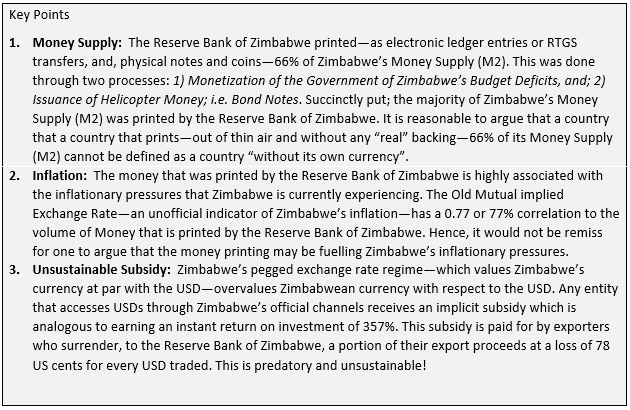

i) The Reserve Bank of Zimbabwe printed 66%—i.e. the majority—of Zimbabwe's Money Supply (M2). Because of this fact, I argued that Zimbabwe already has "its own currency".

ii) The Reserve Bank of #Zimbabwe's money printing is responsible for Zimbabwe's inflation.

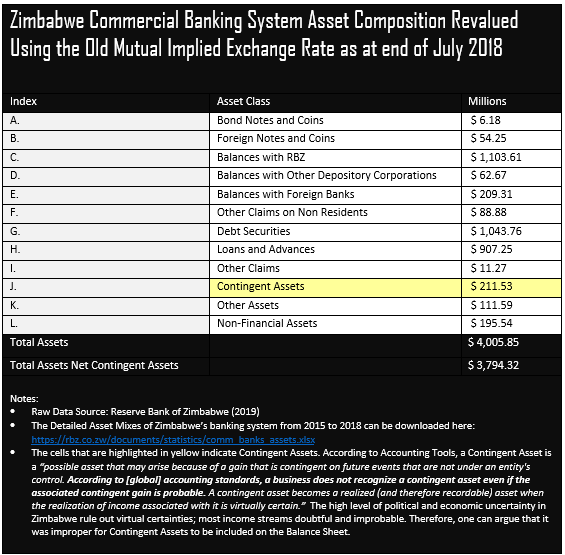

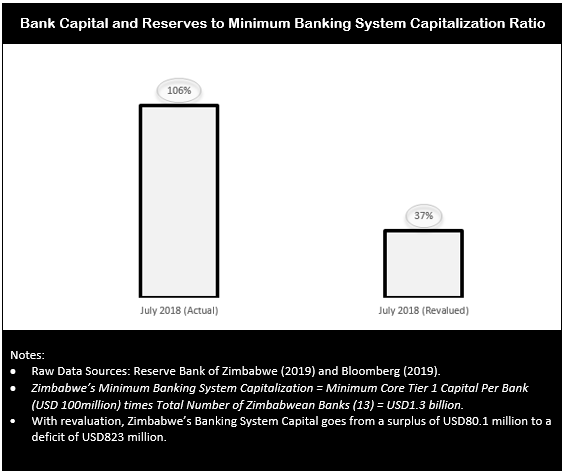

i) Zimbabwe's 13 banks collectively raising capital of USD823 million, or;

ii) Zimbabwe's 13 banks merging into 4 banks (freeing them from having to raise capital), or;

iii) A combination of i) & ii)