1. Population of Nigeria

2. Population of Young people

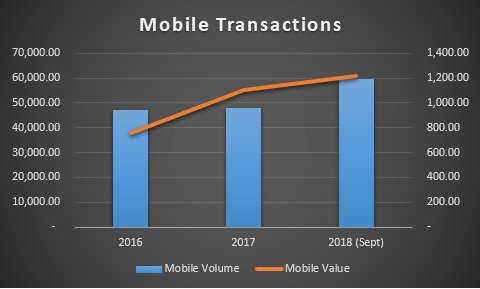

3. Mobile Density

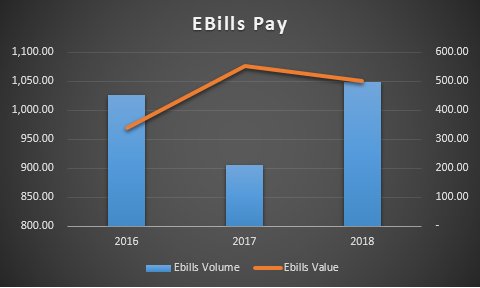

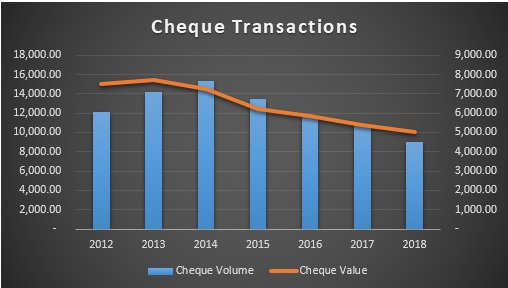

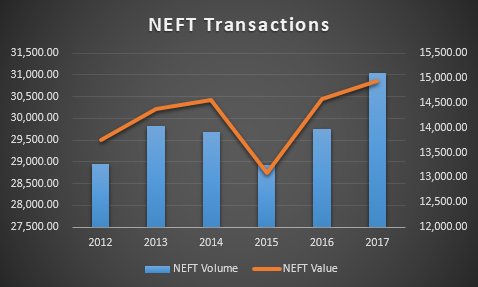

4. Increased epayments volumes

5. Broadband internet

6. Increased emphasis on financial inclusion (policy and regulatory)

All these come together to create a potential ecommerce market

techpoint.africa/reports/

proshareng.com/news/Fintech/A…