Today on #SwotSunday, we examine the "Economic Impact of 2019 Elections" even in the face of postponement by INEC Chairman.

#NigeriaDecides #NigeriaElections #ElectionPostponed

#SwotSunday #NigeriaDecides

#SWOTSunday #NigeriaDecides2019 #VoterRun2019

#NigeriaDecides2019 #SWOTSUNDAY "Economic impact of 2019 Elections"

On the other hand, the administration had been seen as infrastructure conscious one with some evident projects.

#SWOTSunday #NigeriaDecides2019 #NigeriaDesides2019

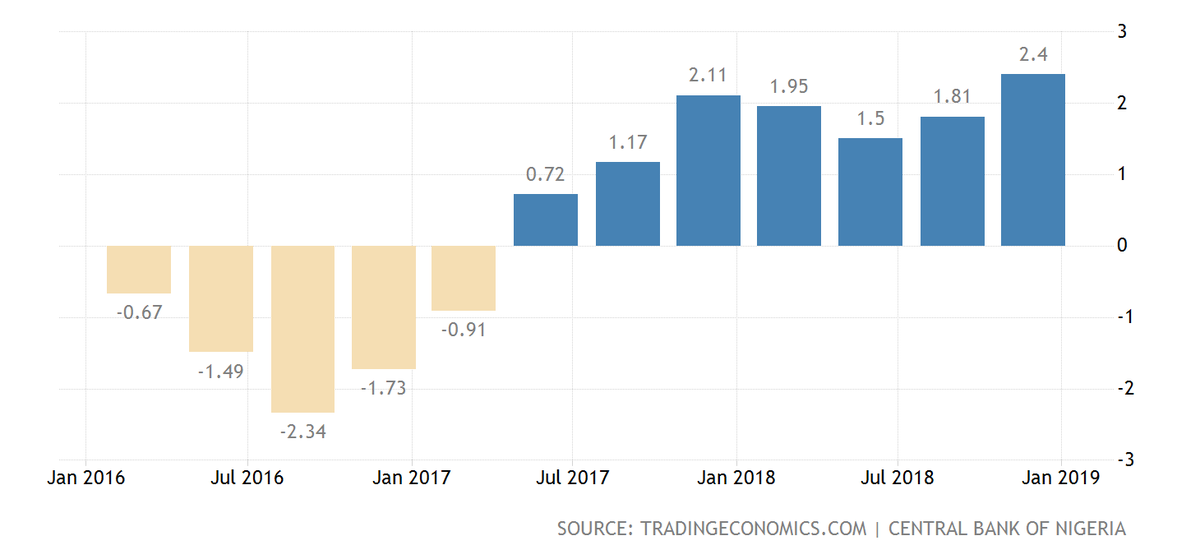

GDP:

#NigeriaDesides2019 #NigeriaDecides2019

#NigeriaDesides2019 #NigeriaDecides2019

#NigeriaDecides2019 #NigeriaDesides2019

#NigeriaDecides #NigeriaDesides2019