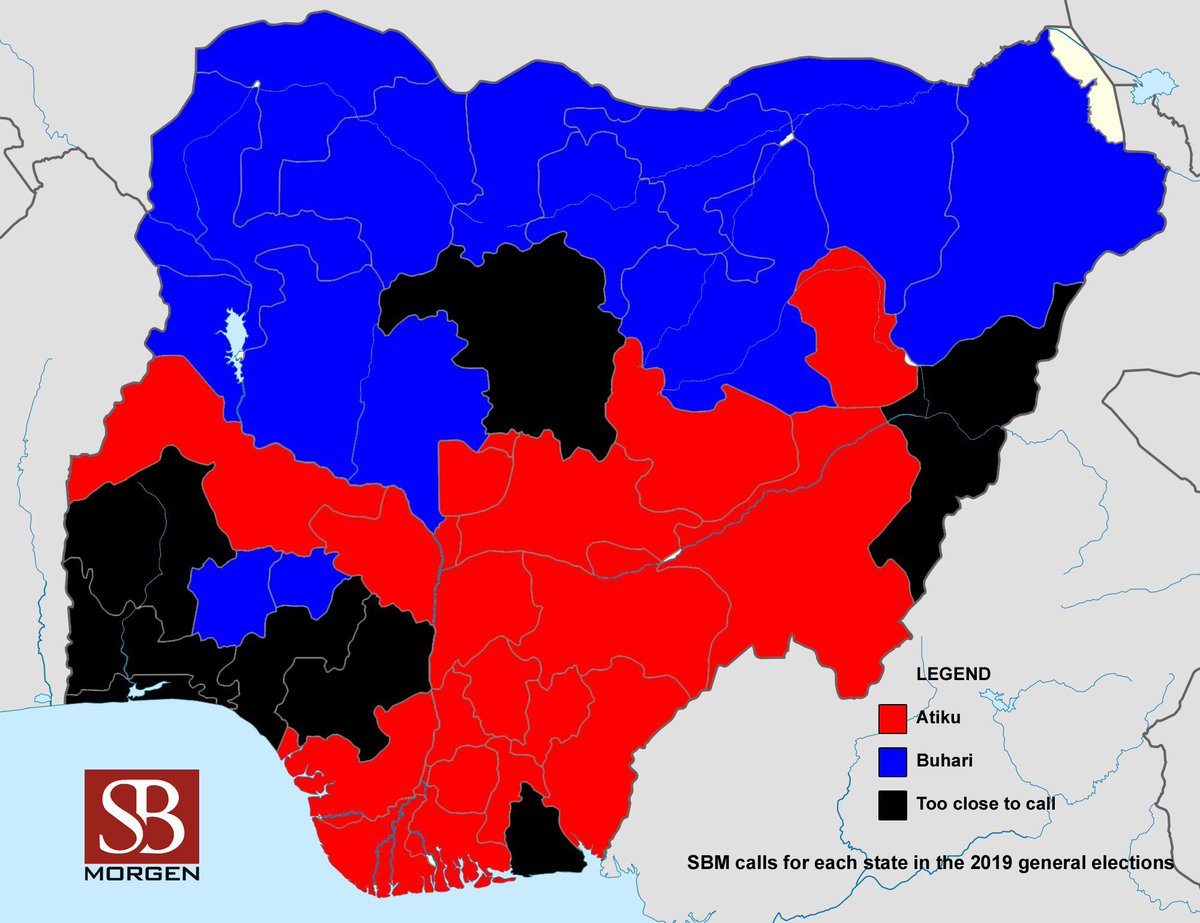

This culminated in the unsightly scenario of one of #Nigeria's most prominent citizens asking his tribesmen to defend themselves.

All this in a year when campaigns for #NigeriaDecides2019 began.

#Nigeria will have an opposition party having the majority in @nassnigeria for the first time.

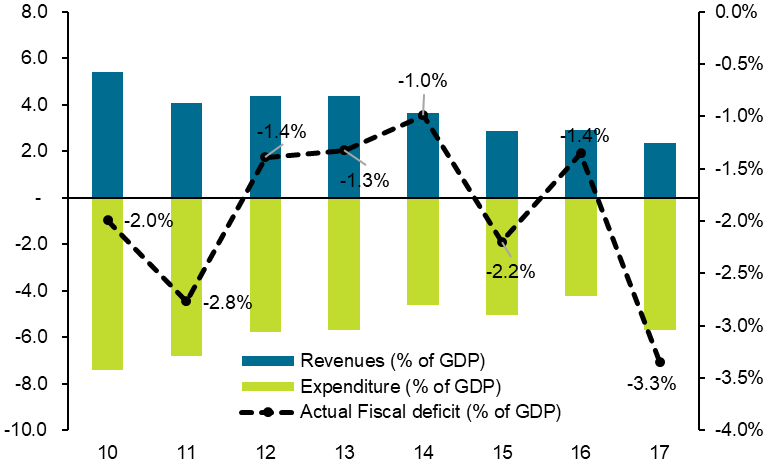

@AsoRock’s already strained revenue position will become totally untenable.

Debt service to revenue ratio will reach 80%.

We expect a steep rise in the exchange rate by between 30% and 40%.

@AsoRock will try to keep a lid on the FX rate opening arbitrage windows akin to 2016 and leading to significant capital flight.

Key investments will unfortunately not be made.

Unpaid salaries will remain a clear and present reality.

We expect an inability to continue to fund some of the social intervention programmes.

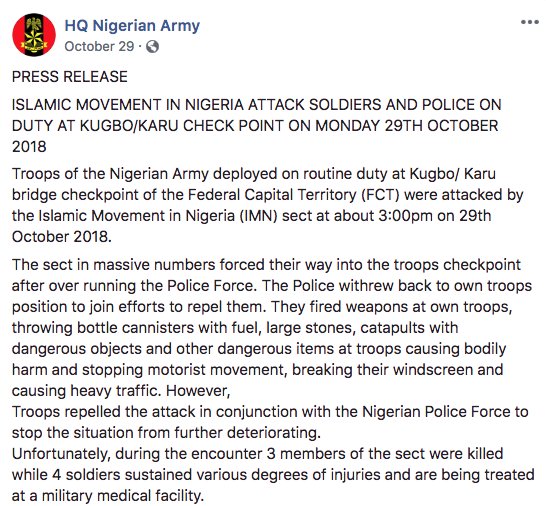

The political will to face the numerous security challenges and attempt to deal with them to finally arrive as #NigeriaDecides2019 approaches.

Various pockets of violence will be faced with renewed vigour as the elections come.

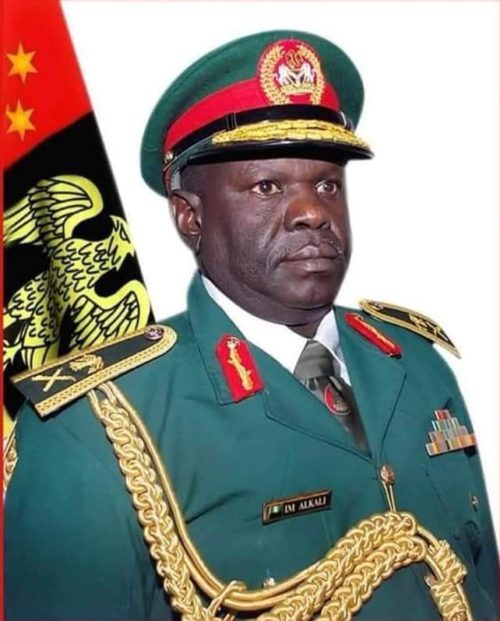

There will be a change of guard at the leadership of security agencies.

There will be a clamour for the current heads to face the “Dasuki Treatment”.

We believe that a close result will be followed by allegations of fraud and irregularities.

We believe that electoral violence in 2019 will be of a greater magnitude than in 2011.

We expect #PastoralConflict to intensify after #NigeriaDecides2019.

@MBuhari might yield to pressure and contract a PMC to take the fight to #BokoHaram.

We expect an increase in IDPs over the course of the year.

Due to the current debt expenditure to revenue ratios, @AsoRock will be cautious of borrowing costs.

Companies will continue to take the option of Rights Issuance.

2019 will be a tough year due to declining oil revenues.

Unemployment will continue to rise, and unofficial figures will put unemployment at half the population by the end of 2019.

More policemen will begin to openly express dissatisfaction with the way @policeNG is being run.

More current and former policemen will also be involved in criminal activity.

Regardless of who wins the 2019 elections, the unions will be back in the battlefield in H2.

The proposed #budget2019 has already failed.