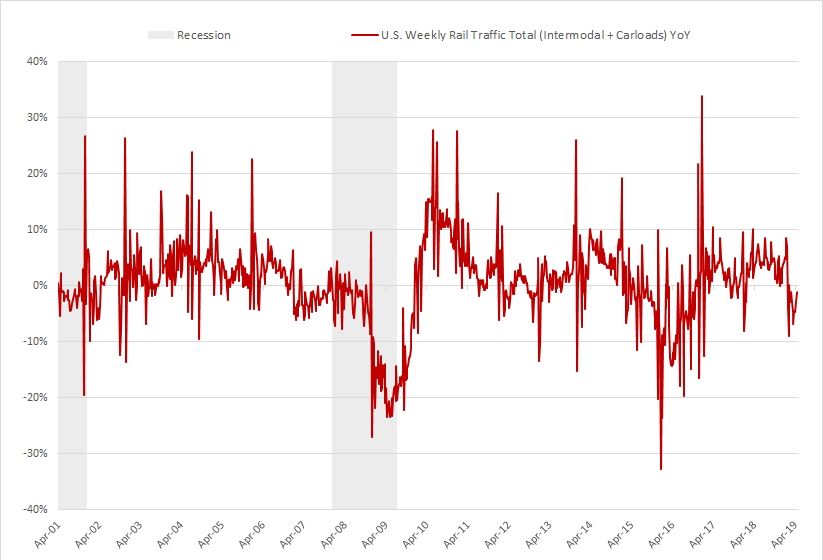

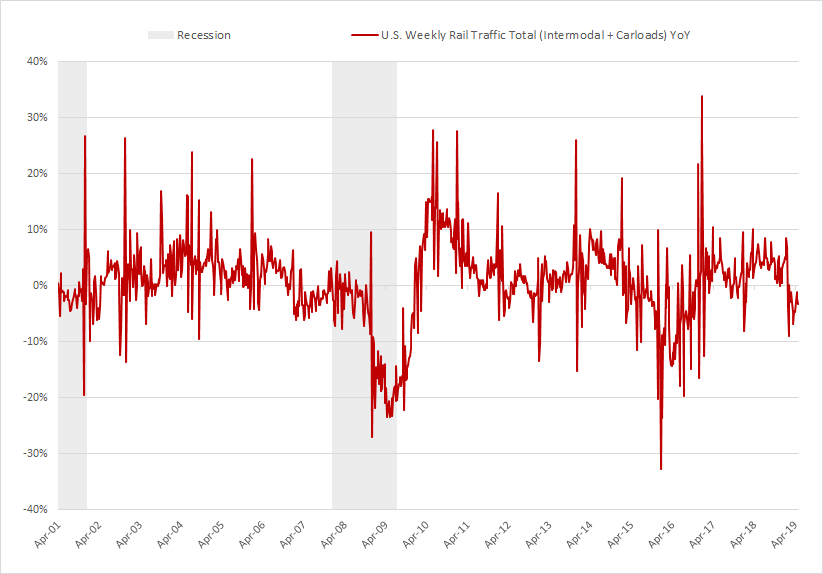

*The index contracted 3 out of the last 4 weeks.

*Link: bit.ly/2H0q2R2

*Link: bit.ly/2Dr977H

*The Harpex TEU Index is now contracting at the fastest pace since early March 2017.

*Link: bit.ly/2UzAbHN

*Link: bloom.bg/2g0FpYX

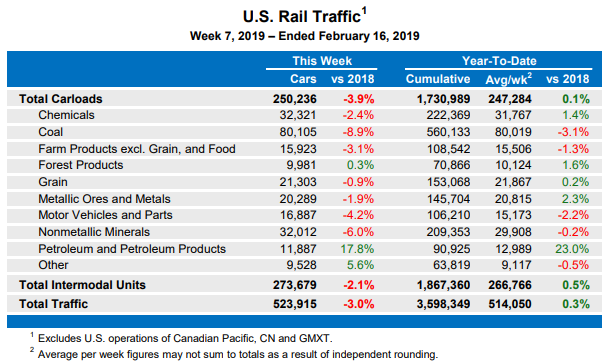

*YoY: -1.4% v +0.7% prior (1st decline since Jan. 2016; largest contraction since Nov. 2009❗)

*On a YoY basis, my proxies suggest that global trade growth will keep contracting at least in Jan. and Feb.

*Link: bit.ly/2rJjz2d

*Most of organisations such OECD, FMI, etc. are likely to revise ⬇ their forecasts at next update.

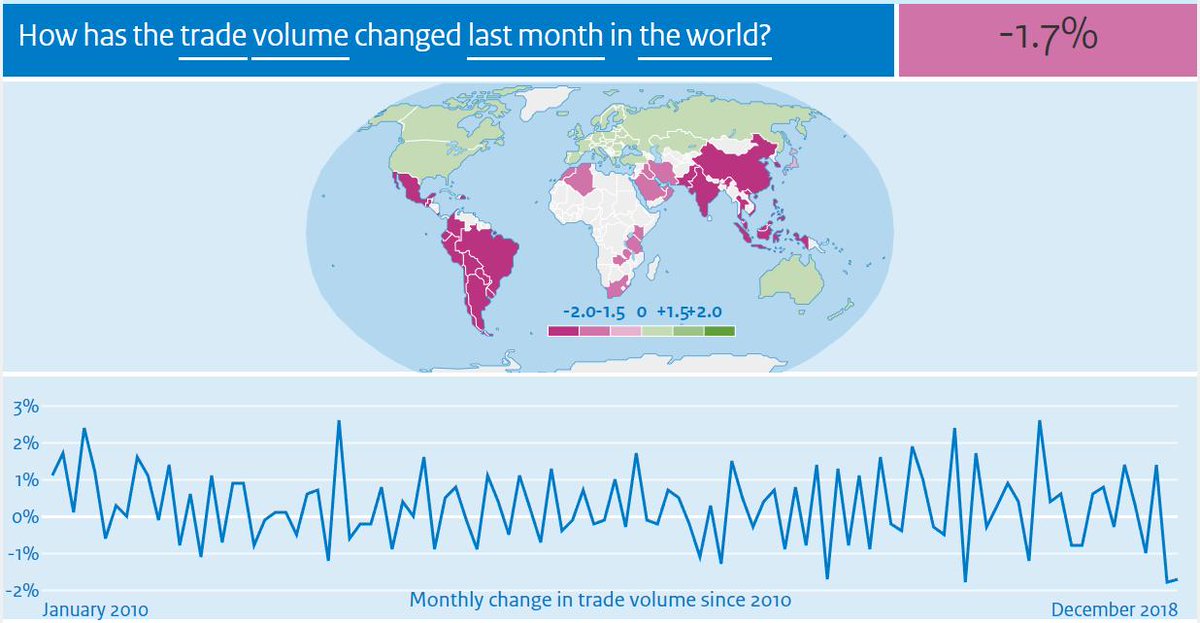

*Flows in the final three months of the year were 0.9% down from the previous quarter, and #China's trade with the rest of the world accounted for most of the ⬇

wsj.com/articles/world…

*The slowdown in price increases is coherent with the ongoing rebound in existing home inventory ⬇

*Manufacturing Confidence: 101.7 v 102.0 prior (lowest since Aug. 2016)

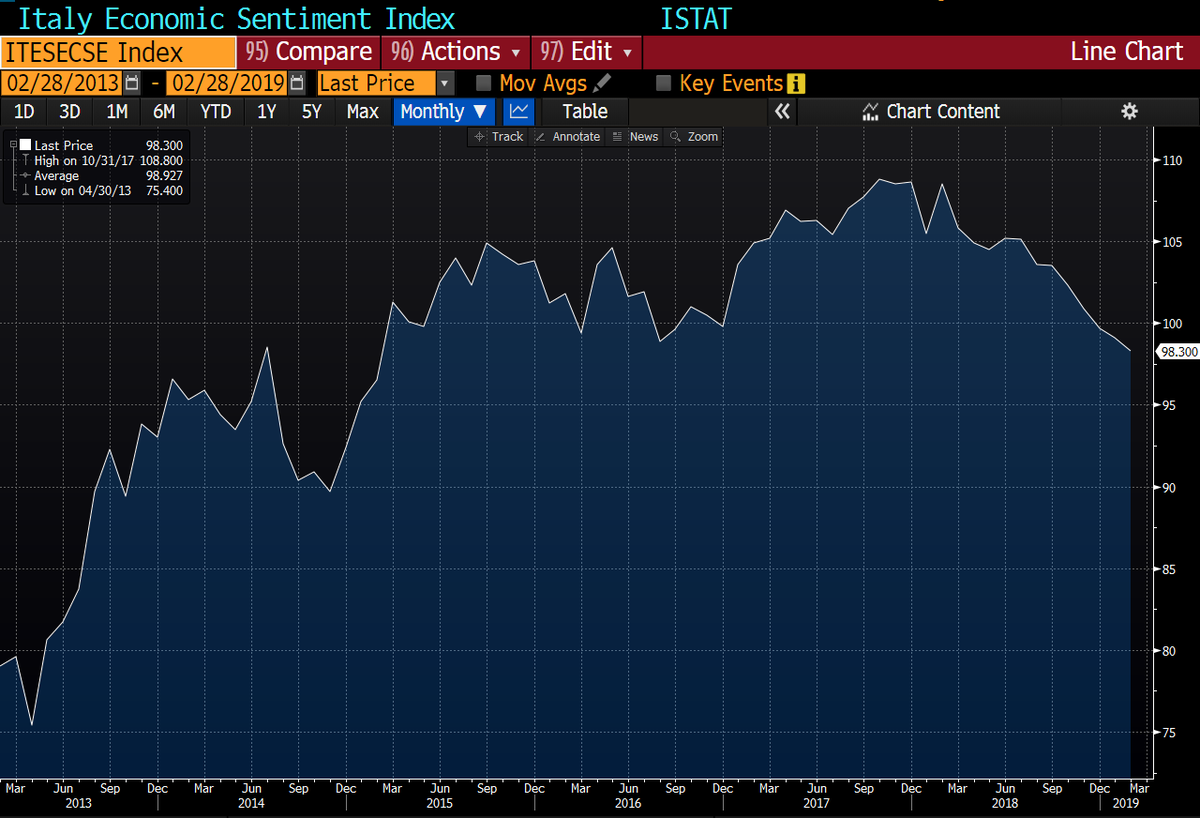

*Economic Sentiment: 98.2 v 99.2 prior (lowest since Feb. 2015)

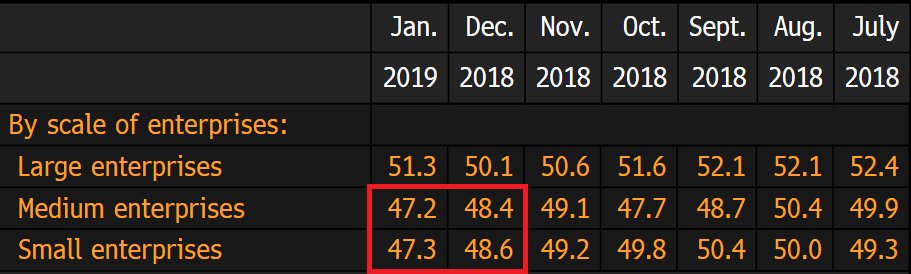

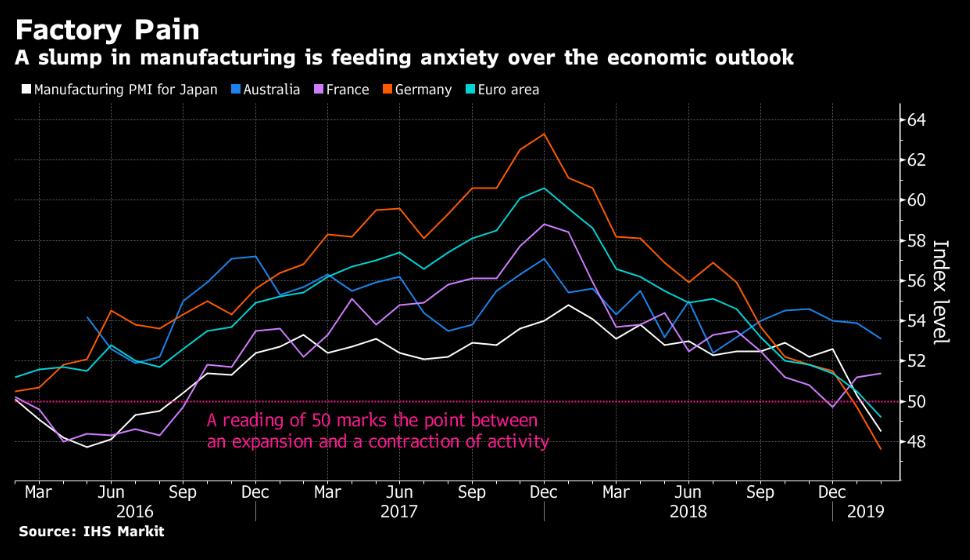

*Manufacturing output sub-index: 49.5 v 50.9 (lowest since Jan. 2009)

*New export orders: 45.2 v 46.9 (lowest since Feb 2009)

*Imports: 44.8 v 47.1 (lowest since Feb. 2009)

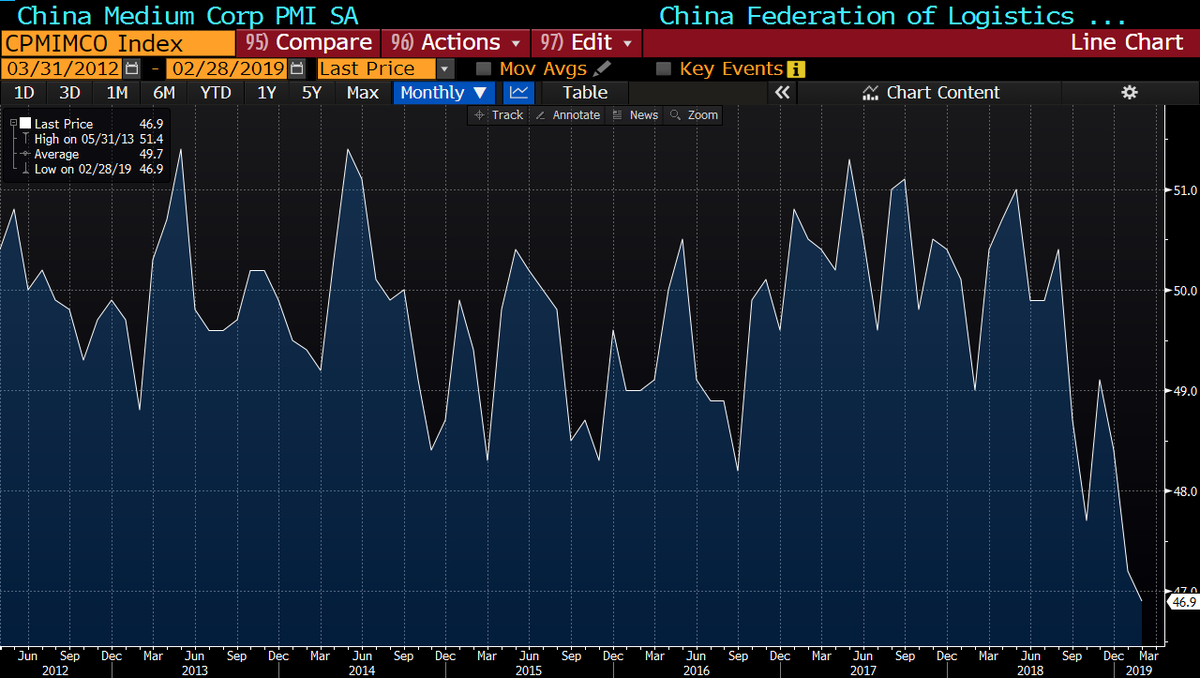

*Medium Corp: 46.9 v 47.2 prior (lowest since figures have been recorded)

*Small Corp: 45.3 v 47.3 prior (lowest since Feb. 2018)

*Japan Government: Cuts assessment of industrial production, says output is 'stalling'

- Retail sales also ⬇ 2.3% MoM in Jan. (largest drop since Feb. 2016)

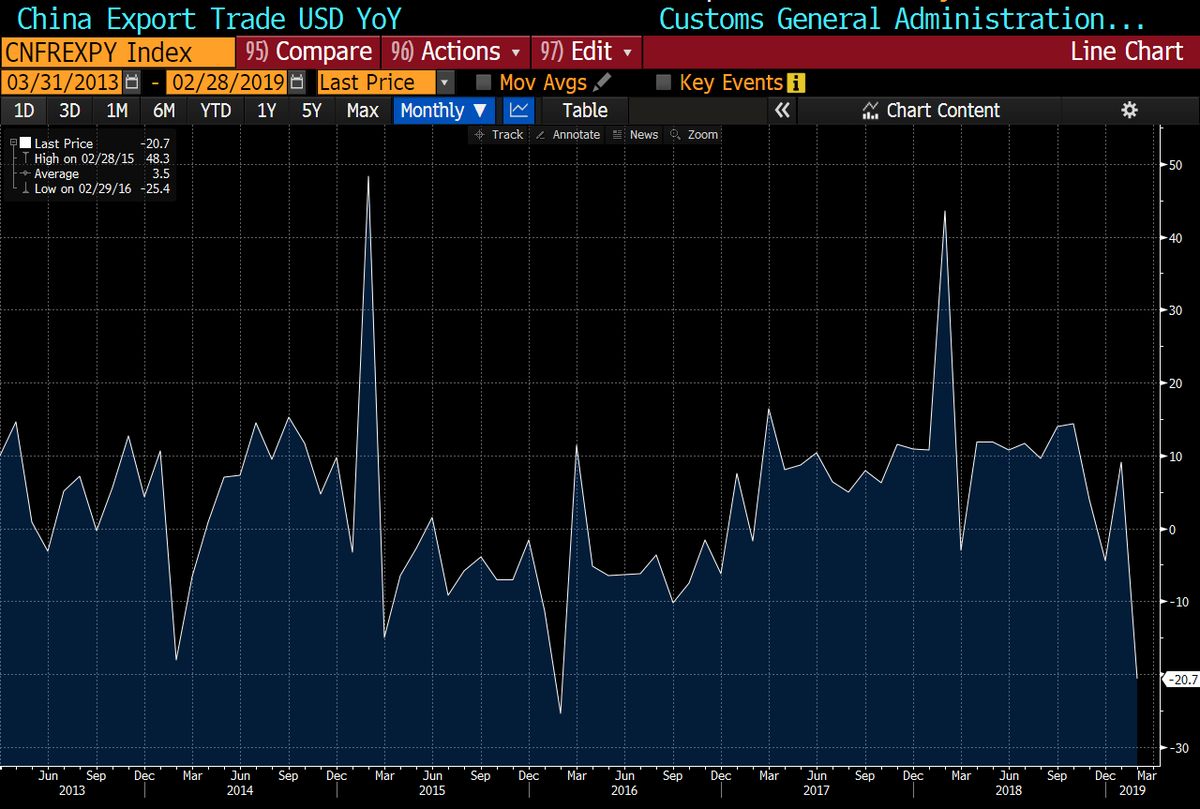

Exports: -11.1% v -9.5%e (largest ⬇ since Apr. 2016)

Exports to 🇨🇳: -17.4% v -19.2% prior

Semiconductor exports Y/Y -24.8% v -23.3% prior (largest ⬇ since Apr. 2009)

*Link: bit.ly/2tJA7tu

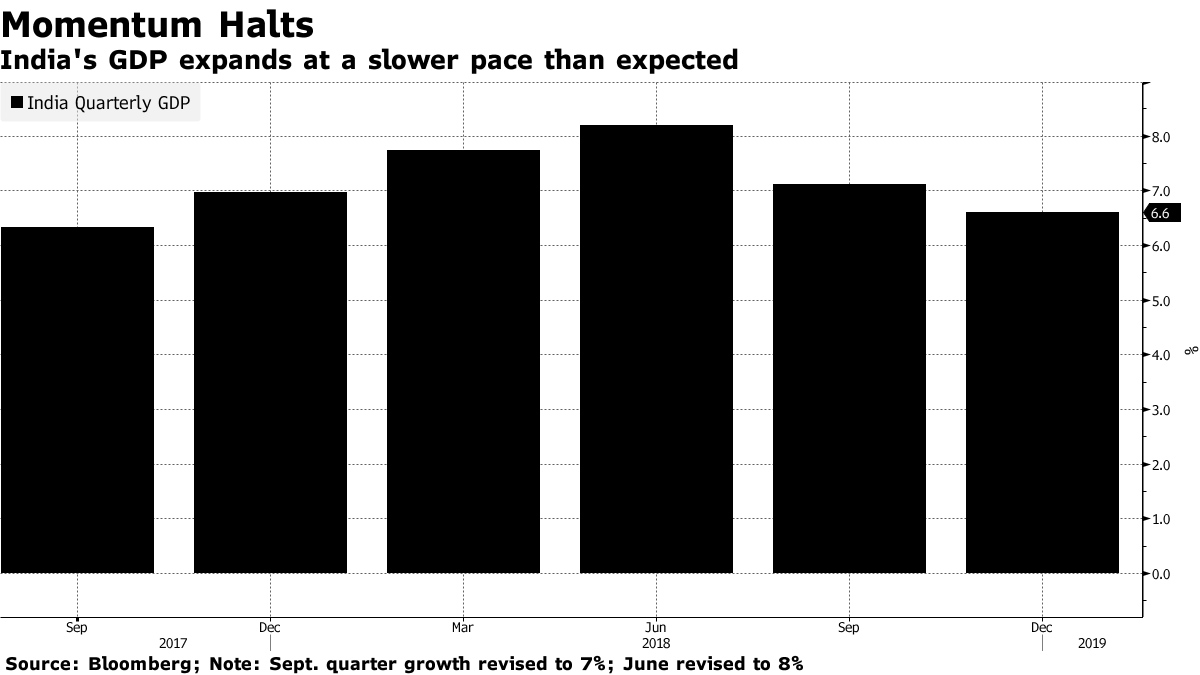

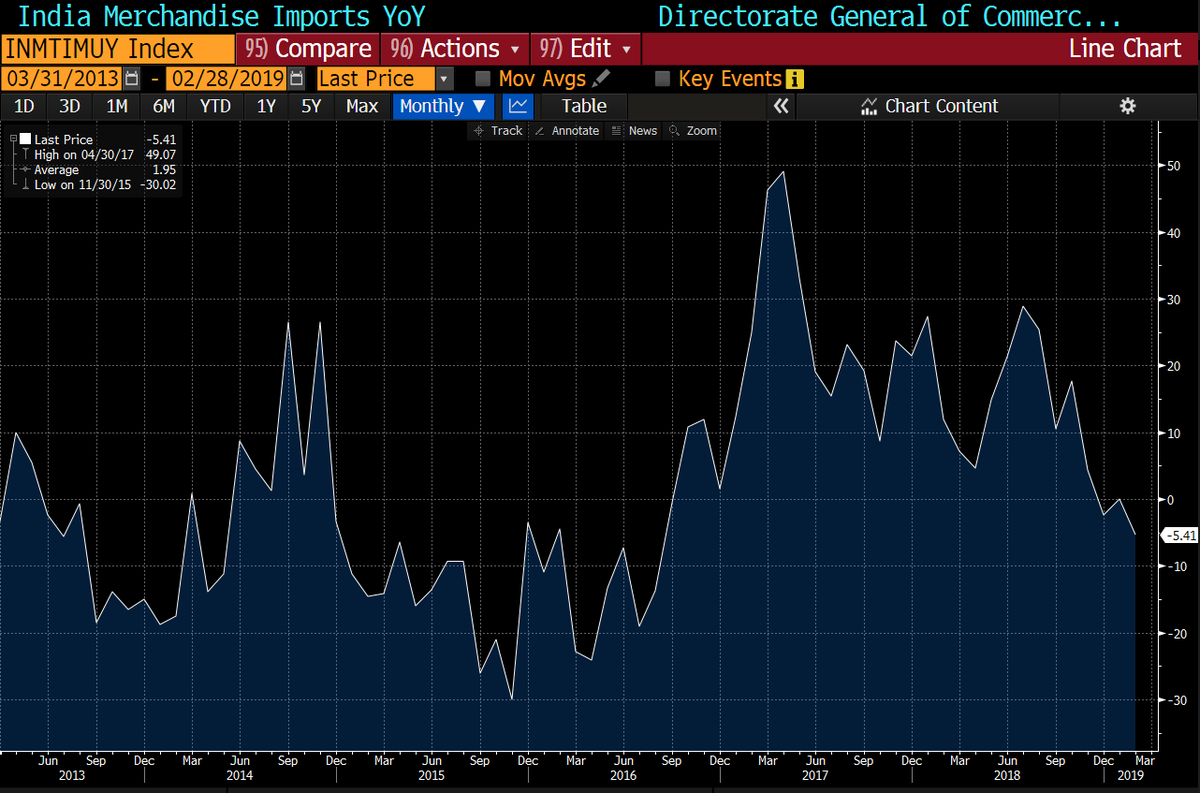

*INDIA Q4 GDP Y/Y: 6.6% V 6.7%E

*GVA Y/Y: 6.3% v 6.5%e

GDP 2018/19 Annual Estimate Y/Y: 7.0% v 7.2%e

*Link: bloom.bg/2tKQrKs

*National housing prices declined 0.7% MoM, and are now down 6.8% from their peak in October 2017,

*Link: bloom.bg/2BVYPeY

*New Orders Index: 55.5 v 58.2 prior

*Production: 54.8 v 60.5 prior

*Employment: 52.3 v 55.5 prior

*Link: bit.ly/2dBZnbi

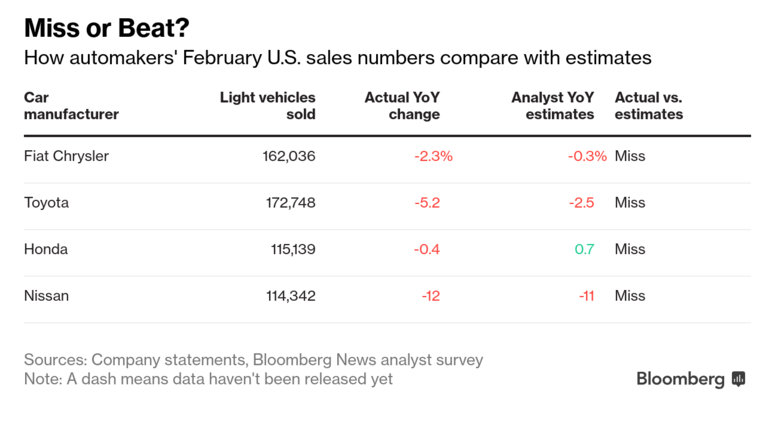

*HONDA FEBRUARY U.S. AUTO SALES DOWN 0.4%, EST. UP 0.7%

*FIAT CHRYSLER FEBRUARY U.S. AUTO SALES DOWN 2%, EST. DOWN 0.3%

*TOYOTA MOTOR REPORTS FEB. SALES DOWN 5.2%, EST DOWN 2.5%

*Fiat Chrysler deliveries ⬇ for the 1st time in a year

*Ford, Toyota, Honda, Nissan ⬇ short of exp

*Total New Vehicle Sales SA: -0.2% to 16.56M (lowest since Aug. 2017)

*Link: bloom.bg/2GWzvJC

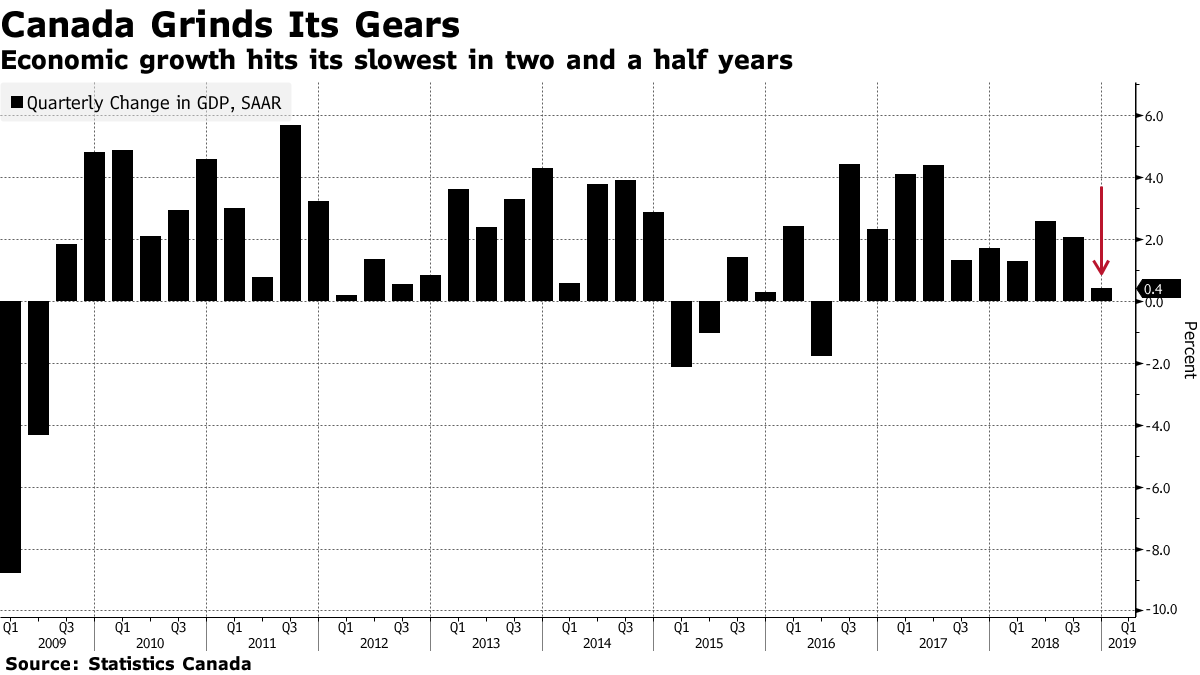

*GDP grew by just 0.1% in 4Q18 or 0.4% annualized

*Dec GDP M/M: -0.1% v 0.0%e; Y/Y: 1.1% v 1.4%e

*Link: bloom.bg/2NBl7ae

*Business optimism ⬇ to its second-lowest level in the series history.

*Confidence eased to its weakest in over 6 years in developed nations and to a 2-month low in EM.

*Link: bit.ly/2EH8J5P

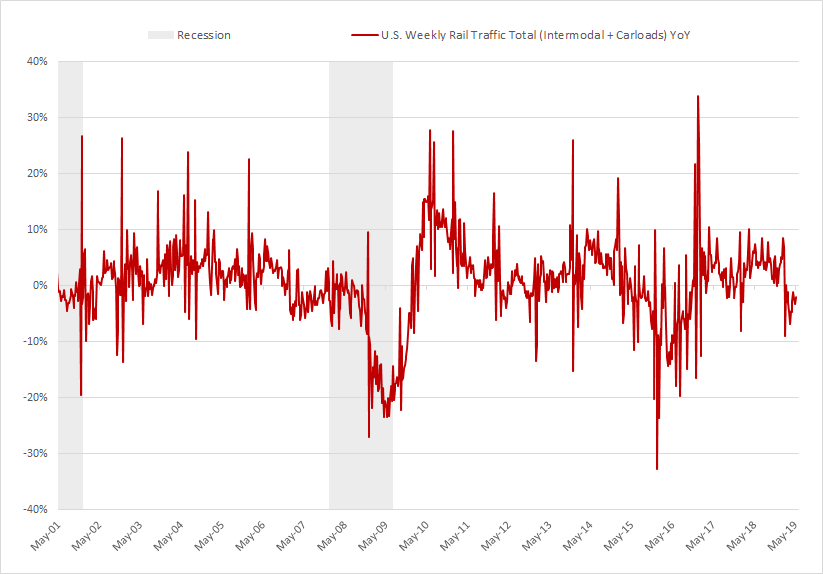

*As discussed (bit.ly/2TiWAMH ), a global trade recession (at least 2 negative quarters) should take place.

*It suggests that global production growth (ex construction) will keep weakening in the coming months.

*The index contracted 4 out of the last 5 weeks.

*Link: bit.ly/2EICRgY

uk.reuters.com/article/us-bri…

*New export orders contract for the 7th consecutive month (⬇at the joint-fastest pace for five-and-a-half years)

*New orders 44.9 v 47.0 prior (largest ⬇ since June 2015)

markiteconomics.com/Survey/PressRe…

*Feb. new export orders shrink at fastest rate since Nov 2011

*Link: bit.ly/2Tbnmap

1/ Asian export orders are usually leading the economic cycle by around 3 months and therefore suggest a pick-up in global manufacturing activity is unlikely to happen before 2H19.

*In addition, SpingFestival sales were disappointing (bit.ly/2SHrGNp).

- PMI Composite: 50.7 v 50.9 prior (4-month low)

*Link: bit.ly/2EN7vWN

🇩🇪 Schaeffler abandoned its long-standing earnings target for 2020 and plans to cut 900 jobs as part of a restructuring program for its struggling auto-parts business

*Shares fell as much as 11%

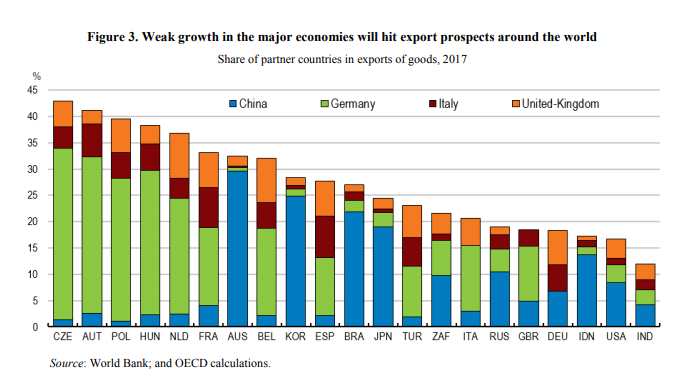

*OECD DOWNGRADES 2019 OUTLOOKS FOR U.S., CHINA, U.K., EURO AREA

*OECD SEES RECESSION RISK FOR U.K. IF NO BREXIT DEAL AGREED

*Link: bit.ly/2Tlcfvq

*The trade restrictions introduced last year are a drag on growth, invest and living standards, particularly for low-income households

*p. 3: bit.ly/2TCCpJs

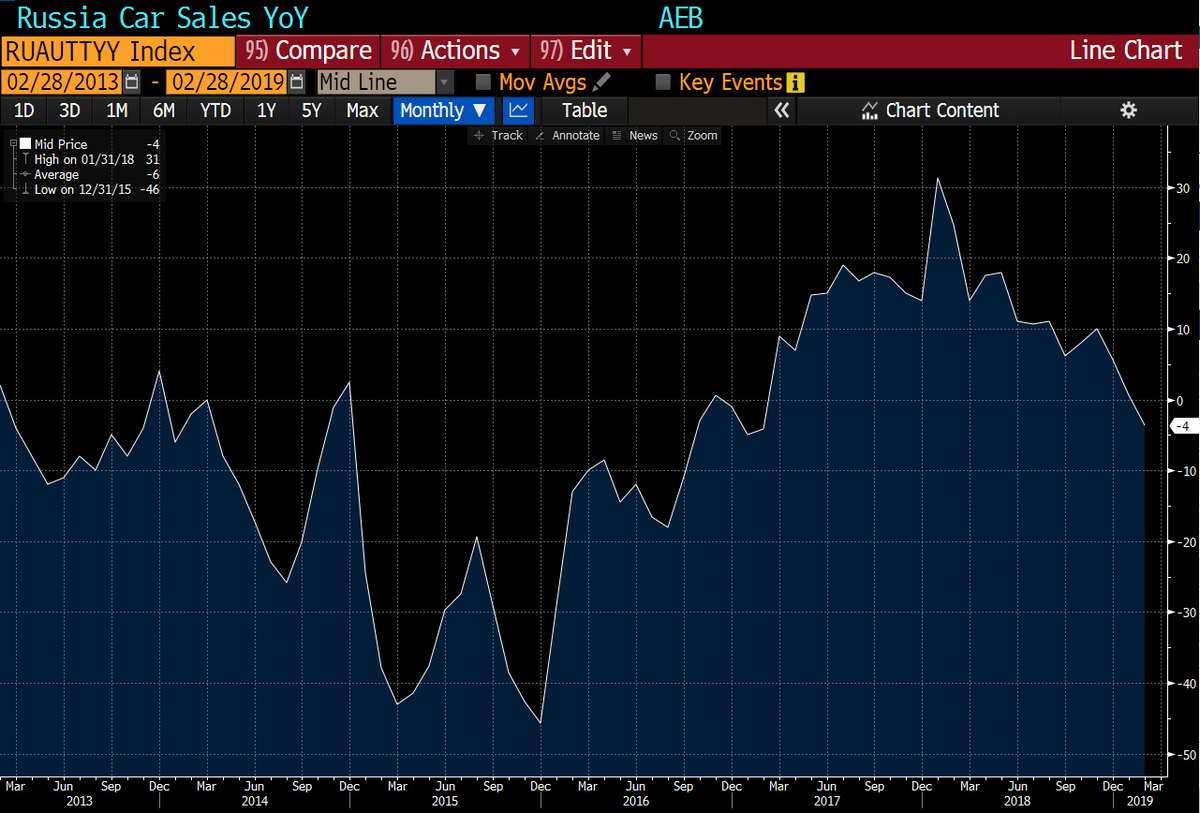

*Russian Feb. New Car, LCV Sales -3.6% y/y

*Link (Korean): bit.ly/2VDAfGX

*Link: goo.gl/ZUzBiL

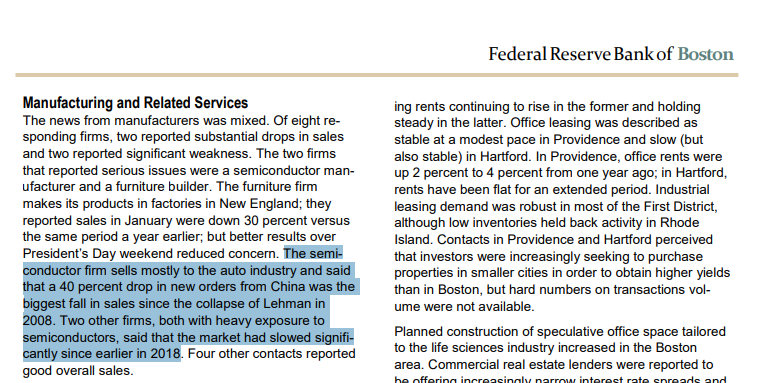

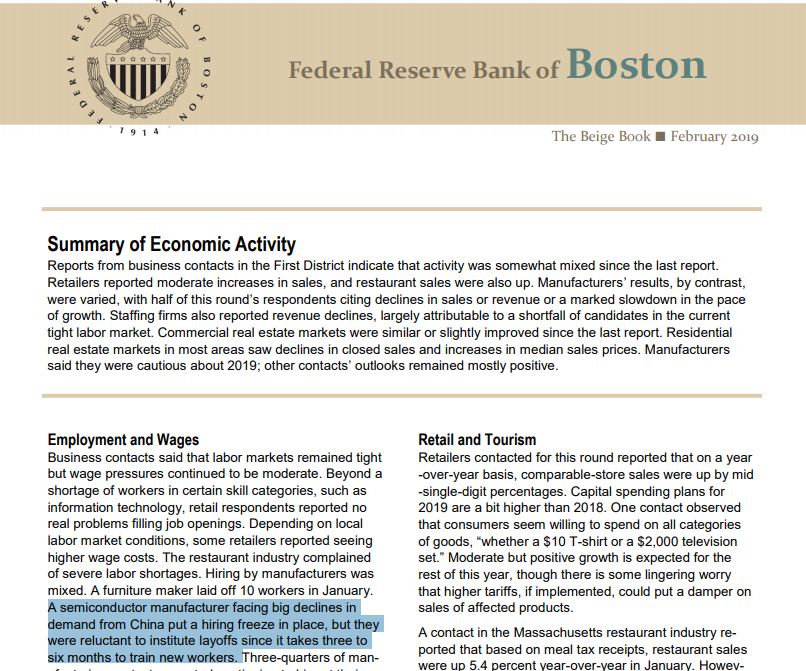

@JeoffHall also highlights that "incidence of the root word "weak-" rose to 34, up from 13x seven weeks ago and 19x in the October version" ❗

*The Boston Fed section made two interesting references to the industry:

*Link: goo.gl/7yRtNw

*Vehicle production during 1H will likely be lower than a year ago.

bloomberg.com/news/articles/…

*Retail sales of sedans, sport utility vehicles, multipurpose vehicles and minivans ⬇18.5% YoY (v -4.0% in Jan.).

*YTD, sales ⬇ 9.6%.

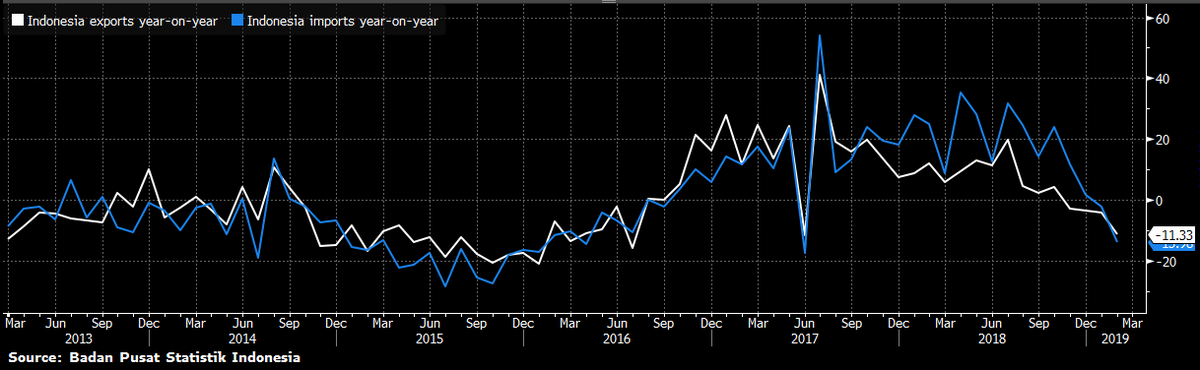

*Imports Y/Y: -5.2% v -0.6%e (largest decline Dec. 2018)

*Link: bloom.bg/2EWzcN0

*Combined imports for the first two months fell 3.1%, following a rise of 4.4% in 4Q.

*Imports from to the U.S. Y/Y: -26.2% v -41.2% prior

➡ Figures confirm that the drop in Chinese imports from the U.S. in January was amplified by the Chinese New Year.

*TAIWAN FINANCE MINISTRY SEES MARCH EXPORTS FALLING 5%-7.5% Y/Y

*TAIWAN FINANCE MINISTRY SEES 2Q EXPORTS FARING BETTER THAN 1Q

*TAIWAN FINANCE MINISTRY SEES 1H EXPORTS DROPPING Y/Y

*The January drop was caused by weak demand for investment goods, particularly from outside the euro area.

*The figure, based on a three-month moving average, marks the first decline in 30 months.

*Link: s.nikkei.com/2tYpsv2

🇯🇵 🇨🇳 Renesas halts chip production at 13 plants as #China demand flags - Nikkei

asia.nikkei.com/Business/Compa…

*As I flagged (bit.ly/2EVBb42), #Trump auto tariffs could happen in a context where pent up demand has been largely absorbed and would have disastrous effect on global economy.

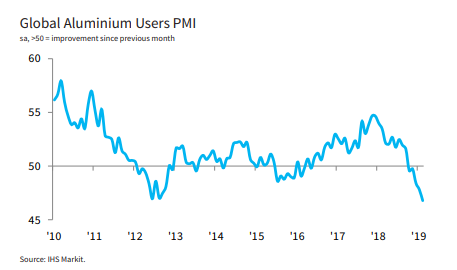

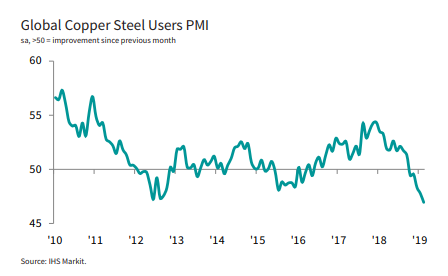

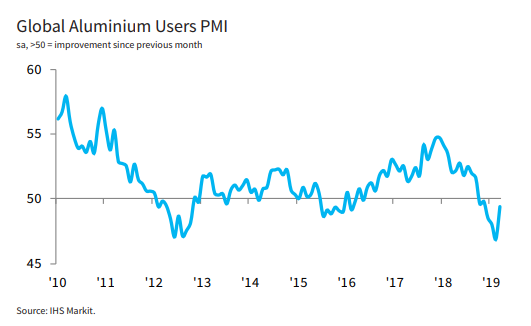

#Aluminium: 46.8 (lowest since May 2009) - bit.ly/2tTasPn

#Copper: 47.0 (lowest since May 2009) - bit.ly/2JduZsv

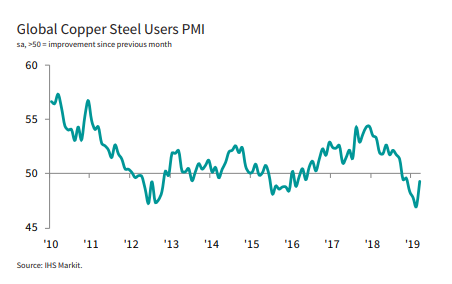

#Steel: 47.0 (lowest since Mar. 2009) - bit.ly/2XFMW65

*It was the strongest ⬇ since global sector PMI data were first available in Oct. 2009.

*New orders ⬇ at the fastest pace in over 6 years.

*Link: bit.ly/2C84lLu

*The index contracted 5 out of the last 6 weeks.

*Link: bit.ly/2Cc10es

*The Harpex TEU Index is now contracting at the fastest pace since March 2017.

*Link: bit.ly/2UzAbHN

*Link: bloom.bg/2g0FpYX

*CHINA FEB. VEHICLE WHOLESALES -13.8% ON YEAR (V -15.8% PRIOR)

*CHINA FEB. PASSENGER VEHICLE WHOLESALES 1.22M UNITS

*CHINA FEB. PASSENGER VEHICLE WHOLESALES -17.4% ON YEAR (V -17.7% PRIOR)

*Q4 GDP Q/Q: -3.0% v -2.4%e; Y/Y: -2.4% v -2.5%e

*Link: bloom.bg/2HqWhJ8

*Exports: -19.1% v -11.1% in Feb.

*Exports to #China: -23.9% v -17.4% in Feb.

*Semiconductor Exports: -29.7% v -24.8 in Feb.

*Link: bit.ly/2SiGaPI

*Mobile phone shipments fell to 14.5m units in Feb.

*Link (Chinese): bit.ly/2F9uE65

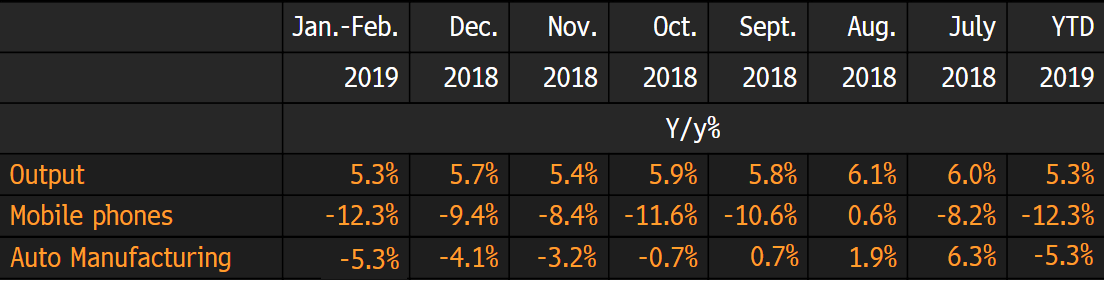

*Auto output ⬇ 5.3% in the first two months of the year, down from a 4.1% ⬇ in Dec. 2018.

*The manufacture of mobile phones ⬇ 12.3% YoY YTD, down from a 9.4% ⬇ in Dec. 2018.

*Imports Y/Y -14.0% v -2.1% prior (2nd straight contraction; largest decline since June 2017)

*New Orders: 3.0 v 7.5 prior (lowest since May 2017)

*Link: nyfed.org/1MhJOln

*Imports Y/Y: -5.4% v 0.0% prior (largest decline since Aug. 2016)

➡ Another sign that Asian demand remains under pressure.

*The index contracts for a 4th straight month (1st time since Aug. 2015).

*Link: bit.ly/2SvU16q

*The index contracted 6 out of the last 7 weeks.

*Link: bit.ly/2TQ7CZN

*After seasonal adjustment, the Harpex TEU Index ⬇ at the fastest pace since March 2017.

*Link: bit.ly/2UzAbHN

*Semiconductor: -15.3% v -17.9% prior

*Motor Vehicles: 0.0% v +7.9% prior

*Real exports ⬇ for the 2nd straight month (1st time since Apr. 2016).

*Imports: YoY: -6.7% v -6.4%e (2nd straight ⬇; largest ⬇ since Nov. 2016)

*KAMPER: #CHINA ORDER VOLUME SHOWED UNEXPECTED REDUCTION

*The shares declined as much as 20%.

*Link: bit.ly/2OfBZDH

*Link: bit.ly/2OfBZDH

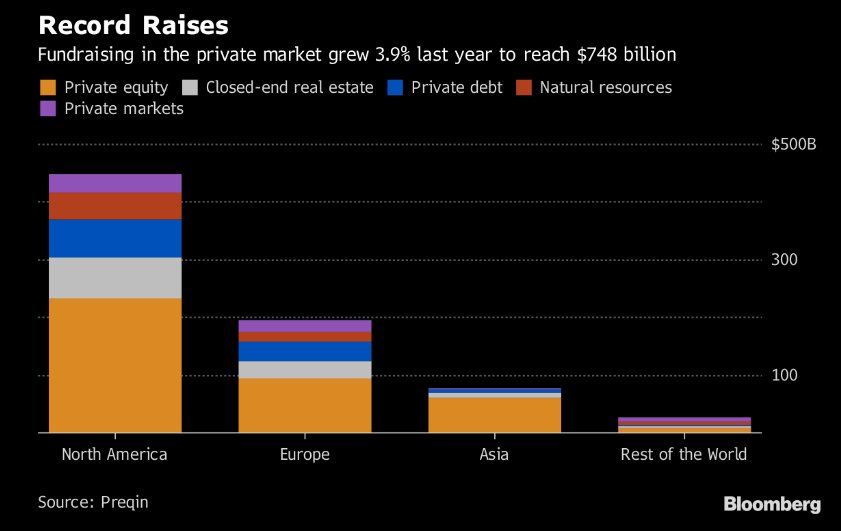

*Capex at the same firms grew nearly 8% last year.

*Link: reut.rs/2OcpJE6

*Link: bit.ly/2uiurH6

bloomberg.com/news/articles/…

*Dongfeng joint venture said to cut 2022 target by 8%, signaling that the downturn in the world’s biggest car market may be an extended one.

bloomberg.com/news/articles/…

*BMW CAN'T RULE OUT GUIDANCE CHANGE IF CONDITIONS WORSEN: CFO

-Latest data related to #semiconductors confirms that sales are under pressure amid:

*a ⬇ in crypto, smartphone, servers and auto sales❗ + Intel CPU shortages

*Exports: -4.9% v -11.1% in Feb.

*Exports to #China: -12.6% v -17.4% in Feb.

*Semiconductor Exports: -25.0% ❗v -24.8 in Feb.

*Link: bit.ly/2SiGaPI

*Link: bloom.bg/2YgsaKj

*Ouput ⬇ at the fastest pace since May 2016

*New Orders ⬇ at sharpest rate since June 2016.

*Export orders showed the fastest decline since Jan. 2019

*Link: bit.ly/2HyHg9d

*New Orders: 40.1 v 42.5 prior (6th straight ⬇and lowest since Apr. 2009), driven by the fastest ⬇ in new export work for nearly 3 years

*Link: bit.ly/2Totyab

*The ⬇ in new #manufacturing export orders was the largest since Aug. 2012 ❗

*New exports of goods and services fell for a sixth straight month

*Link: bit.ly/2uuRwa1

*The index contracted 7 out of the last 8 weeks.

*Link: bit.ly/2U4kVG7

*After seasonal adjustment, the Harpex TEU Index ⬇ at the fastest pace since Feb. 2017.

*Link: bit.ly/2UzAbHN

- Prior revised lower from 10.8 to 10.7

bloomberg.com/news/articles/…

*A downturn sparked by excess inventories and weakened demand, signs of which were evident back in August, could drag on longer than expected.

*Link: bloom.bg/2Ylv1lj

*Link: reut.rs/2uuHq8Z

*Chart link: tmsnrt.rs/2Uf8MhG

*Industrial enterprises of all types of ownership registered declines in profits.

*Manufacturers of motor vehicles experienced a 42% ⬇ in profits (vs -4.7% prior)

*Link: bloom.bg/2U0lcLj

*On a MoM, the index ⬇ 3.1% (the 4th largest ⬇ observed so far)

*Link: bit.ly/2FCRmDR

*It reinforces my call of a global trade recession (bit.ly/2TiWAMH)

*INFINEON ADJUSTING OUTLOOK FOR '19 IN VIEW OF UNCERTAINTIES

*INFINEON FALLS 7% ON XETRA; ADJUSTS OUTLOOK AMID UNCERTAINTIES

*OSRAM 2Q OF FY '19 EXPECTED TO SEE REV DECLINE OF ROUGHLY 15%

*OSRAM SEES 2019 REVENUE DECLINE 11%-14%, SAW 0%-3% GROWTH

*The lack of demand in this sector is a key factor behind the ongoing “Global Trade Recession” (bit.ly/2EVBb42 ; bit.ly/2TiWAMH)

- The rebound of 2.3% MoM was expected amid the shift in calendar dates of the 🇨🇳 New Year, which boosted Asian trade:

*Import: +8.7%

*Exports: +3.7%

*Link: bit.ly/2U1uZRc

*The index contracted 8 out of the last 9 weeks.

*Link: bit.ly/2V4r2Yk

*After seasonal adjustment, the Harpex TEU Index ⬇ at the fastest pace since Feb. 2017.

*Link: bit.ly/2UzAbHN

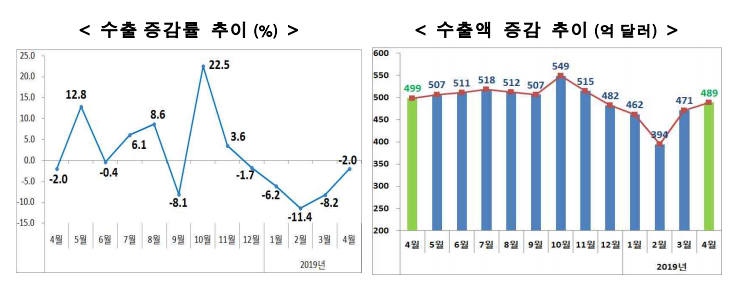

*Exports Y/Y: -8.2% v -7.0%e (4th straight ⬇)

*Chip exports Y/Y: -16.6% v 24.8% prior (4th straight ⬇)

*Exports to #China Y/Y: -15.5% v -17.3% prior (5th straight ⬇)

*Link: bit.ly/2UmVy2u

#Germany: 44.1 v 47.6 prior (lowest since July 2012) - bit.ly/2HRyxiw

#Italy: 47.4 v 47.7 prior (lowest since May 2013) - bit.ly/2YO9bHA

*Link: bit.ly/2I3bXCN

*It suggests that global production growth (ex construction) will keep weakening in the coming months.

*Link: bit.ly/2I3bXCN

*YTD YoY: -0.5% v -0.5% prior

*Link: bit.ly/2HIG0B3

🇮🇳 (3.3%) | 52.6 v 54.3 prior - bit.ly/2YH7FXE

🇲🇽 (1.6%) | 49.8 v 52.6 prior - bit.ly/2VcfEtD

*New car registrations had risen by 0.2 percent to 880,000 during 1Q.

*Official registrations data from Germany’s car authority KBA are due to be released on Wednesday.

uk.reuters.com/article/uk-ger…

*In September, the WTO said #trade would increase by 3.9% in 2018 and 3.7% in 2019.

*Link: bloom.bg/2I50qmw

*Link: bit.ly/2FOwsjF

➡ As I already said 4 months ago (bit.ly/2HV9Bq9), global trade growth (in volume) can't reach 3% this year.

*World economy has weakened since IMF’s last forecast

*The fund will release its new World Economic Outlook with an updated growth forecast on April 9.

bloom.bg/2IdmawH

*Link: bloom.bg/2FOWGTe

#Manufacturing Foreign Orders M/M: -6.0%; Y/Y: -12.6%

*Link: bit.ly/2FSZxuj

*MICHELIN CFO EXPECTS IMPROVEMENT IN CHINA NEW CAR SALES IN 2H

*The index contracted 9 out of the last 10 weeks.

*Link: bit.ly/2UxenjP

*After seasonal adjustment, the Harpex TEU Index ⬇ at the fastest pace since Feb. 2017.

*Link: bit.ly/2UzAbHN

#Aluminium: 49.4 (4-month high) - bit.ly/2YXafbW

#Copper: 49.2 (4-month high) - bit.ly/2OXNLTW

#Steel: 49.3 (4-month high) - bit.ly/2YXafbW

*Exports M/M: -1.3% v -0.5%e (largest ⬇ since Feb. 2018)

*Imports M/M: -1.6% v -0.6%e (largest ⬇ since Aug. 2018)

uk.reuters.com/article/uk-ger…

*Link (p. 7): bit.ly/2IrhpiO

*CHINA MARCH RETAIL PASSENGER VEHICLE SALES -12% ON YEAR: PCA

*CHINA CAR SALES FALL FOR 10TH STRAIGHT MONTH, PCA SAYS

*IMF: RISKS SKEWED TO DOWNSIDE FROM #BREXIT, U.S.-#CHINA TALKS

*IMF RAISES #CHINA 2019 GROWTH FORECAST BY 0.1PPT TO 6.3%

*Link: bit.ly/2D12ys8

*Mobile phone shipments fell to 28.4m units in Mar.

*Link: bit.ly/2U6eQ8m

uk.reuters.com/article/uk-ger…

➡ It confirms Spiegel report:

*Link: bit.ly/2KvBE1G

*The index contracted 10 out of the last 11 weeks.

*Link: bit.ly/2UhGv66

reuters.com/article/us-imf…

*Exports: +8.9% v -8.2% in Mar.

*Exports to #China: +0.8% v -15.5% in Mar.

*Semiconductor Exports: -19.7% v -16.6% in Mar.

*Link: bit.ly/2SiGaPI

*On the positive side, the decline is less pronounced than earlier this year, however, the semiconductor industry remains undr heavy pressure.

*Registrations fall for 7th straight month with 3.6% downturn

*Link: bloom.bg/2Gjhpiw

*#Electronic Exports Y/Y: -26.7% v -8.2% prior (largest ⬇ since Feb. 2013)

*Exports Y/Y: -2.4% v -2.6%e (4th consecutive ⬇; largest ⬇ since Jan. 2019)

*Exports to #China Y/Y: -9.4% v +5.6% prior (largest ⬇ since Jan. 2019)

*Link: bit.ly/13OjAW7

reuters.com/article/us-jap…

*Export orders dipped at a stronger rate in April.

*Link: bit.ly/2DhQ8w4

*The ⬇ in mfg order books was led by a further steep ⬇ in new export orders, which ⬇ at the second-fastest rate in the past 10 years.

*PMI Services: 55.6 v 55.0e

*Link: bit.ly/2ICaaom

*PMI Services: 52.5 v 53.1e (3-month low)

*PMI Composite: 51.3 v 51.8e (3-month low)

*New export orders ⬇ sharply, down for a 7th straight month.

*Link: bit.ly/2V2fqZj

*The index contracted 11 out of the last 12 weeks.

*Link: bit.ly/2KPEqPv

*After seasonal adjustment, the Harpex TEU Index ⬇ at a slower pace this week.

*Link: bit.ly/2UzAbHN

*Exports: -8.7% v -8.2% in Mar.

*Exports to #China: -12.1% v -15.5% in Mar.

*Semiconductor Exports: -24.7% v -16.6% in Mar.

*Link: bit.ly/2Ds6nGZ

*The semiconductor exports are on track to decline by the most since April 2009.

wsj.com/articles/ship-…

Samsung Delays Launch of Galaxy Fold After Screen Failures - Bloomberg

bloomberg.com/news/articles/…

*Link: bit.ly/2UNT0LX

*Link: bit.ly/2GtJPpX

*Link: bloom.bg/2L0UWMB

*Note: At the opposite, services activity remained resilient.

*That followed a 1.4% expansion in the previous quarter.

*On a monthly basis, output fell 0.9% in March.

reuters.com/article/us-jap…

bloomberg.com/news/articles/…

Latest trade figures in volume (for February) also validate my forecast of a “Global Trade Recession” (bit.ly/2TiWAMH)

*Link: bloom.bg/2vpj1lM

⬇ 1.7% MoM

⬇ 1.0% YoY

⬇ 1.9% in the 3 months through Feb. compared with the previous 3 months (largest drop since the period through May 2009).

*As a reminder, global trade growth already fell 0.9% in 4Q18.

*The index contracted 12 out of the last 13 weeks.

*Link: bit.ly/2VocmqD

*After seasonal adjustment, the Harpex TEU Index ⬇ at a slower pace this week.

*Link: bit.ly/2UzAbHN

*YTD YoY: -2.4% v -0.5% prior

*Link: bit.ly/2HIG0B3

- Exports to #China Y/Y: -4.5% v -15.5% prior (6th straight ⬇)

- Chip exports Y/Y: -13.5% v -16.6% prior (5th straight ⬇)

*Link (Korean): bit.ly/2URejHt

*However, the customs office said daily average exports (which reflect working days) ⬇ 6.1% YoY in Apr. (vs -4.1% YoY prior)

*Link: bit.ly/2VCPdAD

*Export orders have now decreased in four of the past five months.

*Link: bit.ly/2UNj5G4

*#Germany continues to lead downturn with negative spillover on #Austria.

*Link: bit.ly/2GTAojK

*Business optimism dipped slightly and remained among the weakest signalled since data on sentiment were first compiled in July 2012 (fourth-lowest overall).

*Link: bit.ly/2Jb0EZI

*Decreases were seen in 🇨🇳, 🇪🇺, 🇧🇷, 🇬🇧, 🇹🇼, 🇰🇷, 🇹🇷, 🇵🇭, 🇨🇦, 🇲🇽, 🇦🇺, 🇵🇱 and 🇨🇿.

*Global production growth (ex construction) YoY will remain subdued in 2Q19.

*Link: bit.ly/2Jb0EZI

*The index contracted 13 out of the last 14 weeks.

*Link: bit.ly/2Wt9lCI

*After seasonal adjustment, the Harpex TEU Index ⬇ at the slowest pace since 5 weeks.

*Link: bit.ly/2UzAbHN

*Export orders totalled US$29.6 billion, down 1.1% from the same period last year and a 0.9% decline from the previous fair in November

scmp.com/economy/global…

- Prior MoM revised higher from -4.2% to -4.0%

- Prior YoY revised higher from -8.4% to -8.1%

*EU CUTS GERMAN GDP FORECAST TO 0.5%, WARNS OF EURO-AREA RISKS

*Link: bit.ly/2VlUMUW

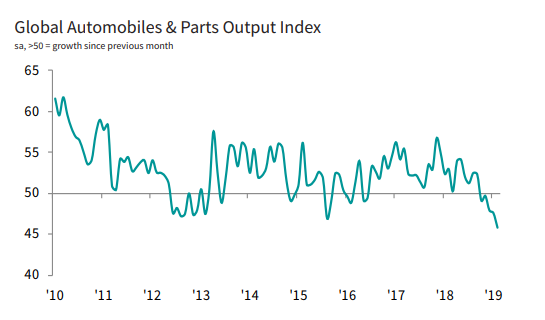

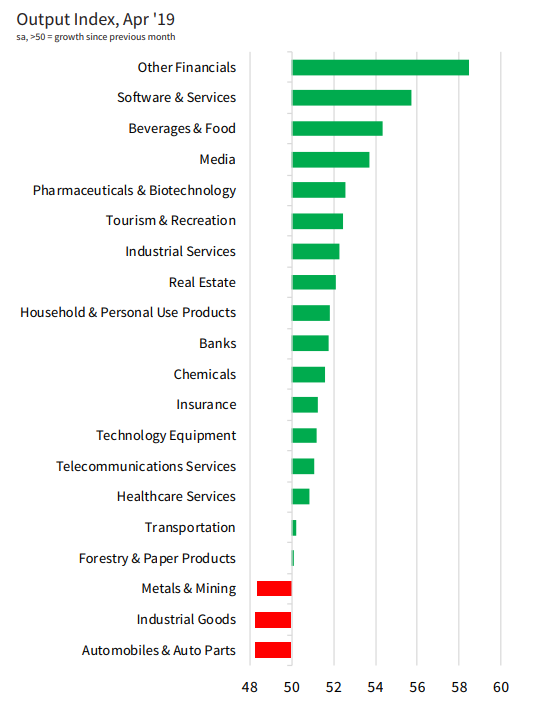

"Automobiles & Auto Parts" sector remained the worst performer

*Output ⬇ for the 7th straight month while New orders ⬇ at the sharpest rate since the series began ❗

*Link: bit.ly/2vOL3XQ

Intel said revenue growth for the next three years will be at a percentage in the low single digits, with its main personal-computer chip business flat to slightly down.

*Link: bloom.bg/2H94nVe

marketwatch.com/story/continen…

*The stock of ASF ⬆ 10.4% YoY (v +10.7% YoY prior)

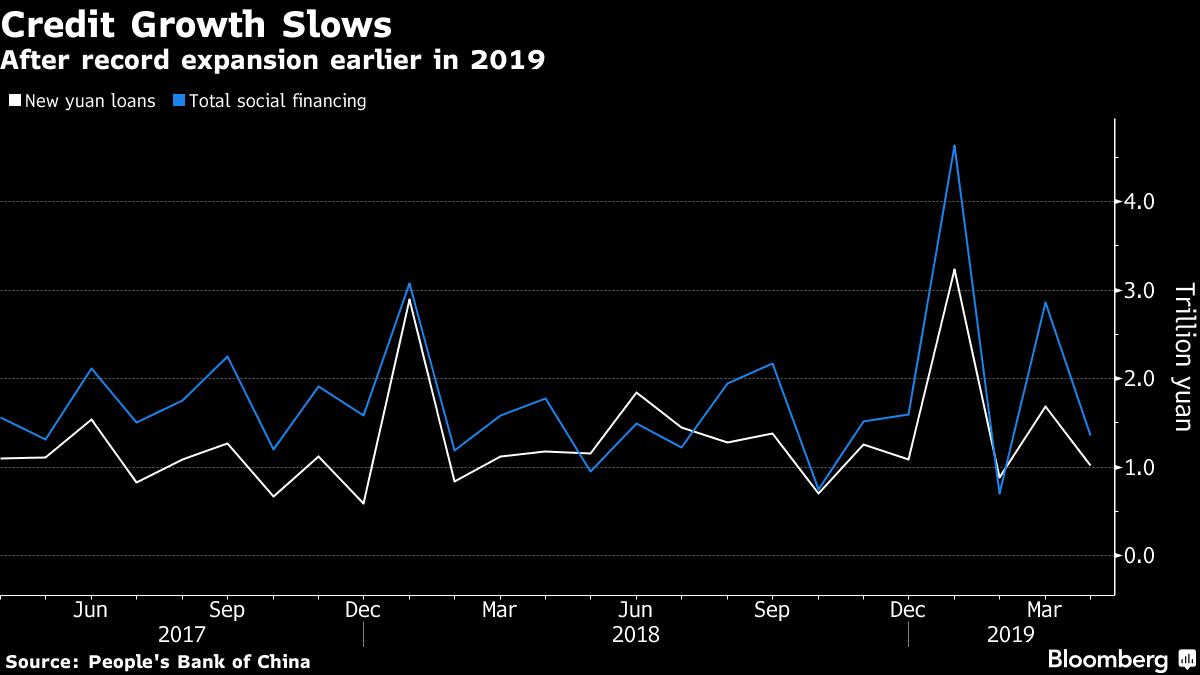

New yuan loans fell to T1.02CNY (v T1.69CNY prior)

*The stock of yuan loan ⬆ 13.5% YoY (v +13.7% YoY prior)

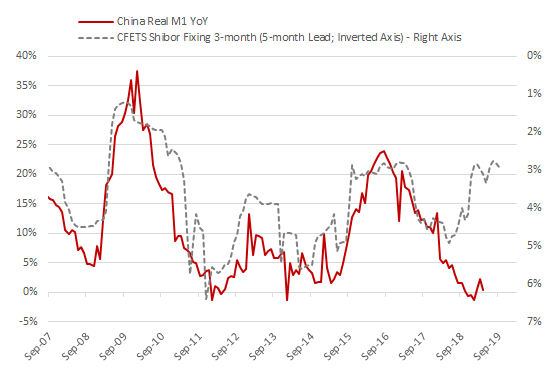

*Real M1 ⬆ 0.4% YoY v +2.3% YoY prior.

As @TeddyVallee mentioned, this is likely due to "large scale deleveraging in off balance sheet products and non-bank fin. institutions"

*Undiscounted Bankers Acceptances ⬇ CNY35.7B (v +CNY136.5B in March)

*Entrusted loans ⬇ CNY119.9B (v -CNY107B in March)

*Trust loans ⬆ CNY12.9B (v +CNY52.8B in March)

*CHINA CAR SALES FALL FOR 11TH STRAIGHT MONTH, PCA SAYS

*The index contracted 14 out of the last 15 weeks.

*Link: bit.ly/2Q1U0qb

*After seasonal adjustment, the Harpex TEU Index ⬇ at the fastest pace since 3 weeks.

*Link: bit.ly/2UzAbHN