1/n

This time there is a jar of coins 5 kopecks each (5 #копійок).

2/n

3/n

4/n

Moreover, crisis was near permanent in #Ukraine during 1980s, when it was part of #USSR that later collapsed unexpectedly for so many.

They were slow and very fast ones. 5/n

@ptcherneva @stf18 7/n

8/n

9/n

10/n

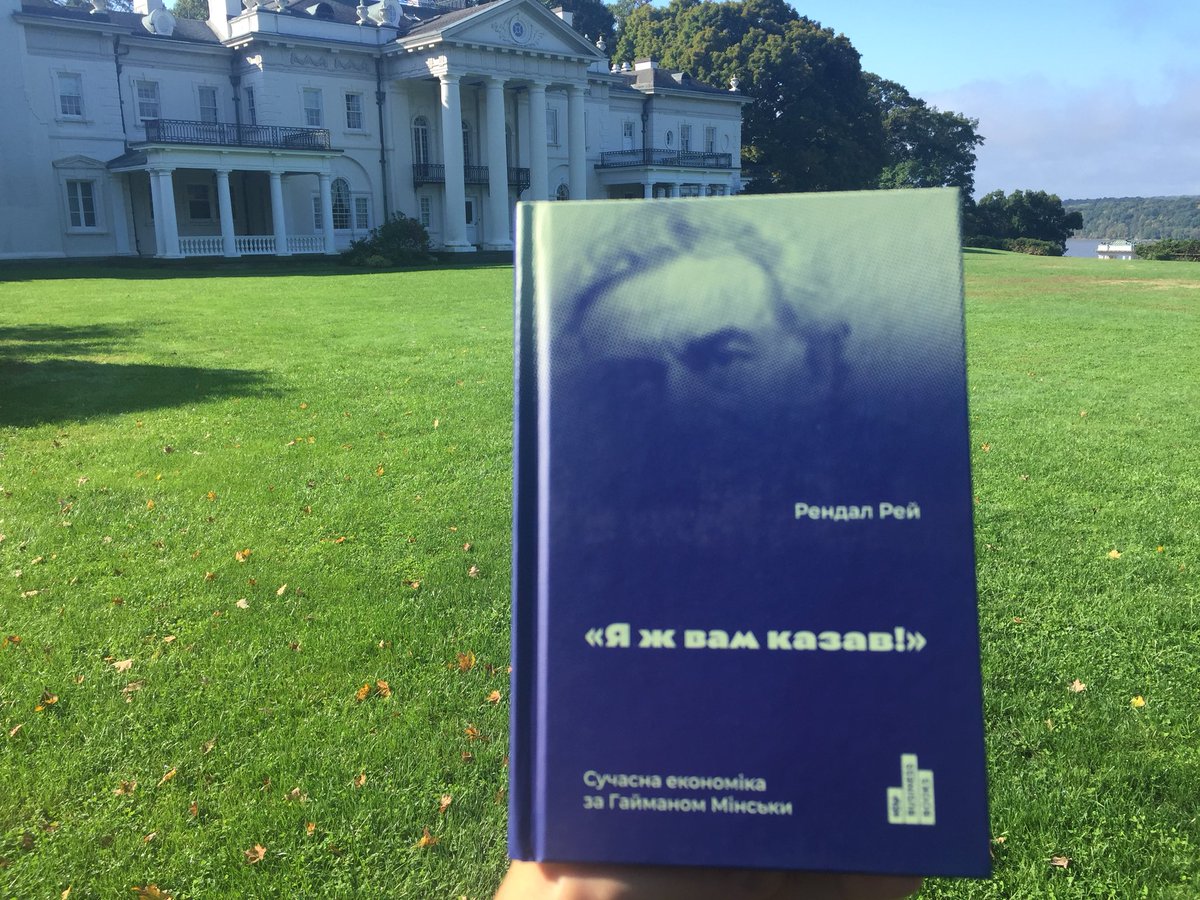

While reading it, being on the 2nd chapter, my 1st thought was 'this is it!'. This just does explain a lot of Ukraine's econ misfortune. 12/n

While orthodox/mainstream econ framework is a receipt for stagnation.

14/n

15/n

16/n

In general, point "f" entirely is like a reality check for a developing country.

18/n

19/n

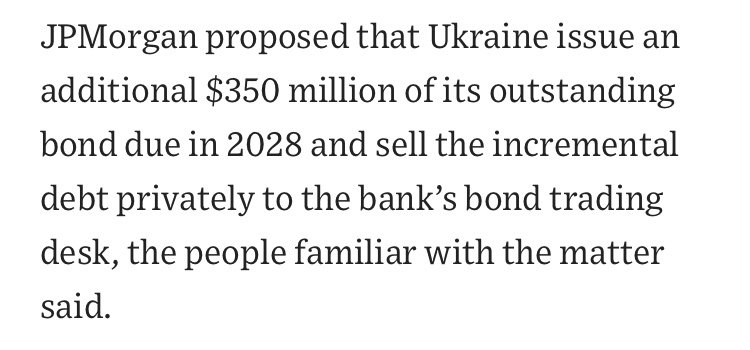

The “tap” was organized by @jpmorgan and as reported by @wsj the issue price was 98.88 cents on the $.

20/n

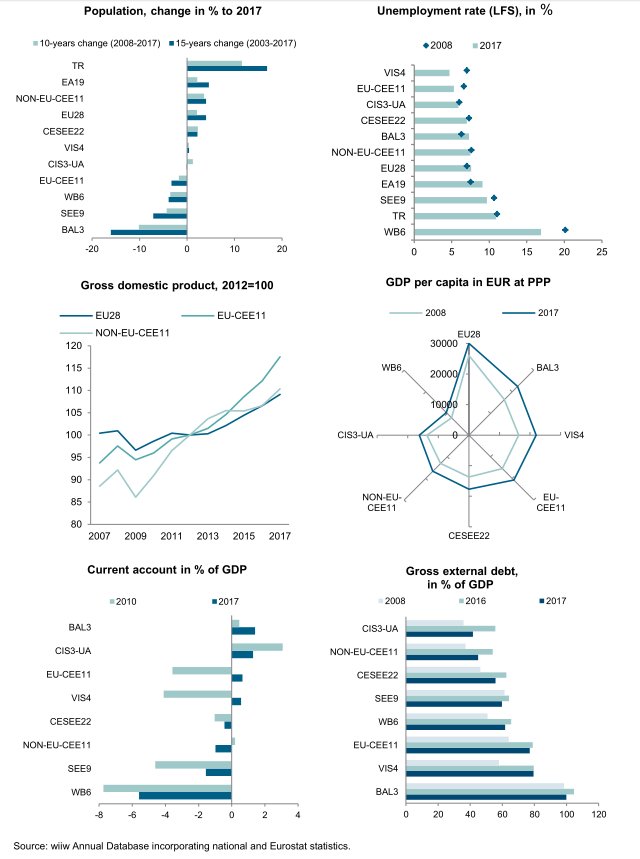

This shows (1) desperate needs for FX monetary reserves, (2) that are required for tight govt FX debt re-payments, (3) #Ponzi like position of the govt that borrows to payback %+principal of past FX debt.

21/n

22/n

25/n

30/n

31/n